YESTERDAY in GOLD, SILVER, PLATINUM and PALLADIUM

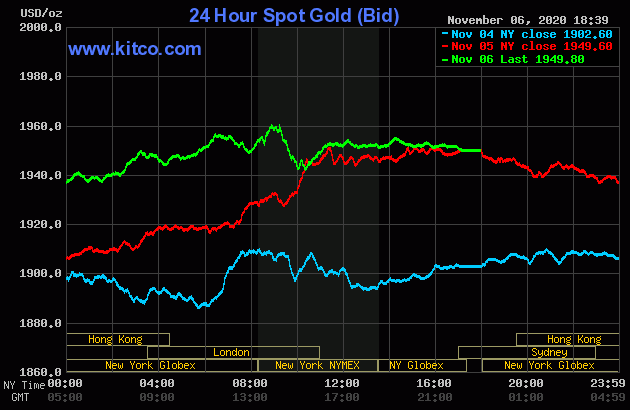

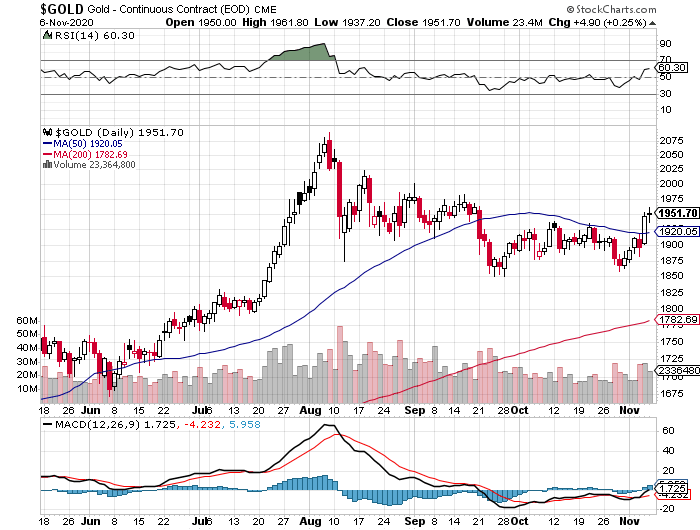

The gold price was sold quietly lower once trading commenced at 6:00 p.m. EDT in New York on Thursday evening -- and that lasted until shortly after 12 o'clock noon China Standard Time on their Friday afternoon. It traded flat until about 2:30 p.m. CST -- and then began to head higher. But it's obvious from the Kitco chart below, that every time it appeared that the rally was about to get too jiggy to the upside, there was someone there to sell if lower, with the final capping coming around 8:45 a.m. in New York. It was sold lower until around 10:20 a.m. EST -- and then edged higher until about 10 minutes after the 11 a.m. EST London close. From that juncture it crept quietly and a bit unevenly lower until the market closed at 5:00 p.m. EST.

The high and low ticks in gold were recorded as $1,961.80 and $1,937.20 in the December contract. The December/February price spread differential in gold at the close yesterday was $7.40...February/April was $5.90 -- and April/June was $4.50.

Gold was closed in New York on Friday afternoon at $1,949.80 spot, up the magnificent sum of 20 cents on the day. Net volume was very decent at a bit over 197,500 contracts -- and there was a bit over 44,500 contracts worth of roll-over/switch volume out of December and into future months...mostly February and April.

|

|

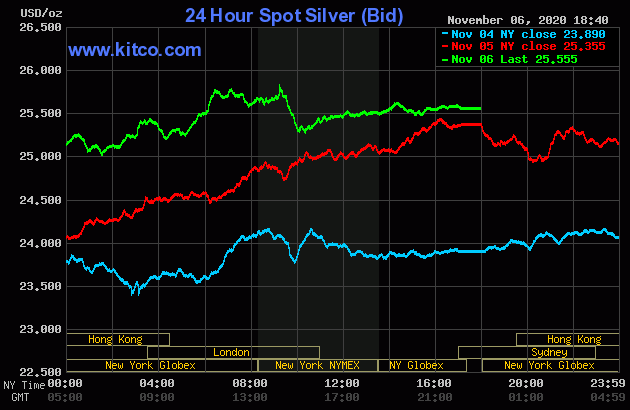

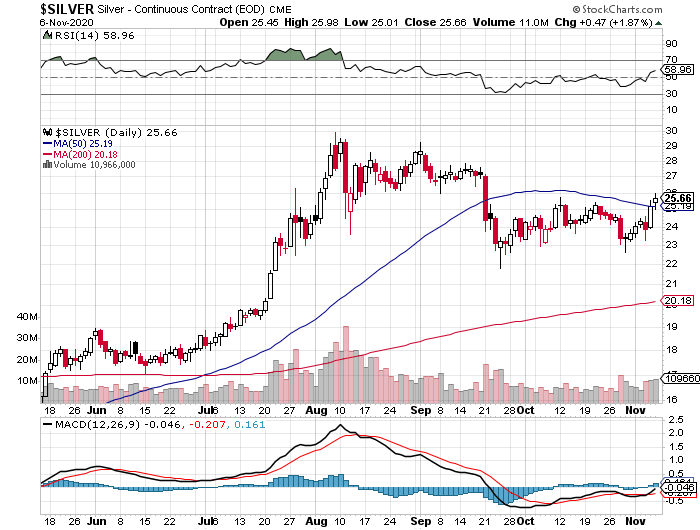

The price path for silver was guided in a similar fashion as gold's, with its high tick coming at 9:15 a.m. in New York as well, although its price was capped about thirty minutes before that. It was sold lower until 10:20 a.m. EST -- and from that juncture it crept a bit higher until around 2:15 p.m. EST in after-hours trading. It didn't do much after that.

The low and high ticks in silver were reported by the CME Group as $25.01 and $25.975 in the December contract. The December/March price spread differential at the close in New York yesterday afternoon was 14.9 cents...March/May was 8.9 cents -- and May/July was 8.4 cents.

Silver was closed in New York on Friday afternoon at $25.555 spot, up 20 cents from Thursday -- and miles off its Kitco-recorded $25.93 spot high tick. Net volume was pretty heavy at a bit under 92,500 contracts -- and there was a bit over 20,500 contracts worth of roll-over/switch volume out of December and into the New Year...mostly March and May.

|

|

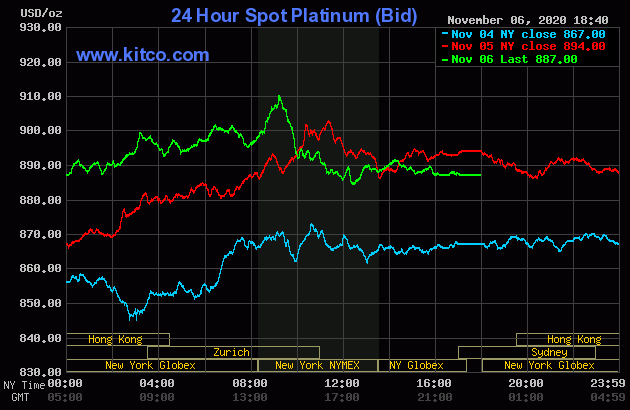

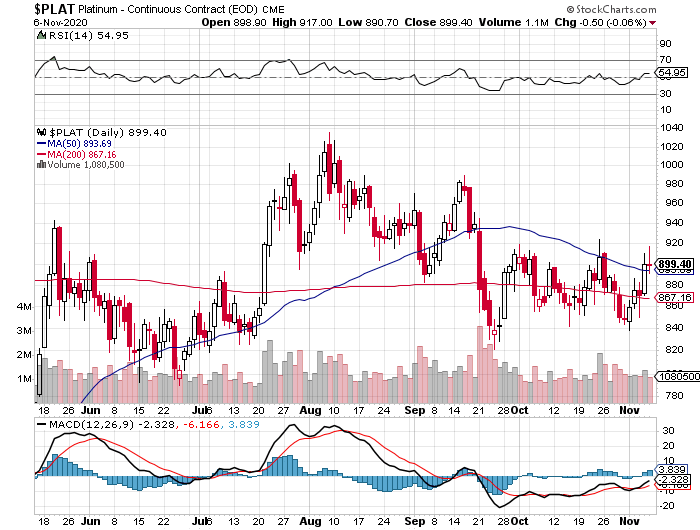

Platinum's price path was guided in a similar manner as both silver and gold, complete with the final price-capping around 9:15 a.m. in New York. It was then sold lower into the 10 a.m. EST afternoon gold fix in London and, like gold, was then sold very quietly lower until trading ended at 5:00 p.m. EST. Platinum was closed at $887 spot, down 7 dollars from Thursday -- and also miles off its Kitco-recorded $920 spot high tick.

|

|

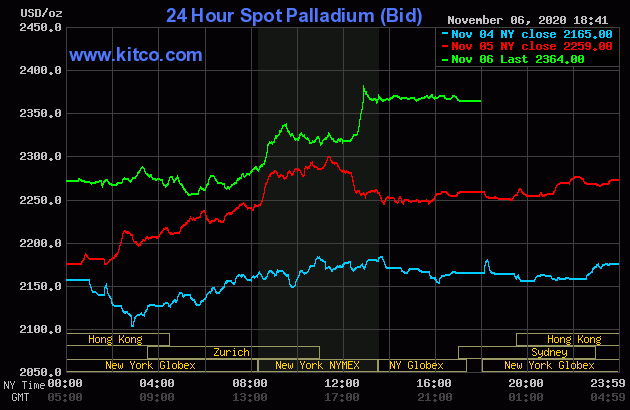

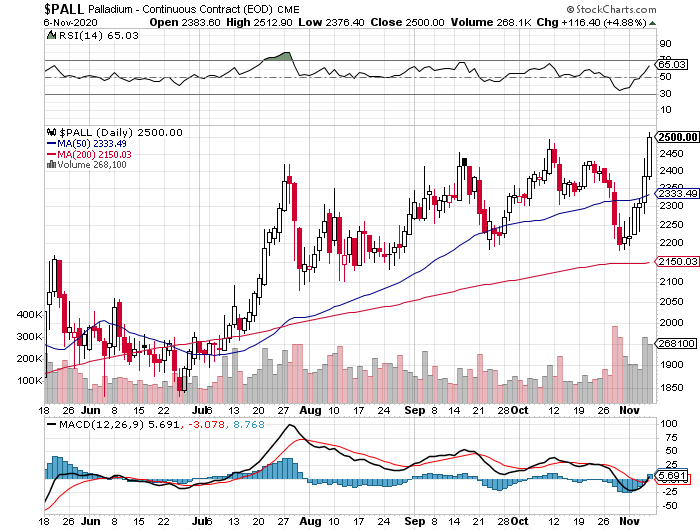

The palladium price traded quietly sideways until around 10 a.m. China Standard Time on their Friday morning -- and it then edged a bit higher at that point. From there it didn't do much of anything until around noon in Zurich/7 a.m. in New York. It then rallied a bit until ran into 'something' at the same time as the other three precious metals...9:15 a.m. EST. It was capped and turned a bit lower at that juncture -- and it then didn't do much until around 12:30 p.m. Then away it went to the upside in a parabolic move -- and appeared to go 'no ask' minutes before 1 p.m. EST. It was obvious that a not-for-profit seller appeared to cap the price and turn it a bit lower going into the 1:30 p.m. COMEX close -- and it then traded flat until 5:00 p.m. EST. Palladium was closed at $2,364 spot, up $105 on the day, but probably would have closed higher by ten times that amount if allowed to trade freely.

|

|

Based on the spot closing prices in both silver and gold, thanks to the kitco.com data posted above, the gold/silver ratio worked out to 76.3 to 1 on Friday...compared to 76.9 to 1 on Thursday.

And here's the 1-year gold/silver ratio chart, updated with this week's data. Click to enlarge if necessary.

|

|

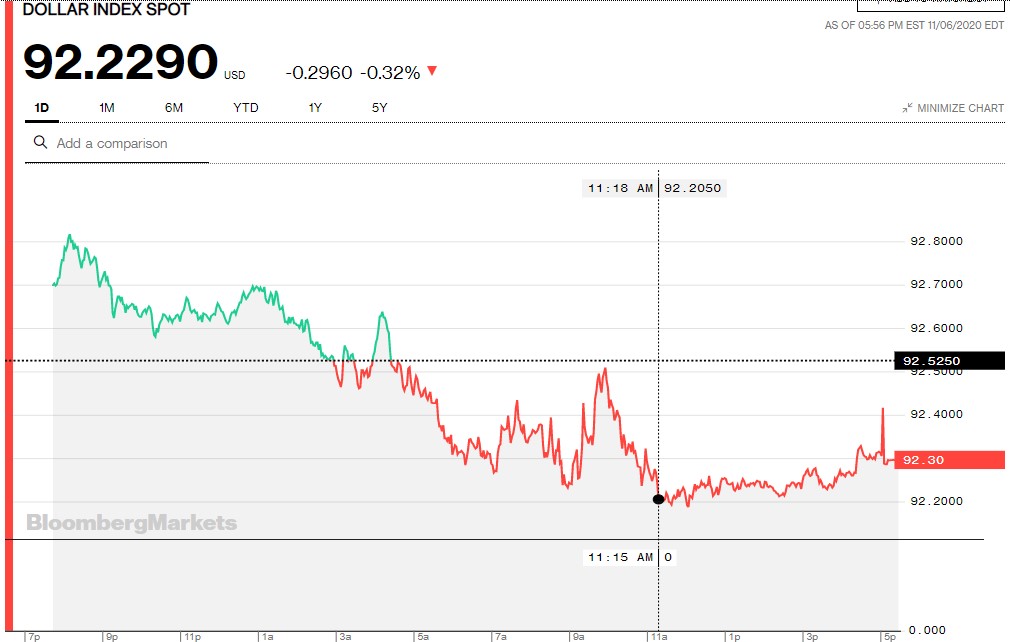

The dollar index closed very late on Thursday afternoon in New York at 92.525 -- and opened up about 18 basis points once trading commenced around 7:45 p.m. EST on Thursday evening, which was 8:45 a.m. China Standard Time on their Friday morning. It rallied to its 92.82 high tick at 9:10 a.m. CST -- and from there the long, slow and uneven price decline began, with all of the decline that mattered coming by 11:18 a.m. in New York. From that juncture it crept quietly higher until trading ended at 5:30 p.m. EST.

The dollar index was marked-to-close on Friday afternoon at 92.229...down 29.6 basis points from its close on Thursday -- and 7 basis points below its indicated close on the DXY chart below.

Here's the DXY chart for Friday, courtesy of Bloomberg as always. Click to enlarge.

|

|

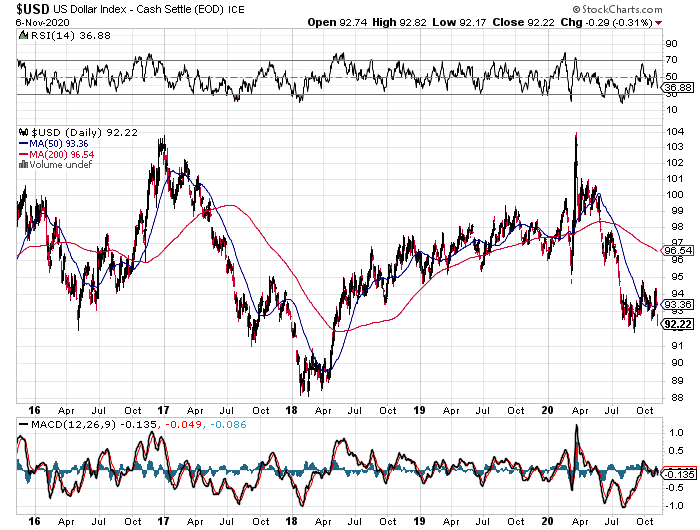

And here's the 5-year U.S. dollar index chart that appears in this spot in every Saturday column, courtesy of the good folks over at the stockcharts.com Internet site. The delta between its close...92.22...and the close on the DXY chart above, was about 1 basis point below its spot close on Friday. Click to enlarge.

|

|

I will point out here that the brief up/down move in the dollar index that commenced around 9:10 a.m. in New York -- and topped out a few minutes before the 10 a.m. EST afternoon gold fix in London, was used by 'da boyz' to beat all four precious metal prices lower. And even though the dollar index fell to a new low on the day by around 11:20 a.m. in New York, this decline was not allowed to manifest itself in the prices of the four precious metals.

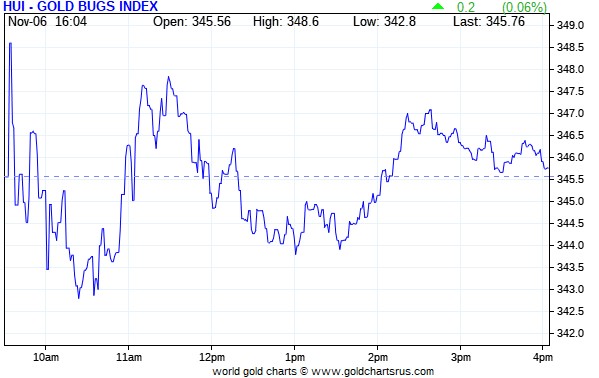

The gold shares gapped higher at the open, but were sold down a bit below the unchanged mark immediately -- and from that point the wandered unevenly sideways either side of unchanged for the remainder of the New York trading session. The HUI closed higher by an insignificant 0.06 percent, so call it unchanged.

|

|

The silver equities fared better. After chopping around the unchanged mark for the first thirty minutes or so, they caught a bit shortly after the 10 a.m. afternoon gold fix in London -- and their respective highs came around 10:35 a.m. EST in New York trading. From that juncture they had a down/up/down move that took them lower going into the 4:00 p.m. close. Those moves were rather counterintuitive considering the fact that the silver price crawled quietly higher for the rest of the day. Nick Laird's Intraday Silver Sentiment Index closed higher by only 1.14 percent. Click to enlarge if necessary.

|

|

Computing the above index manually, showed that it closed higher by 1.27 percent.

And here's Nick's 10-year Silver Sentiment/Silver 7 Index chart, updated with Friday's doji -- and you can't see it on the chart below...or Thursday's big 'up' doji either. But it gives you some idea of how far we've come this year -- and also how much further we have to go. But it's nothing that a $50 silver price wouldn't fix in a hurry. Click to enlarge.

|

|

The star of the day was Coeur Mining, closing higher by 3.73 percent -- and the dog was SSR Mining, closing down 1.39 percent.

It's my opinion that there has been a stealth accumulation of the precious metal shares by the big money/deep state players going on for the last number of years -- and by the time we hit the $50 price mark again, the Silver 7 Index will be far higher than its old 2011 high.

