$USAS, $BTG, $GOLD, $CXB.TO, $DPM.TO, $EQX, $FNV, $GSS, $GORO, $GLDX.V, $GCM.TO, $HL, $IAG, $KL, $LUG.TO, $NEM, $OCG.TO, $PAAS, $RGLD, $SAND, $SKE.V, $SKREF, $TMR.TO, $TMMFF $TXG.TO, $TORXF, $KGC, $WDO.TO, $WDOFF, $WPM

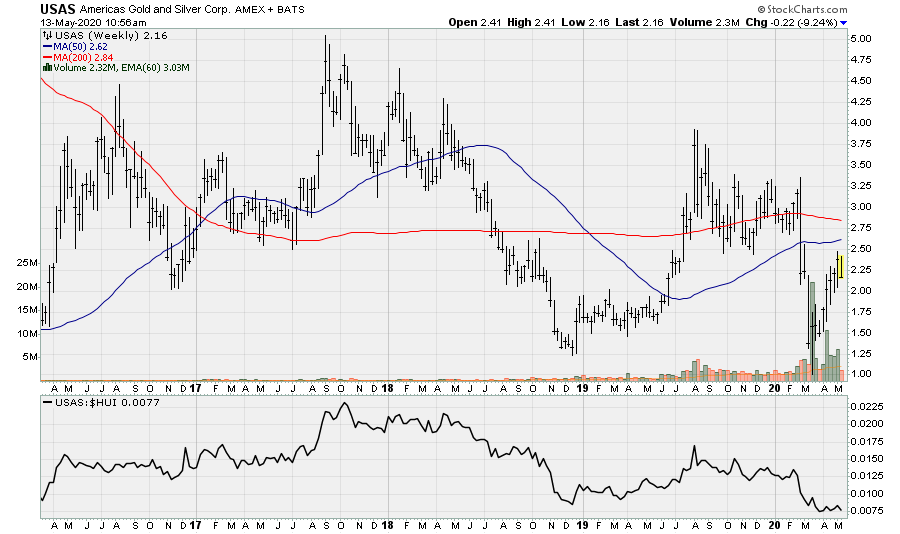

Americas Gold & Silver: Announced a C$25m bought deal offering as it entered into an agreement with a syndicate of underwriters co-led by Cormark Securities and Desjardins Securities. The underwriters have agreed to purchase 8.93m common shares at a price of C$2.80/share for aggregate gross proceeds of C$25m. There is a 15% over-allotment option. Strategic investors led by Pierre Lassonde and Eric Sprott indicated they intend to subscribe for shares totaling C$8.75m.

The company also provided an update of operations at its flagship asset, Relief Canyon in Nevada, the Galena Complex in Idaho and its Mexican operations. Relief Canyon poured first gold in mid-February and the company reiterates that it expects to achieve commercial production mid-year (late Q2-early Q3). The ramp-up has been slower than anticipated due to an inability to get key management and consultants to site to resolve some start up issues. Further, leaching has been slower than planned. Pregnant solution grade and solution application rates are now nearing design levels following improvements to agglomeration, solution application and stacking practices. The Galena recapitalization plan with Eric Sprott is proceeding better than expected with the company seeking benefits in both production and exploration. The company’s Mexican operations remain suspended until the end of May.

The company withdrew its 2020 production guidance but reiterated 2021 guidance of 90-110k AuEq oz. The company was smart to raise additional funds (although a small revolver would have also sufficed) as the company will likely continue to see cash outflows until sometime in May 2020. As at quarter end, the company has a cash position of $16.3m inclusive of funds under the Galena recapitalization plan, so this nicely bolsters its cash position to over US$30m.

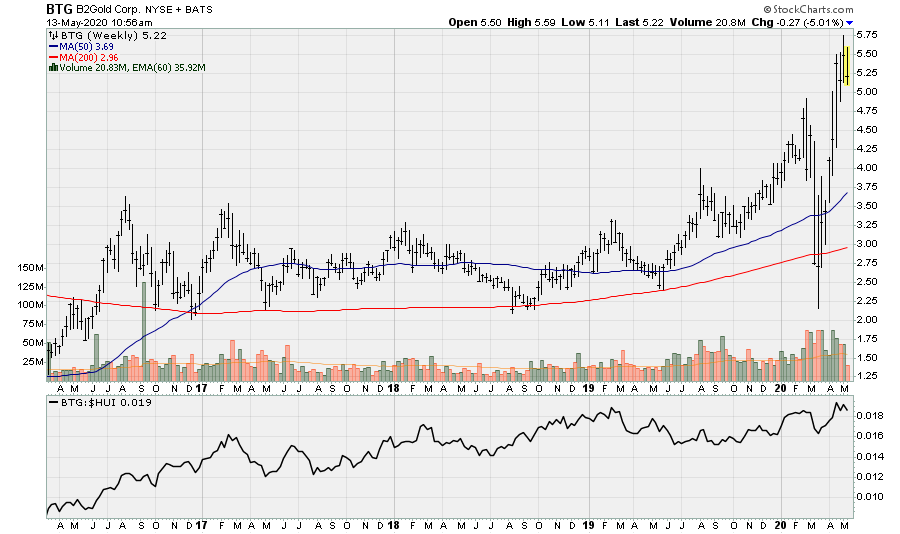

B2Gold: Reported a very strong Q1, setting quarterly records for total gold production, revenue, operating cash flow and operating costs. The company also increased its dividend 100% to $0.02/share per quarter ($0.08/share annualized). Consolidated production totaled 250.63k oz. Au or 7% above budget. Total production (inclusive of its attributable oz. from Calibre) was 264.86k oz. Revenue totaled $380 from its three operations, a 44% increase vs. the year ago period. Operating cash flow saw a whopping 151% increase over the comparable period in 2019 of $216m (vs. $86m). The company also achieved record low quarterly cash costs of $382/oz. Au and AISC of $695/oz. Its flagship Fekola Mine achieved record quarterly gold production of 164k oz. (656k oz. annualized) at record low cash costs of $251/oz. and AISC of $519/oz. B2Gold’s growth profile will remain flat for at least the next three years barring any M&A activity making it a top candidate to either engage in M&A or be taken over by a large senior producer i.e. Barrick Gold. Fekola meets Barrick’s requirements as a Tier-1 asset.

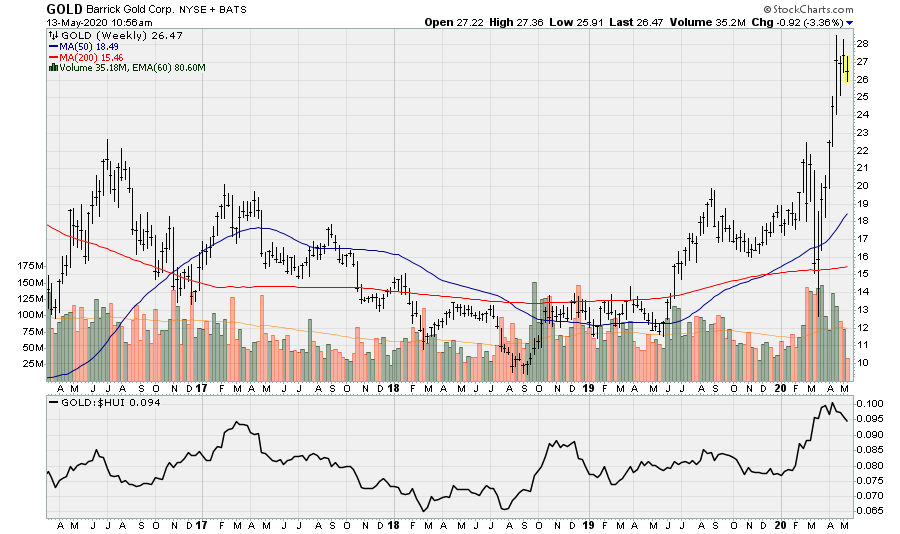

Barrick Gold: Like its rival Newmont, Barrick also started the new year on good footing, generating $889m and $438m in operating and free cash flow during the quarter. Q1 production was in-line with guidance and net debt was reduced by a further 17% from the end of Q4 to $1.85b, with no significant maturities until 2033. Production totaled 1.25m oz. Au with AISC of $954/oz. Barrick will take a hit on 2020 guidance as well as its 5-year estimated average production profile as one its Tier-I assets, Porgera, is on its way to being nationalized, although there is a chance this could be resolved.

Calibre Mining: The company reported a strong first quarter 2020 regarding production and costs as well as setting record quarterly production at Limon of 20.64k oz. Total production was 42.1k oz. Consolidated AISC including corporate G&A was $1,030/oz. Operating cash flow was $20.1m and its cash position increased 31% to $43.1m. This will be needed as it will lose money in Q2 due to suspended mining operations. During the quarter, the company also reported a positive drilling from Limon Norte, highlighted by 5.1m @ 18.65 g/t and Panteon, highlighted by 10.8m @ 17.77 g/t Au.

Dundee Precious Metals: Q1 2020 was a strong quarter operationally and financially as the company produced 72.96k oz. Au, with its newest asset delivering its highest quarterly production to date. Its smelter operation, Tsumeb, had a near-record performance, achieving throughput of 65k tons. AISC was just $593/oz. and a cash cost per ton of complex concentrate smelted of $357. The company generated record free cash flow of $49.2m. The company ended the quarter with $189m of cash.

Equinox Gold: The company announced a positive PEA illustrating the potential for an additional 740.5k oz. of gold production from an underground mine at Aurizona. This would increase production from Aurizona by 65-70k oz. Au over an initial 10-yr mine life (and 80k oz. over the first full 8-years), at least initially. As the project is advanced and more drilling is undertaken there is a reasonable probability this operation can grown in terms of additional production. Combined production from the open-pit and underground would be upwards of 190k oz. annually. There remains significant exploration upside potential at Aurizona and once the operation in fully optimized, the operation should produce upwards of 200k oz. p.a. The capital costs to build the underground component (including a 25% contingency) is estimated at 70m. The cost structure is estimated to be higher relative to the open-pit but only marginally at AISC of $925/oz. Using a $1,350/oz. gold price, the after-tax IRR is 25%, increasing to 38% at $1,620/oz. Au. This is good news for the company as it outlines additional growth initiatives over the medium and long-term.

Franco-Nevada: The company reported another strong quarter in Q1 and raised its dividend for the 13th consecutive year. There were a lot of leadership changes that were planned out some time ago including Pierre Lassonde stepping down as Chairman with former CEO David Harquail appointed Chair. The new CEO is Paul Brink. In Q1, the company sold 135k AuEq attributable oz., generating $241m in revenue. Due to after-tax impairment charges of $207.4m related to its interests in SCOOP, STACK, and Weyburn, the company recognized a $99m net loss. In Q2 and likely through year-end, the company will take a hit from its oil and gas exposure but given the strength in the gold market, it will be more than made up for.

Golden Star Resources: Q1 production totaled 50k oz. Au (vs. 53.3k oz. in Q1 2019), 40.3k oz. coming from Wassa and 9.6k oz. from Prestea. Due to delayed flight schedules in the final Q1 gold shipments, the company saw a 4.3k oz. increase of dore on hand at the end of the quarter. AISC were $1,201/oz. sold but $1,165/oz. produced. The company generated operating cash flow of $13.4m before changes in non-cash working capital. Cash at March 31st stood at $42m with debt of $107.3m (net debt of $65.4m). On March 27th 2020, the Wassa underground saw a significant increase in mineral resource as M&I increased 18% (306k oz.) to 2.03m oz. and a 19% increase in Inferred to 7.1m oz.

