Excerpt from this week's: Technical Scoop: Expected Jobs, Precious Wins, Flat Oils

Source: www.stockcharts.com

2025 was a golden year. Gold rose 63%, silver was up 143%, and platinum gained 125%. Even the near precious metals chimed in with palladium up 78% and copper up 40%. Copper, the laggard, could be the surprise of 2026, given falling supply and rising demand (AI, military, etc.)

This past week, gold rose from the mini-crash of December 29, 2025, up 4.1% and up 4.6% since December 31, 2025. Is another golden year on its way? We are always wary of potential surprises, so taking profits as one moves higher is a wise idea. Strong bull markets for gold have happened before. The most notable ones were during 1976–1980 when gold rose 700% and in 2008–2011 when gold rose 182%. Note that we didn’t count from the absolute lows but from the point where a strong up move got underway. In this round, the absolute low was in December 2015 at $1,045. But this move started in October 2022 at $1,614. Since then, we are up 180%, pretty much the same as in 2008–2011. We are expecting more.

The reasons for owning gold have not budged. Geopolitical and domestic political instability, a slowing economy, debasing of fiat currencies, and falling interest rates encourage moving to gold as a safe haven. As we always note, gold has no liability. It’s been the ultimate safe haven for 3,000 years and the reserve currency or a system of gold-backed currencies for centuries. The current fiat experiment got underway in August 1971 when President Richard Nixon took the world off the gold standard. Note that upwards of 99% of all fiat currencies have ultimately failed.

Sloppy job numbers this past week, thoughts of rate cuts in 2026 (the current prediction is for two), the appointment of a dovish Fed Chairman, continued geopolitical tensions (Venezuela), and domestic unrest (clashes on the street vs. ICE), also clashes in Iran and the threat of attacks on the country are among some of the reasons why gold should continue to rise into 2026.

Gold was up 4.1% this past week, silver up 9.2%, and platinum gaining 6.3%. Palladium was up 12.2% while copper jumped 3.4%, setting new all-time highs at $6.06 before settling at $5.84. The gold stocks soared with the Gold Bugs Index (HUI) up 8.9% and the TSX Gold Index (TGD) up 9.7%, both to new all-time highs.

A break of $4,275 would be of concern. Under $3,890 points to even lower prices. Nonetheless, we see no sign of a top. We’ve already passed the point that would suggest new highs ahead ($4,485 vs. close $4,509). Stay long but be wary of break points. We’re setting up for another golden year but remember that anywhere along the line a sharp correction could take place. Volatility reigns.

Source: www.stockcharts.com

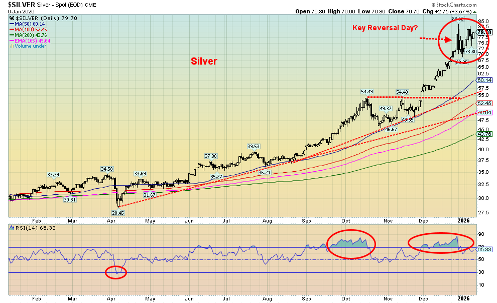

Hi-ho silver, away! Silver appears to be starting off the New Year where it left off in 2025. After a 143% gain, what could silver do next? Well, how about 9.2% in the first week and 11.5% up since December 31, 2025? Yes, there is that rather niggly, potentially key reversal day seen on December 29, 2025. We hit a high (all-time) of $83.62 and then reversed, closing down almost 9% at $72.15. We have since recovered, but we are uncertain at this time of new highs. However, given that the reversal day was a result of the CME raising margin requirements, sparking margin calls and a mini-panic, and not due to fundamental reasons, recovery is possible. There is still the fact that there are roughly 365 ounces of paper silver for every ounce of physical. And physical silver is in short supply, selling at premiums to paper silver. But we need new highs to confirm that. Exceeding $80.82 on a close basis raises the odds of new highs. We did rise above that level but did not close above $80.82.

With gold stocks making new highs this past week, it raises the odds that both gold and silver will make new highs once again. A steady stream of analysts are calling for new highs in 2026, including some fantastical predictions for gold at $5,000 or higher and silver at $100, even $200. It’s not to disbelieve them, but remember they are opinion forecasts. Our preferred route is setting a target, but be wary of where the breakdown points are. Currently, silver is fine. As long as it stays above $69.25 the chance of a mini panic is low. It had been a steep rise from that consolidation pattern seen in October/November 2025, so a pause was no doubt expected as we became quickly overbought. And so far, that’s all it is: a pause to ease the overbought conditions.

As we noted with gold, the conditions that brought us here remain. The trend is up, stay long, add on dips.

Source: www.stockcharts.com

The gold stocks took off in 2026 the way they ended in 2025, rising sharply. On the week, the TSX Gold Index (TGD) rose 9.7% while the Gold Bugs Index (HUI) jumped 8.9%. This follows gains of 142.8% and 154.6% respectively in 2025. Gold stocks have been the stars. We are also seeing more positive signs with the junior developers that dominate the TSX Venture Exchange (CDNX). If they explode upward, as we noted earlier,

2026 promises to be a good year. As well, both the TGD and the HUI once again made all-time highs. But beware of the sharp spike.

By the week’s end, the RSI was just over 70, in overbought territory. No, that doesn’t signal an immediate pullback. In the most recent surge into August/October, the RSI remained consistently above 70 before a much-needed correction set in. It has been a spectacular ride for the gold stocks as it was the place to be in 2025. A reminder, however, that the surge in 1979 and 2010–2011 ended abruptly. The subsequent fall wiped out some 80% of the gain. Taking profits as we go higher is a wise idea, even if one misses the actual top.

Nonetheless, like gold and silver, the conditions remain positive. That is, until they aren’t. The TGD has support down to 760, but under 665 a steeper correction would set in.

Read the FULL report here: Technical Scoop: Expected Jobs, Precious Wins, Flat Oils

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated