According to GFMS, the world is expected to see a peak in silver mine supply in the next 2-3 years. This statement including this year’s supply and demand statistics were released in the GFMS 2014 Silver Market Interim Report for the Silver Institute.

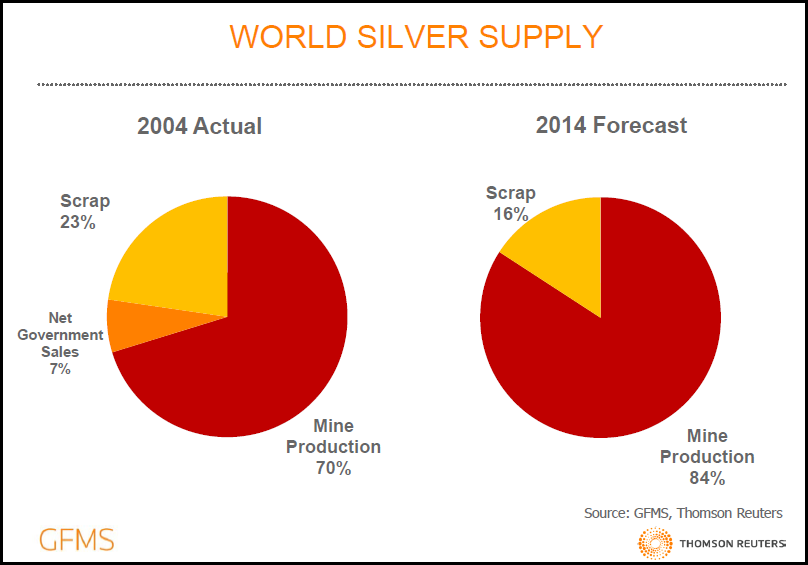

GFMS states the reason for the peak in silver mine supply is due to “current price levels maintaining production but constraining investment in new capacity.” Basically, they are saying the current low silver price will maintain production for the meanwhile, but this has created a decline in mining investment, precipitating a peak in global silver production. In addition, they see silver scrap supply falling from 25% of total supply in 2012 to only 16% in 2014.

One striking statistic from the Silver Interim Report is the total drop-off of government silver sales. From 2004 to 2013, net government silver sales totaled 366 million ounces. Government silver sales hit a high in 2006 at 78.5 million oz and a low of 7.4 million oz in 2012.

However, GFMS shows in this graph (from the Silver Interim Report), that net government sales fell from 7% of total supply in 2004 to ZIP in 2014. During the past decade, most government silver sales came from China, Russia and India. Even though government sales were only 7.9 million oz in 2013, it looks as if this official supply has now totally dried up.

And who could blame them. Why should China, Russia or India sell their government silver bullion into the market for peanuts while the Fed funnels its monetary stimulus through its member banks into the stock and bond markets while capping the value of commodities and the precious metals?

From their press release, GFMS states the following on world mine supply:

On the supply side, mine production is forecast to reach all-time highs in the silver industry in 2014 as supply from Guatemala, Mexico, Chile and Peru increases. This is forecast to see primary supply increase by 3.5% in 2014 to 868 Moz.

GFMS believes total global silver production will increase 3.5% over 2013 to 868 million oz in 2014. Last year, GFMS reported world silver production at 819.6 Moz. I gather 2013 will be revised upwards to 838 Moz. It’s perfectly understandable to revise figures, but how could GFMS miss a whopping 20 Moz??

That being said, the most IMPORTANT FACTOR to understand from their Interim Report is the announcement of the planned peak of world silver mine supply in the next 2-3 years. This actually makes sense if we consider not just the supply constraints coming from reduced mining investment capacity, but also the impact of peak global oil production… which also seems likely to occur in the next few years.

On the demand side of the equation, GFMS forecasts physical silver demand to fall 6.7% in 2014 compared to 2013. They show small percentage declines in jewellery, photography, silverware and industrial application silver consumption, but a larger drop-off in physical silver bar and coin demand.

Even though GFMS estimates silver bar and coin demand to fall 20% in 2014 compared to last year, they had this to say in their press release:

Meanwhile demand for silver bars and coins has soared in recent weeks as bargain hunting retail investors returned to the silver market after a disappointing first half of the year. Nowhere is this more evident than in India where imports of silver are up by 14% year-on-year for the January to October period and set for an annual record. With imports in the first ten months totaling a massive 169 Moz many vaults in the UK, traditionally the largest supplier to India, have seen significant drawdowns, leading to more supply flowing from China and Russia.

According to the data above, if India continues to import a record amount of silver for the rest of the year, total imports may reach 200 million oz — nearly 25% of total world mine supply. Also, Indian silver demand is so strong, the UK is experiencing a draw-down of silver inventories at the LBMA.

If Russia and China had to step in and supply silver to India as the LBMA inventories are running low, what does this mean if we see an explosion in physical silver investment demand in the future?? A draw-down of LBMA silver inventories may be the beginning sign of looming future physical delivery problems.

I believe total physical coin and bar demand will be higher than the 192 Moz figure forecasted by GFMS for 2014. This is down 50 Moz from the high of 242 Moz in 2013. Furthermore, I would imagine the majority of this estimated decline was in physical bar investment as official silver coin sales remain strong.

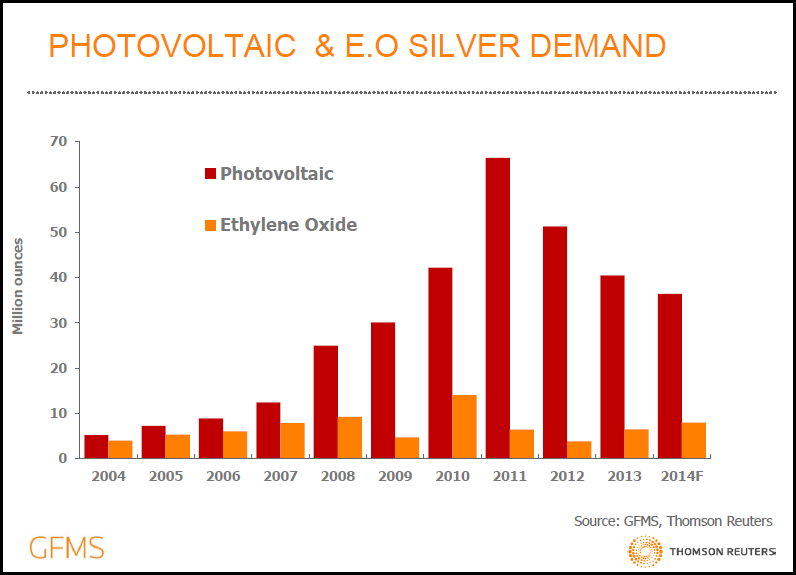

Lastly, there is a lot of hype about the Solar Power Industry becoming a huge consumer of silver in the future. I have always stated that industrial silver demand, especially solar power demand, will not be much of determining factor in setting price in the future. Wall Street analysts continue to regurgitate that industrial silver demand will grow for the next 5-10 years. Hogwash.

When the peak of global oil production takes place within the next several years, this will impact Global GDP growth. Matter-a-fact, world economic activity will contract along with the decline in global oil production. Which means, demand for silver in industrial applications will decline as well.

AND IT ALREADY HAS…LOL. If we look at this last chart also from the Interim Report, we can clearly see that silver demand in the Photovoltiac Market peaked in 2011 at approximately 65 Moz, and is forecasted to nearly fall in half in 2014 at 35 Moz.

Sure, maybe the solar power manufacturers are using less silver in their panels… so what. It’s the overall consumption that matters. If total silver consumption in the solar power industry is declining, then why do we still hear analysts say this will be a BIG MARKET for silver in the future???

Again, I have always stated that the future spike rise in the price of silver will not be due to industrial demand, but rather to the massive increase in physical bullion investment when the Global Paper Ponzi Scheme implodes. This is not a matter of IF, but WHEN.

Industrial silver demand (minus photography) peaked in 2011 at 573 Moz and will decline to an estimated 530 Moz in 2014. However, physical bar and coin demand is four times higher than what it was before the U.S. Investment Banking and Housing Market collapse in 2007 (51 Moz in 2007 & 242 Moz in 2013).

All-in-all, GFMS estimates that silver market will experience a 6 Moz oz surplus this year compared to the revised 85 Moz deficit in 2013. I believe we may actually see a small annual silver deficit in 2014 when GFMS tallies year-end figures and publishes its 2015 World Silver Survey… come April next year.

Remember, the two most important FACTORS from the GFMS Interim Report:

1) World Mine Supply to Peak in 2-3 years.

2) Draw-down of LBMA silver inventories.

Just watch and see how these two indicators will impact the price of silver in the future. Unfortunately, the world is not prepared for what’s coming… and very few are invested in Gold & Silver that enjoy a 2,000+ year proven track record as real money, high quality investments, and stores of wealth.

Please check back for new articles and updates at the SRSrocco Report.