YESTERDAY in GOLD, SILVER, PLATINUM and PALLADIUM

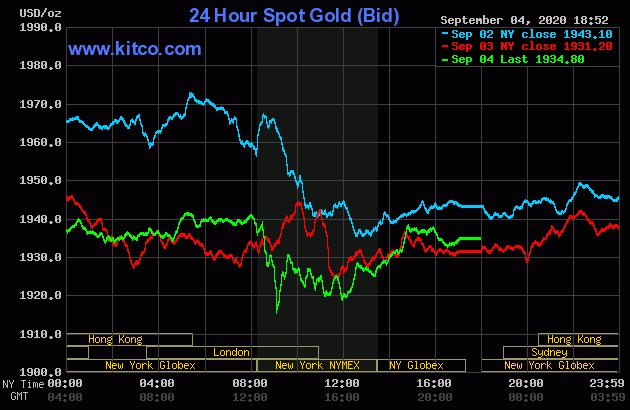

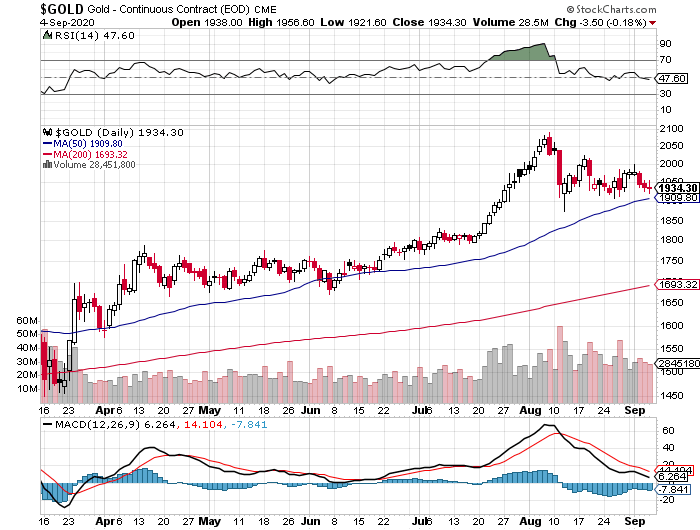

The gold price rallied to its high of the day at the 10:15 a.m. morning gold fix in Shanghai on their Friday -- and then didn't all that much until 1 p.m. BST in London/8 a.m. in New York. It was sold lower from there, with the low tick coming shortly after 9 a.m. in New York -- and although it rallied a bit from there, it then continued lower until noon EDT. A rather spirited rally commenced at that juncture, but that was capped and turned quietly lower starting around 2:45 p.m. in after-hours trading -- and it didn't do much of anything after that.

The high and low ticks in gold were reported by the CME Group as $1,956.60 and $1,921.60 in the December contract...$1,948.80 and $1,914.60 in October. At the close on Friday, the October/December price spread differential in gold was $8.10 ...December/February was $7.40 -- and February/April was $5.10.

Gold was closed in New York yesterday afternoon at $1,934.80 spot, up $3.60 from Thursday. Net volume was around 287,500 contracts -- and there was a bit over 14,000 contracts worth of roll-over/switch volume on top of that.

