As the global economic and financial system head over the cliff, silver investment demand is moving in the opposite direction. Not only has the demand for physical silver increased significantly since the middle of June, it surged to a level that has now put severe stress on the retail market.

This huge demand in the retail market made its way into the wholesale market. According to the article, Investment Silver Demand Draining COMEX Vaults:

One or more major players “jumped the queue” and took delivery of about 6.5 million more ounces of silver out of COMEX warehouses than anticipated at the beginning of the month.

Now, since this article was written (Aug 3rd), there were three more large net withdrawals:

Aug 4th = -672,000 oz

Aug 5th = -548,000 oz

Aug 6th = -1,028,623 oz.

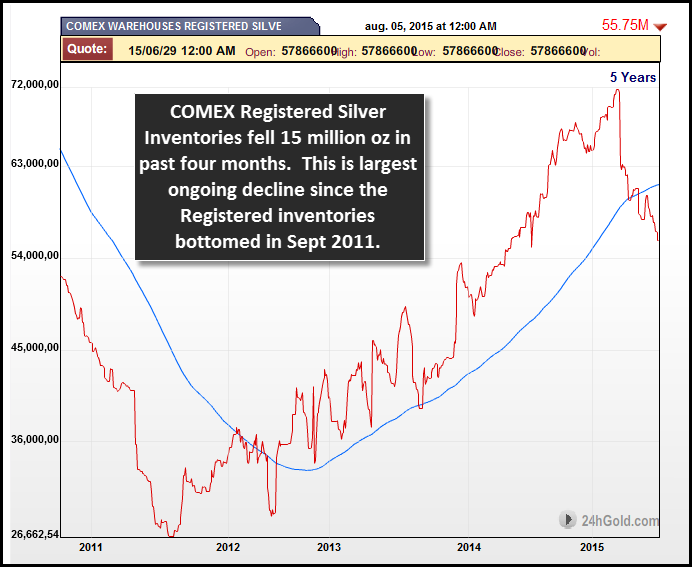

Here is the lasted COMEX Silver Inventory update:

Even though total silver inventories at the COMEX have only fallen 12 million oz (Moz) since its peak in the beginning of July (184 Moz to 172 Moz), the Registered category suffered the largest ongoing decline if we go back all the way to September 2011.

COMEX Registered silver inventories continued to build after bottoming in 2011 at 26 Moz. As we can see in the chart, as Registered Inventories trended higher, it was quite bumpy. However, the largest decline was no more than 10 Moz. The Registered Silver Inventories have fallen 15 Moz in just the past four months.

For clarification, the difference between Eligible and Registered Inventories is explained nicely by this excerpt from Jesse’s Cafe Americain Blog:

The Eligible category means that the silver is in a condition that conforms to the standards of delivery. Size and quality of the bar in other words. It is being stored at the Comex warehouse, but is not offered for delivery into contracts.

Registered means that the silver is available for delivery to those who demand bullion by being registered as such with a bullion dealer, in addition to being in a fit condition to satisfy the contract.

Eligible silver can become registered and deliverable if the owner of the silver declares it saleable at some price. And of course if it is there, and otherwise unemcumbered by senior obligations or conspicuous absence.”

So, in just four months, 21% of the Registered (deliverable) silver inventories were depleted. Unless the Fed and Central Banks have a magic wand to make all the financial and economic problems vanish, silver investment demand will more than likely continue to increase going forward. This will put even more stress on a silver market that has run annual deficits for the past decade.

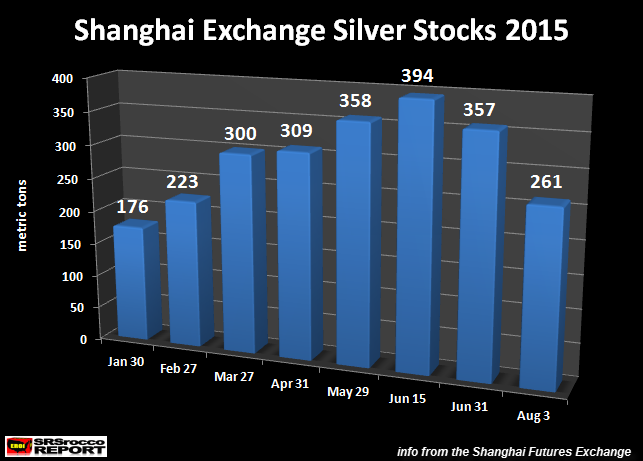

Shanghai Futures Exchange Silver Stocks Continue To Fall

In my recent article, SHANGHAI SILVER STOCKS PLUMMET: More Signs Of A Global Run On Silver?, I provided the following chart:

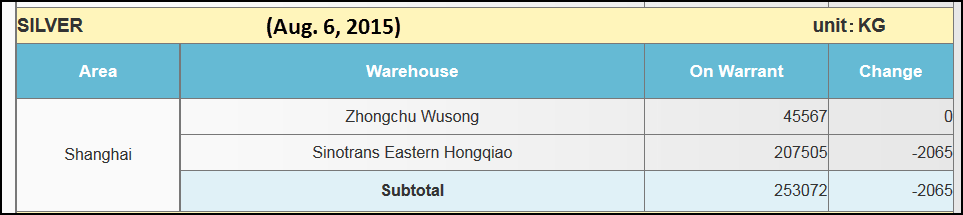

Silver inventories at the Shanghai Futures Exchange (SHFE) peaked in the middle of June at 394 metric tons (mt) and fell to 261 on August 3rd. This was a 34% decline in just seven weeks. I just looked at the recent update for Aug 6th, shown below:

In the past three days, another 8 metric tons of silver were removed and the total now stands at 253 mt. While this is a much smaller amount than the silver withdrawn from the COMEX, it shows that silver continues to be drained off global exchanges.

Investors are becoming increasingly worried about the global financial system going forward. Soon the point of no return will arrive as the world finally experiences the collapse of the greatest Paper Ponzi Scheme in history. Owning precious metals during this time will turn out to be one of the best investments ever.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: