Source: www.stockcharts.com

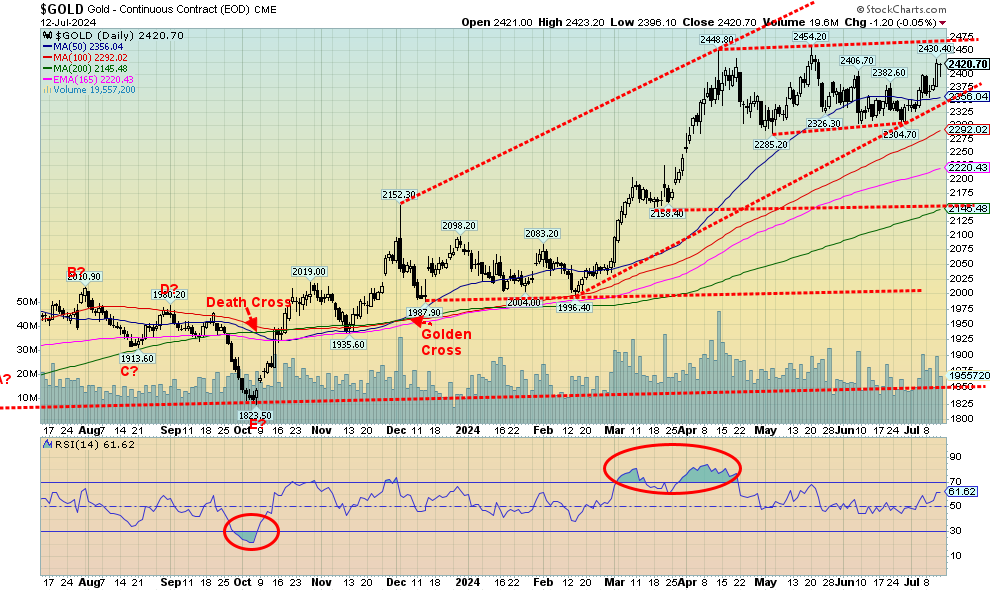

The precious metals (PMs) market was decidedly mixed this past week. Gold, encouraged by thoughts that the Fed could cut rates by September as well as encouraging inflation numbers and falling consumer confidence, rose about 1% this past week and closed over $2420. Silver, however, disappointed and actually fell 1.7%. Platinum was worse, down 3.1%. The near PMs also saw palladium fall 6.5% and copper drop 1.3%. The only real encouragement came from the gold stocks that saw both the Gold Bugs Index (HUI) and the TSX Gold Index (TGD) break out to 52-week highs. The HUI was up 5.9% and the TGD rose 5.7%. But the gold bugs focus mostly on gold, sometimes ignoring the others, even as they are important as well. We want to see all the PMs rising together, not some up and some down or, in the past week, gold up but everyone else down.

Given that gold is now over $2,420, it suggests that we could see new all-time highs above $2,454. Of course, the corollary to that is gold is forming a triple top, instead of a possible head and shoulders top. The other side of this is that gold is forming a trading range consolidation pattern. Usually, those patterns unfold in five waves: ABCDE. So far, we see ABCD, with D being the current wave, so an E wave to the downside could still be in play. Seasonally, that would fit as July lows for gold are not unusual until the more positive seasonals kick in in August. Not helping is a commercial COT at 19%, although when we include options on futures the commercial COT rises to 27%. The RSI is still at a fairly neutral 61 so we are nowhere near overbought. That could give us room to rise further.

Gold in other currencies is also languishing, except for gold in Japanese yen which recently made new all-time highs. As well, the Gold/GDX and Gold/GDXJ (GDX – senior/intermediate gold stocks, GDXJ – junior gold stocks) continue to show favour to the gold stocks, particularly the junior gold stocks. If gold stocks are the leaders, they are performing as they should. Both gold and silver will follow.

With the exception of the risk of another pullback where gold should hold above $2,300, we remain bullish on the sector. A firm break to new all-time highs should set us on the way to $2,500 and even $2,600 this coming year. There is just too much risk, particularly given the astronomical amounts of debt, rising bankruptcies, potential threats to the banking system, softening inflation, and political risk given the deep political divisions that exist today. As a few have pointed out, a Trump presidency could be quite positive for gold, given thoughts of huge tax cuts and a rise in trade wars.

Source: www.stockcharts.com

Silver disappointed this past week as it fell 1.7%, thanks to a bad Friday following the release of the marginally higher PPI numbers. Resistance remains at $32, a level that was hit this week but that failed to break. Based on the recent high at $32.75, we need to break over $33 to suggest we are on our way to projected levels of $39/$40. Silver is not in any danger unless we were to break under $29/$29.50. If that happened, we could soon fall back to $27/$28. Very long-term support is seen down near $23, a level we are not expecting. Most discouraging is the 22% commercial COT that suggests there may be a fall in price, not a rise. Still, silver is in demand deficit and supplies are dwindling. Discoveries are slow. Volume on the recent rise has not been impressive so we could yet face another pullback. The RSI is at a pretty neutral 56. However, silver stocks have done well and could be leading the way. As we noted, the gold/silver ratio has recently been falling in favour of silver, although this past week has not done any favours for silver as the ratio is currently at a still lofty 77.7. As we noted, we still need to get that ratio under 70 to suggest silver is finally gaining.

Source: www.stockcharts.com

Despite the disappointing showing of silver this past week, we wanted to show that silver has broken out of a long multi-year downtrend. That occurred when we broke successfully over $26 and confirmed with a breakout to new highs above $31. As well, recent pullbacks have been encouraging, holding above $29. The multi-year breakout has a potential target up to $63 which, if achieved, is good double from current levels. It would also be new all-time highs, given that twice silver hit about $50 in 1980 and 2011. The 1980 high remains, however, the real benchmark as today that would require silver to hit $190. That’s a seemingly impossible level, but nonetheless one that some analysts are predicting silver to rise to. Potentially more achievable is $70, a level that would equal the 2011 high on an inflation-adjusted basis.

Source: www.stockcharts.com

As we had noted, the breakout this past week of the gold stocks was encouraging, despite the mixed performance of gold and silver. The TSX Gold Index (TGD) broke over 340, closing near 354 and gaining 5.7%. The Gold Bugs Index (HUI) broke over 300 up 5.9%, closing just above that level near 301. Both indices made 52-week highs and some of the stocks we follow also made new 52-week highs. All of this is encouraging. More encouraging would be if they can hold above those levels this coming week and even add to the gains. Are the gold stocks leading? Certainly, in a bull market we need to see the gold stocks along with silver leading. We note they also lead in a bear market but to the downside. We do have two concerns for the TGD. First, we are somewhat overbought with the RSI above 70. Second, we note we appear to be nearing the top of a channel that could be an ascending wedge triangle (bearish). The top of that channel is currently near 358. The HUI shows a somewhat similar pattern as the top of its channel is near 306 and the HUI too has an RSI over 70. But overbought levels can remain for some time. Encouraging is the fact that neither gold or silver are overbought with RSIs near 60. That suggests to us that the gold stocks, at least, could move higher with little concern about the high RSI. Given the move, however, we need to see the TGD continue to hold above 340 on any pullback. At this point, a full breakdown doesn’t occur until under 325. We continue to be positive about gold, silver, and the gold stocks. Even some of the junior exploration stocks are showing some life. For that moribund market, it would be a welcome relief. Gold stocks are also being helped by good results. Indeed, their most recent quarterly results are the best on record. That in turn should attract more professional investors and funds.

Read the full report here: Technical Scoop: Panic Trigger, Speculated Cut, Toppy Gold

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.