06 March 2021 -- Saturday

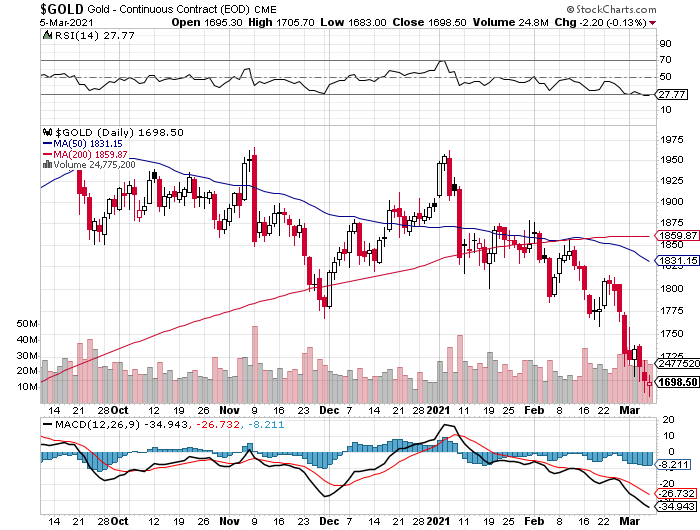

YESTERDAY in GOLD, SILVER, PLATINUM and PALLADIUM

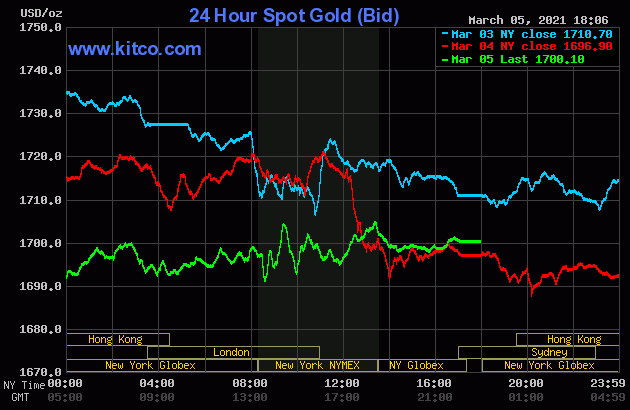

The gold price was sold quietly lower from the 6:00 p.m. open in New York on Thursday evening -- and a new low tick for this move down was set a few minutes after 9 a.m. China Standard Time on their Friday morning. From that juncture the price crept quietly and unevenly higher until the dollar index 'rally' ended about ten minutes before the London open -- and the price was sold a bit lower until 9 a.m. GMT. From that point it began creep/chop quietly higher until a few minutes before the 1:30 p.m. COMEX close in New York -- and was then sold down a bit until around 2:10 a.m. in after-hours trading. I didn't do a whole heck of a lot after that.

The low and high ticks in gold were recorded by the CME Group as $1,683.00 and $1,705.70 in the April contract. The April/June price spread differential in gold at the close on Friday was $3.10...June/August was $2.20 -- and August/October was $2.00.

Gold was closed on Friday afternoon in New York at $1,700.10 spot, up $3.20 from Thursday. Net HFT gold volume was nothing special at around 204,500 contracts, but roll-over/switch volume out of April and into future months was very enormous at 59,500 contracts...mostly into June.

|

|

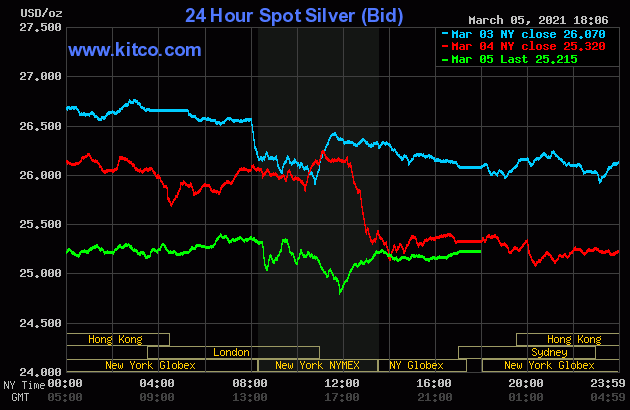

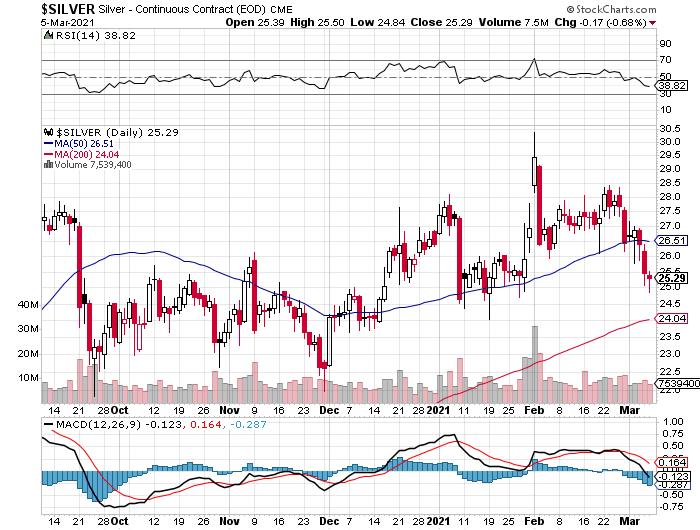

The silver price action was a much quieter version of what happened in gold, but only up until the 8:30 a.m. jobs report in New York on Friday morning. It had a sharp down/up move at that point, but the real selling didn't start until the equity markets opened at 9:30 a.m. EST. At that point the Big 4/8 traders showed up -- and engineered its price lower to a new low for this move down -- and below $25 spot intraday. It recovered rather nicely from there until a few minutes after the COMEX close -- and then didn't do much of anything after that.

The high and low ticks were reported as $25.505 and $24.845 in the May contract. The May/July price spread differential in silver at the close yesterday was 3.1 cents... July/September was 3.7 cents -- and September/December was 5.1 cents.

Silver was closed in New York on Friday afternoon at $25.125 spot, down 10.5 cents from Thursday, but 35 cents off its Kitco-recorded low tick of the day. Net volume was fairly decent at 72,500 contracts -- and there was around 6,100 contracts worth of roll-over/switch volume on top of that.

|

|

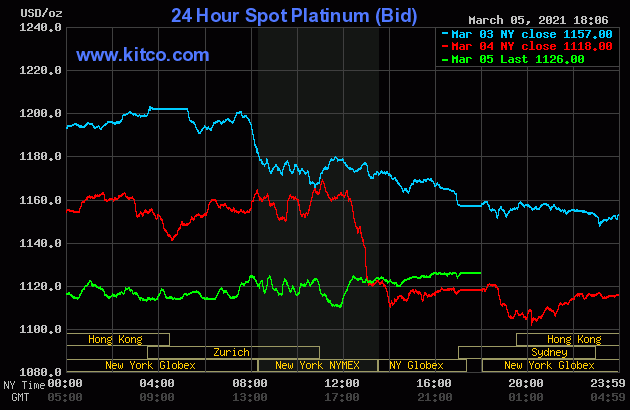

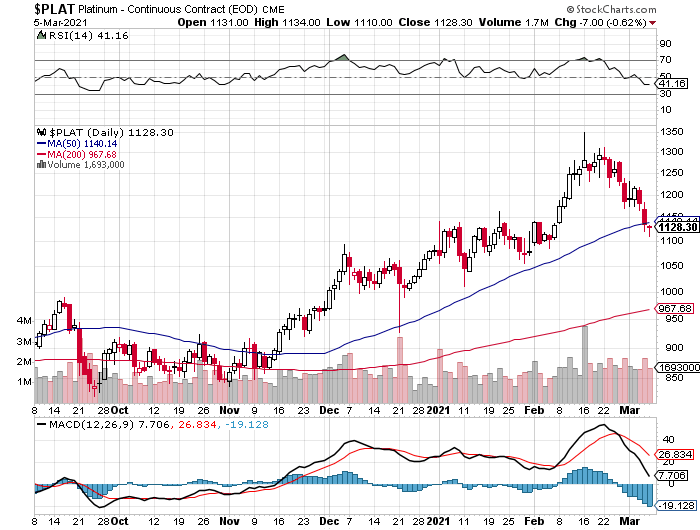

The Big 4/8 shorts pulled the same price stunt in platinum as they did in gold...setting its low of the day at a new low for this move down very shortly after 9 a.m. in Shanghai on their Friday morning. It recovered from there until the Zurich open -- and then didn't do much after that. Platinum was closed at $1,126 spot, up 8 dollars on the day.

|

|

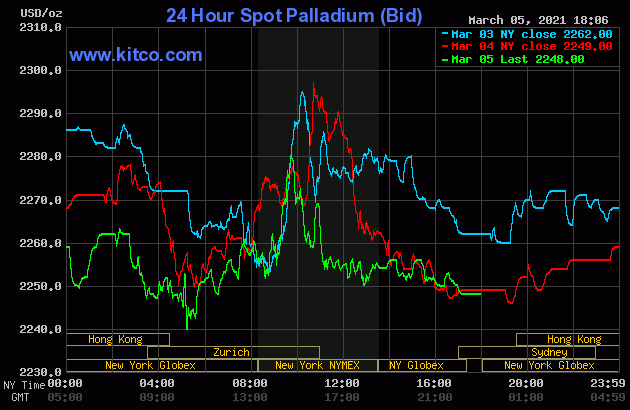

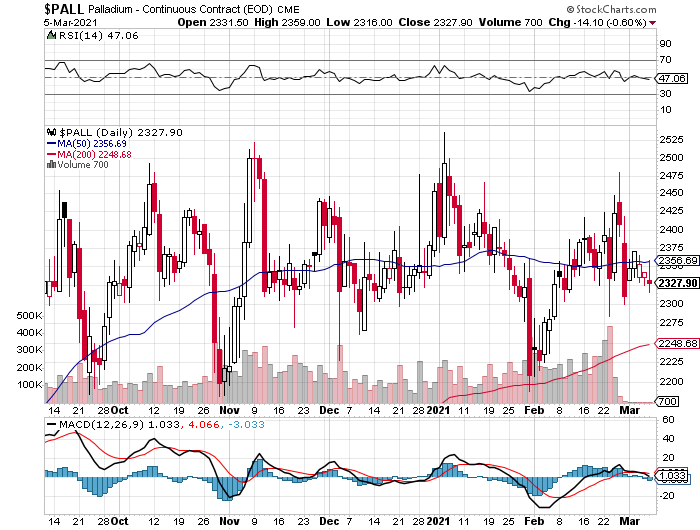

The palladium price chopped erratically higher in Far East trading on Friday -- and that lasted until around 3:15 p.m. China Standard Time on their Friday afternoon. It was sold lower from that point -- and the low tick was set very shortly after 11 a.m. in Zurich. The ensuing rally was capped and turned lower around 9:40 a.m. in New York -- and that sell-off lasted until Zurich closed at 11 a.m. EST. It then traded sideways until about 3:15 p.m. in the very thinly-traded after-hours market, before being kicked downstairs a bit more going into the 5:00 p.m. close. Palladium was closed at $2,248 spot, down a dollar on the day.

|

|

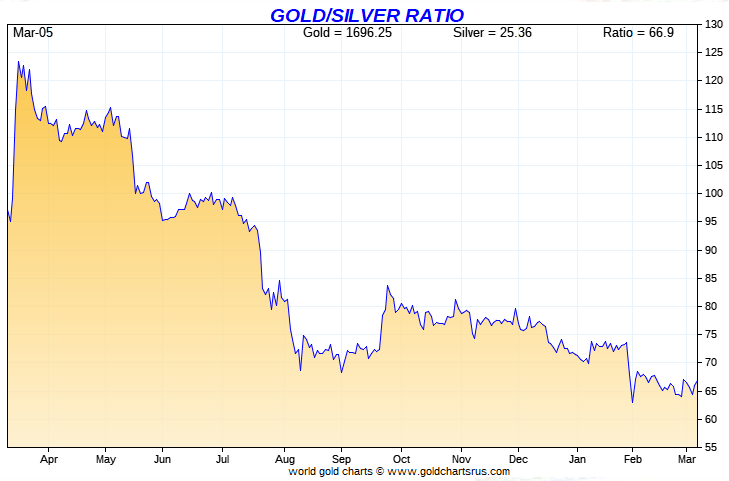

Based on the kitco.com closing spot prices in silver and gold posted above, the gold/silver ratio worked out to 67.7 to 1 on Friday...compared to 67.0 to 1 on Thursday.

