Gold's quiet rally that began right at the start of Globex trading in New York on Thursday evening ran into 'resistance' until it was finally rolled over starting around 1:15 p.m. China Standard Time on their Friday afternoon. It was quietly and unevenly down hill from that point until it got booted downstairs a bit more in early COMEX trading in New York. That lasted until around 10:25 a.m. EDT -- and its ensuing rally was capped about ten minutes after the 11 a.m. EDT London close. The selling pressure returned at that juncture -- and that continued until around 4:10 p.m. in after-hours trading when its low tick of the day was set. It didn't do much after that.

The high and low ticks in gold were recorded by the CME Group as $3,398.30 and $3,328.80 in the August contract...an intraday move of $69.50 an ounce. The June/August price spread differential in gold at the close in New York yesterday was $23.90...August/October was $27.90 -- and October/ December was $28.20 an ounce.

Gold was closed in New York on Friday afternoon at $3,308.70 spot...down $43.70 on the day -- and about 65 dollars off its Kitco-recorded high tick. Net volume, surprisingly enough, was only a bit on the heavier side at a bit under 172,000 contracts -- and there were a bit over 13,500 contracts worth of roll-over/switch volume on top of that.

I saw that 81 gold, plus 367 silver contracts were traded in June yesterday -- and it's always of great interest to see how much of this shows up in tonight's Daily Delivery and Preliminary Reports.

![]()

Silver's quiet rally in early Globex trading also ran into 'da boyz' around 1:15 p.m. CST on their Friday afternoon -- and from that point it chopped wandered quietly sideways to a bit higher until more firm selling pressure resurfaced at 9:15 a.m. in COMEX trading in New York. It was sold/engineered lower until 10:25 a.m. EDT...just like for gold -- and its ensuing rally attempt was allowed to last until around 12:10 a.m. From that juncture it chopped quietly sideways to a tad lower until trading ended at 5:00 p.m. EDT.

The low and high ticks in silver were reported as $35.755 and $36.51 in the July contract...an intraday move of 75.5 cents. The July/September price spread differential in silver at the close in New York yesterday was 32.4 cents...September/December was 43.3 cents -- and December/ March26 was 38.9 cents an ounce.

Silver was closed on Friday afternoon in New York at $35.895 spot...up 31 cents from Thursday -- and 36.5 cents off its Kitco-recorded high tick. Net volume was only a bit on the heavier side as well, at a hair under 63,000 contracts -- and there were a very impressive 22,500 contracts worth of roll-over/switch volume out of July and into future months in this precious metal... mostly September, but with very noticeable amounts into December and March26 as well.

![]()

Platinum took two big steps higher in Globex trading in the Far East on their Friday -- and ran into not-for-profit selling minutes after Zurich opened. It was sold/engineered lower until 10 a.m. CEST -- and then wandered quietly and unevenly sideways to a bit higher until trading ended at 5:00 p.m. in New York. Platinum was closed at $1,169 spot, up 31 dollars from Thursday.

![]()

Palladium jumped up about ten dollars or so at the Globex open in New York on Thursday evening -- and then rallied quietly higher...running to momentary resistance at the Zurich open -- and then again at 2 p.m. CEST/8 a.m. EDT. Once the COMEX opened twenty minutes after that, the rally got really serious until a short seller of last resort appeared around 11:30 a.m. EDT. It then traded pretty flat until the COMEX close -- and was then tapped a few dollars lower in after-hours trading. Palladium was closed at $1,046 spot...up 58 bucks on the day.

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 92.3 to 1 on Friday...compared to 94.2 to 1 on Thursday.

Here's Nick Laird's 1-year Gold/Silver Ratio chart -- and updated with this past week's data. Click to enlarge.

![]()

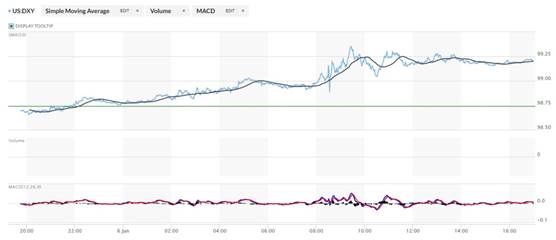

The dollar index closed very late on Thursday afternoon in New York at 98.74 -- and then opened lower by 4 basis points once trading commenced at 7:45 p.m. EDT on Thursday evening...which was 7:45 a.m. China Standard Time on their Friday morning. It edged a tad lower until 8:06 a.m. CST -- and then began to wander very broadly and quietly higher until that rally topped out at 9:25 a.m. in New York. It then began to wander/chop broadly and quietly lower until it began to creep higher starting around 3:25 p.m. EDT -- and that lasted until the market closed at 5:00 p.m.

The dollar index finished the Friday trading session in New York at 99.19...up 45 basis points from its close on Thursday.

Here's the DXY chart for Friday...thanks to marketwatch.com as usual. Click to enlarge.

![]()

Here's the 6-month U.S. dollar index chart...courtesy of stockcharts.com as always. The delta between its close...99.19...and the close on DXY chart above, was zero basis points for the second day in a row. Click to enlarge.

![]()

U.S. 10-year Treasury: 4.5100%...up 0.1160/(+2.6400%)...as of the 1:59:54 p.m. CDT close

The ten year wandered quietly higher right from the COMEX open on Friday morning -- and it certainly appeared that the Fed stepped in a couple of minutes after 9 a.m. in New York to prevent its yield from rising even more. From that point it crawled very quietly but steadily higher until trading ended.

The 10-year closed higher by 9.40 basis points on the week.

Here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- which puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

As I continue to point out in this spot every week, the 10-year hasn't been allowed to trade above its 4.92% high tick set back on October 15, 2023 -- and it's more than obvious from the above chart that it will he held at something under 5% until further notice. And whether or not we get a rate cut at the June FOMC meeting, is now open for debate. A few weeks ago everyone thought it was a slam dunk...but not anymore. Here's the latest on that.

![]()

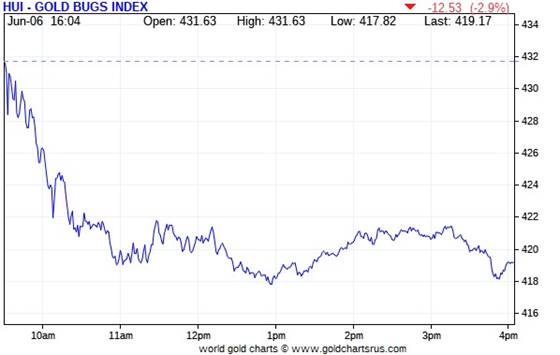

The gold shares were sold lower the moment that trading began at 9:30 a.m. in New York -- and their respective lows were set minutes before 1 p.m. EDT...which had nothing to do with what was going on with the gold price, as it continued its quiet decline. They had a quiet up/down move from that juncture until some bottom fishing appeared a few minutes before trading ended at 4:00 p.m. EDT. The HUI closed down 2.90 percent.

![]()

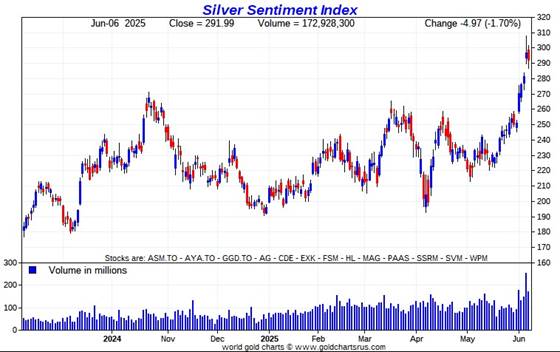

Despite the fact that silver closed in positive territory -- and was never down on the day at any time during the Friday trading session, the silver equities got tossed out with the bathwater too, as Nick Laird's Silver Sentiment Index closed lower by 1.70 percent. Click to enlarge.

![]()

The 'star' -- and the only one of the thirteen stocks that closed in positive territory on Friday, was Pan American Silver, closing up 0.17 percent. There were five that closed down on the day by 3+% -- and the biggest loser of the five was Fortuna Silver...as it closed lower by 3.65 percent.

I didn't see any news on any of the thirteen silver companies that comprise the above Silver Sentiment Index.

The silver price premium in Shanghai over the U.S. price on Friday was 5.64 percent.

The reddit.com/Wallstreetsilver website, now under 'new' and somewhat improved management, is linked here. The link to two other silver forums are here -- and here.

![]()

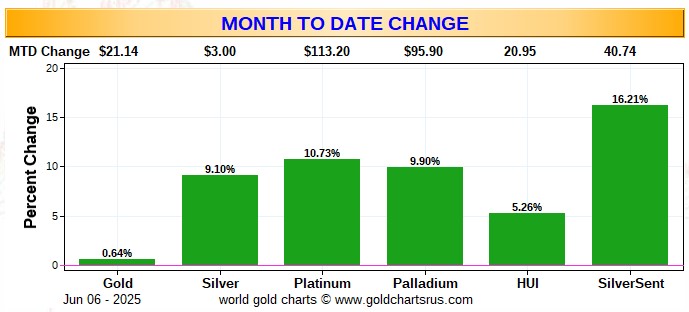

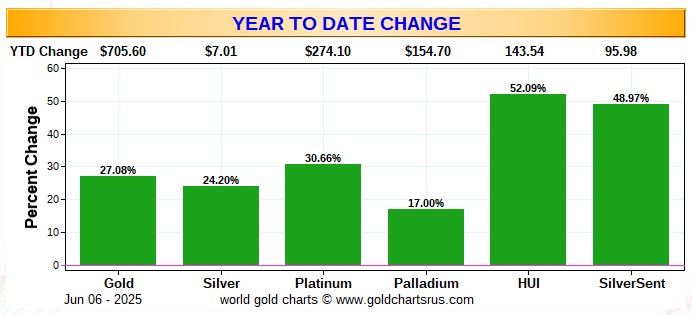

Here are two of the usual three charts that appear in this spot in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the Silver Sentiment Index.

Here's the month-to-date chart...which does double duty as the weekly chart for this one week only -- and it's green across the board for the second week in a row -- and the huge outperformance of the silver stocks is the stand-out feature...something I've been going on about for the last ten days or so. Click to enlarge.

Here's the year-to-date chart -- and the silver equities have certainly caught up a lot with their golden brethren. However -- and as I said in this spot last week, the performance of all the precious metal stocks vis-à-vis their underlying precious metals is still nothing to write home about...but has improved by quite a bit in both over the last two weeks. Click to enlarge.

Of course -- and as I also point out in this spot every Saturday -- and will continue to do so...is that if the silver price was sitting close to a new all-time high of 'whatever' dollars an ounce, like gold is sitting at its current price of $3,308 spot -- and within a few percentage points of its all-time high...it's a given that the silver equities would be outperforming their golden cousins... both on a relative and absolute basis -- and by an absolute country mile...or two. That day, as I also keep mentioning, lies in our future...somewhere.

![]()

The CME Daily Delivery Report for Day 7 of June deliveries, showed that 85 gold -- and 462 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the two largest of the three short/issuers in total were JPMorgan and British bank Barclays, issuing 67 and 13 contracts out of their respective client accounts. There were eight long/stoppers in total -- and the only two that really mattered were JPMorgan and Deutsche Bank, picking up 37 and 20 contracts respectively...Deutsche Bank for its house account.

In silver, the three short/issuers were Marex Spectron, StoneX Financial and ADM...issuing 260, 152 and 50 contracts respectively...Stonex Financial from their house account. The only two of the three long/stoppers that mattered were JPMorgan and Wells Fargo Securities, picking up 337 and 111 contracts... Wells Fargo for their house account.

In platinum, there was 1 contract issued and stopped.

The link to yesterday's Issuers and Stoppers Report is here.

Month-to-date there have been 21,594 gold contracts issued/reissued and stopped -- and that number in silver is already very decent at 2,882 COMEX contracts. In platinum, it's 694 contracts --and in palladium...59.

The CME Preliminary Report for the Friday trading session showed that gold open interest in June declined by 87 contracts, leaving 1,960 still open... minus the above-mentioned 85 contracts out for delivery on Tuesday. Thursday's Daily Delivery Report showed that 98 gold contracts were actually posted for delivery on Monday, so that means that 98-87=11 more gold contracts just got added to the June delivery month.

Silver o.i. in June rose by 355 contracts, leaving 557 still around...minus the 462 contracts out for delivery on Tuesday as per the above Daily Delivery Report. Thursday's Daily Delivery Report showed that only 5 silver contracts were posted for delivery on Monday, so that means that 355+5=360 more silver contracts were added to June deliveries.

Total gold open interest on Friday only fell by a net 453 contracts...not much of a drop considering the beating 'da boyz' laid on the gold price. Total silver o.i. rose by a further and net 2,582 contracts...yet another ugly number to add to the long list of ugly increases we've seen all week. Total silver open interest has risen by 10,699 contracts since the Tuesday cut-off -- and as you already know, I'm not at all amused by this. I have more on this in The Wrap.

[I checked the final total open interest numbers for the Thursday trading session -- and they showed a slight downward adjustment in gold...from +2,399 contracts, down to +812 contracts. Total silver open interest was also adjusted downwards...also by a smallish amount...from +5,276 contracts, down to 5,079 COMEX contracts. As has been the case every day this week so far, I was hoping for a far bigger downward adjustments in silver than that.]

I noted that gold open interest in July fell by a net 161 COMEX contracts, leaving 6,675 contracts still open.

![]()

After no activity in GLD for two days, there was a withdrawal from it yesterday, as an authorized participant removed 46,077 troy ounces of gold. There was yet another deposit into SLV, as an a.p. added 1,181,757 troy ounces/two truckloads of silver. And according to Nick's numbers, there were 59,941 troy ounces of gold added to GLDM...which seems unlikely -- and my e-mail asking him about that has yet to be answered...as have all the other e-mails I sent him last night and early this morning.

Since back on May 14, there have now been 23,721,525 troy ounces of silver added to SLV...ten deposits, with nothing out -- and hopefully some of that is being added to cover an existing short position. We'll know more on Tuesday when the new short report comes out.

The SLV borrow rate started the Friday session at 0.69% -- and finished at it 0.63%... with 4.0 million shares available. The GLD borrow rate started the day at 0.75% -- and closed at 0.71%...with 3.0 million shares available for shorting purposes.

In other gold and silver ETFs and mutual funds on Earth on Friday...net of any changes in COMEX, GLD, GLDM and SLV activity, there were a net 6,368 troy ounces of gold added -- and a net 450,250 troy ounces of gold were added as well...of which another 400,102 troy ounces ended up in Sprott's PSLV.

There was no sales report from the U.S. Mint on Friday. Month-to-date they've sold what I reported in yesterday's column...500 troy ounces of gold eagles...plus 3,000 one-ounce 24K gold buffaloes...but no silver eagles.

![]()

It was yet another day where there was no gold reported received over at the COMEX-approved depositories on the U.S. east coast on Thursday...but 182,499 troy ounces were shipped out.

The three largest 'out' amounts started with the 80,731.161 troy ounces/2,511 kilobars that left Loomis International...followed by the 55,942.740 troy ounces/1,740 kilobars the departed Brink's, Inc. -- and the 44,282 troy ounces that were shipped out of Asahi.

There was no paper activity -- and the link to Thursday's COMEX gold action is here.

But it was another busy day in silver, as 1,197,065 troy ounces were reported received -- and 2,021,328 troy ounces were shipped out.

The largest 'in' amount was the one truckload/600,195 troy ounces that showed up at Manfra, Tordella & Brookes, Inc...with the remaining truckload/ 596,870 troy ounces arriving at Loomis International.

The largest 'out' amount were the 1,114,614 troy ounces that left Asahi... followed by the one truckload/600,809 troy ounces that departed Loomis International.

There was no paper activity here, either -- and the link to Thursday's COMEX silver action is here.

The Shanghai Futures Exchange reported that a net 341,925 troy ounces of silver were added to their inventories on Friday...which now stand at 35.943 million troy ounces.

![]()

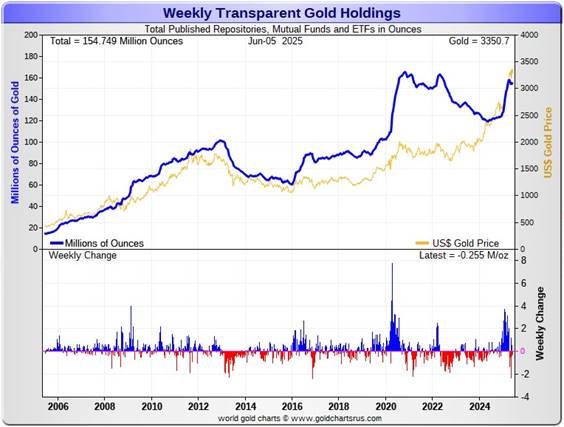

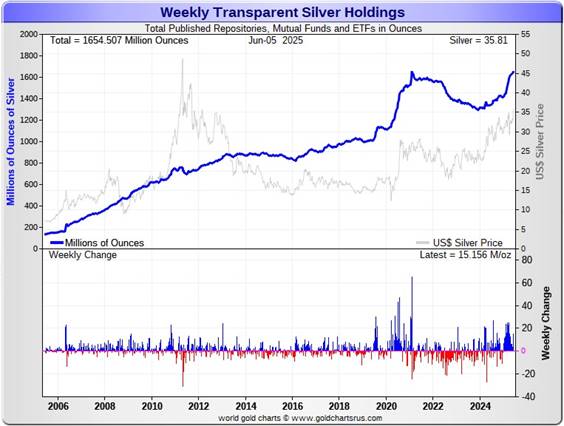

Here are the usual 20-year charts that show up in this space in every weekend column. They show the total amounts of physical gold and silver held in all known depositories, ETFs and mutual funds as of the close of business on Friday.

During the business week just past, there were a net 255,000 troy ounces of gold removed -- but a net 15,156 million troy ounces of silver were added...all of which ended up in SLV or Sprott's PSLV. Click to enlarge.

According to Nick Laird's data on his website, a net 1.137 million troy ounces of gold were added to all the world's known depositories, mutual funds and ETFs during the last four weeks -- and the sole reason for that was because of the 2.082 million troy ounces added to all the Chinese funds over that time period. More than half of the other ETF and mutual funds had withdrawals in the last four weeks.