Gold Resource Corp: The company reported Q1 production and earnings. Production from its Oaxaca Mining Unit totaled 6.45k oz. Au, 402.5k oz. Ag, 488 tons Cu, 2,514 tons Pb, and 5,844 tons Zn. Production from its Nevada Mining Unit totaled 3.7k oz. Au. The company saw elevated costs during the quarter, notably at its Isabella Pearl mine. Lower base metal prices and higher treatment charges also weighed on revenue and cash flow. The company generated $5m in cash flow from operations. Of the $5m, $0.7m were paid to its shareholders in dividends or $0.01/share. The company remains in solid financial shape with cash and equivalent of $18.4m. Up to a couple million will be needed to cover the first two months of cash outflow flow from its Oaxaca Mining Unit due to temporarily suspended mining operations.

Its Nevada operations should continue to make progress as the overburden it removes at the high-grade Pearl zone in the deposit. 2020 is really a transitional year for the company at its Nevada operations as there is more overburden to be removed with the high-grade mineralization to be mined beginning in Q3 and ramping up through year end. Increased production, lower costs and higher cash flow will be weighted toward the back half of the year, with Q4 expected to be the best quarter.

Gold X Mining: The company announced a Fast Track to a production decision. This is the strategy under the new management led by Paul Matysek. The company is taking all the steps for fast tracking its flagship asset, Toroparu, towards a production decision. The project will generate a 27.7% after-tax internal rate of return (IRR) and a 2-year payback of $378m pre-production initial capital ($272m net of Wheaton Precious Metals remaining payment for a 10% gold stream), at a $1,500/oz. gold price. This sizeable project, with 7.35m oz. of M&I resource from 202k meters and 675 diamond drill holes. There have been several feasibility level engineering studies complete. These non-optimized and the significate gold resource could allow management to unlock additional value. A feasibility level study will likely illustrate a larger project in terms of initial mine life and possible production. Per the 2019 PEA, with a revised mine schedule and operating plan for the projects (reduced starting capacity), the 2019 technical report envisions a total of 4.52m oz. of gold production at an average rate of 188k oz. p.a. over an initial 24-year mine life. For the first 11-years, processing would be via CIL plant at 11.5ktpd expanding to 23ktpd with parallel CIL leach and gravity-flotation-leach circuits.

Gran Colombia: The company announced it signed a LOI with Renergetica Colombia, a developer in the field of renewable energy and of the smart grid worldwide and an independent power producer and asset manager for third party investors. The LOI encompasses Gran Colombia’s acquisition, through its Segovia operations, of a solar project with a total installed capacity of 11.2 MW of power called “Suarez.” Capital costs associated with the project are estimated at $8m with a life of 30-years. It will connect to the Colombian National Electric System and become operational later in 2020.

Hecla Mining: The company reported Q1 2020 results. It was an unimpressive quarter and Q2 will likely be about the same to a slight improvement. While silver prices will be slightly lower (on average, the company has a floor price of $16/oz. in Q2), gold prices will be higher. Given the current metals price environment, with gold greatly outperforming silver, Hecla’s key asset is the Casa Berardi gold mine, which restarted operations on April 16th and will be the primary source of positive cash flow generation. For the quarter, the company produced 3.2m oz. Ag (but only 2.6m oz. sold) and 58.8k oz. Au, generating sales of $137m and operating cash flow of $5m. The company recognized a gain of $7.9m on metals derivatives. During the quarter, the company successfully refinanced its long-term debt (due 2021), reducing long-term debt and extending its maturity. Cash and equivalents stood at $215.7m at quarter end.

IAMGOLD: The higher cost producer generated $44m in operating cash flow on attributable gold production of 170k oz. (and 159k oz. of sales) in Q1 2020 with AISC of $1,230/oz. Gold sales were lower at Essakane due to the postponement of sales at quarter end for obvious reasons (COVID). The company maintains a healthy balance sheet with cash and equivalents of $830m at quarter end. The company has mismanaged its hedge book (through at least through the end of 2021) with a significant amount of oil hedged (using call and put options) at much higher prices (both Brent and WTI) through 2023.

Kirkland Lake Gold: Following up on its reported Q1 production numbers, the company reported strong financial results in Q1 2020. The quarter saw the added benefit of having two months of production from Detour Lake. Revenue for the quarter totaled $554.7m, an 82% increase relative to the comparable period in 2019 on the back of both higher production and gold prices. Gold sales totaled 344.6k oz., 48% higher than Q1 2019. The company generated $131m of free cash flow and $241.5m in operating cash flow. These should both be adjusted upward by approx. $60m due to the non-recurring and restricting costs related to the Detour Lake acquisition.

Lundin Gold: Having achieved commercial production on February 20, 2020, gold production in Q1 totaled 51.3k oz. Au and sold 59.32k oz. Au at AISC of $908/oz. The company ended the quarter with $57.5m in cash. The company is working towards the restart of operations and the company believes its financial position is sufficient to support the company until production resumes at Fruta de Norte.

Newmont Mining: The company reported a solid start to the year with gold production of 1.5m oz with AISC of $1,030/oz. The company generated $939, in operating cash flow and $611m in free cash flow. During the quarter, the company received $1.4b in cash proceeds from the sale of its interest in KGCM, Continental Gold, and Red Lake. The company also refinanced $1b of outstanding debt at a low 2.25% coupon. As of quarter end, the company had a cash position of $3.7b with $6.6b of liquidity, giving the company a net debt/EBITDA of 0.7x. Lastly, the company hiked its dividend 79% vs. the comparable period in 2019. Having completed its planned asset sales, average annual production (once COVID-19 suspensions are lifted) should be approx. 6.0-6.3m oz., down from roughly 7m oz. prior to the asset sales.

OceanaGold: The company appointed former COO, Michael Holmes, President and CEO. Gold and silver production during Q1 totaled 80.7k oz. and 54k oz. (91.4k oz. Au sold) at AISC of $1,218/oz. The company improved its total liquidity position through the advance of gold sales netting $79m and a fully draw down revolver, exiting the quarter with $177m in cash. Subsequent to quarter end, the company fully resumed operations at Macraes and continued development of the Martha underground. 2020 guidance remained unchanged. Operations are expected to improve as the year progresses and into 2021.

Pan-American Silver: The company reported a relatively strong quarter (from a cash flow and production point of view), significantly strengthening its balance sheet to brace for the Q2 impact of suspended operations in Mexico, Peru, Bolivia, and Argentina. The company generated $114m in operating cash flow during the quarter, though this was, for the most part, prior to mining suspensions. Earnings were significantly impacted by non-cash, mark-to-market investment losses and non-cash tax expense due to COVID-19 related currency devaluations. Pan-American has a strong balance sheet with roughly $480m of total liquidity and the company has taken precautionary steps to defer and/or reduce non-essential expenditures to preserve its financial strength. The company shouldn’t fare too horribly in Q2 as its largest assets continue limited production at the open-pit gold mines (La Arena and Shahuindo) from circulation of process solutions on the heap leach pad. Further, its Canadian operations continues to operate at 90% of capacity.

Royal Gold: Reported strong FY Q3 2020 results. Revenue increased 24.3% to $136.4m, generating operating cash flow of $99.7m. The company drew down $200m on its revolver after quarter end as a precautionary measure in the event of suspension at its operating assets, should they arise or be reinstated. The Khoemacau Project in Botswana, on which Royal Gold has an 80-100% silver stream agreement, which by the time it reaches production should account for roughly 10% of revenue (assuming a contraction in the GSR to 75:1). The company took an impairment charge on its Mt. Milligan stream due to lower annual output and a significant reduction in mine life.

This will also increase the depletion rate from $402/oz. to $764/oz. Barrick reported that it continues to advance engineering and evaluation work towards a feasibility study for the process plan expansion that could extend the mine life beyond 2040. This could also increase throughput such that Barrick maintains average annual of 800k oz. Au beyond 2022. Lastly, attributable production from Cortez will significantly increase. In 2020, production subject to its royalties is estimated at 175k oz. Au, increasing to average 425k oz. Au from 2021-2026. Some of Royal Gold’s production growth will go toward replacing assets with declining production i.e. Mt. Milligan.

