Excerpt from this week's: Technical Scoop: Domination Impact, Golden Performance, Energetic Pressure

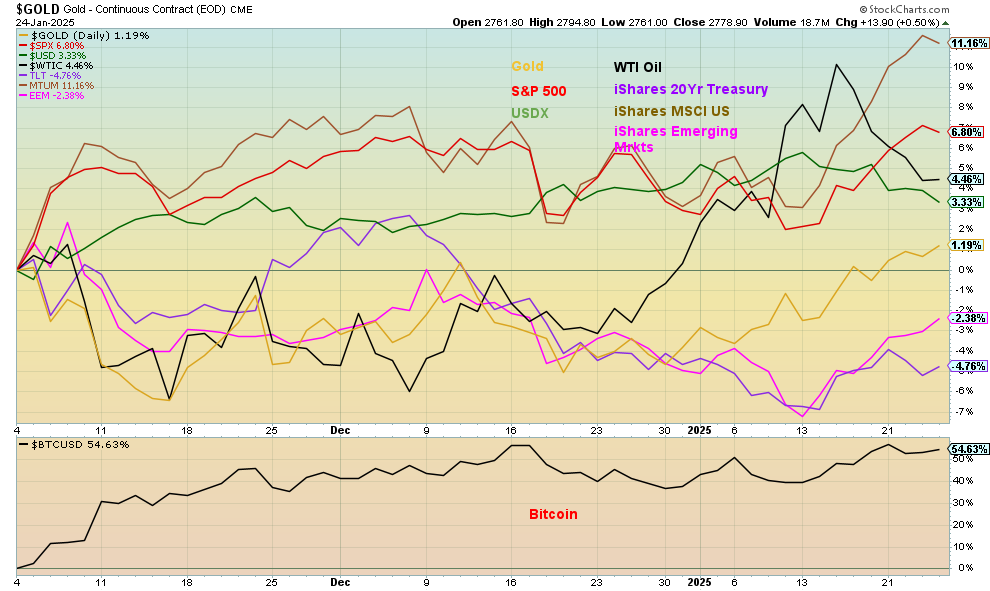

Performance of Selected Indices since the Election November 5, 2024

Source: www.stockcharts.com

Emerging markets have been weak, primarily because of the strength of the US$ Index. Many of these countries have debt denominated in U.S. dollars. As a result, a strengthening US$ Index implies that what they now have to pay back will rise as their revenues are in the local/home currency. Surprisingly, while tariffs could hurt the economy, they help strengthen the U.S. dollar. A stronger U.S. dollar makes U.S. exports more expensive but does it make U.S. imports cheaper? Will a rise in the US$ Index offset any tariffs placed on U.S. exports?

Which way will the U.S. dollar go? Trump has shaken many corporations with his recent speech at Davos, WEF. He’s also threatening the Fed to lower interest rates setting up a potential fight with the Fed that would shake markets. As a result, are we seeing the start of a sell-off of the US$ Index? That bottoming pattern suggested a potential move for the US$ Index to 114. The high at 110.01 implies the index has achieved at least minimum targets so far. A firm break under 107 could send the US$ Index lower.

Source: www.stockcharts.com

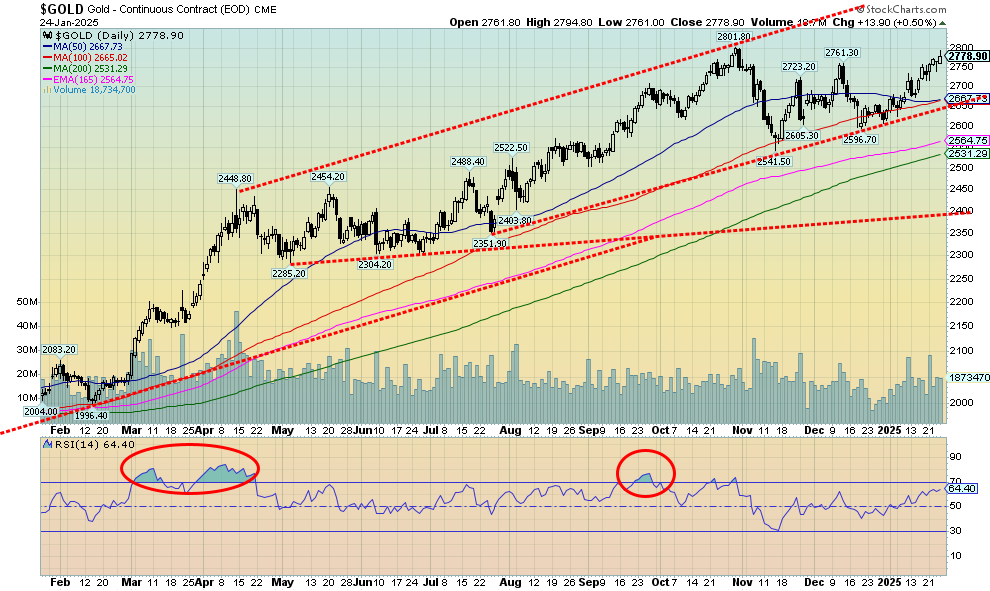

As we have noted, the precious metals have been the best performers so far in 2025. Gold crossed above our $2,750 threshold this past week, telling us we should make new all-time highs above $2,801. Once above targets could be $3,050–$3,100. Our big concern is that silver and the gold stocks are nowhere near confirming gold’s run. Silver remains down roughly 37% from its all-time high set in 1980 and 2011 near $50, while the Gold Bugs Index (HUI) remains down 52% from its 2011 high and the TSX Gold Index (TGD) is off 17% from its 2011 high. As with the DJI and DJT, the averages are not confirming each other. It’s been an ongoing concern.

On the week, gold was up 1.1%, silver was weak but rebounded and closed up 0.1%, platinum had an okay week, up 0.7%, while palladium was a winner, up 4.4%. Copper fell 1.1% even as it remains up 7.2% in 2025. The HUI gained 3.1% while the TGD was up 2.8%. Now if only some of the positive vibes for the senior/intermediate/junior producing gold stocks would flow over to the junior exploration plays. We’re seeing some stirring but nothing substantial, with very small exceptions.

Helping gold this past week was a turnaround for the US$ Index, plus Trump calling for lower interest rates. Indeed, Trump’s remarks at Davos helped push the US$ Index lower. The USDX fell 1.8% this past week as the currencies benefitted. The euro was up 2.2%, the Swiss franc up 1.0%, the pound sterling up 2.6%, the Japanese yen gained 0.2%, while the Canadian dollar was up 1.0%. With Trump threatening everyone with tariffs, it weighed heavily on the USDX.

Dominant economic issues for 2025 the U.S. debt and budget deficits, tariffs and trade, income inequality, and immigrants. Already, kicking out immigrants (illegal or otherwise) has met with resistance and desertion. Fruit and vegatable fields are suddenly lying fallow as the pickers flee. A few factories have seen a chunk of their workforce either arrested or fleeing. And this is just the first week.

All this should weigh on the US$ Index and ultimately be good for gold. Oil doesn’t know what to do as tariffs could impact oil as well. Trump’s repeated promises for increased drilling been met with resistance by some companies because the conditions or the prices aren’t there. WTI oil fell this past week, off 3.5%, while Brent crude dropped 4.1%. Natural gas (NG) bounces around with the weather as NG at the Henry Hub fell 12.7% while the EU Dutch Hub saw NG rise 4.9%. The energy stocks were negative with the ARCA Oil & Gas Index (XOI) off 2.6% and the TSX Energy Index (TEN) down 0.4%. WTI oil still appears to us to be forming a huge base for a launch. But if we break under $63/$65 all bets are off.

Gold’s seasonals are usually positive during this period, often topping out in March around the time of the Prospectors and Developers Association of Canada’s Conference (PDAC) on March 2–5. We need to see more positive response from silver and the gold stocks. Silver needs to get over $32 and especially over $34 to think of new highs above $35. The TGD needs to clear 400 to suggest new highs there as well.

We remain positive on this sector as we proceed into 2025 as it’s a haven when things become volatile and uncerrtain. Since January 20, the uncertainty is sure to rise.

Read the FULL report here: Technical Scoop: Domination Impact, Golden Performance, Energetic Pressure

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.