Excerpt from this week's: Technical Scoop: Fed Attack, Precious Toplessness, Yield Spook

Source: www.stockcharts.com

Geopolitical and domestic political concerns continue to help gold prices. The investigation against Fed Chair Jerome Powell sparked a jump in the price of gold and silver, but an announcement that Trump was taking Kevin Hassett off the list to replace Powell sparked the drop into Friday. Hassett was viewed as being very bullish for gold prices, given his propensity to agree with Trump and his request for lower interest rates. Now it’s all thrown back and, while there are others, the choice of who will replace Powell remains a mystery. Confirming any replacement by the Senate won’t be easy either as there remain concerns amongst some of appointing anyone who might be perceived as just following Trump’s orders. The independence of the Fed is paramount, as we pointed out. Even some Republican senators believe that. Nonetheless, other noted replacements such as former Fed Governor Kevin Warsh are also interest rate doves on monetary policy.

Gold rose 1.8%, silver rose 13.0%, platinum jumped a lackluster 2.4%, but palladium fell 1.7% while copper was up a small 0.2%. Gold, silver, and copper all made new all-time highs this past week. Gold stocks also hit new all-time highs as the Gold Bugs Index (HUI) rose 5.1% and the TSX Gold Index (TGD) was up 4.9%.

Gold, silver, and the gold stocks have been the place to be over the past year. Yet oddly, gold (and silver) remains under-owned compared to the rest of the stock market. In other words, there is potential for new sources of demand as more are attracted to the rise in the metals or profits come out of the broader stock market and are placed into the precious metals market. Gold, which has no liability, remains a key choice even as it approaches $5,000 with many predicting gold will hit $6,000 in 2026. After years of frustration, the gold bugs are having their day in the sun.

Gold’s bull remains in place unless we fall back under $4,275. While not a killer zone, it suggests a somewhat deeper correction. Under $3,900 is a problem and under $3,700 a panic sell-off could take place. A breakout above $4,700 signals that we are on our way to $5,000.

Source: www.stockcharts.com

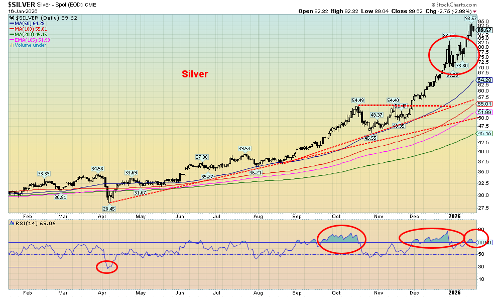

Hi-ho silver, away! Just when you thought that silver was about to have a steep correction, given that outside day key reversal on December 29, 2025, the signal slammed back in our face. Silver turned and raced once again to new all-time highs, this time up to $93.57, even as we closed mildly lower at $89.62. It looks like $100 silver is now in the headlights. Admittedly, we do get concerned by excited calls for silver to rise to $200, $300, $400, and even $600. Silver fever? We’ve heard of gold fever, but silver fever? Silver is already up 25.9% in 2026 vs. gold up 6.5%. Stories of shortages abound along with soaring demand, even as paper silver outnumbers physical silver by almost 350:1. Nonetheless, the sharply rising silver price has also helped big jumps in silver stocks. The Global X Silver Miners ETF (SIL/NYSE) is up 383% since the 2022 low and just below 18% so far in 2026.

Silver is overbought with an RSI at 70, but we note as well that the RSI is diverging as the recent high saw the RSI at a lower level than it was before. Other indicators are also diverging with previous highs; i.e., silver is pricing higher, but a lower high is being made by the indicators. We pulled back from the high at the end of the week, similar to gold, after the Hassett announcement. We’d get a negative signal under $82.50, but a super sell signal wouldn’t occur until we break that recent low at $69.25.

Source: www.stockcharts.com

The gold stocks continue to go up, continuing where they left off in 2025. Already this year the Gold Bugs Index (HUI) is up 14.4% while the TSX Gold Index (TGD) is up 15.0%. Nice start to 2026. On the week, we jumped, then wobbled as the TGD rose 4.8% and the HUI rose 5.1%. Both indices made new all-time highs as did several individual gold stocks. Life continues to percolate with the junior gold/silver mining explorers. It is with them the real big gains can be made; however, they come with elevated risk. The current bull channel suggests the TGD could rise as high as 990/1000. Yes, we are overbought as the RSI is at 75.82, but we noted we remained highly overbought for several weeks from August to October before a correction of any substance set in. This is not to be fearful that a sharp correction could occur at any moment but to understand that in a powerful bull market, which we are in, “overbought” is just a figure of speech. The 2008–2011 bull saw the TGD rise 200% while the HUI leaped 325%. Thus far, from an important low in 2022, the HUI is up 364% while the TGD has gained 331%. By comparison, today’s run has been remarkable compared to the 2008–2011 a run that saw a number of 10%+ pullbacks. Nonetheless, we shouldn’t get complacent as a sharp correction can come out of the blue. However, this run has been remarkable. The week ended with a wobble so we can’t rule out a pullback this coming week. But the background conditions continue to be good for gold, silver, and by extension the gold stocks.

Read the FULL report here: Technical Scoop: Fed Attack, Precious Toplessness, Yield Spook

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.