Excerpt from this week's: Technical Scoop: Potential Scares, Golden Falter, 25 Consensus

Source: www.stockcharts.com

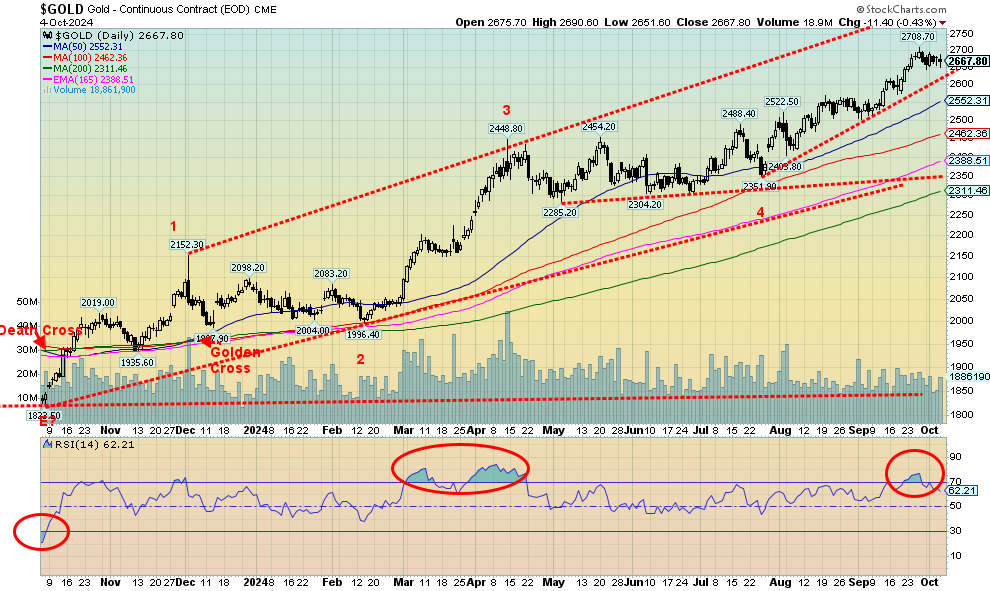

Gold was flat on the week—okay, off 0.01%. Given that the US$ Index jumped higher and bond yields rose, that gold remained flat was a positive sign. Gold is a safe haven and the beating of war drums in the Middle East has not gone away. Nor has the monstrous debt in the U.S. and the world. Nor have deep political divisions in the U.S. and an overvalued stock market that many claim is in a bubble. Silver didn’t stay flat as it rose 1.8%. Platinum can’t seem to get out of the way of itself and fell 2.0%. Of the near precious metals, palladium lost 2.4% and copper was off 0.7%. The gold stocks had a down week with the Gold Bugs Index (HUI) down 3.1% and the TSX Gold Index (TGD) off 2.0%. But, as we note later, we did see some life in a number of junior mining stocks. That sector has been moribund, even as the larger cap gold stocks have enjoyed a banner year.

Gold also reacted negatively on Friday following the job numbers, as the strong report seemed to nix thoughts of a 50 bp cut. A 25 bp cut remains a possibility. Gold has been knocking on $2,700 and it has not been unusual to see pauses at these even levels. We saw it at $2,500 and $2,600 before we pushed higher. The trend remains up. Gold has gained 28.8% thus far in 2024, making it already one of the best years ever.

Gold did get a bit overbought at $2,700 as the RSI went over 70 but has since pulled back to 62. We note the 50 RSI level has acted as reasonable support over the past six months. A drop under $2,650 would be short-term negative and under $2,600 we could fall further to $2,550. But with numerous pullbacks along the way,

the advance appears strong as pullbacks remain shallow. The only caveat for gold continuing to rally is now is that October is not normally a good month for gold. In the past we’ve seen selloffs start in October and the low doesn’t come until December. 2015 is still remembered as was 2016. But with the current background of war, divisions, debt, etc., gold should really only have one way to go and that is up. Even if we pause first.

Source: www.stockcharts.com

Silver appears to have made a slight new high on this past Friday’s volatile day. It finished the day off small but did manage to end the week up 1.8%, outpacing gold. That said, we continue to bang up against that resistance zone at $33, hitting a high of $33.22 but closing at $32.39. It highlights the $33 resistance zone which has held us back now since May. Still, silver is up 34.5% on the year, making it one of its best years ever. We read that, according to Bloomberg, silver needs a $2.1 trillion investment by 2050 to meet rising demand for net-zero demand. There was also a mega-merger this past week of Silvercrest Metals (SIL/TO) and Coeur Mining (CDE/NYSE). But the merger is being met with a lukewarm reception as CDE fell after, down 9.5% on Friday, while SIL rose 9.7% the same day. Could other suitors for SIL emerge?

Silver needs to break through $33 to suggest to us that we are on our way to long-held targets up at $38–$40. Higher targets are also noticeable, but let’s get the first one. Silver’s RSI is only 63 so it is not yet overbought and has room to move higher. Long-term support is down at $29, but under that level long-term support comes in around $26.50. We remain bullish on silver and expect at some point to see new all-time highs above $50. First, let’s get through $33 and keep pullbacks shallow.

Source: www.stockcharts.com

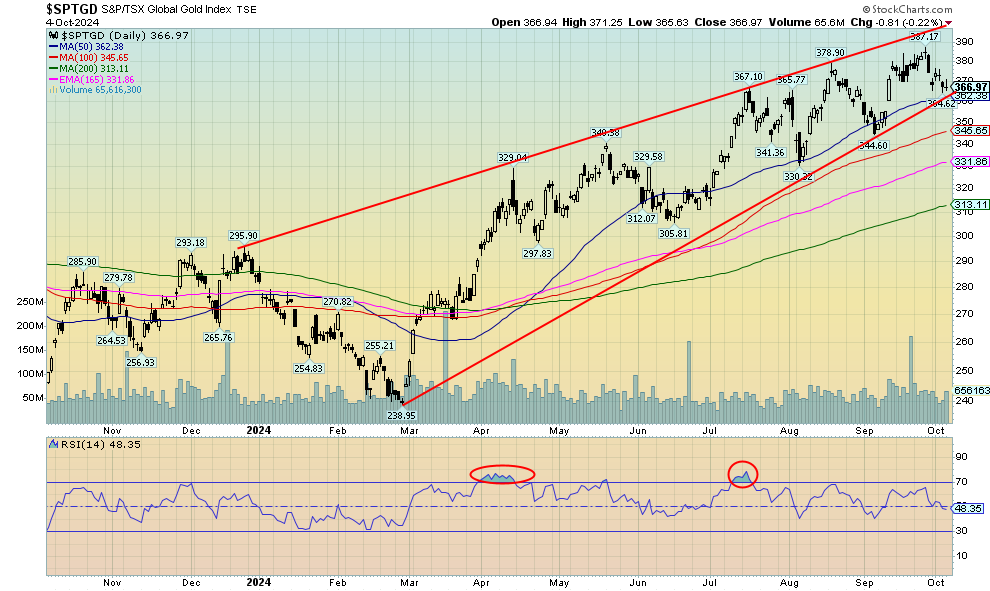

Despite silver being up and gold flat on the week, the gold stocks waffled and finished the week down. The TSX Gold Index (TGD) fell 2.0% while the Gold Bugs Index (HUI) was off 3.1%. On the good news side, we did see positive movement in some junior gold mining stocks this past week. In the TSX Venture Exchange (CDNX), which is over 50% junior mining stocks, many of the gold companies rose 2.1% this past week, one of the better performers for indices. While we remain bullish on the gold stocks into 2025, we continue to wonder if a short-term correction is in the offing. Can’t say we liked the pullback this week, especially with silver putting in a decent week to the upside. As well, that pattern still has the look of an ascending wedge triangle (bearish), which is getting narrower as we move higher. Right now, a break of 360 would do the trick, but we need to break under 345 to put more downward pressure on the sector. We would not want to see 305 or 295 taken out on the downside as that could signal a more serious decline. We never really became overbought on this up so we may still recover yet. The background remains bullish for both gold and silver and that in turn helps the stocks. Both indices are up 29%/30% this year.

Read the FULL report here: Technical Scoop: Potential Scares, Golden Falter, 25 Consensus

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.