While the Federal Reserve continues to rig the financial markets by way of its insane interest rate policy, U.S. silver production took a big hit in September. How big? Well, let’s just say…. it took me by surprise.

According to the U.S. Geological Survey (USGS), overall domestic silver production for 2015 has trended lower compared to last year. However, the recent data for September show a much larger decline.

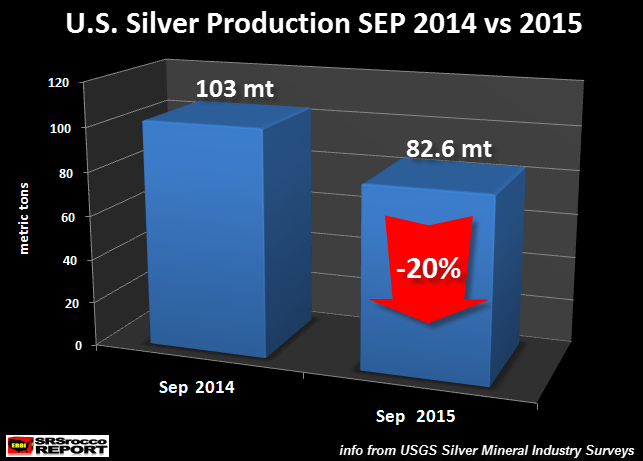

U.S. silver production for September fell a staggering 20% compared to the same month last year:

As we can see from the chart U.S. silver production fell to 82.6 metric tons (mt) in September compared to 103 mt during the same month last year. This amounts to a decline of 20.4 metric tons or a 20% plunge versus last year.

This is a large amount if we compare the total decline year to date in 2015 (JAN-SEP) is only 41 mt (5%). I asked the USGS silver specialist if he thought the September’s production figures would be revised higher in the following months. He responded by saying, “Probably not.”

Falling silver production is also taking place in several of the top producers in the world:

Mexico = -4% (Jan-Sep)

Chile = -4% (Jan-Aug)

Canada = -23% (Jan-Oct)

Australia = -41% (Jan-Aug)

(data from Canada Dept of Natural Resources, Mexico INEGI & Chilean Copper Commission)

As I have stated in many articles and interviews, PEAK SILVER will occur first in the base metal mining industry where the majority of by-product silver is produced. According to the data from the 2015 World Silver Survey, 55% of all silver produced in 2014 came as a by-product of zinc, lead and copper production. Furthermore, 13% came as a by-product of gold mining, while the remaining 31% was from primary silver production.

Global silver production will fall more rapidly in the following years as an increasing number of base metal mines shut down due to lower copper, lead and zinc prices. This will occur right at a time when investors finally realize just how undervalued silver is compared to most of the highly overvalued paper garbage the world is invested in.

Lastly, something changed in the U.S. Silver Market this year. Please look for my article, Something Broke In The U.S. Silver Market This Year to be published tomorrow.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: