Excerpt from this week's: Technical Scoop: Precious Calm, Oil Glut, Shutdown Chaos

Source: www.stockcharts.com

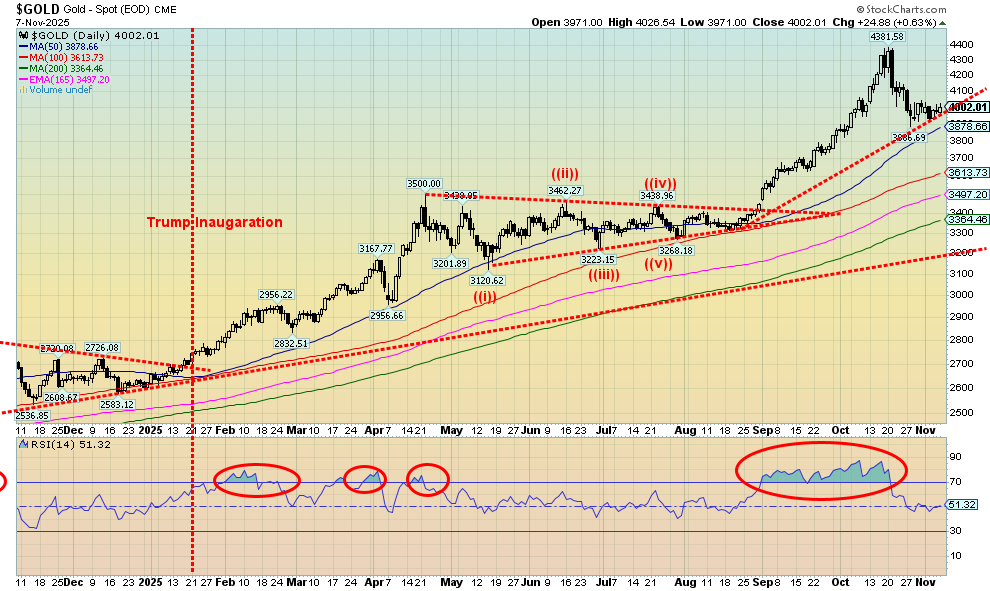

Gold is going through an overdue correction. We had never seen such a long period of overbought (RSI) conditions before. Gold rose this week a small 0.1%. Gold rebounded on Friday as concerns mounted over the government shutdown and the lack of jobs data. Yes, there are private surveys, but, overall, they don’t replace what is released by the BLS. Central bank purchases are also continuing. So far so good, in that gold appears to be holding near $4,000. However, we would not be surprised to see it fall further with a breakdown under $3,900. That could target down to $3,600 where gold would be making a healthy correction following that overbought period.

Gold rose 0.1% on the week, silver fell 0.4%, platinum was down 1.4%, palladium lost 3.1%, and copper fell 3.0%. All in all, not a particularly good week for the precious metals (PMs). We need to regain back above $4,210 to suggest new highs. We remain bullish on gold for the long term, but this correction was clearly overdue. Following a low which we expect sometime in November or even December, we expect to rise to new highs in Q1 2026.

