Excerpt from this week's: Technical Scoop: Inflation Stick, Commodity Fall, Bank Watch

Source: www.stockcharts.com

Gold had a rough week, despite the weaker than expected job numbers and a weaker US$ Index. With signs that we are headed for stagflation plus continued tensions on the geopolitical front, gold should have been higher, not lower. On the week, gold lost 1.6%, silver fell 2.1%, and platinum surprised, gaining 4.7. The near precious metals saw palladium lose 1.0% while copper consolidated, off a small 0.2%. The gold stock indices joined the metals as the Gold Bugs Index (HUI) fell 3.2% and the TSX Gold Index (TGD) was off 3.0%.

As to stagflation fears, Fed Chair Jerome Powell dismissed it. But then it is a statement we’d expect just as the Fed also said inflation was transitory. The trouble is, inflation remains stickily high while we are seeing the economy begin to slow, suggesting stagflation. That employment continues to be good is not unusual either.

Unemployment usually peaks after the recession ends not before. Wage growth also continues to be stronger than the Fed would prefer. Wages grew 4.4% y-o-y, not consistent with the Fed’s 2% inflation.

With the weakness in the jobs report and growing expectation that the Fed will cut rates in September, the fact that gold fell even as the stock market soared and the U.S. dollar fell was a surprise. Gold also broke the trendline up from the February 2024 low. However, the volume was not very high, suggesting that this breakdown is more like a waffle down than a breakdown. We continue to hold above $2,300. Further support can easily be seen, down to $2,240/$2,250. A breakdown under $2,200/$2,225 would be more problematic as we’d question the rally.

The positive aspect of this consolidation is that we have eased the overbought conditions that have prevailed. Volume rose sharply on the rise and, in typical corrective action, volume has tailed off considerably. A golden cross remains firmly in place, but then it is a lagging technical indicator. The only question we have is, is this a five-wave decline or merely a zig-zag? The gold bug bull-boards remain extremely bullish, which is a small negative as bullish extremism usually translates into “they are wrong.”

As we have so often noted, gold remains a lightly owned commodity as the focus remains on AI stocks. But central banks have noticed and in the desire to de-dollarize they keep adding to their gold reserves particularly the BRICs countries. Except, of course, the Bank of Canada (BofC) that sold all their gold back in 2016, the only major country to do so. The Bank of England (BOE) also sold off a good amount of their gold holdings and criticism of that action now dominates some discussions.

Still, the signs remain positive for gold and we should eventually see $3,500. The commercial COT remains low at 26.4% when we’d prefer to see that at least in the mid 30s to suggest higher prices. Below $2,300 we could fall further towards $2,200. Above $2,400 we should start the process of testing or exceeding the recent high of $2,449.

Source: www.stockcharts.com

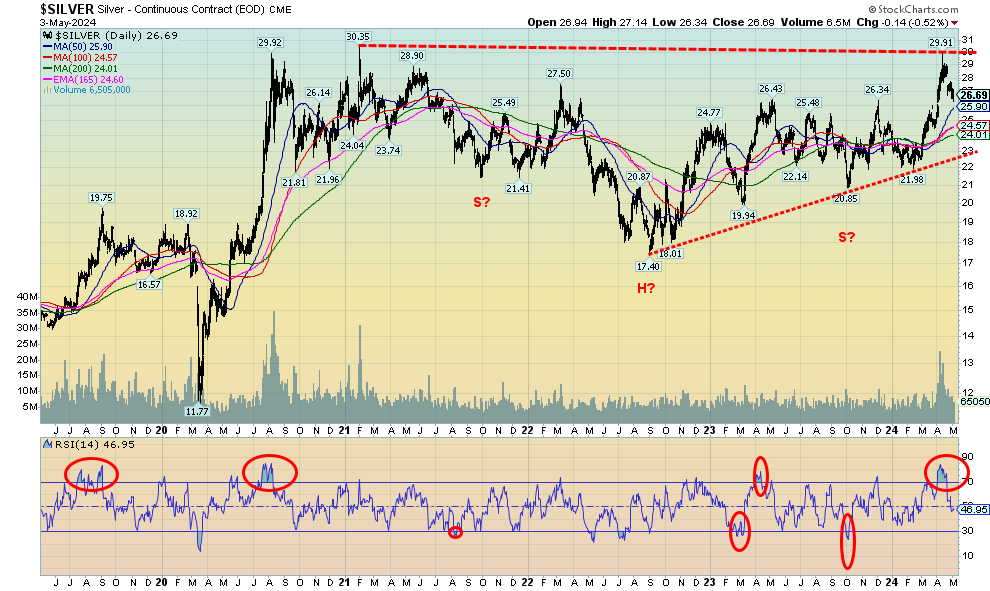

Silver fell this past week, despite as we noted a weaker than expected jobs report and a weaker US$ Index. Silver lost 2.1% as it continued to test $26.50 support. Further support can be seen to $26, but under that level the current rally becomes more questionable. The commercial COT is no help as it is at 26%, well below levels we’d consider bullish. This is despite silver experiencing supply shortages and remaining cheap vis-à-vis gold. We have support as noted to $26 and bigger support down to $24. But under $26 we’d have to question the rally that topped out so far just under $30. By reaching $30 we presumed that eventually we’d take out the February 2021 high of $30.35. So far, no such luck. A head and shoulders bottom also remains compelling. By taking out $26.50, targets were now up to $39/$40. This could just be a test of the breakout level, so in theory the breakout is still in place. Under $26, a problem exists but over $30 our targets should eventually be seen.

Source: www.stockcharts.com

With both gold and silver faltering this past week, it was no surprise to see the gold stocks falter as well. The TSX Gold Index (TGD) fell 3.0% while the Gold Bugs Index (HUI) was off 3.2%. Gold stocks remain incredibly cheap by most measurements and the junior gold exploration plays remain mostly unloved and under-owned. The 330 zone for the TGD continues to be stiff resistance for the index. We have good support down to 278, but under 275 we could test lows near 240. The pattern that has formed over the past two years still appears to be a large head and shoulders. Although we have noted that the right shoulder did go lower than the left shoulder when normally it is the other way around. We can’t say it won’t work yet, at least not until we bust under 240. If that falls, we are going lower to test to the 2022 low of 218. Not what the gold bugs want to hear. The good news is we’ve worked off the overbought levels that were seen earlier. The Gold Miners Bullish Percent Index (BPGDM) remains high at 82.14 which was overbought territory. Are we headed for one of those situations that got everyone excited when we rallied but that’s now going to shake everyone out again, sparking a sell-off? We need to hold above 280 and preferably above 300.

Read the full report: Technical Scoop: Inflation Stick, Commodity Fall, Bank Watch

Copyright David Chapman 2024

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.