And here's Nick's 1-year Gold/Silver Ratio chart, updated with the last five trading days worth of data. Click to enlarge.

|

|

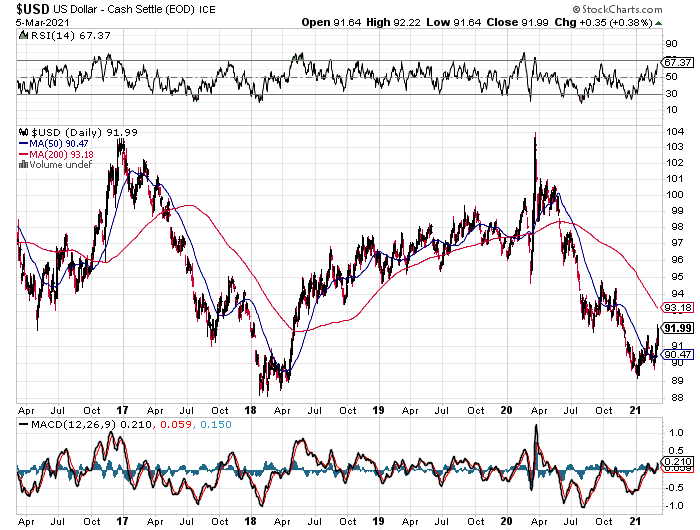

The dollar index closed very late on Thursday afternoon in New York at 91.631 -- and opened higher by just about 2 basis points once trading commenced around 7:45 p.m. EST on Thursday evening, which was 8:45 a.m. China Standard Time on their Friday morning. It then chopped aimlessly sideways until it began to drift higher staring around 11:55 a.m. CST. The 'rally' became somewhat more intense starting about five minutes before the London open -- and all the gains that really mattered were in by around 8:52 a.m. GMT. And except for an up/down spike at the release of the jobs number at 8:30 a.m. in New York, the index chopped quietly sideways until the market closed at 5:30 p.m. EST.

The dollar index finished the Friday session at 91.977...up about 34.5 basis points on the day.

And here's the DXY for Friday, courtesy of Bloomberg as always. Click to enlarge.

|

|

And here's the 5-year U.S. dollar index chart that appears in this space every Saturday...courtesy of the fine folks over at the stockcharts.com Internet site. The delta between its close...91.99...and the close on the DXY chart above, was one basis point and small change above its spot close on Friday. Click to enlarge as well.

|

|

With the U.S. equity market and dollar index higher on the day -- and what appeared on its face to be a blow-out jobs report, the Big 4/8 traders weren't really a force in the market yesterday, even though they set tiny new intraday lows in all four precious metals during the Friday session.

But as I've stated before, I've always been somewhat concerned about a real or engineered rally in the dollar index that the Big 4/8 shorts could use as a fig leaf to hide behind while they bludgeoned precious metal prices lower. That's worked fine so far, but it certainly was no factor yesterday.

And I also suspect that if the big shorts weren't stomping around in the COMEX futures market trying to cover their obscene and grotesque short positions they way they are, precious metal prices would be rising regardless of any dollar index rally, no matter how it was caused.

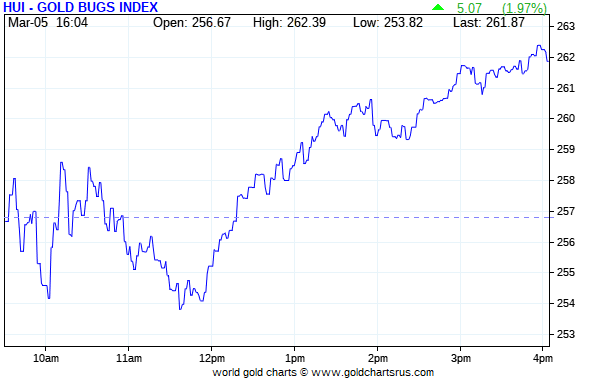

The gold shares opened unchanged once trading began at 9:30 a.m. in New York on Friday morning -- and then chopped sideways until shortly after 10 a.m. EST. They were then sold lower until around 11:35 a.m. -- and from there they marched quietly higher until the market closed at 4:00 p.m. EST. The HUI closed up 1.97 percent.

|

|

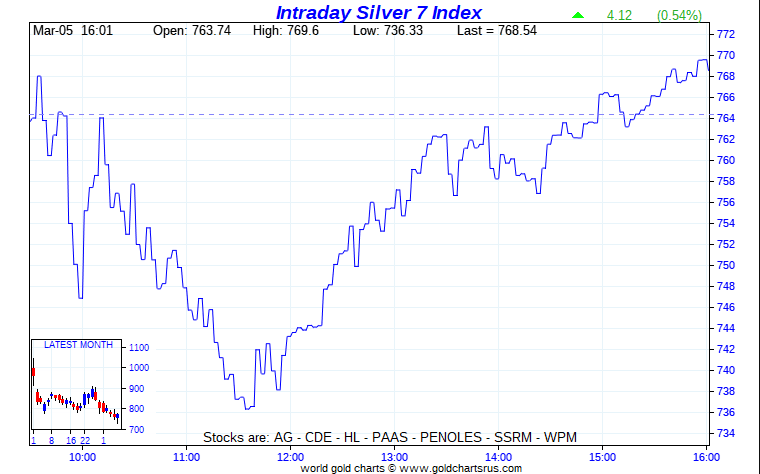

The silver equities ticked a bit higher at the open, but were then sold down hard, with their respective lows coming at the same time as it did for the gold stocks. From that point they headed briskly higher -- and Nick Laird's Intraday Silver Sentiment/Silver 7 Index closed up by 0.54 percent...dragged down a bit by Peñoles once again. Click to enlarge if necessary.

|

|

Computed manually, the above index closed higher by 1.02 percent.

And here's Nick's 1-year Silver Sentiment/Silver 7 Index chart, updated with Friday's candle. Click to enlarge as well.

|

|

The star of the day was SSR Mining once again, as it closed higher by 3.22 percent...followed very closely by Hecla and Coeur Mining, finishing up 3.13 and 2.93 percent respectively. The dog was Peñoles, closing down 2.77 percent on pretty big volume for it.

Without doubt, there was some very serious deep-pocket bottom fishing going on in the precious metal equities yesterday -- and I was one of them...as I added to my already considerable position in First Majestic Silver.

And while on the subject of my/our favourite silver mining company, they had this press release yesterday headlined "First Majestic Awarded as Socially Responsible Business in Mexico". Good on them!

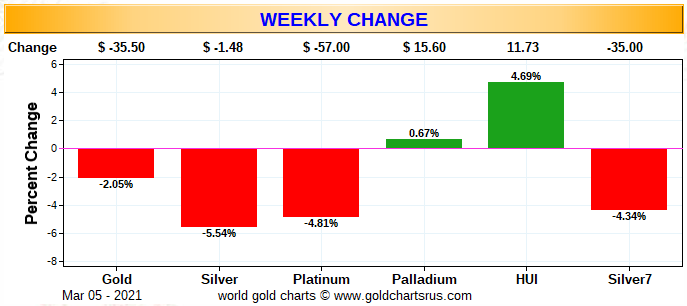

Here are two of the three usual charts that shows up in every Saturday missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York - along with the changes in the HUI and the Silver 7 Index.

Here's the weekly chart, which is also the month-to-date chart for this week only. Palladium closed up a hair, but the gold stocks were the stars this week for a change, despite the fact that the gold price closed lower on the week. Sadly, the silver equities reflected the underperformance of silver itself. Click to enlarge.

|

|

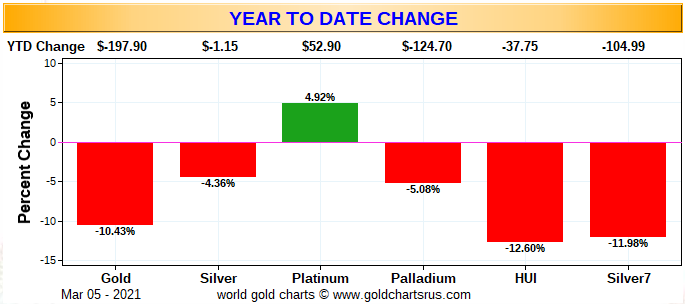

And here's the year-to-date chart -- and only platinum is up over that time period. The underperformance of the silver equities stands out like the sore thumb that it is. But as I keep saying, it would only take one or two very decent rally days in the precious metals themselves, to pop their associated equities back into the green year-to-date...particularly the silver stocks. Those days are coming. Click to enlarge.

|

|

And as Ted Butler has pointed out on many occasions, the short positions of the Big 8 traders in general -- and the Big 4 shorts in particular, are the sole reason that prices aren't at the moon already, as virtually every other group of traders in the COMEX futures market are net long against them in all four precious metals.

In the COT discussion further down, the Big 8 traders decreased their short positions in both gold and silver by very impressive amounts...far beyond what either Ted or I were expecting.

The CME Daily Delivery Report showed that 37 gold and 417 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the two short/issuers were JPMorgan and Advantage, with 31 and 6 contracts out of their respective client accounts. JPMorgan also stopped 10 contracts for its client account as well -- and the other 27 were picked up by Standard Chartered for its own account.

In silver, there were six short/issuers in total -- and the two largest by far were Barclays and JPMorgan, as they issued 233 and 132 contracts out of their respective client accounts. Once again there was a big list of long/stoppers. ADM was the largest, picking up 84 contracts for their client account -- and in second place was JPMorgan, as they stopped 75 contracts in total...9 for their own account, plus another 66 for clients. In third spot was Morgan Stanley, as they picked up 67 contracts for their client account -- and the list goes on and on...

In palladium, there were 3 contracts issued and stopped.

So far this month, there have been a very impressive 5,402 gold contracts issued/reissued and stopped -- and that number in silver is 9,344 contracts. In platinum and palladium those numbers are 240 and 287 contracts respectively.

The link to yesterday's Issuers and Stoppers Report is here.

The CME Preliminary Report for the Friday trading session showed that gold open interest in March fell by 80 contracts, leaving 919 contracts still open for delivery, minus the 37 contracts mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 321 gold contracts were actually posted for delivery on Monday, so that means that 321-80=241 more gold contracts just got added to March deliveries...simply amazing. Total silver o.i. in March dropped by 420 contracts, leaving 1,759 still around, minus the 417 contracts mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 431 silver contracts were actually posted for delivery on Monday, so that means that 431-420=11 more silver contracts were added to the March delivery month.

Total open interest in gold at the close on Friday rose by 5,313 COMEX contracts -- and total silver o.i. declined by 123 contracts.

There was another monster withdrawal from GLD yesterday, as an authorized participant took out 290,528 troy ounces -- and there as another big withdrawal from SLV, as an a.p. removed 3,900,145 troy ounces of silver.

Ted would be of the opinion that all that gold withdrawn would now have JPMorgan's name on it -- and that virtually all of the silver removed on Friday was a conversion of SLV shares for physical metal.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD & SLV inventories, there was a net and eye-watering 606,411 troy ounces of gold removed, with the lion's share...498,497 troy ounces...coming out of Deutsche Bank. But a net 176,626 troy ounces of silver was added.

There was no sales report from the U.S. Mint yesterday.

Month-to-date the mint has sold 11,500 troy ounces of gold eagles -- 11,000 one-ounce 24K gold buffaloes -- 761,000 silver eagles -- and 30,500 one-ounce platinum eagles.

And still no Q4/2020 Annual Report from the cretins over at the Royal Canadian Mint.

There was a very decent amount of activity in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday. Although nothing was reported received, a very hefty 139,791 troy ounces was shipped out. The largest amount...107,641.548 troy ounces/3,348 kilobars [SGE kilobar weight]...departed Malca-Amit USA. The rest...32,150.000 troy ounces/1,000 kilobars [U.K./U.S. kilobar weight] was shipped out of Loomis International.

There was some paper activity as well. The most was the 22,003 troy ounces that was transferred from the Eligible category and into Registered over at JPMorgan's 'Enhanced Delivery' sub-depository...most likely out for delivery in March. The remaining 385.812 troy ounces/12 kilobars [SGE kilobar weight] made the trip in the opposite direction over at Brink's, Inc. The link to all this, is here.

It was another very busy day in silver, as 1,645,144 troy ounces was reported received -- and 1,540,584 troy ounces was shipped out. The largest amount in the 'in' category was the 1,034,246 troy ounces that showed up at Brink's, Inc. Next was the one truckload...579,290 troy ounces...that was dropped off at Manfra, Tordella & Brookes, Inc. Delaware picked up 29,618 troy ounces -- and the remaining 1,989 troy ounces, two good delivery bars, found a new home over at CNT. In the 'out' category, there were two truckloads...1,211,024 troy ounces...that departed CNT -- and the remaining 329,559 troy ounces was shipped out of Delaware.

There was big paper activity as well -- and all of it from the Registered category and back into Eligible once again, with almost all of that being a transfer of 4,482,528 troy ounces over at Manfra, Tordella & Brookes, Inc. The remaining 34,239 troy ounces made that trip in the same direction over at JPMorgan.

Ted will certainly have something to say about the huge movement in silver in his weekly commentary this afternoon. The link to 'all of the above' is here.

Not to be left out of the action, there was very big activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday...the most I've seen in a very long time. They reported receiving 4,239 of them -- but shipped out only 302. And except for the 192 kilobars that were received over at Loomis International, the remainder of the in/out activity occurred over at Brink's, Inc. The link to all that, in troy ounces, is here.

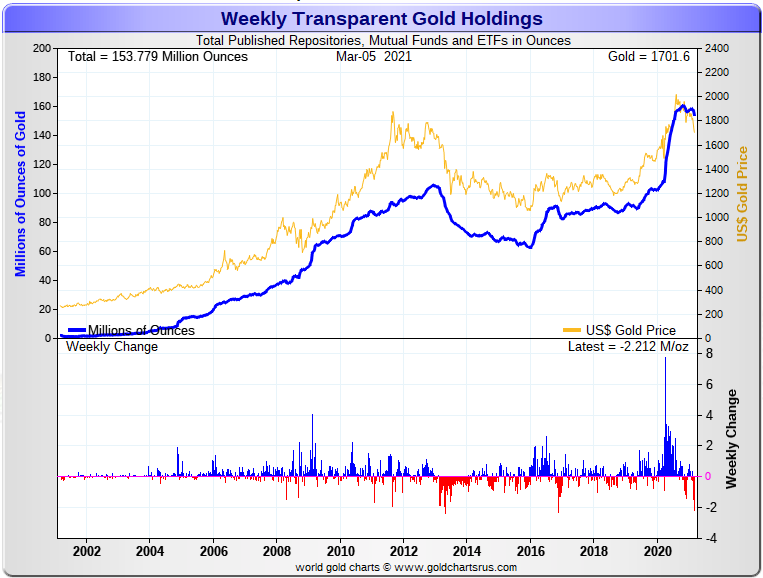

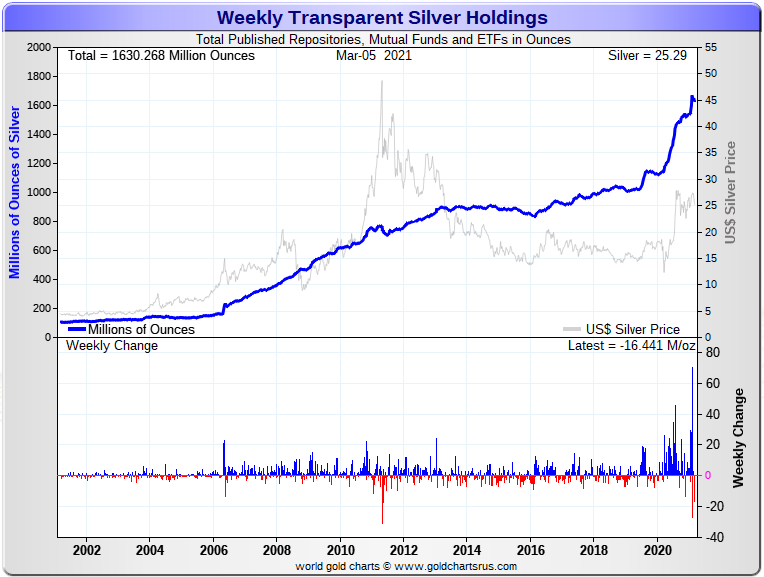

Here are the usual two 20-year charts that show up in this space every Saturday. They show the total amount of physical gold in all know depositories, ETFs and mutual funds as of the close of business on Friday.

For the week just past, there was a net 2,212,000 troy ounces of gold taken out, with almost all of it coming out of GLD -- and Ted would assume that all of this now owned by JPMorgan. In silver, there was a net 16,441,000 troy ounces removed as well -- and that number would have been far less [and most likely a net positive number] if the conversion of SLV shares for physical metal during the reporting week are added back in. I expect that Ted will have something to say about that in his weekly review later today as well. Click to enlarge for both.

|

|

|

|

But if one considers the fact that gold and silver prices have been...cough, cough 'consolidating' cough, cough...for the last seven months now, the physical declines in all these ETFs and mutual funds is not all that large. That's particularly the case in silver when you consider that the conversion of SLV shares for physical metal are not really withdrawals at all.

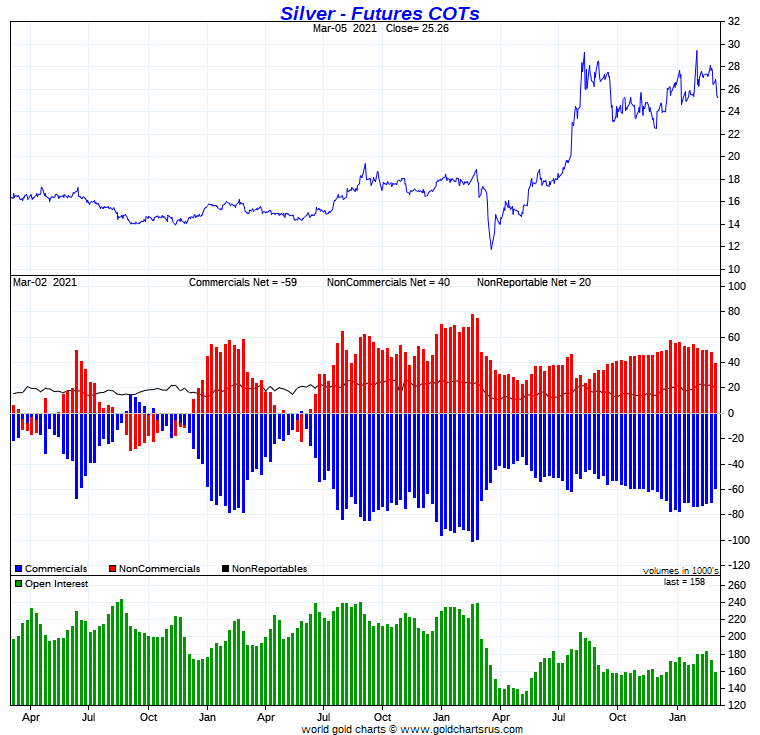

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, March 2, showed far larger improvements in the commercial net short positions in both gold and silver than either Ted or I were expecting. That was all good news -- and we were happy to see it.

In silver, the Commercial net short position declined by a very chunky 11,242 COMEX contracts, or 56.2 million troy ounces.

They arrived at that number by reducing their long position by 372 contracts, but they also covered 11,614 short contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, all the selling came from the Managed Money and Nonreportable/small traders, as the traders in the Other Reportables category sat on their hands during the reporting week.

The Managed Money traders reduced their net long position by 7,977 contracts -- and the Nonreportable/small traders reduced their net long position by 3,215 contracts. The Other Reportables decreased their net long position by an insignificant 50 contracts.

Doing the math: 7,977 plus 3,215 plus 50 equals 11,242 COMEX contracts, the change in the Commercial net short position.

The Commercial net short position in silver is now down to 296.0 million troy ounces, a big drop from the 352.2 million troy ounces they were short in last week's COT Report.

The Big 8 traders are short 368.2 million troy ounces of silver in this week's report, compared to the 399.9 million troy ounces that they were short in last week's COT Report. And as Ted pointed out on the phone yesterday, the Big 8 have now covered all the short positions that they put on to cap the silver price explosion during the first week of February...mission accomplished.

As of Tuesday's cut-off, the Big 8 traders were short 124 percent of the Commercial net short position, up 8 percentage points from last week's COT Report.

Ted figures that JPMorgan's short position in silver is now zero, after being short around 1,000 contracts in last week's COT Report.

Here's Nick Laird's 3-year COT chart for silver -- and the huge improvement should be noted. Click to enlarge.

|

|

Of course there's been even further improvement in the Commercial net short position since the Tuesday cut-off -- and to say that the set-up in the COMEX futures market is wildly bullish in the extreme, would be an understatement.

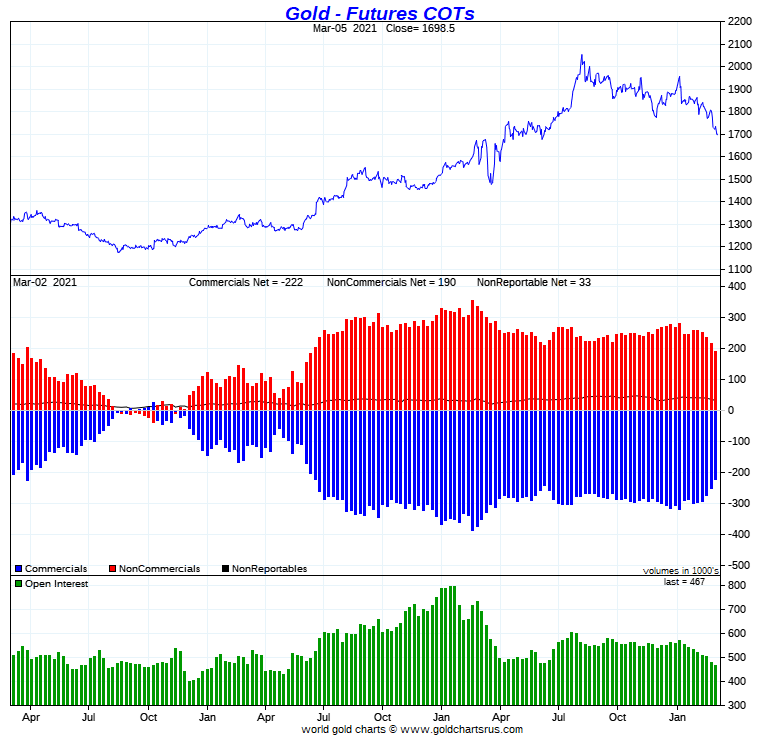

In gold, the commercial net short position plunged by 29,526 COMEX contracts, or 2.95 million troy ounces.

They arrived at that number by increasing their long position by 2,758 contracts -- and also covered 26,768 short contracts. It's the sum of those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was mostly Managed Money traders that did all the selling during the reporting week, as they decreased their net long position by 23,163 COMEX contracts -- and although the other two categories contributed, they didn't really do much. The Other Reportables decreased their net long position by 2,932 contracts -- and the Nonreportable/small traders decreased their net long position by 3,431 contracts.

Doing the math: 23,163 plus 2,932 plus 3,431 equals 29,526 COMEX contracts...the change in the commercial net short position, which it must do.

The commercial net short position in gold is now down to 22.22 million troy ounces, compared to the 25.17 million troy ounces they were short in last week's COT Report...that's a big improvement.

The Big 8 traders are short 20.50 million troy ounces in this week's COT Report, compared to the 21.84 million troy ounces they were short this time last week.

The Big 8 are short about 92 percent of the commercial net short position, up 4 percentage points from what they were short in last week's report.

Their situation is now approaching what currently exists in silver -- and that is that just about every other trader in the commercial category in gold is now net long against the Big 8...only 8 more percentage points to go!

Ted figures that JPMorgan increased their long position in gold in the COMEX futures market by about another 1,000 contracts -- and are now long about 6,000 contracts.

Here's Nick's 3-year COT chart for gold, updated with Friday's data -- and the change is quite significant. Click to enlarge as well.

|

|

As in silver, the COT Report in gold is equally wildly bullish and, of course, is even more so since the Tuesday cut-off. So, when the Big 8 run out of sellers in the Non-commercial and small trader categories, the set-up for a huge move to the upside will be in place. The path of least resistance for both gold and silver is now up -- and up a lot.

In the other metals, the Managed Money traders in palladium increased their net long position by a fairly hefty 489 COMEX contracts during the last reporting week -- and are net long the palladium market by 1,693 COMEX contracts...around 18 percent of the total open interest...up about 5 percentage points from last week. And as I keep pointing out, the COMEX futures market in palladium continues to be a market in name only. In platinum, the Managed Money traders reduced their net long position by another 5,315 contracts during the reporting week, but are still net long the platinum market by 20,824 COMEX contracts... about 29 percent of total open interest -- down about 6 percentage points from last week. In copper, the Managed Money traders decreased their net long position by 5,315 contracts -- and are net long copper to the tune of 65,021 COMEX contracts...about 1.63 billion pounds of the stuff -- and about 26 percent of total open interest...unchanged from last week.

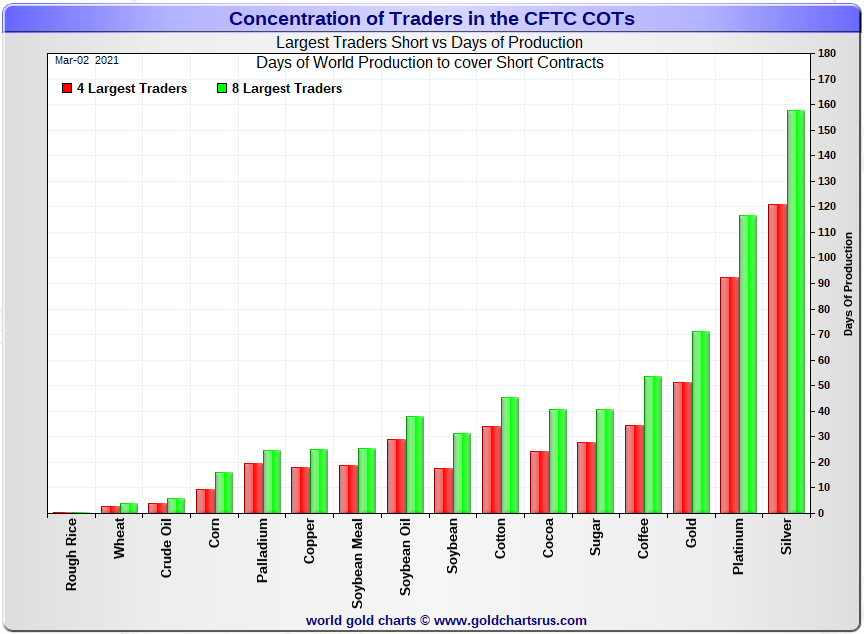

Here's Nick Laird's "Days to Cover" chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, March 2. It shows the days of world production that it would take to cover the short positions of the Big 4 - and Big '5 through 8' traders in each physically traded commodity on the COMEX. Click to enlarge.

|

|

The Big 4 traders are short about 121 days of world silver production, down about 10 days from the prior week's report. The '5 through 8' large traders are short an additional 37 days of world silver production...down about 3 days from the prior COT Report - for a total of about 158 days that the Big 8 are short...down about 13 days from the prior week's COT report.

This represents a bit over five months of world silver production, or about 369 million troy ounces of paper silver held short by the Big 8. [In the prior reporting period -- they were short 171 days of world silver production.]

In the COT Report above, the Commercial net short position in silver was reported by the CME Group at 296 million troy ounces. As mentioned in the previous paragraph, the short position of the Big 8 traders is around 369 million troy ounces. So the short position of the Big 8 traders is larger than the total Commercial net short position by about 369-296=73 million troy ounces...up about 26 million troy ounces from last week's report. That's a big increase!

The reason for the difference in those numbers...as it always is...is that Ted's raptors, the 34-odd small commercial traders other than the Big 8, are net long that amount.

Another way of stating this [as I say every week in this spot] is that if you remove the Big 8 shorts from the commercial category, the remaining traders in the commercial category are net long the COMEX silver market. It's the Big 8 against everyone else...a situation that has existed for almost five decades in silver -- and in platinum and palladium as well...and now coming close in gold.

As per the first paragraph above, the Big 4 traders in silver are short around 121 days of world silver production in total. That's a bit over 30 days of world silver production each, on average...down a lot from last week's COT Report. The four big traders in the '5 through 8' category are short 37 days of world silver production in total, which is a bit over 9 days of world silver production each, on average...which is also down a decent amount from last week's report.

The Big 8 commercial traders are short 46.5 percent of the entire open interest in silver in the COMEX futures market, which is up an insignificant amount from the 46.4 percent they were short in last week's COT report. And once whatever market-neutral spread trades are subtracted out, that percentage would be a bit over the 50 percent mark. In gold, it's 43.9 percent of the total COMEX open interest that the Big 8 are short, which is down from the 45.4 percent they were short in the prior week's COT Report -- and around the 50 percent mark once their market-neutral spread trades are subtracted out.

In gold, the Big 4 are short 51 days of world gold production, down about 2 days from last week's COT Report. The '5 through 8' are short 20 days of world production, down another 3 days from last week's report, as they continue to cover...for a total of 71 days of world gold production held short by the Big 8 -- and down about 5 days from last Friday's COT Report. Based on these numbers, the Big 4 in gold hold about 72 percent of the total short position held by the Big 8...up about 2 percentage points from last week's report.

The Big '5 through 8' continue to cover their short positions like mad -- and have been doing so for well over a month now. But starting last week, the Big 4 have joined them.

Ted says that JPMorgan is now net long about 6,000 COMEX contracts in gold, up about 1,000 contracts from last week's COT Report -- and are now market neutral in silver, after being short about a thousand contracts a week ago. They have been a non-factor in the COMEX futures market for about the last year...leaving the other Big 8 traders to struggle through on their own -- and those Big 8 have sure made their presence felt during the last ten days.

The "concentrated short position within a concentrated short position" in silver, platinum and palladium held by the Big 4 commercial traders are about 77, 79 and 80 percent respectively of the short positions held by the Big 8...the red and green bars on the above chart. Silver is about unchanged from last week's COT Report...platinum is down about 1 percentage point from a week ago -- and palladium is down about 5 percentage points week-over-week.

The Big 8 shorts are still hugely exposed in all four precious metals in the COMEX futures market, especially the Big 4 -- and although they made more big improvements in gold and silver during the past reporting week -- and since the Tuesday cut-off, the above chart tells you all you need to know about their current plight.

Despite these improvement, the situation regarding the Big 4/8 shorts continues to be beyond obscene and grotesque -- and as Ted correctly points out, its resolution will be the sole determinant of precious metal prices going forward.

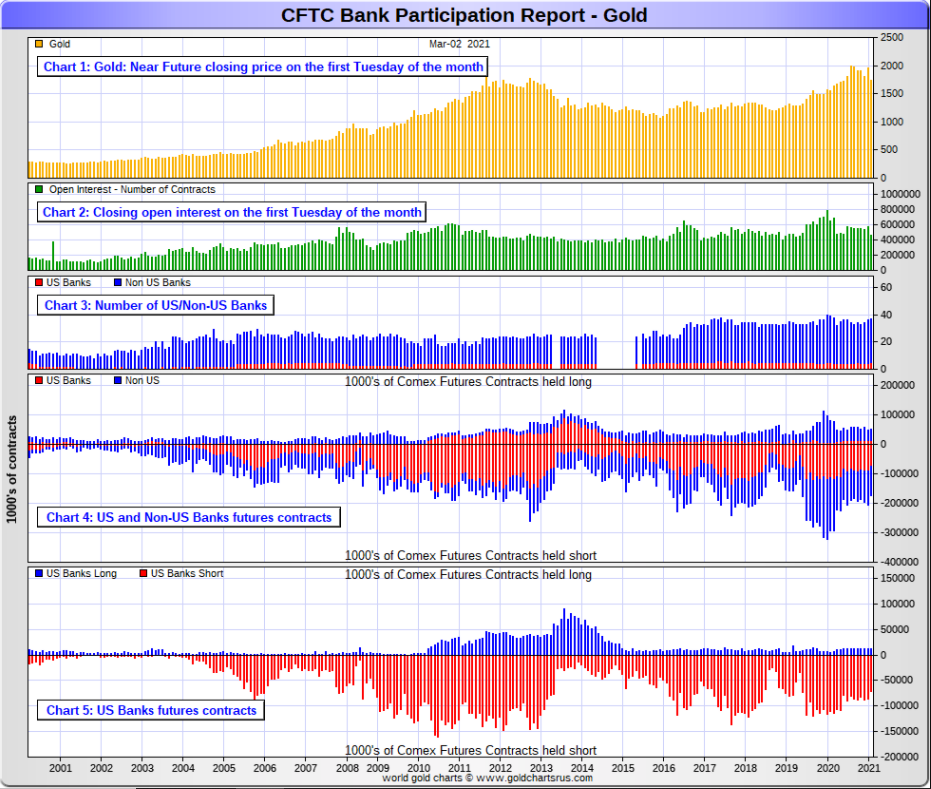

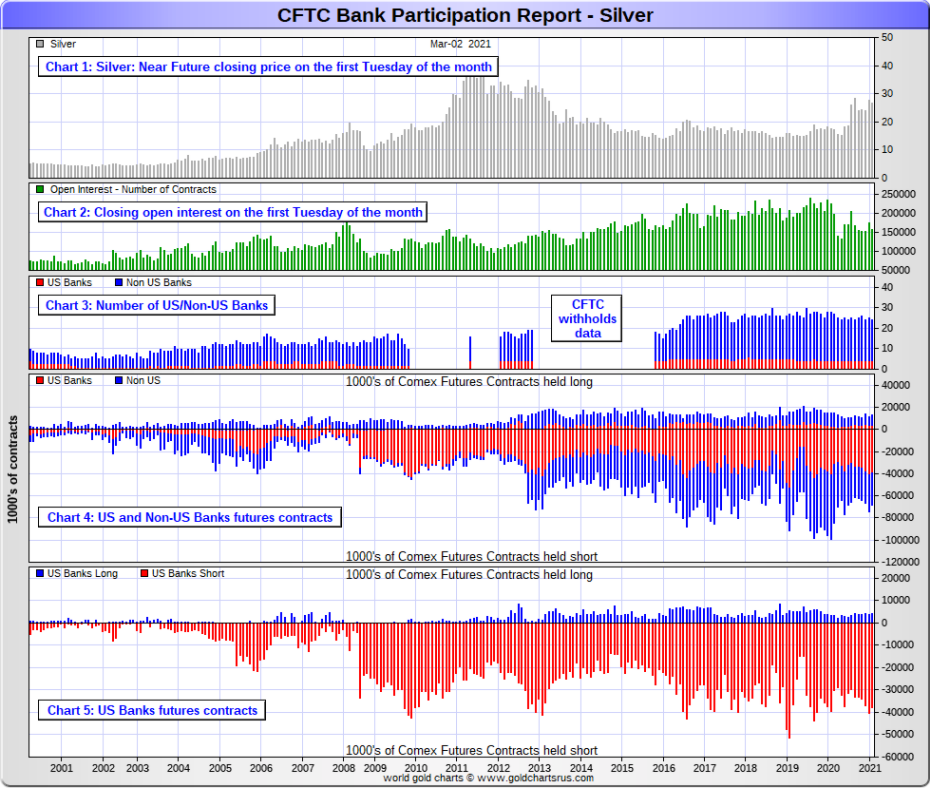

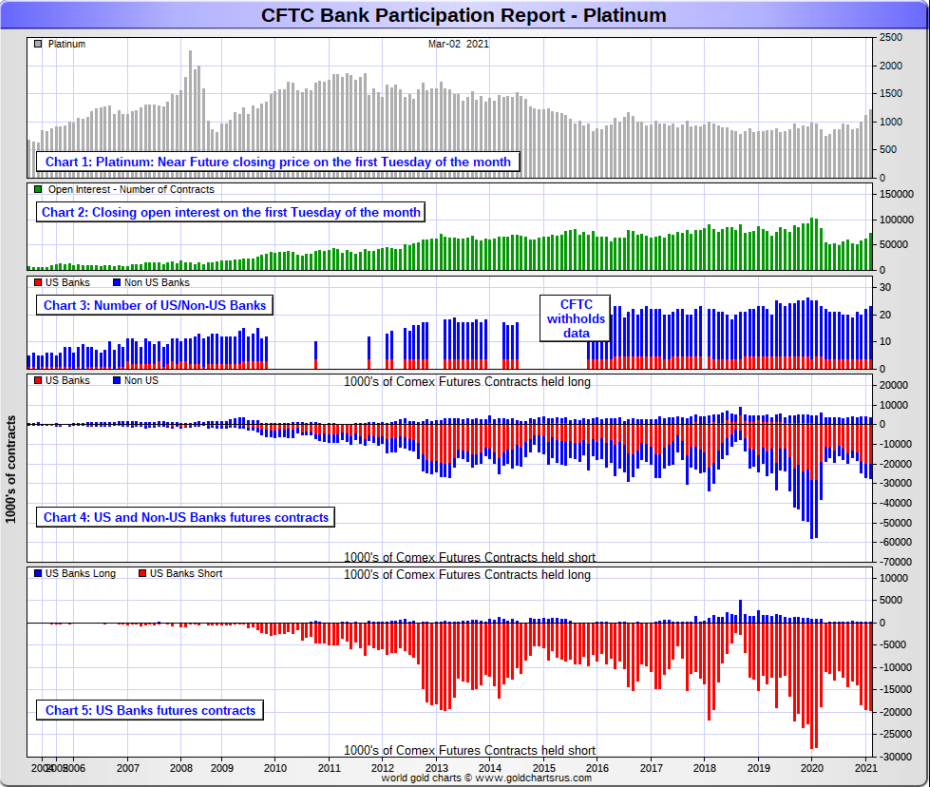

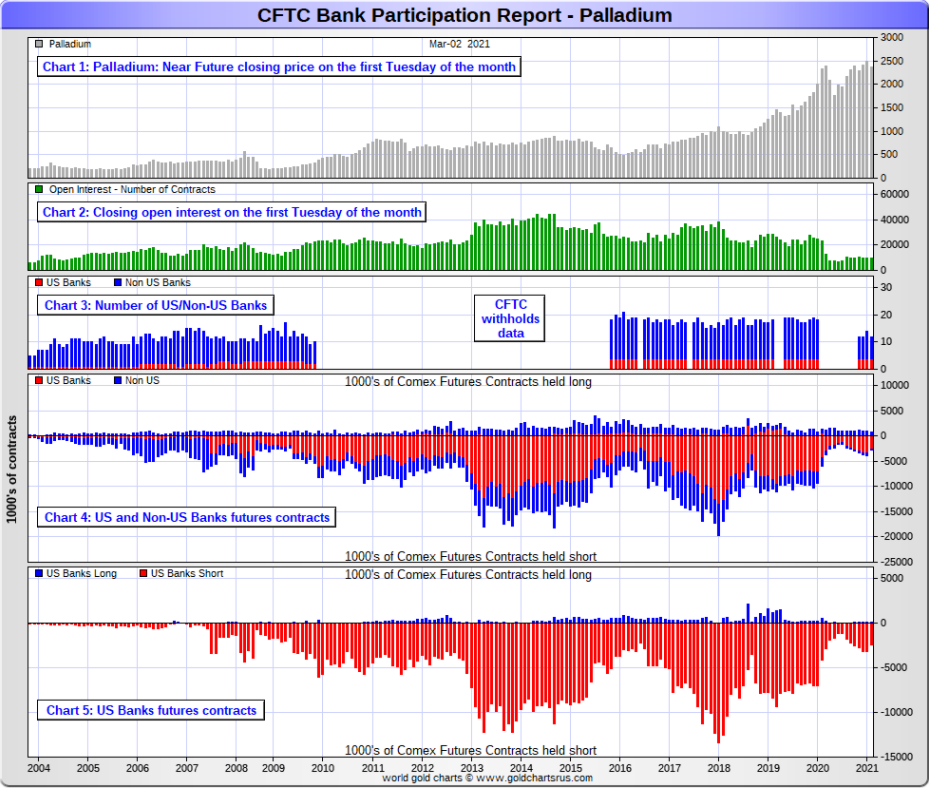

The March Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of Tuesday's cut-off in all COMEX-traded products. For this one day a month we get to see what the world's banks are up to in the precious metals -and they're usually up to quite a bit.

[The March Bank Participation Report covers the time period from February 3 to March 2 inclusive.]

In gold, 5 U.S. banks are net short 59,629 COMEX contracts in the March BPR. In February's Bank Participation Report [BPR] these same 5 U.S. banks were net short 71,776 contracts, so there was a decrease of 11,487 COMEX contracts from four weeks ago, which is a very decent amount.

Citigroup, HSBC USA, Goldman Sachs and Morgan Stanley would most likely be the U.S. banks that are short this amount of gold -- and most likely in the in-house/proprietary trading accounts. I'm also starting to harbour some suspicions about the Exchange Stabilization Fund as well, although they are most likely just backstopping these banks.

Also in gold, 32 non-U.S. banks are net short 63,187 COMEX gold contracts. In February's BPR, 30 non-U.S. banks were net short 75,092 COMEX contracts...so the month-over-month change shows a decrease of 11,905 COMEX contracts...just about the same improvement as the U.S. banks it total...but spread out over 32 banks, not just 5 U.S. banks.

At the low back in the August 2018 BPR...these same non-U.S. banks held a net short position in gold of only 1,960 contacts -- and they've been back on the short side in a big way ever since.

I suspect that there's at least two large non-U.S. bank in this group, one of which would be Scotiabank/Scotia Capital...plus HSBC most likely. And I have my suspicions about Barclays, Dutch Bank ABN Amro, French bank BNP Paribas, plus Australia's Macquarie as well. Other than that small handful, the short positions in gold held by the vast majority of non-U.S. banks are mostly immaterial and, like in silver, have always been so.

As of this Bank Participation Report, 37 banks [both U.S. and foreign] are net short 26.3 percent of the entire open interest in gold in the COMEX futures market, which is down a bit from the 28.3 percent that 35 banks were short in the February BPR.

Here's Nick's BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank's COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

|

|

In silver, 4 U.S. banks are net short 33,977 COMEX contracts in March's BPR. In February's BPR, the net short position of these same 4 U.S. banks was 38,722 contracts, so the short position of the U.S. banks has decreased by 4,795 contracts month-over-month.

As in gold, the three biggest short holders in silver of the four U.S. banks in total, would be Citigroup, HSBC USA -- and Goldman or maybe Morgan Stanley in No. 3 and 4 spots. And, like in gold, I'm starting to have my suspicions about the Exchange Stabilization Fund's role in all this.

Also in silver, 20 non-U.S. banks are net short 20,249 COMEX contracts in the March BPR...which is down 4,299 contracts from the 24,548 contracts that 22 non-U.S. banks were short in the February BPR.

I would suspect that Canada's Scotiabank/Scotia Capital holds a goodly chunk of the short position of these non-U.S. banks. I also suspect that a number of the remaining non-U.S. banks may actually be net long the COMEX futures market in silver. But even if they aren't, the remaining short positions divided up between these other 19 non-U.S. banks are immaterial - and have always been so.

As of March's Bank Participation Report, 24 banks [both U.S. and foreign] are net short 34.2 percent of the entire open interest in the COMEX futures market in silver-down a tiny bit from the 35.2 percent that 26 banks were net short in the February BPR. And much, much more than the lion's share of that is held by Citigroup, HSBC USA, Goldman, Scotiabank -- and maybe one other non-U.S. bank...all of which are card-carrying members of the Big 8 shorts.

Here's the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns-the red bars. It's very noticeable in Chart #4-and really stands out like the proverbial sore thumb it is in chart #5. Click to enlarge.

|

|

In platinum, 4 U.S. banks are net short 19,222 COMEX contracts in the March Bank Participation Report, which is down a tiny amount from the 19,867 COMEX contracts that these same banks were short in the February BPR.

[At the 'low' back in July of 2018, these U.S. banks were actually net long the platinum market by 2,573 contracts]

Also in platinum, 19 non-U.S. banks are net short 4,578 COMEX contracts in the March BPR, which is up a bit from the 3,459 COMEX contracts that 17 non-U.S. banks were net short in the February BPR. Nothing much to see here...for the second month in a row.

[Note: Back at the July 2018 low, these same non-U.S. banks were net short 1,192 COMEX contracts.]

And as of March's Bank Participation Report, 23 banks [both U.S. and foreign] are net short 32.8 percent of platinum's total open interest in the COMEX futures market, which is down from the 36.1 percent that 21 banks were net short in February's BPR. But it's the U.S. banks that are on the short hook big time -- and the real price managers. They have little chance of delivering into their short positions, although a very large number of platinum contracts have already been delivered during the last six months. But that fact, like in both silver and gold, has made no difference whatsoever to their short positions held. Their short positions in the COMEX futures market in this precious metal is equally as dire as it is in silver and gold.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

|

|

In palladium, 4 U.S. banks are net short 2,389 COMEX contracts in the March BPR, down a bit from the 2,522 contracts that these same U.S. banks were net short in the February BPR.

They were short only 1,194 COMEX contract in the July 2020 BPR.

Also in palladium, 8 non-U.S. banks are net long 353 COMEX contracts-down from the 688 contracts that 10 non-U.S. banks were net long in the February BPR.

These are not material changes in either group of banks.

And as I've been commenting for almost forever now, the COMEX futures market in palladium is a market in name only, because it's so illiquid and thinly-traded. Its total open interest at Tuesday's cut-off was only 9,611 contracts...compared to 72,681 contracts of open interest in platinum...158,349 in silver -- and 467,0008 contracts in gold.

As of this Bank Participation Report, 12 banks [both U.S. and foreign] are net short 21.2 percent of the entire COMEX open interest in palladium...down from the 19.2 percent of total open interest that 14 banks were net short in February.

And because of the small numbers of contracts involved, along with a tiny open interest, these numbers are pretty much meaningless. So, for the last twelve months in a row, the world's banks are no longer involved in the palladium market in a material way. According to Ted, palladium is mostly a cash market now.

Here's the palladium BPR chart. And as I point out every month, you should note that the U.S. banks were almost nowhere to be seen in the COMEX futures market in this precious metal until the middle of 2007-and they became the predominant and controlling factor by the end of Q1 of 2013. They have imploded into insignificance over the last nine or so Bank Participation Reports, although their short position has been sneaking higher for six of the last seven months. It remains to be seen if they return as big short sellers again at some point like they've done in the past. Click to enlarge.

|

|

Except for palladium, only a small handful of the world's banks/investment house, eight or so in total...mostly U.S-based...continue to have meaningful short positions in the other three precious metals -- and it's a near certainty that they run this price management scheme from within their own in-house/proprietary trading desks.

The futures positions in silver and gold that JPMorgan holds, are immaterial -- and have been since last March. It's the next Big 8 shorts et al. that are on the hook in everything precious metals-related -- and it's only in the last ten days or so that they've really been aggressive in their attempts to cover some of their short positions.

But as has been the case for over a year now, the short positions held by the Big 8 traders/banks is the only thing that matters -- and how it is ultimately resolved [as Ted said earlier] will be the sole determinant of precious metal prices going forward.

I have a very decent number of stories, articles and videos for you today.

CRITICAL READS

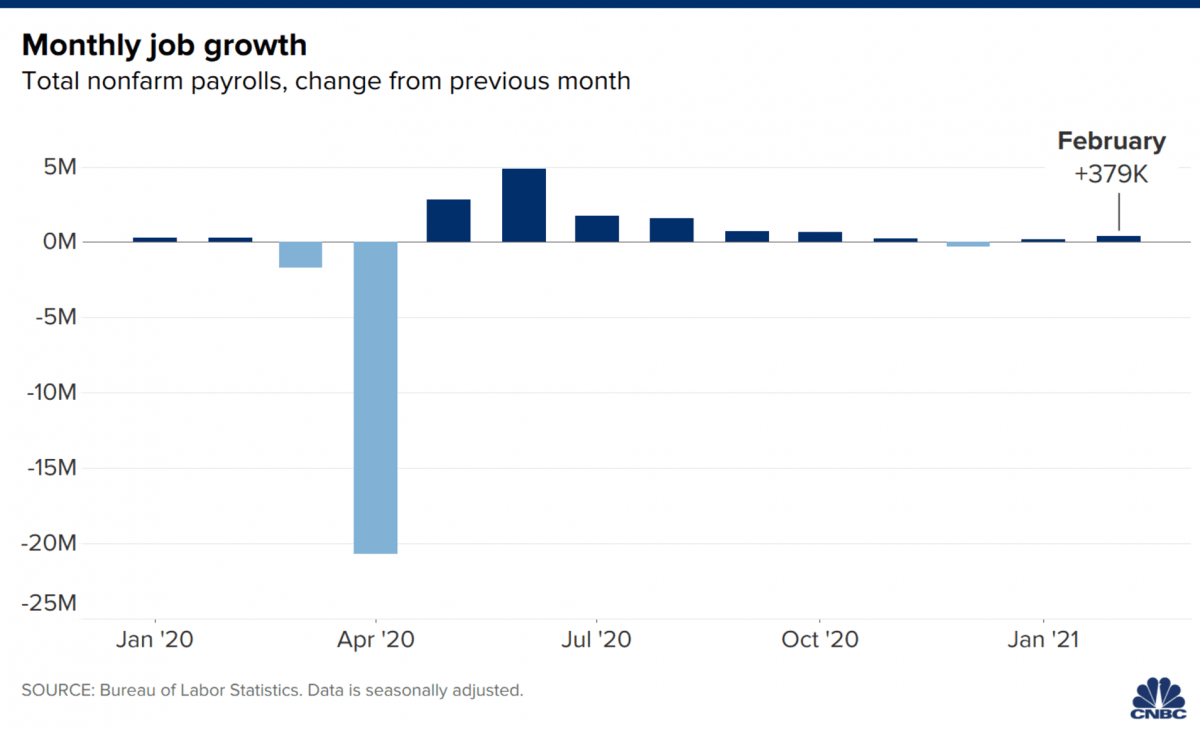

Job growth surges in February on hiring jump in restaurants and bars

Hiring surged in February as U.S. economic activity picked up with Covid-19 cases steadily dropping and vaccine roll-outs providing hope for more growth.

The Labor Department reported Friday that non-farm payrolls jumped by 379,000 for the month and the unemployment rate fell to 6.2%. That compared with expectations of 210,000 new jobs and the unemployment rate holding steady from the 6.3% rate in January. Click to enlarge.

|

|

An alternative measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons was unchanged at 11.1%.

"Today's jobs report sets an extremely positive tone as we move into warmer months and the pace of COVID-19 vaccinations accelerates," said Tony Bedikian, head of global markets at Citizens Bank. "While the labor market still has a lot of ground to make up, we are in a different place than we were a year ago and the economy seems poised for a strong rebound."

This CNBC story appeared on their Internet site at 8:30 a.m. EST on Friday morning -- and was updated an hour later. I thank Swedish reader Patrik Ekdahl for sending it our way -- and another link to it is here. The Zero Hedge spin on this is headlined "75% of All Jobs Added in February Were Waiters and Bartenders" -- and that comes courtesy of Brad Robertson.

10-year Treasury yield jumps to 2021-high of 1.62% before pulling back

The 10-year U.S. Treasury yield jumped Friday after the February jobs report topped expectations, sending the benchmark yield to its highest level this year, before retreating as the day wore on.

The yield on the 10-year Treasury note was trading up at 1.56% at around 4:20 p.m. ET after hitting an intraday high of 1.626%. The yield on the 30-year Treasury bond fell to 2.29%. Yields move inversely to prices.

At 8:30 a.m., the Labor Department reported that the U.S. added 379,000 jobs in February, much stronger than expectations of a 210,000 gain. The unemployment rate fell slightly to 6.2%. The jobs surge comes after the labor market's recovery had turned sluggish in recent months.

"This should continue to push treasury yields higher and will present a headwind to those sectors that did so well last year like Technology, Communication Services and, to a lesser extent, Consumer Discretionary (particularly because of Amazon)," said Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, in an e-mail.

The benchmark yield has been climbing quickly in recent months after ending 2020 under the 1% level. It topped 1.5% last week for the first time in over a year, and briefly flashed above 1.6%. Thursday's jump for Treasury yields put the 10-year above that mark.

This article showed up on the cnbc.com Internet site at 3:49 a.m. EST on Friday morning -- and was updated about thirty minutes later. It's the second offering in a row from Patrik Ekdahl -- and another link to it is here. A somewhat related Zero Hedge article is headlined "PPT? Stocks Rescued by Biggest Intraday Dip-Buy Since 2011 E.U. Crisis Bailouts" -- and I thank Brad Robertson for that one.

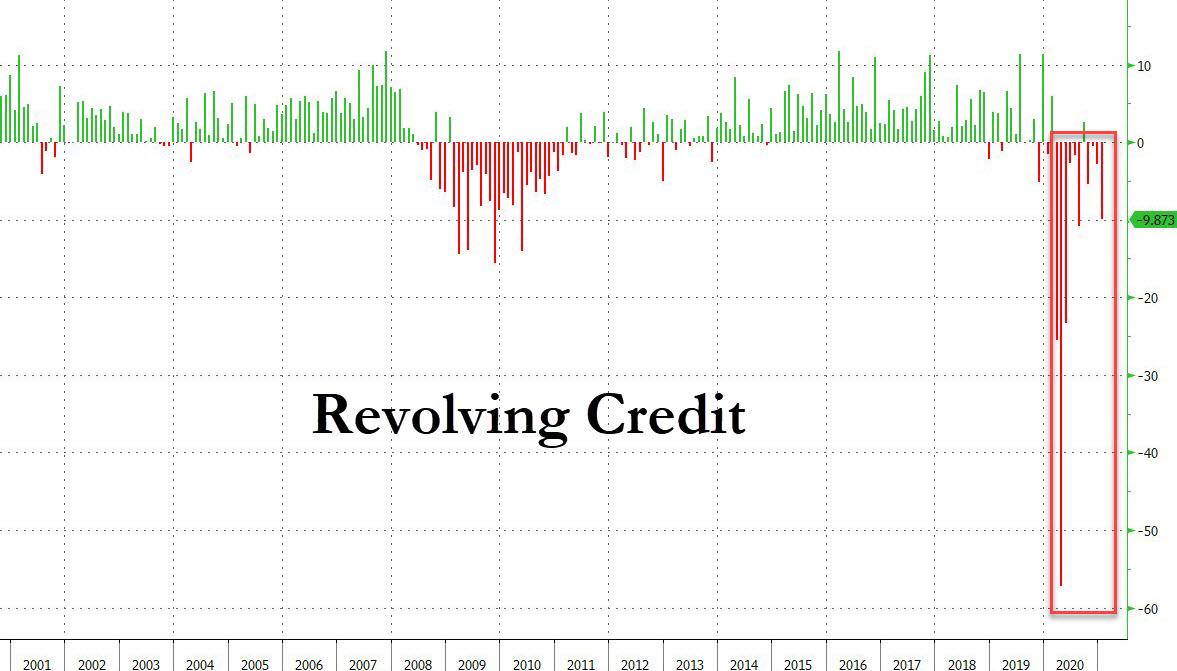

There appears to be a major discrepancy between BofA's in house debit/credit card data, which showed a remarkable increase in credit card-funded spending in both January and February (the Texas-freeze induced drop notwithstanding) and the Fed's own consumer credit data aggregation, because according to the latest Consumer Credit (G.19) report, in December revolving debt, i.e., credit card debt, shrank for a fourth consecutive month declining by a whopping $9.9BN following a $2.8BN drop in December, $465MM drop in November and a $5.3 billion drop in October. In fact, this was the 10th decline in consumer credit in the past 11 months! Click to enlarge.

|

|

This means that in the past 12 months, U.S. consumers have paid down a record $126.5Bn in credit card debt, a staggering amount for an economy that runs on credit.

The flip side, as usual, is that as revolving credit dropped, non-revolving credit rose like clockwork (if far more subdued than usual), and in November U.S. consumers increased their student and auto loans - the two largest component of this category - by a far lower than expected $8.6 billion, down from $11.6BN in December and bringing the total January consumer credit change to a decline of $1.31 billion, which was not only far below the $12BN increase expected by economists, but was the first decline in total consumer credit since August!

This Zero Hedge article put in an appearance on their website at 3:15 p.m. on Friday afternoon EST -- and is another contribution from Brad Robertson. Another link to it is here. Gregory Mannarino's post market close rant for Friday is linked here -- and I've had no time to listen to it, so I wasn't able to rate the content...so you're on your own with this one. I thank Brad Robertson for pointing it out.

There's More to Inflation Than the Numbers -- Bill Bonner

Yesterday, Jerome Powell, jefe of the Federal Reserve, speaking at a Wall Street Journal virtual conference, let the cat out of the bag.

CNN reports:

"U.S. stocks tumbled Thursday after Federal Reserve Chairman Jerome Powell predicted an increase in consumer prices this summer - something investors fear will force interest rates up sooner than expected.

...the market reacted strongly to his interview. The 10-year U.S. government bond yield jumped and was up 0.07% at 1.54% around the time of the closing bell.

Meanwhile, stocks sold off. The Dow finished down 1.1%, or 346 points, and the S&P 500 closed 1.3% lower.

The NASDAQ Composite fell even more sharply, tumbling 2.1%. The index managed to just avoid dipping into correction territory - defined as a 10% drop from its most recent high - as it was down 9.7% from its February 12 record high. The NASDAQ has erased its gains for the year.

