Silver and its miners’ stocks have had a tough year. They plunged with gold in spring and summer as extreme Fed tightening catapulted the US dollar parabolic. The resulting deep lows left this tiny fringe contrarian sector deeply out of favor, but it has started recovering in recent months. The major silver miners’ upside potential is partially dependent on their fundamentals, which were just detailed in new quarterlies.

The silver-stock universe is vanishingly small by stock-market standards, with the leading sector ETF only commanding a trifling $969m in net assets this week. That remains the SIL Global X Silver Miners ETF. After launching way back in April 2010, it has grown into silver stocks’ main benchmark. SIL’s dreadful price action this year certainly explains why silver stocks have been mostly abandoned by traders, left for dead.

Early on SIL actually got off to a solid start, rallying 23.4% between late January to mid-April. But then the bottom fell out, with the major silver stocks cratering a catastrophic 45.5% by late September! While SIL has rebounded 34.1% at best since then as of Thanksgiving eve, it was still down 21.3% year-to-date. All that selling was fueled by silver breaking down with gold on the Fed’s most-extreme tightening ever.

The white metal itself rallied 20% from mid-December to early March, plunged 30.4% into late September, and then mean reverted 19.8% higher into mid-November. Those moves amplified parallel gold swings by 1.3x, 1.5x, and 2.2x. The far-smaller silver market usually depends on the way-bigger gold market to set the psychological tone. With gold and silver plunging as the US dollar soared, silver stocks were scorned.

That’s understandable since price action drives sentiment, but unfortunate given silver’s super-bullish backdrop. Traders flock back to silver after gold powers high enough for long enough to convince them a decisive sustainable upleg is underway. Also temporarily derailed by that red-hot wildly overcrowded long-dollar trade, gold’s upside potential is massive with the first inflation super-spike since the 1970s now raging.

Gold nearly tripled in monthly-average-price terms during the 1970s’ first inflation super-spike, then more than quadrupled during the second! Monthly-average silver prices from those same trough-to-peak CPI months enjoyed colossal 184.4% and 448.5% gains! Silver ought to multiply again before this current inflation super-spike runs its course. Silver investment demand will skyrocket as gold mean reverts way higher.

That will catapult silver prices sharply higher. Interestingly the white metal’s own fundamentals are very strong. The Silver Institute collects and publishes the best-available data on silver’s global supply and demand. While the resulting reports are only published annually, SI just gave a mid-November update on 2022’s silver demand. It reported total global demand is tracking to hit a record 1,210m ounces this year!

That would make for outstanding 15.7% year-over-year growth even while silver prices languish sapping investors’ interest. Physical silver investment is faring even better, with SI now estimating it is going to surge 18.3% YoY to a record 329m ounces in 2022! If that is already happening now despite miserable silver price action, imagine how demand will explode when silver soars attracting in far more investors.

Silver’s huge upside potential amplifying gold during this inflation super-spike is incredibly bullish for the silver miners’ stocks. Their earnings really leverage material silver-price moves. The question now is how are they faring fundamentally before silver shoots stratospheric again? Their latest Q3’22 earnings season wrapping up in mid-November revealed the major silver miners are actually doing surprisingly well!

For 26 quarters in a row now, I’ve painstakingly analyzed the latest results released by SIL’s 15-largest component stocks. These include the world’s biggest silver miners, now accounting for a commanding 88.1% of this ETF’s entire weighting. Digesting hard fundamental results as they are released is essential for cutting through obscuring sentiment fogs. It helps traders rationally understand silver stocks’ real outlook.

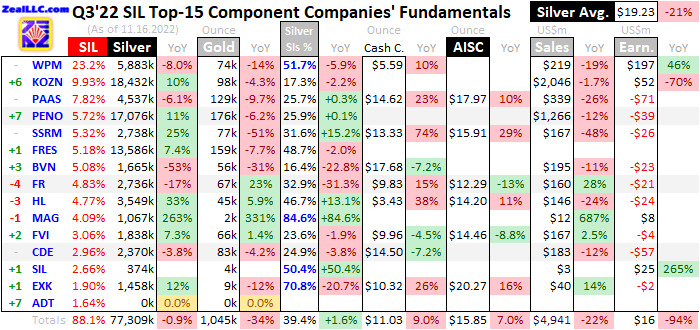

This table summarizes the operational and financial highlights from the SIL top 15 during Q3’22. These major silver miners’ stock symbols aren’t all US listings, and are preceded by their rankings changes within SIL over this past year. The shuffling in their ETF weightings reflects shifting market caps, which reveal both outperformers and underperformers since Q3’21. Those symbols are followed by current SIL weightings.

Next comes these miners’ Q3’22 silver and gold production in ounces, along with their year-over-year changes from the comparable Q3’21. Output is the lifeblood of this industry, with investors generally prizing production growth above everything else. After that is a measure of silver miners’ relative purity, their percentage of quarterly sales actually derived from silver. Most silver miners also produce gold or base metals.

Generally the more silver-centric a miner, the more responsive its stock price is to changing silver prices. So traders looking for leveraged silver exposure via its miners’ stocks should overweight purer producers. Then the costs of wresting that silver from the bowels of the earth are shown in per-ounce terms, both cash costs and all-in sustaining costs. The latter subtracted from average silver prices help illuminate profitability.

That is followed by these miners’ hard quarterly revenues and earnings reported to national securities regulators. Blank data fields mean companies hadn’t reported that particular data as of mid-November when Q3’s earnings season was winding down. Annual percentage changes are excluded if they would prove misleading, like comparing two negative numbers or data shifting from positive to negative or vice versa.

With weaker silver prices last quarter, it was a challenging time for silver miners. Yet their Q3 results still proved considerably better than I expected. While raging inflation forced mining costs higher to strangle profitability, the SIL-top-15 silver miners largely held the line. Their mining costs rose much slower than the major gold miners’ costs last quarter, which I discussed last week with similar analysis on GDX gold stocks.

Production is always of paramount importance for silver miners, but even more so when silver prices are weak. That was certainly the case in Q3’22, when quarterly-average silver prices plunged 20.7% YoY to just $19.23. Those were the worst silver prices by far in nine quarters! Silver fared way worse than gold, which saw its quarterly-average prices slump just 3.5% YoY to $1,727. That really pressured silver miners.

The top 25 GDX gold miners suffered an outsized 4.1% YoY decline in their aggregate Q3’22 gold output. Yet the SIL top 15 somehow managed to merely see their total silver production slip a small 0.9% YoY to 77,309k ounces! That was even more impressive considering a major composition change with one of this ETF’s top holdings. SIL booted the Russian-owned UK-listed Polymetal International earlier this year.

For years Polymetal had been SIL’s second-largest component, a larger producer yielding 399k ounces of gold and 4,500k of silver in the comparable Q3’21. But after Russia invaded Ukraine and started inflicting cruel destruction on its people and cities, global investors dumped Russian stocks in protest. So Polymetal’s market capitalization cratered, which alone would’ve bludgeoned it out of these elite SIL-top-15 ranks.

That wasn’t the end of Polymetal’s woes, as its Big Four accounting firm resigned as its auditor back in early April. Deloitte warned it was no longer safe to audit Polymetal’s extensive Russian operations. It faced delisting in London without an auditor, and extensive international sanctions against Russia also threatened to impact its mines. Polymetal was effectively replaced in the SIL top 15 by a small explorer.

While Adriatic Metals is currently constructing its maiden silver mine in Bosnia, it won’t start producing until Q3’23 at best. So the SIL-top-15 results really aren’t comparable between Q3’21 to Q3’22 with a big producer exchanged for an explorer. Excluding Polymetal from those year-ago totals, the SIL top 15’s total silver production actually surged a big 5.2% higher YoY! That is radically better than the major gold miners.

A majority of the SIL-top-15 silver miners actually grew their silver output last quarter, a higher proportion than among GDX-top-25 gold miners. And this growth wasn’t trivial, averaging hefty 15.1% YoY gains excluding MAG Silver which is ramping up a big new mine. So the silver miners greatly outperformed on the critical production front in Q3’22, at least with silver. Yet their gold production still shrunk considerably.

These elite major silver miners saw their collective gold output plunge 34.2% YoY to 1,045k ozs. But that too is heavily distorted by Polymetal getting kicked out of this ETF. Exclude its gold output from Q3’21, and that slashed last quarter’s year-over-year decline to a more-reasonable 12.1%. And even that was skewed by another anomalous event, SSR Mining’s gold production crashing 51.5% YoY to just 77k ounces!

That sounds apocalyptic, but thankfully it was only temporary. In late June SSRM discovered a small cyanide leak at its primary gold mine in Turkey, from a pipeline running to its leach pad. This was quickly cleaned up and fixed, but local regulators didn’t authorize mining to resume until late September. So that mine’s gold output was almost totally lost in Q3’22! It is back online now and ramping up in this current Q4.

Had that run at Q3’21 levels last quarter, the SIL top 15 excluding Polymetal would’ve only seen their total gold production retreat 5.5% YoY. That’s still considerable, but a far cry from that unadjusted 34.2% shocker! The major silver miners generally boosting their silver production as gold output slumps has improved their silver purity a bit. They averaged 39.4% of their Q3’22 sales from silver, 1.6% better than Q3’21.

Four of these elite silver miners qualified as primary silver ones, deriving over half their revenues from silver. Their purity percentages are boldfaced in blue in this table. But the SIL-top-15 average will likely resume slipping in coming quarters. SSRM’s full gold output bouncing back will be one key driver, as its purity percentage soared from 11.8% in Q2’22 to 31.6% in Q3’22 with its primary gold mine briefly suspended.

That mine coming back online will drag the overall SIL-top-15 purity average about 1.3% lower. But silver outperforming gold in coming quarters could more than offset that. Silver prices are more beaten down than gold ones, and silver tends to amplify major gold advances by roughly 2x. So if silver rallies faster than gold on their coming mean reversions with the Fed-fueled parabolic US dollar surge dying, purity could rise.

Like their major-gold-miner peers, the silver miners faced mounting inflationary pressures on their mining costs last quarter. In normal times, silver-mining unit costs are generally inversely-proportional to silver-production levels. That’s because silver mines’ total operating costs are largely fixed during pre-construction planning stages, when designed throughputs are determined for plants processing silver-bearing ores.

Their nameplate capacities don’t change quarter-to-quarter, requiring similar levels of infrastructure, equipment, and employees to keep running at full-speed. So the only real variable driving quarterly silver production is ore grades fed into these plants. Those vary widely even within individual silver deposits. Richer ores yield more ounces to spread mining’s big fixed costs across, lowering unit costs and boosting profitability.

But while fixed costs are the lion’s share of silver mining, there are also sizable variable costs. Energy is the biggest category, including electricity to power ore-processing plants like mills and diesel fuel to run excavators and dump trucks hauling raw ores to those facilities. Other smaller consumables range from explosives to blast out ores to chemical reagents necessary to process various ores to recover their silver.

Many of the SIL top 15’s latest quarterly reports complained about this raging inflation. Major silver miner Pan American Silver’s inflation warning was representative, declaring “all operations were negatively impacted by inflationary pressures, mainly reflecting increased prices for diesel and certain consumables, including cyanide, explosives, and steel products (such as grinding media), as well as supply-chain shortages.”

PAAS’s explanation continued “We are also experiencing indirect cost increases in other supplies and services due to the inflationary impact of diesel and consumable prices on third-party suppliers.” Inflation forcing mining costs higher makes it harder to profitably produce silver. But the SIL top 15 did a great job tightening their belts, as evident in relatively-constrained jumps in both of their key unit costs last quarter.

Cash costs are the classic measure of silver-mining costs, including all cash expenses necessary to mine each ounce of silver. But they are misleading as a true cost measure, excluding the big capital needed to explore for silver deposits and build mines. So cash costs are best viewed as survivability acid-test levels for the major silver miners. They illuminate the minimum silver prices required to keep the mines running.

The SIL top 15’s cash costs did surge 9.0% YoY to $11.03 per ounce in Q3’22. That’s the highest on record, probably ever but definitely in the 26 quarters I’ve been advancing this research thread. But still that increase was much better than the GDX-top-25 gold miners’ blistering 22.4% YoY cash-cost surge last quarter! The major silver miners appear to be managing their variable mining costs better than gold miners.

All-in sustaining costs are far superior than cash costs, and were introduced by the World Gold Council in June 2013. They add on to cash costs everything else that is necessary to maintain and replenish silver-mining operations at current output tempos. AISCs give a much-better understanding of what it really costs to maintain silver mines as ongoing concerns, and reveal the major silver miners’ true operating profitability.

The SIL-top-15 silver miners’ AISCs climbed a similar 7.0% YoY to $15.85 in Q3’22. That too proved the highest in the last 26 quarters and likely ever witnessed. But again this magnitude of cost increase seems quite constrained given the severe inflation ravaging silver miners. That alone is probably running well over 7%, so these companies are apparently controlling their costs much more effectively than gold miners.

The GDX top 25’s average AISCs in Q3’22 soared 21.9% YoY to their own all-time-record peak of $1,391! That equated to 1.17x the prior four quarters’ average AISCs. But the SIL top 15’s milder cost increases left that same ratio better at 1.09x. The major silver miners are either better managing their costs, or there are less AISC outliers skewing their average than the GDX gold miners are contending with today.

Still those high AISCs along with weaker silver prices largely garroted silver-mining profits last quarter. Again quarterly-average silver prices plunged 20.7% YoY in Q3’22 to just $19.23. Subtracting those high average AISCs of $15.85 from silver yields implied sector unit profits of just $3.38 per ounce. That didn’t just collapse a brutal 64.2% YoY, but it is the SIL top 15’s worst by far since all the way back in Q1’20!

In the eight quarters before Q3’22, this sector-unit-profits proxy averaged a whopping $10.87 per ounce. So the major silver miners’ profitability is definitely impaired by low silver prices and surging inflation-fueled costs. But this pinching should really moderate in coming quarters, enabling unit earnings to quickly soar back near normal levels. Higher silver prices are coming as the white metal amplifies the yellow’s surge.

With the Fed’s parabolic US-dollar surge rolling over and unwinding, there’s no reason gold and silver can’t mean revert back up near their Q1’22 averages before the Fed’s extreme tightening. Those ran $1,879 and $24.03. Quarterly-average silver prices would have to power up 25.0% from Q3’22 levels to regain Q1’22 levels! Also some of the SIL-top-15 miners themselves are forecasting lower AISCs ahead.

Pan American Silver is a great example. Last quarter its AISCs climbed a reasonable 10.2% YoY to hit $17.97. Yet this company just reaffirmed its full-year AISC guidance in its Q3’22 results, at $15.25 per ounce. In 2022’s first couple quarters, PAAS’s AISCs averaged $15.36. To hit the that midpoint forecast of $15.25, Q4’s would have to come in near $12.30. Expecting SIL-top-15 AISCs to retreat to $14.00 is conservative.

At $24 silver and $14 AISCs, SIL-top-15 unit profits would nearly triple back up near $10 per ounce! That isn’t likely in this current Q4, as silver has only averaged $20.05 quarter-to-date. But higher silver prices are very likely in 2023 and beyond as gold mean reverts much higher to better reflect this raging inflation unleashed by extreme central-bank money printing. Silver-mining earnings are destined to head much higher.

On the hard-accounting front under Generally Accepted Accounting Principles or their equivalents in other countries, the SIL top 15’s revenues definitely suffered with lower silver prices and less gold production. They plunged 22.1% YoY to $4,941m in Q3’22, reflecting that 20.7% lower average silver and 5.5% lower adjusted gold output. But if Polymetal’s sales are removed from Q3’21, that revenue drop moderates to 10.5%.

Actual bottom-line accounting earnings reported to securities regulators proved dismal for the SIL top 15 last quarter, cratering 94.5% YoY to just $16m! And even that was skewed high by Wheaton Precious Metals, which reported a $104m gain on selling a mineral-stream interest. SilverCrest Metals also had a big $26m forex gain as it ramps up its new silver-and-gold mine. So silver miners’ GAAP profits were ugly.

But higher silver prices will work wonders to catapult silver-miner profitability higher. The SIL top 15’s cash flows generated from operations are a better measure of their financial health than easily-distorted earnings. OCFs blasted up 50.7% YoY to $471m in Q3’22, but that too is skewed. In Q3’21, Buenaventura paid a colossal $544m for tax litigation to the government of Peru! Without that, overall OCFs fell 45.0% YoY.

But the SIL top 15’s cash treasuries still remained robust, adding up to $5,887m exiting Q3’22. That actually climbed a slight 2.6% YoY, and wasn’t affected by Polymetal’s booting since it didn’t report cash in its Q3’21 report. The major silver miners’ big cash hoards will help them continue to grow their output, both by expanding existing mines and developing or buying new ones. Higher silver prices will accelerate that.

If you regularly enjoy my essays, please support our hard work! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. These essays wouldn’t exist without that revenue. Our newsletters draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

That holistic integrated contrarian approach has proven very successful, yielding massive realized gains during gold uplegs like this overdue next major one. We extensively research gold and silver miners to find cheap fundamentally-superior mid-tiers and juniors with outsized upside potential as gold powers higher. Our trading books are full of them starting to really surge. Subscribe today and get smarter and richer!

The bottom line is major silver miners are actually faring pretty well fundamentally despite the depressed silver prices. They are growing their collective silver production, which along with weaker gold output is boosting their relative purity. That makes their stock prices more responsive to the coming higher silver levels as gold mean reverts higher to reflect this raging inflation. Silver will amplify gold’s upside like usual.

The silver miners are also doing a good job managing mining costs, which only climbed by single-digit percentages last quarter. That was just a third of what gold miners suffered! The silver miners are also projecting lower costs in coming quarters, which along with better silver prices will really boost profitability. The silver stocks’ solid fundamentals even in this challenging Q3’22 support much higher prices as silver recovers.

Adam Hamilton, CPA

November 25, 2022

Copyright 2000 - 2022 Zeal LLC (www.ZealLLC.com)