There's a lot of current bullishness in the precious metals sector, and much of it is justified. However, you must always remember that the current digital derivative pricing scheme allows for ebbs and flows each month, so be sure to time your trades and your optimism accordingly.

So here we go again. The end of the calendar month approaches, and with it comes the regular COMEX option and contract expirations. Longtime precious metal investors will recognize that these expirations almost always bring price volatility, and the month of April will be no different.

First, let's consider the COMEX calendar. The front contract/delivery months for COMEX gold are February, April, June, August, October (sort of), and December. For COMEX silver, these months are March, May, July, September, and December. Since it is now late April, that means our focus is the May22 COMEX silver. The expiration schedule is below:

April 26: COMEX options expire for the May22 silver. There are also a significant number of COMEX gold options that expire that day, too.

April 29: The May22 silver contract goes "off the board" and into "delivery" at the COMEX close.

And what do we know about the trading that leads up to these expirations each month? IT WILL BE VOLATILE. We feel confident that we've discovered one root cause of the front-month volatility. It's the legging out of spread trades that were placed earlier in the month. We've written about this quite frequently of late. Here are a few links:

- Another COMEX Gold Price Smash

- COMEX Gold Trade at Settlement

- Updating COMEX Gold Trade at Settlement

In short, here's what you should expect in the days ahead...

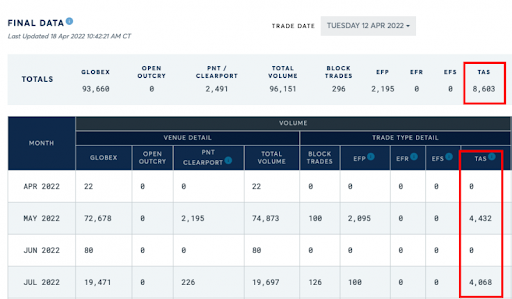

Trade at Settlement volume has again surged on schedule in April. For COMEX silver (where May is the front/delivery month), daily TAS volume surged from the normal 1,500/day to an average of 7,700 in the five-day period of April 7-13. The total volume for those five days was 38,471.

By dissecting the weekly Commitment of Traders reports, we've found that almost all of this TAS volume is spread trades, which is about the only reason someone would use this system where your fill price is the daily close/settlement price.

Then, if you watch the daily per-contract volume flows, you'll note that the volume is spread equally between May and the next front month of July. As an example, here's the CME data from last Tuesday, the 13th. Note the total TAS volume of 8,603 is spread almost evenly between the soon-to-expire May22 and the next front month of July22. What you undoubtedly see here is about 4,000 May longs spread against 4,000 July shorts.

So, what’s going on here? While I’m certain that there is at least a small amount of legitimate hedging and arbitrage, the majority of this TAS/spread volume is placed with nefarious and manipulative intent. One other note of interest. Since these are spreads and thus “fully hedged” in the eyes of the CFTC, these positions can be as large as possible without drawing any regulatory scrutiny.

And so, what happens next as the calendar inevitably moves toward option expiration and contract delivery? These spread trades are often “legged out” for maximum price control and impact. What does that mean?

To “leg out” means that you take just one side of the spread off at a time. In this case, a trader with that aforementioned “nefarious intent” will dump/liquidate his May longs while maintaining his July short. This has the impact of immediately driving the price lower and affords the trader the luxury of covering the short side at a lower price. On Monday, April 18, with the COMEX silver price rallying and option expiration just six days away, is this sort of “long dumping” what helped to create the chart below?

Whether or not Monday’s chart was produced through this type of price manipulation is immaterial. What matters is that you know what to expect in the 5-7 trading days to come. History and experience have taught us to expect these sorts of price downdrafts. Knowing how they come about does not prevent them from occurring.

Which brings us to the point of this week’s post. All of this incessant manipulation does not preclude prices headed higher. The Banks operate this scheme for profit, and they can profit each month just as easily at $35 as they can at $25. You, as the trader/investor/enthusiast simply need to understand these processes so that you can time your own trading actions for maximum personal impact.

We should all be very excited about where prices are headed in the intermediate and longer term as the stagflationary eventualities we've discussed since 2020 play out. However, this does not mean that we can change the monthly tides of the COMEX calendar. As much as you may want it to be spring, if the calendar says it's still January, then you aren't going to get a lot of warm and sunny days. The calendar will always overrule your sentiments.

Thus, always be mindful of where we are in the month and then position yourself accordingly.