Even though the silver price has surged over the past two months, we haven’t seen anything yet. Step aside, Tesla. Watch what happens when investors begin to understand the true meaning of “STORE OF VALUE.” I can assure you; Tesla is not a store of value but rather a perfect example of the 2000 TECH-BUBBLE 2.0.

Unfortunately, the glitz, glamor, and allure of Technology will only last as long as the world is capable of supplying lots of cheap and available oil. Technology doesn’t really solve problems; it just consumes one hell of a lot more energy with the illusion of a FIX. Tesla isn’t solving our problem with fossil fuel addiction. Without the burning of one hell of a lot of oil, natural gas, and coal, Elon Musk wouldn’t be able to roll just one of his Model 3 Electric vehicles off the assembly line. This is the BAD JOKE that most “Renewable Energy Aficionados” would like you to ignore.

Again, let me clarify the term “Renewable Energy.” The only thing renewable about Solar & Wind Power is that the sun will continue to shine, and the wind will continue to blow. Thus, they are renewable and free. However, the highly sophisticated Technology that produces wind and solar power units is NOT RENEWABLE. We can prove this by the thousands of tons (soon to be hundred thousand tons) of wind blade waste that will be disposed of in landfills across the world.

If someone can honestly say that the dumping of thousands of tons of wind blade waste is renewable, then maybe I don’t understand what the term “Renewable” really means. My prediction is that when the global economies really start to suffer from PEAK OIL, and the Falling EROI of energy, we are going to see thousands of wind turbine power units sitting idle across the horizon, rotting and decaying with no funds to remove them properly.

Regardless, while many highly touted technological wonders will turn out to be a FART in the wind, silver will continue to provide a store of value for more than 2,000 years.

Do You Think The Availability Of Silver Bullion Is A Problem Now… We Haven’t Seen Anything Yet

There are lots of clues pointing to a BLINKING RED LIGHT when it comes to the silver bullion market. However, the overwhelming majority of investors are still gambling on FLY-BY-NIGHT Tech stocks. So, I say… let them have their fun while it lasts.

One indicator that silver bullion product is still very tight is the “Fractional Silver Round” market. While this isn’t a large market, usually dealers will have a wide assortment of private fractional silver rounds. This is no longer the case. If you go to any large online dealer, you will find pages of fractional silver rounds, with no current availability. I mean.. basically ZERO. Sure, there might be a few out there, mostly highly specialized fraction silver “Gram” coins.

Here is a screenshot of the fractional silver coins available from two leading online dealers:

You will notice a lot of “RED X’s.” I put those there to show how many of the fractional silver coins were available. Now, just wait until the U.S. Federal Government provides the second economic stimulus plan in September-October. Unfortunately, the overwhelming majority of investors still have no idea about acquiring physical silver bullion. The huge increase in silver bullion demand is mostly from “Diehard” precious metals investors and a new small group of buyers who have been hounded by the family and friends for years to get into the metals.

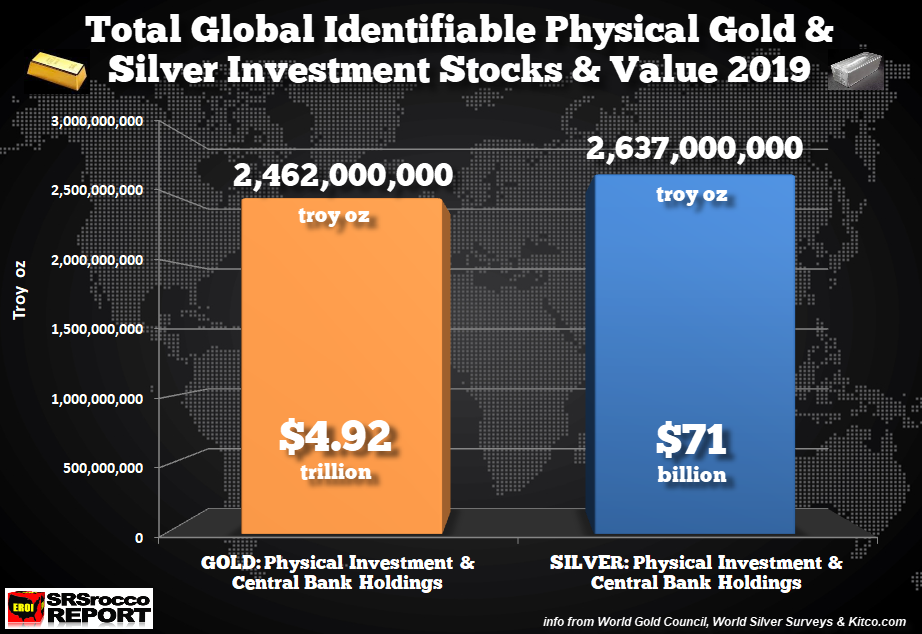

Here is my updated chart showing the value of global “identifiable” gold and silver investment stocks. The gold and silver total ounces are still based upon 2019 data, but the values have been updated to include $2,000 gold and $27 silver.

As you can see, there aren’t that much more physical silver investment stocks (bullion) in the world versus gold. Furthermore, look just how tiny the value of the global silver investment stocks are compared to gold… about 70/1. When the investors of the world finally get PRECIOUS METALS RELIGION, we are going to find out just how tiny the silver market has been.

If just a mere $500 billion worth of funds attempts to acquire some of this silver, we are talking about a SEVEN TIMES increase in the price… using simple math ($500 billion / $71 billion = 7). With the current silver price at $27, seven times that would be $189. Yeah, I know that may sound like a bit of “HYPE,” but no one was saying this when Tesla surged from $200 in 2019 to $1,500 recently. That’s SEVEN TIMES higher in just a year… LOL.

But, of course, Tesla is a legitimate investment…

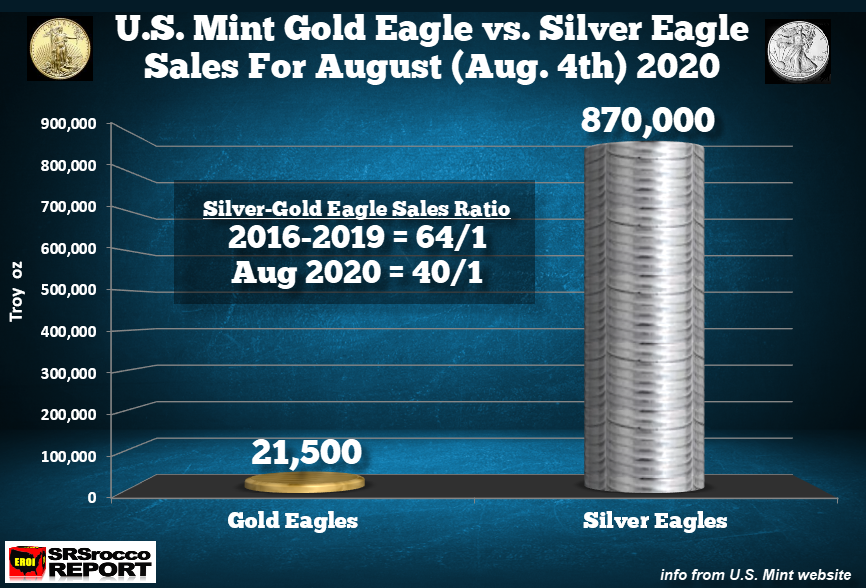

Lastly, the U.S. Mint recently stated that due to employee policy changes to protect workers from the virus, they would not be running both Gold and Silver Eagle production simultaneously. So, it looks like they finally switched to Silver Eagle mintage as the newest numbers from the U.S. Mint show 870,000 sales as of August 4th versus 21,500 oz of Gold Eagles:

With the U.S. Mint total Silver Eagle sales of 1,084,500 for the entire month of July, this seems like a significant improvement. Another interesting note… the total 21,500 Gold Eagle oz sold were all 1 oz coins. No smaller denomination Gold Eagle coins were included in this last update.

Currently, the silver price is up another 90 cents in early trading today and seems to be heading for the next target level of $27.50. I will provide a silver price update tomorrow.