Read full report here: Gold & Silver Seeker Issue #44 ~ This Week in Mining: Metals moving higher into year end

2021 is setting up to be a great year for gold (and mining stocks) but especially for silver. As we head into year-end, the gold stocks have been grinding higher while the silver stocks have been trending up. Generally speaking, the miners lead the metals, and together with the technical setup, silver is set to move quite a bit higher. Gold stocks will, too, but I fully expect the gold-to-silver ratio (GSR) to contract in 2021 and, in turn, silver stocks to outperform gold stocks.

While news flow has started to slow as many go on the holidays, the last several weeks have seen a resurgence in M&A activity, highlighted this week by a smart strategic friendly acquisition of Premier Gold by Equinox Gold. Assuming a $1,800/oz. gold price, this acquisition excluding the 30% interest in I-80 gold increase's Equinox's NAV by over $500m. At Goldseeker.com, we are in the process of finishing two company reports, analysis, and valuation, which will be sent to our free email-list before the new year, including $EQX.

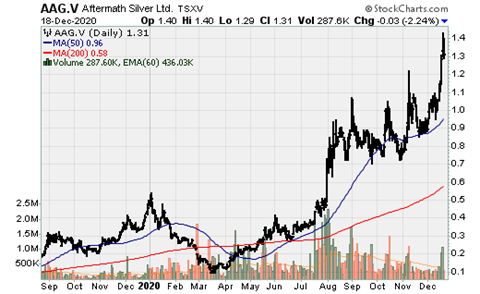

$AAG.V, $AYA.TO, $BSR.V, $EQX, $GATO, $GPL, $GRSL.V, $MKO.V, $MUX, $NFG.V, $OIII.V, $PGM.V, $ROXG.TO, $SCZ.V, $WDO.TO

Aftermath Silver: Announced a resource estimate for its Challacollo Ag-Au project in Chile. Indicated resources stand at 35m oz. Ag (30m.6m oz. O/P and 4.5m oz. U/G) @ 165 g/t and 58k oz. Au @ 0.27 g/t. Inferred resources stand at 11.1m oz. Ag @ 124 g/t and 15k oz. Au @ 0.17 g/t. 165 g/t Ag is relatively high grade for an open-pit deposit.

Aya Gold & Silver: The junior silver producer announced the best drill result on record of 4m @ 9,436 g/t Ag. The company’s flagship asset in the Zgounder mine in Morocco is currently being optimized to double annual silver production to 1m oz. Ag p.a.; however, there is significant expansion potential, with a medium-term goal of achieving 4.0m oz. Ag p.a. There is also significant resource expansion potential. Once 8m oz. Ag has been produced; the company can also increase its interest from 85% to 100%. A Feasibility study is currently being undertaken for the expansion of Zgounder to 4m oz. p.a. and a PEA is being undertaken at its Azegour.

This is one silver producer that goes overlooked given the upside potential not just at Zgounder but through other assets in its portfolio, notably Boumadine. Per the PEA, Boumadine would produce 83k AuEq oz. for 2-yrs, increasing to 105k AuEq oz. for 11-yrs. This a definitely a company worth keeping an eye on.

Read full report here: Gold & Silver Seeker Issue #44 ~ This Week in Mining: Metals moving higher into year end