Sandstorm Gold Royalties: Had a weaker Q1 on the back of lower production. This can be attributed, in part, to the cessation of fixed delivery payments of 1.5k oz. per quarter from its amended gold stream on (Bachelor Lake), which is now a royalty on Moroy (previously Bachelor Lake) and Barry. It can also be attributed to a lower realized diamond price from its Diavik royalty and a decrease in AuEq oz. sold from the Karma stream in Burkina Faso. This was partially negated by higher royalty revenue from Aurizona (as the sliding scale NSR royalty moved up to 4%), and a small amount of royalty revenue from the Fruta Del Norte mine in Ecuador. The company still generated $14.4m in operating cash flow and while Q2 should be a weaker quarter, production should increase in the 2H 2020, driven by its Relief Canyon gold stream, its Fruta Del Norte royalty, higher royalty rate at Aurizona, and improved output from its Karma stream. The company, under its NCIB, purchased and cancelled roughly 4.6m shares for $23.5m at an average price of $5.11/share. This partially negated the early exercise incentive program, whereby 15m unlisted share purchase warrants were exercised at a price of $3.35/warrant, providing a $50.25m cash inflow.

The company has been stealthy in increasing its share price buy buying back low and selling higher. The company intends to initiate an ATM equity program, raising up to $140m (basically company has been buying back a lot of stock over last 18 or so months at an average price below $5/share and should it issue shares to fund a new deal, it will likely be at $7.50/share or higher). This is more evidence that there will be a new royalty of royalty and streaming deals in this niche. The company continues to improve its liquidity position to complete sizeable royalty and streaming deals over the next 12-18 months with $5.4m in net cash (following the warrant money inflow) as at quarter end, $11m in short-term investments, $54.5m in equity and debt investments, $47.3m from in the money options and warrants (expiring November 2020), and up to $300m from its credit facility. In other words, should the company sell its investments and once the warrant and option money come in, the company will have $558m total liquidity, and approx. $575m when its investments are marked to market (and >$600m by year end from additional operating cash flow generation). Both Osisko Gold Royalties ($OR) and Sandstorm can and likely will significantly improve its 3-5-year production growth profile through several acquisitions ranging from $50-$300m.

Skeena Resources: The company continues to report successful Phase I surface drilling at its Flagship, Eskay Creek Project. This was infill drilling, meant to upgrade Inferred resources to Indicated and should improve a future PFS and FS. Though a small drill program, the highlight includes 22.50m @ 32.21 g/t Au and 121 g/t Ag (33.82 g/t AuEq) in the 21B Zone. Infill drilling within this zone has intersected substantial high-grade mineralization. This mineralization is hosted within the contact mudstones as well as mudstone-rhyolite breccias and improves upon the grades from the surrounding historical drill holes, including 19.75m @ 4.94 g/t AuEq. Skeena remains a takeover target with a gold-silver project with excellent economics. Eskay Creek has a total Indicated resource (pit + underground) of 1.9m oz. Au and 48m oz. Ag plus an additional 1.12m oz. Au and 22.5m oz. Ag Inferred. The cap-ex is very reasonable per the 2019 PEA at US$233m for a project that is expected to average 236k oz. Au and 5.8m oz. Ag annually over the life of mine. It also has a very attractive cost structure with AISC of $615/oz. Using a $1,500/oz. gold price and $18/oz. long-term silver price, yields an after-tax IRR and NPV of 63% and $625m, with a payback period of just 11 months. A pre-feasibility study is expected to be complete in the 1H 2021.

TMAC Resources: Has agreed to be acquire by a Chinese gold company, Shandong Gold for C$1.75/share in an all cash deal. The total equity value is roughly $150m on a fully diluted basis. This represents a 52% premium to TMAC’s 20-day VWAP as at May 6th, 2020. Resource Capital, Newmont Mining and directors and officers of TMAC collectively holding 58.6% of the current outstanding TMAC common share have agreed to support the transaction. This may turn out to be a good acquisition but will require significant capital investment to be realized. Time will tell.

