Excerpt from this week's: Technical Scoop: Anticipatory High, Gilded Age, Commodity Impact

Source: www.stockcharts.com

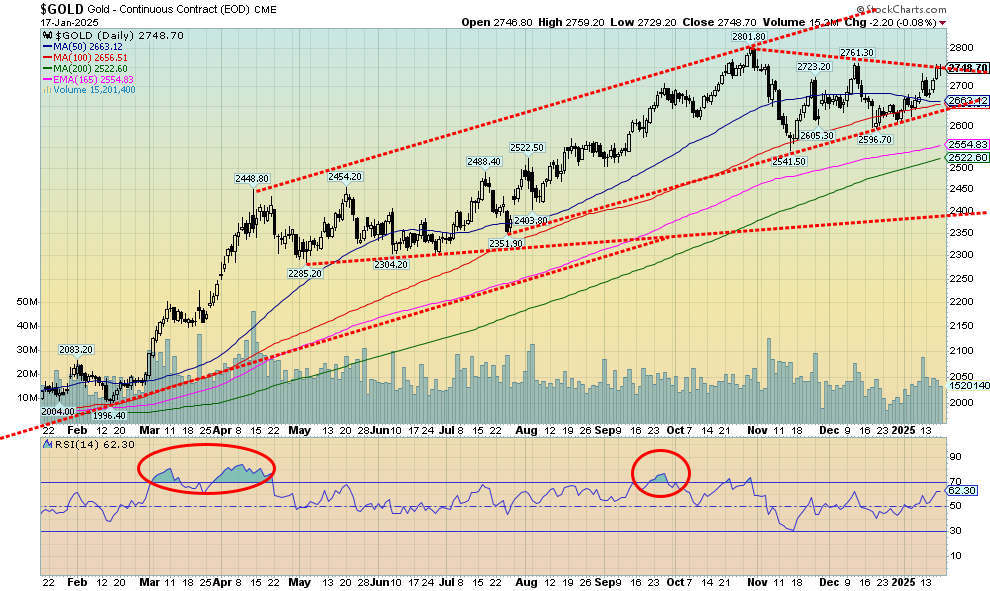

Despite a down Friday, gold prices managed to gain this past week, up 1.2%. Silver was down 0.5% while platinum fell 3.1%. Of the near precious metals, palladium was down 0.1% while copper (a leading indicator) gained 1.6%. The Gold Bugs Index (HUI) was up 1.1% and the TSX Gold Index (TGD) gained 1.9%. The catalyst for gold was the unknowns surrounding the incoming president, Donald Trump. Trump’s policies on trade, tax cuts, deportations, etc. all give rise to uncertainty and that in turn is positive for gold. Demand has been shooting up in the London gold market as dealers seek to purchase physical bullion to close out futures trades in New York. The demand was to bring the bullion to the U.S. before any tariffs could be imposed. The same is happening with silver. The fear is that there just isn’t enough physical supply around.

Lease rates have soared to their highest level in decades. That hasn’t stopped the hunt for physical gold and silver, even as some suggest that because gold and silver are monetary metals they’d be exempt from tariffs. All these squeezes in the physical market could send gold and silver prices even higher. Gold stopped at our $2,750 breakout spot this week, but we fully expect it to break above it soon. A strong U.S. dollar on Friday dampened gold a bit. But we noted that despite gold slipping the gold stocks rose. That’s ultimately bullish. Targets for gold remain up: $3,060 for gold and at least $38/$39 for silver. Higher prices could be seen later. The policies of incoming president Donald Trump could be very positive for gold as it is expected that the debt will grow even faster. And the market is also looking for at least two rate cuts from the Fed in 2025. If, as we noted, 2025 is a year of chaos and volatility, gold will do well in that kind of market.

Source: www.stockcharts.com

Despite gold rising this past week, silver prices softened, losing 0.5%. Still, with being only slightly over two weeks into the new year, silver is up 6.5% vs. gold up 4.1%. Only the gold stocks (HUI, TGD) have gained more than silver. Silver fell sharply on Friday, once again falling short of a breakout of that downtrend line from the October high of $35.07. We need to get through $32 resistance to break out and we need to break above $33.75 to suggest new highs above $35.07. Despite everything, silver is leading gold, which is what we want to see in a bull market. Note: silver also leads to the downside. Silver has support down to $30 and $29.50. However, we still need to break above $32 to suggest to us that a low is in. Further resistance can be seen up to $33.25, but above that level the $33.75 breakout looms. Despite silver’s struggles, it still appears to hold more upside promise than gold. Gold has been making new all-time highs for sometime now. On the other hand, silver’s all-time highs were made in 1980 and in 2011 near $50.0. On an inflation-adjusted basis, that’s $175 and $67 today.

Source: www.stockcharts.com

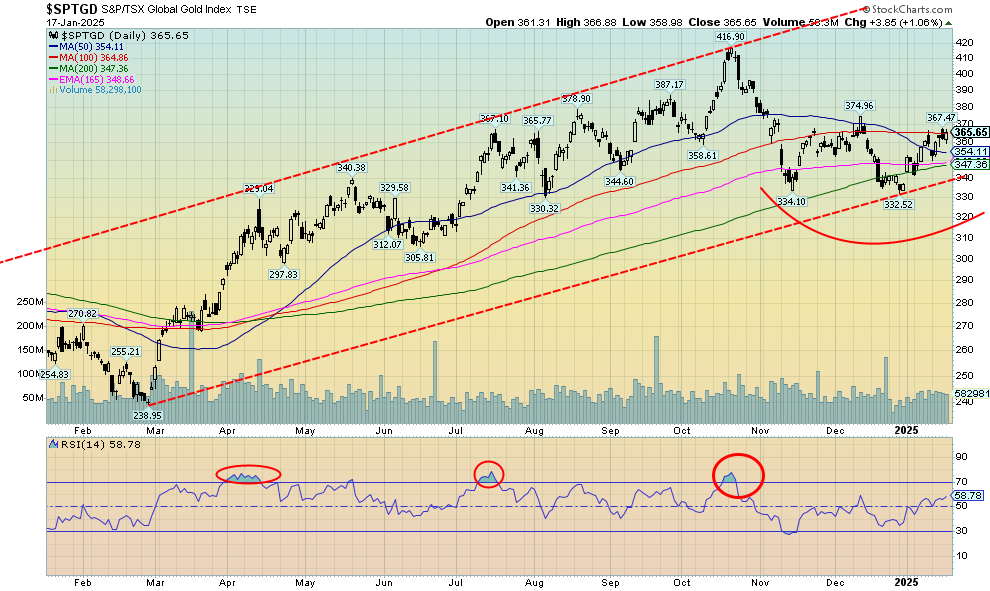

Gold stocks continued their recent rise this past week. What’s especially impressive is that they rallied on Friday despite a drop in gold prices. The TSX Gold Index (TGD) gained 1.9% this past week while the Gold Bugs Index (HUI) rose 1.1%. The TGD still needs to break out over 400 to suggest to us we could see new highs over 417. We still remain a long way from the 2011 high of 455, which would be at least 610 today after adjusting for inflation. The TGD stopped at the 100-day MA, a potential resistance zone. The HUI is at resistance of converging 50- and 200-day MAs, with the 100-day still above at 308. The HUI needs to break above 334 to suggest new highs. Its all-time high, also in 2011, was at 639. We are a long way from that level. It shows how gold stocks remain undervalued, despite gold itself flirting with all-time highs. Over on the TSX Venture Exchange (CDNX) where it’s 50%+ junior mining stocks, it is even more undervalued. Sometimes it feels like nobody knows junior mining stocks even exist, so enamoured are they with AI and cryptos. But as another writer pointed out, junior miners perform best in a bust economy as they did in the 1930s and 1970s. The sector remains an accumulation buy. Support for the TGD is down to 345 and 340. Under 340, we are most likely headed lower.

Excerpt from this week's: Technical Scoop: Anticipatory High, Gilded Age, Commodity Impact

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.