|

|

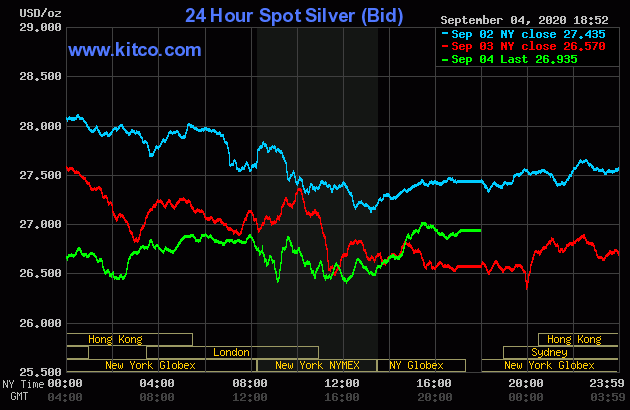

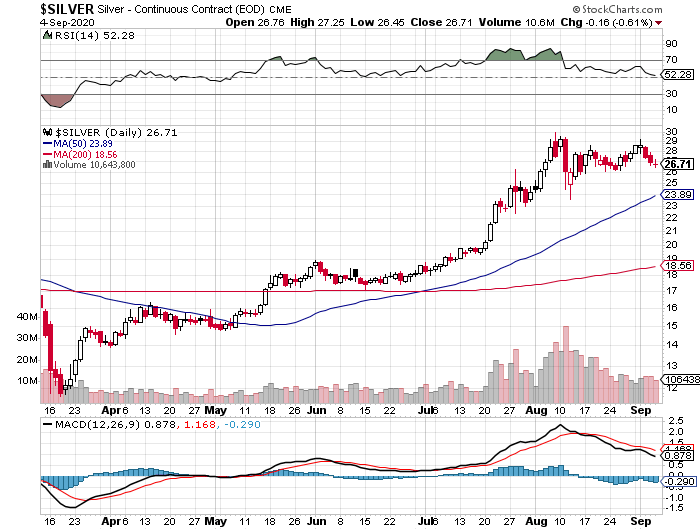

Silver's choppy price action on Friday was mostly similar to gold's -- and I note that the rally that began at the COMEX close, was capped and turned a bit lower starting around 3:30 p.m. in after-hours trading in New York. That 3:30 p.m. EDT price turned out to be silver's high tick of the day.

The low and high ticks in silver were recorded as $26.455 and $27.245 in the December contract.

Silver was closed on Friday afternoon in New York at $26.935 spot, up an impressive 36.5 cents from Thursday. Net volume was very high once again at a bit over 110,000 contracts -- and there was only 4,300 contracts worth of roll-over/switch volume, almost all of which went into the New Year...mostly March.

|

|

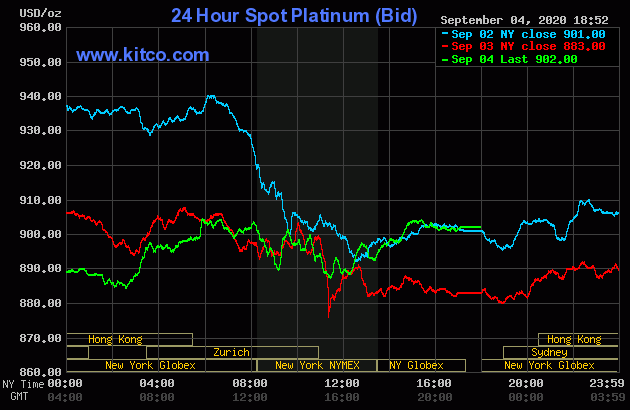

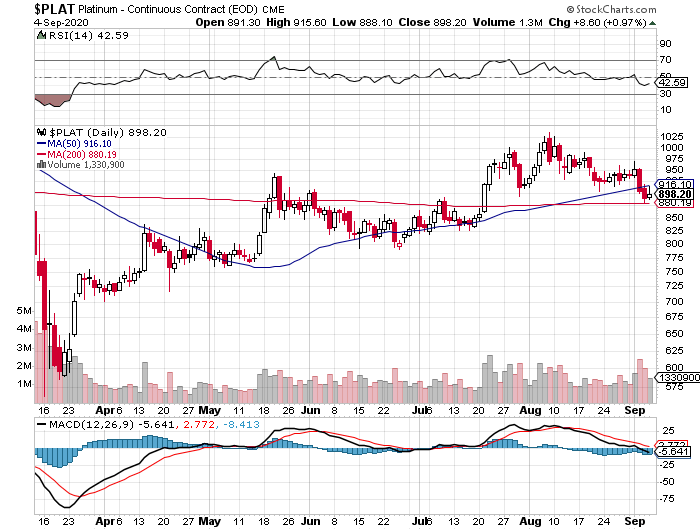

The platinum price had a quiet up/down move in Far East trading on their Friday -- and was almost back at unchanged by shortly before the Zurich open. It then rallied from there until around noon CEST -- and then didn't do much until 2 p.m. CEST/8 a.m. in New York. After that, its price path was guided in a similar fashion as both silver and gold. Platinum finished the day at $902 spot, up 19 dollars from its close on Thursday.

|

|

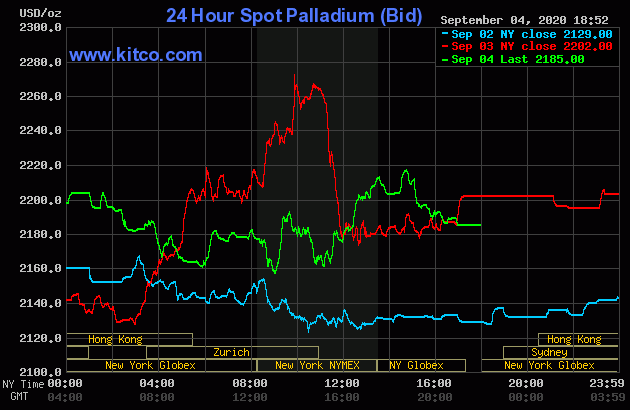

The palladium price traded mostly flat until around 1:35 p.m. China Standard Time on their Friday afternoon -- and from that juncture it was sold very unevenly lower until 9 a.m. in New York. It rallied a bit from there, but was turned lower starting shortly before 3 p.m. in the very thinly-traded after-hours market. Palladium was closed at $2,185 spot, down 17 bucks on the day.

|

|

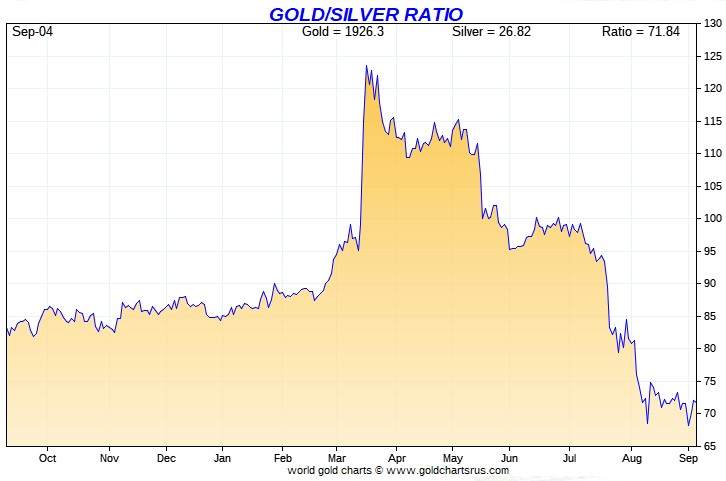

Based on the Kitco-recorded spot closes posted above, the gold/silver ratio worked out to a bit under 72 to 1 on Friday.

Here's Nick's 1-year gold/silver ratio chart, updated as of the close of trading on Friday. Click to enlarge.

|

|

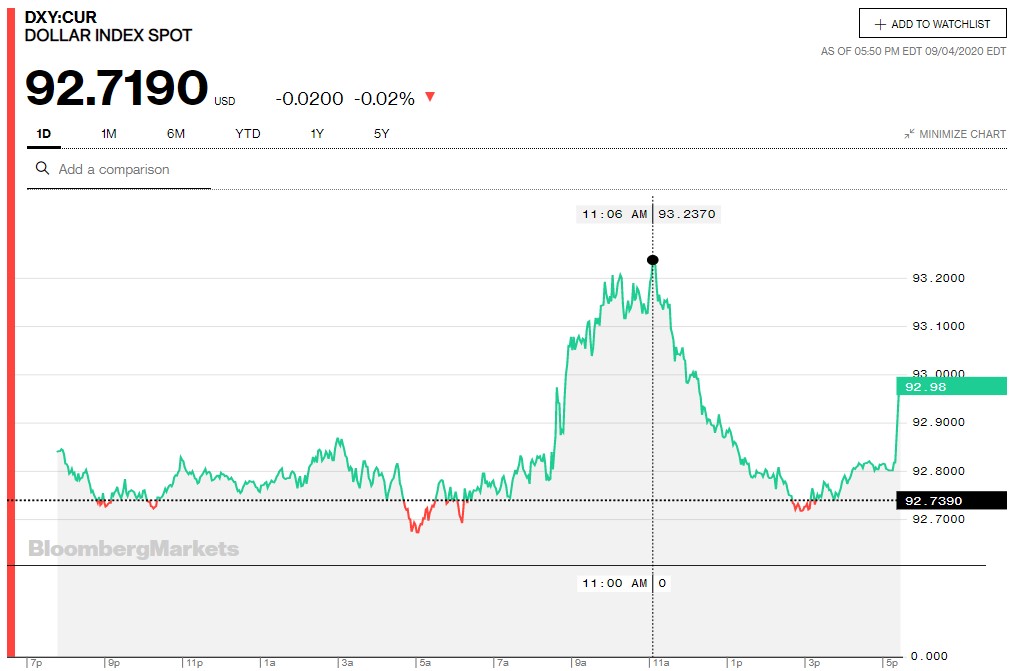

The dollar index closed very late on Thursday afternoon in New York at 92.739 -- and opened down 10 basis points once trading commenced around 7:48 p.m. EDT on Thursday evening, which was 7:48 a.m. China Standard Time on their Friday morning. It then proceeded to trade quietly and somewhat unevenly sideways until a 'rally' commenced at 8:30 a.m. in New York when the job numbers hit the tape. That rally ran out of gas at 11:05 a.m. EDT...five minutes after the London close. It was all down hill from there until around 3 p.m. EDT -- and it then crawled a bit higher until around ten minutes before trading ended at 5:30 p.m. It shot higher at that point -- and according to the DXY chart below, closed at 92.98 on the day...up about 24 basis points

However, it ended up getting marked-to-close at 92.719...down 2 basis points from Thursday. And if you're wondering what that was all about...I don't know. But it certainly appears that they can market the DXY index to close at whatever they wish. They do that every day, but mostly it's only by smallish amounts.

Here's the DXY chart for Friday, courtesy of Bloomberg as always, so you can see what happened for yourself. Click to enlarge.

|

|

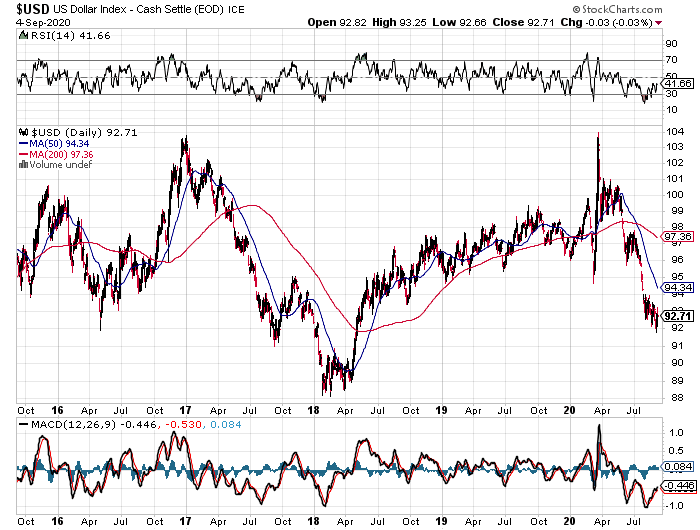

And here's the 5-year U.S. dollar index chart, thanks to the fine folks over at the stockcharts.com Internet site. The delta between its close...92.71...and the close on the DXY chart above, was about 1 basis point above its spot close on Friday. Click to enlarge as well.

|

|

Whether or not we have a new leg down in the offing, or a screaming and engineered short-covering rally in our future, remains to be seen.

And as I pointed out in my Thursday column..."Bill King of King Report fame had this to say about it in the Tuesday edition of his column: "The dollar got slammed to a 2-year low during Asian trading. After trading sideways during European trading, the dollar soared during NYSE trading. Gold, which had rallied when the dollar sank, retreated. Hedge funds and commercial traders are enormously short the dollar. The probability of a short-squeeze on the buck is very high. This, of course, would hinder gold."

He would be right about that, dear reader."

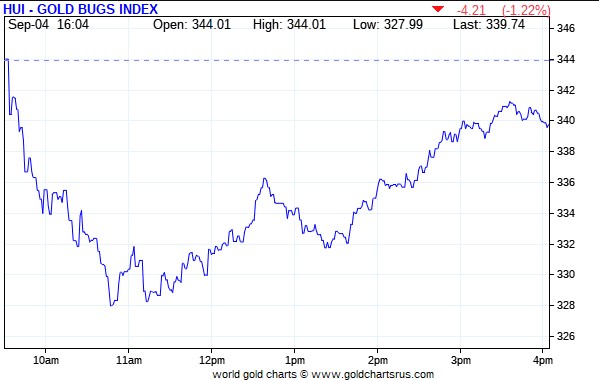

The gold shares were sold lower the moment that the equity markets opened in New York at 9:30 a.m. on Friday morning -- and their collective lows were printed about 10:45 a.m. EDT...which was nowhere near the low tick in gold, or at the start of any rally. From there they headed somewhat unevenly higher until the trading day ended at 4:00 p.m. EDT. The HUI closed down 1.22 percent.

|

|

The silver equities followed an identical price path...tick for tick...as the gold stocks -- and that lasted until around fifteen minutes before trading ended at 4:00 p.m. EDT in New York. Then they jumped higher because very thinly-traded Peñoles caught a bid. But despite that, Nick Laird's Intraday Silver Sentiment/Silver 7 Index still closed down 0.39 percent on the day, which was more than underwhelming considering how well the underlying precious metal performed. Click to enlarge if necessary.

|

|

Computing Nick's Silver Sentiment/Silver 7 Index manually, as I do every day, showed that it closed up 0.64 percent.

And here's Nick's 1-year Silver Sentiment/Silver 7 Index chart, updated with Friday's doji. Click to enlarge as well.

|

|

As previously mentioned, thinly-traded Peñoles caught a bid, closing up 6.59 percent -- and that distorted the final Silver 7 number. Removing them from the equation, the best performer was First Majestic Silver, down only 0.26 percent -- and the worst of was Hecla Mining, closing down 2.96 percent.

And, for the third day in a row, the trading pattern in the precious metal equities was more than counterintuitive. There were obviously buyers of some size lurking about -- and going about their business regardless of the price action in both silver and gold.

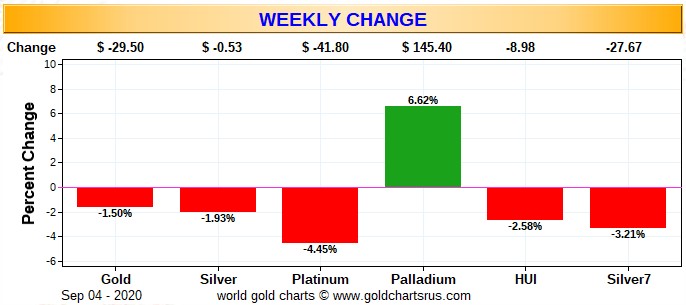

Here are two of the usual three charts that show up in every Saturday missive. The first one shows the changes in gold, silver, platinum and palladium for the past trading week, in both percent and dollar and cents terms, as of their Friday closes in New York - along with the changes in the HUI and the Silver 7 Index.

Here's the weekly chart and, except for palladium, it's red across the board. Although the price action during the week seemed more horrendous than this, it didn't turn out too badly. It could have been far worse. Click to enlarge.

|

|

I'll dispense with the month-to-date chart, as it's only four days old. This chart will reappear in next Saturday's column once we have more of September under our belts.

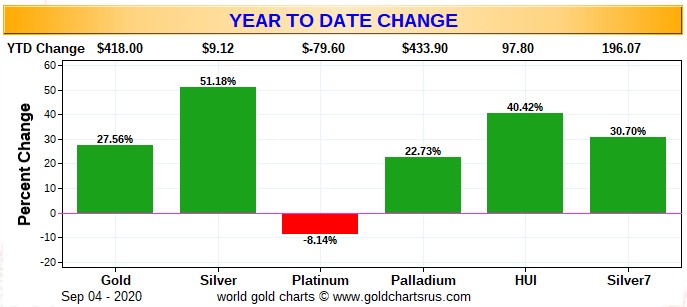

Here's the year-to-date chart -- and although the silver price is now outperforming the gold price by a substantial margin, the silver equities continue to lag their golden cousins -- and lag badly. And the underperformance of the gold stocks compared to the underlying metal itself, is very obvious here as well. Click to enlarge.

|

|

No one is happy about the underperformance of the precious metal equities, but with 'da boyz' in firm control of precious metal prices, we'll have to wait a bit longer for the situation to improve. I know that Eric Sprott has some comments on this situation in his weekly interview posted in the Critical Reads section below -- and you may find it worth your while to check that out.

As per the COT and Days to Cover discussion a bit further down, the Big 8 traders are still mega short gold and silver in the COMEX futures market -- and that situation hasn't changed one bit from last week, or for the last many months. But more than enough gold has now been brought into the COMEX warehouses to cover their short positions by physical delivery, if that's its purpose. The short position of the Big 8 traders in gold decreased by a hair during this reporting week, However, their short position in silver increased by a material amount over the same time period. There's more on that in the COT discussion further down.

The CME Daily Delivery Report showed that 274 gold and 359 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, of the three short/issuers in total, the only one that mattered was JPMorgan, with 269 contracts out of its client account. There were a bunch of long stoppers, but by far the largest were JPMorgan and Morgan Stanley, as they picked up 134 and 109 contracts...JPMorgan for their own account -- and M.S. for their client account.

In silver, there were four short/issuers and the two largest by far were Morgan Stanley and ADM, with 195 and 154 contracts...M.S. from their house account -- and ADM from their client account. There was a big list of long/stoppers. The Big Kahuna/JPMorgan stopped the most...180 contracts for its client account. Australia's Macquarie Futures was in very distant second spot with 50 contracts for its own account -- and the list goes on and on once again.

The link to yesterday's Issuers and Stoppers Report is here.

So far in September there have been 3,457 gold contracts issued/reissued and stopped -- and that number in silver is 8,814 contracts.

The CME Preliminary Report for the Friday trading session showed that gold open interest in September rose by 260 contracts, leaving 384 still open, minus the 274 contracts mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 59 gold contracts were actually posted for delivery on Monday, so that means that 59+260=319 more gold contracts just got added to the September delivery month. Silver o.i. fell by 484 contracts, leaving 2,043 contracts still open, minus the 359 mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 440 silver contracts were actually posted for delivery on Monday, so that means that 484-440=44 silver contracts disappeared from September.

Total gold open interest on Friday rose by 6,251 contracts -- and total silver o.i. declined by 2,257 contracts.

There were no reported changes in GLD on Friday, but there was another big withdrawal from SLV, the third in as many days. This time an authorized participant took out 3,630,502 troy ounces.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD & SLV inventories, there was a net 52,621 troy ounces of gold added, but a net 131,220 troy ounces of silver was removed.

There was no sales report from the U.S. Mint yet again.

Not only have there been no mint sales so far in September, they haven't reported selling a single bullion coin in either silver or gold for more than two weeks now. And as I said the other day in this space, you have to wonder what the hell their doing to wile away their working day, since they're obviously not minting anything.

It was a very quiet day in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday. There was only 38,580.000 troy ounces received/1,200 kilobars [U.K./U.S. kilobar weight] -- and all of that was dropped off at Loomis International. All of the out activity...739.470 troy ounces/23 kilobars [SGE kilobar weight...occurred at Brink's, Inc. The link to this is here.

i know that Ted will have something to say about the COMEX gold stocks in his weekly review later this afternoon.

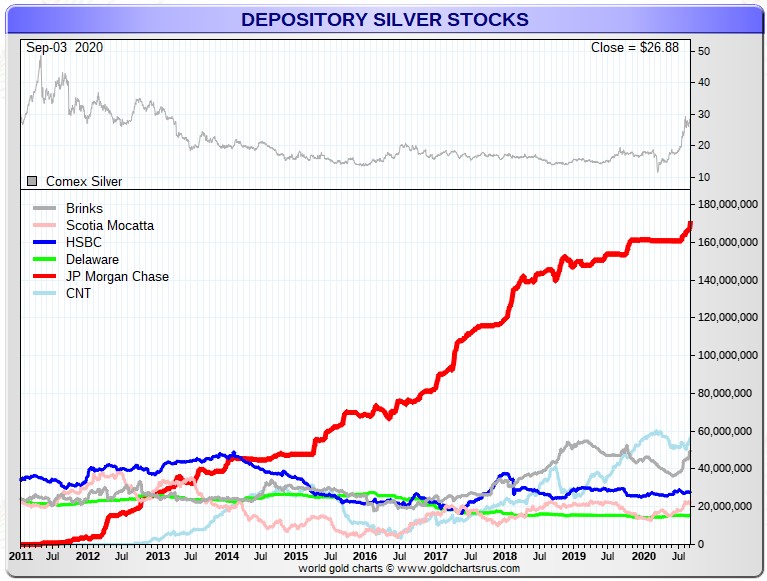

But -- and as it has been all week, it was another very busy one in silver, as 3,076,034 troy ounces were received -- and 629,957 troy ounces was shipped out.

In the 'in' category, the largest amount received...1,485,900 troy ounces...ended up at JPMorgan -- and that's another new record high for them, as they now hold 171.10 million troy ounces in their COMEX depository, a hair under 49 percent of all the silver on the COMEX. Next was Canada's Scotiabank, as they received 984,567 troy ounces -- and they were followed by the one truckload...605,567 troy ounces...that was dropped off at Brink's, Inc. In the 'out' category, the largest amount by far...605,567 troy ounces...was shipped out of Manfra, Tordella & Brookes, Inc. -- and that's most certainly the amount that was reported received at Brink's, Inc. There were smaller amounts moved at three other depositories...16,423 troy ounces at CNT...5,029 troy ounces at Loomis International -- and 2,938 troy ounces at Delaware.

There was also some paper activity, as 497,602 troy ounces was transferred from the Eligible category and into Registered...no doubt destined for delivery this month sometime...492,697 troy ounces at JPMorgan, with the remaining 4,904 troy ounces being transferred in that direction over at CNT. The link to all this silver-related activity is here.

Here's the chart showing JPMorgan's total COMEX warehouse inventory, updated with Thursday's big deposit. Click to enlarge.

|

|

As Ted Butler said on the phone yesterday...anyone who doubts that JPMorgan is the big kahuna in all things silver [and gold] related, needs to get their head read -- and I agreed.

There was a bit of activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday. They reported receiving 10 of them -- and shipped out 315. And except for 15 kilobars shipped out of Loomis International, the rest of the in/out activity occurred at Brink's, Inc. The link to that, in troy ounces, is here.

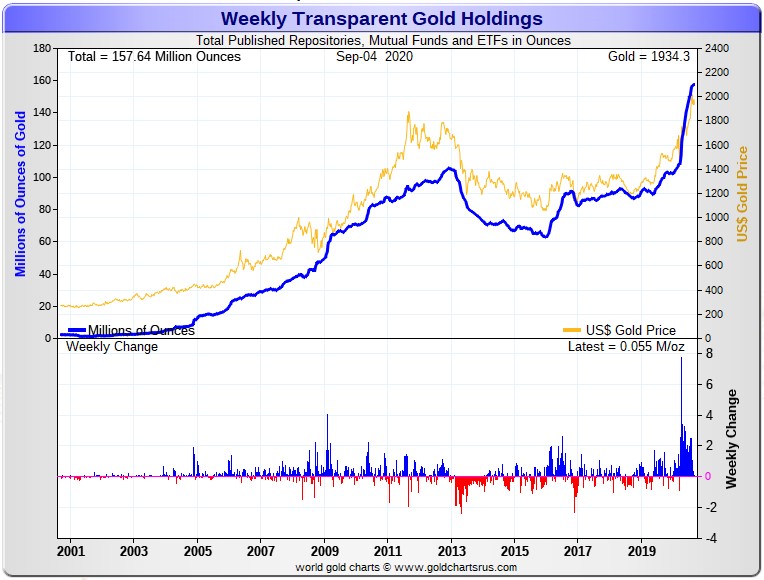

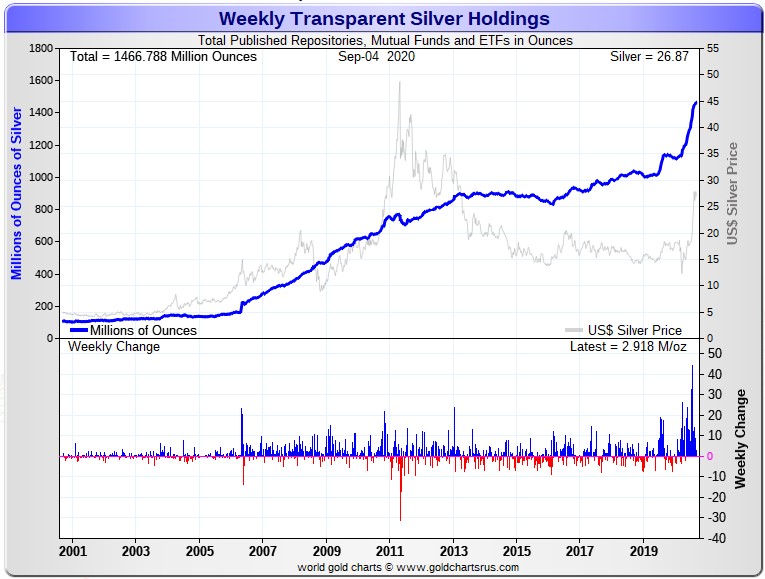

Here are the usual two 20-year charts that show up in this space in every Saturday column. They show the activity in all known gold and silver depositories, mutual funds and ETFs on Planet Earth, updated with this past week's data.

During the reporting week, there was only a net 55,000 troy ounces of gold added -- and that number in silver was 2.92 million troy ounces. Click to enlarge for both.

|

|

|

|

The number for gold would have been much higher than this, except for the fact that there have been some rather large amounts of gold shipped out of the COMEX depositories during the past week. And the only reason that silver's number is as low as it is, is because of the huge withdrawals from SLV over the last three business days...9.25 million troy ounces.

