Excerpt from this week's: Technical Scoop: Debt Unsustainability, Recessionary Signs, Metallic Creep

Source: www.stockcharts.com

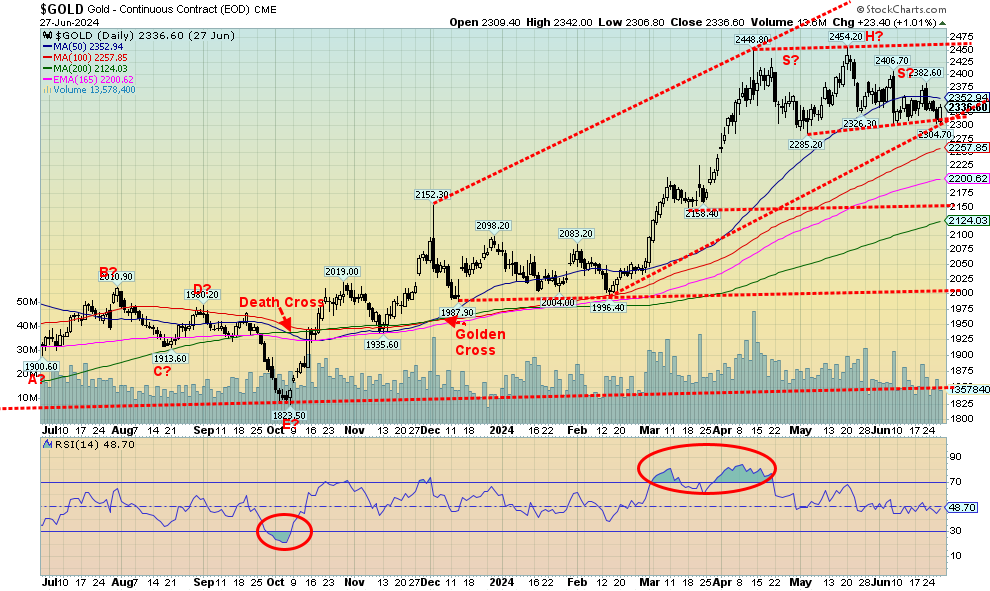

Gold continues to bounce around as it has done for the past three weeks. Ever since that sharp break on June 7, 2024, gold seems to put in nothing more than a series of up days followed by down days. The good news was that the sharp down move on June 7 never generated any serious follow-through. Support at $2,300 continues to hold. Yes, we dipped under that level, and silver dipped under $29, but neither followed through, suggesting that we may be sold out. Given that a close over $2,400 remains elusive, we can’t at this time eliminate the downside risk. We also have what appears to be a compelling head and shoulders top, but once again support at $2,300 has held. Nonetheless, the quiet sideways action has left the daily trends for both gold, silver, and platinum in neutral territory.

Seasonally, gold enters a positive period that lasts until usually October before a correction may set in. The lows then occur in December before another seasonal run-up gets underway. The chart below shows the potential June/July low as well as the October/December low. They denote only that a low could occur but do not measure the magnitude. It could well be that the October/December is lower than the June/July low. Peaks seem to occur into March, May, and September. This does not mean that 2024 will follow the pattern but indicates what might occur. We are moving into July and gold has been weak since topping in May 2024 at $2,454.

Source: www.seasonalcharts.com

On the week, Gold rose a small 0.4%, silver was off 0.2%, and platinum rose 1.8%. Palladium bounced back up 5.8%, but copper continued its recent weakness, down 1.1%. The gold stocks eked out gains with the Gold Bugs Index (HUI) up 0.2% and the TSX Gold Index (TGD) up 0.4%. Currencies had a quiet week as well with the only real noise being the sinking Japanese yen that fell to new 52-week lows, down 0.8%. The US$ Index rose about 0.1%, the euro was up 0.2%, the Swiss franc down 0.8%, and the pound sterling was flat. The Cdn$ gained about 0.1%.

As noted, support for gold is at $2,300, but a break below that level could target down to $2,150. The trend is up and we see few signs that we could be making a more significant top, given strong demand particularly from central banks and Asia and an economic and political background that is supportive. Silver is in a similar position. Silver has support down to $29, but if that breaks the next support comes in at $28.50. Below that, we don’t find support until $26.50. Resistance is at $32. We need to close above $32 to suggest we could move to our targets up around $39/$40. Silver has badly lagged gold. While gold has made all-time highs, silver remains well under its major highs seen in 1980 and 2011 near $50. More recently the gold/silver ratio has been falling in favour of silver. The last peak was seen in February 2024 at 92.41. Last the gold/silver ratio was at 79.15 although it hit a low of 72.62 in May.

The gold stocks, represented by the HUI and the TGD, remain down, well below their all-time highs of 639 and 455 respectively. As well both are down from their most recent high in May 2024. The TSX Venture Exchange (CDNX) that holds roughly 50% junior mining companies is well down from its all-time highs seen back in 2007 at 3,372. Today, it is at 567, down even from its most recent high at 1,113 back in 2021. Junior mining stocks are under-owned, undervalued, and under-noticed. That won’t last forever. They’re up 71% from their major low in March 2020 but still down 83% from their all-time high. A depressive market when the focus has been instead on the AI stocks and meme stocks.

Oil is struggling to break above $82. We need to get over $84 to suggest we are seriously breaking out. Nervousness concerning the geopolitical situation is supporting oil prices at this time. WTI oil was up 1.0% this past week, Brent crude rose 0.6%, natural gas (NG) fell a sharp 8.5%, but NG at the EU Dutch Hub was up 1.6%. The energy stocks rebounded, with the ARCA Oil & Gas Index (XOI) up 2.6% and the TSX Energy Index (TEN) gaining 3.6%. Are the energy stocks leading once again?

Central banks around the world have been increasing their gold holdings. The buying is led by the People’s Bank of China (PBOC) along with central banks from emerging economies. China may be the world’s largest producer of gold but they have also become a large net importer of gold. Central banks of the world have been concerned about the politicization of world institutions such as the IMF, the World Bank and SWIFT the global payments system along with the freezing and seizing of government assets particularly by the U.S. and its application of sanctions. Central banks cite golds stability, its ability to hold its value, its liquidity and that it has no liability. (www.livemint.com/market/stock-market-news/explained-why-are-central-banks-like-rbi-pboc-accumulating-gold-in-large-quantities-gold-prices-today-gold-rates-11714963880948.html) Gold is a go-to asset in periods of economic and political instability.

Read the full report here: Technical Scoop: Debt Unsustainability, Recessionary Signs, Metallic Creep

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.