The Scorecard

Source: www.stockcharts.com

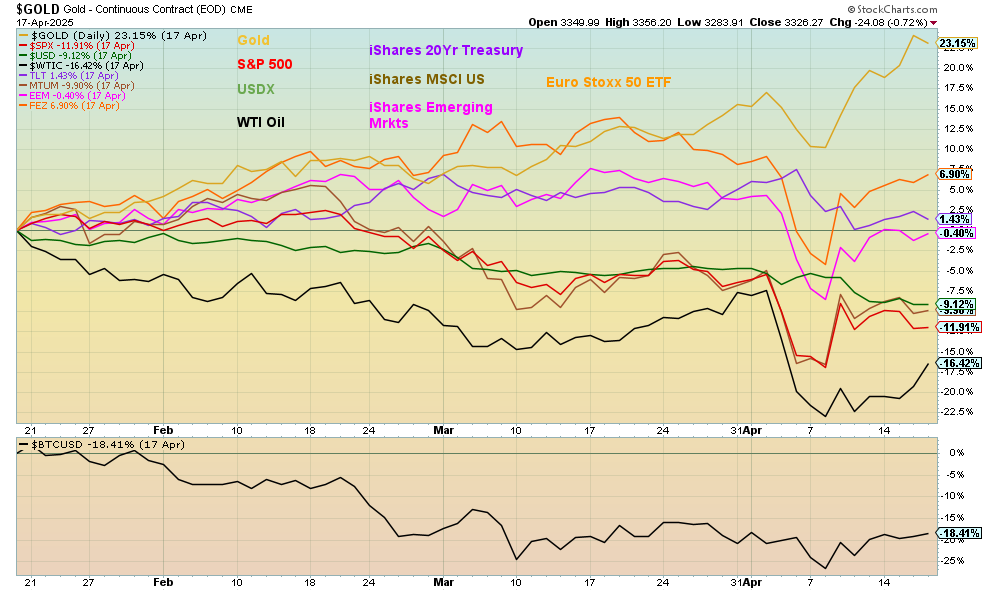

Here’s our scorecard. We’ve changed the date from November 5, 2024, the date of the election, to January 20, 2025, the date of the inauguration and official start of the Trump presidency. The only other change we’ve made is to add the Euro Stoxx 50 ETF to represent the EU market. Not surprisingly, gold remains the best performer since January 20, up 23.2%. Next is the Euro Stoxx ETF, up 6.9% and rising. This is the one that may be reflecting the flight of capital from the U.S. to Europe. For bonds, as represented by the iShares 20-year treasury bond, the gain is a small 1.4% so far. All others are down: S&P 500 down 11.9%, the US$ Index down 9.1%, WTI oil off 16.4%, the MSCI Momentum Stocks down 9.9%, and the best-performing one iShares Emerging Markets down 0.4%. For the record, the TSX is down 3.5%, highlighting Canada’s outperformance.

Gold

Source: www.stockcharts.com

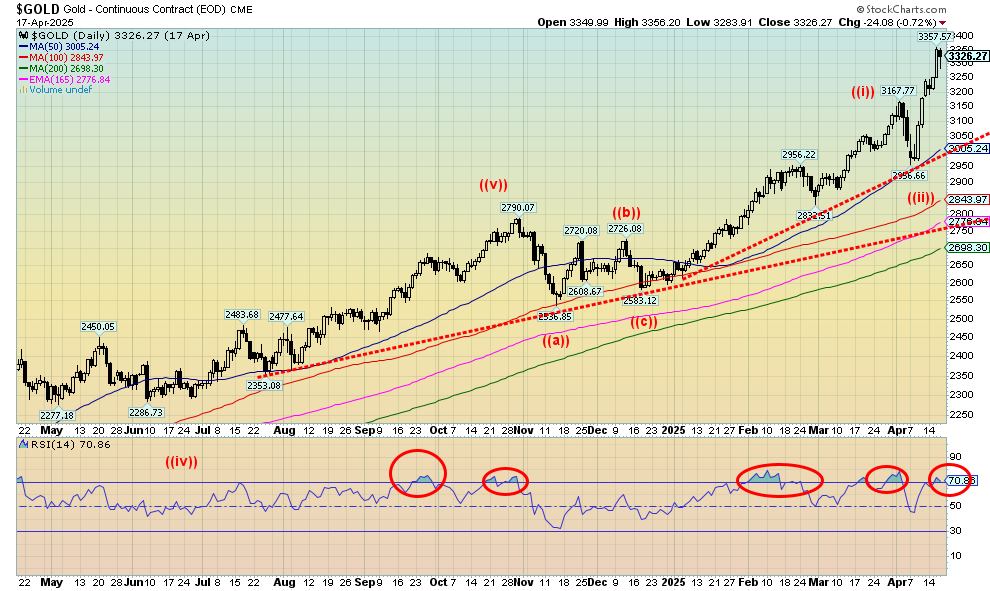

The prime beneficiary of the current market chaos has been gold. Or, as we say, gold is protection against geopolitical tensions, economic uncertainty, and loss of faith in government. It is also protection against currency devaluation. Right now, we have all four in play. Inflation/deflation are merely side issues as both are contributors to economic uncertainty. From that standpoint, it is no surprise that gold is up 26% in 2025, consistently making new all-time highs. Not only has gold regularly been making nominal new all-time highs, but it is now equaling the inflation-adjusted high of January 1980. That high is now at $3,395 with the high this past week at $3,356.

On the week, gold gained 2.9%. However, our big bugaboo is the gross underperformance of silver. Usually in both bull and bear markets silver leads. This past week silver gained only 1.0% and is up 11.2% in 2025, badly lagging gold. There are a number of reasons for this, but one appears to be suppression in order to keep silver prices lower, given its extensive use as an industrial metal with the monetary aspects pushed aside. The gold stocks remain ultra-cheap with gold/HUI ratio last at 8.3. The all-time high was 10.9. It needs to first break under 8, then under 6.5 to suggest to us that we are breaking down and gold stocks would outpace gold itself. The all-time low was 1.55 made way back in 2004.

Nonetheless, the gold stocks have done well in 2025. The Gold Bugs Index (HUI) gained 2.4% and is up 45.0% in 2025 as it made new 52-week highs. The TSX Gold Index (TGD) has been even better, up 1.7% this past week and up 45.7% in 2025 to record highs, taking out the high of 2011 on a nominal basis. Inflation-wise, the TGD still has a way to go, needing to exceed 625 vs. the current high of 497.

For the record, this past week platinum was up 2.8% but only 5.9% on the year, a distinct laggard. Near precious metals are palladium, up 5.8% this past week, and copper, up 4.0%. Copper made all-time highs earlier and remains a key metal going forward in 2025. Copper is up 16.6% in 2025. A quick mention of energy: WTI oil rose this week by 4.8% but it remains well shy of breaking out above $72. Brent crude was up 4.5%. Both remain in bear markets and down on the year. Natural gas (NG) at the Henry Hub was down 8.5%, but EU NG at the Dutch Hub gained 5.2%. Energy stocks benefitted as the ARCA Oil & Gas Index (XOI) was up 3.1% and the TSX Energy Index (TEN) gained 5.2%. Both, however, remain down on the year.

Is gold entering a runaway move to the upside? It is possible. We’ve achieved next targets at $3,350, but are higher highs coming? We are a bit overbought, but that condition can remain in a strong bull market. Next targets could go up to $3,600, which is our current target. Many are predicting even higher. Breakdown right now would not occur until under $3,000. For the gold stocks, concern rises if the TGD falls under 450 but breaks down under 400. Otherwise, we are in a potentially powerful bull that hasn’t been seen since the 1979 run-up. Even the run-up in 2011 was not as frenetic as this one. But the background favourable to gold is here in spades.

At this stage we are not even sure what might end it. The U.S. backing off on tariffs would end it. Resolution of wars, particularly the Russia/Ukraine war, would help. And the end of confrontations due to extreme polarization in the U.S. and elsewhere would also help end it. The trouble is, we don’t see any of that happening at this time. We live in chaotic, volatile times and, as we noted, the world of 2024 is over. Gold is the beneficiary.

Read the FULL report here: Technical Scoop: China Ace, Overbought Gold, Capital FlightDisclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.