Excerpt from this week's: Technical Scoop: Signal Impacts, Precious Consolidation, Oil Recovery

Source: www.stockcharts.com

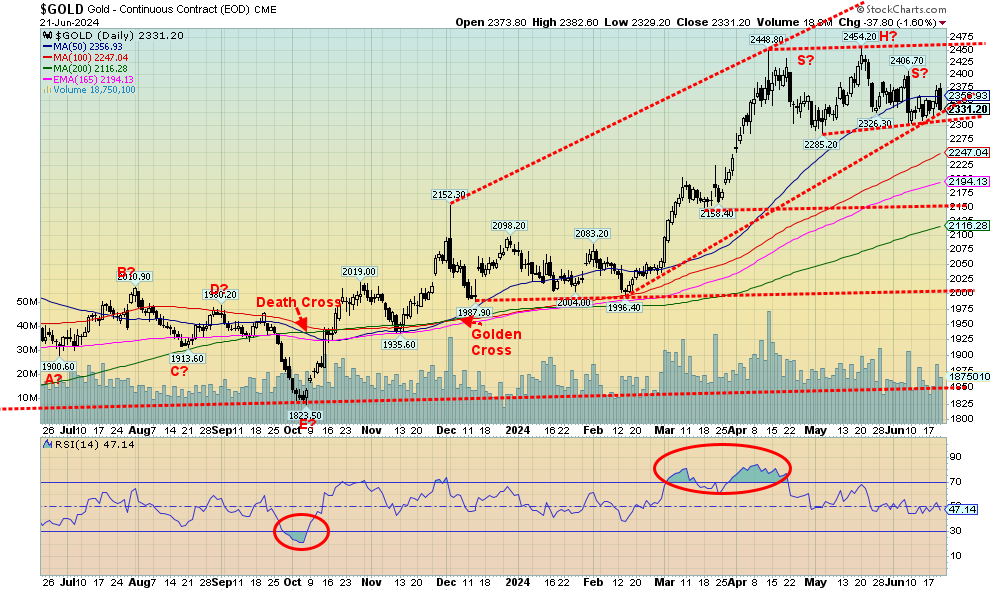

Gold prices faltered this past week as gold fell 0.8% while silver was up barely 0.5%. Platinum rebounded, gaining 3.9%, while the near precious metals saw palladium rise 2.9% but copper fall 1.1%. The past week or two has been volatile with a number of sharp up days followed by sharp down days. That was seen, especially on Thursday and Friday when gold rose over $22 Thursday, then promptly fell $38 on Friday. Feeling whipsawed? Friday was also a reversal day, given a higher high, lower low and lower close. Reversal days are not uncommon but we don’t want to see significant follow-through. Gold continues to suggest a head and shoulders top. A breakdown under $2,300 then could project down to around $2,150.

While poor retail sales and a sliding housing market helped gold rise stronger than expected earlier in the week, the rise in business activity that came out Friday sunk gold prices. Specifically, it was the PMIs that displayed strength, helping the US$ Index and bond yields to rise. That in turn sunk gold. Still there is expectation and optimism that the Fed would cut rates in September. Currently, traders are betting 62% a rate cut in September. Despite Friday’s fall, the expectation is that gold prices (and silver) could continue to rise. Regardless, we can’t rule out a short-term hiccup if $2,300 breaks. Demand remains strong, particularly out of Asia and from central banks that continue to shore up their gold reserves to strengthen their currency. Central banks cite three strong reasons as to why they are purchasing gold – no default risk, strong performance during a crisis and historical significance. They also cite gold being a long-term store of value, its liquidity, a portfolio diversifier, fear of systemic risks, its use as collateral, no political risk, domestic gold production, a policy tool and concerns about sanctions and trade wars.

So far, $2,300 is holding, but for how much longer? Many analysts continue to see gold rising to $2,500 and $2,600. However, we need to get through this bad patch. A break back above $2,400 would go a long way to satisfy the bulls. However, we must do that before we break $2,300. Nonetheless, the current malaise could continue into July, even if we don’t break $2,300.

Source: www.stockcharts.com

Silver eked out a 0.5% gain on the week, despite last Friday’s sharp pullback. Silver lost $1.21 this past Friday or 3.9%. Otherwise, it would have been a good week. Silver remains up 22.9% in 2024. So far, silver is finding support at the 50-day MA (currently $29.20) and good support down to $29. But a downtrend is underway and a break under $29 could send silver down to support at $27. Silver should be a lot more bullish, given industrial demand and shortages. But the paper market continues to rule. Like gold, silver may continue the current malaise into July.

Source: www.stockcharts.com

Despite both gold and silver hesitating this past week, the gold stocks actually rose, even after Friday’s drop trimmed some of the gains. The TSX Gold Index (TGD) rose 2.2% while the Gold Bugs Index (HUI) was up 2.0%. We note that the TGD stalled out at the 50-day MA. A firm burst through 318 is required to push the 50-day into the background. Major resistance is up at 340, a level that must fall if we are rise further. A successful break above 340 could target over 500 and new all-time highs for the TGD. The junior mining market remains moribund as the TSX Venture Exchange (CDNX) remains down over 80% from highs dating back to 2007. The CDNX is down almost 50% from highs seen in 2021. The lament is that companies with real assets and potential continue to be ignored for meme stocks, AI stocks, and cryptos. That makes them cheap but doesn’t do a lot for price appreciation, at least not yet.

The TGD could break support under 310, but better support lies at 290/294 then down 283. Under 270, the market breaks down completely. The reality is, we need to break above 340 to keep this going.

Read the full report here: Technical Scoop: Signal Impacts, Precious Consolidation, Oil Recovery

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.