Source: www.stockcharts.com

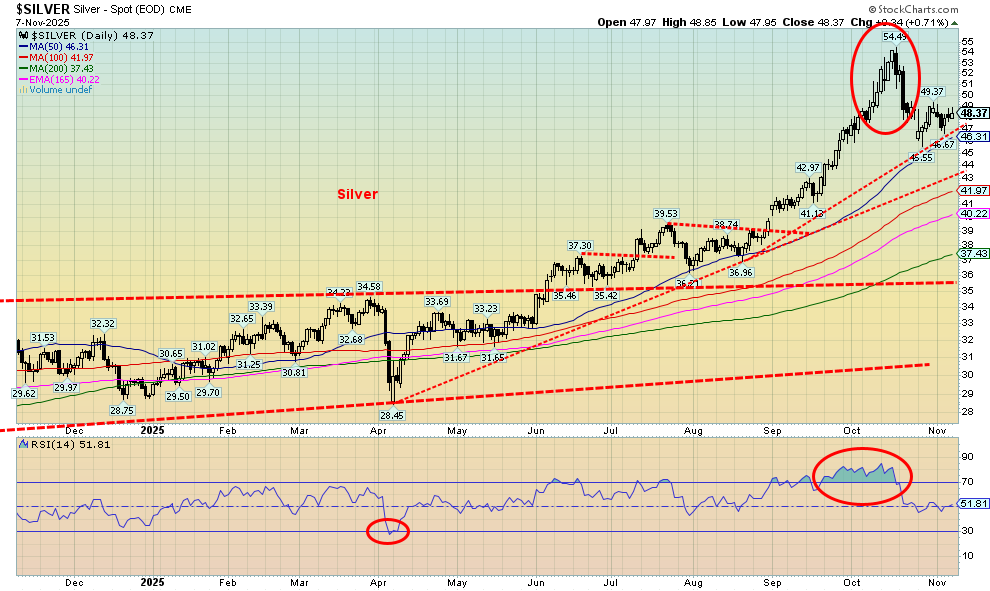

Silver continues to correct that extreme overbought period as it fell a small 0.4% this past week. Like gold, it was largely a dull week. Possibly helping silver going forward is that the U.S. added silver to its list of critical minerals. That’s interesting as the U.S. relies heavily on imported silver. Mexico is the world’s largest silver producer, producing upwards of six times more than the U.S. who ranks eighth. China is number two and even they produce over three times more than the U.S. The U.S. is the world’s largest of importer of silver, followed by the U.K. The U.S. imports about double what the U.K. imports. Silver is heavily used in industry for electronics, cars, solar panels, chemicals, and a lot more.

We may have a support zone near the 50-day MA ($46.31). A break under $46 would send us down towards $43 which may be our ultimate target. Silver needs to regain above $52.60 to suggest new highs. We are not oversold yet. Silver miners have done well this year with the Silver Miners ETF (SIL) up for the year to date 104% vs. silver’s gain of 65.4%. The Junior Silver Miners ETF (SILJ) is up 118%. That’s marginally better than the gold miners ETFs GDX and GDXJ.

Source: www.stockcharts.com

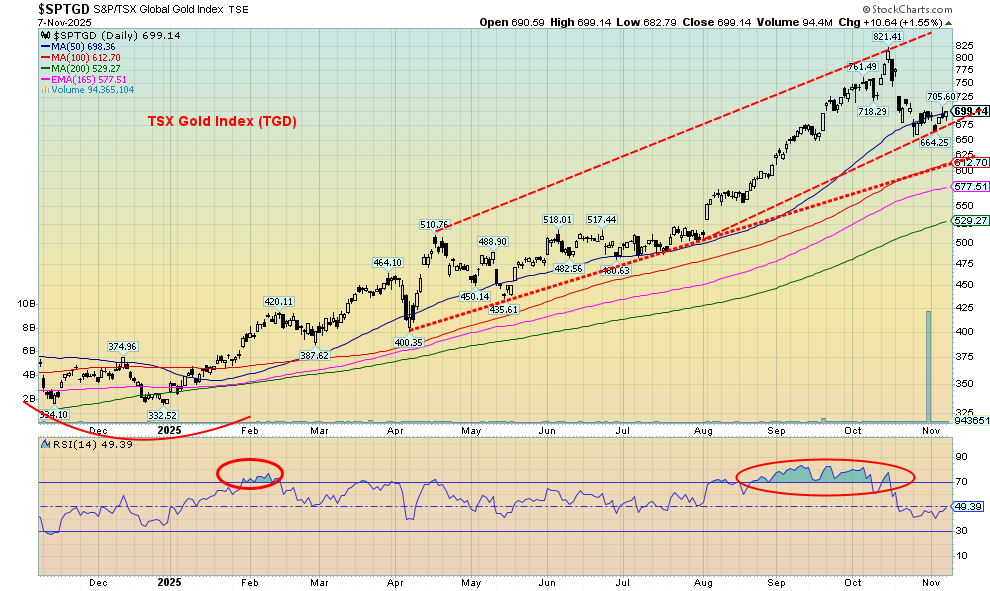

Gold stocks flopped around this past week, forming what might be a B wave. To come, a possible C wave to the downside. On the week, the Gold Bugs Index (HUI) was down 0.2% while the TSX Gold Index (TGD) rose 1.2%. For the TGD there is some resistance at 750, but we need to break back above 765 to suggest new highs. We are currently hovering around the 50-day MA, but a good break of 660 suggests lower prices, possibly to that next support line near 610. A break of that line could send us even lower. The 200-day MA is currently at 529. We remain bullish on gold stocks but recognize this is an overdue correction to one of the most overbought periods we’ve ever seen. In that respect this correction is healthy and needed.

Read the FULL report here: Technical Scoop: Precious Calm, Oil Glut, Shutdown Chaos

Copyright David Chapman 2025

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.