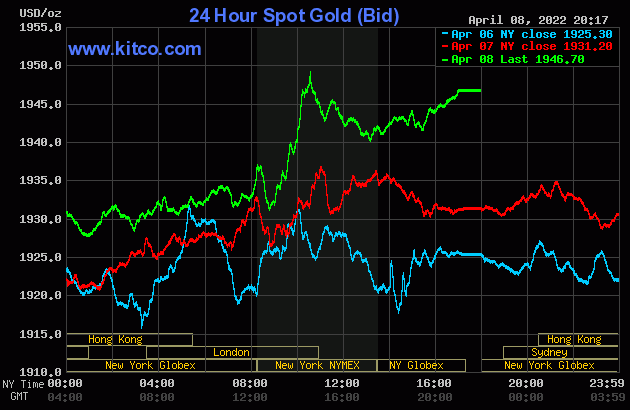

The gold price wandered quietly lower in the Far East on their Friday morning -- and the low tick of the day was set around 1 p.m. China Standard Time on their Friday afternoon. It then wandered quietly higher from there until about five minutes before the COMEX open -- and was then sold lower until 8:45 a.m. EDT. The ensuing rally was capped minutes after 10 a.m. in New York, which may or may not have coincided with the afternoon gold fix in London. It was sold quietly lower from that point until around 1:10 p.m. -- and then crawled quietly higher until the market closed at 5:00 p.m. EDT.

The low and high ticks in gold were reported as $1,930.40 and $1,952.20 in the June contract. The April/June price spread differential in gold at the close yesterday was $4.00...June/August was $6.60...August/October was $6.40 -- and October/December was $7.60 an ounce.

Gold was closed in New York on Friday afternoon at $1,946.70 spot, up $15.50 from Thursday. Net volume was very light at 129,500 contracts -- and there was a bit under 14,500 contracts worth of roll-over/switch volume on top of that...mostly into August and December.

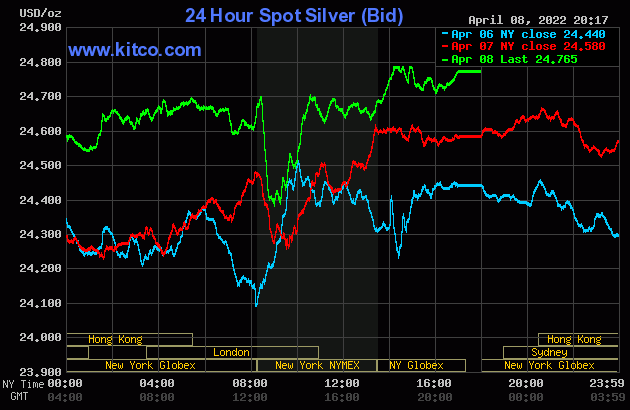

Silver's price path was mostly similar gold's in GLOBEX trading...but only up until a minute or so before 8:30 a.m. in New York. It was then hammered lower, with its low tick coming at exactly 9:00 a.m. EDT. Its ensuing rally was capped at the same moment as gold's -- and from that juncture it wandered very quietly lower until 1:10 p.m. At that point it made another bolt for freedom, but ran into a brick ceiling at $24.79 spot around 2:10 p.m. EDT. A quiet down/up move followed for the remainder of the after-hours trading session.

The low and high ticks in silver were recorded by the CME Group as $24.495 and $24.935 in the May contract. The May/July price spread differential in silver at the close in New York yesterday was 8.5 cents...July/September was 8.8 cents... September/December 14.0 cents an ounce.

Silver was closed on Friday afternoon in New York at $24.765 spot, up 18.5 cents from Thursday. Net volume was very much on the lighter side at 34,500 contracts -- and there was around 19,700 contracts worth of roll-over/switch volume in this precious metal...mostly into July, with a bit into September.

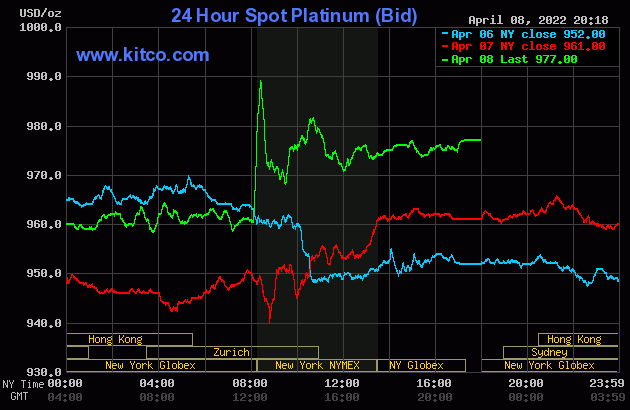

Platinum wandered/chopped very quietly sideways throughout all of the GLOBEX trading session overseas -- and that ended with a bang minutes after 2 p.m. in Zurich/8 a.m. in New York when this LPPM news hit the wires. The price went near vertical, but 'da boyz' stepped in about thirty minutes later to cap that rally -- and then drive it lower. That sell-off lasted until around 9:35 a.m. EDT -- and its ensuing rally ran into the same fate -- and its price was returned to 'trend' at exactly noon in New York. It was allowed to crawl a bit higher until trading ended at 5:00 p.m. Platinum was closed at $977 spot, up 16 bucks on the day -- and 22 dollars off its Kitco-recorded high tick.

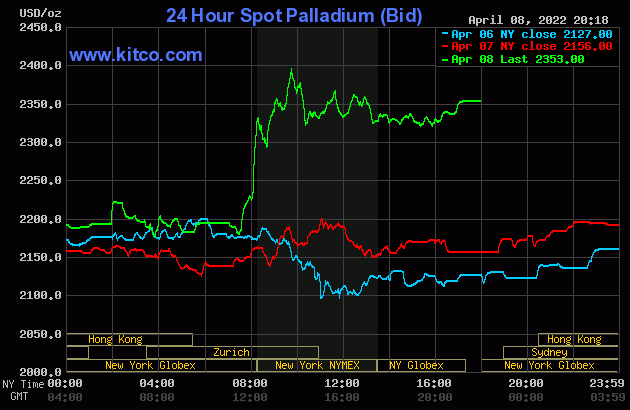

Palladium rallied to around the $2,200 spot mark by around 10 a.m. China Standard Time on their Friday morning -- and then traded rather unevenly sideways to a bit lower until around 1:30 p.m. in Zurich. It began to head sharply higher from there -- and then piggy-backed on the same LPPM news starting minutes after 2 p.m. CEST/8 a.m. EDT. The Big 4/8 shorts finally got the price capped around 9:45 a.m. during the COMEX trading session in New York -- and it was sold lower until around 10:20 a.m. EDT. >From that juncture it was forced to chop/wander quietly sideways until trading ended at 5:00 p.m. Palladium was closed at $2,353 spot, up $197 on the day -- and 42 dollars off its Kitco-recorded high tick.

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 78.6 to 1 on Friday...unchanged from Thursday.

And here's Nick Laird's 1-year Gold/Silver Ratio chart, updated with this week's data. Click to enlarge.

![]()

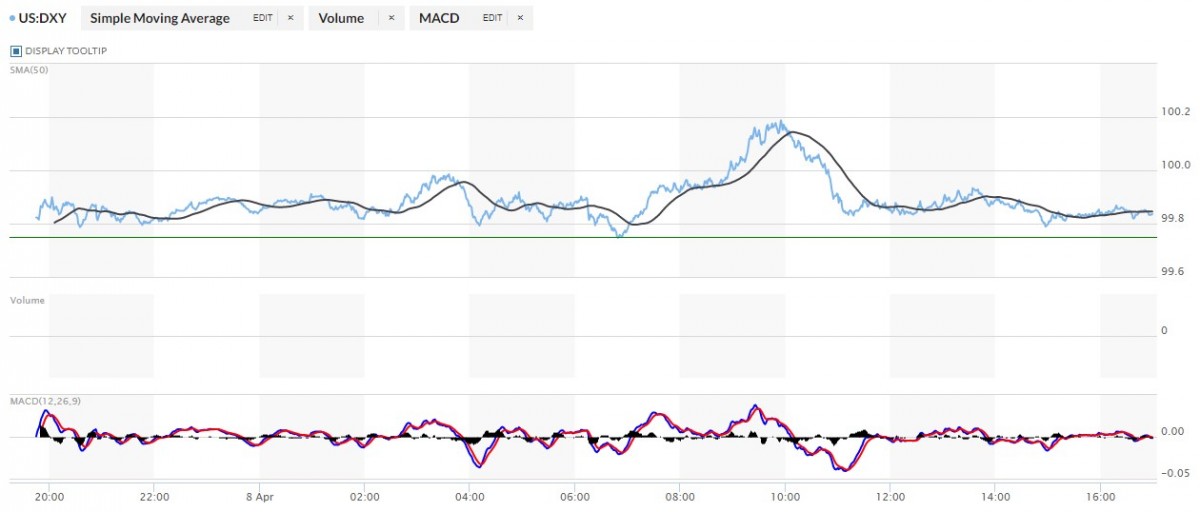

The dollar index closed very late on Thursday afternoon in New York at 99.75 -- and then opened higher by 7 basis points once trading commenced at 7:45 p.m. EDT on Thursday evening, which was 7:45 a.m. China Standard Time on their Friday morning. It rallied a bit from there over the next fifteen minutes or so -- and then proceeded to wander quietly sideways to a bit lower until around 11:50 a.m. in London. Its ensuing rally topped out at 9:55 a.m. in New York -- and it was then sold quietly lower until around 11:12 a.m. EDT. It then wandered quietly sideways from that juncture until the market closed at 5:00 p.m.

The dollar index finished the Friday trading session at 99.84...up 9 basis points from its close on Thursday.

Here's the DXY chart for Friday, thanks to marketwatch.com. Click to enlarge.

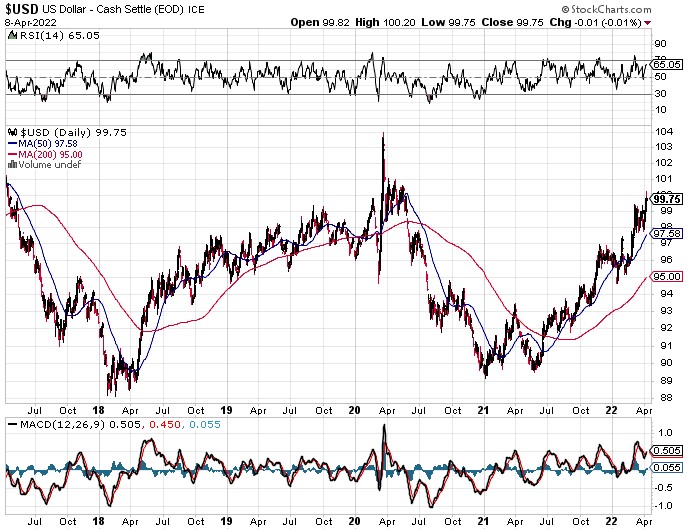

And here's the 5-year U.S. dollar index chart that appears in this spot in every Saturday column, courtesy of stockcharts.com as always. The delta between its close...99.75...and the close on the DXY chart above, was about 9 basis points below its spot close on the DXY chart above. Click to enlarge.

One again there was zero correlation between the currencies and what was happening with regards to precious metal prices.

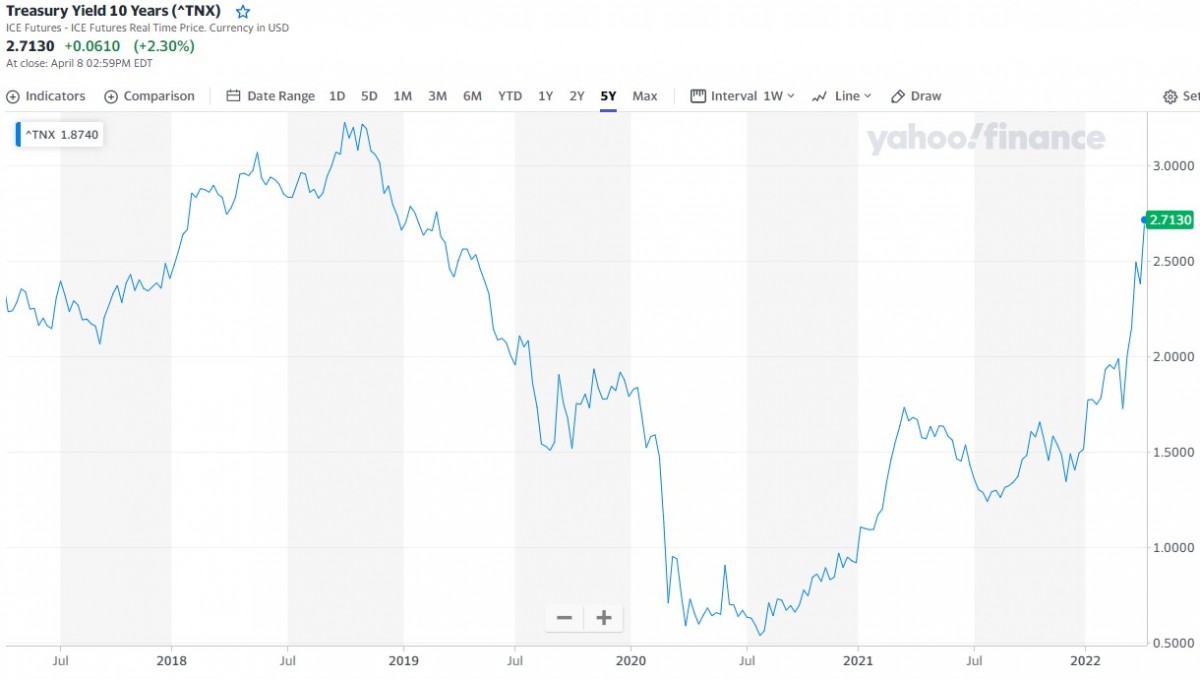

U.S. 10-Year Treasury: 2.7130%...up 0.0610 (+2.30%)...as of 02:59 p.m. EDT

Here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- and it puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

As you are more than aware, the only reason that yields are where they are, is because the central banks of the world continue to buy up virtually all, if not all of the sovereign debt being issued. That isn't about to stop anytime soon, as Japan just announced very recently -- and the European Central Bank was in a snit about yesterday in this Zero Hedge article from Richard Saler linked here.

As the saying goes "bonds are guaranteed certificates of confiscation" -- and that fact is now on full display in all the bond markets of the world. The Fed says it's going to be unwinding its balance sheet -- and the obvious question on everyone's lips is..."who's going to buy them?"

![]()

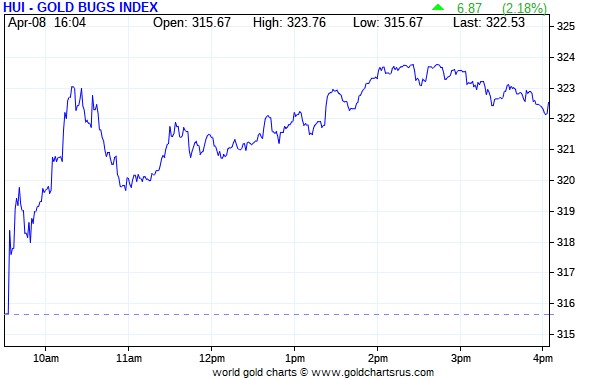

The gold shares began to head higher right from the moment that trading began at 9:30 a.m. in New York on Friday morning -- and that lasted until around 10:20 a.m. EDT. They were then sold a bit lower until a few minutes before 11 a.m. They began to creep higher from there, with their respective highs coming around 2:25 p.m. EDT. They were sold a bit lower until the market closed at 4:00 p.m. The HUI finished up 2.18 percent.

Computed manually, Nick Laird's Intraday Silver Sentiment/Silver 7 Index closed up 2.69 percent.

And here's Nick's 3-year Silver Sentiment/Silver 7 Index chart, updated with Friday's candle. Click to enlarge.

The star yesterday was SSR Mining, as it closed higher by 4.20 percent -- and the biggest underperformer was Peñoles, as it closed up only 1.14 percent on 7,600 shares traded.

The latest silver eye candy from the reddit.com/Wallstreetsilver crowd is linked here.

![]()

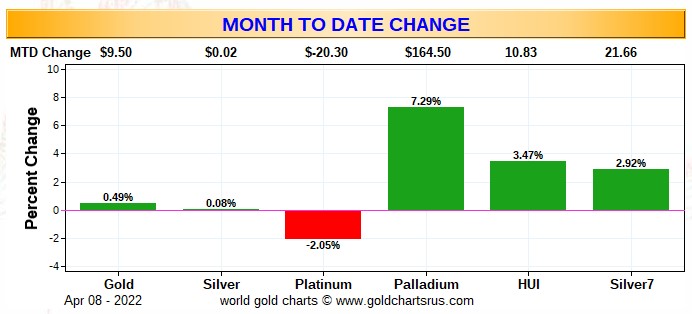

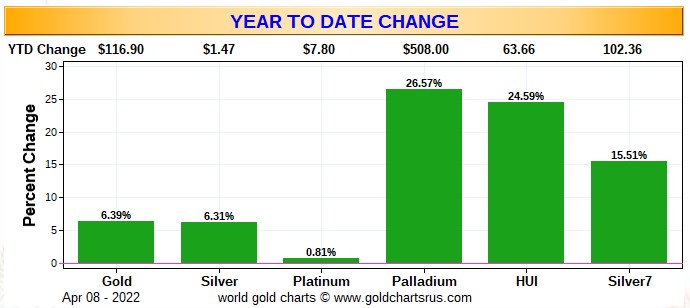

Here are two of the three usual charts that show up in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the Silver 7 Index.

Here's the month-to-date chart...and it's green across the board, except for platinum. The Silver 7 Index would be doing a little better if Peñoles wasn't part of it, but there's nothing that can be done about that. Click to enlarge.

Here's the year-to-date chart -- and it's still wall-to-wall green...with the silver stocks being the underperformers vs. its underlying precious metal so far this year. That will obviously change at some point. Palladium's gain year-to-date is impressive...but obviously down a very considerable amount because of the pounding it has taken during the last month. It would have been down even more, except for its strong rally yesterday -- and platinum got saved for the same reason. Click to enlarge.

Of course how much more in the way of gains were going to see going forward continues to be in the hands of the commercial traders of whatever stripe, as they alone control the price of everything precious metals-related...until they don't.

![]()

The CME Daily Delivery Report for Day 8 of April deliveries showed that 62 gold and 11 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, there were five short/issuers in total -- and the three biggest were Japanese trading house Mizuho, Goldman Sachs and Morgan Stanley, with 28, 15 and 15 contracts out of their respective client accounts. There were eight long/stoppers in total -- and the three largest there were JPMorgan and British bank Barclays, picking up 25 and 11 contracts for their respective client accounts... followed by Citigroup, stopping 11 contracts for their house account.

In silver, the only short/issuer was Morgan Stanley -- and the two long/stoppers were JPMorgan and ADM, as they picked up 8 and 3 contracts. All contracts, both issued and stopped, involved their respective client accounts.

In platinum, there were 44 contracts issued and stopped.

The link to yesterday's Issuers and Stoppers Report is here.

Month-to-date there have been 23,941 gold contracts issued/reissued and stopped -- and in silver that number is now up to 999 COMEX contracts. In platinum, there have been 2,248 COMEX contracts issued and stopped so far in April. In palladium, there have been 2 contracts issued and stopped.

The CME Preliminary Report for the Friday trading session showed that gold open interest in April dropped by 20 contracts, leaving 2,046 still open, minus the 62 contracts mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that 64 gold contracts were actually posted for delivery today, so that means that 64-20=44 more gold contracts just got added to the April delivery month. Silver o.i. in April declined by 119 COMEX contracts, leaving only 102 still around, minus the 11 contracts mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that 132 silver contracts were actually posted for delivery on Monday, so that means that 132-119=13 more silver contracts were added to April deliveries.

Total gold open interest at the close on Friday rose by 10,139 COMEX contracts -- and total silver o.i. increased by 4,607 contracts...not unexpected...with both numbers subject to some revision by the time the final figures are posted on the CME's website on Monday morning CDT.

There was a deposit in GLD yesterday, as an authorized participant added 102,643 troy ounces of gold -- and there was also 35,762 troy ounces of gold added to GLDM. There were no reported changes in SLV.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD, GLDM & SLV inventories, there was a net 47,954 troy ounces of gold removed, but a net 75,979 troy ounces of silver was added.

There was no sales report from the U.S. Mint yesterday.

Month-to-date the mint has sold 26,000 troy ounces of gold eagles -- 7,000 one-ounce 24k gold buffaloes -- and only 425,000 silver eagles.

And still no Q4/2021 or 2021 Annual Report from the Royal Canadian Mint. I don't remember them being this late before -- and we're already into Q2/2022.

There was very little activity in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday. There was 5,690.727 troy ounces/177 kilobars received -- and every kilobar of that amount ended up at Manfra, Tordella & Brookes, Inc. There was 14,950.224 troy ounces/465 kilobars shipped out...250 from the International Depository Services of Delaware...200 from Brink's, Inc. -- and the remaining 15 kilobars departed Manfra, Tordella & Brookes, Inc.

There was a bit of paper activity, as 25,648 troy ounces was transferred from the Eligible category and into Registered over at Brink's, Inc...no doubt scheduled for delivery in April sometime. The remaining 192.900 troy ounces/8 kilobars was transferred from the Registered category and back into Eligible over at Manfra, Tordella & Brookes, Inc.

The link to the above COMEX gold activity on Thursday is here.

It was another pretty busy day in silver, as one rather small truckload...542,787 troy ounces...was dropped off at JPMorgan -- and that was all the 'in' activity there was. There was 1,176,383 troy ounces shipped out.

In the 'out' category, there were six different depositories involved. The largest amount was the 599,005 troy ounces/one truckload that departed JPMorgan. In second and third place were the 289,004 and 177,291 troy ounces that got shipped out of Brink's, Inc. and HSBC USA respectively.