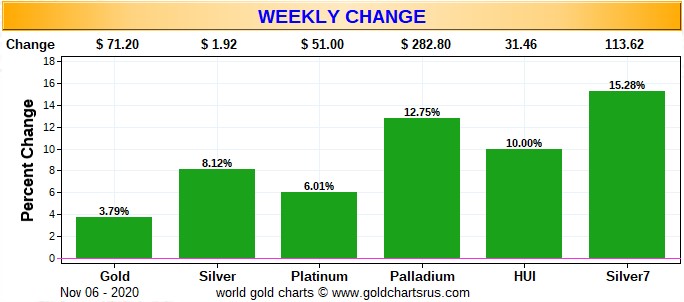

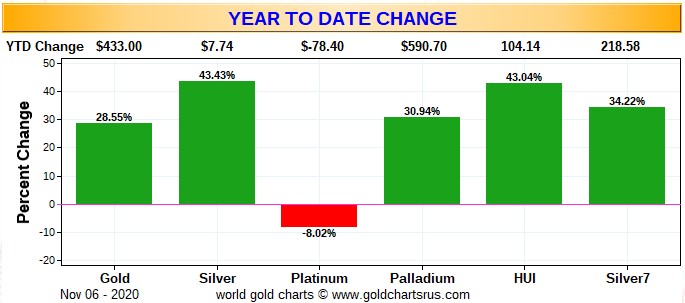

Here are two of the three usual charts that show up in every Saturday missive. The first one shows the changes in gold, silver, platinum and palladium for the past trading week, in both percent and dollar and cents terms, as of their Friday closes in New York - along with the changes in the HUI and the Silver 7 Index.

Here's the weekly chart -- and it's wall-to-wall green this week, compared to the bloodbath we saw in this chart last week. That was mostly due to the big up day we had on Thursday. But it should be noted that despite silver's big rally, it certainly wasn't reflected in the prices of the precious metal equities. Click to enlarge.

|

|

The month-to-date chart is the same as the weekly chart, so I shan't bother posting it.

Here's the year-to-date chart -- and with the exception of platinum, it's still green across the board. It's equally obvious that even though the gold stocks are 'outperforming' the silver equities on a relative basis...all of the precious metal equities are still vastly underperforming their respective underlying precious metals -- and it's most obvious on this chart, particularly in silver. Click to enlarge.

|

|

As per the COT and Days to Cover discussion a bit further down, the Big 8 traders are still mega short gold and silver -- and that situation hasn't changed one bit for months on end now. The short positions of the Big 8 traders in silver was unchanged week-over-week -- and their short position in gold decreased by an immaterial amount over the same period.

The CME Daily Delivery Report showed that 263 gold and 4 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, there were five short/issuers in total -- and the largest was Morgan Stanley, issuing 141 contracts out of its own account. They were followed by Marex and Advantage, with 93 and 22 contracts out of their respective client accounts. There were seven long stoppers -- and head and shoulders above all was Standard Charter, picking up 146 contracts for their house account. They were followed by Scotia Capital/Scotiabank, as they stopped 50 contracts for their own account as well. In third spot was JPMorgan...stopping 38 contracts for its client account.

In silver, the biggest short/issuer was ADM with 3 contracts from its client account. The two long/stoppers were Wells Fargo Securities and JPMorgan, with 2 contracts each...the former for its own account -- and the latter for their client account.

In platinum, there were another 4 contracts issued and stopped.

The link to yesterday's Issuers and Stoppers Report is here.

Month-to-date there have been 4,051 COMEX gold contracts issued/reissued and stopped -- and in silver that number is 486 contracts. In platinum, that number is 278 contracts.

The CME Preliminary Report for the Friday trading session showed that gold open interest in November rose by another 141 contracts, leaving 364 still around, minus the 263 contracts mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 116 gold contracts were posted for delivery on Monday, so that means that 141+116=257 more gold contracts were just added to the November delivery month. Silver o.i. in November increased by 47 contracts, leaving 274 still open, minus the 4 contracts mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 2 silver contracts were actually posted for delivery on Monday, so that means that 47+2=49 more silver contracts were added to November.

Total gold open interest on Friday increased by 3,813 contracts -- and total silver o.i. on Friday rose by 1,747 COMEX contracts. Both these numbers are 'preliminary' -- and both will be slightly adjusted [usually downward] when the final number appears on the CME's website mid-morning EST on Monday.

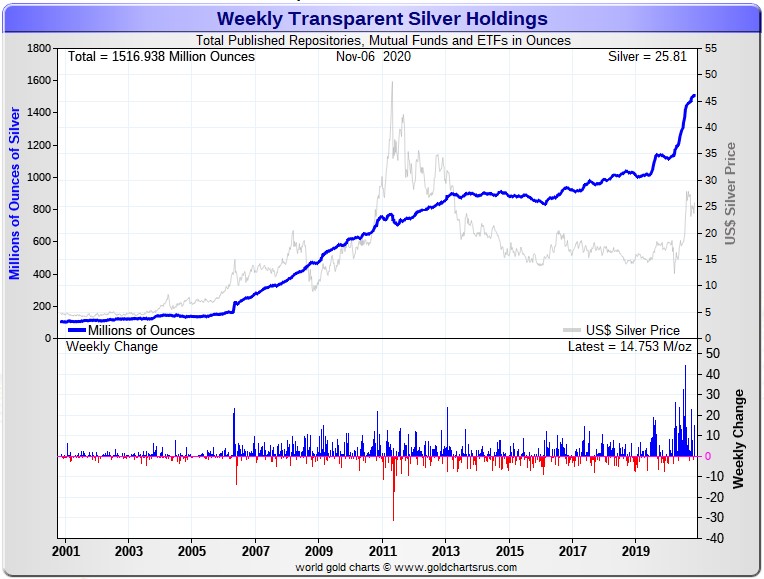

There was a very large deposit into GLD yesterday, as an authorized participant added 313,382 troy ounces of gold. There was an even larger deposit into SLV, as an a.p. added an eye-watering 10,323,622 troy ounces of silver -- and it's a given that Ted will have something to say about all this in his weekly review this afternoon.

I commented in yesterday's column that I had some concerns about the authorized participants of these two ETFs shorting the shares in lieu of depositing physical metal -- and those fears were laid to rest after seeing the above numbers.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX and GLD & SLV inventories, there was a net 8,469 troy ounces of gold added -- and a net 1,000,556 troy ounces of silver was added as well.

There was another sales report from the U.S. Mint yesterday. They reported selling 5,500 troy ounces of gold eagles -- and that was all.

Month-to-date the mint has sold 25,000 troy ounces of gold eagles -- 7,500 one-ounce 24K gold buffaloes -- and 1,653,000 silver eagles.

I've been checking the Royal Canadian Mint's website daily since the start of the month, hoping that they'd post their Q3/2020 report, but nothing so far. It could be another month before they finally get around to it.

It was yet another day where there was very little activity in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday. They didn't report receiving any -- and only shipped out 5,337.066 troy ounces...166 kilobars...SGE kilobar weight. 162 of those kilobars departed Manfra, Tordella & Brookes, Inc. -- and the remaining 4 kilobars were shipped out of Delaware. There was some paper activity, as 9,913 troy ounces was transferred from the Registered category and back into Eligible over at JPMorgan's 'Enhanced Delivery' sub-depository. The link to this is here.

It was very quiet in silver as well. Nothing was reported received -- and only 10,033 troy ounces...two COMEX contracts worth...was shipped out -- and that all departed CNT. The link to that, is here.

There was some decent activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday. All of this occurred at Brink's, Inc...as they received 500 of them -- and shipped out 41. The link to that, in troy ounces, is here.

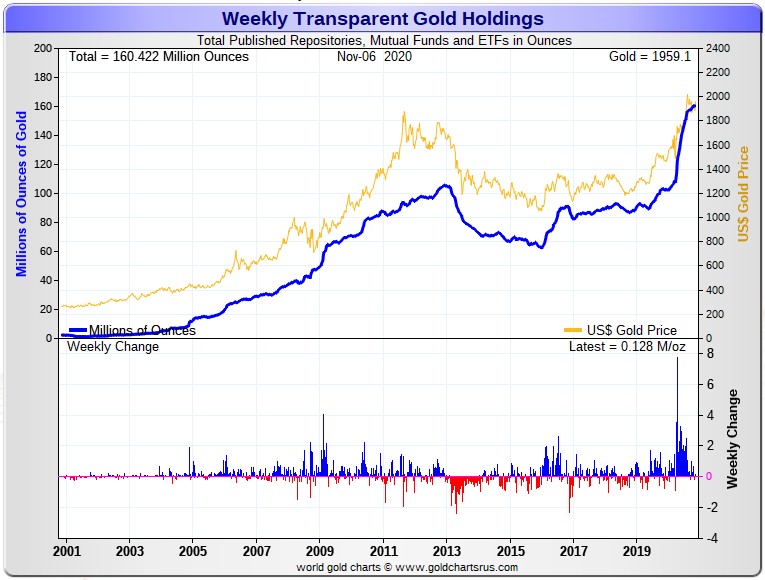

Here are the usual 20-year charts that appear in this space in every Saturday column. They show the total amount of gold and silver in all known depositories, mutual funds and ETFs as of the close of business on Friday.

