Excerpt from this week's: Technical Scoop: Hurricane Swans, Understated Overvaluation, Bullish Oil

Source: www.stockcharts.com

Despite signs that the U.S. economy is still strong and the US$ Index has been rising, gold battled against the headwinds and eked out an 0.3% gain this past week. An earlier pullback had taken us down to an uptrend line and it held. Silver didn’t fare as well and fell about 2.0%. Platinum continues to struggle, losing 0.7%. Of the near precious metals, palladium showed some life, rising 7.1%, but copper fell 1.8%. The gold stocks were positive with the Gold Bugs Index (HUI) up about 1.0% while the TSX Gold Index (TGD) rose 2.7%.

We’d be more excited about gold’s rise this past week if silver, platinum, and copper were also up on the week. You want to see all metals rising in tandem, not some up and some down. It suggests to us that the recent mild weakness for gold could still prevail for a bit longer. October is known as a weak month and, so far, we can’t say we’re wrong. Catalysts for gold to rise further include an escalation of the war in the Middle East, given Israel’s threat to retaliate against Iran or even a shift in the war between Russia/Ukraine if Ukraine were to actually use the long-range missiles to attack Moscow itself. The other wild card is the deeply divisive election in the U.S. that could still turn violent. Concern over the U.S. debt (the highest in the world) appears to have slipped back.

Friendly inflation numbers (CPI, PPI) this past week helped gold rebound from the mild sell-off. It kept hopes alive that the Fed might still cut 50 bp in November. 25 bp remains the overwhelming consensus. Another 25 bp would come at the December meeting. With the U.S. economy showing some signs of slowing, coupled with the mild rise in the CPI, some are now concerned about stagflation setting in. That would also be friendly for gold. So, the big three concerns that could spark higher gold prices are geopolitical tensions, domestic political tensions, and the potential for stagflation.

$2,700 remains resistance while $2,600 is support. Under $2,550 we could fall further; however, our expectations are that $2,600 would hold. Any upping of geopolitical tensions or domestic political tensions would spark gold higher. We consider gold rising in the face of a rising US$ Index positive and bullish for the longer term. There is considerable room for gold to rise towards $2,800 in the bull channel. The RSI, after being in the overbought zone for a short period, has room to move higher. For the past number of months, the RSI 50 has generally been support. And, so far, it continues to be that.

Source: www.stockcharts.com

Silver can’t seem to get out of the way of itself. For almost six months now, we have been in what appears to be a large sideways pattern. The foray down to $26.50 occurred in August two months ago. We do have the appearance of what might be an awkward reverse head and shoulders pattern. If that’s correct, then once silver (finally) breaks above $33, our targets could be up to $39/$40, targets we have had for some time. All that is premised on any pullback holding above $30. If $30 broke, we could negate the pattern and fall to $27/$28. Silver actually fell about 2% this past week, despite gold gaining a small 0.3%. Both gold and silver stocks responded positively and, as we note next, rose on the week. We have noted before that silver broke out of what appears as a large cup and saucer pattern. The target for that pattern was also up to at least $39/$40.

Optimists are touting that silver could eventually see new all-time highs over $50. We are in agreement, but first we need to break above $33. We await.

Source: www.stockcharts.com

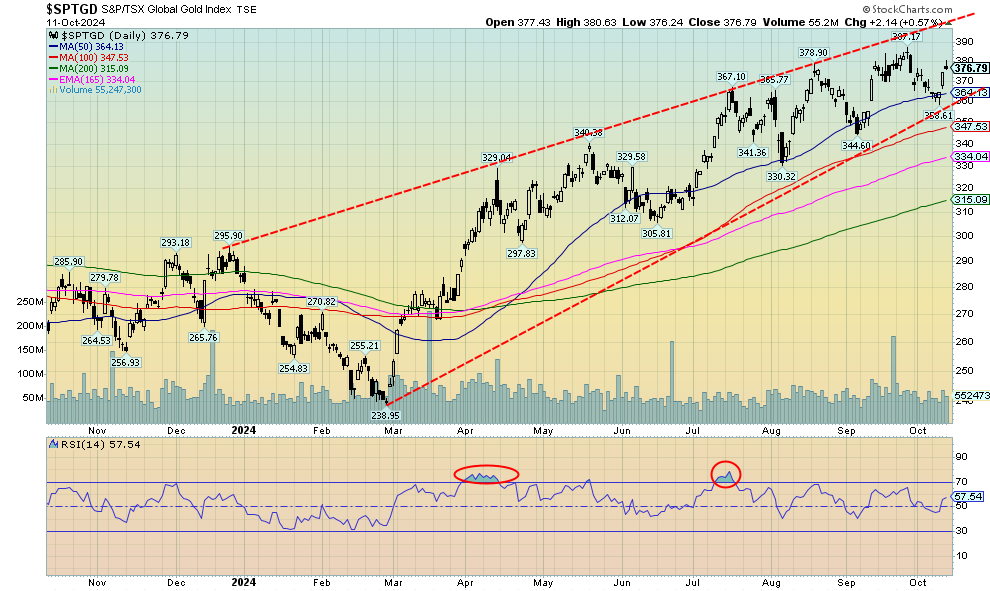

With gold higher, even as silver was lower, the gold stocks responded positively this past week. The TSX Gold Index rose 2.7% but the Gold Bugs Index (HUI) was up only 1%. Both indices are up over 30% thus far in 2024, one of the best-performing sectors. It’s been a steady climb for the TGD since that low seen last February. What is really positive about the climb is that it has been very choppy with constant pullbacks. To us, that indicates strength and we should continue to plow higher. The top of the bull channel is up around 400. A break under 360 would not be positive. But there is good support down to 330/345. Our trend is up and we appear poised to go higher—but it will be choppy.

Read the FULL report here: Technical Scoop: Hurricane Swans, Understated Overvaluation, Bullish Oil

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.