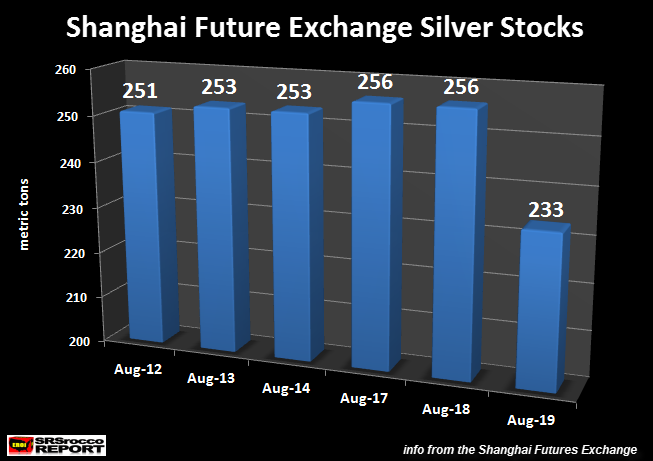

In a surprising update, the Shanghai Futures Exchange reported one of the largest single-day withdrawals of silver off its exchange today. As of yesterday, the total amount of silver stored at the Shanghai Futures Exchange (SHFE) was 256 metric tons (mt). If we look at the chart below, we can see how the SHFE silver inventories grew slightly over the past week and then dropped significantly today:

From Aug 12th to Aug 18th, the silver stocks at the SHFE increased a mere 5 mt, from 251 mt to 256 mt. However, in just one day, silver inventories fell a whopping 23 mt to 233 mt today. This was nearly a 10% decline of total silver warehouse stocks at the SHFE in a single day. If we convert 23 mt to ounces, it turns out to be 739,450 oz. That’s a lot of silver.

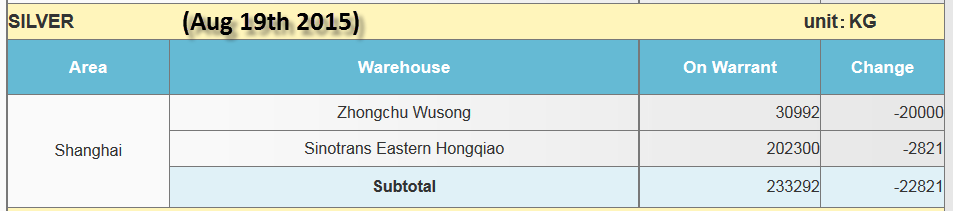

For the individuals who want to see the real proof of the data, here is the actual screenshot from the Shanghai Futures Exchange website:

These figures are stated in kilograms, which converts to 22.8 mt. I just rounded the figures to 23 mt. Furthermore, you will notice the larger 20 mt withdrawal came from the Zhongchu Wusong warehouse. Even though total SHFE silver inventories declined nearly 10% today, the majority of it came from the Zhongchu Wusong warehouse. Thus, the Zhongchu Wusong warehouse suffered a 40% decline of its silver inventories in one day (50.9 mt to 30.9 mt).

Now compare this to how much was taken off the COMEX yesterday:

Here we can see that the COMEX reported a total 675,541 oz silver withdrawal yesterday. Even though this is a pretty nice size withdrawal, it was less than a 1/2% of total COMEX silver inventories. So, the single-day 739,450 oz silver withdrawn from the SHFE was even larger than the 675,541 oz removed from the COMEX.

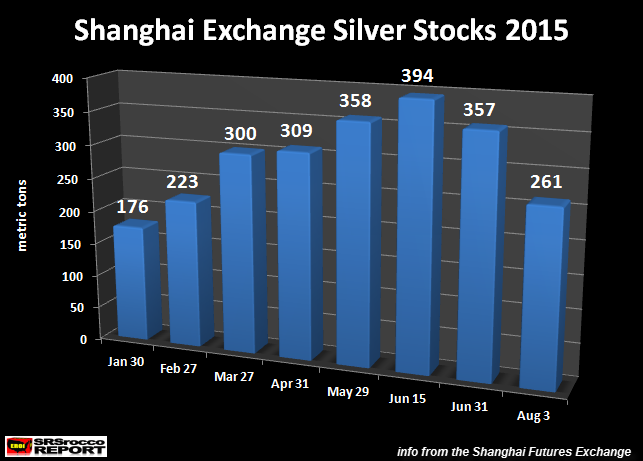

For whatever reason, investors in China have been withdrawing silver from the Shanghai Futures Exchange at an increased pace ever since the warehouse inventories peaked at 394 mt on June 15th:

So, in a little more than two months, the SHFE silver stocks have declined a whopping 41% from 394 mt (June 15) to 233 mt today. We have seen the same kind of decline at the COMEX Registered Silver Inventories, but over a longer period of time.

The chart below (from Sharelynx.com) shows the decline of COMEX Registered from a peak of 70.6 Moz at the end of March to 55.8 Moz currently. This was a 21% decline (15 Moz) in a little more than four months:

For those who do not understand the difference between Eligible and Registered Inventories, here is an explanation taken from Jesse’s Cafe Americain site:

The eligible category means that the silver is in a condition that conforms to the standards of delivery. Size and quality of the bar in other words. It is being stored at the Comex warehouse, but is not offered for delivery into contracts.

Registered means that the silver is available for delivery to those who demand bullion by being registered as such with a bullion dealer, in addition to being in a fit condition to satisfy the contract.

Eligible silver can become registered and deliverable if the owner of the silver declares it saleable at some price. And of course if it is there, and otherwise unemcumbered by senior obligations or conspicuous absence.”

Investors need to realize something has changed in the silver market ever since financial turmoil increased significantly due to a possible Greek Exit of the European Union in the middle of June. Even though we are not seeing a massive shortage of silver on the wholesale market, that could arrive overnight.

I will be putting out an article on the upcoming global silver shortage at the end of this week. I encourage investors to check it out as it will try to explain how quickly global silver supplies could dry up… virtually overnight.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: