Excerpt from this week's: Technical Scoop: Armageddon Belief, Precious Benefit, Market Divergences

Source: www.stockcharts.com

Despite a bumpy past few weeks, gold managed to gain roughly 1.4% in May. On the year, we are up 13.2%. Silver has done even better, up 14.2% in May and 26.4% in 2024. Nonetheless, the market often tends to look at the negatives for gold, The past two weeks have been down for gold, and, as well, four of the past six weeks have been down. That’s when we start seeing articles that question the value of holding gold. Yes, gold’s upward push has been helped immensely by central bank buying and Asian buying, particularly China and India as the people snap up gold as a hedge against all of the real estate problems and economic uncertainty. Central bank buying has been spurred on concern about the West, EU, and U.S. seizing Russian reserves to be used by Ukraine. De-dollarization is a theme that can’t be ignored. However, the “why hold gold” crowd cites that gold ETFs have faced net withdrawals.

However, the indictment of former president Donald Trump has raised some questions about “why hold gold.” Political uncertainty and loss of confidence in government are two reasons. But gold, unlike other asset classes, is nobody’s liability. Gold is also private as opposed to digital. Of course, we are talking about physical gold (and silver) bullion as opposed to gold stocks, gold ETFs, digital gold, and more. Even Bitcoin that crypto fans claim is private leaves a digital footprint somewhere. Cryptos are also massive users of energy so they have climate and energy implications. Gold mining is also dirty and leaves dangerous tailing ponds. Cryptos are hacked, stolen, and used for money laundering and numerous scams. However, gold too can be stolen—remember the recent Pearson Airport heist? However, in many instances the perpetrators are also caught. Hello, Sam Bankman-Fried. So, there are pluses and minuses.

Gold’s privacy is paramount. As an article in MarketWatch suggested, if Trump had paid off stormy Daniels in gold coins there’d be no record (www.marketwatch.com/story/trumps-guilty-verdicts-make-34-cases-for-gold-bb962dd8). Using the regular banking system, irrespective of how you disguise it, leaves a paper trail. Certainly, that’s an argument against moving to exclusively digital currencies where every coffee purchase is tracked.

On the week, gold gained 0.5% while silver was off 0.2%. Platinum was up 0.3%. The near precious metals were off as palladium fell 5.9% and copper came off its highs, down 3.2%. The copper rally in particular we do not believe is over. The gold stock indices were mixed as the Gold Bugs Index (HUI) rose 1.1% but the TSX Gold Index (TGD) fell 0.2%. The gold exploration mining dominating the TSX Venture Exchange (CDNX) gained 0.5% on the week. The reality, however, is that gold stocks remain very cheap compared to the price of the gold. Junior mining exploration stocks remain even cheaper as they are under-owned, unloved, and unrecognized by the broader investing public. However, if a shift comes, that market can move upward swiftly because of the lack of product. A breakout over 300 for the HUI and 340 for the TGD could start a more significant rally.

