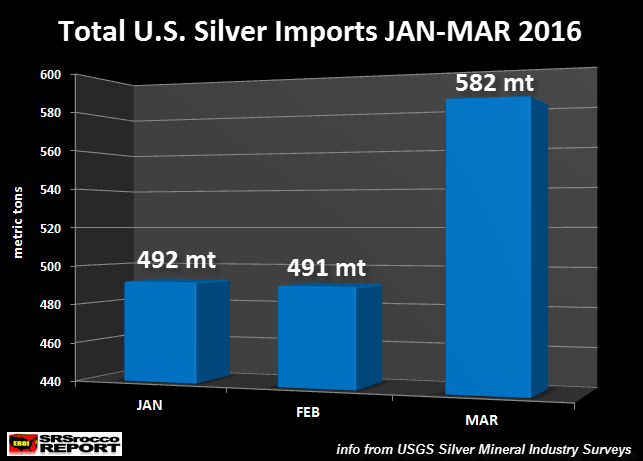

With leading indicators pointing to a decline in economic activity, U.S. silver imports surged in March. How much did U.S. silver imports increase? They jumped by nearly 20% compared to the previous month. If we take a look at the chart below, we can see how much U.S. silver imports in March increased compared to January and February:

The United States imported 492 metric tons (mt) of silver in January and 491 mt in February. However, silver imports in March jumped to a record 582 mt.

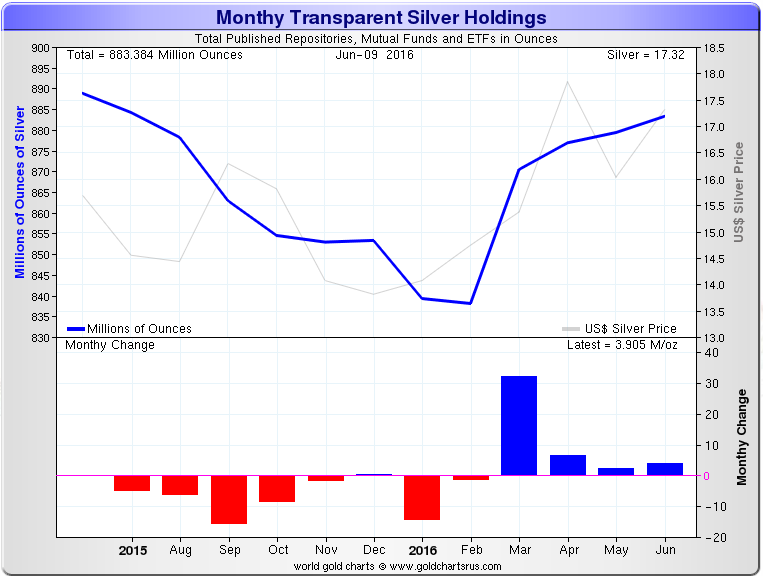

What could cause the U.S. to import a record amount of silver in March? Was it the price? No, even though the price of silver moved higher to $16.00 in March, it fell back to $15.20 by the end of the month. Could have it been investment demand? Why Yes, this seems to be the culprit.

If we take a look at the next chart, we can see the jump of metal into Silver ETF’s & Funds:

The amount of silver that flowed into Silver ETF’s & Funds surged to over 30 million oz (Moz) in March. Blackrock’s iShares Silver Trust (SLV ETF) stores its metal in the United States. I spoke with a representative from iShares and they confirmed that metal is stored in the United States. However, there are many other Silver ETF’s & Funds across the globe.

Regardless, U.S. silver imports in March were the highest in the past two years:

It will be interesting to see how the rest of the year unfolds. If we do see more problems in the broader markets, investors may turn to buying gold and silver in a big way. We must remember, inflows into Global Gold ETF’s & Funds surged to 364 mt during the first quarter of 2016… due to the 2,000 point fall in the Dow Jones.

Check back for new articles and updates at the SRSrocco Report.