"We do expect that as the economy reopens and hopefully picks up, we'll see inflation move up," Powell said..."

More to the Story

We've spent the entire week poking around in the marshes... the tidal flats where inflation flourishes... between the water world and solid ground.

"Inflation is always and everywhere a monetary phenomenon," said Nobel Prize-winning economist Milton Friedman.

Alas, about that he was wrong. He was too literal. Too numerical. Too confident of his own power of intellectual reductionism.

This interesting commentary from Bill, which I'm not entirely in agreement with, was posted on the rogueeconomics.com Internet site on Friday sometime -- and another link to it is here.

Something Just Doesn't Feel Right! -- Dennis Miller

Friday the 13th, Atlanta Hartsfield Airport. I'll soon be home for Christmas. It was a long year, 40+ weeks on the road; several two-week international trips. I was exhausted.

We finally rolled down the runway, headed home. Suddenly the pilot reversed thrust, slamming on the breaks. I felt my seat belt straining. I heard a couple screams in the back.

We chattered to a stop. Amazingly calm, he announced, "Ladies and gentlemen, I apologize for the abrupt stop. There is nothing on my instrument panel that indicated a problem. I've been flying for a long time; something just doesn't feel right. I'm going to get things checked out."

At the gate, mechanics flocked to the cockpit. The dreaded announcement came, "Ladies and gentlemen, this flight has been canceled due to mechanical difficulty."

Getting rebooked out of Hartsfield on a Friday night is a nightmare. As passengers began bitching, the elderly woman next to me spoke up, "I'd rather be late than in a crash." Bitching stopped. I stuck my head in the cockpit and said, "Captain, I'm a million miler and I'll gladly fly with you anytime."

Instincts flashing warnings?

Since the 2008 bank bailout, pundits have warned us of pending doom. Since the COVID-19 crisis, the drumbeats are getting louder. Our instruments are giving us mixed messages and hints; something just doesn't feel right.

This long but interesting commentary from Dennis was posted on his Internet site on Thursday sometime -- and another link to it is here.

ECB Seen Stepping Up Pace of Bond-Buying to Rein In Yields

The European Central Bank will step up its pace of emergency asset purchases to counter rising bond yields that risk hurting growth prospects in the euro area, according to economists.

That's the majority view in a Bloomberg survey, which also showed that more than half the respondents expect the €1.85 trillion ($2.23 trillion) program to be extended beyond its current end-date of March 2022. At the same time, just one fifth expect another increase in the size of the tool, suggesting market moves so far haven't fundamentally changed the economic outlook.

Multiple policy makers have dismissed the need for drastic action after returns on government debt started to increase last week, yet they've also stressed that the ECB is ready to counter any "unwarranted" gains. For now, there's no evidence that the region's central banks have accelerated purchases. The Governing Council holds its next meeting on March 11.

"The ECB will express its discomfort with rising bond yields and underline its willingness to use all available instruments," said Kristian Toedtmann, an economist at DekaBank. "But it probably won't be specific."

When the ECB expanded its pandemic program in December, officials pledged to preserve "favorable financing conditions." That concept has kept many observers guessing about which gauges the ECB is watching and whether the recent rise in nominal bond yields poses a concern.

This Bloomberg article appeared on their website at 9:00 p.m. PST [Pacific Standard Time] on Thursday evening -- and I thank Patrik Ekdahl for sharing it with us. Another link to it is here.

Doug Noland: De-risking/Deleveraging at the Periphery

It was another unsettled week for notably synchronized global markets. The week began with a decent bout of hope. The S&P500 rallied 2.8% in Monday trading, "its strongest one-day gain since June." Having begun in Asia, the market rally gained momentum in European trading, which set the stage for a gap higher opening for U.S. equities.

A spark was provided by the Reserve Bank of Australia. After its previous Friday attempt fell flat, Australia's central bank Monday doubled down on its bond purchases, essentially expending $3.1 billion in its yield control operation. Australian 10-year yields collapsed a remarkable 35 bps to 1.67%, more than reversing the previous Friday's price spike.

After Japanese 10-year yields rose to a five-year high 16 bps Friday, there was a report Monday claiming the Bank of Japan was prepared to act against any excessive rise in yields. And then ECB governing council member Francois Villeroy stated the ECB "can and must react" against any unwarranted tightening (aka higher bond yields). European yields reversed sharply lower on his comments, with double-digit declines in Italian and Greek yields. Equities caught fire. Relief that a concerted central bank effort was poised to counter rising global yields powered Monday's risk market recovery. It would prove fleeting.

De-risking/deleveraging has initiated a tightening of financial conditions out at the global "periphery". Not atypically, incipient tightening at the "periphery" provides transitory favor to the "core." The dollar index's 1.2% gain this week surely lent some support to U.S. Treasuries and securities markets more generally. With massive stimulus as far as the eye can see, the U.S. "periphery" (i.e. junk bonds) has so far remained bulletproof. Indications of vulnerability began to emerge this week.

I fully expect the tightening of financial conditions at the "periphery" to gravitate to the "core." Despite the Fed's ongoing $120 billion monthly liquidity injections, I don't believe the "core" is immune to de-risking/deleveraging dynamics. That U.S. equities are in a full-fledged mania and U.S. corporate Credit still demonstrating a powerful Bubble Dynamic complicate the analysis. Beijing also creates a high degree of uncertainty.

Beijing recognizes it faces acute Bubble risk both at home and from abroad. Unrelenting U.S. fiscal and monetary stimulus - with resulting massive trade deficits - ensures powerful inflows into China. This only further complicates Beijing's already great challenge of reining in Bubble excess without unleashing the forces of risk aversion, panic and collapse. I'll take this week's announcements as indicating that Beijing believes it must sacrifice growth to mitigate escalating risks associated with over-indebtedness and asset Bubbles.

Surging global yields, fragile equities Bubbles, and prospective Chinese tightening measures. That's a confluence of risks that beckon for a more cautious approach to leverage and risk-taking more generally. Indeed, today's backdrop places myriad levered strategies in harm's way. I'll assume the global leveraged speculating community - the marginal source of finance globally - has commenced de-risking/deleveraging. Issues in the "repo" and dollar swaps markets point to mounting stress in derivative hedging markets. In sum, the volatility experienced across markets over the past couple weeks indicates growing risk of a financial accident.

As I say every week about Doug's weekly commentary...it's always a must read for me. This week's iteration showed up on his website in the very wee hours of Saturday morning -- and another link to it is here.

Bank of America, Morgan Stanley win dismissal of metals spoofing litigation

A federal judge in Manhattan on Thursday dismissed litigation by traders and trading firms accusing Bank of America Corp and Morgan Stanley of manipulating the precious metals futures market by placing trades and then cancelling them before execution, or "spoofing".

U.S. District Judge Lewis Liman in Manhattan said the June 2019 lawsuit over alleged spoofing in gold, silver, platinum and palladium futures from 2007 to 2014 was filed long after the two-year federal statute of limitations had run out.

The investors said the clock started in January 2018 when the traders Edward Bases and John Pacilio, both from Connecticut and also defendants, were charged with commodities fraud. Six other people were criminally charged at the time.

But in a 32-page decision, the judge said the clock had begun ticking by December 2016, when a lawsuit alleging manipulation of silver futures contracts in the same period was filed by the same lawyers in the same Manhattan courthouse.

"They knew of the harm as early as 2016," Liman wrote. "They just did not know the identity of everyone who perpetrated it. The wrong itself was not concealed."

Lawyers for the investors did not immediately respond to requests for comment.

This Reuters article, filed from New York, was picked up by the kfgo.com Internet site on Thursday afternoon -- and I thank Chris Marcus for pointing it out. Another link to it is here.

Chinese gold consumption booms during the 2021 Chinese New Year holiday

Conversations with our partners in China's gold jewellery industry mirrored the trend reported by the Ministry of Commerce and the China Gold Association: in value terms, sales of all jewellery categories during the holiday soared by 161% y-o-y and consumption of gold jewellery, bars and coins during the same period rose by more than 80% y-o-y.

Almost all gold jewellery categories realised substantial growth on a y-o-y basis. One of the leading gold retailers in China even reported a 710% surge in its gold product sales during the 2021 CNY week y-o-y. This was partially due to the low base impact amid the COVID-19 outbreak during 2020's CNY holiday.

Even so, leading gold jewellery retailers told us that sales during the 2021 CNY holiday dwarfed their 2019 levels. Main drivers of this sales boom include:

- the local gold price adjustment ahead of the holiday, which made gold products more affordable

- the tradition of hoarding gold products ahead of and during the holiday

- the "stay put" initiative, which spurred gold consumption in major cities.

In addition, gold bars and coins also attracted tremendous attention during the holiday as many retail investors took advantage of the local gold price dip ahead of the festival to enter the market for gifting and long-term saving.

This very interesting 1-chart gold-related news item put in an appearance on the gold.org Internet site on Monday morning -- and I found it on Sharps Pixley. Another link to it is here.

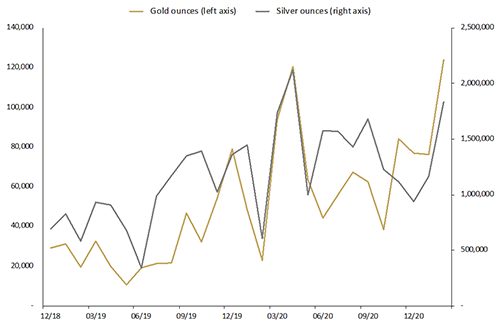

Buying frenzy fuels record sales of physical gold from The Perth Mint

A large spike in demand for Perth Mint coins and minted bars pushed sales of physical gold to a new monthly record in February 2021. The Mint shipped 124,104 troy ounces of gold product, up 63% on the previous month and an enormous 441% on February 2020.

Sales of silver bullion coins also jumped sharply to 1,830,707 troy ounces, up more than 57% on the previous month and 202% ahead of February 2020.

Troy oz. of gold & silver sold as coins and minted bars: December 2018 to February 2021

General Manager Minted Products, Neil Vance, attributed the success to a buying frenzy in the U.S. "To meet demand we streamlined manufacturing to focus on products that are hot in the U.S. right now, including our Kangaroo Minted Gold Bars made in 1 oz. and 10 oz. formats," he said. "It was also a strong month for our signature Australian Kangaroo 1 oz. Gold Coin and the latest Dragon 1oz. Gold Rectangle Coin which sold through its lucky 8,888 mintage in record time."

Similar efficiencies were achieved in the production of physical silver coins, he said, which saw more Australian Kangaroo 1oz Silver Coins out the door.

This worthwhile precious-metals related news item showed up on the perthmint.com Internet site on Wednesday -- and I found it posted at Sharps Pixley yesterday evening. Another link to it is here.

Interest in silver and concerns about its price being artificially suppressed by excessive short selling are now at levels never seen before. While those concerns are well-founded, in my opinion, too often the remedy for what to do about it is less clear.

Since silver and silver futures trading is regulated by the U.S. Commodity Futures Trading Commission (CFTC), it is the statutory first line of defense against market manipulation. Here's something that will take only a few moments and has always worked in the past in assuring the agency will, at least, address the issue directly.

If you are concerned that the silver price is being artificially influenced by excessive and manipulative short selling, please email or send a copy of the enclosed letter to the CFTC. If you would like, substitute my name with your name, but please send it to the addresses of the Commissioners I've included.

For U.S. citizens, please take an extra few minutes to send a copy to your local representative or senator, asking them to request the CFTC address this matter. I can further assure you that the agency will respond to every inquiry from every elected official who contacts it. Interestingly, this is one of the few completely non-partisan issues of the day, so politics shouldn't determine whether you contact your elected representatives and senators.

