Excerpt from this week's: Technical Scoop: Euphoria Concerns, Potential Peaks, Precious Beatings

Source: www.stockcharts.com

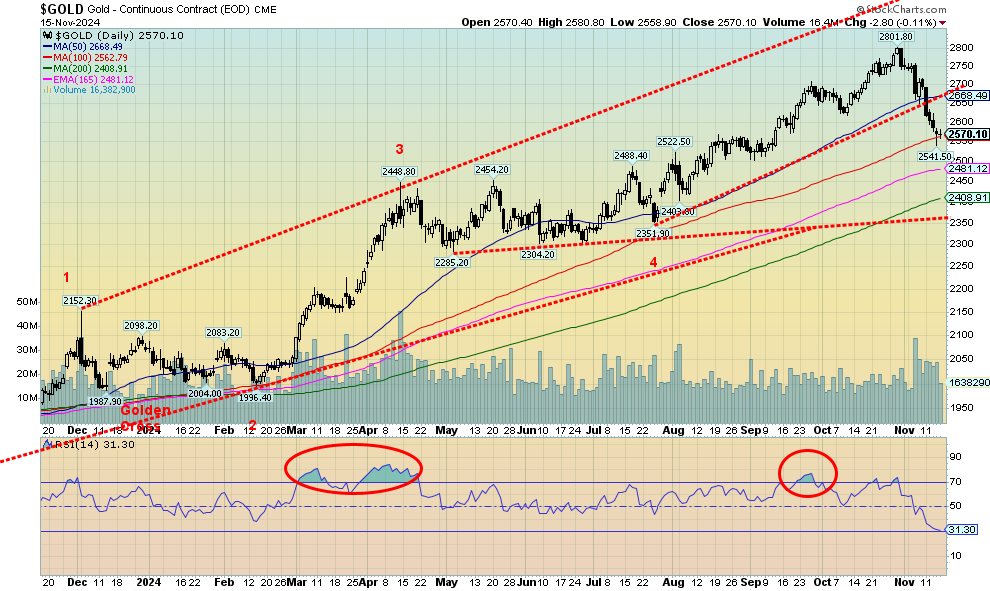

It was not a good week for gold. Gold has reacted negatively to Trump’s election losing out to the stock market and Bitcoin. It hasn’t helped that interest rates are higher, the U.S. economy is still demonstrating strength and there is even talk that the Fed might now not lower rates as earlier predicted. Higher interest rates are negative for gold given increased carrying charges. And as well the US$ Index has been fire. The thus far 9.3% drop from the October high is the worst drop in three years. Despite the drop, gold remains up 24.1% on the year. Above $2,740 new highs are possible. Ironically gold falling as it has it been following Trump’s election has also happened in 2016. Then gold didn’t make its low until mid-December. After that gold embarked on a 22% gain into September 2017 and a marginally higher high in April 2018. Gold then fell and made its final low in August 2018. If it is any consolation gold went up some 73% from October 2022 to the recent high in October 2024.

On the past week, gold fell 4.6%, silver dropped 3.2% a divergence with gold, and, platinum continues to be miserable off 3.4% on the week and down 7.6% on the year. Of the near precious metals’ palladium continues its woes down 4.9% on the week and 17.3% on the year. Copper also felt the drop as it fell 5.8% but clings to 4.4% gain in 2024. The gold stocks were “whacked” with the Gold Bugs Index (HUI) down 8.6% and the TSX Gold Index (TGD) off 8.2%.

Not helping gold is that many of Trump’s proposals from tariffs, to the expelling of illegal immigrants to tax cuts are all potentially inflationary. And that translates into higher interest rates. Better for gold is stagflation

rather than inflation. Deflation is usually good for gold as well. Gold is approaching oversold if the RSI were to drop under 30. But we don’t really see a good sign that we may have bottomed until we regain above $2,675. The result of all of this is the seeming bounce we got this past week may not last long and we continue a decline into December. At the time the Trump decline in 2016 was 16%. So far, the drop is 8.2% suggesting we may have more downside.

We continue to view the current decline as a correction to the run-up from October 2023 to the high in November 2024. The run-up was over 53%. So, a 10% correction thus far isn’t much.

Source: www.stockcharts.com

Silver followed gold lower this past week losing 3.2%. While silver lost it was encouraging as silver lost less than gold. Could it be signaling a turnaround? Silver entered correction territory with a drop now of 15.2% from the October high. We broke an uptrend line as well putting silver in the position of facing further losses. Granted we did bounce off support when we hit the weekly low at $29.75. Longer term we see support down to around $28.50 but would be quite concerned if we broke that level. Longer term we see major support down to $26.50 even as we believe we won’t go that low. Course breaking $29.75 might change our minds. Silver like gold has been in a downswing since the Trump election. It did the same thing in 2016. That year the low wasn’t seen until at least mid-December. We are not as yet oversold on the RSI so we do have potentially more downward to come. Only back above $32 could we feel comfortable that a low might be in.

Source: www.stockcharts.com

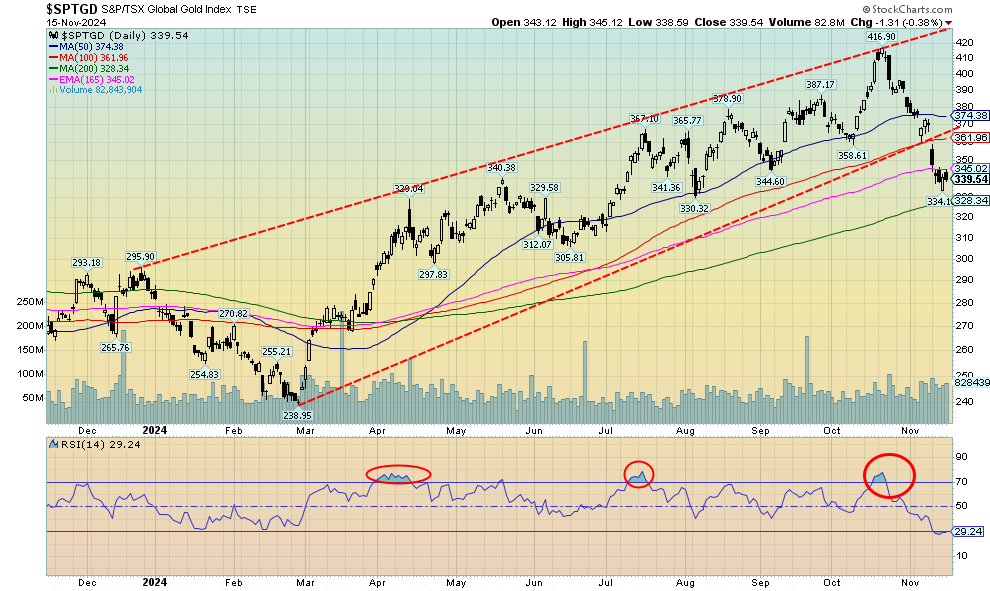

It was a very unpleasant week for the gold stocks. The TSX Gold Index (TGD) fell 8.2% while the Gold Bugs Index (HUI) dropped 8.6%. Lower gold and silver prices will do the trick. It also seemed to be a mini-panic sell off. It’s a thin market at the best of times so movements up and down can sometimes be exaggerated. The dop this past week has shaved 18.5% off the TGD and 19.5% off the HUI. It’s the worst drop since the decline in January to March 2024 when the TGD fell almost 18%. Still all this move might be is a steep correction in a bull market. We are now not that far from the major 200-day MA support near 328. The low on the week was 334. We’d be more concerned if we broke under 320 but the action towards the end of the week while negative was somewhat encouraging with a bounce back. We won’t feel comfortable until we at least regain above 360 or even 375. Volume on the week wasn’t great and we note that the RSI has now fallen under 30 into oversold territory. No, that doesn’t guarantee a rebound but it does bring us into better buying areas if we are to consider the bull intact. We broke our uptrend line. We had no real topping pattern just the sudden drop in the market. Despite all the negatives this past week the TGD is still up 19.4% and the HUI up 17.2% in 2024. But it felt a lot better when the indices were up over 30% before this drop hit.

Read the FULL report here: Technical Scoop: Euphoria Concerns, Potential Peaks, Precious Beatings

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.