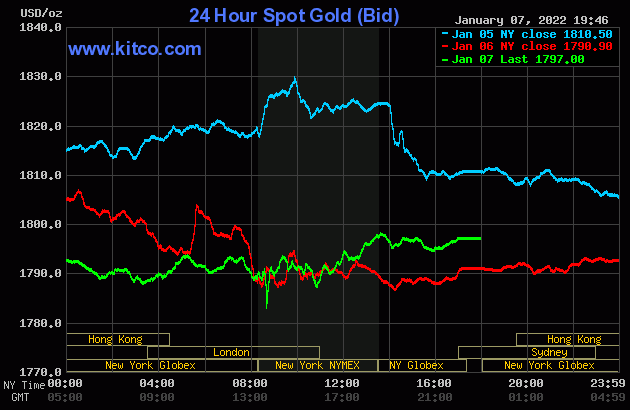

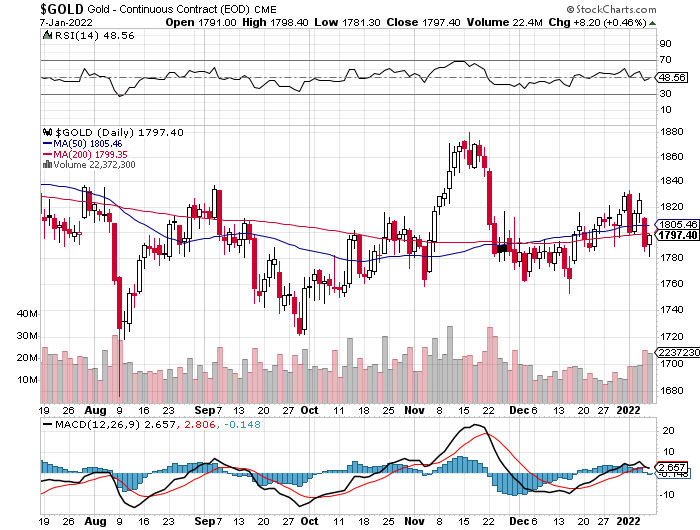

The gold price certainly didn't do much in either Far East or London trading on their respective Friday's -- and only began to show signs of life starting about five minutes before the 11 a.m. EST London close. It rallied a bit from there until it ran into 'something' a few minutes after the COMEX close in New York -- and from that juncture it had a quiet down/up move until trading ended at 5:00 p.m. EST.

The low and high ticks in gold on Friday were recorded by the CME Group as $1,798.40 and $1,781.30 in the February contract. The February/April price spread differential in gold at the close yesterday was $2.50...April/June was $2.00 -- and June/August was only $1.80 an ounce. The wholesale gold market is still very tight.

Gold was closed on Friday afternoon in New York at $1,797.00 spot, up $6.10 from Thursday. Net volume was a bit elevated at 150,000 contracts, but roll-over/switch volume out of February and into future months was very enormous once again at a bit under 106,000 contracts.

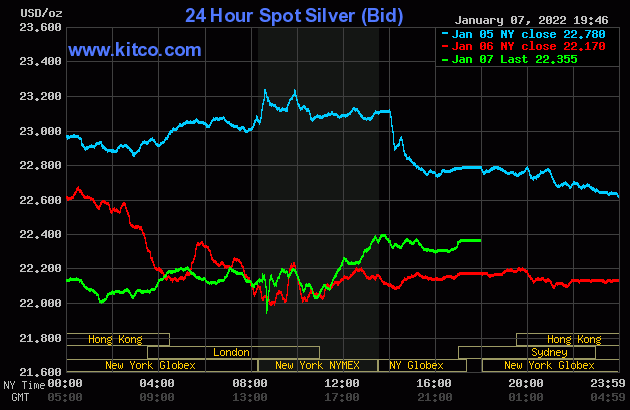

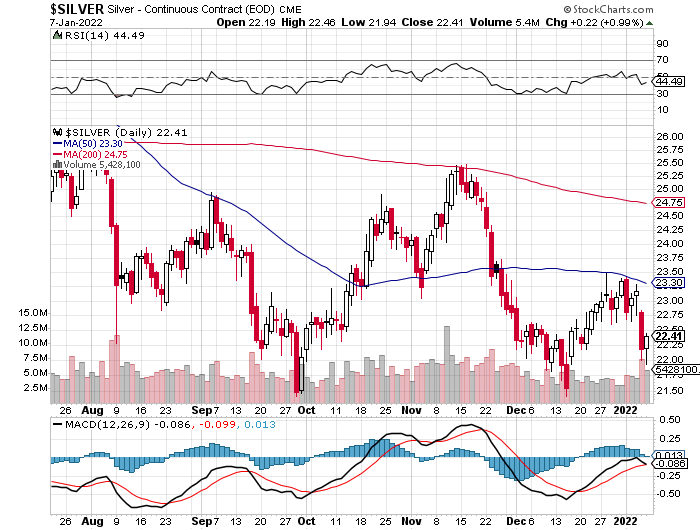

The price action in silver was pretty quiet as well on Friday, although there was about a twenty cent up/down move between 2:30 p.m. in Shanghai, the noon silver fix in London -- and the rally that began about 10:40 a.m. in New York. That was allowed to last until about five minutes before the 1:30 p.m. COMEX close -- and from that point it also had a quiet down/up move until trading ended at 5:00 p.m. EST.

The low and high ticks in silver were reported as $21.945 and $22.46 in the March contract. The March/May price spread differential in silver at the close yesterday was 3.4 cents...May/July was 3.8 cents -- and July/September was 4.2 cents an ounce.

Silver was close in New York on Friday afternoon at $22.355 spot, up 18.5 cents from Thursday. Net volume was pretty decent, relatively speaking, at a tiny bit over 54,000 contracts -- and there was 7,600 contracts worth of roll-over/switch volume in this precious metal...mostly into May and July.

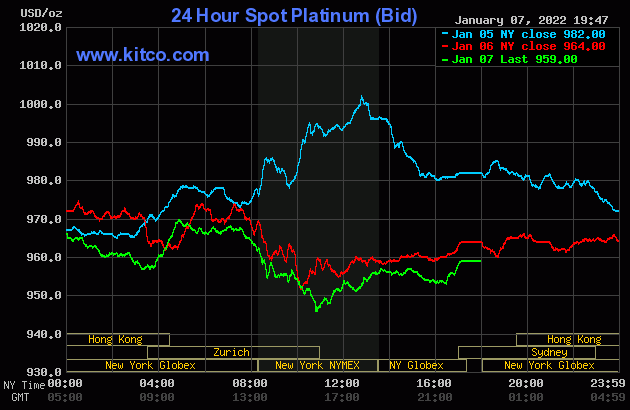

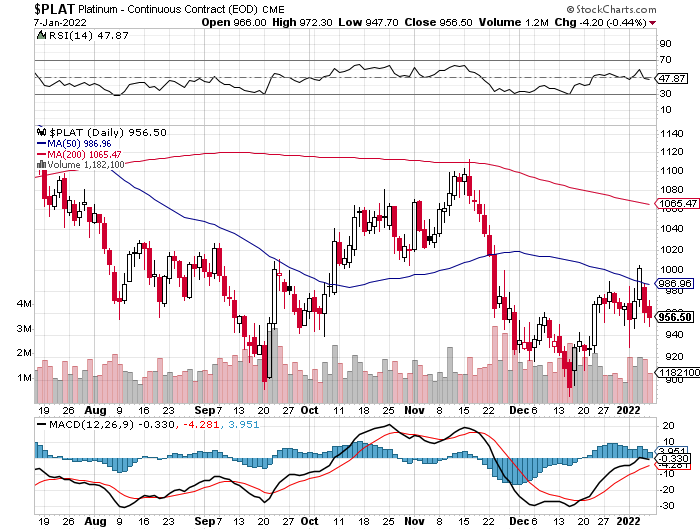

Platinum wandered quietly sideways in price until around 1:45 p.m. China Standard Time on their Friday afternoon -- and then was sold lower until shortly after Zurich opened. It began to rally shortly before 10 a.m. CET -- and that was capped and turned a hair lower about an hour later. The selling pressure resumed around 1:45 p.m. CET -- and its low tick was set about the same time as silver and gold...shortly before the 11 a.m. EST Zurich close. Its price path after that was pretty much identical to gold and silver until trading ended at 5:00 p.m. in New York. Platinum was closed at $959 spot, down 5 dollars on the day.

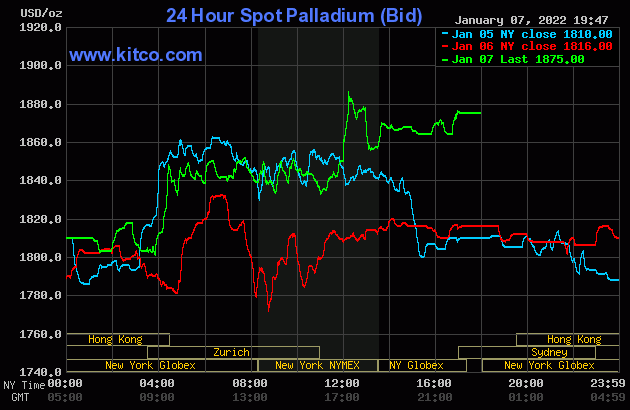

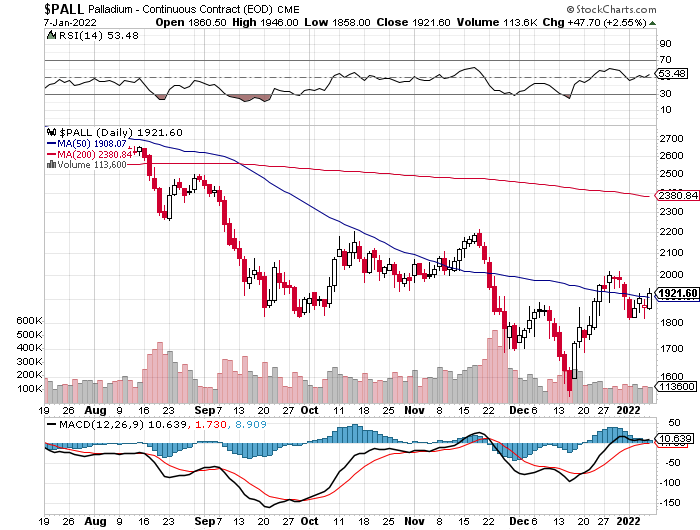

Palladium chopped unevenly sideways to a bit lower in Far East trading on their Friday -- and then took off higher starting a few minutes before 10 a.m. in Zurich. That rally got stepped on hard around 11:25 a.m. CET -- and from that point it chopped unevenly sideways until the 11 a.m. EST Zurich close. It rallied anew until it ran into 'something' just before 12:15 p.m. in New York -- and from that juncture it had a rather choppy down/up move until the market closed at 5:00 p.m. EST. Palladium was closed at $1,875 spot, up 59 dollars on the day.

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 80.4 to 1 on Friday...compared to 80.8 to 1 on Thursday.

And here's the 1-year Gold/Silver Ratio chart, courtesy of Nick Laird. Click to enlarge.

![]()

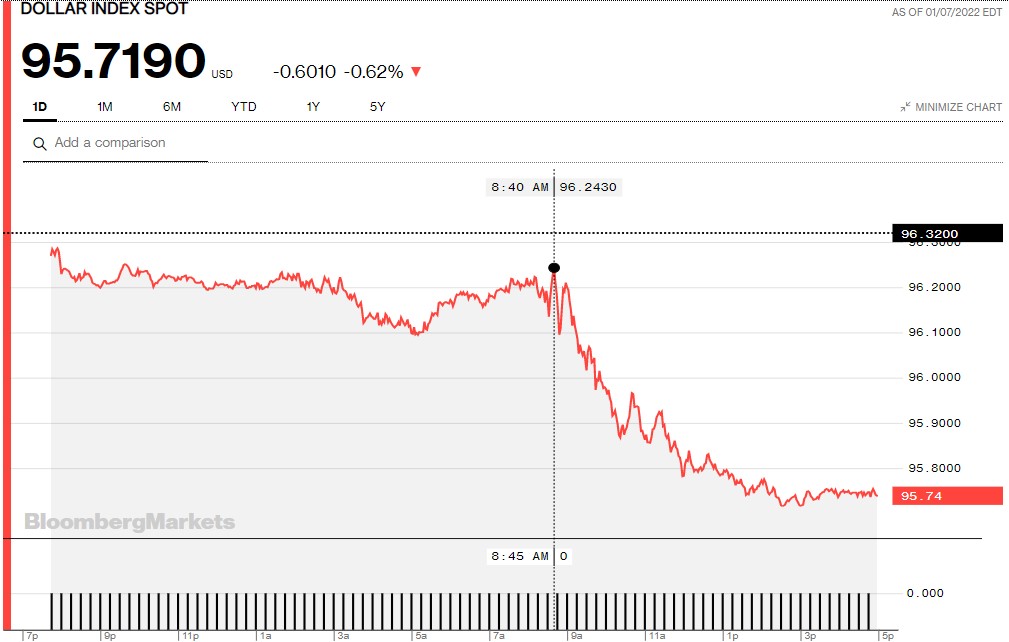

The dollar index closed very late on Thursday afternoon at 96.320 -- and the opened lower by about 5 basis points once trading commenced around 7:45 p.m. EST on Thursday evening, which was 8:45 a.m. China Standard Time on their Friday morning. It dropped a bit more from there during the next twenty minute of trading -- and then didn't do much of anything until 8:40 a.m. in New York. A very robust decline began at that juncture -- and that ended around 2:30 p.m. EST. It didn't do a thing after that.

The dollar index finished the Friday trading session in New York at 95.719...down 60 basis points on the day -- and about 2 basis points below its indicated spot close on the DXY chart below. It also closed right on its 50-day moving average -- and whether it's allowed to break below that by any meaningful amount, remains to be seen.

Here's the DXY chart for Friday, thanks to Bloomberg as usual. Click to enlarge.

And here's the usual 5-year U.S. dollar index chart that appears in this spot just about every Saturday, thanks to stockcharts.com as always. The delta between its close...95.72...and the close on the DXY chart above, was a tiny fraction of 1 basis point on Friday. Click to enlarge as well.

![]()

It's certainly obvious that the swoon in dollar index yesterday wasn't allowed to manifest itself in the prices of either silver or gold yesterday.

U.S. 10-Year Treasury: 1.7710%...up 0.0380 (+2.19%)...as of 02:59 p.m. EST

Here's the 5-year 10-year Treasury chart, courtesy of finance.yahoo.com as always -- and this puts the current trend in some perspective. Click to enlarge.

As you know, the only reason that interest rates aren't at the moon is because the Fed continues to buy whatever amount of Treasuries necessary to keep the yield curve under control.

![]()

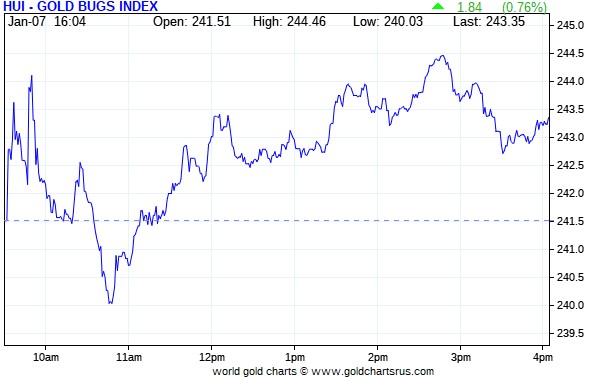

The gold shares rallied a bit at the 9:30 open in New York on Friday morning, but were sold back into negative territory starting about twenty minute later, with their respective low ticks coming about 10:50 a.m. EST. From that point they followed the gold price very closely until the markets closed at 4:00 p.m. The HUI closed higher by only 0.76 percent.

Computed manually, Nick Lairds' Intraday Silver Sentiment/Silver 7 Index closed down 0.02 percent, so call it unchanged. Peñoles didn't trade yesterday, so the index was computed on the basis of the six silver shares that did.

Here's Nick's 3-year Silver Sentiment/Silver 7 Index chart, updated with Friday's candle. Click to enlarge.

There were no stars or dogs yesterday, as they all closed within small fractions of unchanged.

The latest silver eye candy from the reddit.com/Wallstreetsilver crowd is linked here.

![]()

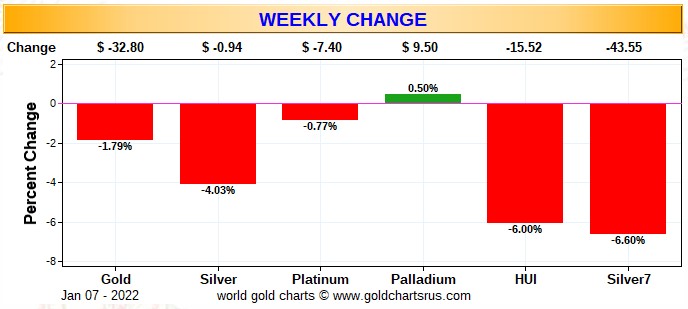

Because we've only had one week of trading in the New Year, I only have one of the usual three charts that show up in every weekend missive. It shows the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the Silver 7 Index.

Here's the weekly/month-to-date -- and year-to-date charts all rolled into one. It certainly wasn't an auspicious start to the year, as the commercial traders worked their magic in their usual way. The precious metal equities got hammered -- and it's always cold comfort to point out that the silver equities vastly 'outperformed' their golden counterparts compared to the declines in their respective underlying precious metals. Click to enlarge.

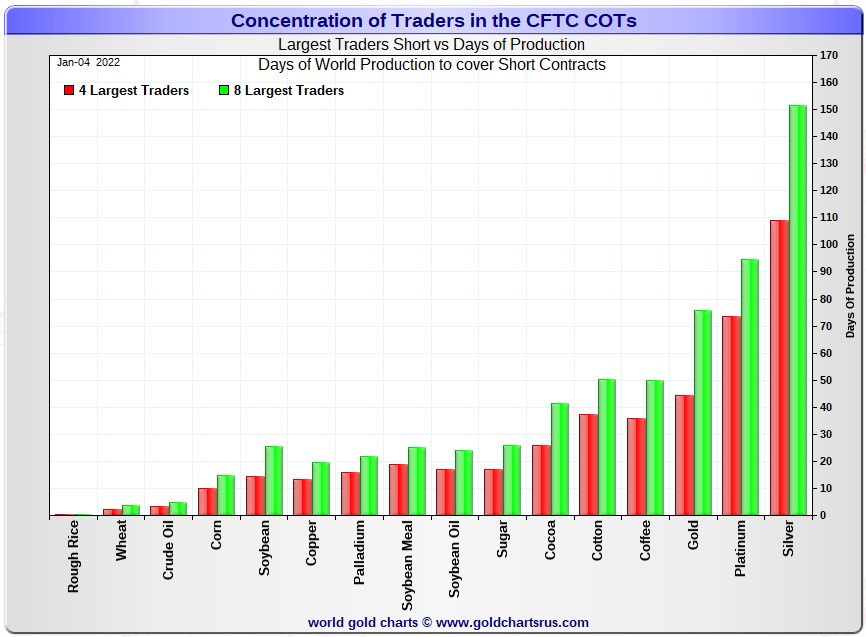

As Ted has pointed out on more occasions that I can remember, the concentration data in the weekly COT Report is prima facie evidence that the Big 4/8 traders -- and primarily the Big 4, are the corks in the precious metal price bottle. It's been that way for decades, but the miners refuse to go there. And as I said in this space last Saturday, they are now just as complicit in this price management scheme as the CME Group and the CFTC...silent co-conspirators if you will -- and have been for a very long time.

One has to wonder what's happened to their fiduciary responsibility in this regard. And it grieves me to say this, but the largest of the precious metal miners also have one foot in the deep state/New World Order camp. This is particularly true of the World Gold Council.

![]()

The CME Daily Delivery Report showed that zero gold and zero silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday, which I found rather surprising, especially considering the amount of January open interest remaining in silver.

The link to yesterday's Issuers and Stoppers Report is here.

So far in January there have been 1,175 gold and 1,980 silver contracts issued/reissued and stopped -- and that number in platinum is 1,963 COMEX contracts.

The CME Preliminary Report for the Friday trading session showed that gold open interest in January declined by 7 contracts, leaving just 36 left. Thursday's Daily Delivery Report showed that 11 gold contracts were actually posted for delivery on Tuesday, so that means that 11-7=4 more gold contracts were added to January. Silver o.i. in January dropped by 24 COMEX contracts, leaving 473 still open. Thursday's Daily Delivery Report showed that 24 silver contracts were actually posted for delivery on Tuesday, so the the change in open interest and deliveries match for once.

Total gold open interest at the close yesterday increased yet again, this time by 4,946 COMEX contracts -- and Ted attributes most of the increases in gold's open interest this week to the placing of market-neutral spread trades...something he might mention in his weekly commentary this afternoon. Total silver o.i. rose by 1,642 contracts.

Silver open interest in February increased by another 7 contracts, leaving total open interest in that month at 641 COMEX contracts.

![]()

There was another withdrawal from GLD yesterday, as an authorized participant removed 56,042 troy ounces of gold -- and for the second day in a row there were no reported changes in SLV.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in GLD & SLV, there was a net 63,311 troy ounces of gold removed, but a net 66,606 troy ounces of silver was added.

There was no sales report from the U.S. Mint.

Month/year-to-date the mint has sold what I reported in yesterday's column...107,500 troy ounces of gold eagles -- 35,000 one-ounce 24K gold buffaloes -- and 3,001,000 silver eagles.

![]()

There was no in/out movement, or any paper activity in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday.

The only activity in silver yesterday occurred over at Brink's, Inc. Nothing was reported received -- and they shipped out 502,485 troy ounces. There was also some paper activity there as well, as 179,171 troy ounces was transferred from the Registered category and back into Eligible. The link to this is here.

There was a bit of activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday. There were 347 kilobars received -- and 151 were shipped out. Except for the 235 kilobars that were dropped off at Loomis International, the remaining in/out activity took place over at Brink's, Inc. as always. The link to that, in troy ounces, is here.

![]()

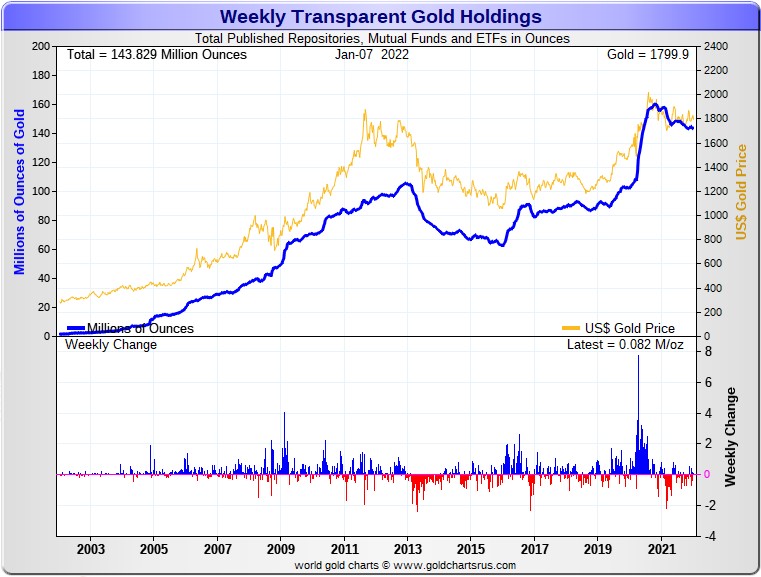

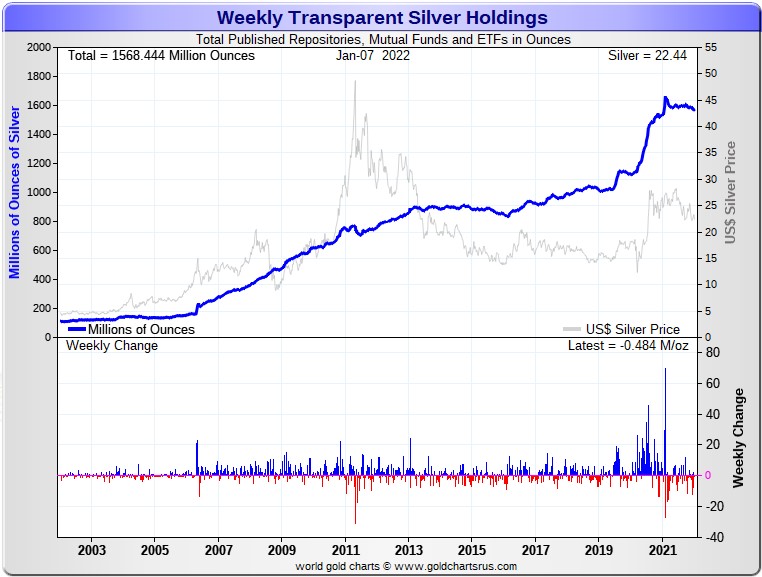

Here are the usual two 20-year charts that show up in this space every Saturday. They show the total amount of physical gold and silver held in all know depositories, ETFs and mutual funds as of the close of business on Friday.

For the week just past, there was a net 82,000 troy ounces of gold added -- but a net 484,000 troy ounces of silver was withdrawn. Excluding COMEX and GLD activity in silver, the other ETFs and mutual funds on Planet Earth showed an increase for the week. Click to enlarge.

As I mention every week in this spot, with the physical market in silver as squeaky tight as it is, you have to ask yourself where all the physical silver is going to come from to deposit into all these various and sundry ETFs and mutual funds once the next silver rally is allowed to begin.

Ted is of the opinion that this is the reason why the commercial traders of whatever stripe are holding silver's price where it is at the moment. But they can't keep it below its critical moving averages forever.

![]()

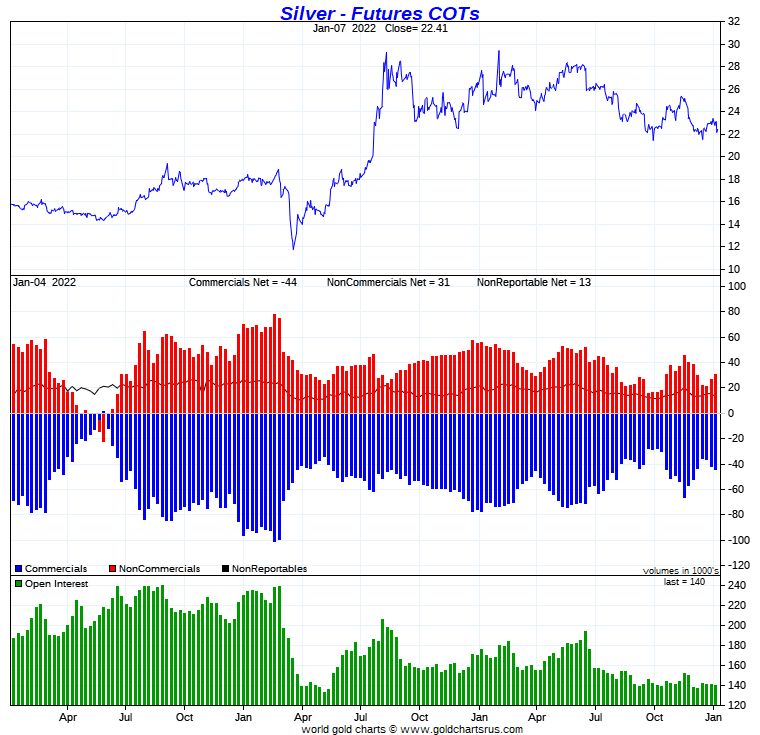

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, January 4 showed a smallish increase in the Commercial net short position in silver -- and fairly decent decrease in the commercial net short position in gold.

In silver, the Commercial net short position rose by 2,045 COMEX contracts, or 10.2 million troy ounces of silver.

They arrived at that number by reducing their long position by 1,494 contracts -- and also increased their short position by 551 contracts. It's the sum of those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was all Managed Money traders and then some that were on the buy side, as they increased their net long position by 4,331 contracts. The traders in the Other Reportables category were also net buyers, but only added a paltry 130 contracts to their net long position. The Nonreportable/small traders were the big sellers, as they reduced their net long position by 2,416 COMEX contracts.

Doing the math: 4,331 plus 130 minus 2,416 equals 2,045 COMEX contracts, the change in the Commercial net short position.

The Commercial net short position in silver now sits at 219.9 million troy ounces...up 10.3 million troy ounces from the 209.6 million troy ounces that they were short in Monday's COT Report.

The Big 8 are short 325.8 million troy ounces in this week's COT Report, down 10.4 million troy ounces from the 336.2 million troy ounces they were short in Monday's COT Report. But as you know by now, the Big 8 are not all commercial traders, as I comment on below.

However, the headline number showed a increase in the commercial net short position of only 10.2 million troy ounces, it was Ted's raptors, the small commercial traders other than the Big 8 shorts that made up the difference during the reporting week...to the tune of 10.4-10.2=only 200 thousand troy ounces...around 40 COMEX contracts, as they increased their long position by that tiny amount.

Don't forget that despite their small size, Ted's raptors are still commercial traders in the commercial category.

But that Big 8 short position of 325.8 million troy ounces is not entirely accurate once again, because Ted said that the short positions of two of the Managed Money traders are still large enough to be in the Big 8 category. So the Big 8 are no longer entirely made of up of commercial traders...just 6 of the 8. That distorts that number. Ted says it should certainly be lower than the 325.8 million troy ounces stated. As to how much their positions changed during the reporting week is impossible to tell. However he thought that because of the reduction in the short position of the Big 8 during the reporting week, both these Managed Money traders may be in the Big '5 through 8' category, instead of one in the Big 4 -- and one in the Big '5 through 8'.

There's more on this in the 'Days to Cover' discussion further down.

The Big 8 are short 325.8/219.9 equals about 148 percent of the Commercial net short position in silver, down from the 160 percent they were short in Monday's COT Report...the numerator muddied by the fact that the Big 8 still have two Managed Money traders in their ranks.

Here's the 3-year COT chart for silver, courtesy of Nick Laird as always -- and the change is worth noting. Click to enlarge.

As I mentioned in a couple of my weekly commentaries, I wasn't expecting much change in silver in this COT Report -- and that's pretty much how it turned out.

And as I also said, after the price action on Wednesday -- and particularly on Thursday, that this COT Report would very much be "yesterday's news" when it came out -- and that's what it was.

Of course -- and because of that engineered price decline on Thursday, there has obviously been massive improvement in the market structure in silver.

So we've gone from an extremely bullish market structure, to a wildly bullish one now.

But whether the ensuing rally is allowed to amount to much, remains to be seen...as it's all up to the commercial traders of whatever stripe to allow it. As you know, they've been most reluctant to let the silver price get anywhere near any moving average that matters.

So we wait some more.

![]()

In gold, the commercial net short position declined by a very respectable 8,206 COMEX contracts, or 820,600 troy ounces of the stuff.

They arrived at that number by increasing their long position by 1,086 contracts -- and also reduced their short position by 7,120 contracts. It's the sum of those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report it was the Managed Money and the Nonreportable/small trader categories that were the big sellers during the reporting week. The former reduced their net long position by 4,155 COMEX contracts -- and the latter by a fairly hefty 6,405 contracts. The Other Reportables increased their net long position by 2,354 contracts.

Doing the math: 4,155 plus 6,405 minus 2,354 equals 8,206 COMEX contracts, the change in the commercial net short position.

The commercial net short position in gold now sits at 23.75 million troy ounces, down from the 24.57 million troy ounces they were short in Monday's COT Report.

The short position of the Big 8 traders is 22.62 million troy ounces, down 740,000 troy ounces from the 23.36 million troy ounces they were short in Monday's COT Report.

But the headline change in the commercial net short position showed an decrease of 820,600 troy ounces, so that means that Ted's raptors, the small commercial traders other than the Big 8, had to have purchased 820,600-740,000=80,600 troy ounces/806 COMEX long contracts to make up the difference -- and that's what they did.

Their buying had the mathematical effect of decreasing the commercial net short position by that amount.

And don't forget that despite their small size, Ted's raptors are still commercial traders in the commercial category.

From the above numbers, the Big 8 traders are short 22.62/23.75 equals about 95 percent of the commercial net short position in gold...unchanged from Monday's COT Report. This means that Ted's raptors are now back to being net short the COMEX futures market in gold for the third week in a row...to the tune of about 5 percent of the commercial net short position.

Here's Nick Laird's 3-year COT chart for gold, updated with Friday's data. Click to enlarge.

As I stated in my Friday column, I didn't know what to expect as far as what changes in the COT Report for either silver or gold, so this decrease in gold was a pleasant surprise...although in the grand scheme of things, it wasn't overly large. However, it's far better than the alternative.

I suspect that Ted's big gold 'whale'...which he believes to be John Paulson...didn't do anything during the reporting week -- and he's still long by around 40,000 contracts in the Other Reportables category...which is a bit under 8 percent of total open interest at the moment. This subject never came up during our phone call yesterday, but believe that he'll report no change in his weekly review this afternoon.

And because he's a long-term holder, Ted says that it's safe to reduce the commercial net short position by that above amount, leaving the commercial net short position in gold around the 19.75 million troy ounce mark...a pretty low number -- and probably lower after Thursday's price 'action'.

And, like in silver, because of the engineered price decline in gold on Thursday, the very bullish configuration for a major rally in gold, has now transformed itself into an extremely bullish set-up.

But, as always -- and also like in silver, how high any future rally is allowed to go, is 100 percent dependent on what the commercial traders of whatever stripe allow.

![]()

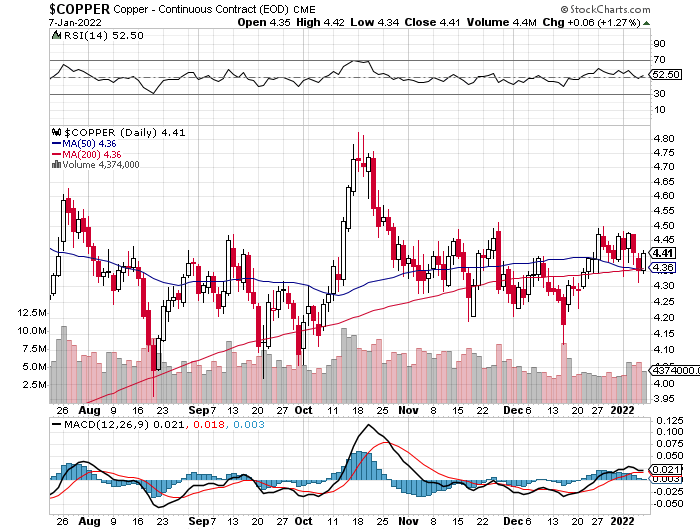

In the other metals, the Managed Money traders in palladium increased their net short position by a tiny 40 COMEX contracts during the last reporting week -- and are net short the palladium market by 2,442 COMEX contracts. Both the Producer/Merchant and Swap Dealers in the commercial category are net long palladium now -- and none of them are banks. In platinum, the Managed Money traders decreased their net short position by a further 1,950 contracts during the reporting week -- but are still net short the COMEX futures market by 2,529 COMEX contracts. The Producer/Merchant category is also net short platinum big time at the moment, the only other category that is. In copper, the Managed Money traders increased their net long position by a further 5,639 COMEX contracts -- and are now net long copper by 26,176 COMEX contracts...about 654 million pounds of the stuff -- and about 14 percent of total open interest...up about 3 percentage points from what they were short in Monday's COT Report.

![]()

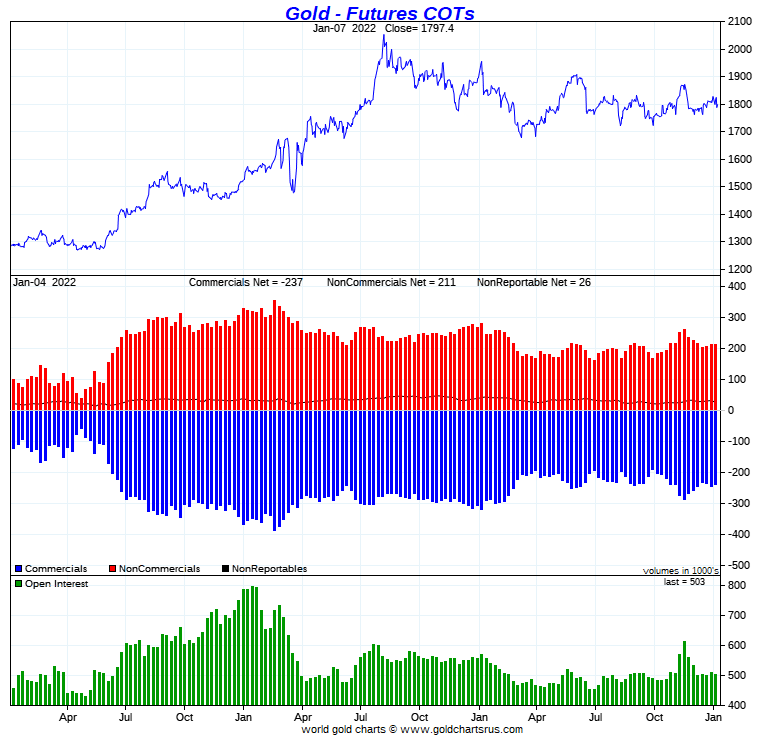

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, January 4. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in each physically traded commodity on the COMEX.

I consider this to be the most important chart that shows up in the COT series -- and it deserves a minute of your time. Click to enlarge.

[NOTE: As mentioned in the COT Report above -- and for the third week in a row, the Big 8 shorts are no longer all commercial traders -- and that's because the short positions of the two biggest Managed Money traders are so large, that they're now in the Big 8 short category...most likely in the Big '5 through 8' category, so only 6 of the 8 traders of the Big 8 are commercial traders. For that reason, the numbers shown below aren't entirely accurate, but close enough for our purposes -- and will remain that way until these two Managed Money traders cover enough of their short positions to disappear from the categories they currently inhabit. That won't happen until the next decent rally is underway. - Ed]

In this week's 'Days to Cover' chart, the Big 4 traders are short about 109 days of world silver production, down about 4 days from Monday's COT Report. The ‘5 through 8’ large traders are short an additional 43 days of world silver production, down about 1 day from Monday's report, for a total of about 152 days that the Big 8 are short -- and down 5 days from Monday's report. [In Monday's COT Report, they were short 157 days of world production.]

That 152 days that the Big 8 are short, represents about five months and a bit of world silver production, or 325.8 million troy ounces of paper silver held short by the Big 8.

In the COT Report above, the Commercial net short position in silver was reported by the CME Group at 219.9 million troy ounces. As mentioned in the previous paragraph, the short position of the Big 4/8 traders is 325.8 million troy ounces. So the short position of the Big 4/8 traders is larger than the Commercial net short position by 325.8-219.9=105.9 million troy ounces...down 20.7 million troy ounces from last week's COT Report.

The reason for the difference in those numbers is that these raptors, the small commercial traders other than the Big 8, are still net long silver by 105.9 million troy ounces/21,180 COMEX contracts.

And because of the two Managed Money traders in the Big 8, this number is overstated by a certain amount...but by how much would be a be a guess...however it wouldn't be an overly material amount. It also distorts the rest of the silver numbers that follow by a bit as well.

As per the first paragraph above, the Big 4 traders in silver are short around 109 days of world silver production in total. That's 27 days and a bit of world silver production each, on average...down 1 day from Monday's report. The traders in the '5 through 8' category are short 43 days of world silver production in total...just under 11 days of world silver production each on average -- and down a tiny bit from Monday's COT Report.

The Big 8 traders are short 46.7 percent of the entire open interest in silver in the COMEX futures market, which is down a tiny amount from the 47.6 percent they were short in the last COT report. And once whatever market-neutral spread trades are subtracted out, that percentage would certainly be over the 50 percent mark. In gold, it's 45.0 percent of the total COMEX open interest that the Big 8 are short, which is down a bit from the 45.9 percent they were short in Monday's COT Report -- and a bit over the 50 percent mark once their market-neutral spread trades are subtracted out.

In gold, the Big 4 are short 44 days of world gold production, down about two days from Monday's COT Report. The '5 through 8' are short 32 days of world production, unchanged from last week...for a total of 76 days of world gold production held short by the Big 8 -- and obviously down two days from Monday's COT Report. Based on these numbers, the Big 4 in gold hold about 58 percent of the total short position held by the Big 8...down one day from Monday's COT Report.

The "concentrated short position within a concentrated short position" in silver, platinum and palladium held by the Big 4 commercial traders are about 72, 78 and 73 percent respectively of the short positions held by the Big 8...the red and green bars on the above chart. Silver is about unchanged from last week...platinum is up about 1 percentage point from a week ago -- and palladium is about unchanged week-over-week.

The Big 4/8 traders are still very firmly stuck on the short side in both gold and silver -- and did little to improve their lot during the reporting week. As Ted has been saying, it's now his raptors, the small commercial traders other than the Big 8, that are running the price management show -- and making obscene profits in the process. But net/net...the commercial traders of whatever stripe didn't do much during this last reporting week.

As I've pointed out before -- and will mention again, it's my firm belief that the Big 4/8 shorts will never be able to extricate themselves fully from the short side -- and at some point are going to have eat the lion's share of the short positions that they currently hold. The only way that can do that is to go into the market and buy longs...or deliver physical metal, but only if the long holders are in a position to accept delivery, as a lot of them aren't.