There was a bit of paper activity, as 313,212 troy ounces was transferred from the Registered category and back into Eligible -- and that took place over at JPMorgan.

The link to all of Thursday's COMEX activity in silver, is here.

The only activity in gold over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday was the 170 kilobars that got shipped out of Loomis International. The link to that, in troy ounces, is here.

![]()

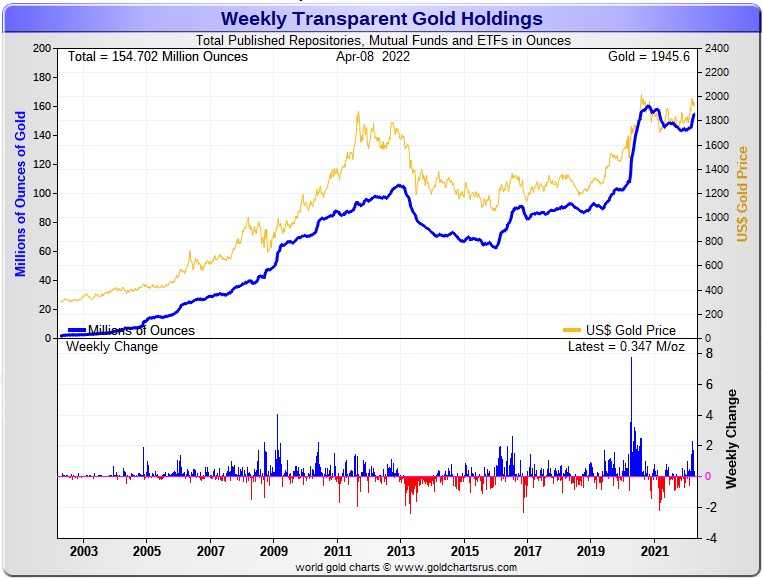

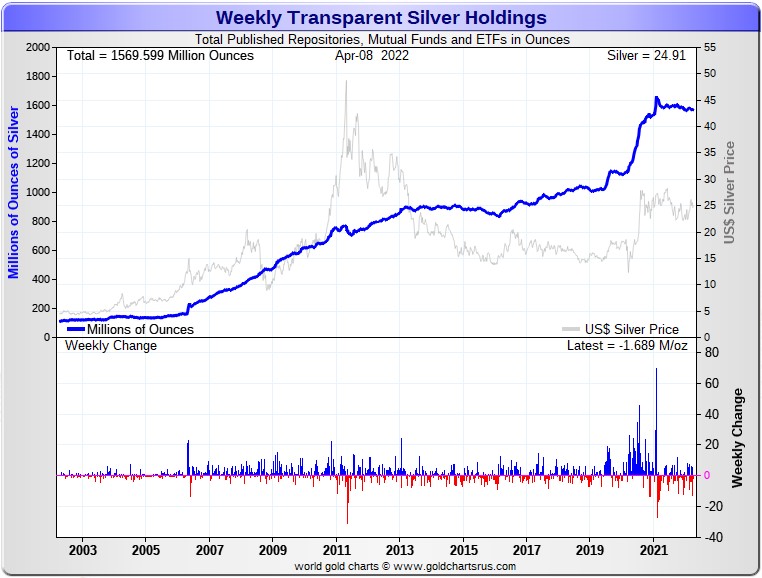

Here are the usual two 20-year charts that show up in this space every Saturday. They show the total amount of physical gold and silver held in all know depositories, ETFs and mutual funds as of the close of business on Friday.

During the week just past, there was a net 347,000 troy ounces of gold added -- and a net 1,689,000 troy ounces of silver was removed. Click to enlarge.

Ted is of the opinion that any and all silver that's required by SLV is being provided by JPMorgan and Friends, rather than allowing the short position to blow out to alarming levels. He also assumes that they're supplying all the other silver ETFs and mutual funds that require physical silver as well.

I'll be more than interested in what the next short report shows on 11 May...which is Monday.

The physical shortage in silver continues to creep along -- and the fact that JPMorgan has been issuing silver contracts out of their house account in both March and April...not to mention the physical silver being provided to all and sundry mentioned above...shows how extreme the situation has become.

Retail silver demand continues to be white hot as far as I can tell -- and delivery times for product from the various sovereign and private mints is still many weeks to months for a lot of bread and butter items.

![]()

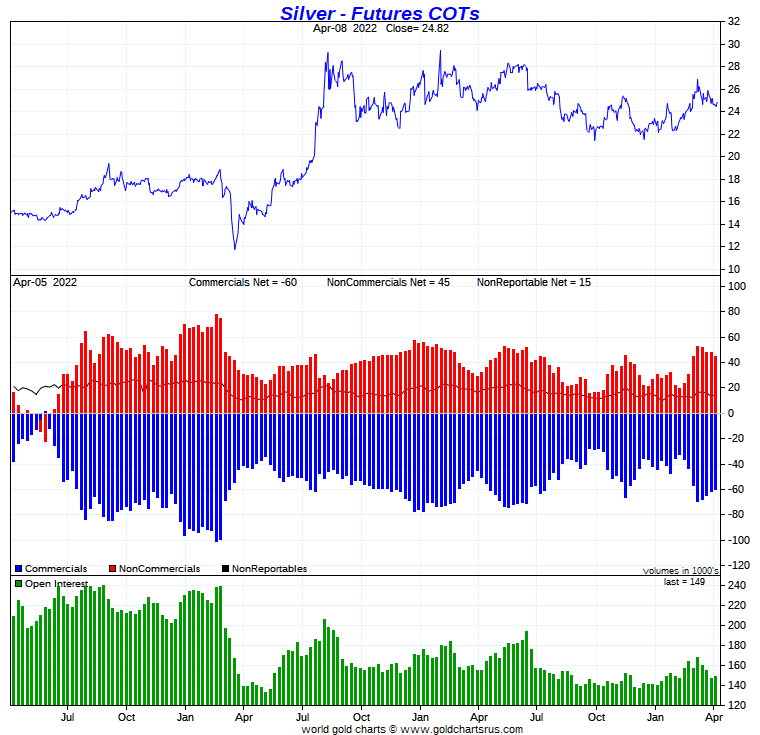

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, showed smallish improvements in the commercial net short positions in both gold and silver.

In silver, the Commercial net short position decreased by 1,336 COMEX contracts, or 6.7 million troy ounces -- and that improvement came as a result of Ted's raptors adding to their long positions, as the Big 8 shorts did next to nothing on a net basis.

The commercial traders arrived at that number by increasing their long position by 1,333 COMEX contracts -- and reduced their short position by 3 contracts. It's the sum of those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was all Managed Money trader selling -- and then some, that accounted for the change, as they decreased their net long position by 3,166 contracts. The Other Reportables were also sellers during the reporting week, but only 40 contracts worth, which was hardly worth calculating. On the other hand, the Nonreportable/small traders were big buyers, as they increased their net long position by 1,870 COMEX contracts.

Doing the math: 2,896 plus 40 minus 1,870 equals 1,336 COMEX contracts, the change in the Commercial net short position.

The Commercial net short position in silver now sits at 300.2 million troy ounces...down 6.7 million troy ounces from the 306.9 million troy ounces that they were short in last Friday's COT Report...which is obviously the headline number change mentioned further up.

The Big 8 are short 369.8 million troy ounces in this week's COT Report, a decrease of only 100,000 troy ounces from the 369.9 million troy ounces they were short in last Friday's COT Report.

The headline change in the Commercial net short position above showed an decrease of 6.7 million troy ounces. So Ted's raptors, the small commercial traders other than the Big 8 shorts did virtually allof the buying during the reporting week...to the tune of 6.7-0.1=6.6 million troy ounces...1,320 COMEX contracts...as they increased their long position by that amount.

It was their buying of long positions that had the mathematical effect of decreasing the commercial net short position by the amount that it did...except for that net 100,000 troy ounces bought by the Big 8 shorts.

Always remember that despite their small size, Ted's raptors are still commercial traders in the commercial category.

The Big 8 are short 369.8/300.2 equals about 123 percent of the Commercial net short position in silver, up from the 121 percent they were short in last week's COT Report -- and all because of all the longs purchased by Ted's raptors.

Here's the 3-year COT chart for silver, courtesy of Nick Laird as always. Click to enlarge.

This insignificant decrease in the Commercial net short position in silver, although welcomed, still leaves the futures market structure in silver very much on the bearish side...especially from a Big 4/8 short perspective. So nothing has changed from last week's COT Report.

However, however tiny the amount, this is the first week of the last three, that the Big 4/8 have decreased their net short position in silver...as it's been an all-raptor affair.

Ted is still of the opinion that there's a 'whale' in the Swap Dealer category that holds a long position of at least 15,000 contracts. That trader has held that position for many months now. What it means, Ted's not sure about...but it certainly isn't bearish for the price.

The commercial traders in silver are still in a position to lay a beating on the silver price going forward -- and Ted's of the opinion that it will take a price of under $23/ounce to do a proper clean out.

But can they or will they, is a question that still remains unanswered as of this writing -- and events of this past month have most likely changed a lot of things.

And to repeat Ted Butler's quote from last Friday's column..."[O]ne of these days, market structure considerations, as defined by readings in the Commitments of Traders (COT) report, will matter little – supplanted by physical market considerations or other things (like the OTC derivatives positions of the banks.)"

Whether we've reached that point, is yet another question that remains unanswered, but it's a given that the current situation can't continue forever, especially considering the near insatiable demand for physical silver at both the wholesale and retail levels.

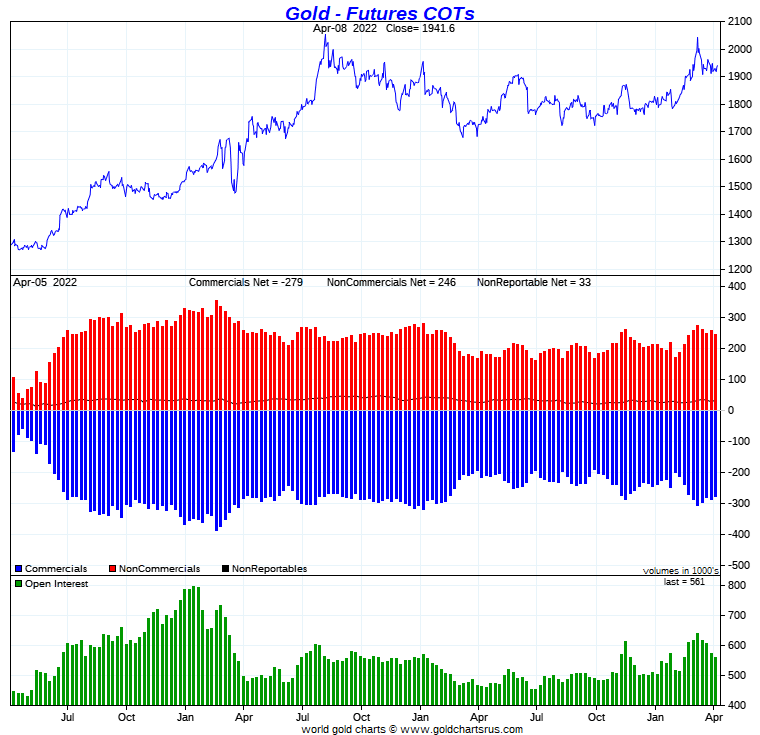

In gold, the commercial net short position declined by 7,179 COMEX contracts, or 717,900 troy ounces of the stuff...0.72 million troy ounces.