For the week just passed, there was a net 128,000 troy ounces of gold added -- plus a stunning and net 14,753,000 troy ounces of silver was added as well...mostly into SLV. Click to enlarge for both.

|

|

|

|

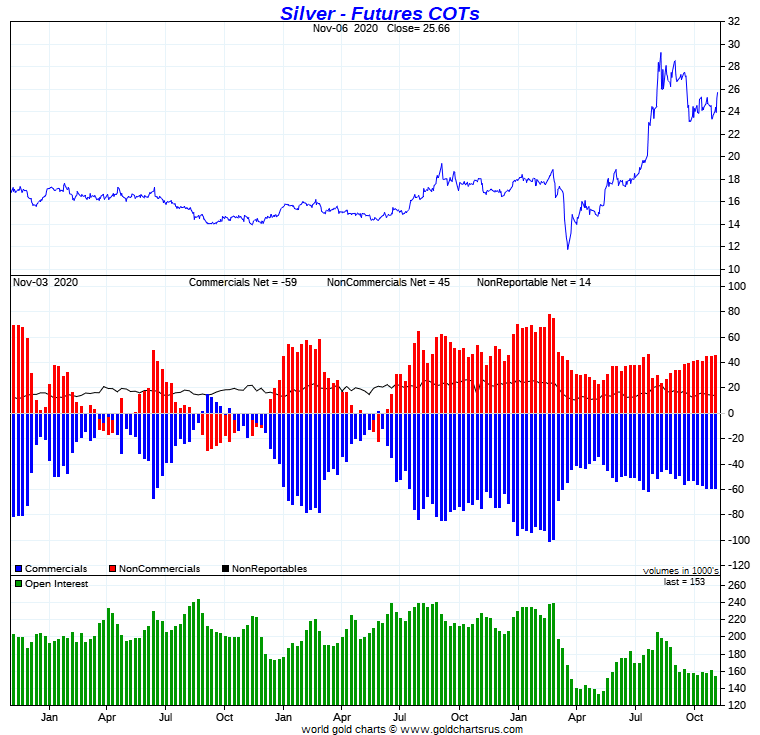

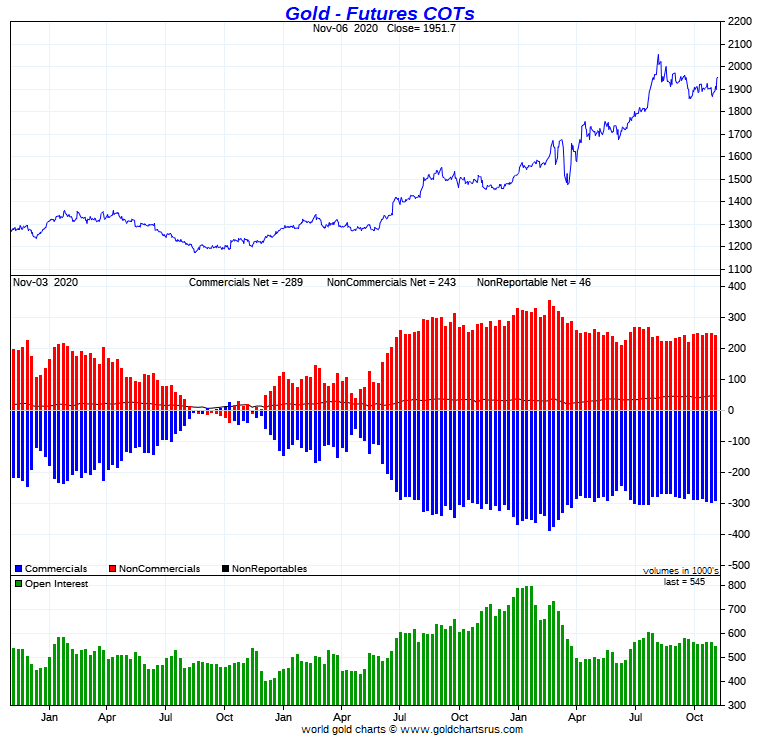

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday showed an immaterial increase in the Commercial net short position in silver -- and a rather smallish decrease in the commercial net short position in gold.

In silver, the Commercial net short position increased by an insignificant 245 contracts, or 1.23 million troy ounces.

They arrived at that number by reducing their long position by 2,529 contracts -- and also reduced their short position by 2,284 contracts. It's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, there wasn't much going on, either. The Managed Money traders decreased their net long position by 949 contracts, while the 'Other Reportables' increased their net long position by 1,659 contracts. The 'Nonreportable'/small traders decreased their net long position by 465 contracts.

Doing the math: 1,659 minus 949 minus 465 equals 245 COMEX contracts, the change in the Commercial net short position.

The Commercial net short position stands at 296.7 million troy ounces...up a tiny bit from the 295.4 million troy ounces they were short last week.

The Big 8 traders are short 371.6 million troy ounces in this week's COT Report, this amount represents 125 percent of the Commercial net short position. In last week's COT Report the Big 8 were short 371.7 million troy ounces, which is basically no change at all.

Looking at the Producer/Merchant category in the Disaggregated COT Report, Ted said that JPMorgan may have added around 1,000 contracts on the long side during the reporting week. They were market neutral last week.

Here's Nick's 3-year COT chart for silver, updated with Friday's data -- and there's nothing to see. Click to enlarge.

|

|

Since I didn't know what to expect in this COT Report for silver, the number didn't surprised me in the slightest. I would have preferred a decrease in the Commercial net short position of that amount, but alas. In the grand scheme of things, this week report was a big "nothing burger".

But what has happened since will be of far more interest when next Friday's COT Report comes out -- and there are still two more trading days left going into the Tuesday cut-off at the COMEX close.

In gold, the commercial net short position decreased by a fairly modest amount...7,124 contracts, or 712,400 troy ounces.

They arrived at that number by reducing their long position by 5,531 contracts, but they also reduced their short position by 12,655 contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was all Managed Money traders and a whole bunch more, as they decreased their net long position by 11,180 contracts, while the 'Other Reportables' increased their net long position by 5,455 contracts. The 'Nonreportable'/small traders decreased their net long position by 1,399 contracts.

Doing the math: 11,180 plus 1,399 minus 5,455 equals 7,124 COMEX contracts...the change in the commercial net short position.

The commercial net short position in gold now sits at 28.93 million troy ounces, down from the 29.65 million troy ounces that they were short in last week's COT Report...which isn't really a material change.

The Big 8 traders are short 23.81 million troy ounces of gold, which is a bit over 82 percent of the commercial net short position. In last week's COT Report, these same Big 8 traders were short 23.84 million troy ounces, so the 'improvement', like for the Big 8 in silver, is immaterial this week -- and has been for many months.

And it shouldn't be forgotten that the Big 8 shorts in gold are the same eight traders that are short up the wazoo in silver as well.

Ted says that JPMorgan's smallish longish position in gold probably didn't change too much during the reporting week...somewhere in the 3-5,000 contracts range on the long side.

Here's Nick Laird's 3-year COT chart gold, updated with yesterday's data. There's nothing to see here, either. Click to enlarge.

|

|

Of course it's what's happened in gold since the Tuesday cut-off that matters, especially after its big rally on Thursday. Of course, like in silver, there are still two more trading days to go before the cut-off for next Friday's COT Report -- and lots can happen between now and then.

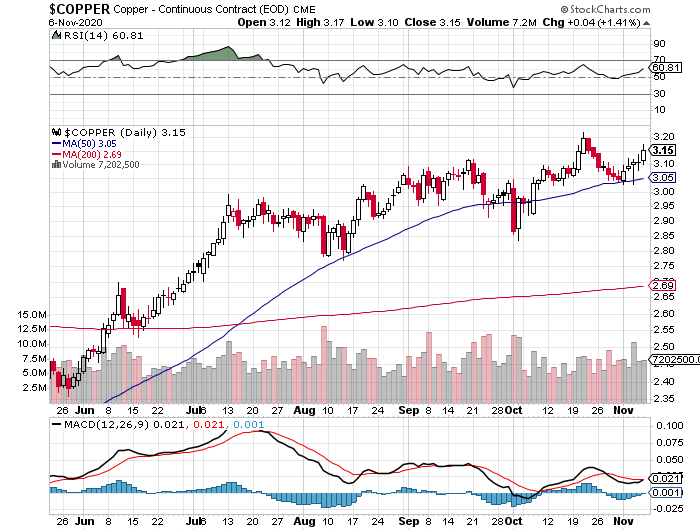

In the other metals, the Managed Money traders in palladium decreased their net long position by a very decent 936 COMEX contracts during the last reporting week -- and are net long the palladium market by 3,150 COMEX contracts...around 31 percent of the total open interest...down about seven percentage points from last week. And as I continue to point out, the COMEX futures market in palladium, is a market in name only. In platinum, the Managed Money traders decreased their net long position by 1,007 contracts during the reporting week -- and are now back to being net short the platinum market once again, but only by 673 COMEX contracts. And except for this smallish short position held by these Managed Money traders, the other three reporting categories in platinum [especially the 'Other Reportables'] are net long against the Big 8 shorts/JPMorgan et al. in the Producer/Merchant category. In copper, the Managed Money traders decreased their net long position by a further 8,865 contracts during this last reporting week -- and are net long copper by 79,032 COMEX contracts...about 1.98 billion pounds of the stuff...about 34 percent of total open interest, down about 2 percentage points from last week.

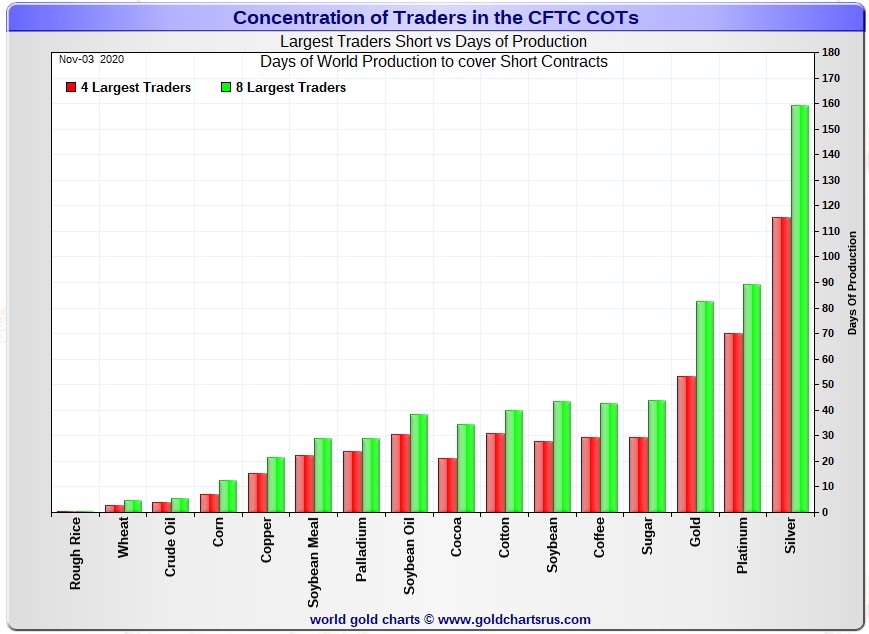

Here's Nick Laird's "Days to Cover" chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, November 3. It shows the days of world production that it would take to cover the short positions of the Big 4 - and Big '5 through 8' traders in each physically traded commodity on the COMEX. Click to enlarge.

|

|

[Note: Because there were no material changes in the Commercial net short position in silver -- and none at all in the short position of the Big 8 traders...there are virtually no changes in this Days to Cover data from a week ago. - Ed]

The Big 4 traders are short about 116 days of world silver production, unchanged from last week's report. The '5 through 8' large traders are short an additional 43 days of world silver production...also unchanged from last week's COT Report - for a total of about 159 days that the Big 8 are short...obviously unchanged from last week's report. This represents a bit over five months of world silver production, or about 369 million troy ounces of paper silver held short by the Big 8. [In the prior reporting week, the Big 8 were also short 159 days of world silver production.]

In the COT Report above, the Commercial net short position in silver was reported by the CME Group at about 296 million troy ounces. As mentioned in the previous paragraph, the short position of the Big 8 traders is around 369 million troy ounces. So the short position of the Big 8 traders is larger than the total Commercial net short position by about 369-296=73 million troy ounces...down about 3 million troy ounces from last week's report.

The reason for the difference in those numbers...as it always is...is that Ted's raptors, the 33-odd small commercial traders other than the Big 8...which includes JPMorgan...are net long that amount.

Another way of stating this [as I say every week in this spot] is that if you remove the Big 8 commercial traders from that category, the remaining traders in the commercial category are net long the COMEX silver market. It's the Big 8 against everyone else...a situation that has existed for over four decades in both silver and gold -- and in platinum and palladium as well.

As per the first paragraph above, the Big 4 traders in silver are short around 116 days of world silver production in total. That's 29 days of world silver production each, on average...unchanged from last week's report. The four big traders in the '5 through 8' category are short 43 days of world silver production in total, which is a bit under 11 days of world silver production each, on average...also unchanged from last week's report.

The Big 8 commercial traders are short 48.5 percent of the entire open interest in silver in the COMEX futures market, which is up a bit from the 46.3 percent they were short in last week's COT report. And once whatever market-neutral spread trades are subtracted out, that percentage would be around the 55 percent mark. In gold, it's 43.7 percent of the total COMEX open interest that the Big 8 are short, which is up a bit from the 42.1 percent they were short in last week's report -- and a bit over the 50 percent mark once the market-neutral spread trades are subtracted out.

In gold, the Big 4 are short 53 days of world gold production, down 1 day from last week's COT Report. The '5 through 8' are short another 30 days of world production, up 1 day from last week's report...for a total of 83 days of world gold production held short by the Big 8...unchanged from last week's COT Report. Based on these numbers, the Big 4 in gold hold about 64 percent of the total short position held by the Big 8...down about 1 percentage point from last week's report.

According to Ted -- JPMorgan might be long the silver market by about 1,000 COMEX contracts -- and is net long 3-5,000 COMEX contracts in gold, about unchanged from what they were long in last week's report. I was somewhat surprised that they didn't increase their net long position in gold during the reporting week. If they did, it wasn't by much.

The "concentrated short position within a concentrated short position" in silver, platinum and palladium held by the Big 4 commercial traders are about 73, 79 and 83 percent respectively of the short positions held by the Big 8...the red and green bars on the above chart. Silver is obviously unchanged from last week's COT Report...platinum is also unchanged from a week ago -- and palladium is up about 6 percentage points week-over-week.

The Big 8 shorts are still hugely exposed in all four precious metal, at least in the COMEX futures market. Their short positions in silver remained unchanged during this last week -- and their short position in gold decreased by a bit over the same period.

But the truth of the matter is that, they've made no progress at all in the last many months -- and appear firmly locked into their currently estimated $14 billion in both realized and unrealized loses. Ted will have a more accurate number in his weekly commentary this afternoon.

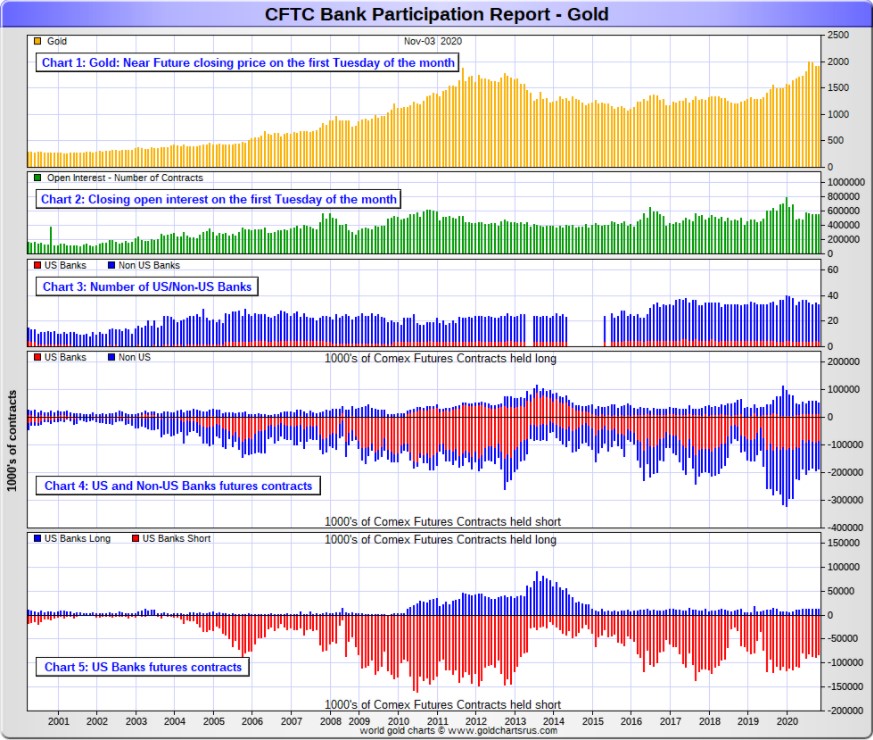

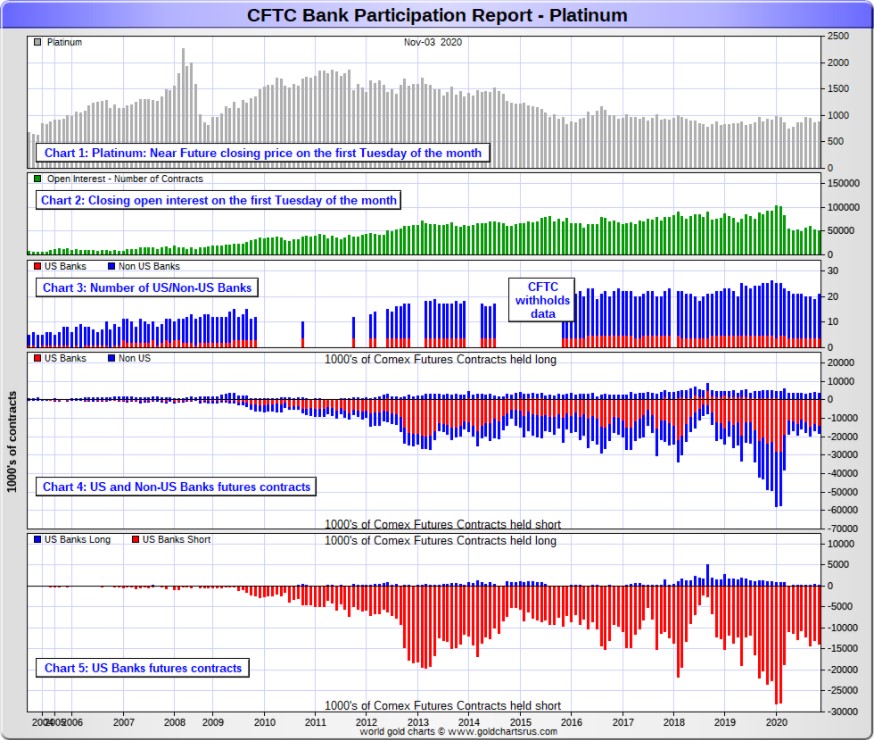

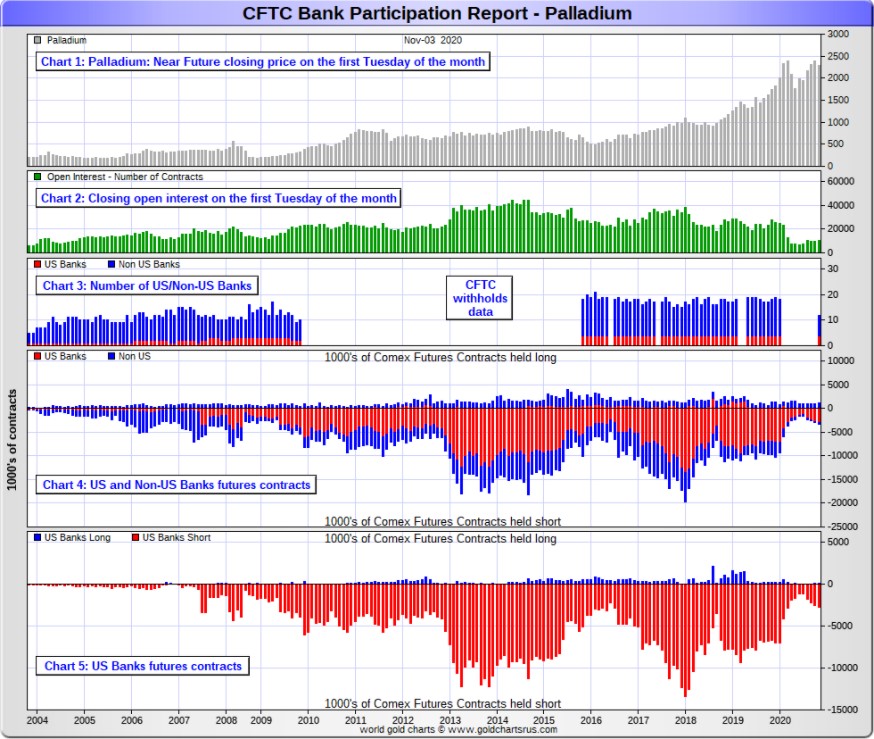

The November Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of Tuesday's cut-off in all COMEX-traded products. For this one day a month we get to see what the world's banks are up to in the precious metals -and they're usually up to quite a bit. However, it was pretty quiet during this past reporting period.

[The November Bank Participation Report covers the time period from October 7 to November 3 inclusive.]

In gold, 4 U.S. banks are net short 71,079 COMEX contracts in the November BPR. In October's Bank Participation Report [BPR] 5 U.S. banks were net short 76,993 contracts, so there was a decrease of 5,914 COMEX contracts from four weeks ago, which is not a material change at all.

Citigroup, HSBC USA, Goldman Sachs and possibly Morgan Stanley would most likely be the U.S. banks that are short this amount of gold...or one should presume that it's their clients that are short.

Also in gold, 29 non-U.S. banks are net short 65,080 COMEX gold contracts. In October's BPR, these same 29 non-U.S. banks were net short 59,009 COMEX contracts...so the month-over-month change shows an increase of 6,071 COMEX contracts...which exactly cancels out the improvement in the U.S. banks. So net-net, there was no change in the short position held by the world's banks in gold during October.

At the low back in the August 2018 BPR...these non-U.S. banks held a net short position in gold of only 1,960 contacts -- and they've been back on the short side in a big way ever since.

However, as I always say at this point, I suspect that there's at least two large non-U.S. bank in this group, one of which would be Scotiabank/Scotia Capital...plus HSBC most likely. And I have my suspicions about Barclays, Dutch Bank ABN Amro, plus Australia's Macquarie as well. Other than that small handful, the short positions in gold held by the vast majority of non-U.S. banks are mostly immaterial.

As of this Bank Participation Report, 33 banks [both U.S. and foreign] are net short 25.0 percent of the entire open interest in gold in the COMEX futures market, which is up a tiny bit from the 24.5 percent 34 banks were short in the October BPR.

Here's Nick's BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank's COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

|

|

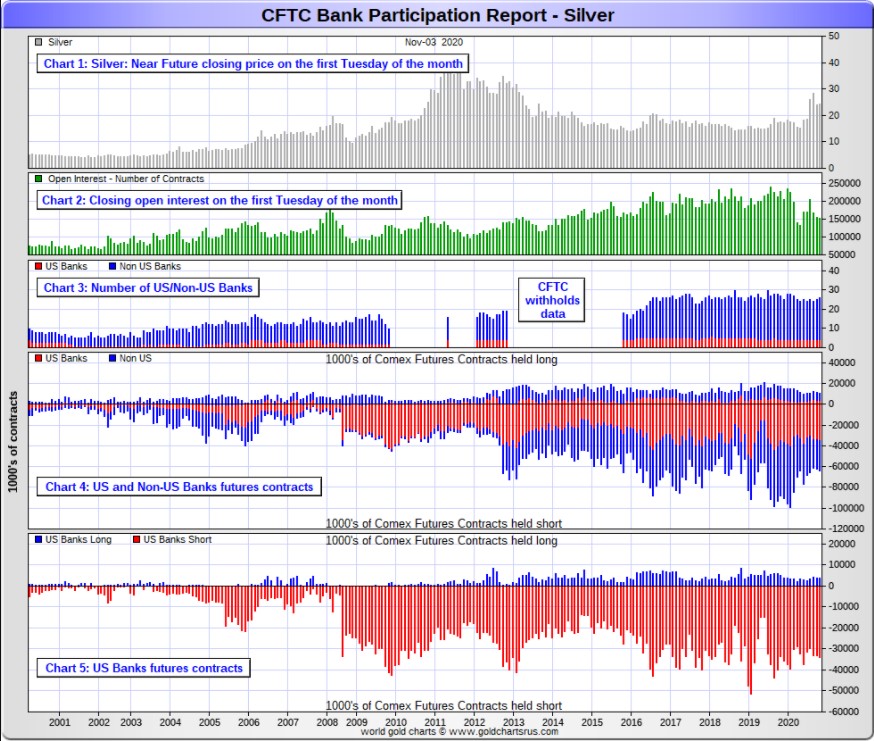

In silver, 4 U.S. banks are net short 30,166 COMEX contracts in November's BPR. In October's BPR, the net short position of these same 4 U.S. banks was 29,302 contracts, so the short position of the U.S. banks has increased by a smallish 864 contracts month-over-month.

As in gold, the three biggest short holders in silver of the four U.S. banks in total, would be Citigroup, HSBC USA -- and Goldman or maybe Morgan Stanley in No. 3 and 4 spots.

Also in silver, 22 non-U.S. banks are net short 23,178 COMEX contracts in the November BPR...which is up 2,063 contracts from the 21,115 contracts that 20 non-U.S. banks were short in the October BPR. I would suspect that Canada's Scotiabank/Scotia Capital holds a goodly chunk of the short position of these non-U.S. banks. I also suspect that a number of the remaining 20 non-U.S. banks may actually be net long the COMEX futures market in silver. But even if they aren't, the remaining short positions divided up between these other 21 non-U.S. banks are immaterial - and have always been so.

As of November's Bank Participation Report, 26 banks [both U.S. and foreign] are net short 34.8 percent of the entire open interest in the COMEX futures market in silver-up a bit from the 32.5 percent that 25 banks were net short in the October BPR. And much, much more than the lion's share of that is held by Citigroup, HSBC USA, Goldman, Scotiabank -- and maybe one other non-U.S. bank.

Here's the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns-the red bars. It's very noticeable in Chart #4-and really stands out like the proverbial sore thumb it is in chart #5. Click to enlarge.

|

|

In platinum, 4 U.S. banks are net short 13,665 COMEX contracts in the November Bank Participation Report. In the October BPR, these same 4 U.S. banks were net short 12,440 COMEX contracts...up 1,225 contracts from a month ago.

[At the 'low' back in July of 2018, these same U.S. banks were actually net long the platinum market by 2,573 contracts -- and they've still got a long way to go to get back to that number, if they ever do.]

Also in platinum, 17 non-U.S. banks are net short only 1,017 COMEX contracts in the November BPR, which is up a bit from the piddling 161 COMEX contracts that 15 non-U.S. banks were net short in the October BPR.

[Note: Back at the July 2018 low, these same non-U.S. banks were net short 1,192 COMEX contracts...so this month's BPR shows a new record low short position]

And as of November's Bank Participation Report, 21 banks [both U.S. and foreign] are net short 28.8 percent of platinum's total open interest in the COMEX futures market, which is down a bit from the 24.3 percent that 19 banks were net short in October's BPR. But it's the U.S. banks, or most likely their clients, that are on the short hook big time. They have little chance of delivering into their short positions, although a very large number of platinum contracts have already been delivered in both October and November so far. Despite that, they're still very short the COMEX futures market -- and may be forced to cover the rest at some point. Time will tell.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

|

|

In palladium, 4 U.S. banks are net short 2,683 COMEX contracts in the November BPR, up from the 2,530 contracts that '3 or less' U.S. banks were net short in the October BPR. This is the fourth month in a row that the U.S. banks have increased their short position in palladium. They were short only 1,194 COMEX contract in the July BPR.

Also in palladium, 8 non-U.S. banks are net long 471 COMEX contracts-up a handful of contracts from the 426 COMEX contracts that '8 or more' non-U.S. banks were net long in the October BPR.

And as I've been commenting for almost forever now, the COMEX futures market in palladium is a market in name only, because it so illiquid and thinly-traded. Total open interest at Tuesday's cut-off was only 10,169 contracts.

As of this Bank Participation Report, 12 banks [both U.S. and foreign] are net short 21.8 percent of the entire COMEX open interest in palladium...down a hair from the 22.2 percent of total open interest that 10 banks were net short in October. Because of the small numbers of contracts involved, along with a tiny open interest, these numbers are pretty much meaningless. So, for the eighth month in a row, the world's banks are no longer involved in the palladium market in a material way -- and if they are, I suspect that it's their clients that are on the hook, not the banks themselves.

Here's the palladium BPR chart. And as I point out every month, you should note that the U.S. banks were almost nowhere to be seen in the COMEX futures market in this precious metal until the middle of 2007-and they became the predominant and controlling factor by the end of Q1 of 2013. They have imploded into insignificance over the last seven Bank Participation Reports, although their short position has been sneaking higher for the last four months. It remains to be seen if they return as big short sellers again at some point like they've done in the past. Click to enlarge.

|

|

Except for palladium, only a small handful of the world's banks still have meaningful short positions in the other three precious metals -- and in most cases, it's their clients that are the ones on the short hook, not the banks themselves.

I don't know if it means anything, but the one stand-out feature in this latest Bank Participation Report was the fact that, with the exception of gold, the U.S. banks increased their short positions in the other three precious metals. That's the second month in a row this has happened.

As mentioned further up, JPMorgan is currently net long both silver and gold by a bit...the former by around 1,000 COMEX contracts -- and the latter by 3-5,000 contracts. They may be out of their short positions in platinum and palladium as well, but there's no way to tell.

When things get really serious to the upside, it will be very much to the detriment of those Big 8 shorts in particular -- and the rest of the shorts in general, as their short covering will be the rocket fuel that drives precious metal prices to the moon, particularly silver. So far there's no real sign of that happening, but some day it will -- and whatever day that is, you won't have to ask if that's the day, as it will be evident in the price.

I only have a tiny handful of stories, articles and videos for you today.

CRITICAL READS

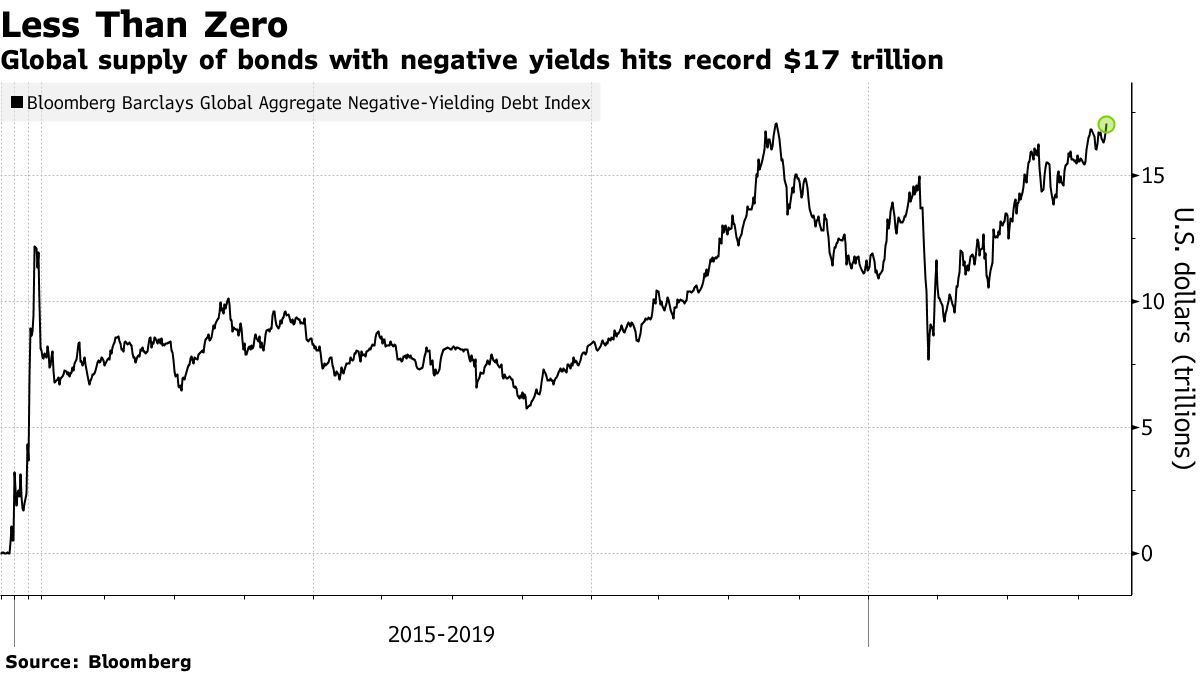

World's Negative-Yield Debt Pile Has Just Hit a New Record

The world's stockpile of negative-yielding debt has swelled to a record in the wake of the U.S. election, as investors lower expectations for a fiscal splurge and turn their focus back to monetary support.

The market value of the Bloomberg Barclays Global Negative Yielding Debt Index rose to $17.05 trillion on Thursday, the highest level ever recorded and narrowly eclipsing the $17.04 trillion it reached in August 2019.

Almost $600 billion of bonds have seen their yields turn negative this week, meaning 26% of the world's investment-grade debt is now sub-zero. Thanks to the slew of global issuance in 2020 as governments and companies wrestle with the impact of the coronavirus, that remains below 30% peak reached last year. Click to enlarge.

|

|

The borrowing binge has been mostly met with trillions of dollars of quantitative easing that suppress yields. Just this week, the Bank of England and Reserve Bank of Australia announced plans to expand their bond-buying programs, while the Federal Reserve discussed a shift.

Well, dear reader, if they're looking for returns, an investment in the precious metals would be advisable. This Bloomberg article was posted on their Internet site at 5:03 p.m. PST [Pacific Standard Time] on Thursday afternoon -- and updated about eleven hours later. I found it embedded in a GATA dispatch -- and another link to it is here.

America Is Still Counting Presidential Election Ballots -- Bill Bonner

What a jolly week!

The whole world has been on the edge of its chair. Here, on the frontier of civilization in Northwest Argentina, our neighbor reported:

"I stayed up until 1:30 a.m. to see who your next president will be."

As of this morning, we still don't know for sure who will get to boss us around over the next four years. But the spectacle has been entertaining...

Each country... each era... needs its unifying myths and rituals. Pharaoh was a god. Louis XIV exercised the "divine right" given to him by God Himself.

And now, when all the votes are finally counted, recounted, hidden under the table, and miscounted... either Donald Trump or Joe Biden will be crowned by the voters.

Succession has always been a dangerous time. Even in the time of Pharaoh and divinely appointed kings, being next in line was no sure thing.

This commentary from Bill put in an appearance on the rogueeconomics.com Internet site on Friday sometime -- and another link to it is here.

Life Under Biden -- Jim Rickards

It's becoming increasingly evident that Joe Biden is likely to win the election.

He's now taken the lead in Pennsylvania, which Trump needs to win reelection. Biden's also taken the lead in Georgia, while holding onto leads in Nevada and Arizona. It's not over yet, but everything would have to break right for Trump if he's to win.

He's also issued a number of legal challenges, but they're unlikely to overturn the results in any state.

Were there instances of voter fraud in states like Pennsylvania, Wisconsin and Michigan? It's highly likely, but it would be very difficult to prove in court that they substantially impacted the outcome.

So it appears right now that Joe Biden will be the next president of the United States, unless Trump can somehow run the table or succeed in the courts.

An Historic Turning Point Election

This was a historic, turning-point election. Turning-point elections are the most historic because they put the country on a different path: Party Politics in 1800, Populism in 1828, Civil War in 1860, Liberalism in 1932, and Conservatism in 1980.

Every 100 years, America gets a president who shakes the establishment and cleans out the Washington sewers. In the 1800s it was Andrew Jackson. In the 1900s it was Teddy Roosevelt. In the 2000s, it's Donald Trump.

There is no doubt that Trump and Biden would lead America in almost opposite directions with profound consequences for the future of the country and for future elections.

This very interesting commentary from Jim was posted on the dailyreckoning.com Internet site on Friday sometime -- and another link to it is here. Gregory Mannarino's post market close rant for Friday is linked here.

Doug Noland: Critical Juncture

The prospect of a divided Washington would seem to take some pressure off the vulnerable Treasury market - and, through lower Treasury yields, corporate Credit more generally. And I appreciate that divided government has in the past worked to the advantage of the bull market status quo. But are we to believe in today's crisis backdrop an irreconcilably split and hostile Washington will somehow function to the benefit of the markets and our nation?

I have never been more concerned. Having watched "money" and Credit run increasingly amuck over recent decades, I have long harbored fears of an inescapable future of calamitous financial, economic, social, political and geopolitical instability. That future is now unfolding.