And the moment the rest of the traders in the COMEX futures market sees that, the 'ask' will disappear -- and prices will explode...unless the powers-that-be at the CFTC and CME Group have something nefarious up their sleeves.

The circumstance in silver has also been altered by an unimaginable [and hugely bullish] amount by Ted's discovery of the 800 million troy ounce short position in silver that Bank of America now holds as of the last OCC Report.

The situation regarding the Big 4/8 shorts in silver, gold [and platinum] continues to be far beyond obscene, twisted and grotesque -- and as Ted correctly points out ad nauseam, its resolution will be the sole determinant of precious metal prices going forward.

As always, nothing else matters.

Of course it's a given that some of the Big 4 traders are there for the sole purpose of keeping the cork in the precious metal price bottle until told to release it.

![]()

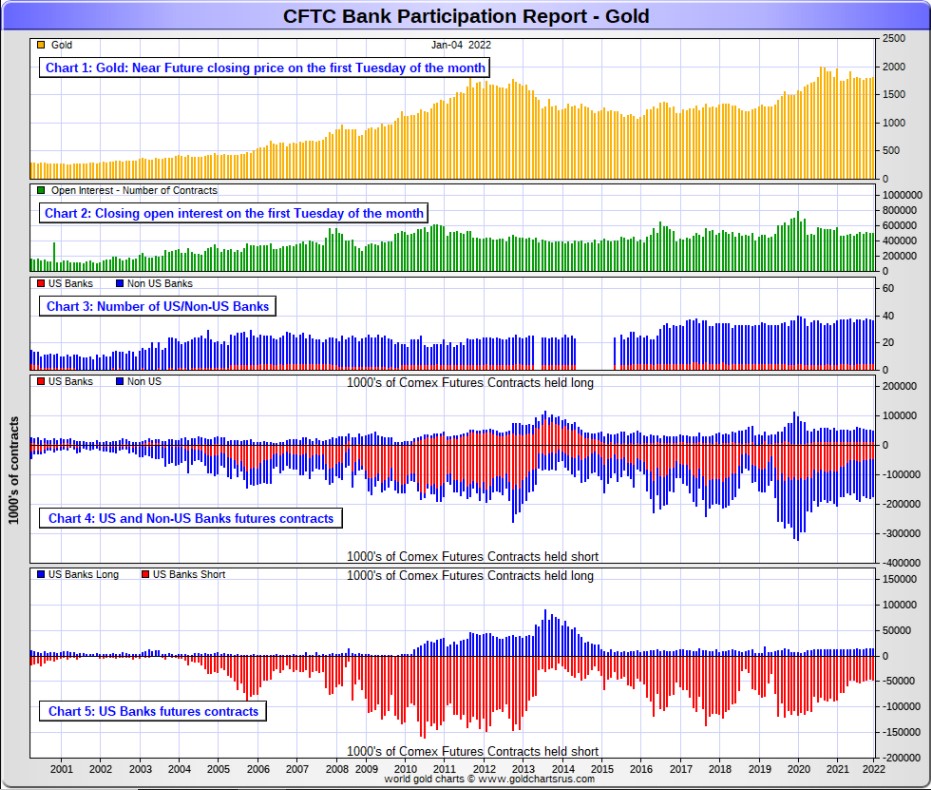

The January Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of Tuesday’s cut-off in all COMEX-traded products. For this one day a month we get to see what the world’s banks are up to in the precious metals. They’re usually up to quite a bit, but didn't do much in December, except for the non-U.S. banks in gold.

[The January Bank Participation Report covers the time period from December 7 to January 4 inclusive.]

In gold, 5 U.S. banks are net short 33,055 COMEX contracts in the January BPR. In December’s Bank Participation Report [BPR] these same 5 U.S. banks were net short 32,049 contracts, so there was a smallish increase of about 1,000 COMEX contracts month over month.

Citigroup, HSBC USA, Bank of America and Morgan Stanley would most likely be the U.S. banks that are short this amount of gold. I still have my usual suspicions about the Exchange Stabilization Fund, although if they're involved, they are most likely just backstopping these banks.

Also in gold, 31 non-U.S. banks are net short 89,751 COMEX gold contracts. In December's BPR, 32 non-U.S. banks were net short 99,328 contracts...so the month-over-month change shows a decrease of 9,577 COMEX contracts...the only big change in this month's Bank Participation Report.

At the low back in the August 2018 BPR...these same non-U.S. banks held a net short position in gold of only 1,960 contacts -- and they've been back on the short side in an enormous way ever since.

I suspect that there's at least three large banks in this group, HSBC, Barclays and Deutsche Bank. I also have my suspicions about Scotiabank/Scotia Capital, Dutch Bank ABN Amro, French bank BNP Paribas, plus Australia's Macquarie Futures as well. Other than that small handful, the short positions in gold held by the vast majority of non-U.S. banks are immaterial and, like in silver, have always been so.

As of this Bank Participation Report, 36 banks [both U.S. and foreign] are net short 24.4 percent of the entire open interest in gold in the COMEX futures market, which is down a bit from the 26.3 percent that 37 banks were net short in the December BPR.

Here’s Nick’s BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank’s COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

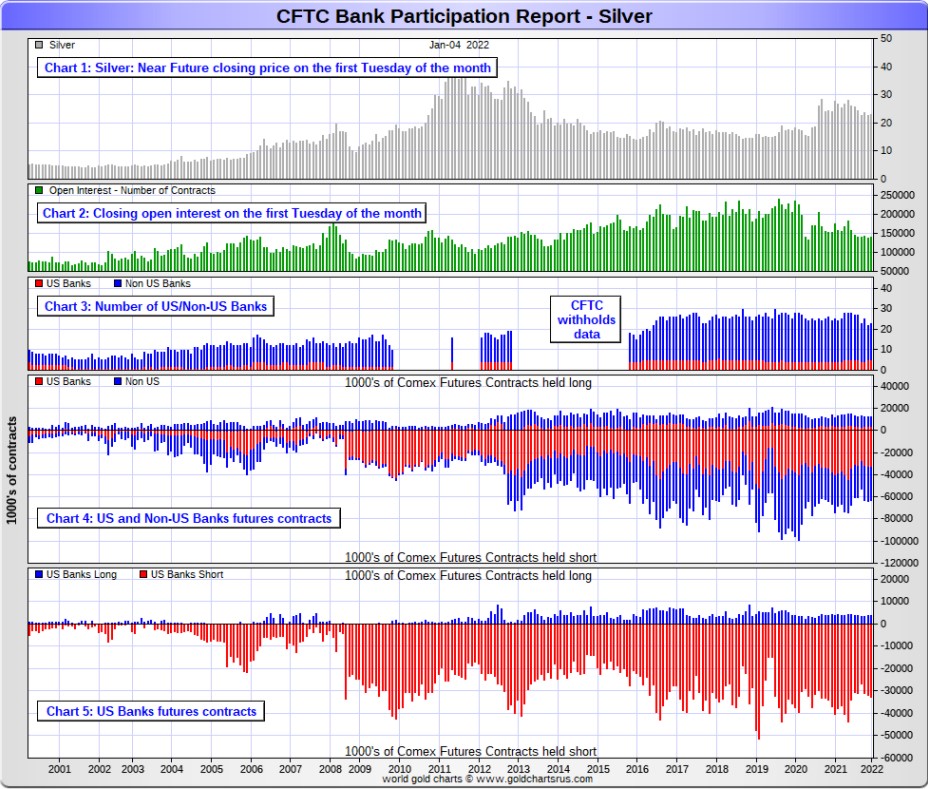

In silver, 5 U.S. banks are net short 28,878 COMEX contracts in January's BPR. In December's BPR, the net short position of these same 5 U.S. banks was 28,215 contracts, so the short position of the U.S. banks increased by a bit more than 600 contracts month-over-month, an immaterial amount.

The five biggest short holders in silver of the five U.S. banks in total, would be Citigroup, HSBC USA, Bank of America, Morgan Stanley...and now Goldman Sachs...but not JPMorgan. And, like in gold, I have my suspicions about the Exchange Stabilization Fund's role in all this...although, also like in silver, not directly.

Also in silver, 18 non-U.S. banks are net short 22,750 COMEX contracts in the January BPR...which is down a tiny bit from the 23,407 contracts that 17 non-U.S. banks were short in the December BPR.

I would suspect that HSBC and Barclays holds a goodly chunk of the short position of these non-U.S. banks...plus some by Canada's Scotiabank/Scotia Capital still. I'm not sure about Deutsche Bank... but now suspect Australia's Macquarie Futures. I'm also of the opinion that a number of the remaining non-U.S. banks may actually be net long the COMEX futures market in silver. But even if they aren’t, the remaining short positions divided up between these other 13 or so non-U.S. banks are immaterial — and have always been so.

As of January's Bank Participation Report, 23 banks [both U.S. and foreign] are net short 37.0 percent of the entire open interest in the COMEX futures market in silver—down a bit from the 37.8 percent that 22 banks were net short in the December BPR. And much, much more than the lion’s share of that is held by Citigroup, HSBC, Bank of America, Barclays -- and Scotiabank -- and possibly one other non-U.S. bank...all of which are card-carrying members of the Big 8 shorts.

I'll point out here that Goldman Sachs, up until late last year, had no derivatives in the COMEX futures market in any of the four precious metals, but did show up in the last OCC Report as being short a bit...most likely in silver.

Here’s the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns—the red bars. It’s very noticeable in Chart #4—and really stands out like the proverbial sore thumb it is in chart #5. But as of March of 2020...they're out of their short positions, not only in silver, but the other three precious metals as well. Click to enlarge.

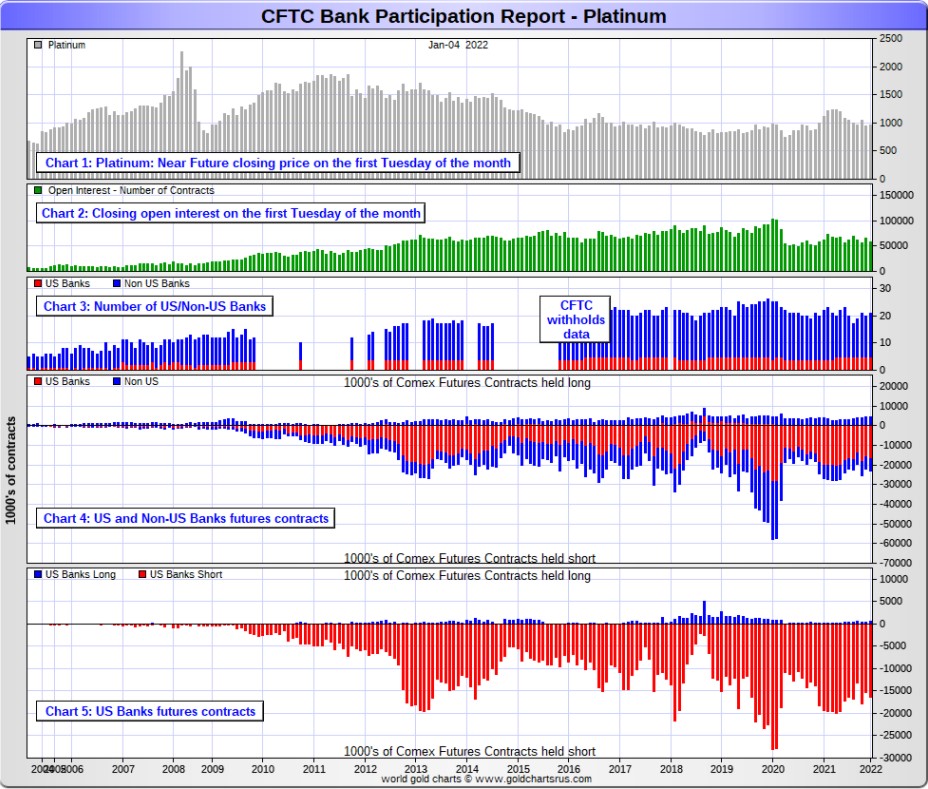

In platinum, 5 U.S. banks are net short 15,719 COMEX contracts in the January Bank Participation Report, which is up about 800 contracts from the 14,918 COMEX contracts that these same 5 U.S. banks were short in the December BPR.

At the 'low' back in July of 2018, these U.S. banks were actually net long the platinum market by 2,573 contracts. So they have a long way to go to get back to just market neutral in platinum...if they ever intend to, that is.

Also in platinum, 16 non-U.S. banks are net short 2,627 COMEX contracts in the January BPR, which is up a bit from the 2,356 COMEX contracts that 15 non-U.S. banks were net short in the December BPR.

[Note: Back at the July 2018 low, these same non-U.S. banks were net short only 1,192 COMEX contracts in platinum.]

And as of January's Bank Participation Report, 21 banks [both U.S. and foreign] are net short 31.4 percent of platinum's total open interest in the COMEX futures market, which is up a very decent amount from the 26.5 percent that 20 banks were net short in December's BPR.

But it's the U.S. banks that are on the short hook big time -- and the real price managers. They have little chance of delivering into their short positions, although a very large number of platinum contracts have already been delivered during the last year or so. But that fact, like in both silver and gold, has made no difference whatsoever to their short positions held. The situation for them in this precious metal is as equally dire in the COMEX futures market as it is with the other two precious metals...silver and gold...particularly the former.

The reason that they'll never improve their short positions in a big way is the same reason as in gold and silver...the Managed Money traders flatly refuse to go short big time like they used to in the past -- and they're only short about 2,500 COMEX contracts at the moment, which is a small amount for them on an historical basis.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

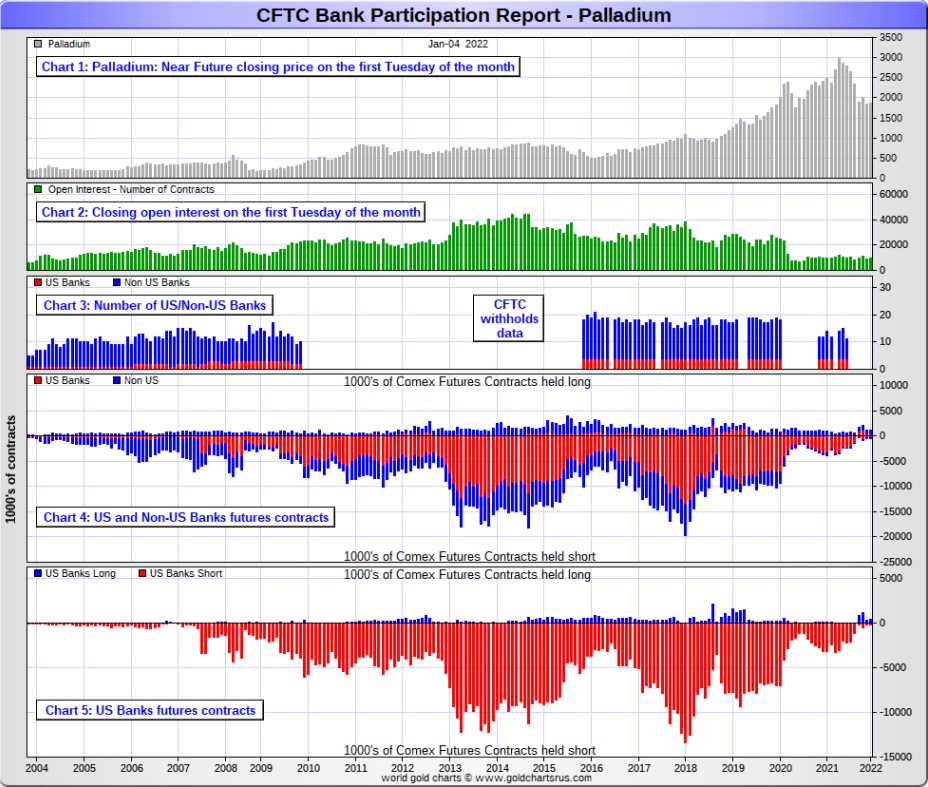

In palladium, '4 or less' U.S. banks are net long 280 COMEX contracts in the January BPR, which is up an inconsequential amount from the 185 contracts that these same '3 or less' U.S. banks were net long in the December BPR.

Also in palladium, '9 or more' non-U.S. banks are net long 467 COMEX palladium contracts—also up an inconsequential amount from the 365 contracts that '11 or more' non-U.S. banks were net long in the December BPR. These non-U.S. banks have been net long by a bit in palladium for the last two years in a row -- and have now been joined by the U.S. banks on the long side for the fourth month in a row.

And as I've been commenting for almost forever now, the COMEX futures market in palladium is a market in name only, because it's so illiquid and thinly-traded. Its total open interest at Tuesday's cut-off was only 9,480 contracts...compared to 58,275 contracts of total open interest in platinum...139,521 in silver -- and 502,717 COMEX contracts in gold.

The only reason that there's a futures market at all in palladium, is so that the Big 8 traders can control its price.

As of this Bank Participation Report, 13 banks [both U.S. and foreign] are net long 7.9 percent of the entire COMEX open interest in palladium...compared to the 5.9 percent of total open interest that 15 banks were net long in December's BPR.

And because of the small numbers of contracts involved, along with a tiny open interest, these numbers are pretty much meaningless.

But, having said that, for the last two years in a row, the world's banks have not been involved in the palladium market in a material way -- and for the fourth month in a row, they are now net long in unison in this precious metal.

Here’s the palladium BPR chart. Although the world's banks continue to be net long, it remains to be seen if they return as big short sellers again at some point like they've done in the past. Click to enlarge.

Excluding palladium for obvious reasons, only a small handful of the world's banks/investment houses, most likely four or so in total -- and mostly U.S-based, except for HSBC, Barclays and maybe Deutsche Bank...continue to have meaningful short positions in the other three precious metals. It's a near certainty that they run this price management scheme from within their own in-house/proprietary trading desks...although it's a given that some of their their clients are short these metals as well.

The futures positions in silver and gold that JPMorgan holds are immaterial -- and have been since March of 2020. And what positions they do hold, would certainly be on the long side of the market. It's the new 7+1 shorts et al. that are on the hook in everything precious metals-related.

And as has been the case for over a year now, the short positions held by the Big 4/8 traders/banks is the only thing that matters -- and how it is ultimately resolved [as Ted said earlier] will be the sole determinant of precious metal prices going forward.

The Big 8 shorts continue to have an iron grip on their respective prices -- and nothing has changed in that regard over the last month. They are the cork in the price bottle.

That situation will persist until they either voluntarily give it up...or are told to step aside, as it now appears that there's no chance that they will ever get overrun. If that possibility had ever existed in reality, it would have happened already. However, considering the current state of the financial system, I suppose one shouldn't rule it out entirely.

I have a decent number of stories, articles and videos for you today...including a few that I've been saving for length and/or content reasons.

![]()

CRITICAL READS

Hiring falters in December as payrolls rise only 199,000, though the unemployment rate fell to 3.9%

The U.S. economy added far fewer jobs than expected in December just as the nation was grappling with a massive surge in Covid cases, the Labor Department said Friday.

Nonfarm payrolls grew by 199,000, while the unemployment rate fell to 3.9%, according to Bureau of Labor Statistics data. That compared with the Dow Jones estimate of 422,000 for the payrolls number and 4.1% for the unemployment rate.

“The new year is off to a rocky start,” wrote Nick Bunker, economic research director at job placement site Indeed. “These less than stellar numbers were recorded before the omicron variant started to spread significantly in the United States. Hopefully the current wave of the pandemic will lead to limited labor market damage. The labor market is still recovering, but a more sustainable comeback is only possible in a post-pandemic environment.”

This news item put in an appearance on the cnbc.com Internet site at 8:31 a.m. EST on Friday morning -- and comes to us courtesy of Swedish reader Patrik Ekdahl. Another link to it is here. The Zero Hedge spin on this is headlined "December Payrolls Huge Miss Again, Just 199K Jobs Added, as Unemployment Rate Tumbles" -- and I thank reader B.R. for that one.

![]()

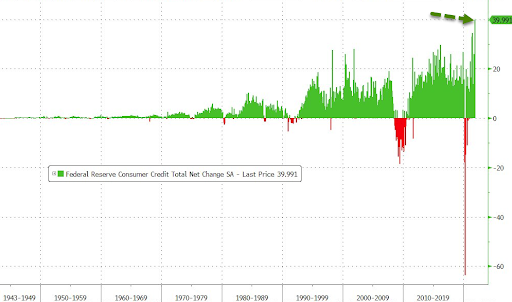

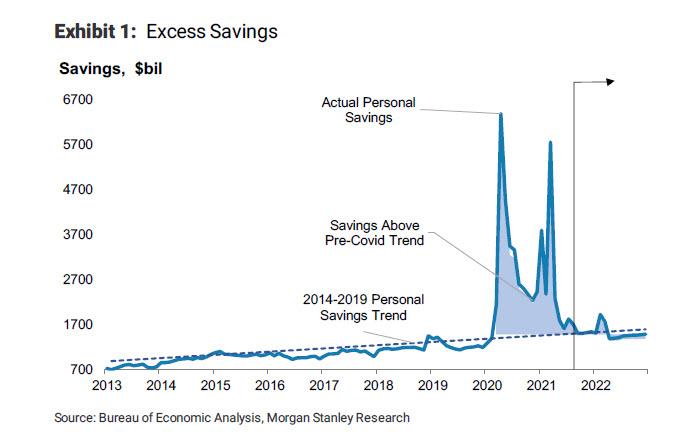

Shocking Consumer Credit Numbers: U.S. Credit Card Debt Soars Most on Record With Savings Long Gone

While it is traditionally viewed as a B-grade indicator, the November consumer credit report from the Federal Reserve was an absolute stunner and confirmed what we have been saying for month: any excess savings accumulated by the US middle class are long gone, and in their place Americans have unleashed a credit-card fueled spending spree.

Here are the shocking numbers: in November, consumer credit exploded by a whopping $40 billion, double the expected $20 billion print, more than double the $16 billion October number, and the highest on record! The click to enlarge feature DOES NOT HELP.

And while non-revolving credit (student and car loans) jumped by a solid, if not necessarily remarkable $20 billion, this was only the 7th biggest increase for the series in record...the real stunner was revolving, or credit card debt, which more than tripled in November, soaring to $19.8 billion from $6.6 billion in October, by far the highest such print on record.

While this unprecedented rush to buy everything on credit ahead of and during the Thanksgiving holiday should not come as much of a surprise, after all we have repeatedly shown that for the middle class any "excess savings" are now gone, long gone...Click to enlarge.

... the fact is that most economists - such as those at Goldman Sachs - anticipate that continued spending of savings is what will keep the U.S. economy levitating in 2022. Unfortunately, as today's consumer credit numbers clearly demonstrate, any savings that US middle class households may have had courtesy of stimmies, are now gone. The implications are profound: any model that projected that U.S. spending will be fueled by "savings" can now be trashed. And since this is most of them, the consequences are dire as they confirm - once again - that the Fed is tapering, QTing and hiking right into a recession.

This story showed up on the Zero Hedge website at 3:18 p.m. on Friday afternoon EST -- and another link to it is here.

![]()

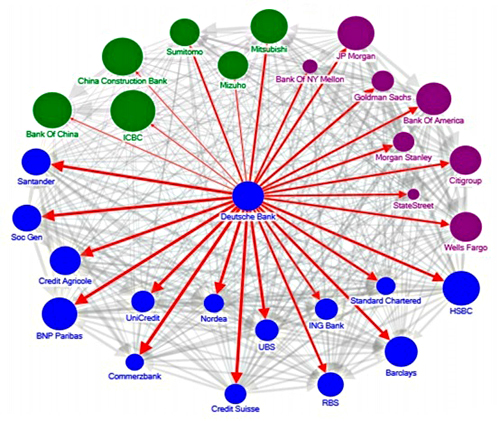

These Charts Are the Smoking Guns in the Fed’s 2019-2020 Emergency Repo Loan Bailouts

Nine days ago the Fed released the names of the Wall Street trading houses that had borrowed a cumulative total of $4.5 trillion in emergency repo loans from the Fed during just the last quarter of 2019. From September 17, 2019 through July 2, 2020, the same banks had borrowed a cumulative total of $11.23 trillion. The Fed is slowly doling out the names of the banks and the specific amounts borrowed on a quarterly basis, after eight quarters of time has elapsed. The Fed is only releasing the information because the Dodd-Frank financial reform legislation of 2010 made it a legal obligation of the Fed to do so. The Fed had fought a multi-year court battle with the press after the 2008 financial crisis to keep its secret bailouts to Wall Street firms hidden from the American people.

Strange as it may seem, the same press outlets that battled the Fed in court following the 2008 financial crisis to get the names of the banks and the amounts borrowed, have this time around invoked a total news blackout on publishing the names of the banks.

One of the large borrowers under this 2019-2020 Fed facility was not even a U.S. bank. On October 8, 2019 the Fed conducted a one-day (overnight) repo loan operation, offering $37.5 billion. Deutsche Bank Securities, a unit of the giant German bank, took two lots totaling $7.5 billion. On the same day, Deutsche Bank Securities took another $3 billion of a 14-day term repo loan offered by the Fed, bringing its total borrowing from the Fed on just that one day to $11.5 billion. But the 14-day term loan that Deutsche Bank Securities had previously taken on September 27 for $3 billion had not yet expired, so it actually had an outstanding Fed loan balance at that point of $14.5 billion.

The Fed, the U.S. central bank, was making loans of this size (although they were collateralized) to the trading unit of a serially troubled foreign bank.

October 8, 2019 was just 13 days after Deutsche Bank’s headquarters in Frankfurt, Germany were raided by police for the second time in less than a year. The police were probing a vast money laundering operation in Europe. On January 30, 2017, Deutsche Bank was fined a total of $630 million by U.S. and U.K. regulators over claims it had laundered upwards of $10 billion on behalf of Russian investors.

This was not a propitious time for Deutsche Bank to be splashing about in the headlines over having its headquarters raided again. It was one of the largest derivative counterparties (taking the other side of derivative trades) to some of the largest systemically important banks in the world, including the largest U.S. banks.

This commentary from Pam and Russ Martens showed up on the wallstreetonparade.com Internet site on Friday -- and I thank reader B.R. for sending it our way. Another link to it is here.

![]()

The Great Debate: Peter Schiff vs. Brent Johnson -- Dollar Predictions For 2022

George Gammon got Peter Schiff and Brent Johnson together to do a moderated simultaneous interview, which to some extent was also a debate. It runs just over one hour.

Essentially, both men agree that precious metals and mining stocks are an essential part of any portfolio, and that they will rise greatly in value as the fiat currencies decline.

Where they disagree is on the time it will take for things to play out, and the fiat dollar to collapse via inflation and metals prices to make their long awaited huge upward move.

Peter Schiff says it will happen in the relatively near future… though like Mike Maloney and countless others… they have been saying that for well over 15 years.

Brent Johnson says Peter and the many people who likewise believe that this great reckoning is just-around-the-corner are wrong. Johnson says they are underestimating the strength, resourcefulness, and resolve of the corrupt U.S. Government / FED / Treasury / Monetary System cabal, and its ability to manipulate everything and kick the can down the road for many more years to come. Johnson says they are also failing to adequately account for the fact that the U.S. Dollar is very heavily needed by foreign nations due to the global reserve currency position of the dollar, which will not just disappear quickly. Johnson presents some powerful arguments that while the system must eventually collapse and metals and metal equities must rise… it is several years into the future before the fullness of this is realized.

This very interesting 1-hour debate with moderator George Gammon was posted on the youtube.com Internet site on Monday -- and I thank reader John L. Jeffcoat III for the link -- and providing the above paragraphs of introduction. Another link to this worthwhile debate is here.

![]()

Omicron dents euro zone's economic rebound; inflation at record high

Euro zone economic sentiment dropped more than expected last month while inflation hit another record high, indicating the economy is under renewed stress as surging coronavirus infections force governments to tighten restrictions.

With infections breaking records almost daily as the Omicron variant sweeps across Europe, growth is likely to take a hit around the turn of the year even though governments have largely avoided the debilitating measures that brought their economies to a standstill a year ago.

Foreshadowing the pain, the European Commission's Economic Sentiment Indicator, a key gauge of the bloc's economic health, fell more sharply than forecast in December to a level last seen in May. The outlook for services worsened significantly and employment expectations also fell.

In Germany, the euro zone's biggest economy, the slowdown is already evident in hard data.

This Reuters story, filed from Frankfurt, appeared on their Internet site at 4:13 a.m. Pacific Standard Time on Friday morning -- and comes courtesy of Patrik Ekdahl. Another link to it is here.

![]()

Issue (singular) 2022. Is “money” (monetary inflation) more the solution or the problem? For a number of years now, I’ve highlighted in my January “Issues” pieces the Credit Bubble Maxim: “The Bubble Either Further Inflates or Bursts.” As I detailed in “2021 Year in Review,” last year’s Bubble inflation went to perilous extremes. This significantly raised the odds for a destabilizing 2022 bursting episode.

Our nation (and the world) was profoundly scarred by the Great Depression experience. At the time, it was recognized that years of Bubble excess had fostered deep economic structural maladjustment. The Credit system had degenerated into a mechanism promoting epic asset inflation, mal-investment and chicanery. The securities markets devolved into a bastion of speculation, with destructive end-of-cycle excesses (1927-1929) placing the system in great peril. Boomtime Federal Reserve monetary management was an abject failure. And, especially late in the cycle, resources – real and financial – could not have been more poorly (or inequitably) allocated. Years of accelerating Credit and speculative excess – and attendant Monetary Disorder - ensured hopelessly over-levered and dysfunctional Bubble markets.

Milton Friedman and Anna Schwartz couldn’t accept that free market Capitalism had gone completely off the rails; that markets were not rationally self-regulating. Throughout their almost 900-page tome, discussion of the key topics Credit and Credit excess were curiously omitted. In portentous historical revisionism, they fashioned analysis that the Great Depression was not the upshot of boom-time excess, but rather the result of Federal Reserve negligence for not flooding the system with money after the 1929 crash and subsequent banking crisis. The “Roaring Twenties” were designated “the golden age of Capitalism.” Their fallacious thesis was eagerly accepted by an intelligentsia happy to button up the depression experience and move on.

The trio Friedman, Schwartz and Bernanke converge for the greatest misadventure in central bank monetary doctrine the world has ever experienced. I’ve argued for years now that history’s greatest Bubble would end in catastrophe. In the meantime, however, it has appeared nothing short of the “Golden Age of Capitalism.” Last year’s monetary madness fueled “Roaring Twenties” redux.

We’re living history. The backdrop could not simultaneously be more fascinating, intriguing and deeply troubling. I could be back this time next year again chanting, “Bubbles inflate or burst.” But I have high conviction it’s time to be prepared. “We are never prepared for what we expect” (James A. Michener). And as we begin 2022, never has a phrase seemed more germane: Let’s hope for the best, but prepare for the worst.

This long but very worthwhile commentary from Doug put in an appearance on his Internet site in the wee hours of Saturday morning Pacific Standard Time -- and another link to it is here. Gregory Mannarino's post market close rant for Friday is linked here.

![]()

The Warning We Ignored: Del Bigtree Interviews G. Edward Griffin

An almost 40 year-old interview with an ex-KGB Defector, Yuri Bezmenov, has re-emerged and is going viral. Why is it going viral now? Del sits down with the journalist who conducted that interview, G. Edward Griffin, for a deep dive into the Russian spy’s extraordinary warning to the American people in 1984, and why this warning must be heeded today.

I've only had the time to watch the first twenty minutes of this -- and I implore you to look at least that much of it. If you wish to see our future, it is here. This long [1 hour 17 minute] video interview was posted on thehighwire.com Internet site earlier in the week -- and it's more than worth your while if you have the time. I thank Roy Stephens for sharing it with us -- and another link to it is here.

![]()

Steppe on Fire: Kazakhstan’s Color Revolution -- Pepe Escobar

So is that much fear and loathing all about gas? Not really.

Kazakhstan was rocked into chaos virtually overnight, in principle, because of the doubling of prices for liquefied gas, which reached the (Russian) equivalent of 20 rubles per liter (compare it to an average of 30 rubles in Russia itself).

That was the spark for nationwide protests spanning every latitude from top business hub Almaty to the Caspian Sea ports of Aktau and Atyrau and even the capital Nur-Sultan, formerly Astana.

The central government was forced to roll back the gas price to the equivalent of 8 rubles a liter. Yet that only prompted the next stage of the protests, demanding lower food prices, an end of the vaccination campaign, a lower retirement age for mothers with many children and – last but not least – regime change, complete with its own slogan: Shal, ket! (“Down with the old man.”)

The “old man” is none other than national leader Nursultan Nazarbayev, 81, who even as he stepped down from the presidency after 29 years in power, in 2019, for all practical purposes remains the Kazakh gray eminence as head of the Security Council and the arbiter of domestic and foreign policy.

The prospect of yet another color revolution inevitably comes to mind: perhaps Turquoise-Yellow – reflecting the colors of the Kazakh national flag. Especially because right on cue, sharp observers found out that the usual suspects – the American embassy – was already “warning” about mass protests as early as in December 16, 2021.

Maidan in Almaty? Oh yeah. But it’s complicated.

With very worthwhile commentary from Pepe is certainly worth reading, if you have the interest that is -- and it was posted on the saker.is Internet site on Thursday night -- and I found it on Zero Hedge. Another link to it is here. A related ZH story from yesterday afternoon is headlined "Kazakh President Issues "Shoot to Kill Without Warning" Order As Armed Insurgent Groups Form" -- and I thank reader B.R. for pointing it out.

![]()

I didn't see any precious metal-related news items that I thought worth posting. The one that was worthy of your time was hidden behind their subscription wall -- and the usual method I use to dig it out, didn't work for that website.

![]()

The Photos and the Funnies

Here are the last four photos of our whirlwind tour of Hatley Castle and its grounds just west of Victoria, B.C. on 13 December 2020. We were surprised to find peacocks on the property you see in photo two -- and I'm somewhat embarrassed to say that they're out of focus. I was using a large f-stop for the shot -- and thought them far away enough to be within the lens's depth-of-field, but I was wrong. The last shot was taken on the way back to the parking lot of a little girl running to catch up with her parents. That splash of colour against the green and a somber gray sky, was worthy of a photo. Click to enlarge.

![]()

The WRAP

Today's pop 'blast from the past' is from Sweden's most famous pop group. The song was released in February 1977 as the third single from the group's fourth album, Arrival. It's hard to believe that this was 45 years ago! You'll know it immediately -- and the link is here. Of course there's a bass cover to it -- and it's not only superb, but trickier than it looks as well. Rutger Gunnarsson was one the great bass guitarists -- and that's linked here.

Today's classical 'blast from the past' is a showpiece virtuoso violin work composed by Pablo de Sarasate. It's his Carmen Fantasy, Op. 25, on themes from the opera Carmen by Georges Bizet. To say that it's considered to be one of the most challenging and technically demanding pieces for the violin, would be the understatement of this century, or any other. American-born virtuoso violinist Hilary Hahn tosses it off -- and the Frankfurt Radio Symphony Orchestra accompanies. The link is here.

![]()

Considering the somewhat precipitous decline in the dollar index yesterday, the reaction of silver and gold prices was muted -- and I didn't see much sign of heavy interference in their prices, as their touch was very light when it did appear. And why the didn't respond, is a mystery.

And as I commented in my Commitment of Traders discussion further up, we're back in an ultra-bullish configuration from a COMEX futures perspective. But as you already know, that means nothing if the Commercial traders of whatever stripe aren't prepared to leave their hands in their pockets when the next rally is allowed to begin.

Gold touched its 200-day moving average to the upside yesterday, but was tapped lower before it could break above it. Silver hit a new intraday low on Friday, closing well above that mark, but still a very long way below any moving average that matters.

Platinum was closed at a new low for this move down -- and is now below its 50-day moving average by 30 bucks in its current front month. Palladium's big gain took it back above its 50-day moving average by a bit, but it's still 400 bucks below its 200-day.

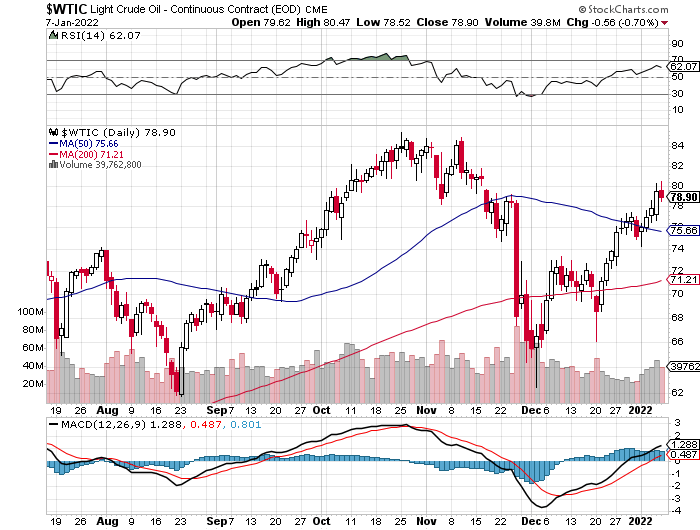

Copper closed up 6 cents a pound -- and is back above both its 50 and 200-day moving averages, but only by a nickel. WTIC closed down 56 cents/barrel at $78.90 per.

Here are the 6-month charts for the Big 6 commodities, thanks to stockcharts.com as always. Click to enlarge.

As I scan the news headlines at Zero Hedge, the King Report -- and other publications every day in search of stories for this column, it's sad to see how corrupt all three branches of the U.S. government have become -- the Executive, the Legislative and the Judicial. The "separation of powers" has become almost nonexistent. As Gregory Mannarino has correctly pointed out on numerous occasions, the Federal Reserve and the Wall Street banking syndicate now run the show...not only at home, but abroad.

Of course this corruption is not at all confined to the U.S. Here in Canada, the descent into tyranny has accelerated, as all three political parties, regardless of their so-called "ideological differences", are all sounding the same these days. It's even worse in places like Australia, New Zealand and the U.K. In some countries in Europe, Austria and Germany in particular, the rhetoric is sounding like that heard under the Nazis.

The deep state/New World Order crowd are now closing in for the kill at an ever-increasing rate with each passing week -- and now with each passing day.

And regardless of all the happy talk on the deep state-controlled media, the world economy continues to sink further into the abyss.

The only thing holding it all together is the 24/7 intervention by the powers-that-be in whatever markets they see fit -- and the non-stop money printing by the world's central banks.

As Nick Giambruno stated in an article posted over at the internationalman.com website yesterday...

"The Fed has two choices: 1) keep printing trillions and let inflation skyrocket or 2) tighten monetary policy and watch the markets crash.

In other words, it can sacrifice the stock market or the dollar.

When faced with the choice, politicians usually choose the most expedient option. Therefore they are likely to choose the easy option—keep printing money.

Max Keiser summed up the situation best, "you can’t taper a Ponzi scheme."

On a slightly different tack, I note that Goldman Sachs is out with yet another forecast of a commodities supercycle...

"Oil prices could reach $95 if Iran doesn’t return to the market this year, while commodities overall are set for a supercycle that could potentially last a decade, according to Goldman Sachs, which is “extremely bullish” on the whole commodity complex.

Currently, we are seeing record dislocations in energy markets, metals markets, and agriculture markets, Jeff Currie, global head of commodities research at Goldman Sachs, told Bloomberg Television in an interview on Thursday.

There is still a lot of money in the system, while investment positions in commodities are very low, which is setting the stage for further upsides in oil prices and the prices of other commodities, Currie said.

“The best place to be right now, particularly given the Fed pivot, are commodities.”

“We think you’re going to see another year of out-performance of commodities and real assets more broadly,” Currie added."

The rigging of precious metal prices is now obvious to all, whether they care to admit it or not. This fact is no longer debatable -- and as you're more than aware, the precious metals haven't been allowed to join in the rally in commodities that we've already had to this date. So it remains to be seen if they'll be allowed to join he party during the next rally in commodity prices once it materializes.

From a COMEX futures market perspective, we're certainly set up for it. However, we've been in this position on many occasions in the past...only have our hopes crushed.

But when it's finally allowed to come to pass, then I can't help but think once more that the end of the bull market in all things paper will be its first casualty, as the move from paper and into "real assets" as Currie states, will turn from a trickle into a flood. This would be especially true if the price management scheme in the precious metals is abandoned at that point.

Whether or not the New World Order crowd will make their move sometime during this hoped-for commodities cycle is unknown. But what I do known, is that this "everything bubble" that has grown slowly -- and now to Frankenstein proportions since we were taken off the gold exchange standard 51 years ago, owes its entire existence to our current debt-based monetary system.

Ludwig von Mises, the godfather of free-market Austrian economics, summed up the Fed’s -- and the other central banks of the world's dilemma when he stated this now-familiar quote:

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved."

One or the other is in our future, but as I and other have already pointed out repeatedly, this time it will be global -- and only those holding Mr. Currie's "real assets" will survive it.

So despite the losses I/we've had imposed upon us over the last year, I see no intelligent alternative to investing in commodities in general -- and the precious metals in particular.

I'll end this Saturday column as I always state...I'm still "all in" -- and will remain that way to whatever end.

I'm done for the day -- and the week -- and I'll see you on Tuesday.

Ed