Chris Marchese

Chief Mining Analyst, GoldSeek & SilverSeek

Week Ended March-13, 2020

$USA $EDV.to $EQX.to $FSM $FNV $WPM $KGC $MAX.to $OSK.to $PVG $NVO.V

America’s Gold and Silver Corp: Reported FY 2019 production of 5.8m AgEq oz, though only 1.2m oz. of that was actual silver ounces, the rest being base metals converted to silver equivalent. 2019 was a transition year for the company as it recapitalized and entered into a JV agreement with Eric Sprott for its Galena Complex. Having visited the site a couple times over the years, it is a solid smaller silver operation but optimization measures, a larger resource base and in turn production coupled with higher silver prices will make this a profitable operation in a couple of years. The real-story here is achieving commercial production at its Relief Canyon gold mine. When first acquired, this was going to be a profitable operation but with low margins, but now with gold $200-$250/oz. higher, it should have solid margins (assuming a long-term gold price deck between $1,450-$1,500/oz). In other words, it is looking like the worst days are behind it and over the next year and a half, should begin to generate a fair amount of cash flow.

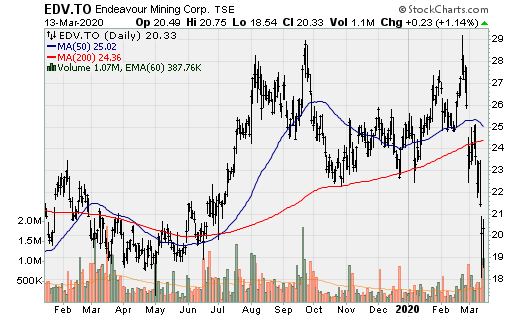

Endeavour Mining: Another strong year for the company, with a material bump in cash flow expected in 2020. FY 2019 production totaled 651k oz. Au (178k oz. in Q4) with AISC of $818/oz. Cash flow from operations totaled a whopping $120m (1.10/share) in Q4 and $302m in FY 2019 ($2.75/share). Now that the four years of heavy capital investment is passing, the company is quickly deleveraging, reducing debt by $132m in 2H 2019. Endeavour had a rather large overhang, that being the issuance of convertible bonds that could have led to significant shareholder dilution. But due to the combination of increased production, lower AISC and higher gold prices, it is allowing the company to pay down debt and soon repurchase a good amount of the convertibles, thereby keeping the potential dilution to a minimum. Companywide M&I resources increased 1.2m oz. (net of depletion) while 2P reserves remained flat, although an increase is expected in Q2 with the conversion of the maiden 1m oz. indicated resource for Kari West and Kari Center.

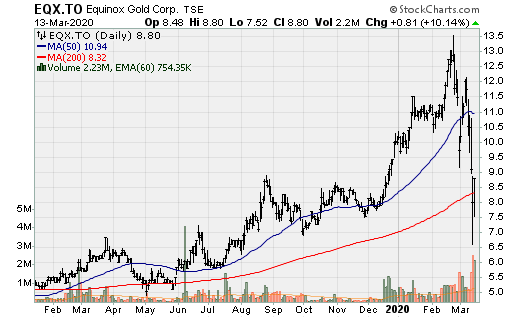

Equinox Gold: Completed the all-stock transaction of Leagold, creating the world’s next emerging senior gold producer. The company continues to trade at significant discount to Net Asset Value (using a long-term gold price deck of $1,400/oz.). The company has a countless number of catalysts over the coming 3years and that’s assuming the company doesn’t engage in additional M&A, which is highly unlikely given the Chairman’s stated objectives and the fact that he, serial successful entrepreneur is willing to invest an addition $460m of his own capital! (should the company find the right project). By 2023/2024 or so, I expect Equinox to produce 1.2-1.4m oz. Au with a cost structure in the bottom half of the industry cost curve. Coming catalysts for the company include but aren’t confined to:

· Integration of Leagold’s assets, which will increase companywide production from approx. 215k oz. Au in 2019 to 670-705k oz. Au (+200k oz. Au from Los Filos, +200k oz. from Pilar, RDM, and Fazenda, and +20k oz. Au from Castle Mountain Phase I) for 2020.

· In 2021, the Los Filos expansion will be complete, increase output by +125-to+160k oz., bringing companywide production to +900k-to+925k oz. Au.

· Construction to bring Santa Luz back into production in 2020, due to the short buildout period, increasing production 90-105k oz. Au and thereby increasing companywide production to between 990k-1.03m oz. Au

· Castle Mountain Phase II should also be completed in 2022, but 2023 will see its first full year of production, increasing companywide production by additional (+150-to+160k oz. Au), to a total of 1.15m oz. Au-to-1.20m oz. Au.

· Beyond that, there are additional opportunities such as an underground operation at Aurizona or a potential underground mine at Santa Luz, and M&A.

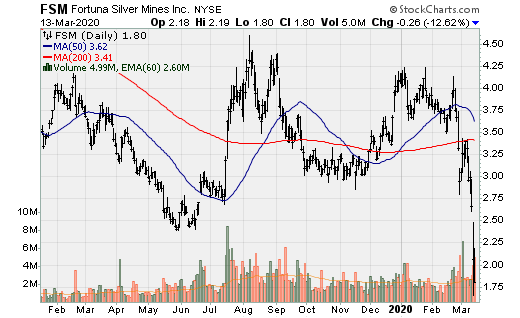

Fortuna: Reported solid FY 2019 results, although investors should really pay Lindero attention, which should give earnings a nice boost as early as Q3, increasing in Q4 and 2021. When commercial production is achieved and production fully ramped up, Lindero will more than double operating and free cash flow. In 2019, Fortuna produced 8.81m oz. Ag and 50.53k oz. Au with all-in sustaining costs (AISC) of $11.90/oz. AgEq. Operating cash flow is higher than one would think because Fortuna’s definition of silver-equivalent is silver + gold + zinc + lead, as opposed to the majority of companies which use gold and base metals or base metals as byproduct credits to reduce the AISC per silver ounce. Operating and free cash flow were approx. $65m and $35m for FY 2019, a 13% and 9% decrease relative to 2018 on the back of slightly lower production and reduced base metal prices (when adjusting for changes in non-cash working capital). The company remains in strong financial condition with $84m in cash and $110m drawn under its $150m credit facility. Construction of the Lindero open-pit heap leach operation was 89% complete at the end of January 2020, so the ramp-up to full scale commercial production should commence sometime in April.

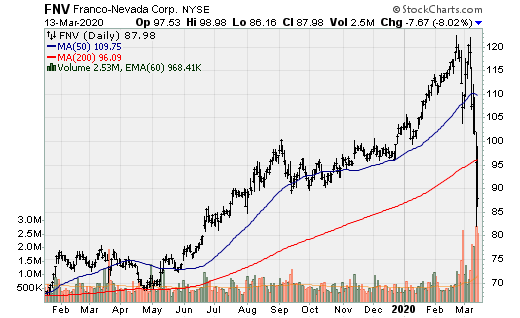

Franco-Nevada and Wheaton Precious Metals: The two stalwarts in the royalty and streaming niche put up excellent results once again. Franco set a new record with 516k AuEq oz. sold for FY 2019 with records set on every metric i.e. revenue, net income, EBITDA, and operating cash flow. Franco-Nevada’s most valuable asset, Cobre-Panama started to really impact performance for the better in Q4 (and will continue to do so over the next 3 years) as the company’s attributable gold-equivalent production totaled 153.4k oz. (>600k AuEq oz. annualized). 2020 guidance is for 550-580k AuEq oz. and $80-$95m from its energy assets. Looking out 5-years, by 2024, AuEq production is expected to be 580-610k oz. and $115-$135m in revenue from energy assets. The growth of Cobre-Panama through 2023, will contribute to growth but also make up for royalties and streams that will either drop-down, see lower production or becoming depleted. Franco, like Wheaton Precious, is on the hunt for sizeable deals to complete in what is an ideal scenario, in that base metal producers are looking to improves its balance sheet or engage in M&A and in turn willing to part with precious metal byproducts, in addition to the cost of royalty and stream financing being well below the cost of equity.

