Excerpt from this week's: Technical Scoop: Fifty Expectation, Recession Signs, Precious Disconnect

Source: www.stockcharts.com

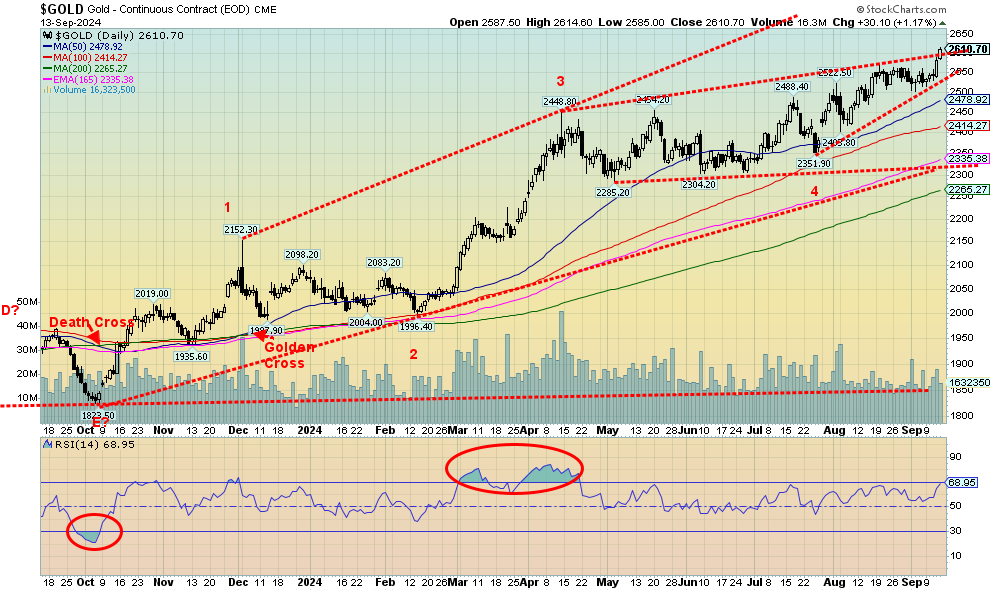

If there was a star this past week it was gold and commodities. Just the prospect of a 50 bp cut this coming week sent gold once again to new all-time highs. Gold was up 3.4% and closed over $2,600. For Canadians, that’s $3,500. It’s been a big bright spot. Gold is now up 26% on the year. No, silver still is nowhere near its all-time high, but at least it put in a stellar performance this past week, up 10.3% and up 29% on the year. We are inching towards a breakout level at $31.50, suggesting new yearly highs for silver are close. Silver is also leading, which it should in a bull market. The stellar performance of gold ignited the stocks as the Gold Bugs Index (HUI) rose 12% and the TSX Gold Index (TGD) was up 9.6%. On the year, the HUI is up 35.1% and the TGD 32.8%. It’s been a banner year for the gold stocks. Nonetheless, both indices remain well below their former highs seen back in 2011.

Gold is a hedge against economic woes, falling interest rates, and falling currencies. (The US$ Index was flat this week, but after rising it reversed and closed unchanged. The only currency showing life was the Japanese yen, up a sharp 1.0%. Gold is also a safe haven in times of geopolitical uncertainty, such as the divisive U.S. election and conflicts involving Russia/Ukraine, Israel/Hamas, Hezbollah, Iran, Syria, and Houthis.

With gold having a stellar week, others joined the party. Platinum gained 9.6% and palladium was up 19.2%. Copper was up 4.1% and the CRB Index gained 2.6%. It could have gained more, but the big drag is energy as WTI oil gained only 1.5% but is under $70 down 4.4% in 2024. Brent crude was down 0.1%, Natural Gas (NG) gained 1.8%, but NG at the EU Dutch hub was down 1.8%. The energy stocks were negative with the ARCA Oil & Gas Index (XOI) down 0.9% and the TSX Energy Index (TEN) off 1.9%. With excitement in the commodity sector, it’s no surprise we were hearing rumblings of the commodity super-cycle getting under way again. The big struggle now is energy as economic stress is sparking pessimism there, but it’s offset by supply disruptions due to hurricanes in the Gulf and ongoing conflicts in Libya.

We remain optimistic that gold is going higher. Maybe we’ll see some resistance here at $2,600 but ultimately, we should be next headed for $2,700. Also, beware of a spike. RSIs are still under overbought at 70, which suggests to us that we could move higher still. Gold under $2,500 is troublesome, but gold under $2,300 could suggest the rally is over. We remain committed to higher prices for gold, silver, and the gold stocks. We are well aware of potential tops in this period, but as we go into 2025, we should be rising sharply again.

READ the full report here: Technical Scoop: Fifty Expectation, Recession Signs, Precious Disconnect

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.