Excerpt from this week's: Technical Scoop: January Trifecta, Energy Sign, Jobs Week

So how did markets perform in 2024?

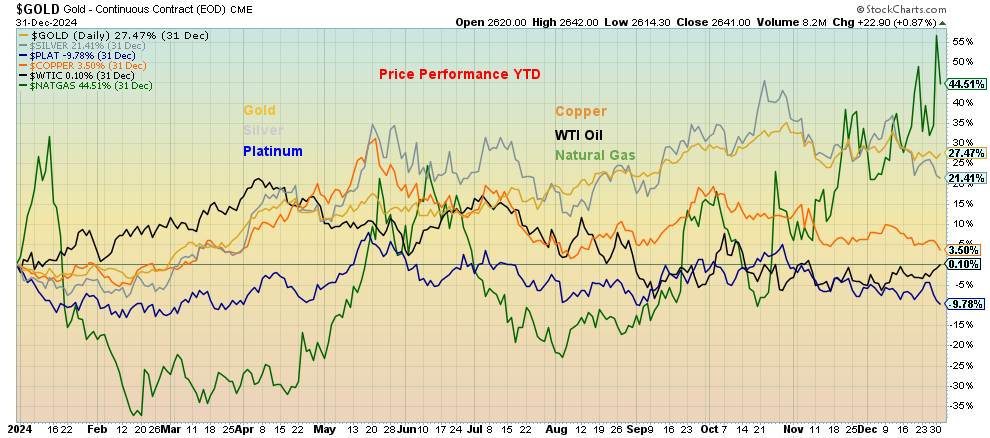

Commodities were decidedly mixed. Natural gas (NG) was the big winner for 2024, up 44.5%. NG at the EU Dutch Hub gained 56.0%. Others, we note, were gold +27.5%, silver +21.4%, copper +3.5%, oil +0.1%, while platinum was a loser, down 9.8%. Palladium was also a loser, down 20.2%. Gold stock indices were positive with the Gold Bugs Index (HUI) up 13.3% and the TSX Gold Index (TGD) up 18.4%. Note that the gold stock indices lagged both gold and silver. Energy indices didn’t fare as well. While the TSX Energy Index (TEN) gained 10.4%, the ARCA Oil & Gas Index (XOI) fell 5.3%. Commodities once again should be at the forefront in 2025, with potential upward pressure on energy prices and continued positive up moves from the precious metals.

Selected Commodities Performance 2024

Source: www.stockcharts.com

Noteworthy in 2024 was the performance of the US$ Index. While the US$ Index was gaining 7.2% in 2024, the euro fell 6.2%, the Swiss franc dropped 7.3%, pound sterling was down 1.7%, and the Japanese yen was off 10.3%. The Canadian dollar fell about 8.0%. Given wars, economic problems and more, funds flowed into the U.S., sparking demand for U.S. dollars. Funds primarily went into the stock market as the investors feared U.S. bonds, given the massive size of the U.S. Federal debt (123% of GDP) and the potential for even larger increases in debt. Despite the massive flow into U.S. dollars and the U.S. stock market, gold did exceptionally well. If the U.S. dollar is rising, gold normally falls moving inversely to the US$. The same occurs with interest rates as long-term U.S. interest rates rose despite the Fed cutting rates. Gold, instead of falling against rising U.S. interest rates rose and a US$ Index, rose instead. The 10-year U.S. treasury rose in yield by 18.3% (prices that move inversely to yields fell 4.1% in 2024) before considering the coupon. Gold rose 27.5% in 2024. Gold is a currency and a contrarian signal.

Read the FULL report here: Technical Scoop: January Trifecta, Energy Sign, Jobs Week

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.