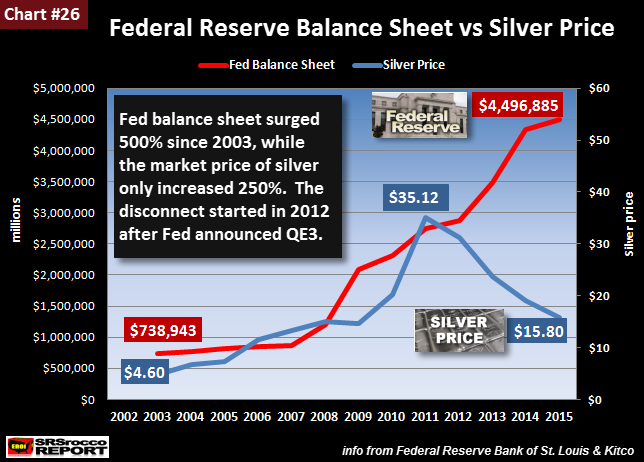

Something quite interesting happened as the Federal Reserve increased its balance sheet from 2003 to 2012. As the Fed’s balance sheet jumped from $738 billion to $2.8 trillion by 2012, the price of silver increased to $30 that year. However, as the Fed continued to increase its balance sheet by printing money and acquiring worthless assets, the price of silver changed direction and headed lower over the next four years.

According to information and Chart #26 published in THE SILVER CHART REPORT:

The Fed’s balance sheet was $738 billion in 2003, but grew to $2.8 trillion by 2012, thanks to Quantitative Easing 1 – QE1 (adding $800 billion in bank debt, including U.S. Treasuries and mortgaged-backed-securities –source) and QE2 (adding $600 billion in U.S. Treasuries –source).

The Fed basically printed money out of thin air to purchase these financial instruments, which it placed on its balance sheet. As the market realized the Fed’s QE policies were quite inflationary, silver investment surged, pushing the price of silver to a record annual price of $35.12 in 2011. However, something interesting took place when the Fed announced QE3 in September 2012.

The QE3 policy allowed the Fed to purchase $40 billion a month of mortgaged-backed securities and $45 billion of U.S. Treasuries. From the end of 2012 until 2015, the Fed’s balance sheet increased another $1.7 trillion, to $4.5 trillion. The market began anticipating QE3 after then-Fed Chairman Ben Bernanke stated that more easing might be necessary in a press conference held on June 20, 2012 (source).

Investors started buying silver in early July 2012 at the low price of $26 and by the time QE3 was announced on Sept 12, the price skyrocketed to $35. Unfortunately, the price of silver did not continue to rise with the Fed’s balance sheet as it did before, but rather started a long bear market decline, to a low of $15 in 2015. Instead of the QE3 liquidity heading into the precious metals or commodities, the majority went into the broader stock and bond markets.

Again, that came from THE SILVER CHART REPORT. As we can see, the price of silver is now close to $14. Fortunately for the fundamentals of owning precious metals, the Fed is in a real corner. While some individuals believe the Central Banks will control the paper prices of gold and silver indefinitely, this is one hell of a lousy assumption.

At some point, the Fed and Central Banks will lose control of the market and things will get out of hand rapidly. The idea that the paper price of gold and silver will head toward zero as monetary printing and debt skyrocket towards the heavens… just goes to show how serious the BRAIN DAMAGE has become in a good percentage of Americans.

————

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: