Source: www.stockcharts.com

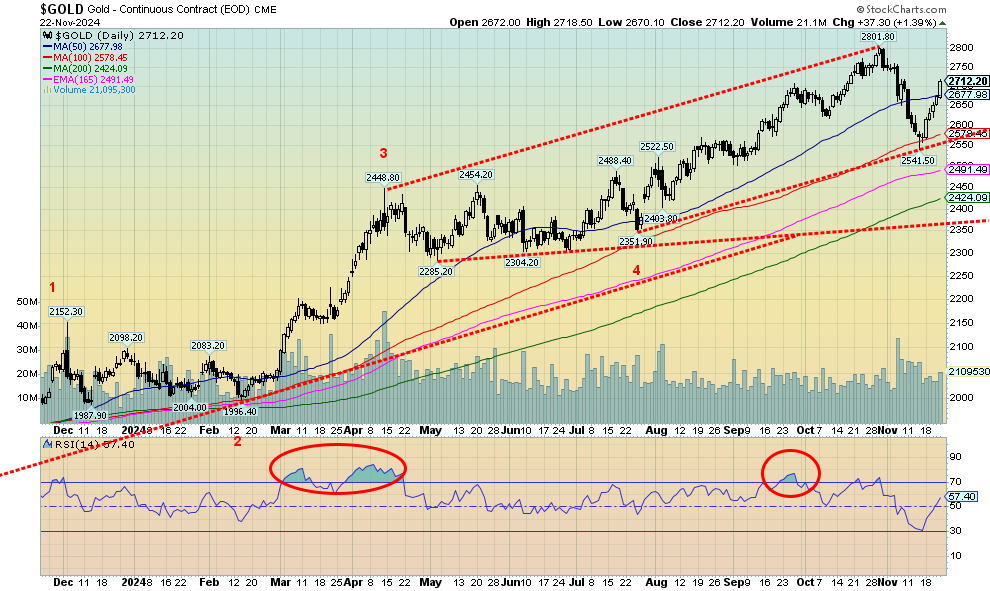

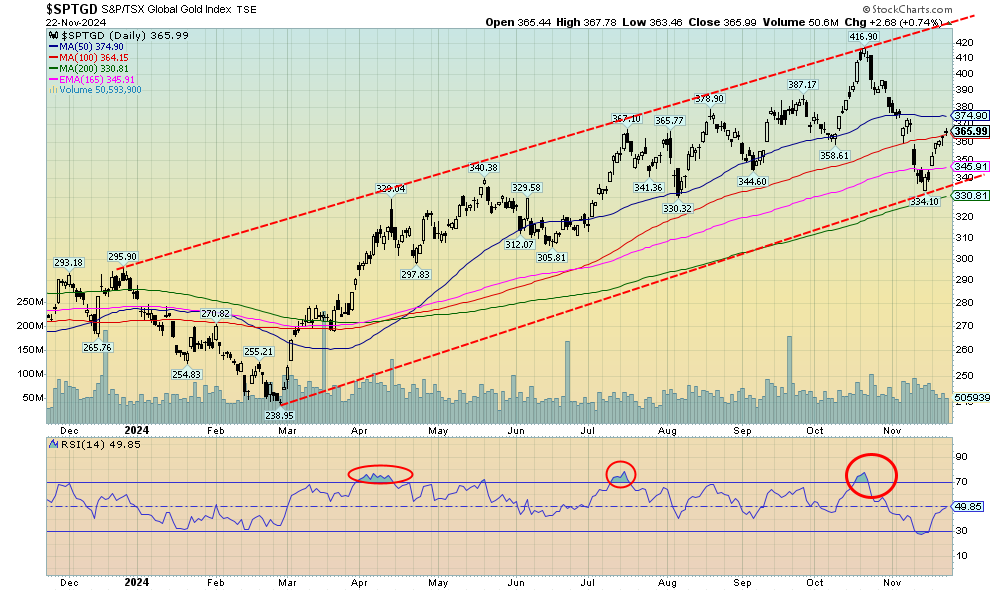

Gold had a good week on safe haven demand because of the uptick in the Russia/Ukraine war. Over the week, gold leaped 5.5% but silver lagged, gaining only 3.0%. As we note in our silver commentary, this is a concern. We want silver to lead, not lag. Elsewhere, platinum gained 3.2% but remains down 4.7% on the year. Of the near precious metals, palladium gained 8.1% on signs of supply shortages but is still down 10.6% in 2024. Copper was up 0.7% and 5.1% on the year. On the year, gold is up 30.9% while silver has gained 30.1%. A stellar year. The gold stocks loved it as the Gold Bugs Index (HUI) rose 8.1% and the TSX Gold Index (TGD) was up 7.8%.

As noted, the biggest catalyst for gold was the seeming expansion of the Russia/Ukraine war. Other concerns are that the Fed now won’t cut much in December, maybe 25 bp only. Gold shines during periods of geopolitical risk, economic risks, and low interest rates. Gold also rises on loss of confidence in government. Trump’s proposed cabinet picks are also generating concern, including any move to try and control the Fed which may be happening with whomever Trump picks as the new Fed chair.

The gain this week for gold came against the backdrop a sharply rising US$ Index that was up 0.8% to new 52-week highs, closing around 107.50. Usually when the US$ Index rises, gold falls. However, Fed officials voiced some reservations this week, suggesting inflation may have stalled. They may support further rate cuts but are cautious now on what inflation might do. As well, Trump’s proposed policies for tax cuts, tariffs, deportations, and firings would have an impact as these are inflationary. Deportations and firings could create labour shortages, driving up wages.

Then there is Bitcoin vs. gold, especially given Bitcoin’s spectacular gains. Bitcoin has been a clear winner against gold. Yet, unlike gold you can’t touch it, feel it, or hold it.

With gold now through $2,700, it’s important that level holds. We need to rise above $2,750 to suggest new highs ahead. There’s still a chance we could hit $3,000 by year end, but we wouldn’t want to guarantee that. New lows below $2,540 would suggest even further declines ahead, possibly down to $2,350.

Source: www.stockcharts.com

Gold accelerated this past week due to safe haven demand, but silver lagged, which is concerning. We prefer silver to lead. Silver gained only 3.0% on the week to gold’s 5.5%. The cheaper priced silver should have been an attraction as gold’s little companion. Silver did bounce off of support near $29.75 and we did close over $31 for the first time since early November, but its failure to at least match gold’s rise is a concern. That concern includes the entire rally, suggesting that all this action might be corrective only to the downdraft from the high of $35.07 to the recent low at $29.75 a drop of 15%+. Corrections like this are not unusual, but the reality is we must regain back above $33.80 to suggest new highs ahead. We continue to maintain targets of $39/$40 but the struggle to get there is concerning. Arguably, we could say we are not making a new leg up but instead a topping pattern. Getting back above $33.25 would go a long way to lose the idea that this just a larger topping pattern. Volume has not been impressive on this upswing. All this keeps us cautious for the near term, even as we expect much higher levels for the longer term.

Source: www.stockcharts.com

The gold stocks recovered nicely this past week with the TSX Gold Index (TGD) gaining 7.8% while the Gold Bugs Index (HUI) gained 8.1%. However, we remain far from the October high by just over 12% for the TGD. The RSI is entering neutral territory, just over 40. We did briefly dip under 30 RSI, a sign of being oversold. We note a couple of points above that need to be taken out to suggest higher prices. First, we must get over 375, then next 390. Above 400, new highs become probable. As with gold itself, we can’t quite tell if this is just a corrective wave to the October/November drop (which was 20%) or the start of a new leg to the upside. Breaking above 400 would strongly suggest that a new up leg is underway. However, we can’t rule out that this up wave is just a corrective one. Volume has not as yet noticeably turned higher, suggesting this is just a corrective wave. From the February 2024 low we are up 53% so it has been a good run. We are also up 28.6% for the TGD and 26.7% for the HUI so far in 2024. It’s been a good year with a month to go.

Read the FULL report here: Technical Scoop: Gold Rally, USD Breakout, Oil Jump

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.