Excerpt from this week's: Technical Scoop: Job Surprise, Yield Rise, Silver High

Source: www.stockcharts.com

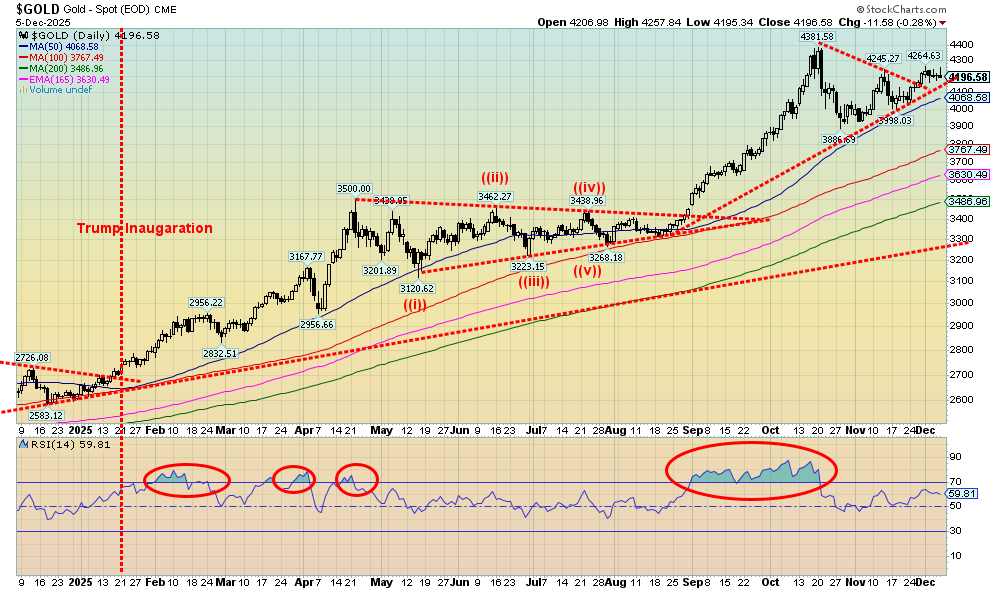

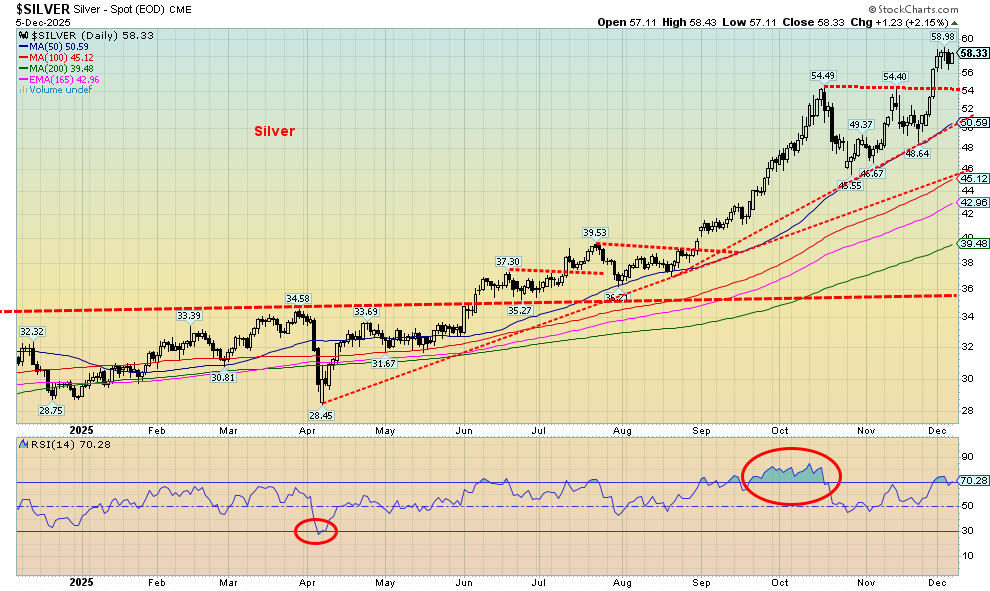

The gold rally of 2025 was put on pause this past week. Overall, gold fell a small 0.5% while silver continued its big run, up 3.5% to new all-time highs. Platinum fell 1.6% while the near precious metals saw palladium rise 1.5% and copper jump 3.5%. The gold stocks were back on their heels with the Gold Bugs Index (HUI) down 2.0% and the TSX Gold Index (TGD) off 3.2%. Still, no one can complain, given that gold is up 58.9% on the year, outpacing most of the other assets. Silver is up 99.5%, now almost doubling.

If there is a concern we have, it is that only silver has been making all-time highs while gold and the gold stocks remain short of new all-time highs. Dow Theory says the averages must agree with each other. While the precious metals are not stock indices, they should all agree with each other all making new all-time highs together. Until that happens, there remains some downside risk. While gold broke out over a small downtrend line and does project up $4,650 or even up to $4,875, we still need to see new highs if we are to realize those targets. A break back under $4,100 would signal trouble and under $4,000 would signal new lows under $3,887.

With high expectations of a Fed interest rate cut this coming week, the pressure is put on the US$ Index while boosting gold. Momentum has also played a role and ongoing purchases from central banks are also putting upward pressure on gold prices. As well, we are seeing increased demand from Chinese insurance companies and India pension funds. Gold is on target for its best year since 1979. That was the year that gold soared from around $215 at the beginning of the year to a high of $835 by January 1980. A comparable move today would

take gold to $7,600. The odds of that happening are low to nil right now. Recommendations to hold gold from the likes of Goldman Sachs and JP Morgan Chase also help demand as more flows into ETFs. The chaos emanating from the Trump presidency doesn’t hurt, either. It creates uncertainty and the U.S. debt just keeps on rising. If one is concerned about the debt, then holding gold is wise.

Seemingly lagging are the junior gold developers, many of which trade on the TSX Venture Exchange (CDNX). Most junior miner indices contain companies that produce, not develop. The best known is the VanEck Junior Gold Miners ETF (GDXJ), up 155% in 2025, thus far outpacing the HUI and TGD. The Sprott Junior Gold Miners ETF (SGDJ) is up 156%. Eric Sprott, the founder, has significant positions in numerous junior gold developers and junior gold producers. Talisker Resource (TSK.TO) leads the pack for returns in 2025, up 390%.

The precious metals have been the place to be in 2025. Will that continue into 2026?

Source: www.stockcharts.com

Silver continues its remarkable recent run and once again makes new all-time highs before settling back. On the week, silver jumped 3.5%, far outpacing gold and the gold stocks. Industrial demand and the tightening supply of physical silver have led to the price rise. Can it be maintained? At this stage, the simple answer is yes. Silver broke out of what appeared initially as a potential double top. It failed, telling us we are headed higher. Potential targets are up to $63. Higher targets may exist. We have been a bit overbought with the RSI poking above 70, but so far nothing like that stretch in September/October where overbought was the norm. The past week has seen a much-needed consolidation. That may continue, but eventually silver should break out and continue its upward journey. What we don’t want to see is it break back under $54 and especially $48.50 as that would signal to us that the uptrend is over. Under $48.50 would signal to us that new lows are possible under $45.55.

Read the FULL report here: Technical Scoop: Job Surprise, Yield Rise, Silver High