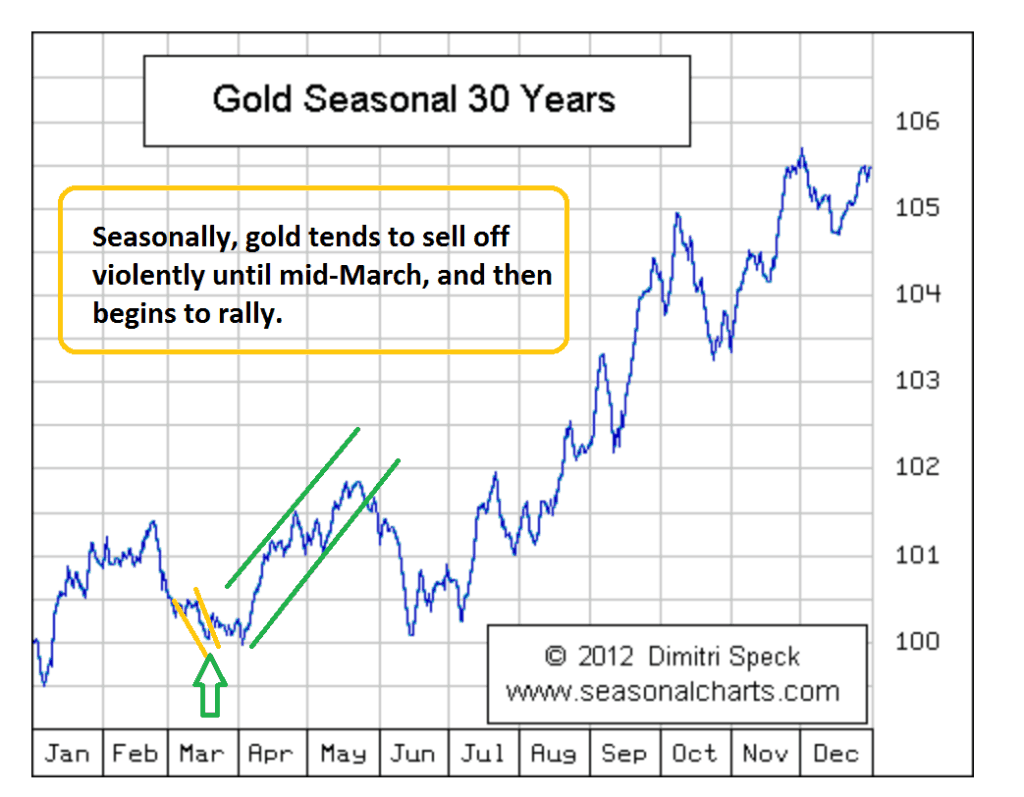

May and June tend to be weak months for gold. But, as the chart below suggests, once seasonal weakness is out of the way gold has a tendency to soar. A low could come in June, but normally no later than July. The current pullback is to be accumulated. The seasonal chart below is over 30 years. A look over a 40-year seasonal chart shows the decline into May/June/July is even more pronounced. But after that a rally gets underway with usually an interruption into September/October that can drag into December if the top is later. Given the political uncertainty that the U.S. election in November is sure to generate, there might be numerous reasons to hold gold. As well, geopolitical uncertainty continues in Russia/Ukraine/NATO, Israel/Gaza/Lebanon/Syria/Iran, and U.S./China. Even we were surprised to read that over one-third of Canadians believe another world war could occur over the next 5–10 years. Given the current geopolitical situation, they may not be wrong.

Gold could be forming an ABC corrective pattern with the potential to test that secondary support near $2,275. The A and B waves are complete. We may be working on the C wave. Or if current levels hold, we could be tracing out a rising or ascending triangle which is bullish. However, that is normally a five-pronged correction of the nature abcde. Silver had quite the run, topping at $32.75. Then silver fell to $30.24 before rising again to $32.51. Now silver is off again, last at $30.44. A test under $30, the breakout point, is now not impossible. Strong support can be seen down to $28. Nonetheless, we continue to view this as a corrective period with a low either sometime in June but no later than in July. Currencies, which can impact the price of gold, were mixed this week with the US$ Index flat on the week as was the euro. The Swiss franc, which is often viewed as a safe-haven currency, jumped 1.4%.

A quick note on oil. WTI oil did not have a good week, falling 0.9%. Brent crude was also down 0.9%. Natural gas (NG) fell 6.5%, but NG at the Dutch Hub gained 2.0%. The ARCA Oil & Gas Index (XOI) was up 1.3% and the TSX Energy Index (TEN) gained 1.5%. A lot of oil sloshing around and there has been no major Middle East clash to impact the price—at least, not yet. But eyes will be on an upcoming OPEC+ meeting that could see production cuts. As a result of OPEC cuts, the U.S. is now the world’s largest producer. But they are also the world’s largest consumer and still import oil primarily from Canada.

Source: www.seasonalcharts.com, www.goldsurvivalguide.co.nz

Read the full report: Technical Scoop: Armageddon Belief, Precious Benefit, Market Divergences

Copyright David Chapman 2024

Disclaimer: David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.