Source: www.stockcharts.com

Gold, the ultimate hedge; geopolitics, domestic politics, and huge debt. These are, we believe, the main drivers today. Another record high for gold prices that hit a high of $2,772, then turned down and actually had an outside day reversal. A key reversal? We can’t tell that yet. We can only wait and see if there is further follow- through to the downside. The gold stocks took it on the chin and, yes, silver also turned down after making 52-week highs, so those could be warning signs. But with geopolitical uncertainty and, even more, domestic political uncertainty with the upcoming U.S. election, that could either make gold soar further to the upside or have a nasty correction.

On the week, gold made new all-time highs and, despite the reversal, managed to close up 0.9%. Silver gained 1.7%. All this came against the backdrop of a still-rising US$ Index. Gold normally trades inversely to the U.S. dollar. Platinum gained 1.2%, but this week it was palladium’s time to shine, jumping 10.9%. Copper didn’t fare as well and lost a small 0.2%. The gold stocks turned tail, most likely negatively impacted by Newmont’s poor results. The Gold Bugs Index (HUI) fell 3.9% as did the TSX Gold Index (TGD).

It is no surprise to discover that $2,700 is now support. We’d prefer to see it hold. Under that level, the next good support is down to $2,600/$2,625. Under that level, further declines could be seen. Gold is attracting a lot more attention these days, particularly from the media, who are usually gold-agnostic. Firms such as Goldman Sachs have been recommending gold. It’s no surprise it has caught the attention of scribes and firms, given gold’s 33% move thus far in 2024. Silver is even better, up 40% while the HUI is up 36% and the TGD up about 38%. Our preference is to see silver and the gold stocks leading. Except mostly this year, until recently, it has been gold that has led.

We do have higher targets, as noted earlier, over $3,000. At $2,700 we are not that far off, but we do seem to run into resistance every $100. We’ll see how gold responds to the Israeli/Iran bombings. Failure to put in new highs might mean we correct back further. But ultimately, even after another possible pause, we should be headed higher.

Source: www.stockcharts.com

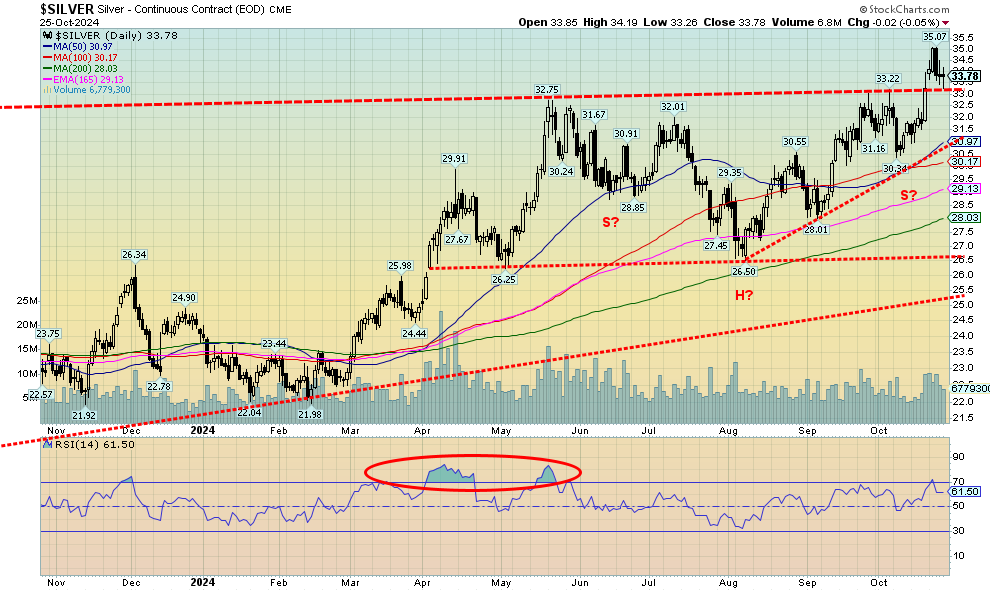

Silver, it appears, remains unloved and under-appreciated, particularly given its industrial uses in electronics, green energy, and more, along with it being the companion of gold as a means of exchange. On the week, silver rose 1.7% which did outpace gold. Silver made 52-week highs after hitting just over $35. Then came the sharp pullback as gold, silver, and the gold stocks corrected back. The good news is it eased the overbought conditions and in turn could set us up for the next upward move. Silver did break above a long-standing resistance zone near $33. The pullback this past week seemed to be testing that breakout. It should act as support. We wouldn’t be concerned about silver unless it were drop back under $32. Targets following the breakout remain up to $39/$40. That pattern still appears as a somewhat awkward head and shoulders reversal. Now we need to see the proof.

Source: www.stockcharts.com

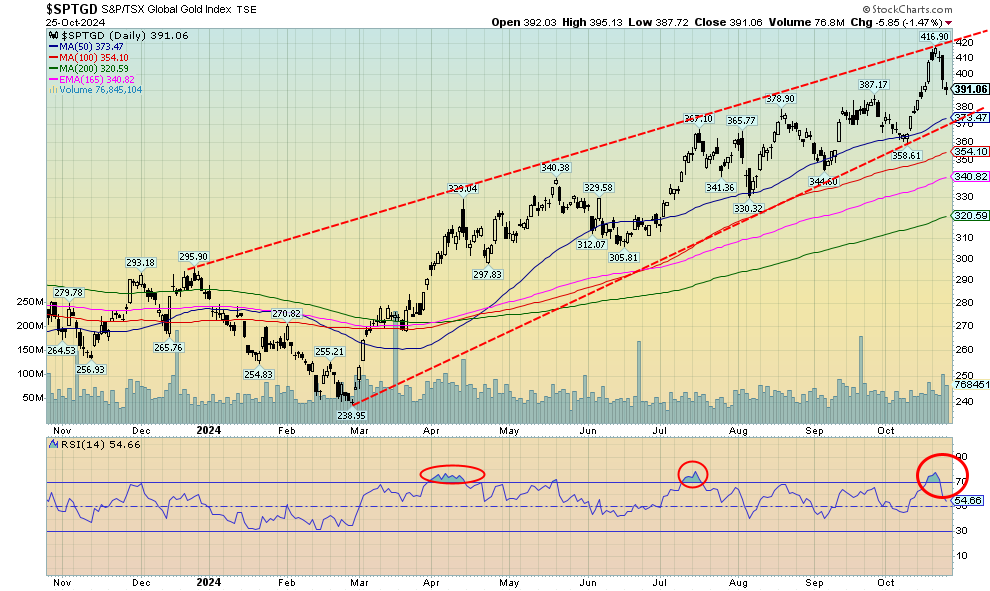

Gold stocks fell this past week, despite both gold and silver being up modestly on the week. The good news is that the pullback has removed the overbought conditions and potentially sets us up for the next up move. We did make fresh 52-week highs at the beginning of the week before the fall came. Impacting gold stocks negatively were the poor results from Newmont, the world’s largest gold mining company. The negative impact of Newmont spread into the rest of the market and profit-taking followed, sending the gold stocks tumbling. On the week, the TSX Gold Index (TGD) lost 3.9% as did the Gold Bugs Index (HUI). Most of the loss came following the Newmont earnings announcement.

Last week it looked like we were breaking out, but we questioned it at the time. All it did was raise the top of the current bull channel. The bottom of the channel is near 373, so a break under 370 would be more negative. The 50-day MA is currently at 373.50. The area has held the TGD since those lows in February 2024. As well, we note that an RSI near 50 has also held the market. The RSI was 54.66 on Friday. We expect that this area will hold, particularly given the geopolitical events on the weekend. The rally since the February low has seen consistent pullbacks, which we view as a sign of strength. Expectations are that new highs will come once this pullback is finished.

Read the FULL report here: Technical Scoop: Election Strife, Gold Highs, Rate Rise

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.