They arrived at that number by reducing their long position by 8,544 COMEX contracts, but also reduced their short position by 15,723 contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, both the Managed Money and Other Reportables were the big sellers. The former category reduced their net long position by 6,675 COMEX contracts...mostly by adding to their gross short position -- and the latter category by 5,380 contracts...mostly by reducing their gross long position.

Once again -- and like in silver, it was the Nonreportable/small traders that were the big buyers, as they increased their net long position by a hefty 4,876 COMEX contracts.

Doing the math: 6,675 plus 5,380 minus 4,876 equals 7,179 COMEX contracts, the change in the commercial net short position.

The commercial net short position in gold now sits at 27.88 million troy ounces, down 710,000 troy ounces [0.71 million] from the 28.59 million troy ounces they were short in last Friday's COT Report...which is obviously the change in the headline number further up...with the minor difference being a rounding error.

The short position of the Big 8 traders is now 26.97 million troy ounces, up 0.08 million troy ounces from the 26.89 million troy ounces they were short in last week's COT Report.

But since the headline change in the commercial net short position showed an decrease of 717,900 troy ounce/0.72 million troy ounces rounded up, it means that Ted's raptors, the small commercial traders other than the Big 8, decreased their own short position by 0.72+0.08=0.80 million troy ounces/8,000 COMEX contracts to make up the difference -- and that's what they did.

Their buying of long contracts/covering short positions had the mathematical effect of decreasing the commercial net short position by that amount.

As in silver, don't forget that despite their small size, Ted's raptors are still commercial traders in the commercial category -- and it was yet another all raptor affair this week.

From the above numbers, the Big 8 traders are short 26.97/27.88 equals about 97 percent of the commercial net short position in gold...down about 3 percentage points from the approximately 94 percent they were short in last Friday's COT Report.

This means that Ted's raptors, the small commercial traders other than the Big 8, hold the remaining 3 percent of the commercial net short position in gold -- and are that far away from being net long gold.

Here's Nick Laird's 3-year COT chart for gold, updated with Friday's data. Click to enlarge.

Ted said that the gold 'whale' in the Other Reportables category...which he believes is John Paulson...is still there -- and appears that he took delivery of about 5,000 contracts worth of gold during April, so he remains long gold by about 35,000 contracts in the COMEX futures market...down from the 40,000 Ted reported last week.

Like last week's COT Report the Big 4 reduced their short position during the current reporting week, while the Big '5 through 8' increased their net short position during the same period...which was something that Ted mentioned on the phone again yesterday afternoon.

So, like in silver, the set-up in the COMEX futures market still remains very bearish.

Ted feels that it would take an engineered price decline in gold down to about $1,800 to clean out all the longs that have been added in the last month or so -- and [like in silver] whether or not that is even possible in the current monetary, financial and political environment remains to be seen.

Gold's 50 and 200-day moving averages still remain unbroken to the downside -- and whether that matters this time or not, also remains to be seen.

And to repeat Ted's quote from the COT commentary on silver above..."[O]ne of these days, market structure considerations, as defined by readings in the Commitments of Traders (COT) report, will matter little – supplanted by physical market considerations or other things (like the OTC derivatives positions of the banks.)"

So we wait some more.

In the other metals, the Managed Money traders in palladium increased their net long position by 63 COMEX contracts -- and are still net short palladium by 324 contracts. In platinum, the Managed Money traders decreased their net long position by a further 3,316 contracts during the reporting week -- but are still net long the COMEX futures market by 5,360 COMEX contracts...about 9 percent of total open interest, down about 5 percentage points from last week. The Producer/Merchant category continues to be mega net short against all others in platinum...including the Swap Dealers in the commercial category. In copper, the Managed Money traders decreased their net long position by an insignificant 140 COMEX contracts -- and are net long copper by 40,554 COMEX contracts at the moment...about 1.01 billion pounds of the stuff -- and about 19 percent of total open interest...down about 1 percentage point from what they were net long in last Friday's COT Report.

![]()

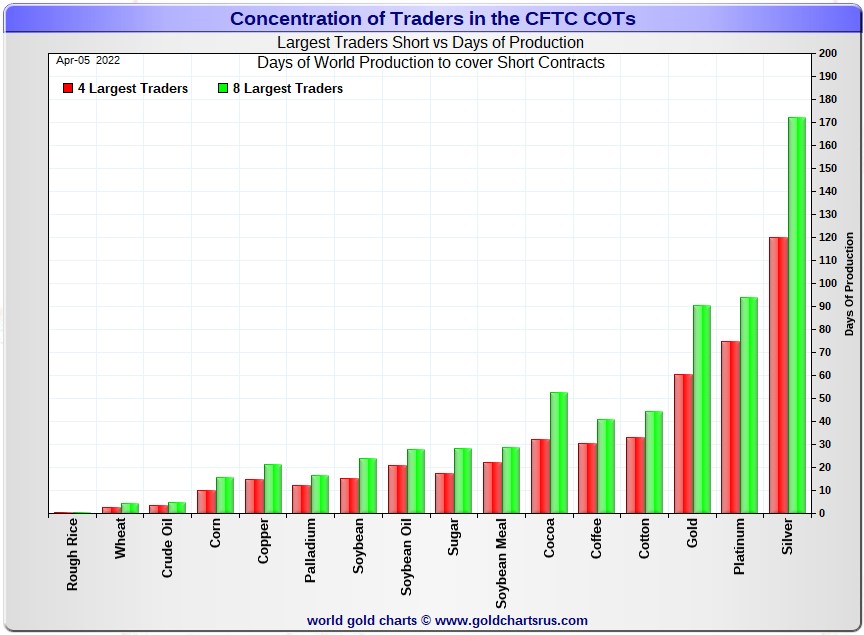

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, April 5. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in each physically traded commodity on the COMEX.

I consider this to be the most important chart that shows up in the COT series -- and it always deserves a minute of your time. Click to enlarge.

In this week's 'Days to Cover' chart, the Big 4 traders are short about 120 days of world silver production, down about 1 day from last week's COT Report. The ‘5 through 8’ large traders are short an additional 52 days of world silver production, up about 1 day from last Friday's report, for a total of about 172 days that the Big 8 are short -- unchanged from last week's COT Report.

That 172 days that the Big 8 are short, represents almost six months of world silver production, or 369.8 million troy ounces of paper silver held short by the Big 8 commercial traders.

In the COT Report above, the Commercial net short position in silver was reported by the CME Group at 300.2 million troy ounces. As mentioned in the previous paragraph, the short position of the Big 4/8 traders is 369.8 million troy ounces. So the short position of the Big 4/8 traders is larger than the Commercial net short position by 369.8-300.2=69.6 million troy ounces...up 6.6 million troy ounces from last week's COT Report...1,320 COMEX contracts...the number of long contracts bought by Ted's raptors during the past reporting week.

The reason for the difference in those numbers is that Ted's raptors, the small commercial traders other than the Big 8, are net long silver by that amount...69.6 million troy ounces/13,920 COMEX contracts.

As per the first paragraph above, the Big 4 traders in silver are short around 120 days of world silver production in total. That's 30 days of world silver production each, on average...down a tiny amount from last Friday's report. The traders in the '5 through 8' category are short 52 days of world silver production in total...13 days of world silver production each on average -- up a small amount from last week's COT Report.

The Big 8 traders are short 49.8 percent of the entire open interest in silver in the COMEX futures market, which is down a tiny bit from the 50.2 percent they were short in the last COT report. And once whatever market-neutral spread trades are subtracted out, that percentage would certainly be over the 55 percent mark. In gold, it's 48.1 percent of the total COMEX open interest that the Big 8 are short, up a bit from the 46.8 percent they were short in last Friday's COT Report -- and close to the 55 percent mark once their market-neutral spread trades are subtracted out.

In gold, the Big 4 are short 60 days of world gold production, down about 1 day from last Friday's COT Report. The '5 through 8' are short 30 days of world production, up 1 day from last week...for a total of 90 days of world gold production held short by the Big 8 -- unchanged from last Friday's COT Report -- and the week before. Based on these numbers, the Big 4 in gold hold about 67 percent of the total short position held by the Big 8...down about 1 percentage point from last Friday's COT Report.

The "concentrated short position within a concentrated short position" in silver, platinum and palladium held by the Big 4 commercial traders are about 70, 80 and 75 percent respectively of the short positions held by the Big 8...the red and green bars on the above chart. Silver is about unchanged from last week...platinum is also about unchanged from a week ago -- and palladium is up about 6 percentage points week-over-week.

Nothing has changed. The Big 4/8 traders are still very firmly stuck on the short side in both gold and silver -- and they increased their short position in gold during the reporting week -- and decreased it in silver by an immaterial amount.

As I keep pointing out -- and will mention again, the Big 4/8 shorts will never be able to extricate themselves fully from the short side, if that was ever their intent...particularly the Big 4. At some point they're going to have eat the lion's share of the short positions that they currently hold. The only way that they can do that is to go into the market and buy longs...or deliver physical metal, but only if the long holders are in a position to accept delivery. Ted says that a lot of them aren't.

So unless the powers-that-be at the CFTC and CME Group have something nefarious up their sleeves, or they're bailed out by the likes of the Exchange Stabilization Fund, the U.S. Treasury or the Fed, their potential loses can only be imagined...think LME nickel times 100 or more. But I very much doubt that it will be allowed to happen, especially for the 'too big to fail' bullion banks in the Big 4 category.

What happened on the LME involving the nickel market will most likely be a template for what will occur over at the CME Group at some point, as they rush to protect the big shorts on any runaway price activity to the upside, as that's their primary function.

But as of this moment, there are no upside daily limits as to how high gold and silver prices can rise in the COMEX futures market.

However, the circumstances in silver have been altered by an unimaginable [and monstrously bullish] amount by Ted's discovery of the approximately 1.2 billion troy ounce physical short position in silver that Bank of America appears to hold in the OTC market...along with the big increase in Goldman's derivatives position in silver in that market, as shown in last Friday's OCC Report...which Ted figures is a long position.

He has also come to the conclusion that BofA is short about 30 million ounces of gold in the OTC market as well.

The situation regarding the Big 4/8 shorts in silver, gold [and platinum] continues to be far beyond obscene, twisted and grotesque -- and as Ted correctly points out ad nauseam, its resolution will be the sole determinant of precious metal prices going forward.

As always, nothing else matters.

![]()

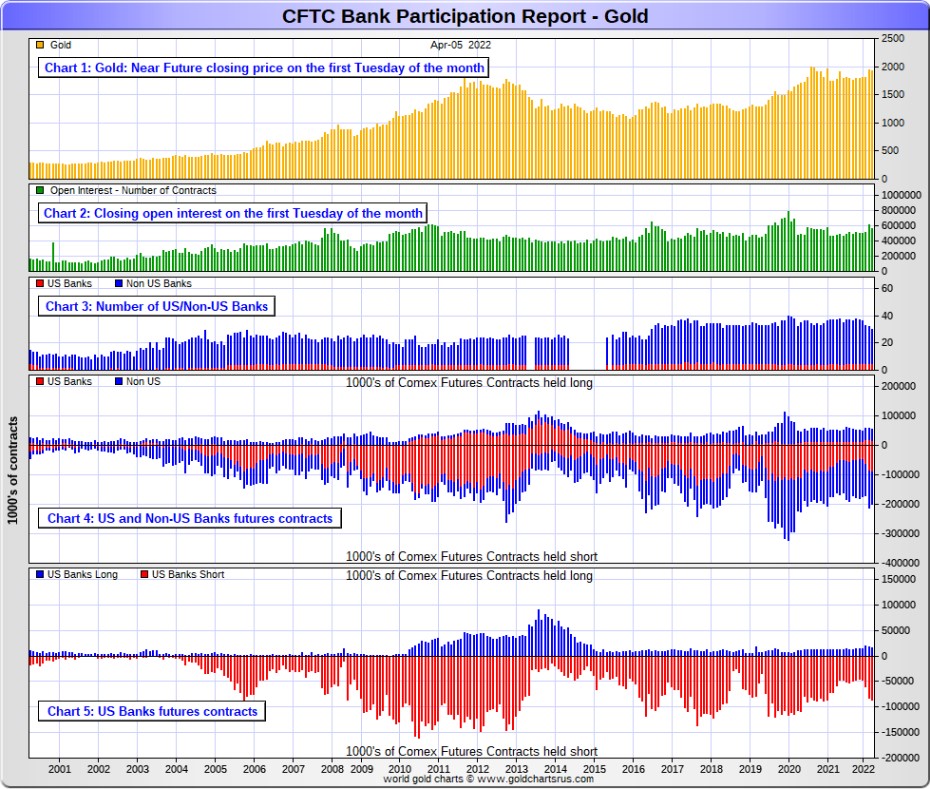

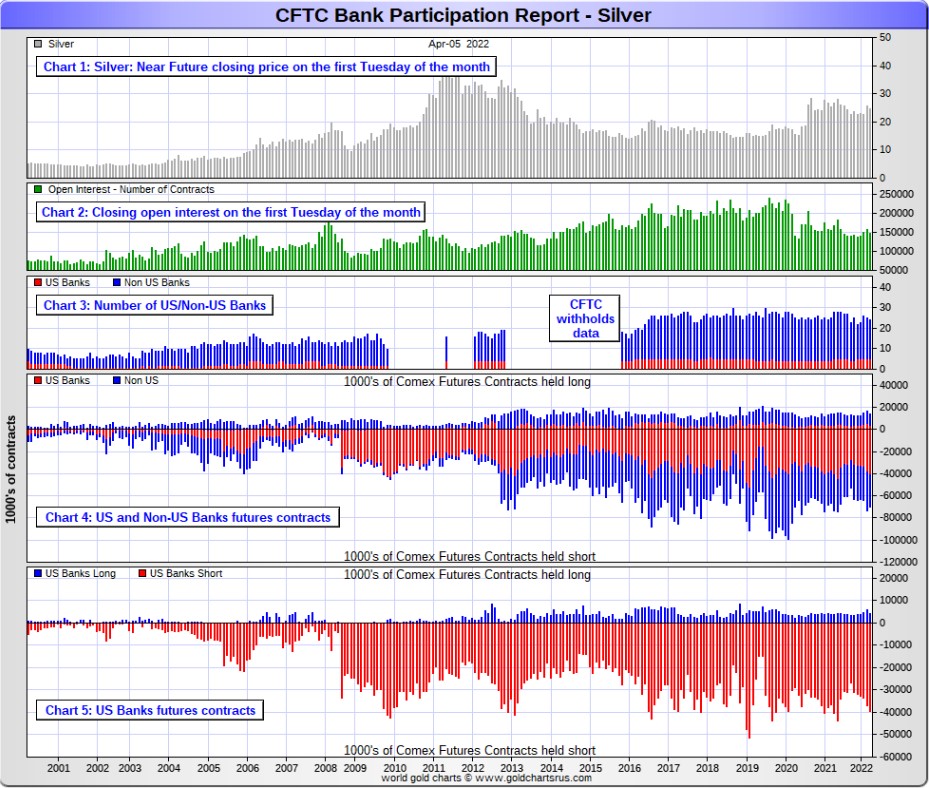

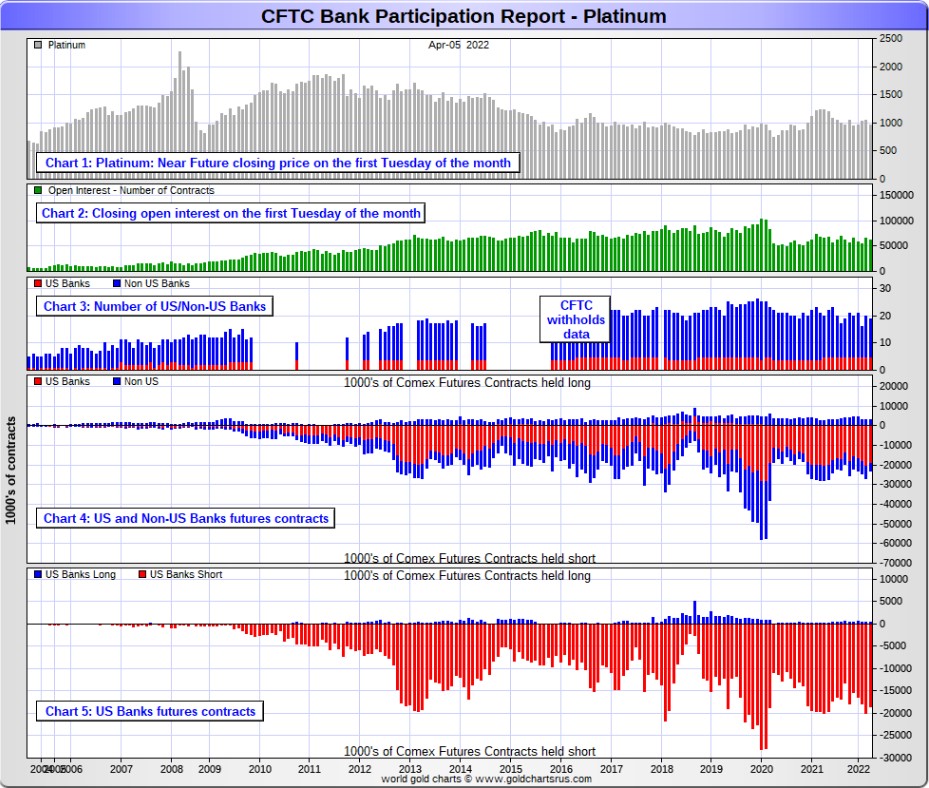

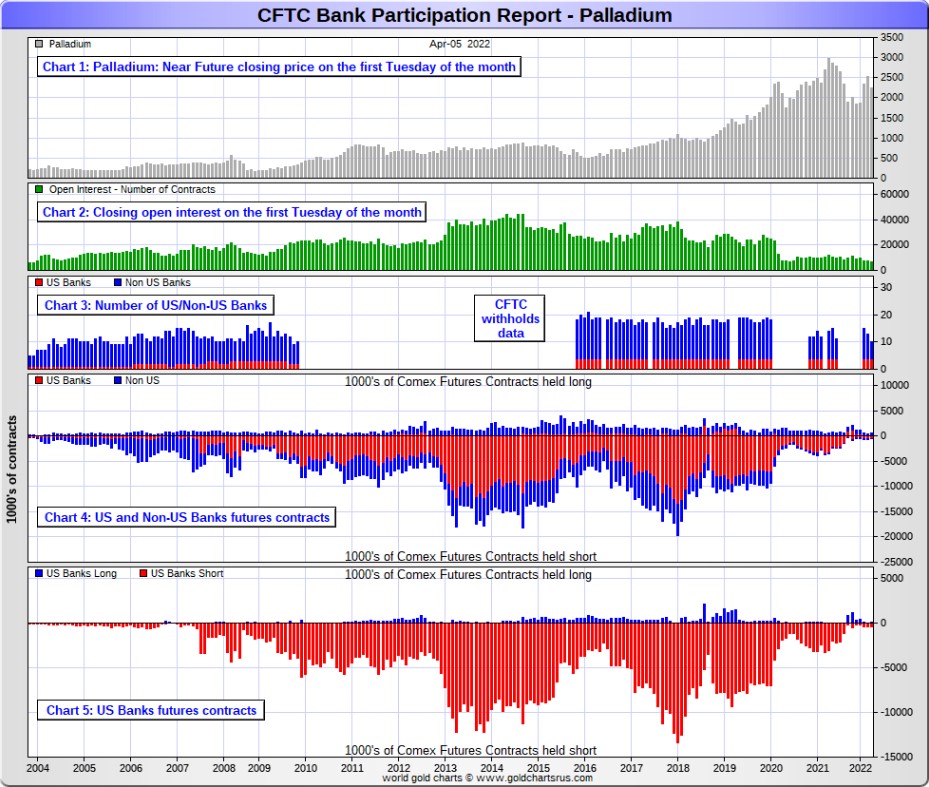

The April Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of Tuesday’s cut-off in all COMEX-traded products. For this one day a month we get to see what the world’s banks are up to in the precious metals. They’re usually up to quite a bit -- and they certainly were this past month.

[The April Bank Participation Report covers the time period from March 1 to April 5 inclusive.]

In gold, 5 U.S. banks are net short 71,460 COMEX contracts in the April BPR. In March’s Bank Participation Report [BPR] these same 5 U.S. banks were net short 64,587 contracts, so there was an increase of 6,873 COMEX contracts month-over-month. That's the fourth month in a row that the U.S. banks have increased their short position in gold.

Citigroup, HSBC USA, Bank of America and Morgan Stanley would most likely be the U.S. banks that are short this amount of gold. I still have my usual suspicions about the Exchange Stabilization Fund, although if they're involved, they are most likely just backstopping these banks.

Also in gold, 25 non-U.S. banks are net short 75,145 COMEX gold contracts. In March's BPR, 27 non-U.S. banks were net short 92,025 contracts...so the month-over-month change shows a big decrease of 16,880 COMEX contracts.

At the low back in the August 2018 BPR...these same non-U.S. banks held a net short position in gold of only 1,960 contacts -- and they've been back on the short side in an enormous way ever since.

I suspect that there's at least three large banks in this group, HSBC, Barclays and Deutsche Bank. I also have my suspicions about Scotiabank/Scotia Capital, Dutch Bank ABN Amro, French bank BNP Paribas, plus Australia's Macquarie Futures. Other than that small handful, the short positions in gold held by the vast majority of non-U.S. banks are immaterial and, like in silver, have always been so.

As of this Bank Participation Report, 30 banks [both U.S. and foreign] are net short 26.2 percent of the entire open interest in gold in the COMEX futures market, which is up a bit from the 25.4 percent that 32 banks were net short in the March BPR.

Here’s Nick’s BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank’s COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

In silver, 5 U.S. banks are net short 35,475 COMEX contracts in April's BPR. In March's BPR, the net short position of these same 5 U.S. banks was 31,126 contracts, which is up another 4,349 COMEX contracts month-over-month. This is the third month a row where the short position held by these big 5 U.S. banks has increased...but not by an overly large amount.

The biggest short holders in silver of the five U.S. banks in total, would be Citigroup, HSBC USA, Bank of America, Morgan Stanley...and maybe Goldman Sachs...but not JPMorgan according to Ted. And, like in gold, I have my suspicions about the Exchange Stabilization Fund's role in all this...although, also like in gold, not directly.

Also in silver, 19 non-U.S. banks are net short 21,002 COMEX contracts in the April BPR...which is down a pretty decent amount from the 26,224 contracts that 20 non-U.S. banks were short in the March BPR.

I would suspect that HSBC and Barclays holds a goodly chunk of the short position of these non-U.S. banks...plus some by Canada's Scotiabank/Scotia Capital still. I'm not sure about Deutsche Bank... but now suspect Australia's Macquarie Futures. I'm also of the opinion that a number of the remaining non-U.S. banks may actually be net long the COMEX futures market in silver. But even if they aren’t, the remaining short positions divided up between these other 14 or so non-U.S. banks are immaterial — and have always been so.

As of April's Bank Participation Report, 24 banks [both U.S. and foreign] are net short 38.0 percent of the entire open interest in the COMEX futures market in silver— up a bit from the 36.4 percent that 25 banks were net short in the March BPR. And much, much more than the lion’s share of that is held by Citigroup, HSBC, Bank of America, Barclays -- and Scotiabank -- and possibly one other non-U.S. bank...all of which are card-carrying members of the Big 8 shorts.

I'll point out here that Goldman Sachs, up until late last year, had no derivatives in the COMEX futures market in any of the four precious metals. But they did show up in the last two OCC Reports. Now they have a $4.8 billion position, mostly in silver -- and as I pointed out a bit further up, Ted thinks they're long the market.

Here’s the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns—the red bars. It’s very noticeable in Chart #4—and really stands out like the proverbial sore thumb it is in chart #5. But, according to Ted, as of March 2020...they're out of their short positions, not only in silver, but the other three precious metals as well. Click to enlarge.

In platinum, 5 U.S. banks are net short 18,119 COMEX contracts in the April Bank Participation Report, which is down 1,503 contracts from the 19,622 COMEX contracts that these same 5 U.S. banks were short in the March BPR.

I will point out here that this is the first month of the last four that these 5 U.S. banks have decreased their collective short positions in platinum...the Big 8 shorts No. 2 problem child after silver.

At the 'low' back in July of 2018, these U.S. banks were actually net long the platinum market by 2,573 contracts. So they have a very long way to go to get back to just market neutral in platinum...if they ever intend to, that is.

Also in platinum, 14 non-U.S. banks are net short 2,233 COMEX contracts in the April BPR, which is down 1,727 contracts from the 3,960 COMEX contracts that 15 non-U.S. banks were net short in the March BPR.

[Note: Back at the July 2018 low, these same non-U.S. banks were net short only 1,192 COMEX contracts in platinum, so they're closing in on that number again.]

And as of April's Bank Participation Report, 19 banks [both U.S. and foreign] are net short 33.3 percent of platinum's total open interest in the COMEX futures market, which is down a bit from the 36.1 percent that 20 banks were net short in March's BPR.

But it's the U.S. banks that are on the short hook big time -- and the real price managers. They have little chance of delivering into their short positions, although a very large number of platinum contracts have already been delivered during the last year or so...including this current delivery month. But that fact, like in both silver and gold, has made no difference whatsoever to their short positions held. The situation for them in this precious metal is as equally dire in the COMEX futures market as it is with the other two precious metals...silver and gold...particularly the former.

The reason that they'll never improve their short positions in a big way is the same reason as in gold and silver...the Managed Money traders flatly refuse to go short big time like they used to in the past -- and they're actually net long about 5,400 COMEX contracts at the moment.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

In palladium, 4 U.S. banks are net short 318 COMEX contracts, down 67 contracts from the 385 contracts that they were short in March's BPR.

Also in palladium, 6 non-U.S. banks are net long 281 COMEX contracts in the April BPR, up from 9 non-U.S. banks that were net long 130 contracts in March.

Except in February's Bank Participation Report, these non-U.S. banks have been net long palladium by a bit for the last 24 months.

And as I've been commenting for almost forever now, the COMEX futures market in palladium is a market in name only, because it's so illiquid and thinly-traded. Its total open interest at Tuesday's cut-off was only 6,642 contracts...compared to 60,983 contracts of total open interest in platinum...148,526 contracts in silver -- and 560,666 COMEX contracts in gold.

The only reason that there's a futures market at all in palladium, is so that the Big 8 traders can control its price. That's all there is, there ain't no more.

As of this Bank Participation Report, 10 banks [both U.S. and foreign] are net short 0.6 percent of the entire COMEX open interest in palladium...compared to the 1.8 percent of total open interest that 13 banks werenet short in March's BPR.

And because of the small numbers of contracts involved, along with a tiny open interest, these numbers are pretty much meaningless.

But, having said that, for the last two years in a row, the world's banks have not been involved in the palladium market in a material way. It's all hedge funds and commodity trading houses now.

Here’s the palladium BPR chart. Although the world's banks are market neutral at the moment, it remains to be seen if they return as big short sellers again at some point like they've done in the past. Click to enlarge.

Excluding palladium for obvious reasons, only a small handful of the world's banks, most likely four or so in total -- and mostly U.S-based, except for HSBC, Barclays and maybe Deutsche Bank...continue to have meaningful short positions in the other three precious metals. It's a near certainty that they run this price management scheme from within their own in-house/proprietary trading desks...although it's a given that some of their their clients are short these metals as well.

The futures positions in silver and gold that JPMorgan holds are immaterial -- and have been since March of 2020...according to Ted Butler. And what net positions they might hold, would certainly be on the long side of the market. It's the new 7+1 shorts et al. that are on the hook in everything precious metals-related.

And as has been the case for years now, the short positions held by the Big 4/8 traders/banks is the only thing that matters...especially the short positions of the Big 4 -- and how it is ultimately resolved [as Ted said earlier] will be the sole determinant of precious metal prices going forward.

The Big 8 shorts, along with Ted's raptors...the small commercial traders other than the Big 8 commercial shorts...continue to have an iron grip on their respective prices -- and nothing has changed in that regard over the last month...at least what can be seen on the surface. They continue to be the cork in the precious metal price bottle.

That situation will persist until they either voluntarily give it up...or are told to step aside, as it now appears that there's no chance that they will ever get overrun. If that possibility had ever existed in reality, it would have happened already. However, considering the current state of affairs in the world today -- and the physical shortage in silver, I suppose one shouldn't rule it out entirely.

I have a very large number of stories, articles and videos for you today, including quite a few I've been saving for today's column for length and/or content reason.

![]()

CRITICAL READS

Heads shaking, market professionals these days must be questioning who on the FOMC has their interests at heart. Still, markets believe the Fed has their backs. The Fed has no choice, unless they are willing to risk seeing everything come crashing down.

After a few decades of drifting ever deeper into the muck of inflationism, it’s at least encouraging to see the Fed commence the return to a more traditional inflation focus. I remain skeptical of this tightening cycle’s staying power. It’s also worth noting the unity around the concept of a “neutral rate” – “the rate that neither restricts nor spurs economic growth.” While an interesting theoretical concept, the “neutral rate” does not exist in reality, and thus is a dead end as a guide for policymaking.

Markets these days dictate system Credit Availability and financial conditions more than ever before. And there is certainly no “neutral” Federal Reserve rate that will magically return even a semblance of equilibrium to Bubble markets. There is no “neutral rate” as this point to smooth the boom and bust cycle that has haunted our system for the past 30 years.

The thought that the Fed can raise rates to the right level to orchestrate a coveted “soft landing” is no more than wishful thinking. Instead, the tightening cycle appears poised to proceed until “something breaks.” And when exactly that occurs has much more to do today with speculative market dynamics and geopolitics than with a particular interest-rate.

It is also important to appreciate that this is the first tightening cycle since the adoption of QE. This significantly complicates both the market environment and the Fed’s tightening challenge. The Fed has too many times in the past responded to market stress with pampering rate cuts and QE liquidity support. Bonds, today seeing Bubble fragility everywhere, price in the likelihood of future rate cuts and additional aggressive Fed purchases. And the resulting artificially low (negative real) bond yields work to sustain loose financial conditions and attendant inflationary pressures. This dynamic is forcing even the Fed doves to speak hawkishly of an aggressive tightening cycle.

Doug's weekly commentary appeared on his website in the wee hours of Saturday morning PDT -- and another link to it is here.

International Man: Whether we like it or not, the reality is, the Federal Reserve has an enormous influence over the dollar and the stock market.

And right now, the Fed has an urgent and fateful decision to make.

It can keep printing trillions of dollars, let inflation skyrocket or tighten monetary policy, and watch the stock market crash.

In other words, it can sacrifice the stock market or the dollar.

David, what do you think the Fed will do, and what are the implications?

David Stockman: Well, I think whether it wants to or not, the Fed will crash the stock market. The Fed has painted itself into a hellacious corner because it’s made such a fetish out of its 2% inflation target, especially since January 2012, when it officially adopted this quantitative target.

In fact, most of the massive money printing, which has occurred since 2012, when the economy was pretty much recovered from the Great Recession anyway, has been justified by an inflation shortfall, which wasn’t true, but that was the justification.

They were trying to raise inflation and therefore felt that they could keep quantitative easing at these huge rates, including $120 billion per month, until recently. And as a result, we’re now in a world in which inflation is heading towards double digits.

I think they’re going to have no choice but to throw on the brakes much harder than the market is expecting, much harder than they would like to do, or maybe even intend at the moment, but there’s no choice.

![]()

Ahead of last weekend's Hungarian parliamentary election, the pollsters were predicting a landslide loss for the loathed by the western/E.U. establishment current prime minister, the pro-Putin Viktor Orban. Well, there was a landslide, just not in the direction the so-called experts predicted (which begs the question: why do people still listen to polls after 2016, but we digress), and in the latest humiliation for Brussels, Orban was re-reelected in a huge victory, steamrolling the opposition alliance. So with all eyes on this weekend's French elections which pit Davos crowd pet and former Rothschild banker Emanuel Macron against outspoken nationalist Marine Le Pen. Here too, fears are growing that what until recently was seen by the always wrong pollsters as a "done deal" and blowout victory for Macron, suddenly is looking very shaky.

With French voters taking to the polls on Sunday, the race is suddenly wide open because while Macron's lead over Le Pen had been narrowing in recent weeks, a shock poll released yesterday by Atlas Politico showed that Le Pen (50.5%) now has a slight advantage over Macron (49.5%).

A little background: the first round of the French presidential election will take place on Sunday (April 10). The two candidates gathering the most votes will qualify for the second round of the election, which will take place on Sunday, April 24.

Incumbent President Macron still enjoys a comfortable lead in the polls at over 25% of voting intentions, although this is down marginally from the early-March highs. Voting intentions for far-right candidate Marine Le Pen have increased to about 20% (from about 15% a few weeks ago), placing her as the most likely candidate facing Macron in the second round.

Macron, who had sought to put himself at the center of European and U.S. efforts to end the crisis in Ukraine since late last year with dismal results so far, only began campaigning in earnest about a week ago. The calculation was that he’d benefit from the image of peacemaker and seasoned statesman, and that his handling of the pandemic and a strong economic rebound would be enough to keep him in the Champs-Élysées.

Until recently, polls suggested that was true... but suddenly the unthinkable appears possible, and a big reason for that is the exploding inflation across France.

This Zero Hedge news story put in an appearance on their Internet site at 4:50 a.m. EDT on Friday morning -- and another link to it is here.

![]()

Scott Ritter, the former Marine and U.N. weapons inspector who The New York Times called “the loudest and most credible skeptic of the Bush administration’s contention that Saddam Hussein’s government was hiding weapons of mass destruction," sat down with Gerald Celente for a candid interview about the Ukraine War.

I have all the time in the world for this guy. This interview, with host Gerald Celente, showed up on the youtube.com Internet site back on April 1. It runs for 54 minutes -- and I promised myself that I would only listen to part of it, but was so drawn in by his bio -- and what he had to say, that I ended up watching the entire thing. In the end, I was ever so glad I did, as it was very profound -- and the closer to the end it got, the more profound and philosophical it became. I thank Brad Robertson for sending it our way -- and another link to it is here.

![]()

“After failing to weaken China head-on through a trade war, the Americans shifted the main blow to Russia, which they see as a weak link in the global geopolitics and economy. The Anglo-Saxons are trying to implement their eternal Russophobic ideas to destroy our country, and at the same time to weaken China, because the strategic alliance of the Russian Federation and the PRC is too tough for the United States. They don’t have the economic or military power to destroy us together, not separately,” says Sergey Glazyev, an academician of the Russian Academy of Sciences and former adviser to the Russian President. Glazyev spoke in an interview with BUSINESS Online about what opportunities are now opening up for the Russian economy, whether the Central Bank is pandering to the enemy and whether a new world currency will replace the dollar.

"The fact is that there are long-term patterns of economic development, the analysis and understanding of which allows us to predict events that are currently taking place. We are now experiencing a simultaneous change in technological and world economic structures, while the technological basis of the economy is changing, the transition to fundamentally new technologies is taking place, and the management system is also being transformed. This kind of event occurs about once a century.

However, technological patterns change about once every 50 years, and their change is usually accompanied by a technological revolution, depression, and an arms race. And world economic patterns change once every 100 years, and their change is accompanied by world wars and social revolutions. This is due to the fact that the ruling elite of the core countries of the old world economic structure prevents changes, does not take into account the emergence of more effective management systems, tries to block the development of new world leaders using them, and tries to maintain its hegemony and monopoly position by any means, including military and revolutionary ones."

This very long...and I mean VERY long question and answer interview with Sergey Glazyev, who is well known to me, was posted on the telegra.ph website back on March 29 -- and I've read the whole thing. The translation from Russian is mostly OK. But for both length and content reasons, it obviously had to wait for today's column -- and I thank Mike Coombs for pointing it out back on March 31. I overlooked posting it in my column last Saturday, so here it is now -- and another link to it is here -- and pack a lunch before you start.

![]()

The Russian ruble strengthened to 75 rubles to the U.S. dollar and 81 against the euro on Thursday, reaching its strongest levels against major currencies since February 19.

The ruble plunged to historic lows after Russia launched the special military operation in Ukraine, and the U.S. and its allies imposed unprecedented sanctions targeting the country’s financial system. On March 7, the Russian currency fell to as low as 150 rubles to the dollar.

The ruble nosedived on February 24, immediately after the start of the military operation, as international penalties targeted its freely traded currency. Western countries froze Moscow’s foreign reserves, making it difficult for the Bank of Russia to support the ruble by selling foreign currencies.

The Russian government took steps to stabilize the sanctions-hit economy, helping the currency to bounce back from record low levels. The central bank introduced immediate capital controls, including a ban on foreigners selling Russian assets, as well as mandated hard currency sales by exporters.

Another factor in favor of the ruble was the announcement by the Bank of Russia on March 25 that the regulator is resuming gold purchases at a fixed price of 5,000 rubles ($52 at the time) per 1 gram between March 28 and June 30. The move effectively links the ruble to gold, and since gold trades in U.S. dollars, this sets a floor price for the ruble in terms of the dollar, establishing a new exchange rate between the two currencies closer to the levels seen on Thursday.

This rt.com news item appeared on their website early on Thursday morning Moscow time -- and I thank Roy Stephens for pointing it out. Another link to it is here. A directly related Reuters article is headlined "Russian central bank cuts key rate to 17%, signals further easing" -- and comes courtesy of Swedish reader Patrik Ekdahl.

![]()

We will look back at current events and realise that they marked the change from a dollar-based global economy underwritten by financial assets to commodity-backed currencies. We face a change from collateral being purely financial in nature to becoming commodity based. It is collateral that underwrites the whole financial system.

The ending of the financially based system is being hastened by geopolitical developments. The West is desperately trying to sanction Russia into economic submission, but is only succeeding in driving up energy, commodity, and food prices against itself. Central banks will have no option but to inflate their currencies to pay for it all. Russia is linking the rouble to commodity prices through a moving gold peg instead, and China has already demonstrated an understanding of the West’s inflationary game by having stockpiled commodities and essential grains for the last two years and allowed her currency to rise against the dollar.

China and Russia are not going down the path of the West’s inflating currencies. Instead, they are moving towards a sounder money strategy with the prospect of stable interest rates and prices while the West accelerates in the opposite direction.

The Credit Suisse analyst, Zoltan Pozsar, calls it Bretton Woods III. This article looks at how it is likely to play out, concluding that the dollar and Western currencies, not the rouble, will have the greatest difficulty dealing with the end of fifty years of economic financialisation.

This very worthwhile, but also very long commentary from Alasdair appeared on the goldmoney.com Internet site on Thursday -- and for obvious length reasons, I thought it best to wait for Saturday's column. I found it on the gata.org Internet site -- and another link to it is here. A somewhat related Zero Hedge new item is headlined "Global Food Prices Explode Higher in March as Ukraine Supply Shock Strikes" -- and I thank Richard Saler for sending it along.

![]()

Commodities could surge by as much 40% — taking them far into record territory — should investors boost their allocation to raw materials at a time of rising inflation, according to JPMorgan Chase & Co.

While allocations appear to be above historical averages on commodities, they are not very overweight, according to strategists led by Nikolaos Panigirtzoglou. That suggests scope for gains in raw materials, they said.

Commodities soared to a record last month as Russia’s invasion of Ukraine roiled markets, boosting the prices of everything from oil to wheat. That’s helped to spur already-elevated global inflation and a tougher response from the Federal Reserve, prompting investors to weigh reshuffling the weighting of assets between stocks, bonds and raw materials in their portfolios.

“In the current juncture, where the need for inflation hedges is more elevated, it is conceivable to see longer-term commodity allocations eventually rising above 1% of total financial assets globally, surpassing the previous highs,” the JPMorgan strategists wrote in an April 6 note. All else being equal, that “would imply another 30% to 40% upside for commodities from here,” they said.

This article showed up on the mining.com Internet site at 9:48 a.m. on Thursday morning -- and I thank Swedish reader Patrik Ekdahl for sharing it with us. Another link to it is here.

![]()

London’s metal traders are still reeling from the historic squeeze in nickel a month ago, but they may not get much time to recover — inventories across the exchange’s warehouses have dropped to perilously low levels, raising the threat of further spikes in everything from aluminum to zinc.

The available stockpiles across the six main contracts on the London Metal Exchange have plunged to the lowest on record in data going back to 1997. Goldman Sachs Group Inc. warned that copper is “sleepwalking towards a stock-out,” while freely available zinc inventories shrank by more than 60% in less than three weeks as Trafigura Group booked out large volumes. Nickel itself remains at risk of further turmoil.

“It seems as though we’re facing a new squeeze every week on the LME at the moment,” Michael Widmer, head of metals research at Bank of America Corp., said by phone from London.

Inventories were already dropping as industrial activity roared back last year while global logistics and shipping systems remained snarled. Metals like aluminum and zinc came under pressure in Europe as surging power prices made some plants unprofitable, leading to closures. More recently, supplies from Russia’s giant metal producers have become less desirable and harder to ship following the country’s invasion of Ukraine.

This very interesting and worthwhile Bloomberg article was picked up by the mining.com Internet site at 1:03 p.m. EDT on Thursday afternoon -- and also comes courtesy of Patrik Ekdahl. Another link to it is here.

![]()

After a brief but glorious spike above $5 a pound, or $11,000 a tonne one month ago, copper prices have retreated, with New York futures trading either side of the $4.70 a pound ($10,362 a tonne) mark.

The record intraday high set March 7 came on the back of historically low global inventories of the bellwether metal and in a research report released on Thursday, Goldman Sachs said copper is “sleepwalking towards a stock-out”.

It’s not the first such warning by Goldman, which is the most bullish investment bank on where copper prices are heading by comfortable margin.

In February, Goldman flagged a “scarcity episode” by the end of the year as global stocks shrunk to just over 200,000 tonnes – scarcely enough to cover three days of global consumption.

In Thursday’s report, Goldman points to “an extreme fundamental turn” for the metal, as for the first time in a decade stocks on exchanges declined through March “instead of rising during what is this metal’s main seasonal surplus phase.”

This news item, also from the mining.com Internet site -- and also courtesy of Patrik Ekdahl, was posted there at 2:36 p.m. EDT on Thursday afternoon. Another link to it is here.

![]()

Peru will target the “excess profits” that mining companies have earned from rising metal prices around the world, Economy and Finance Minister Oscar Graham told Reuters in an interview late Friday.

The world’s second-largest copper supplier will focus on surplus profits, potentially through an “adjustment” to taxes, Graham said, as the metal trades at near-record levels of around $10,000 per ton following Russia’s invasion of Ukraine.

Graham said the margins of the adjustment are being evaluated but it is important the mining sector retain its competitiveness and that investment will not be discouraged. He also told Reuters that Peru needs a better distribution of mining wealth to communities to quell recent protests, which have halted output in some key mines.

Peruvian President Pedro Castillo pledged to raise taxes on the mining sector when he came to office last year. His current plan, however, is much less ambitious than initially promised after it faced resistance from miners and a split Congress, according to the report.

This 4-paragraph story is another one from Patrik -- and also from the mining.com website. It's a week old, but obviously still relevant. Another link to the hard copy is here.

![]()

First Russian gold and silver, then diamonds, now platinum and palladium.

On Friday, newly refined Russian platinum and palladium was suspended from trading in London, denying Russia access to the metals' biggest trade hub in the latest in a growing list of measures against Russian interests because of the conflict in Ukraine. Of course, the Russian physical metal ban also means that commodity traders will now have to buy much more for physical - not paper - metal.

The London Platinum and Palladium Market (LPPM), an industry association, said the situation in Ukraine prompted it to review its list of "good delivery" refiners accredited to deliver metal into the London trading system. The LPPM said it would suspend with immediate effect both Russian refiners on its list, JSC Krastsvetmet and the Prioksky Plant of Non-Ferrous Metals.

The suspension blocks platinum and palladium produced by these refiners after April 8 from trading in London, though products they made while accredited remain eligible to trade, the LPPM said.

The decision comes a month after a similar industry group, the London Bullion Market Association (LBMA), suspended the accreditation of Russian refiners, blocking new Russian gold and silver from London.

Prices of palladium surged as much as 11%, with traders fearing the move could worsen a shortage of the metal automakers use in exhaust pipes to reduce emissions.

Just how reliant is the world on Russian metals? Russia's Norilsk Nickel produces 25-30% of the world's palladium supply and about 10% of platinum, which is also used to curb vehicle emissions as well as in other industries and to make jewellery. The company's website says that it sends metals to Krastsvetmet, Prioksky and another refinery, Uralintech, for refining.

![]()

Lebanon’s central bank, also known as Banque du Liban (BDL), is “counting its gold reserves for the first time in at least three decades,” as the international community “pressures the cash-strapped country to evaluate its assets to qualify for a bail-out,” English-language Emirati newspaper The National reported on Thursday.

“About 20 per cent of the time-consuming exercise has been completed in the past two years,” two senior civil servants told The National.

BDL’s employees had to pause their work for months owing to the Covid-19 pandemic, the daily said.

“They have descended into the bank’s vaults several times a week to weigh 12-kilogram gold ingots that are believed to number 13,000 in total. One by one, the metal bars are placed on a scale,” The National added.

“It’s a very physical job,” said one of the sources. The bank also holds around 700,000 coins.

This gold-related story showed up on the naharnet.com Internet site on Wednesday -- and reader George Whyte who sent me this story, also added this comment..."I wonder if they can rely on the 40% that is held at the Federal Reserve in the U.S. Empire?" Another link to it is here.

At 14,000 feet, in the remote jungles of New Guinea is the largest gold and copper deposit in the world. Getting to that deposit and building a profitable mine was one of the biggest engineering challenges ever. In 1975 an American mining company took up the challenge and using the most sophisticated technology available, conquered the jungle and built the Grasberg Mine!

I posted this 52-minute youtube.com video when a subscriber sent it to me a couple of years ago -- and even though I'd seen it before, I watched it again, as I'd forgotten a lot of it. It's certainly worth your while if you have the interest. I thank New Zealand subscriber Kae Lewis for pointing it out back on April 1 -- and it was yet another story that should have been in last Saturday's column, but wasn't. Another link to it is here.

![]()

Stack’s Bowers Galleries set a record for an American historical medal at auction when it sold the only gold Daniel Morgan at Cowpens medal, struck at the Philadelphia Mint in 1839, for $960,000 on April 4.

It flew past its estimate of $250,000 to $500,000 and sold to an anonymous phone bidder after six minutes of bidding.

Stack’s Bowers explained, “The Continental Congress initially authorized a Congressional Gold Medal to be awarded to General Daniel Morgan shortly after his important victory at the 1781 Battle of Cowpens. The unique medal was the product of a special authorization by the United States Congress, signed into law by President Andrew Jackson in 1836.”

The original gold medal given to Gen. Morgan was struck in Paris in 1789, but was stolen in 1818 and not recovered. Morgan’s grandson Morgan Neville sought a replacement for nearly two decades and ultimately this replacement medal was struck and presented to Neville’s son in 1841. It remained in the family for several subsequent generations, and the catalog entry observed, “This is the medal his decades of persistence achieved, the only example struck, the only gold Comitia Americana medal in private hands, and the only Congressional Gold Medal ever authorized by two separate Acts of Congress.”

Well, dear reader, when I posted this story before it was sold, I said at the time that it sell for far in excess of its estimated selling price -- and that's precisely what happened. This story showed up on the coinworld.com Internet site at 8 a.m. EDT on Friday -- and another link to it is here.

The Photos and the Funnies

The first three photos were taken at the green on the 9th hole at the the Mabel Lake Golf and Country Club on May 23, 2021. The fourth is of the private airstrip beside the course. It's only 884 metres/2,900 feet long -- and looks inviting in this photo. However, the photo of it looking in the other direction is far more terrifying. That picture, amongst others of this runway, will be in Tuesday's missive. Click to enlarge.

The WRAP

"Understand this: Things are now in motion that cannot be undone." -- Gandalf the White

Today's pop 'blast from the past' is offered with some sadness, as the artist who sang this pop tune, passed from our sight on Monday. However, as soon as I read that, today's pop selection was cast in stone immediately.

Born in April 1942...eighty years ago...the son of Jennie and Adrio "Al" Ridarelli -- he grew up in South Philadelphia. He changed his last name in the early 1950s -- and by the early 1960s, was considered a teen idol.

Written by the English composer Tony Hatch under the pseudonym Mark Anthony, it was recorded in London, England in February of 1963 -- and released as a single in October of that year. I had just turned 15 years young when this was a smash hit -- and I remember it all too well. The link is here. It has a very simplistic bass line, which was pretty standard back in the early days of pop/rock -- and that's linked here.

Today's classical 'blast from the past' is a violin concerto that took me almost two decades to get used to -- and then finally fall in love with. It's certainly in the top three violin concertos that I would include in any desert island I happened to be stranded on.

Edward Elgar's Violin Concerto in B minor, Op. 61, is one of his longest orchestral compositions, and the last of his works to gain immediate popular success.

The Royal Philharmonic Society of London formally commissioned the concerto in 1909. Elgar, despite himself being a violinist, called upon W. H. "Billy" Reed, leader of the London Symphony Orchestra, for technical advice while writing the concerto. Reed helped him with bowings, passage-work and fingerings, playing passages over and over again until Elgar was satisfied with them. Violin virtuoso Fritz Kreisler, to whom the work was dedicated, also made suggestions, some for making the solo part more brilliant and some for making it more playable.

The premiere was at a Royal Philharmonic Society concert on 10 November 1910, with Kreisler and the London Symphony Orchestra conducted by the composer. Reed recalled, "the Concerto proved to be a complete triumph, the concert a brilliant and unforgettable occasion".

Here's the incomparable [in every sense of the word!] Nigel Kennedy...who I met when he performed with the Edmonton Symphony Orchestra, which is a lifetime ago now...with the BBC Concert Orchestra, at the Proms -- and linked here.

![]()

The short sellers of last resort certainly had their hands full in the precious metal market on Friday...starting around 8 a.m. in New York. They managed to put those fires out, but you have to wonder just how much longer they can keep it up considering how quickly things seem to be circling the drain at an ever-increasing rate these days.

Volumes continue to be low, so 'da boyz' had an easy time of it again -- and how much longer this stint of quiet trading volume will last, remains to be seen.

Some of the commodity-related stories in the Critical Reads section of today's column give some idea of how critical the shortages are becoming in the industrial metals, with the debacle in the LME nickel market kicking things off. I suspect the copper and zinc markets to get exciting soon -- and so it's only a matter of when before it shows up in silver.

For the second day in a row, the gold price pulled a little further away from its nearest important moving average, which is its 50-day -- and it's 200-day, like I've mentioned a couple of times earlier this week, seems like it could be a "bridge too far" for the Big 8 shorts.

I discussed this fact with Ted several times this week, stating my thoughts mentioned above -- and although he agreed with me to a point, he's been through enough of these scenarios over the last four decades that he wasn't about to underestimate the treachery of the collusive commercial traders.

Silver also moved a tad further away from its 50-day yesterday, but here it would seem like an engineered price decline in it would bear more fruit, as both of silver's critical moving averages are less a dollar below its Friday close in the May contract.

Despite the decent gain that was allowed in platinum, it's still a very long way below any moving average that matters but, without doubt, if 'da boyz' hadn't appeared when they did yesterday, it would have closed a very long above all of them.

Palladium on the other hand blew through both its 200 and 50-day moving average yesterday, but was hauled lower and closed below its 50-day. Like platinum, it would have finished at heaven-only-knows what price if a market-clearing event had been allowed to transpire.

Copper closed up 3 cents/pound at $4.72 per -- and unlike three of the four precious metals, the world's banks are actually net long copper by a small amount...about 9 percent of total open interest...using yesterday's Bank Participation Report data.

WTIC closed up $2.23/barrel at $98.26 per -- and still below its 50-day moving average by a bit. But in this commodity, the Bank Participation Report shows that the world's banks are net short about 21 percent of total open interest in Physical WTI...which is a massive amount.

Here are the 6-month charts for the above Big 6 commodities, thanks to stockcharts.com as always. And, as always, I'll point out that all the positive price action in both silver and gold that occurred after the 1:30 p.m. EDT COMEX close, doesn't appear on their respective candles below. Click to enlarge.

There are so many pieces in motion on Zbigniew Brzezinski's "Grand Chessboard" at the moment, it's impossible to keep track of it all, as new things appear to be popping up almost by the hour it seems.

The "fog of war" continues to surround Russia' military incursion into the Ukraine -- and as many have said..."the first casualty of war is the truth"...so it's impossible to know what's really going on. One thing that is for sure about this, is that we're being lied to on a massive scale...as Jim Rickards pointed out in this article.

But the economic, financial and monetary fall-out from this continues to escalate -- and by design in my opinion. The law of unintended consequences is having new chapters written it with each passing day. At some point a critical mass will be reached -- and then...?

One thing that is for sure is that the current world order is already in the trash heap of history -- and whatever new world order rises from its ashes...the one that Klaus Schwab and his merry band of sociopaths envision, or something else entirely...it's going to be far more unpleasant than the life we enjoyed before that Covid 19 thingy was foisted on humanity.

The hysteria about the war and shortages of every kind -- and their ramifications for all of mankind, is now at a fever pitch -- and without doubt will continue non-stop going forward.

As to how far along the path we are to the final denouement remains to be seen, but one has to suspect that there's much further to go -- and much worse to come. Only its form is unknown to us...at least for the moment.

And as I've pointed out countless times in the past, somewhere during this process -- and at a time when the powers-that-be deem it appropriate, this price management scheme in the precious metals will be cast aside -- and the explosion in commodity prices will be on in earnest, to the detriment of everything paper...including our current financial system and it's associated fiat currencies.

Russia fired the starting pistol for that process about two weeks ago -- and it's a genie that can't be put back in the bottle.

And as Gandalf the White said in that quote above..."Understand this: Things are now in motion that cannot be undone."

He would be right about that.

I'm still "all in" in everything precious metal-related, of course -- and always hoping/praying that it will be enough.

See you on Tuesday.

Ed