And it should be noted on the gold chart above, that despite the fact that we're well north of $3,000 in gold -- and have been in record high price territory for a long while now, the amount of gold held by all the world's mutual funds, depositories and ETFs is not even close to a new all-time high.

However, it should be carefully pointed out that despite the fact that silver is a very long way from its previous $50 nominal high of April 2011...the amount of silver held in all these depositories, ETFs and mutual funds is within a whisker of its all-time high...a fact that I find intriguing. There are obviously some deep-pocket silver stackers out there that know what we know.

A net 25.093 million troy ounces of silver were were added during that same 4-week time period, with a net 22.949 million oz. of that amount going into SLV...4.776 million ounces into WisdomTree -- and 3.102 million into Sprott's PSLV. The 'in' list goes on and on. The biggest outflow were the 7.256 million troy ounces that left the COMEX -- and the 1.017 million that departed iShare/SVR.

Retail bullion sales have picked up a bit according to my sources, but it's nothing special -- and U.S. Mint sales in May are the poster child for that. It remains a buyer's market for physical at the retail level for the moment -- and why that's so, is still a mystery. John Q. Public is nowhere to be seen -- although the big institutional investors are certainly starting to make their presence felt...silver in particular.

At some point there will be even larger quantities of silver and gold required by all the rest of these ETFs and mutual funds once serious institutional buying really kicks in -- and as I just pointed out, there have been some signs of that across the board over the last month...but its been spotty in gold for no reason that I [amongst others] can understand.

However, the really big buying lies ahead of us when the silver price is finally allowed to rise substantially, which I'm sure is something that the powers-that-be in the silver world are more than aware of. Maybe its new 14-year new high set on Friday will garner more interest.

And as Ted Butler stated some time ago now, it stands to reason that JPMorgan has parted with a large portion of the one billion troy ounces that they'd accumulated since the drive-by shooting that commenced at the Globex open at 6:00 p.m. EDT on Sunday, April 30, 2011.

I suspect that most of the silver flown into the COMEX from London and other places so far this year...245+ million ounces...came from their stash -- and they continue to build their COMEX silver reserves in New York as well. I'm sure they've been supplying the ever-increasing amounts of silver that are now flowing into the rest of world's ETFs and mutual funds too...including what's been going into SLV and Sprott over the last three weeks.

Little has changed from last week, as the physical demand in silver at the wholesale level continues unabated -- and COMEX silver deliveries have been huge all year. The amount of silver being physically moved, withdrawn, or changing ownership remains extremely strong... including June COMEX deliveries...a non-scheduled delivery month...which totals 14.4 million troy ounces issued and stopped so far.

Not including that 14.4 million ounces delivered so far in June, there have been 243 million ounces of silver deposited in the COMEX so far this year -- and 67 million troy ounces have been shipped out...with a big chunk of that 'out' amount happening in April and May. That's huge movement, as the 'churn' is incredible.

New silver has to be brought in from other sources [JPMorgan in London] and elsewhere to meet the ongoing demand for physical metal...as the metal currently sitting in New York is obviously already spoken for and not for sale.

This demand will continue until available supplies are depleted...which will most likely be the moment that JPMorgan & Friends stop providing silver to feed this deepening structural deficit, now in its fifth year according to the latest Reports from The Silver Institute.

The vast majority of precious metals being held in these depositories are by those who won't be selling until the silver price is many multiples of what it is today.

Sprott's PSLV is the third largest depository of silver on Planet Earth with 189.8 million troy ounces...up 3.1 million troy ounces on the week -- but a great distance behind the COMEX, now the largest silver depository, where there are 495.5 million troy ounces being held...down a net 500,000 troy ounces this past week...but minus the 103 million troy ounces being held in trust for SLV by JPMorgan.

That 103 million ounce amount brings JPMorgan's actual silver warehouse stocks down to around the 112 million troy ounce mark...quite a bit different than the 214.8 million they indicate they have...unchanged for the second week in a row.

PSLV remains a very long way behind SLV as well -- as they are now the second largest silver depository after the COMEX, with 471.7 million troy ounces as of Friday's close...up a net 11.8 million troy ounces from last week.

The latest short report [for positions held at the close of business on Tuesday, May 15] showed that the short position in SLV fell by a further 11.79%...from the 43.25 million shares sold short in the prior report...down to 38.15 million shares in this latest report...around 7.5 percent of total SLV shares outstanding. This amount remains grotesque, obscene -- and fraudulent beyond description...as there is no physical silver backing any of it as the SLV prospectus requires.

BlackRock issued a warning several years ago to all those short SLV that there might come a time when there wouldn't be enough metal for them to cover. That would only be true if JPMorgan decides not to supply it to whatever entity requires it...which is most certainly a U.S. or U.K. bullion bank, or perhaps more than one.

The next short report...for positions held at the close of trading on Friday, May 30...will be posted on The Wall Street Journal's website on Tuesday evening EDT on June 10.

Then there's that other little matter of the 1-billion ounce short position in silver held by Bank of America in the OTC market...with JPMorgan & Friends on the long side. Ted said it hadn't gone away -- and he'd also come to the conclusion that they're short around 25 million ounces of gold with these same parties as well.

The latest OCC Report [hat-tip to Justin Newman] came out a few week ago for Q4/2024 and it showed that the precious metal derivatives held by the four largest U.S. banks fell by ten percent from Q3/2024...with most of that drop coming from the $38 billion/12% decrease over at JPMorgan. Goldman's tiny position was up an immaterial amount -- and Citigroup's derivative positions in the precious metals rose by 11% -- and BofA's position fell by about 31%. But with JPMorgan holding 56% of all the precious metals derivatives -- and Citibank holding 32% of the total, it's only those two banks that matter.

But as I keep pointing out in this spot every weekend, the OCC indicator is flawed for two very important reasons, as way back 10-15 years ago, this report used to include the top dozen or so U.S. banks -- and included the likes of Wells Fargo and Morgan Stanley, amongst others...that are card-carrying members of the Big 8 shorts. Now the list is down to just four banks...so a lot of data is hidden...which is certainly the reason why the list was shortened. On top of that, the list doesn't include the non-U.S. banks that are members of the Big 8 shorts: British, French, German, Canadian -- and Australian.

![]()

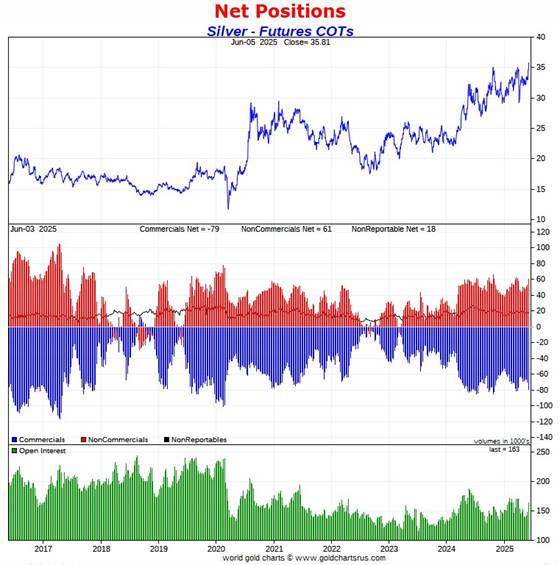

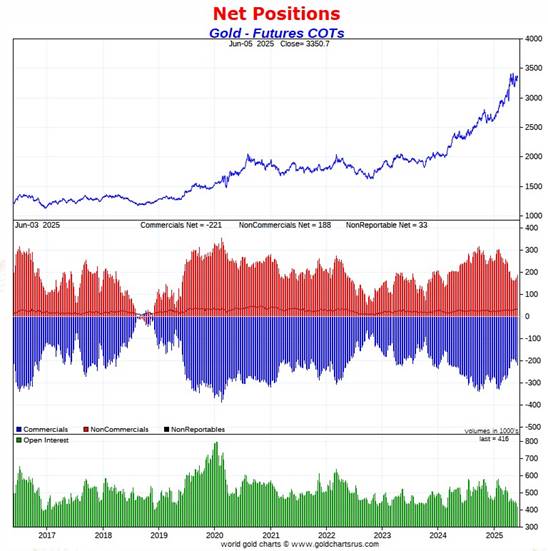

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, was not quite as bad as I expected in silver, but bad enough -- and not at all terrific in gold, either...especially in the Big 8 category.

In silver, the Commercial net short position increased by 8,864 COMEX contracts, or 44.320 million troy ounces of the stuff. This is the third week in a row we've had an increase...but half of that amount was Ted's raptors selling long positions, which doesn't count.

They arrived at that number through the sale of 1,629 long contracts -- and they also sold 7,235 short contracts. It's the sum of those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was the Managed Money traders that were the big buyers as usual, as they increased their net long position by 11,621 COMEX contracts...which they accomplished through the purchase of 10,000 long contracts -- and also bought back 1,621 short contracts. It's the sum of those two numbers that represents their change for the reporting week.

The traders in the Nonreportable/small traders category were also buyers, increasing their net long position by 1,106 COMEX contracts...which meant that the traders in the Other Reportables category had to be net sellers -- and they were...decreasing their net long position by 3,863 COMEX contracts.

Doing the math: 11,621 plus 1,106 minus 3,863 equals 8,864 COMEX contracts...the change in the Commercial net short position.

The Commercial net short positionin silver now stands at 79,141 COMEX contracts/395.705 million troy ounces...up those 8,864 contracts from the 70,277 COMEX contracts/351.385 million troy ounces that they were short in last Friday's COT Report.

The Big 4 shorts increased their net short position by a further and very hefty 2,413 COMEX contracts...from 54,595 contracts, up to 57,008 contracts...their third weekly increase in a row. The Big 4 haven't been this short silver since March 28.

The Big '5 through 8' shorts also increased their net short position, them by 1,884 COMEX contracts...from the 20,658 contracts in last Friday's COT Report, up to 22,542 contracts in yesterday's COT Report. For them to be back in bullish territory, their short position would have to be about 11 contracts less than what it is now. And because their gross short position is so large, it's within the realm of possibility that there's a Managed Money trader with a large enough short position to be in this category. If there is, they'd be the smallest of the bunch.

The Big 8 shorts in total increased their overall net short position from 75,253 contracts, up to 79,550 COMEX contracts week-over-week...an increase of 4,297 COMEX contracts.

But since the Commercial net short position rose by 8,864 contracts in yesterday's COT Report -- and the Big 8 increased their net short position by only 4,297 contracts, this meant that Ted's raptors...the small commercial traders other than the Big 8...had to have been sellers during the reporting week -- and they were, for the second week in a row...decreasing their net long position by 8,864-4,297=4,567 COMEX contracts.

In last week's COT Report, they were net long 4,976 COMEX contracts. In this week's, they're down to a net long position of only 409 contracts. Doing the math on this, of the 8,864 contract increase in the Commercial net short position in silver, 51 percent of it was because of Ted's raptors selling long contracts...which is only a mathematical increase.

Here's Nick's 9-year COT chart for silver -- and updated with the above data. Click to enlarge.

Well, the hoped-for short covering hidden behind a wall of spread trades didn't happen as I wished it would. It was the usual massive long buying/short covering by the Managed Money traders that caused the commercial traders of whatever stripe to sell aggressively...with virtually all of that happening on Monday's big silver rally.

During the reporting week the Managed Money and Other Reportables purchased 12,727 COMEX silver contracts/63.635 million troy ounces of the stuff -- most of it on Monday -- and is the sole reason why the price rose as much as it did on that day.

The Big 8 shorts accounted for about half of the increase in the Commercial net short position...49% -- and the other half of the increase [51%] was long contract selling by Ted's raptors, the small commercial traders other than the Big 8 -- and their selling, as I said just above the chart, had the mathematical effect of increasing the short position...which really isn't an increase at all.

The Big 4 short position is back to where it was on 28 March -- and the short position of the Big '5 through 8' is back to where it was on February 7. Undoubtedly, the short positions of these Big 8 traders has increased even more since the Tuesday cut-off.

So...we're back to being wildly bearish in silver from a COMEX futures market perspective as of the close of trading on Friday.

The Big 8 are short 48.7 percent of total open interest in the COMEX futures market...down quite a bit from that 51.0 percent they were short in last week's COT Report. The only reason reason for that decrease [instead of an increase] was because of the huge 15,792 contract increase in total open interest, which obviously affects the percentage calculation.

But nothing has changed with regards to that ongoing and deepening structural deficit in the physical market...which is now well into its fifth consecutive year.

Of course not to be forgotten -- and which also has a huge and negative impact on the silver price, is the outrageous and grotesque short position in SLV...which now stands at 38.15 million shares/troy ounces...about 7.5% of the total shares outstanding...as of the most recent short report that came out about two weeks ago now.

Not one of those ounces sold short has any physical silver backing it as their prospectus requires. The next short report, for positions held at the close of COMEX trading on Friday, May 30 will be posted on the WSJ's website early Tuesday evening on June 10.

Of course -- and as I pointed out earlier, it's entirely within the realm of possibility that some of the big shorts in SLV are "short against the box"...so the actual short position in SLV may not be as large as it appears.

![]()

In gold, the commercial net short position rose by a further 13,239 COMEX contracts, or 1.324 million troy ounces of the stuff.

They arrived at that number through the sale of 16,604 long contracts, but also bought back 3,365 short contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was almost all Managed Money traders on the buy side, as they increased their net long position by 12,766 COMEX contracts...which they accomplished through the purchase of 12,464 long contracts -- and the buy-back of 302 short contracts.

The traders in the Other Reportables category also increased their net long position by a bit...them by 955 contracts -- and the Nonreportable/small traders were net sellers, reducing their net long position by 482 contracts.

Doing the math: 12,766 plus 955 minus 482 equals 13,239 COMEX contracts ...the change in the commercial net short position.

The commercial net short position in gold now sits at 220,826 COMEX contracts/22.083 million troy ounces of the stuff...up those 13,239 contracts from the 207,587 COMEX contracts/20.759 million troy ounces they were short in last Friday's COT Report.

The Big 4 shorts in gold increased their net short position by 7,743 contracts this reporting week...from the 121,198 contracts they were short in the last COT report, up to 128,941 contracts in yesterday's report. This still remains their smallest short position since March 1 of last year, when they were only short 114,723 COMEX contracts -- and vastly improved from the 198,271 contracts there were net short in the January 21 COT Report.

And the Big '5 through 8' shorts also increased their net short position...for the first time in nine weeks...from 57,317 contracts they were short in last Friday's COT Report, up to a hefty 70,294 contracts held short in the current report...an increase of 12,977 COMEX contracts -- and their largest short position since April 25.

And because the gross short position in the Managed Money category fell by a bit more during this past reporting week, I suspect that if there was a Managed Money trader in the Big '5 through 8' category, he is now gone.

The Big 8 short position rose from 178,515 contracts/17.852 million troy ounces in last Friday's COT Report...up to 199,235 COMEX contracts/19.924 million troy ounces in yesterday's...an increase of 20,720 COMEX contracts. This is the largest short position they've held since April 18.

But the commercial net short position rose by only 13,239 COMEX contracts during the reporting week -- and the Big 8 commercial short position rose by 20,720 COMEX contracts, so that meant that Ted's raptors...the small commercial traders other than the Big 8 had to have been big buyers during the reporting week -- and they were. They decreased their short position by 20,720-13,239=7,481 COMEX contracts. Their short position is now down to 21,591 contracts...from the 29,072 contract short position they held in last Friday's COT Report...which is still a far larger number that I'd like to see.

As for why Ted's raptors were covering short positions through the purchase of long contracts, while their Big 8 co-conspirators were selling, is a mystery. So the commercial traders in gold weren't as 'collusive' as the commercial traders in silver during this past reporting week...where it was 'all for one, and one for all'.

Here's Nick's 9-year COT chart for gold -- and updated with the above data. Click to enlarge.

The short position in gold remains bullish from a COMEX futures market perspective, but obviously not quite as bullish as it was a week ago.

The Big 8 collusive traders are short 47.9 percent of total open interest in gold in the COMEX futures market...up massively from the 40.8 percent they were short in the prior COT Report -- and the sole reason for that whopping increase, is because of the huge 21,597 contract drop in total open interest, which obviously affects the percentage calculation...and was obviously delivery related.

But once you add in the now considerable short position of Ted's raptors... 21,591 contracts...the commercial net short position in gold...all held buy bullion banks and investment houses...now represents 53.1 percent of total open interest...which is an obscene and manipulative amount.

So, all in all, this COT Report was about as ugly as I though it might be -- and I was certainly less than thrilled to see that the increases in their commercial net short positions show up in the Big 4/8 categories in both these precious metals.

As I pointed out in The Wrap in Friday's column, the unbooked margin call losses of the shorts in gold and silver is now close to $50 billion -- and despite that fact, there has been no rush to cover any of those positions.

![]()

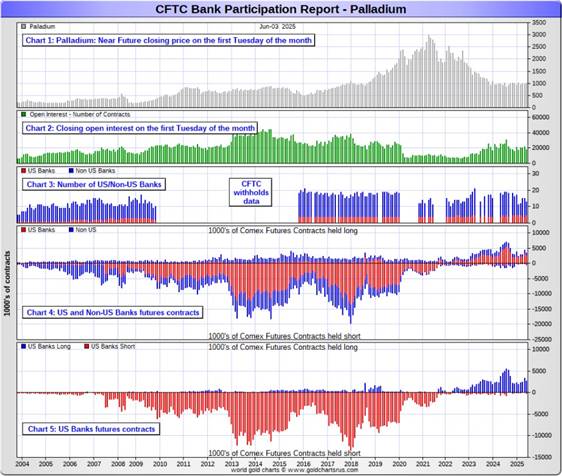

In the other metals, the Managed Money traders in palladium decreased their net short position by by a further 382 COMEX contracts -- but remain net short palladium by 7,789 contracts...43.0 percent of total open interest. The commercial traders in the Producer/ Merchant category remain on the short side by a tiny amount...but the commercial traders in the Swap Dealers category are mega net long palladium by 7,243 contracts. The traders in the Other Reportables and Nonreportable/small trader categories are each net long by a bit.

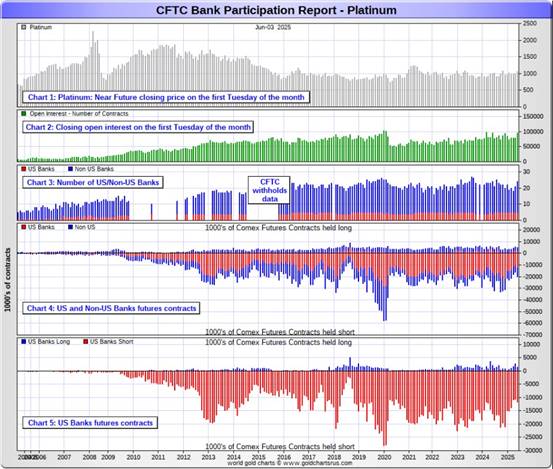

And it shouldn't be forgotten that the world's banks remain net long 16.6 percent of total open interest in palladium in the COMEX futures market as of the latest Bank Participation Report that came out yesterday...down from the 19.1 percent they were net long in the May BPR.

In platinum, the Managed Money decreased their net long position by a hefty 5,915 COMEX contracts during the reporting week -- but remain net long platinum by 11,664 COMEX contracts. And because of platinum's boomer rally this past week, it's a given that they're even further long platinum now.

The commercial traders in the Producer/Merchant category are net short 21,480 COMEX contracts -- and the Swap Dealers in the commercial category are also net short, them by 1,753 contracts in yesterday's COT Report. Both these categories reduced their net short positions by a bit during the reporting week. The traders in the Other Reportables category are net long platinum by 8,385 COMEX contracts...while the Nonreportable/small traders are net long 3,184 contracts. Both these categories increased their net long positions during the reporting week.

It's mostly the world's banks in the Producer/Merchant category that are 'The Big Shorts' in platinum in the COMEX futures market, as per June's Bank Participation Report that came out yesterday -- and have increased their short position in platinum by quite a bit since the May report.

In copper, the Managed Money traders increased their net long position by 2,328 contracts -- and are net long copper by 23,165 COMEX contracts...about 579 million pounds of the stuff as of yesterday's COT Report...up from the 521 million pounds they were net long copper in last Friday's COT report.

Copper, like platinum, continues to be a wildly bifurcated market in the commercial category. The Producer/Merchant category is net short 36,012 copper contracts/900 million pounds -- while the Swap Dealers are net long 8,999 COMEX contracts/225 million pounds of the stuff.

Whether this means anything or not, will only be known in the fullness of time. Ted said it didn't mean anything as far as he was concerned, as they're all commercial traders in the commercial category. However, this bifurcation has been in place for as many years as I've been keeping records -- and that's a very long time.

In this vital industrial commodity, the world's banks...both U.S. and foreign...are net long 4.8 percent of the total open interest in copper in the COMEX futures market as shown in the June Bank Participation Report that came out yesterday -- and down a bit from the 6.6 percent they were net long in May's.

At the moment it's mostly the commodity trading houses such as Glencore and Trafigura et al., along with some hedge funds, that are net short copper in the Producer/Merchant category, as the Swap Dealers are net long, as pointed out above.

The next Bank Participation Report is due out most likely on Monday, June 7...as Friday, July 4th is obviously a holiday in the U.S.

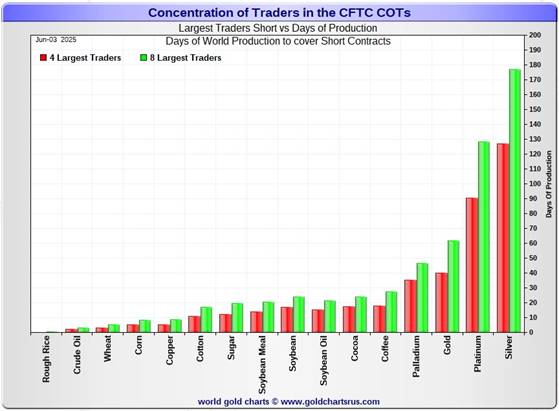

![]()

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, June 3. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in every physically traded commodity on the COMEX. Click to enlarge.

In this week's data, the Big 4 traders are short 127 days of world silver production...up another 5 days from the prior COT report. The ‘5 through 8’ large traders are short an additional 50 days of world silver production ...up about 4 days from the last COT Report, for a total of about 177 days that the Big 8 are short -- and up a further 9 days from last Friday's COT report.

Those 177 days that the Big 8 traders are short, represents around 5.9 months of world silver production, or 397.750 million troy ounces/79,550 COMEX contracts of paper silver held short by these eight mostly commercial traders. Several of the largest of these are now non-banking entities, as per Ted's discovery a year or so ago. May's Bank Participation Report continues to confirm that this is still the case -- and not just in silver, either.

The small commercial traders other than the Big 8 shorts, Ted's raptors, decreased their long position in silver from 4,976 contracts...down to just 409 contracts in yesterday's COT Report.

In gold, the Big 4 are short about 40 days of world gold production...up 2 days from the prior COT Report. The Big '5 through 8' are short an additional 22 days of world production...up about 5 days from last the last report...for a total of 62 days of world gold production held short by the Big 8 -- and up about 7 days from last Friday's COT Report.

As mentioned further up, the Big 8 commercial traders are net short 48.7 percent of the entire open interest in silver in the COMEX futures market as of yesterday's COT Report, down from the 51.0 percent they were net short in last Friday's report. The only reason that the percentage is down, when it should have been up, was because of the 15,792 contract increase in total open interest, which obviously affects the calculation.

In gold, it's 47.9 percent of the total COMEX open interest that the Big 8 are net short, up huge from the 40.8 percent they were short last week -- and mostly because of the 21,597 contract decrease in total open interest.

And as I mentioned further up in the COT discussion in gold, the short position of Ted's raptors is significant factor once again in the total commercial net short position...even though they decreased it by 7,481 contracts during the past reporting week. Adding in their 21,591 contract current short position, increases the commercial net short position to 53.1 percent of total open interest. So their short position represents 53.1-47.9=5.2 percentage points of total open interest. But to put that increase in some perspective, back on February 14, the total commercial net short position was about 64% of total open interest.

Ted was of the opinion that Bank of America is short about one billion ounces of silver in the OTC market, courtesy of JPMorgan & Friends. He was also of the opinion that they're short 25 million ounces of gold as well.

The latest OCC Report [hat-tip to Justin Newman] that came out over two months ago now for Q4/2024...showed that the precious metal derivatives held by the four largest U.S. banks fell by ten percent from Q3/2024...with most of that drop coming from the $38 billion/12% decrease over at JPMorgan. Goldman's tiny position was up an immaterial amount -- and Citigroup's derivative positions in the precious metals rose by 11% -- and BofA's position fell by about 31%. But with JPMorgan holding 56% of all the precious metals derivatives -- and Citibank holding 32% of the total of the four reporting banks, it's only those two banks that matter.

However, as just stated, that's only four of the U.S. banks. The likes of Wells Fargo and Morgan Stanley are not included, because they aren't the largest banks...even though their respective precious metal derivatives positions may be huge...which I suspect they are...that doesn't count for anything in this report, which is the reason that it's only marginally useful.

The short position in SLV now sits at 38.15 million shares as of the latest short report, for positions held at the close of COMEX trading on Thursday, May 15 -- and is down 11.79% from the 43.25 million shares sold short on the NYSE in the prior report. This number remains off-the-charts grotesque and obscene -- and yet another way that 'da boyz' are controlling the silver price, as I mentioned further up.

In actual fact, the short position could be far less than stated above, if some of those traders are "short against the box".

The next short report is due out Tuesday, June 10...for positions held at the close of business on Friday, May 30.

In the overall, the Big 8 commercial traders increased their short position in silver by a lot -- and the Big 8 in gold increased their short positions by a fair amount as well. The set up in silver from a COMEX futures market perspective is back to very bearish...but in gold, it remains bullish. I don't recall that there has ever been a dichotomy such as this between them before -- and how it gets resolved in each, is going to interesting to watch.

As Ted Butler had been pointing out ad nauseam, the resolution of the Big 4/8 short positions will be the sole determinant of precious metal prices going forward...although that big short position in gold held by Ted's raptors is a factor once more.

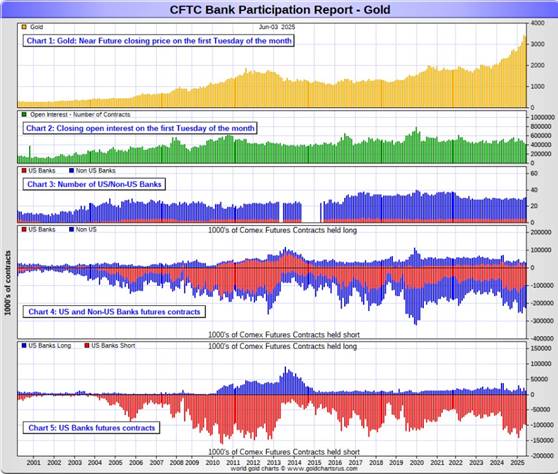

![]()

The June Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report data. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of Tuesday’s cut-off in all COMEX-traded products.

For this one day a month we get to see what the world’s banks have been up to in the precious metals. They’re usually up to quite a bit -- and they certainly were again this past month.

[The June Bank Participation Report covers the four-week time period from May 6 to June 3 inclusive]

In gold, 5 U.S. banks are net short 84,597 COMEX contracts, up from the 75,948 contracts that these same 5 U.S. banks were net short in the May BPR.

Also in gold, 26 non-U.S. banks are net short 113,255 COMEX contracts, up 5,458 contracts from the 107,797 contracts that 25 non-U.S. banks were short in May's BPR.

At the low back in the August 2018 BPR...these non-U.S. banks held a net short position in gold of only 1,960 contacts -- so they've been back on the short side in a gargantuan way ever since. Only a handful of these banks hold meaningful short positions in gold. The short positions of the rest are of no consequence -- and never have been.

Although a lot of the largest U.S. and foreign bullion banks are in the Big 8 short category, some of the hedge fund/commodity trading houses are short even more grotesque amounts of gold in that category.

There's also the possibility that the BIS could be short gold in the COMEX futures market as well.

As of June's Bank Participation Report, 31 banks [both U.S. and foreign] were net short 47.5 percent of the entire open interest in gold in the COMEX futures market...up from the 40.6 percent that 30 banks were net short in the May BPR. This remains an obscene and manipulative short position.

Here’s Nick’s BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank’s COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

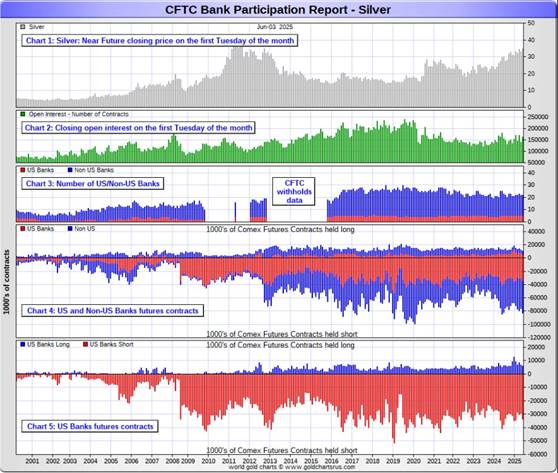

In silver, 5 U.S. banks are net short 27,857 COMEX contracts, up 5,383 contracts from the 22,474 contracts that these same 5 U.S. banks were short in the May BPR.

The five U.S. banks that are mega net short silver would be Citigroup, Wells Fargo, Bank of America, Goldman Sachs and JPMorgan.

Also in silver, 17 non-U.S. banks are net short 43,846 COMEX contracts, up 3,375 contracts from the 40,471 contracts that these same 17 non-U.S. banks were net short in the May BPR.

It's a given, based on silver deliveries so far this year, that HSBC, Barclays, Standard Chartered, BNP Paribas and Macquarie Futures hold by far the lion's share of the short positions of these non-U.S. banks...as do some of Canada's banks as well...with the Bank of Montreal and Scotia Capital/Scotiabank coming to mind.

And, like in gold, the BIS could also be actively shorting silver. However, the remaining short positions divided up between the remaining small handful of non-U.S. banks are immaterial — and have always been so....the same as most of the 20 non-U.S. banks in gold as well.

As of June's Bank Participation Report, 22 banks [both U.S. and foreign] were net short a grotesque 43.9 percent of the entire open interest in silver in the COMEX futures market — down a bit from the 44.9 percent that these same 22 banks were net short in the May BPR...and only down because of the big increase in silver open interest during the four week reporting period, which affects the percentage calculation.

Here’s the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns—the red bars. It’s very noticeable in Chart #4—and really stands out like the proverbial sore thumb it is in chart #5. Click to enlarge.

In platinum, 5 U.S. banks are net short 10,144 COMEX contracts in the June BPR, up 2,218 contracts from the 7,926 contracts that these same 5 U.S. banks were short in the May BPR. This is the first increase in their short position since last October's BPR.

At the 'low' back in September of 2018, these U.S. banks were actually net long the platinum market by 2,573 contracts...so they still have work to do just to get back to market neutral.

Also in platinum, 19 non-U.S. banks increased their net short position by a hefty 2,534 contracts...from 2,443 contracts held by 16 banks in May's BPR...up to 4,977 contracts in the June BPR.

Back in the December 2023 BPR, these non-U.S. banks were net short a microscopic 35 platinum contracts...so they also have more work to do if they ever want to get back to that number.

As you know, platinum remains the big commercial shorts No. 2 problem child after silver -- and there's now a long-term structural deficit in it [and palladium] as well..as per the story in the upcoming Critical Reads section.

And as of June's Bank Participation Report, 24 banks [both U.S. and foreign] were net short 15.9 percent of platinum's total open interest in the COMEX futures market, up from the 13.3 percent that 21 banks were net short in May's BPR.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

In palladium, 5 U.S. banks are net long 2,439 COMEX contracts in the June BPR, down 822 contracts from the 3,261 contracts that 4 U.S. banks were net long in the May BPR.

Also in palladium, 8 non-U.S. banks are net long 554 COMEX contracts...down from the 848 contracts that 11 non-U.S. banks were net long in the May BPR.

And as I've been commenting on for almost forever, the COMEX futures market in palladium is a market in name only, because it's so illiquid and thinly-traded. Its total open interest in yesterday's COT Report was only 18,110 contracts...compared to 95,262 contracts of total open interest in platinum...163,347 contracts in silver -- and 414,941 COMEX contracts in gold.

Total open interest in palladium has increased quite a bit over the last number of years, because I remember when it was less than 9,000 contracts. So it's nowhere near as illiquid as it used to be -- and it's also been helped along by the fact that the bid/ask is now only 40 bucks. It used to be $150 at one point way back when.

As I say in this spot every month, the only reason that there's a futures market at all in palladium, is so that the Big 8 commercial traders can control its price. That's all there is, there ain't no more.

As of this Bank Participation Report, 13 banks [both U.S. and foreign] are net long 16.6 percent of total open interest in palladium in the COMEX futures market...down from the 19.1 percent of total open interest that 15 banks were net long in the May BPR.

For the last 5 years or so, the world's banks have not been involved in the palladium market in a material way...see its chart below. And with them still net long, it's almost all hedge funds and commodity trading houses that are left on the short side. The Big 8 commercial shorts, none of which are banks, are short 46.9 percent of total open interest in palladium as of yesterday's COT Report...up from the 43.7 percent they were short in May's BPR.

Here’s the palladium BPR chart. Although the world's banks are net long at the moment, it remains to be seen if they return as big short sellers again at some point like they've done in the past. Click to enlarge.

Excluding palladium for obvious reasons, and almost all of the non-U.S. banks in gold, silver and especially platinum...only a handful of the world's banks, most likely no more than a dozen or so in total -- and mostly U.S. and U.K.-based...along with French bank BNP Paribas...continue to hold meaningful short positions in the other three precious metals...although I won't let Canada's Bank of Montreal or Scotia Capital/Scotiabank off the hook just yet...nor Deutsche Bank in gold.

As I pointed out above, some of the world's commodity trading houses and hedge funds are also mega net short the four precious metals...far more short than the U.S. banks in some cases. They have the ability to affect prices if they choose to exercise it...which I'm sure they're doing at times -- and this is particularly obvious in the thinly-traded and illiquid palladium market. But it's still the collusive Anglo/American/Western bullion bank cartel in the commercial category that are at Ground Zero of the price management scheme in the COMEX futures market in the other three.

And as has been the case for years now, the short positions held by the Big 4/8 traders is the only thing that matters...especially the short positions of the Big 4...or maybe only the Big 1 or 2 in both silver and gold. How this is ultimately resolved [as Ted kept pointing out] will be the sole determinant of precious metal prices going forward.

The collusive Big 8 commercial traders et al. continue to have an iron grip on their respective prices -- and this was as plain as day in yesterday's COT and Bank Participation Reports once again. That circumstance will continue until they either relinquish control voluntarily, are told to step aside...or get overrun. Of course closing the COMEX/LBMA would also get them out with their skins intact.

Considering the current state of affairs of the world as they stand today -- and the structural deficit in silver -- and now in platinum and palladium as well, the chance that these big bullion banks and commodity trading houses could get overrun at some point, is no longer zero -- and certainly within the realm of possibility if things go totally non-linear at some point.

But...as Ted kept reminding us from time to time...if they do finally get overrun, it will be for the very first time...which obviously wasn't allowed to happen this past month, either.

The next Bank Participation Report is most likely due out on Monday, July 7.

![]()

CRITICAL READS & VIDEOS

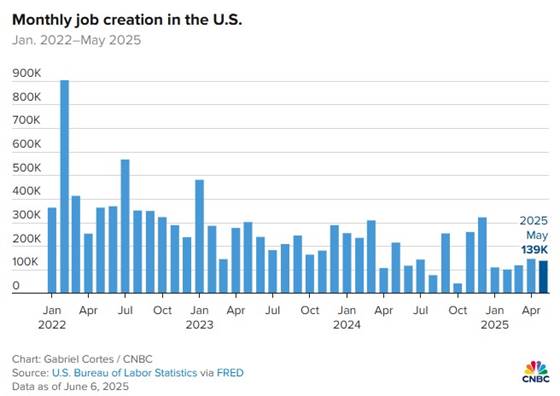

U.S. payrolls increased 139,000 in May, more than expected; unemployment at 4.2%

Hiring decreased just slightly in May even as consumers and companies braced against tariffs and a potentially slowing economy, the Bureau of Labor Statistics reported Friday.

Non-farm payrolls rose 139,000 for the month, above the muted Dow Jones estimate for 125,000 and a bit below the downwardly revised 147,000 that the U.S. economy added in April. Click to enlarge.

The unemployment rate held steady at 4.2%. A more encompassing measure that includes discouraged workers and the underemployed also was unchanged, holding at 7.8%.

Worker pay grew more than expected, with average hourly earnings up 0.4% during the month and 3.9% from a year ago, compared with respective forecasts for 0.3% and 3.7%.

Believe this at your own risk, dear reader. This news item, courtesy of Swedish reader Patrik Ekdahl, appeared on the cnbc.com Internet site at 8:30 a.m. EDT on Friday morning -- and another link to it is here. The Zero Hedge spin on this his headlined "May Payrolls Rise By 139K, Beating Estimates, But Report Shows Sweeping Labor Market Weakness" -- and linked here. Gregory Mannarino had a few things to say about it -- and that's linked here -- and I thank Tolling Jennings for pointing this out.

![]()

At some point a clarifying event occurs which confirms that you are at the end of the road. In this particular case we are talking again about the bothersome subject of fiscal sanity—and the exclamation point the Donald supplied this morning when his was trolling the House GOP caucus in behalf of his Big Beautiful Bill.

In order to ensure the extension of his precious (but unpaid for) 2017 tax cut and provide budgetary sanction for a 13% increase in defense spending and 60% rise in outlays for border control, the Donald doesn’t want any "grandstanders" upsetting the works:

"Don’t f‑‑‑ around with Medicaid," Trump told lawmakers in the private meeting. Trump had told reporters before the meeting that the bill is not cutting "anything meaningful (from Medicaid)," and instead was focused on "waste, fraud and abuse."

Well, let’s see. Along with his defense and border control increases, Trump has ruled out cuts in Social Security, Medicare, veterans benefits and presumably interest on the public debt. So those sacred cows alone account for fully $62 trillion or 66% of total Federal spending over the next 10-years, and today he was commanding the corporal’s guard of fiscal hawks left in the GOP caucus to stay away from another $8.2 trillion in Medicaid spending over the decade, too.

So that’s a no-fly zone amounting to more than $70 trillion or 77% of Federal spending during the 10-year budget window ahead. In turn, that means there’s only $24 trillion left to cut, representing the entirety of the rest of the Federal government from the Washington Monument to the Klondike National Park in Alaska.

Then again, what’s left outside of this $70 trillion ring-fence also happens to be less than the size of the out-of-control deficit that would result from the Donald’s Great Big Beautiful Bill over the next 10-years. The idea of painting yourself into a corner, therefore, hardly does justice to the sheer fiscal lunacy of where the Trumpified GOP has implanted itself.

Gee, I wonder what David really thinks? There's more in this rant that was posted on the internationalman.com Internet site yesterday morning -- and I thank reader Don Carrick for sharing it with us. Another link to it is here.

![]()

Uncertainty Squared -- Doug Noland

When you thought things couldn’t possibly get any weirder… (“Have a nice day, DJT!”)

“Uncertainty” is the word of the year, for an environment dominating by a unique array of uncertainties – policy, market, economic, geopolitical… There are tariff and trade war uncertainties, highlighted by the President’s uniquely whimsical approach. With a third of the 90-day pause period remaining, it’s unclear how many trade deals can be squeezed into such a short negotiations window – and how much hardball the administration is willing to play as the deadline approaches. More specifically, complex trade agreements with the EU and China will require extensive, and likely protracted, talks.

While markets are said to abhor uncertainty, stocks these days seem to eat it up. It’s basically uncertainty on top of uncertainty. The world has never been so awash in speculative finance, ensuring aberrant market behavior. Never has the global leveraged speculating community been as colossal and powerful. Egregious Treasury “basis trade” leveraging drives unprecedented overall hedge fund leverage. Household (loving dip buying) market participation is unparalleled, with the proliferation of online accounts, options trading, and herd-like speculation creating extraordinary market-moving power.

Importantly, the current remarkable backdrop creates a uniquely potent “risk on/risk off” market dynamic.

Unique uncertainty and myriad clear and present risks beckon for market risk hedging. But massive hedging and speculating only compound marketplace uncertainty and instability. As we witnessed in April and last August, “risk off” now tends to quickly spiral into deleveraging, illiquidity, and dislocation.

Meanwhile, acute Bubble fragilities ensure swift policy responses (i.e., Trump’s tariff pause) that trigger destabilizing unwinds of hedges and bearish bets – along with “buy the dip” FOMO madness. Orderly market adjustment no longer appears possible.

This very interesting commentary from Doug appeared on his website around midnight PDT last night -- and another link to it is here. Gregory Mannarino's post market close rant for Friday is linked here -- and this one runs for 25 minutes.

![]()

Two important and worthwhile videos

1. SACHS is BACK! - Professor Jeffrey Sachs : Why the West Wants War!

This interesting and worthwhile 25-minute video interview with the professor was hosted by Judge Andrew Napolitano early on Friday morning EDT -- and I thank Guido Tricot for this one -- and the one that follows. The link to this one is here.

2. INTEL Roundtable w/Larry Johnson & Ray McGovern - Weekly Wrap :: June 6

This 26-minute video interview with former CIA analysts McGovern and Johnson was posted on the youtube.com Internet site late on Friday afternoon EDT -- and it's worth your while if you have the interest. The link to it is here.

![]()

Canadians snap up gold bars and coins amid stock and bond market turmoil

At first glance, a one-ounce gold bar doesn't look like much -- it's about the size of a loonie. But pick it up and you'll feel the difference. It's heavy, about 19 times denser than water and nearly twice as dense as steel.

In uncertain times, that weight carries more than just physical heft. For many Canadians, it represents stability -- something dollars or digital assets can't always guarantee.

At Global Bullion Suppliers, a gold dealer in Toronto, owner Max Smirnov has seen one of the busiest seasons in recent memory. Sales are up 25 to 30% compared to last year, he said.

He's noticed a pattern: Fear moves people. Whenever news stokes anxiety, people enter the store like clockwork, he said. The loonie drops in value? A flood of customers. "Liberation Day" tariffs? More gold purchases.

"People are looking at gold as a safe haven against the unknown future," Mr. Smirnov said.

That instinct is being felt across the country. As economic uncertainty deepens and financial markets whip back and forth, demand for gold is surging. From bullion bars to Maple Leaf coins, many Canadians are seeking refuge in one of the oldest and most tangible forms of financial security.

And a growing share of them are younger. Gold dealers say they're seeing more buyers in their 20s and 30s people who might otherwise have considered real estate or cryptocurrencies but now see physical gold as a steadier, more emotionally reassuring store of value.

The rest of this story from Thursday is hidden behind their paywall over at theglobeandmail.com Internet site -- and I found it embedded in a GATA dispatch. Another link to it is here.

![]()

The World Is Quietly Running Out of Platinum

Platinum has required saintly patience from its buy-and-hold investors...

The metal has stubbornly refused to join the precious metals rally. Since 2016, platinum has returned just about 22%... while gold has returned more than 200% in the same period.

But today, gold's big brother looks poised to take its revenge...

We already discussed how cultural values around the metal are changing in the East. Chinese commodity investors have noted the massive valuation gap between gold and platinum. And they're buying the latter hand over fist.

On top of that, platinum is headed for a generational supply crisis. We can see this by looking at the metal's supply-demand balance...

This metric takes the number of platinum ounces the globe uses each year, subtracted from the current stock of platinum mined worldwide.

Based on this metric, the global economy has been running at a platinum deficit for the past three years. Take a look...

This worthwhile story [with an excellent chart] about platinum's deficit... which I've been pointing out for quite some time now...put in an appearance on the chaikinanalytics.com Internet site yesterday -- and I thank Bill Moomau for sending it our way. Another link to it is here.

![]()

Sprott Money's Andrew Sleigh says it's still 'buy the dip' as manipulation weakens

Sprott Money's Andrew Sleigh, interviewed by his colleague Kellen Ainey, says suppression of gold and silver prices by bullion banks continues but is far less effective and has much less duration lately, in part because the bullion banks are using their own price smashing in the futures market to acquire actual metal at lower prices.

Sleigh advises investors to "buy the dip" as the bullion banks are doing.

The actual headline of this video is "Gold/Silver Markets Are Being Manipulated, and So Are YOU!" -- and was posted on the youtube.com Internet site earlier this week. For obvious length reasons, it had to wait for today's missive -- and although I haven't watched it yet, I'll do so over the weekend. I found this on the gata.org Internet site on Tuesday -- and another link to it is here.

![]()

New gold audit legislation targets everything, including leases and swaps

As U.S. debt soars and foreign central banks stockpile gold, four members of Congress today introduced a bill to require the first comprehensive audit of America's gold reserves in decades.

Sponsored by Reps. Thomas Massie (R-KY), Troy Nehls (R-TX), Addison McDowell (R-NC), and Warren Davidson (R-OH), the Gold Reserve Transparency Act (H.R. 3795) would require a full assay, inventory, and audit of all United States gold holdings.

Importantly, H.R. 3795 will also require full disclosure of all transactions involving America's gold, including any purchases, sales, loans, pledges, leases, swaps, and other encumbrances, dating back 50 years. Such activities have not been publicly disclosed.

"Americans deserve transparency and accountability from the institutions that underpin our currency," said Rep. Thomas Massie.

"It's been literally decades since actual inventories and assays have been conducted with respect to U.S. gold reserves, and the Department of the Treasury has lost records as well as failed to account for many occasions when vault compartments were inexplicably opened and resealed without new audits," said Stefan Gleason, CEO of Money Metals Depository.

This story from the moneymetals.com Internet site is posted in this GATA dispatch -- and there's also a link to the bill itself embedded in the article. The link to all of this is here.

![]()

QUOTE of the DAY

![]()

The WRAP

"Understand this. Things are now in motion that cannot be undone." -- Gandalf the White

![]()

Today' pop 'blast from past' comes from the now 39 year old movie 'Top Gun'...which I've featured once before...but years ago...so it's time for a revisit. I never cared for the movie, but one of the tunes that still resonates to this day is the one linked here. The bass cover to it is here. But these lead guitar and drum covers to this tune are exceptional -- and the former is linked here -- and the latter is linked here. The drum cover has had 5.3 million views -- and for good reason, as she is awesome.

Today's classical 'blast from the past' is just about as far away from today's pop 'blast from the past' that one can possibly get. It's Max Bruch's Kol Nidrei, Op. 47...which he completed in Liverpool, England in 1880 -- and was published in Berlin in 1881. After his Violin Concerto No. 1, the Kol Nidrei is Bruch's second most frequently performed piece. This performance, featuring Croatian-Slovenian born virtuoso cellist Luka Šulić, is as good as it gets -- and the link is here.

![]()

For the second time in as many days, gold was closed down on the day -- and silver closed higher. I thought it extraordinary that it happened the first time...but two days in a row? As the gold chart shows at the top of today's column, these down days did not come about by chance...they were deliberately engineered lower in price for that effect.

In Friday's column, one of my paragraphs in The Wrap stated..."As for the gold price, I've never seen a day like it. Reader John Glavin, who trades these markets, had this comment on Thursday..."Some more crazy action in silver today -- and extra crazy when compared to gold. Wouldn't surprise me if they were trying to use gold as an anchor on silver.""

He said the same thing on the phone to me yesterday afternoon about Friday's action -- and it still remains the only plausible explanation. The effect has been to lower the gold/silver ratio quite dramatically -- and it also took the wind out of the sails of the silver stocks yesterday.

Almost all of gold's big Monday gain had vanished by the close on Friday -- but still remains above its 50-day moving average by a fair amount -- and is back to market neutral on its RSI trace on its 6-month chart below.

Silver was closed well off its high tick -- and below $36 by 3 cents in its current front month, which is July -- and is now only a hair below being overbought. I'm wondering if 'da boyz' are attempting to set an interim top in silver. It certainly looks like it on its 6-month chart -- and a wildly bearish set-up in the COMEX futures market doesn't help.

Reader Paul Fitzgerald sent along market maven Alyosha's thoughts on silver's price action yesterday -- and here they are...

"Silver made new contract highs of $36.51, held its gains, and posted a new high close for all contracts, usually meaning margin calls for the entire short side of the book.

Silver had an excellent week, accelerating above sequential multi-year ranges in force since the Y2-teens. I like the April 4 isolated low, indicating extreme long liquidation, leaving the long side of open interest in “anchored” control, which has proven to be more powerful than the habitual suppression [by] the shorts.

In fact, the SLV shorts had a challenging week of gamma hedging. If anyone has ever had the job, it’s akin to being a chain smoker in a gas station.

The rally in silver knocked the stuffing out of the gold-silver ratio, and part of the silver rally might have been liquidation of the GSR, but there is no evidence of that in open interest."

Platinum's fifth 'up' day of the week now has it well into overbought territory on its RSI trace. I suspect that its big rally of the last three weeks has something to do with the structural deficit in it. There have been a number of stories about that in the last few months, with the latest iteration being in today's Critical Reads section.

It's a given that the managed money traders et al. have been going massively long platinum, which of course means that the commercial traders of whatever stripe have been going equally massively short again them to prevent its price from blowing to the moon and beyond...which is identical to the current situation in silver.

Palladium had its biggest one-day 'up' move of the last six months, but still remains some distance below overbought on its RSI trace. It's my understanding that there's also a structural deficit in it as well...although I haven't seen anything about that topic recently.

Copper, which had closed higher five days in a row up until Friday, was closed lower to end the week. It closed down 9 cents at $4.81/pound -- and the stories have been circulating for quite along time now about a supply/demand issue in it as well.

Natural gas [chart included] closed up 11 cents at $3.79/1,000 cubic feet -- and WTIC closed higher too...up $1.40 at $64.77/barrel -- and now above its 50-day moving average by a bit over two dollars.

Here are the 6-month charts for the Big 6+1 commodities...courtesy of stockcharts.com as always and, if interested, their COMEX closing prices in their current front months on Friday should be noted. Click to enlarge.

Returning to yesterday's COT Report in silver, although the headline number was pretty ugly...an increase of 8,864 COMEX contracts...half of that amount was long selling by Ted's raptors, the small commercial traders other than the Big 8...which is only a mathematical increase in the commercial net short position, not a real one...so the report was not nearly as bad as I had feared it might be...despite what I said about it in my commentary further up.

I'm sure that virtually all of that increase in the commercial net short position in silver during the reporting week came as a result of its monster rally on Monday.

But as I've been chronicling all week long, total open interest in silver has been rising rapidly -- and at a pace I've never seen before. Yesterday's Preliminary Report data posted further up, showed another increase in total open interest on Friday...this time it was 2,582 COMEX contracts.

Since the Tuesday cut-off for the next COT Report due out next Friday, total silver open interest has ballooned by a further 10,700 contracts over the last three trading sessions -- and it's a certainty that it's due to massive long buying and short covering by the managed money traders et al...with the collusive commercial traders going massively short against them in lockstep.

Of course there are still two more trading days left in the reporting week -- and as I mentioned above the charts regarding silver, as did Alyosha, that silver traded above $36 intraday in the July contract on Friday, but was hauled down and closed below that price by the time COMEX trading ended. It appears, as I said a bit further up, that 'da boyz' are attempting to set an interim top in it.

Although the upcoming July delivery month is still a long way off...with First Day Notice still three weeks away...I suspect that they will attempt to move heaven and earth to ensure that as many long holders that might be thinking of standing for delivery in that month, get their minds changed between now and then.

How successful they are in their endeavours going forward remains to be seen, as their last attempt to blow silver lower during the first week of April...two months ago now...was not at all successful...as Alyosha also mentioned -- and we're now back at a silver price not seen since September 2011.

They can huff and puff all they want in paper, but sooner or later that deepening structural deficit is going to rise up and bite the short holders of all stripes...commercial, or otherwise...just like it's in the process of doing in platinum -- and most likely palladium as well. Then there's the supply/demand situation in copper looming in the background.

Like I've said numerous times in the past, the plot hatched back in the 1970s to suppress commodity prices in general -- and precious metal prices in particular at the dawn of the fiat currency era, was easy to get into...however no thought was given at the time as to how they might extract themselves if it was every required to do so at some later date.

It's too late to build an off ramp -- and all they're left with is the ability to go short everything in the COMEX/Globex futures market. That will work, until it doesn't...as there will be a force majeure moment in the precious metals that they won't be able to paper over.

At that point the only two paths left will be to cover -- and go bankrupt in the process within days, if not hours...or close the COMEX. Ted Butler always stated that the number one priority of all the paper exchanges in the Anglo/ American/Western empire was to protect the shorts, which is what occurred in the nickel debacle in the LME some years back now, as you already know.

That was only nickel...a dinky market. The four precious metals, plus copper, are a different breed of cat entirely. A melt-up in their prices, however caused, would be catastrophic for the bullion banks -- and the world's financial system as a whole...not to mention the large short positions held by the thousands of smaller entities that trade paper contracts only.

Jim Rickard spoke of gold swaps and lease back in March -- and that it risks "tampering with the primal forces". He would be 100% correct about that. But he left out silver...the most most shorted metal in the history of Planet Earth ...and although no longer accumulated by central banks, would also turn into a weapon of mass financial destruction in a heartbeat the moment that the commercial traders of whatever stripe let down their guard...or were overrun.

So if the East really wanted to stick it to the West, they could do so without firing a single shot.

And although we still have to wait some more, the wait is now turning into a grand spectacle. There's never been a dull moment recently...as the accelerating action in the precious metals since the start of the year are the foreshocks of what's to come.

We are living through a pivot moment in financial and monetary history...the consequences of which will result in the greatest financial reset in modern times -- and only the precious metals will emerge unscathed.

For those reasons, which are more than enough, I'm still "all in" -- and, as always, will remain so to whatever end.

I'm done for the day -- and the week -- and I'll see you here on Tuesday.

Ed