Chris Marchese

Chief Mining Analyst, GoldSeek & SilverSeek

Week Ended Feb-21, 2020

$AXU $USAS $KOR.to $AG $FSM $KNT.v $GSV $KL $OR $SILV $PAAS $TXG.to $WGO.v

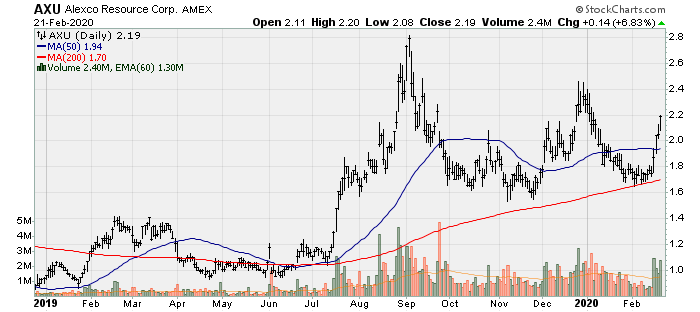

Alexco: is in the process of divesting its profitable and fast-growing remediation business (AEG) to the AEG management group. On closing of the transaction AEG will be pay Alexco $12.1m in cash, with the balance of $1.25m payable pursuant to a promissory note maturing on February 14th, 2021. This will go a long way to reducing the required capital investment to bring several Keno Hill mines back into production, feeding a central mill. Construction will start in 2020 and the because the company has already built the mill and started mine development, the buildout period is estimated at 8 or so months.

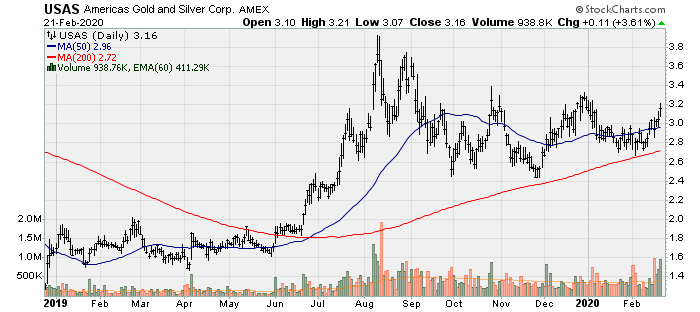

Americas Gold and Silver: poured first gold at its Relief Canyon mine and provided a 2yr outlook. The Galena complex isn’t included in the following forecast as the focus is on the recapitalization plan. In 2020, the company has guided for 50-60k oz. of gold production and 800-900k oz. of silver production. In 2021, both gold and silver production are expected to increase to 80-90k oz. of gold production and 1-1.5m oz. of silver production. AISC per AuEq oz. in 2020 and 2021 are projected to be in the range of $900-$1,100/oz. and $850-$1,050/oz.

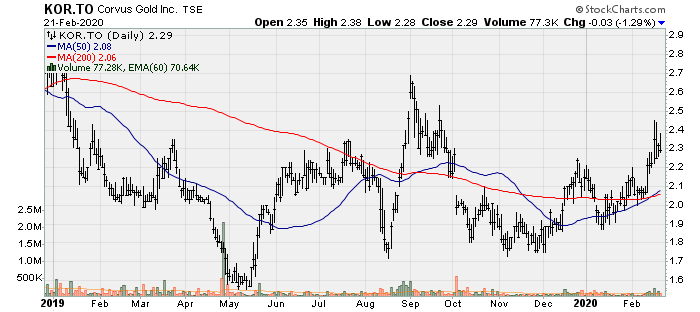

Corvus Gold: The company continues to intersect high-grade mineralization and expand its resource base. It has received positive assay results from the upper part of its first diamond core hole in the North Deep target, designed to evaluate the intrusive connection to the Mother Lode gold system at depth. Recent results include 19.3m @ 2.79 g/t Au and 12.9m @ 2.91 g/t Au. This outlines a new exploration front for continued Mother Lode expansion to the north and at depth below the main deposit. Higher-grade zones in this initial core (see Jan and Mar drilling results from January and March 2019) indicate an intermediate intrusive system at depth. The deeper intrusive target illustrates a strong alteration and increasing silver values which are characteristics of a higher temperature zone favorable for higher-grade gold systems. The on-going phase IV drilling program continues to deliver exciting results which could very well lead to a major expansion for the Mother Lod deposit at depth and along strike. Corvus remains a likely takeover target.

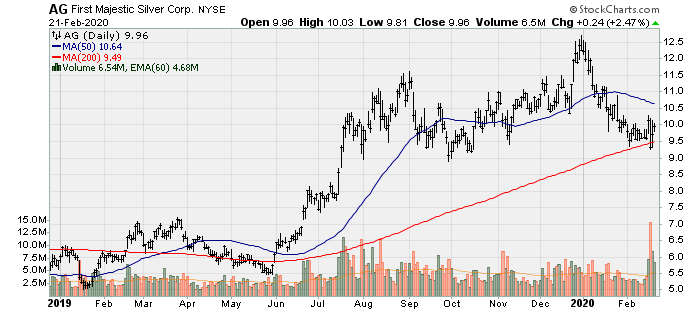

First Majestic: 2019 production totaled 13.2m oz. Ag and 25.6m AgEq oz. The company generated operating cash flow of $109m as companywide AISC decreased 15% relative to 2019 at $12.64/oz. First Majestic continue to focus its efforts on optimizing its two core assets in San Dimas and Santa Elena with the Ermitano project (initial production scheduled for early 2021). The company ended the quarter with $169m in cash and equivalents but this was primarily due to dilution ($81.9m raised in equity financing). In 2019, all but three mines were put on care and maintenance. 2020 production is expected to decline with guidance of 11.8-13.2m oz. Ag and 21.5-24m oz. AgEq. Increased production at San Dimas will help offset no production in 2020 from San Martin, La Parrilla and Del-Toro. Having a higher cost structure, the transition to care and maintenance makes sense for a couple of its mines. At Del-Toro, the company will engage in exploration to develop new resources. At San Martin, the mine will be suspended due to security concerns in 2020. The company continues to trade with one of, if not, the highest P/NAV multiples among primary silver miners, but is this warranted?

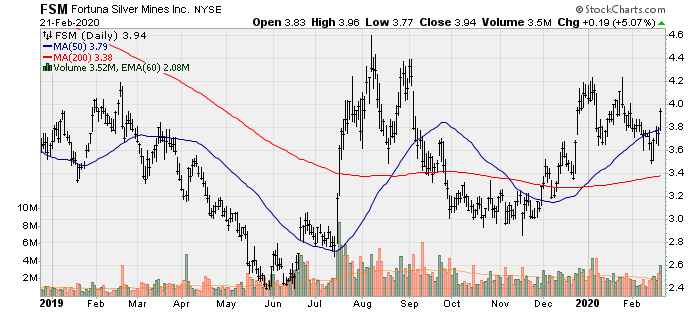

Fortuna: 2020 guidance was issued and while Lindero will only have roughly 6 or months of production, operating cash flow will see a significant increase. Silver production is projected to be 7.5m-8.3m oz. from San Jose and Caylloma as well as 41-45k oz. Au from San Jose. AISC/AgEq oz. is projected to $9.6-$11.7/oz. at San Jose and $14.8-$18.1/oz. At Caylloma, however on a net of byproduct basis, both operations will have considerably lower costs. At Lindero, gold production is estimated at 60-80k oz. with AISC between $520-$620/oz. using the mid-point of production and cost guidance and a $1,550/oz. Au average price for the 2H 2020, Lindero should increase operating cash flow by $60m or so.

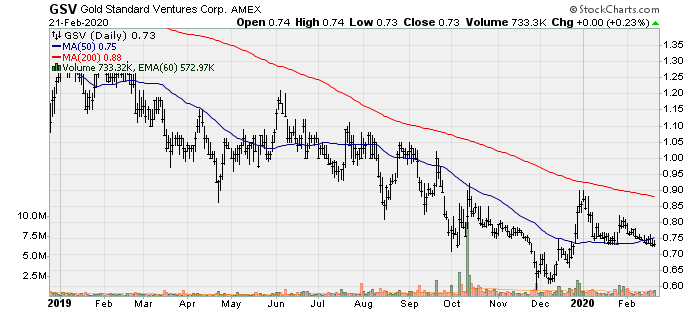

Gold Standard Ventures: announced an updated PFS with a 40% IRR for the South Railroad portion of the Railroad-Pinion oxide gold project (consisting of the Dark Star deposit and Pinion Deposit). Trade-off studies enhanced project economics and reduced project risks by lowering initial capital investment from $194m to $133m, increasing the after-tax IRR from 27.8% to 40%, and increasing after-tax NPV from $241.5m to $265m. This is based on a long-term gold and silver price of $1,400/oz. and $17.11/oz. Average annual output of 116k oz. Au and 205k Ag over an initial 8yr mine life with cash costs and AISC of $582/oz. and $707/oz.

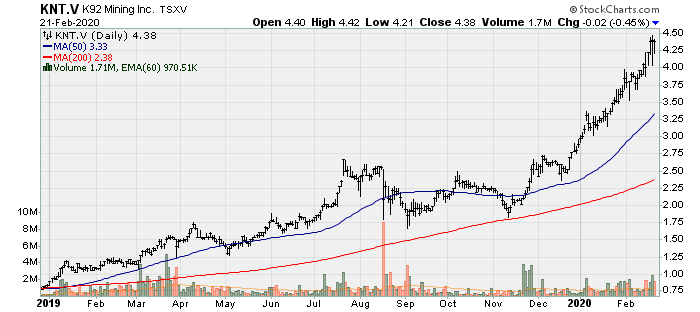

K92 Mining: Released the latest drill results from Kora, including significant southern strike extension. Some highlights include:

· 30.1m @ 22.7 g/t Au, 5 g/t Ag and 0.54% Cu

· 14.6m @ 5.96 g/t Au, 35 g/t Ag and 3.32% Cu

· 8.08m @ 20.01 g/t Au, 13 g/t Ag and 0.87% Cu

· 8.50m @ 10.83 g/t Au, 52 g/t Ag and 3.81% Cu

· 3.7m @ 48.57 g/t Au, 177 g/t Ag and 1.31% Cu

· 8.74m @ 21.58 g/t Au, 3 g/t Ag and 0.74% Cu

K92 continues to demonstrate resource expansion potential as well as the potential for future material increases in average annual output.

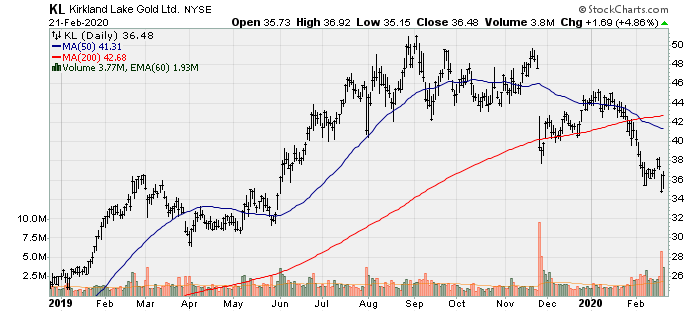

Kirkland Lake: Another stellar quarter for the company with record Q4 and full year 2019 results. Q4 production totaled 279k oz. Au with cash costs and AISC of $255/oz. and $512/oz. This cash cow generated $247m in operating cash flow (normalized OCF was higher but prior quarter saw a big decrease in non-cash working capital, which reversed in Q4). Free cash flow increased nearly 50% to $132.8m (which again would have been higher ignoring the increase in non-cash working capital).

Kirkland continues to build a mountain of cash, now standing at over $700m, a 15% higher relative to the end of Q3 and a 113% higher relative to December 2018. The company yet again increased its dividend, this time by 50% to $0.06/share. The stock has taken a hit from the acquisition of Detour Gold and rightly so, at least at the time of the acquisition. This was for a couple of reasons i) Detour Lake has a much higher cost structure relative to Kirkland’s other assets and ii) the opportunity cost of acquiring Detour Gold over the likes of Red Lake (and consolidating assets in the area) among other large scale asset (producing and development) held up for sale in the US, Canada, or Australia.

This acquisition does look a lot better now at higher gold prices but the premium the stock had previously traded with has been taken away because of the high cost structure. If Kirkland can optimize this asset by a fair degree, it should again trade at a premium, time will tell. I would like to see the company to lower mine-site AISC somewhere between $950-$1,000/oz. and expand production (which should help lower per ounce costs) in the neighborhood of 750-850k oz. p.a. Going forward, this mid-tier producer should derive 1.4-1.5m oz. Au from these three cornerstone assets. Kirkland also said it will categorize the Holt Complex and assets in the Northern Territory assets as non-core, meaning it will likely divest these assets over time but will likely first want to significantly increase the resource base at each.

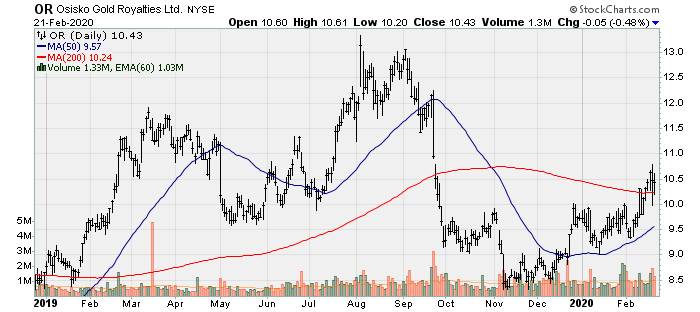

Osisko Gold Royalties: The cheapest (on a P/NAV basis) royalty and streaming company among the big 5 (Franco, Wheaton, Royal, Sandstorm, and Osisko) announced another strong quarter. As with most royalty and streaming companies actual operating results tend not to differ significantly from projected results. The company generated $17.2m in operating cash flow for the quarter and $91.6m for the full year (while annualized quarterly results are materially below full year results, changes in non-cash working capital is responsible). The company also saw record revenue from royalties and streams of $38.9m in Q4 and $140.1m for the full year. Attributable production totaled 20.5k AuEq oz. in Q4 and 78k AuEq oz. for the full year. In addition to significant embed growth over the next 3-5 years (Eagle, Hermosa, Windfall, Horne 5, Back-Forty, Mantos Blanco (expansion), Cariboo etc.), Osisko has a strong financial position with nearly $110m of cash on hand, $480m available under its credit facility and the value of its equity portfolio to complete sizeable deals.

Osisko reported a significant net loss for the quarter courtesy of impairment charges to the Amulsar gold-silver stream, Eleonore and a $50m impairment charge on the Coulon zinc project as the company decided not to pursue the development of the project in the near term (and will likely be added to the North Spirit Discovery Group).

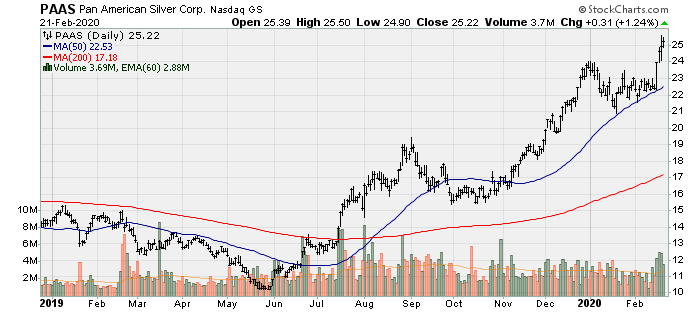

Pan-American: released a very impressive Q4 2019 and FY 2019, largely due to its acquisition of Tahoe Resources and its gold assets. In Q4 and 2019, Pan-American generated operating cash flow of $129.5m and $282m. The company retired $60m in debt and increased its quarterly dividend by 43% to $0.05/share. For the year, Pan-American produced 25.9m oz. Ag at all-in sustaining costs (AISC) of $10.46/AgEq oz. and 559k oz. Au at AISC of $948/oz. Pan-American’s financial position remains strong with $238.3m in cash and equivalents and $275m in bank debt. The company will be able to deleverage very quickly and is ideally positioned to advance the skarn-deposit at La Colorada, move ahead with La Arena II, and re-start mining operations at Escobal, if it gets the go ahead. In 2020, the company is expecting a 7% and 16% increase in gold production.

On February 13th, 2019: Pan-American announced additional drill results at its cornerstone silver asset La Colorada polymetallic skarn discovery in Mexico during Q4 2019. Pan-American announced an initial resource estimate in December 2019 totaling 72.5m tons. This discovery is likely to get much larger over the next 12-18 months and play a key role in the medium-to-long-term. Some highlights from recent drilling include (14 holes drilled since the resource estimate):

· 271m @ 60 g/t Ag, 0.17% Cu, 2.69% Pb ad 4.52% Zn including 167m @ 85 g/t Ag, 0.18% Cu, 3.93% Pb and 6.39% Zn.

· 192m @ 30 g/t Ag, 0.15% Cu, 2.42% Pb and 3.51% Zn

· 19.2m @ 133 g/t Ag, 0.88% Cu, 0.25% Pb and 3.36% Zn

· 24.5m @ 54 g/t, 0.05% Xu, 2.01% Pb and 10.33% Zn

· 28.8m @ 43 g/t Ag, 0.16% Cu, 1.03% Pb and 3.54% Zn

· 62.5m @ 51 g/t Ag, 0.28% Cu, 1.79% Pb and 4.57% Zn

In 2020, Pan-American plans to invest $16-$18m on the drilling program and metallurgical and engineering testing for the discovery. In total, this will amount to a 44,000-meter drill program focused both on infill drilling and exploration drilling to further define and upgrade the resource and confidence level. At the end of June, Pan-American will announce its first update to initial resource estimate. These are very exciting times indeed for the company as it continues to advance Escobal permitting, generate significant cash flow with rising metal prices, new production from Argentina, and advancing this existing skarn discovery.

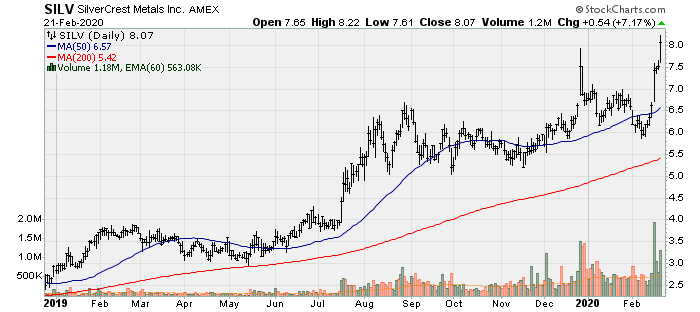

SilverCrest Metals: announced highest-grade discovery to date at Las Chispas, at the Area 200 zone. This already incredibly high-grade silver-gold deposit continues to grow and impress. This news release includes results for a total of 216 holes (65% infill and 35% expansion) from the Babicanora Norte Vein and the newly discovered Babi Norte southeast faulted extension names “Area 200” after the discovery drill hole which intercepted 2m @ 6,418 g/t AgEq. The Babi Norte vein becomes the highest-grade currently known on the property. Expansion drilling has increased the strike length of the Babi Norte vein to 2km from 1.2km. 39 of the 216 holes establish an initial high-grade footprint for Area 200 of 500m long by 125m in height. Drilling in Area 200 on average had a true width of 1.5m with a weighted average grade of 16.11 g/t Au and 2,166 g/t Ag (3,375 g/t AgEq). Some drill highlights from this release include:

· 1.4m @ 90 g/t Au and 9,422 g/t Ag (16,189 g/t AgEq)

· 2.4m @ 45.71 g/t Au and 5,577 g/t Au (9,006 g/t AgEq)

· 1.6m @ 75.78 g/t Au and 7,662 g/t Ag (13,345 g/t AgEq)

· 1.9m @ 10.06 g/t Au and 1,962 g/t Ag (2,717 g/t AgEq)

· 2.2m @ 17.72 g/t Au and 1,801 g/t Ag (3,130 g/t AgEq)

· 2.1m @ 20 g/t Au and 2,400 g/t Ag (3,900 g/t AgEq)

· 2m @ 39.27 g/t Au and 3,473 g/t Ag (6,418 g/t AgEq)

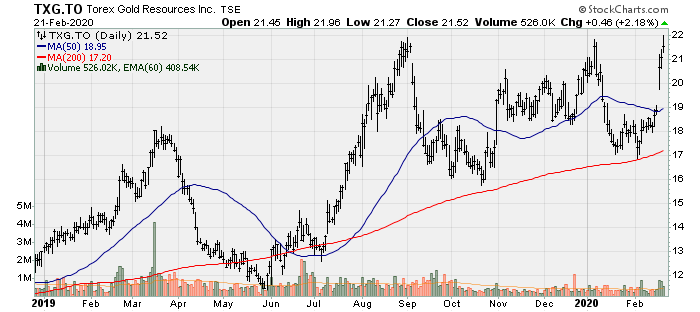

Torex: The company set yet another annual production record as gold output totaled 454k oz., beating the previous record set in 2018 of 354k oz. Cash costs and AISC totaled $619/oz. and $805/oz., the upper and midpoint of full year guidance range. Torex generated over $300m in operating cash flow and $181m in free cash flow. Torex continues to improve its financial position as it prepares to commence construction at Media Luna in a couple of years. The company ended 2019 with a cash position of $162m and paid down $164.4m in debt, reducing total debt to $175m.

Torex is on the forefront of innovation with Muckahi (a low-carbon underground mining technology which is aimed at significantly reducing Capex, Opex, and development timelines). Torex expects this system to give it a significant advantage when competing for assets as the company projects this system to reduce underground capital expenditures up to 30%, up to a 30% reduction in operating expenses, up to an 80% reduction in time between investment and revenue, and up to a 95% reduction in greenhouse gas emissions.

Testing continues to hit its objective and in 2020, Torex will pilot individual components as an integrated system in ELD (underground component of the ELG project) in 2020. Torex also continues to upgrade mineral resources at Media Luna (25% of Inferred upgraded to Indicated).

In 2020, gold production is guided between 420-480k oz. with cash costs of $640-$670/oz. AISC will be elevated at $900-$960/oz. due to increased capital expenditures of $85m, with $51m of that related to capitalized waste mined and non-sustaining capital expenditures of $82m.

Note: Please Visit the Torex Gold Website to get a better understanding of the Muckahi system

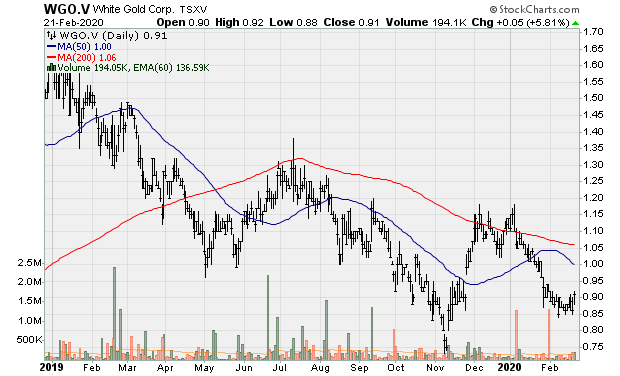

White Gold: The exploration vehicle of Kinross and Agnico-Eagle continues it success. It recently announced it has further extended the VG deposit mineralization and advances new high priority targets nearby the VG deposit on the QV property. There is currently has a historic Inferred resource estimate for the VG deposit of 230k oz. @ 1.65 g/t Au as of June 2014. The following are some highlights from recent drillings:

· 10.67m @ 2.09 g/t Au (<5m depth)

· 7.62m @ 4.03 g/t Au

· 13.71m @ 0.67 g/t Au

· 50.3m @ 2.07 g/t Au

· 36.58m @ 1.42 g/t Au

· 38.1m @ 1.97 g/t Au

Chris Marchese for the Gold Seeker Report

Chief Mining Analyst at GoldSeek & SilverSeek

Chief Mining Analyst with GoldSeek and SilverSeek. Previously he was the Senior Mining Equity and Economic Analysis at The Morgan Report. He was a Co-Founder and Director of Lemuria Royalties, before it was acquired in March 2018. He also co-authored The Silver Manifesto with David Morgan in 2015.

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. GoldSeek.com, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; SilverSeek / GoldSeek.com makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of SilverSeek / GoldSeek.com only and are subject to change without notice. GoldSeek.com assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto. No companies mentioned in this report is a sponsor of this, or any other related, websites. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.