Torex Gold: With another solid quarter (operationally and less so financially) under its belt (production of 108.54k oz. Au), the company remains well position to advanced its development projects. Its cost control program was successful, with oxygen addition to the leach circuit, resulting in a 25% reduction in cyanide consumption since the start of the program. The company failed to properly hedge its currency as a result of the COVID pandemic, wasting an opportunity to capitalize on a depreciating Peso impacted earnings. The company also accounting changes to stockpiled ore resulted in an increase of $100/oz. to both total cash costs and AISC. This will decline over coming quarters. Cash costs and AISC were $794/oz. and $975/oz. (would have been $694/oz. and $875/oz.). Q2 earnings will take a significant hit due to the forced suspension of its only operation in Mexico. The recommencement of operations is expected to be May 18th as the company believes it will qualify for the earliest star-up based upon the lack of COVID cases in the GGB. In late April, Torex drew $50m on its revolver as a buffer, giving the company a cash position of $135m as of the end of April 2020 and has the ability to draw down an additional $50m on its revolver.

Kinross: Like its peer group ($NEM, $GOLD, $KL, etc.), Kinross reported a strong quarter despite lower output, which was more than negated by higher gold prices. Kinross’s expertise tends to lie in O/P heap leach operations, so even if it has to suspend mining operations, production could continue for a while at a reduced rate. But none of its mining operations have been impacted thus-far. The company production 567k Au. With AISC of $993/oz. Free and operating cash flow during the quarter was $299m and $418.6m, a 19% and 81% increase relative to Q1 2019. As at March 31, 2020 Kinross has cash and equivalents of $1.14b and total liquidity of $1.9b, having no maturing debt until September 2021. The company received an upgrade to its credit rating by Moody’s to investment grade. Tasiast achieved record production for the second consecutive quarter.

Wesdome: A top takeover candidate among junior producers reported a strong first quarter operationally and financially. The company produced 24.45k oz., a 36% increase over the comparable period in 2019. The company generated C$16.7m in free cash flow, resulting in a cash position at the end of quarter of C$49.4m. AISC was US$1,058/oz., higher relative to the 2019 comparable quarter due to lower grades and decision to process stockpiles in response to uncertainty surrounding the impact of COVID-19. The Eagle River mine is in reduced operations due to COVID management and because of accelerated mining of the stockpile, production is expected to be lower in Q2, though the company is maintaining 2020 guidance of 90-100k oz. with AISC of $985-$1,040/oz. The company also announced it will likely not drill out its planned 237k meters.

Wesdome increased reserves at Eagle River by 36% net of 91k oz. of depletion to 550k oz., 72% of which is located in the high grade 300 zone. M&I resources (exclusive of reserves) by 258% of 3.6x relative to 2018 to 111k oz. Au. The value at Wesdome lies in part at Eagle River given its exploration upside but more so at its Kiena project.

Wheaton Precious Metals: Similar to its primary competitor, Franco-Nevada, the company reported an outstanding Q1 2020. Driven by record attributable production at Penasquito and continued outperformance at Salobo, the company’s total attributable AuEq oz. produced a total of 182k oz. (selling 166.1k AuEq oz.) and generating $177.6m in operating cash flow. The company continues to deleverage its balance sheet with a net debt position of $590m (and net debt position net of equity investments of $430m). At the Constancia mine, Hudbay announced the formal approval of the surface rights agreement for the higher-grade Pampacancha satellite deposit, which should increase Wheaton’s attributable gold production from the asset by over 30k oz. from 2021-2025.

The company remains in great shape even though some key assets remain temporarily suspended and as such, look for the company to spend up to $1.5b+ on new streaming interests over the next 24 months. These are likely to be on the base metal side (byproduct). On its recent conference call, when discussing its deal pipeline (only those which the company has completed due diligence on prior to the end of Q1), the company mentioned that these were more or less split 50-50 between gold and silver. Obviously silver deals offer the most upside in terms of value creation but they are also harder to come by. As I’ve written before, a streaming interest in Bear Creek’s Corani silver-lead-zinc project makes the most sense as the company does need and additional $200-$250m to complete a financing package.