With the rapid fall in the price of oil, the primary silver miners production costs declined in the first quarter of 2015. How much? Well, actually a bit more than I forecasted. However, even with lower production costs, the top 12 primary miners as a group still lost money.

According to the U.S. Energy Information Agency (EIA), the average price of a barrel of Brent crude in Q1 2015 was $53.92, down nearly 50% from $101.82 in Q3 2014. This helped to lower costs for the primary silver miners considerably. Unfortunately, the average realized silver price the miners received in Q1 2015 fell even further.

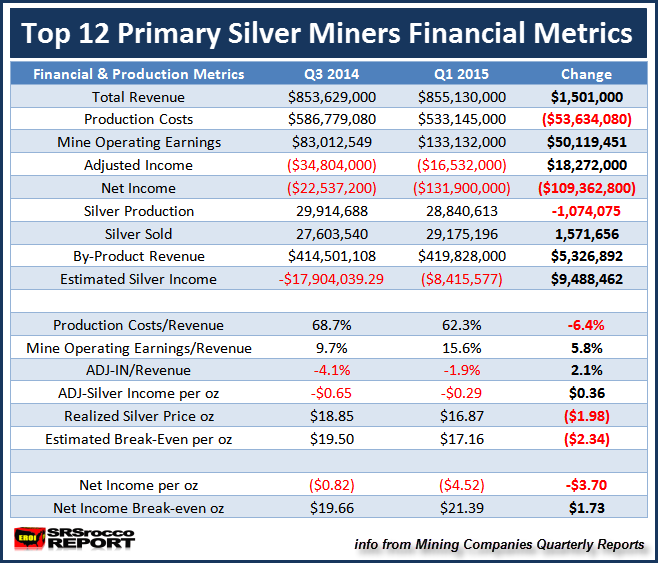

The table below compares the Top 12 primary silver miners financials from Q3 2014 to Q1 2015. Because many of the silver mining companies do not publish separate quarterly statistics with their year-end results (Q4), I do not post results for the last quarter of the year. Instead, I publish FULL YEAR results.

If we look at the table below, we can see that the group’s revenue didn’t change all that much from Q3 2014 to Q1 2015. Total revenues only increased $1.5 million from $853 million to $855 million due to lower realized silver prices balanced out by higher sales of silver (1.5 million oz) and increased by-product base metal and gold sales:

Now, the data that showed the biggest difference was the change in the group’s production cost. Total production cost for the group fell nearly 10% ($53 million) from $586 million in Q3 2014 to $533 million Q1 2015. While the group’s total silver production declined 1 Moz in Q1 2015 compared to Q3 2014, the majority of the cost decline came from lower oil-energy prices.

As we can see, lower production costs had a positive impact on mine operating earnings. The group’s mine operating earnings increased $50 million (shown in the change column on the right) due to lower production costs of $53 million.

Unfortunately, the groups estimated break-even of $17.16 an ounce was higher than the average realized price of $16.87 in Q1 2015. Thus, the group lost a net $0.29 for every ounce they sold. Again, this is an estimated break-even, but at least it provides us with a more realistic cost per ounce than the industry’s “Cash Cost Metric.”

My estimated breakeven for my top 12 primary silver miners of $17.16 is much higher than the average Cash Cost of $8.37 for 2014 from the top two official silver sources; The CPM Group and Thomson Reuters GFMS. Their average cash cost figure isn’t too far off from my group’s average cash cost of $8.67 in 2014. However, I don’t go by the cash cost accounting, because it is a flawed metric that doesn’t account for the real profitability of a company

The Top 12 Primary Miners Estimated Break-Even Lower Than I Expected

In a recent interview, I stated, “I doubt the estimated break-even for my group would go below $18 or the high $17’s.” Well it did. It fell to $17.16. However, I went on to say that I didn’t expect it to fall to the $14-$15 range. I still believe this to be true. Why? Because the price of oil has actually increased in Q2. While the price of barrel of Brent averaged $53.92 in the first quarter of 2015, its Q2 average is approximately 15% higher at $61.50.

So, we will just have to wait and see how the group performs when the silver mining companies release their Q2 results in a few months. Regardless, the silver mining companies in my group produced 29 million oz (Moz) of silver in Q1 2015 and sold 29 Moz of silver for a net adjusted income loss of $16 million.

While the group suffered a net adjusted loss, four companies stated positive adjusted income while eight stated losses. Again, I go by adjusted income because it removes financial gains or losses that are not directly related to the actual mining of silver during the period.

For example, Silver Corp Metals suffered a $130 million net income loss for the quarter due to a huge impairment write down. This large write down had nothing to do with Silver Corp’s performance at its mining operations during the period. Matter-a-fact, Silver Corps adjusted income was only a negative $200,000 for Q1 2015 (according to my calculations) even though they stated a net income loss of $130 million.

Top 12 Primary Silver Miners By-Product Base Metal & Gold Sales = 50% of Total Revenue

If we look at the table above, the group stated $419.8 million in by-product metal and gold sales for the quarter. This is nearly 50% of their total revenue (actually 49%). As I stated before, the industry deducts what they label as their by-product credits to get their artificially low cash cost figure.

Let’s be conservative and say that 80% of that total by-product revenue during the quarter was from base metal-gold sales and not from the few primary gold mines these companies own. So, 80% of $419 million is $335 million. If we were to subtract $335 million from the total revenue, the group’s losses would have been much greater. Instead of an adjusted loss of $16 million for the group in Q1 2015, it would have been closer to -$350 million.

Investors need to understand that these companies NEED THEIR BY-PRODUCT METAL SALES to fortify their balance sheets. These are not credits, unless the company can be profitable without them. As we can see from the figures in the table above, they most definitely need them…. LOL.

I look forward to see how the group performs in the second quarter. Currently, the average silver price for Q2 is $16.46 (Kitco), about $0.41 lower than the average realized price the group received in Q1 2015. Furthermore, we must remember the price of a barrel of Brent crude is 15% higher in the second quarter. It will be interesting to see if the group can continue to lower its estimated break-even as the price of oil moves higher.

Lastly, I am putting the finishing touches on my first Paid Report called THE SILVER CHART REPORT. It will be released shortly. It contains 48 charts on the silver market and industry from my work over the past six years, all updated and including new ones never seen before.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: