Silver’s recent rally looks diminutive and stunted compared to gold’s, but that’s normal at this early stage of a new bullmarket, when silver typically underperforms gold due to investors being risk inverse, with silver being perceived as more risky and volatile than gold. Nevertheless, as we can see on its latest 6-month chart, silver did manage to break out of its reactive downtrend in force from early September. Last week, at the time Iran lobbed missiles at US bases in Iraq it had a go at breaking above its late September highs, but was not up to the task and fell back, putting in a reversal candle on big volume, which suggests that it probably has further to fall short-term – perhaps back to the upper boundary of the downtrend channel shown, but with the overall tenor of this chart positive it should then turn higher again.

Wheeling out the 10-year chart once more, which gives us the big picture, we see that, although so far looking much more restrained than gold, silver appears to be ascending away from the 2nd low of a giant Double Bottom pattern. The advance out of the lows of last Summer was on good volume, that has driven both volume indicators quite strongly higher, which is bullish and marks a breakout drive out of the base pattern, with a completed breakout being signaled by silver breaking above the resistance approaching and at $22. A break above this level will usher in a period of much more dynamic advance.

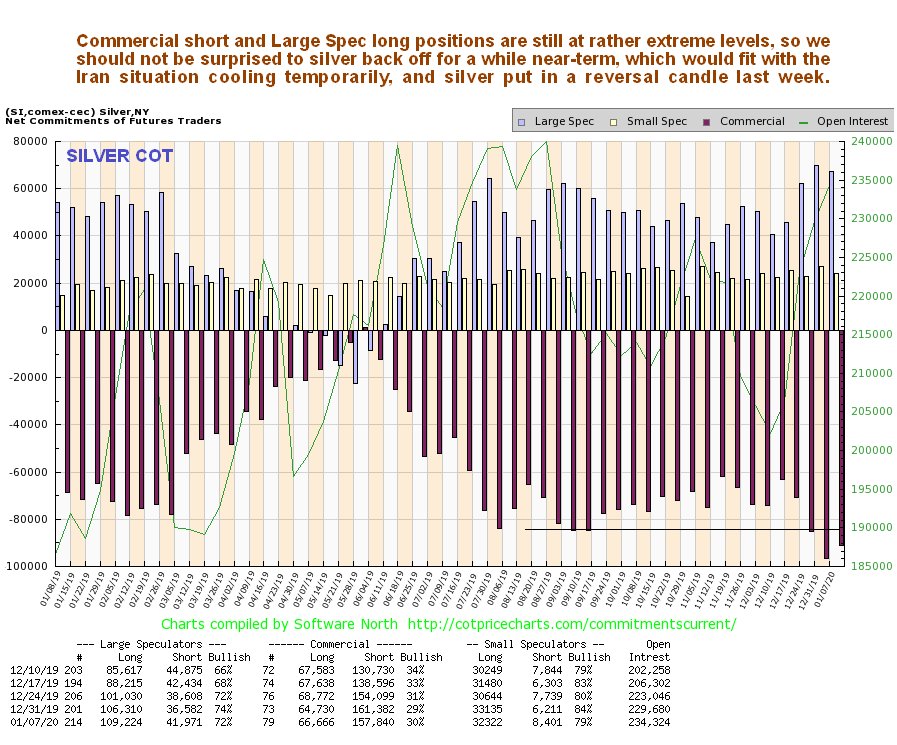

The latest COT chart shows that Commercial short and Large Spec long positions are still at fairly extreme levels, which makes more corrective action over the near-term likely…

Click on chart to popup a larger, clearer version.

Conclusion: although last week’s reversal candle and the current rather extreme COT readings make short-term weakness likely, perhaps to the upper boundary of the Fall downtrend, the overall picture for silver is favorable, with it readying to break out of a giant 5-year plus base pattern to follow gold higher. Marked acceleration is likely to follow a breakout above the $22 level.

End of update,

Clive Maund