Excerpt from this week's: Technical Scoop: Tariff Losers, Inflation Expectation, Gold Win

Source: www.stockcharts.com

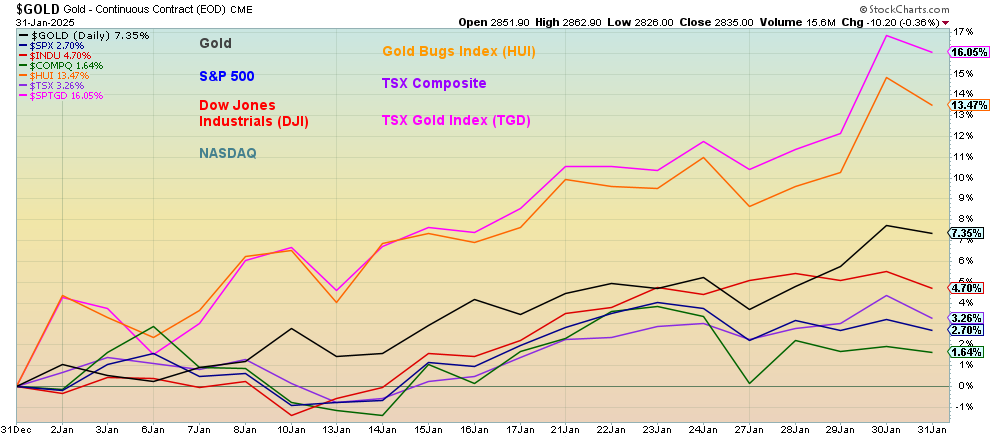

The month of January is over and the winners for the month were the gold indices. The Gold Bugs Index (HUI) was up 13.5%, and the TSX Gold Index (TGD) gained 16.1%. Gold was up 7.4% and, while not shown, silver gained 10.3%. The S&P 500 was up 2.7%, the DJI gained 4.7%, and the NASDAQ was up 1.6%. Golds remain our number one place to be in 2025, irrespective of ups and downs. Indeed, if the stock markets follow Friday’s down day again on Monday, we suspect gold may also follow. But remember that back in 2008 and again in 2020 gold was the first out of the chute. The gold stocks get hit harder than physical gold. And physical gold tends to outshine the stock markets. Gold, unlike stocks or bonds, has no liability.

Source: www.stockcharts.com

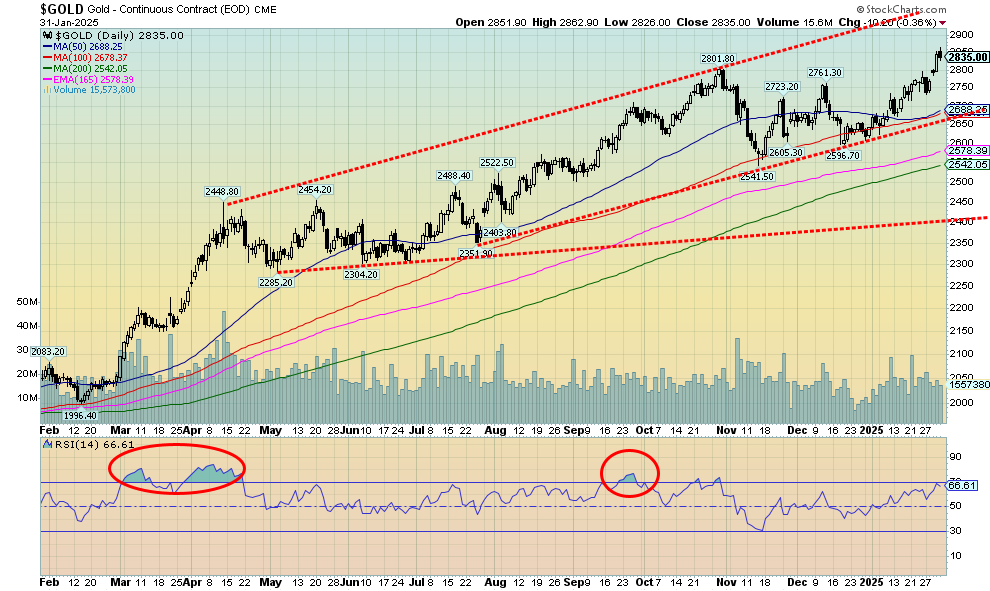

Gold is the safe haven in times of geopolitical troubles, inflation/deflation, and market turmoil. Gold has been around as a monetary metal for over 3,000 years and is viewed as a reliable store of wealth. Gold has no liability. Given recent market uncertainty and volatility, it may be no surprise that gold rose 2.0% this past week to record highs at $2,835. Because of the strong US$ Index, gold had no trouble making all-time highs in all currencies. Gold is also protection against currency depreciation.

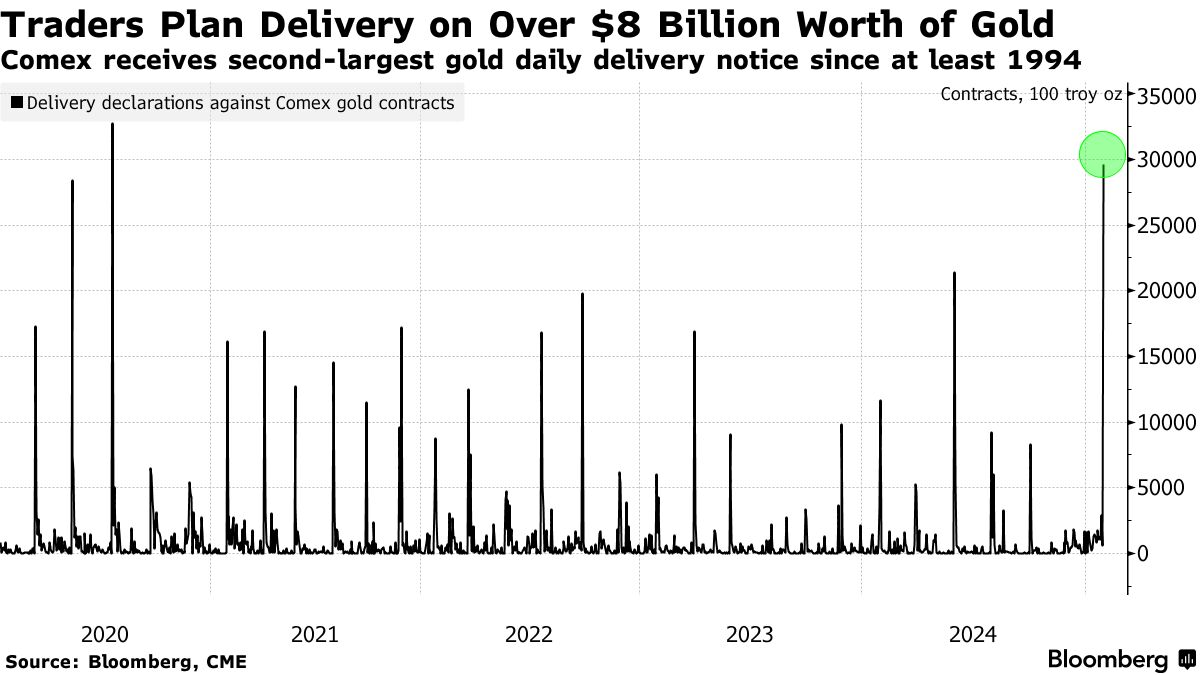

There is no doubt that Trump is rattling the markets. And that is positive for gold. But what we are seeing is something we haven’t seen before. There is a rush on to acquire physical gold. “There is incredible demand for physical gold in New York markets,” according to Peter Spina of Goldseek (www.goldseek.com). It is noted that Trump’s tariff plans could send gold to $3,500. Shortages are developing for physical gold. JP Morgan, the world’s largest bullion dealer, is delivering some $4 billion of gold bullion for settlement of futures contracts. Despite this, gold did pull back on Friday after the announcement that tariffs would indeed take place: 25% on Canada and Mexico (with oil & gas exempt for the moment) and 10% on China. 100% tariffs are threatened on the BRICS who have been trying to develop an alternative to the U.S. dollar and an alternative to the global payments system known as SWIFT. In a word, this could soon get ugly.

Other metals were also up. Silver gained 3.5%, while platinum was up 7.4%. Of the near precious metals, palladium gained 6.2% but copper waffled down 0.9%. We’d prefer to see copper leading.

In all, some $8 billion worth of physical gold could be delivered by the various bullion banks to cover futures contracts. So far, it is the second largest daily delivery notice since 1994. Gold futures have surged over spot prices. Gold finished the week for futures at $2,835 while spot was $2,800. A large physical settlement is noteworthy, as the futures market usually only sees paper trades. Usually positions are rolled over or cashed out, not replaced with physical good. Despite the huge delivery, we don’t know whether this was for arbitrage purposes or for existing short positions. The big five bullion banks besides JP Morgan are Goldman Sachs, BNP Parisbas, Deutsche Bank, and Morgan Stanley.

Source: www.bloomberg.com, www.cmegroup.com

Regardless of short-term gyrations and pullbacks, gold is going higher. Unlike Bitcoin, you can actually touch it, hold it. Friday might be start of a pullback, or not. As long as we hold above $2,650/$2,700 we’re going higher. Holding $2,800 would be positive, but if not, down to $2,750 would still be okay. $2,900 is in sight where we might expect some resistance.

Source: www.stockcharts.com

For a change, silver enjoyed a good week, surpassing the gains seen for gold. Silver gained 3.5% and is now up 10.3% in January. We also surpassed $32, a point we previously noted that needed to be taken out if we are to go higher. Still ahead, however, is that we need to take out $33.75/$34 to tell us that we should see new highs above the October high of $35.07. If that happens and we clear $35, then our next targets could be $39/40. However, that leaves us a long way from the all-time highs near $50 seen in 1980 and 2011. As we have noted, the reality given inflation is we need to see silver at $175 or $65 to equal the 1980 and 2011 highs on an inflation-adjusted basis.

We did break our downtrend from the October high. A pullback could take us down to $31.50 and we’d still be okay. But if we were to fall back under $31 and particularly under $30 we’d be in much more trouble. It would be helpful if we can soon take out that high in December of $33.33. We remain positive and bullish on silver but can’t rule out pullbacks. The final key point is $30 as we do not want to see that level breached. RSI is at a relatively neutral 59 so it does have considerable room to move higher.

Source: www.stockcharts.com

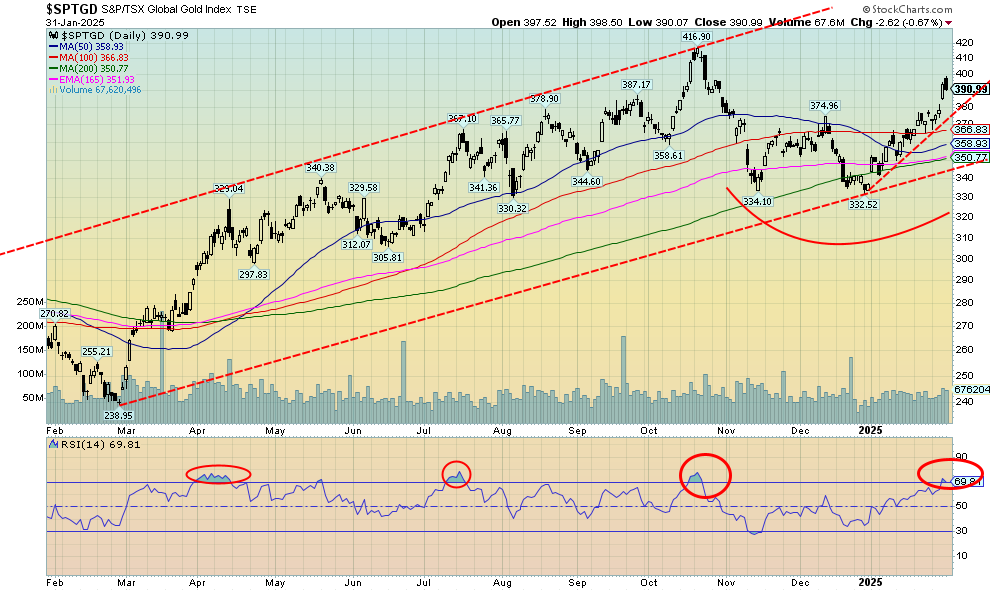

It was another up week for the gold stocks as the TSX Gold Index (TGD) gained 3.8% and the Gold Bugs Index (HUI) jumped 2.2%. The two indices are the best performing, up 16.1% and 13.5% respectively for January. If there is a fly in the ointment, Friday’s tariffs that sparked a stock market sell-off also hit the gold stocks. The TGD fell 0.7% on Friday but held its gains for the week.

We’ve had a nice move up from that December low, but we can’t help but note that the RSI was overbought, over 70 (briefly). Overbought is a condition that can linger for some time. The TGD needs to break out over 400 to suggest to us that new highs above the October high of 417 could be seen. We believe we will eventually see new highs, but for the moment the upward thrust could be on hold. A breakdown under 380 would be negative and could send us to support near 365 and even as low as 350. The move down from the October high appears to have unfolded in an ABC corrective fashion. But we need that close over 400 to tell us that the low is in and we could expect new highs.

Read the FULL report here: Technical Scoop: Tariff Losers, Inflation Expectation, Gold Win

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.