I posited that the U.S. election was the single largest event in terms of market hedging - much of it through derivatives. Moreover, this most hedged event was occurring in a most speculative market environment, having followed an unprecedented $3.0 TN expansion of Federal Reserve "money." Odds were high this was not going to go smoothly. In the event of an outcome hostile to the markets, sinking securities prices had the potential to spur massive self-reinforcing derivatives-related selling. But if an adverse outcome didn't materialize, the unwind of hedges could spur markets higher while stoking speculative excess.

Was the U.S. election outcome really so overwhelmingly positive for securities of all stripes everywhere? I would argue it was yet another example of an overreaction from dysfunctional markets - an upside dislocation in highly synchronized markets dominated by derivatives and speculative trading. From my analytical perspective, it was further corroboration of the late-stage global Bubble thesis. Markets have grown incapable of adjusting to developments in an orderly and reasonable manner.

Doug's weekly commentary showed up on his Internet site in the very wee hours of Saturday morning -- and another link to it is here.

Gold Posts Biggest Weekly Gain Since July as Biden Closes In

Gold had the biggest weekly gain since July and copper rose as Joe Biden tightened his grip on the race for the White House, while investors also weighed prospects for further Federal Reserve stimulus.

Bullion broke out of a narrow trading range seen over the past month as uncertainty over the U.S. election and renewed stimulus hopes boosted demand for the haven. Democrat Joe Biden has taken the lead in Pennsylvania over President Donald Trump, putting him on the cusp of victory in the presidential race.

Bullion gave up some of the early advances as "stocks have come off highs and the dollar is making a modest comeback. There also seems to some notable profit-taking that started around $1,960," said Tai Wong, head of metals derivatives trading at BMO Capital Markets.

The market is looking for an increased likelihood of a Biden victory, and a stimulus package -- albeit rather a modest one compared to a blue wave scenario -- might be still in the horizon, according to Wenyu Yao, senior commodities strategist at ING Bank. With the Fed to stand behind the curve, given its new average-inflation targeting framework, this is leading to low or lower real rates. Investors would still like to add gold into the portfolios, she said.

This Bloomberg story from yesterday afternoon at 3:05 p.m. PDT features the tackiest picture of gold-coloured rocks that I have ever seen. This news item was picked up by the finance.yahoo.com Internet site -- and I thank Swedish reader Patrik Ekdahl for sending it our way. Another link to it is here.

The PHOTOS and the FUNNIES

Continuing west on the dirt track on the north-facing slope of the Thompson Plateau between Kamloops and Cache Creek on May 3...I took the first two photos from the same spot....the first looking in the direction yet to be travelled -- and the second back down the road just traversed. The last two shots were taken as we progressed down an ever-deteriorating road. In the last two photos you can just make out B.C. Highway One...the white scratch in the far distance along the bottom of the Bonaparte Plateau. The Thompson River is out of sight...buried in its canyon. Click to enlarge.

|

|

|

|

|

|

|

|

|

|

|

|

The WRAP

"Experience hath shewn, that even under the best forms of government those entrusted with power have, in time, and by slow operations, perverted it into tyranny." ~ Thomas Jefferson

Sir Sean Connery passed from our sight this past week -- and two of the title songs from the James Bond movies he stared in, turned out be big hits in the pop world as well.

This first was performed by [now] Sir Tom Jones -- and he recalled working with Bond composer John Barry on this song. " I was thrilled to bits when they asked me to do 'Thunderball.' I thought, 'Oh my God, a song for a James Bond film.' The most memorable thing about the session was hitting that note at the end. John told me to hold on to this very high note for as long as possible. I hit it but I had to hold on to the wall of the sound booth to steady myself in case I fell down. Thank God, I didn't."

Here he is at 78 years young in a live performance -- and he's still got the pipes. The voice is unmistakable -- and the link is here.

The recording of "Goldfinger" lasted all night as John Barry demanded repeated takes due to musicians' or technical glitches, not any shortcomings in Shirley Bassey's vocal. Bassey did initially have issues with the climactic final note which necessitated her slipping behind a studio partition between takes to remove her bra. Bassey would recall of the final note: "I was holding it and holding it - I was looking at John Barry and I was going blue in the face and he's going - hold it just one more second. When it finished, I nearly passed out." The link is here.

Today's classical 'blast from the past' is one I've posted before as well, but it was years ago. Mozart composed at least five violin concertos between 1773 and 1776 while in the employ of the Archbishop of Salzburg. Of the five, his Number 3 in G major, K. 216 is the most popular and well known. The manuscript for this work is dated 12 September 1775.

What is remarkable about this performance is the soloist...9-year old Japanese child prodigy Natsuhi Murata. I found this particular youtube.com video a week ago -- and I've had carefully tucked away in my in-box since then.

Playing a 3/4 scale violin, the performance took place in the Glinka Chapel Hall in St. Petersburg in Russia on 12 June 2019. The crowd just loved her to pieces, as did I -- and, not surprisingly, she won the competition hands down. She may be young in years...but her soul is already old. The link is here...enjoy!

It's reasonably obvious that the quiet rallies in the four precious metals were being equally quietly and carefully managed throughout the London/Zurich trading session on Friday -- and the most obvious occurred during the less-than-60-minute 'rally' in the dollar index that took place starting minutes after 9 a.m. in New York -- and concluding a few minutes before the 10 a.m. EST afternoon gold fix in London. Despite the fact that dollar index fell to new lows on the day soon after, that turn of events wasn't allowed to be reflected in the price of the precious metals. But someone was asleep at the switch in palladium, as the price took off in this very thinly-traded and illiquid market -- and was only halted when a short seller of last resort appeared.

But overall it was a pretty good week for the precious metals -- and their associated equities. So let's count our blessings -- and hope that this engineered 'consolidation' that we've been forced to endure for the past three months, is now over with. It can also be hoped that the precious metal equities will begin to reflect the true value of their underlying precious metals.

We're some distance away from being overbought in any of them -- and it will be interesting to see how the Big shorts/'da boyz'/JPMorgan et al. will allow the precious metals to perform next week. Until they stand aside or get overrun, they're still very much in charge as far as prices are concerned.

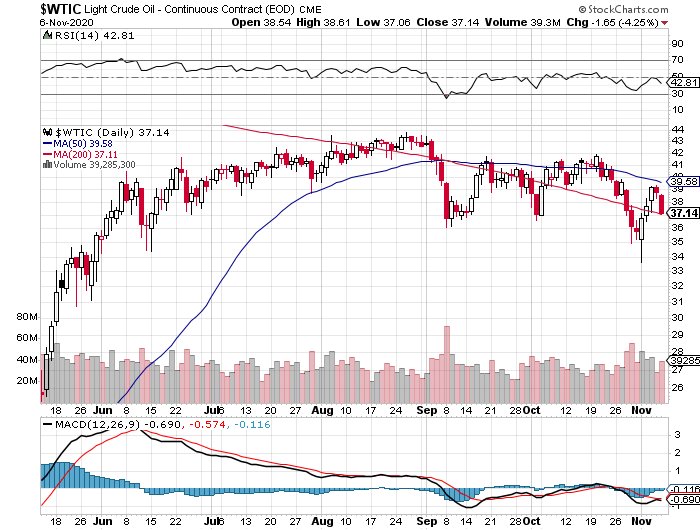

Here are the 6-month charts for the Big 6 commodities, courtesy of stockcharts.com. Gold has closed above its 50-day moving average for the second day in a row -- and silver closed above its for the first time yesterday. Platinum wasn't allowed to do much -- and would have closed higher by a decent amount if allowed, but ended up being closed down on the day. Palladium has been on a bit of a tear for the last week, but one can only fantasize about its closing price on Friday if that not-for-profit seller hadn't appeared before the COMEX close. Click to enlarge.

|

|

|

|

|

|

|

|

|

|

|

|

The election was four days ago -- and still no U.S. President has been declared. The only comment that I'm going to make about it is that it was fraught with 'irregularities' that are begging answers.

Bill King in his Friday column made this statement: "Bottom line on election and aftermath: A widespread massive voter fraud scheme in the U.S. has occurred. Anyone with a modicum of intelligence or integrity knows this, including the SCOTUS...[Supreme Court of the U.S.] How will the SCOTUS resolve this so that Americans can regain confidence in election integrity? Legal experts tell us everything could be on the table, including re-votes under supervision and nullification of ballots. A misguided decision will cause irreparable harm to the republic and populace."

This is banana republic stuff -- and it's frightening to see it show up in the U.S. in such a blatant fashion. I suspect that the Deep State had their fingers in this pie.

As for what happens next -- and over what time frame, no one knows. I'm not even going to attempt to speculate. However I did point out in the recent past, that by the time the New Year put in an appearance, the political, economic and financial landscape will be entirely different -- and I still stand by that statement. Who knows what the Deep State/New World Order crowd have in store for us? But whatever it is, we aren't going to like it.

The 'Everything' bubble is still in place -- and that's particularly true of the worlds' equity and bond markets. This is entirely due to the ongoing participation of the world's central banks, as they're buying up all sorts of debt at an ever-increasing rate. As Gregory Mannarino points on occasion, these are Frankenstein markets...twisted out of shape beyond all recognition, or redemption.

This can't continue forever -- and it won't. That financial reset that has become the talk of the town on the Internet lately, is still in our future -- and heaven only knows what will happen surrounding that event.

But I continue to follow the smart/insider money -- and it's still going into the precious metals at a pretty good clip...silver in particular. If it's good enough for them, it should be good enough for you.

I know it's certainly good enough for me.

That's it for another day and week. I'm still "all in" - and I'll see you here on Tuesday.

Ed