Well, dear reader, here's your chance to vent your rage and frustration on those officials at the CFTC who should have done something decades ago, but haven't. The appended letter in this commentary is an easy 'copy & paste' into an e-mail -- and should be sent to all six e-mail addresses at the bottom of the letter. And, as Ted also pointed out, if you are a citizen of these United States of America, a copy should also be sent to your local representative or senator as well. This appeal for justice was posted on the silverseek.com Internet site on Friday morning EST -- and another link to it is here. Go get 'em!

The PHOTOS and the FUNNIES

Here are four more photos that I took along the Kettle Valley Rail Trail east of Kelowna and high up in the mountains on June 7. The trestle that appears at the far right in photo one, is the same one that's featured in the center of the second shot. The third photo was taken looking up one of the canyon walls -- and the last at a rock cut, which I thought made for a rather dramatic shot. Click to enlarge.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The WRAP

Today's pop 'blast from the past' dates from 1968 as the hippy era drew to a close -- and falls into the 'Psychedelic rock' genre. It's instantly recognizable -- and a very young at the time Eric Clapton overdubbed the guitar parts. The link to it is here. Not surprisingly, there are a goodly number of bass covers to this -- and here's Canada's own Constantine Isslamow doing the honours. The link to that is here.

Robert Schumann's Violin Concerto in D minor, composed in 1853, was his only violin concerto and one of his last significant compositions. It remained unknown to all but a very small circle for more than 80 years after it was written -- and if you wish to read the whole story, the link is here.

The concerto is scored for solo violin, 2 flutes, 2 oboes, 2 clarinets in B♭, 2 bassoons, 2 horns in F, 2 trumpets in B♭, timpani and strings.

Once it's existence became more widely known, then the fight was on as to who would perform it -- and where the world premiere would be held. The German government, now firmly under Hitler's control, insisted on the world premiere being given by a German in Germany. In the end it was Georg Kulenkampff who gave the first performance on 26 November 1937, with the Berlin Philharmonic.

Today's performance comes courtesy of the Freiburger Barockorchester -- with maestro Pablo Heras Casado at the podium. Isabelle Faust is the soloist -- and although it's beautifully shot and recorded, I'm not mad about this particular interpretation of the work. The link is here.

Gold was closed even further below its 50-day moving average in the April contract by the COMEX close yesterday...as was silver, platinum and palladium, so it's obvious that the Big 4/8 shorts are deadly serious about covering as many of their short positions as they can -- and have obviously covered even more since the Tuesday cut-off for yesterday's COT Report.

The limit to how low they can take all four precious metal prices will be determined solely by the number of long and short contracts that Managed Money, Other Reportables and Nonreportable/small traders are prepared to sell -- and once that point is reached, the bottom will be in. And as Ted Butler always points out, we'll only recognize the bottom when we can see it in the rear-view mirror.

But it's a given that we're far closer to that than we are the top of these engineered price declines -- and I was certainly more than encouraged by the activity of the precious metal equities on Friday. I was also happy to make my own contribution to the rally in the silver stocks yesterday...buying more shares of First Majestic Silver...as I mentioned further up in today's missive.

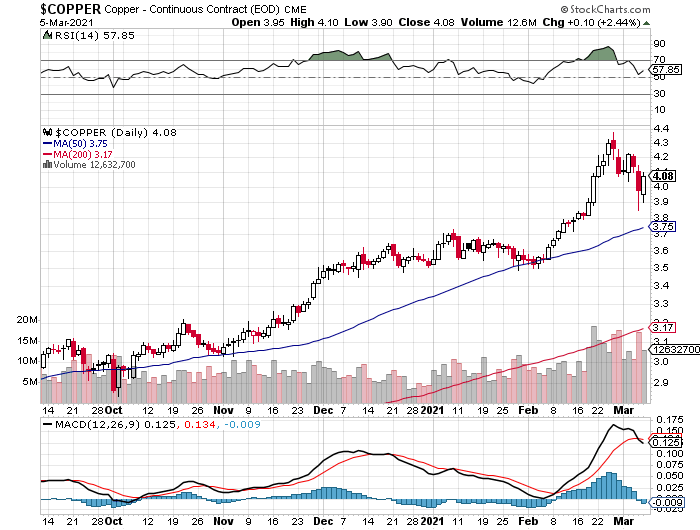

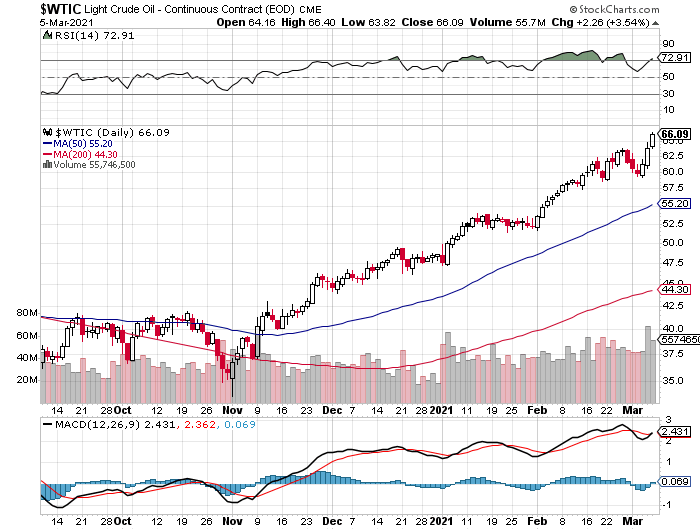

But as the Big 4/8 traders, all of which are banks -- and mostly U.S. banks, were setting new lows in the four precious metals, copper and WTIC were resuming their respective rallies. Copper closed higher by 10 cents...erasing a decent chunk of its loss on Thursday -- and monstrously overpriced WTIC closed higher by another $2.26 a barrel.

But, unlike the four precious metals, the banks aren't overly involved in copper. For instance, yesterday's Bank Participation Report showed that the banks, both U.S. and foreign, were actually net long copper in the COMEX futures market, to the tune of 5.6 percent of total open interest. But in WTIC, the banks are net short around 19 percent of total open interest.

Here are the 6-month charts for the Big 6 commodities, courtesy of stockcharts.com as always, so you can see the results of the Friday trading session for yourself -- and the new lows in all four precious metals should be noted. Click to enlarge.

|

|

|

|

|

|

|

|

|

|

|

|

As reader Chris Marcus pointed out in an e-mail last Monday, a very interesting article showed up on the bloomberglaw.com Internet site on that day headlined "Spike in Silver Prices Has Similarities to GameStop Trading; Regulators on Alert" -- and it's worth a careful read/reread.

My first reaction, like most, was to think that they were after the Robinhood/Reddit crowd -- and before I made that judgement call, I asked silver analyst Ted Butler for his opinion. He saw that connection as well, but came to a different conclusion based on what else else was written and said in what he called "a well thought-out piece" by "a "white shoe" law firm said to be among the ten largest in the world, whose clients are typically large financial institutions."

Needless to say, Ted and I had a lively discussion about this -- and the first thing that he pointed out was the COT Report surrounding that spike higher in the silver price proved hands down that it was the Big 4 traders that were responsible, not the Robinhood/Reddit crowd.

I mentioned that it could have just as easily been a warning to the Big 4/8 shorts and the folks over at the CFTC -- and we talked about that for awhile.

But the big question I had for Ted was this. "What would be the motive for this "white shoe" law firm to decide, unsolicited, to have this "well thought-out piece" posted in the public domain in the first place?"

That, Ted said, was the $64,000 question -- and in closing in his mid-week review for his paying subscriber he mentioned it one more time..."I still can't shake the significance of the document prepared by the lawyers from Clifford Chance."

Neither can I -- and it remains to be seen what part, if any, it has to play in the end-game of the price management scheme in silver.

And end it will, along with the price management scheme in the other three precious metals. But, as I've pointed out before on many occasions in the past, that will not happen in a news vacuum. I don't know what event the powers-that-be have dreamed up as a cover for that moment in time, but you can rest assured that there will be one.

Everyone and his dog now knows that silver is the most undervalued commodity on Planet Earth, along with the reason for it. The other three precious metals are undervalued as well --and for the same reason, but are not even close to being in the same league as silver.

In an opinion piece on Sharps Pixley yesterday, headlined "GOLD - The Mother of All Opportunities as Central Banks Walk the Line"...Ross Norman had this to say...

"As an exercise this morning I selected a random list of commodities to see how they have risen over the past 12 months ... since just before COVID. Most are up double digits ... sugar up 14%, oil up 30%, iron up 90%, rubber up 67%, steel up 30%, minor metals and rare earths up 112%, GSCI up 28%, coal up 45%, lumber up 105%, oil seed rape up 39%, wheat up 22% and the grains index up 34%. The only fallers were milk, live cattle and salmon. Copper is referenced as "Dr. Copper" because its seen as a good benchmark in determining the health of industry ... well that's up 41%. Of course cost-push inflation is only part of the story ... as economies unlock you should see demand-pull, plus the accelerator as the velocity of money increases. All things considered, we would expect the real rate of inflation in H2 to be somewhere between 6% and 12%. Enough to prompt significantly higher gold prices."

Yes Ross, you would be right about that, but you never once mentioned or even hinted at the real reason why gold in particular -- and the other three precious metals in general, have been underperforming vs. the rest of the commodity complex all that time. I'm sure your peer group in the City of London would not be amused if you did.

Commodity inflation is now starting to run away to upside -- and how much longer gold and silver et al. can be kept in check from a price perspective in light of that, remains to be seen. Not much longer, one might suspect. And once the precious metals are freed from their price shackles, the rest of the commodities complex will surge even higher as well.

I'll leave it to another Brit...now [Sir] Peter Warburton...whose paragraphs I've quoted in this column countless time over the years, most recently about a month or so ago, to have the final word on this.

In his now-famous essay from 09 April 2001...twenty years ago next month...headlined "The debasement of world currency: it is inflation, but not as we know it"...Warburton has this to say:

"What we see at present is a battle between the central banks and the collapse of the financial system fought on two fronts. On one front, the central banks preside over the creation of additional liquidity for the financial system in order to hold back the tide of debt defaults that would otherwise occur. On the other, they incite investment banks and other willing parties to bet against a rise in the prices of gold, oil, base metals, soft commodities or anything else that might be deemed an indicator of inherent value. Their objective is to deprive the independent observer of any reliable benchmark against which to measure the eroding value, not only of the U.S. dollar, but of all fiat currencies. Equally, their actions seek to deny the investor the opportunity to hedge against the fragility of the financial system by switching into a freely traded market for non-financial assets.

It is important to recognize that the central banks have found the battle on the second front much easier to fight than the first. Last November, I estimated the size of the gross stock of global debt instruments at $90 trillion for mid-2000. How much capital would it take to control the combined gold, oil and commodity markets? Probably, no more than $200bn, using derivatives. Moreover, it is not necessary for the central banks to fight the battle themselves, although central bank gold sales and gold leasing have certainly contributed to the cause. Most of the world's large investment banks have over-traded their capital [bases] so flagrantly that if the central banks were to lose the fight on the first front, then their stock would be worthless. Because their fate is intertwined with that of the central banks, investment banks are willing participants in the battle against rising gold, oil and commodity prices."

That strategy may have been fine and dandy up until a year or so ago, but now it's a roadblock to the much higher inflation rate that the world's central banks need to inflate away the debts that are certain to bring the world's governments to their financial and economic knees at some point.

Now long after it's "best before use" date, this is the scheme that the powers-that-be are trying to unwind -- and it remains to be seen if they can pull it off without doing irreparable damage to the rest of the financial system in the process.

And as I've said before, by leaving the resolution of this Frankenstein monster of a Gordian Knot to the very last moment, its outcome now threatens to bring down the paper world that has been carefully constructed since Nixon "temporarily" took the U.S. off the gold-exchange standard back in August 1971.

All we can do is sit back and watch as they attempt to unravel it -- and wonder whether we should wish them luck or not.

How did it come to this?

I'm still "all in" -- and I'll see you here on Tuesday.

Ed