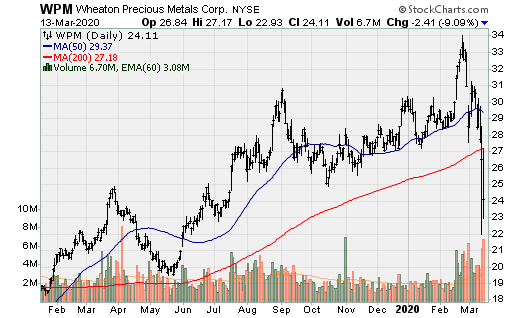

Wheaton Precious also generated record operating cash flow on the back of record gold production and sales volume in 2019. 2019 saw the company generate over half a billion in cash flow from operations. Gold equivalent production totaled 707k oz. consisting of 406.7k oz. Au, 22.56m oz. Ag, and 22k oz. Pd. 2020 production is estimated to be 390-410k oz. Au, 22-23.5m oz. Ag and 23-24.5k oz. Pd for AuEq production of 685k oz. Over the next 5-years, AuEq production is estimating to average 750k oz. AuEq. This will likely be considerably higher as there is a high-probability that the gold-to-silver ratio contracts significantly. Even if it only contracts back to 55 or 60:1, this should increase AuEq production by 110-130k oz. Wheaton Precious Metals also has robust organic growth, optionality, and given the fact it has implicitly made it known another round of deals is nearing.

Embedded Growth: Keno Hill, Pampacancha, Voisey’s Bay, a significant increase in silver output from Penasquito as it enters the highest-grade portion of the pit. Salobo III only partially accounted for given the projected start-up.

Growth not accounted for (optionality): Rosemont (initially given the go-ahead in 2019 but was repealed), Pascua-Lama (definitely outside the 5-year horizon), Navidad, Toroparu, Kutcho Copper, and Cotabambas. Growth not currently accounted for has the potential to increase production by +55k oz. Au and +12.5m oz. Ag.

The company has explicitly said its deal pipeline is busier than ever. In Q2-Q3 2019, the company said the pipeline was filled with sub $300m deals, the majority of which were development projects. The company changed its tune in late 2019/early 2020 saying that a lot more companies were knocking on its door, looking for more sizeable deals, with a primary focus on base metal projects. In the earnings announcement, Wheaton Precious said it has extended its $2b revolving credit facility with a 5-year term. It also announced an at the market equity financing program, from which it could raise up to $300m. By the end of Q1, WPM will have liquidity to complete up to $1.9b in deals (if the $300m was raised and taking into account the value of its equity portfolio and its cash position).

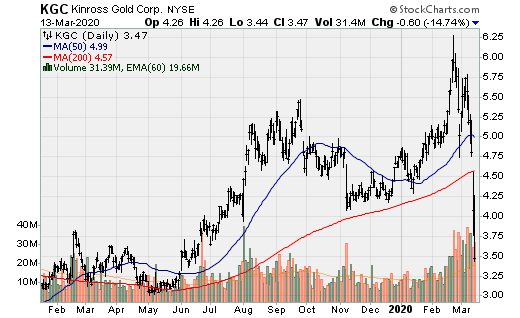

Kinross: Released some very encouraging news at one of its cornerstone assets, Paracatu. It filed a new technical report outlining a mine life of 12 years with average production of 540k oz. Au at lower costs. It also added 828k oz. in reserves and 1.1m oz. in M&I resources. The next 5 or so years will be very exciting for the company with the La Coipa restart, expansion at Tasiast from 16-17ktpd to 21ktpd (by year end 2021) and 24ktpd (by year end 2023).

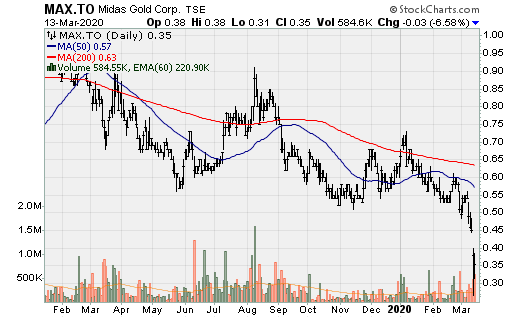

Midas Gold: Announced that it is repricing its previously announced private placement (announced on February 27, 2020) due to market turmoil. The purchase price under the offering has been reduced from C$0.53/share to C$0.4655/share. This will cause a lot of dilution (37.66% of the company’s currently issued and outstanding common shares). This equity financing will raise US$35m.

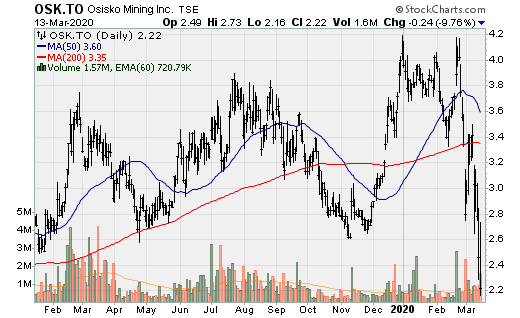

Osisko Mining: Continues to increase the confidence level in its existing resource as well as expanding it at its high-grade Windfall project. The drill program is currently focused on the Lynx deposit, exploration on the main mineralized zones, and deep exploration in the central areas of the mineralized intrusive system. The following are some highlights from the new results:

· 2.4m @ 948 g/t Au

· 2.1m @ 360 g/t Au

· 5.1m @ 72 g/t Au

· 2m @ 139 g/t Au

· 3.4m @ 71.2 g/t Au

· 2m @ 113 g/t Au

· 11.2m @ 19 g/t Au

· 3.5m @ 41.1 g/t Au

· 3.2m @ 58.4 g/t Au

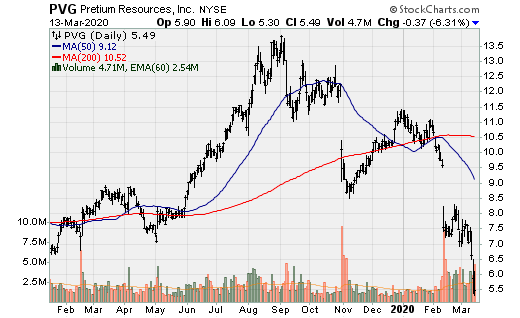

Pretium Resources: As expected, Pretium released another reserve and resource estimate and life of mine plan. The mine life, as it stands now is 13-years, with average annual production of 367k oz. Au for the first 9-years. Using a long-term gold price deck of $1,600/oz, the after-tax NPV is $2.13m, a far cry from what this was supposed to be relative to when average annual production was supposed to be upwards of 525k oz. Au (due to increased throughput). The new all-in sustaining costs (AISC) is now $691/oz. at the mine level and $743/oz. at the corporate level. Relative to the 2019 report, the after-tax NPV has taken a significant hit. In the 2019 report, the gold and silver price deck used was $1,500/oz. Au and $19.50/oz. Ag, which yielded an NPV5% of $3.18b. In the 2020 report, using a higher gold and silver price of $1,600/oz. and $20.80/oz. yields an NPV5% of $2.135b or a 33% decrease even with the use of higher metal prices. Pretium still remains a great takeover target for a senior or large mid-tier producer.

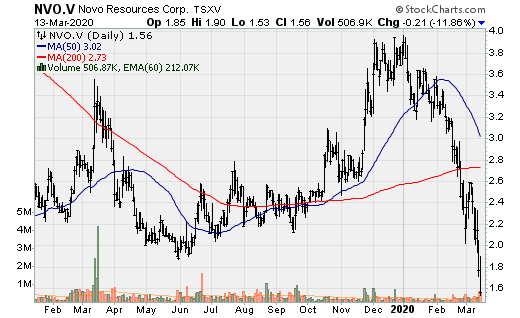

Novo Resources: The company will acquire a 100% interest in Purdy’s Reward and 47k Patch and dissolves the Artemis Resources joint venture. Novo is consolidating its mineral property holdings in the Karratha region of Western Australia via the acquisition of these two properties. In consideration for the 50% of each project Novo didn’t own, Novo will issue 2m common shares and grant Artemis a 1% NSR royalty over the 47k project.

Chris Marchese for the Gold Seeker Report

Chief Mining Analyst at GoldSeek & SilverSeek

Chief Mining Analyst with GoldSeek and SilverSeek. Previously he was the Senior Mining Equity and Economic Analysis at The Morgan Report. He was a Co-Founder and Director of Lemuria Royalties, before it was acquired in March 2018. He also co-authored The Silver Manifesto with David Morgan in 2015.

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. GoldSeek.com, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; GoldSeek.com makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of GoldSeek.com only and are subject to change without notice. GoldSeek.com assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto. Fortuna Silver Mines is not a sponsor of this, or any other related, websites. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.