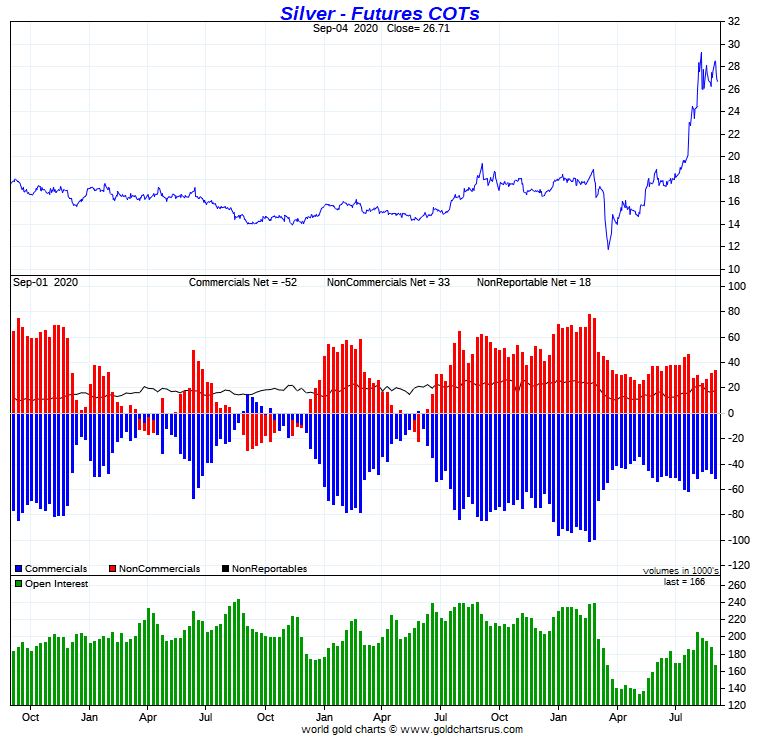

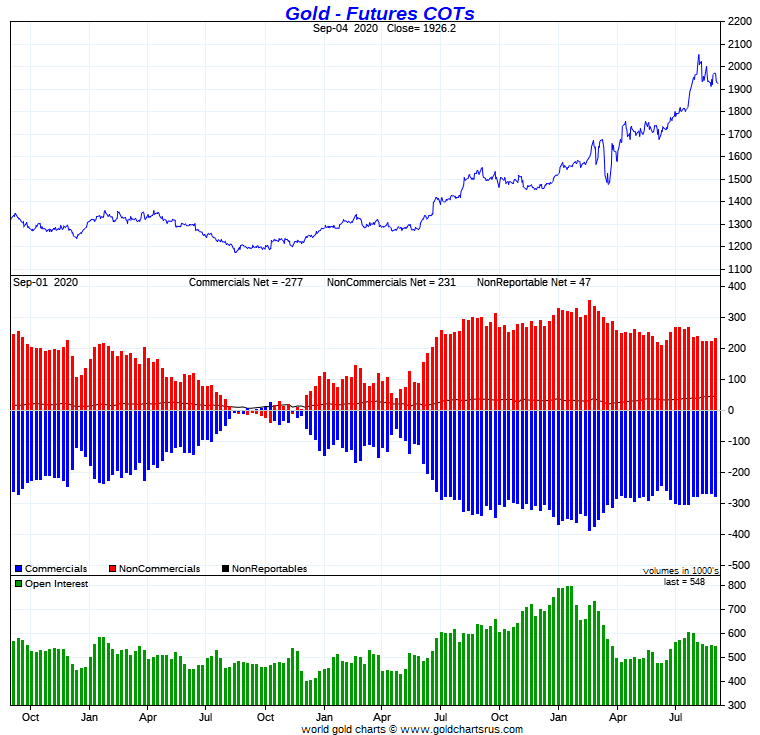

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, showed the expected increases in the commercial net short positions in both silver and gold. But, having said that, the increases weren't much considering the price action during the reporting week.

Ted said that gold closed higher by around $60 during that period -- and was up 80 bucks at one point. Silver closed higher by about $2.50 during the reporting week, but was up about 3 dollars at its high. So the changes reported below are very much on the lighter side -- and could have been much worse.

In silver, the Commercial net short position rose by only 4,002 contracts, or 20.01 million troy ounces.

They arrived at that number by reducing their long position by 6,393 contracts -- and they also reduced their short position by 2,391 contracts. It's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, the Managed Money traders did very little, decreasing their net long position by a scant 493 contracts. All the big activity occurred in the other two non-commercial categories...the Other Reportables and the Nonreportable/small traders. The former decreased their net short position by 2,628 contracts -- and the latter increased their net long position by 1,867 contracts.

Doing the math: 1,867 plus 2,628 minus 493 equals 4,002 contracts...the change in the Commercial net short position.

The Commercial net short position in silver is now up to 51,784 COMEX contracts, or 258.9 million troy ounces.

The Big 8 are short 70,907 COMEX contracts, or 354.5 million troy ounces...137 percent of the Commercial net short position. That's up from the 67,359 contracts/336.8 million troy ounces that they were short in last week's COT Report.

Ted said that it appears the JPMorgan sold their remaining 2,000 or so long contracts in silver -- and are now market neutral in this precious metal.

Here's Nick's 3-year COT chart for silver, updated with Friday's data -- and the change should be noted -- and then promptly forgotten. Click to enlarge.

|

|

As I've been mentioning for the last couple of days, this COT Report is basically "yesterday's news"...which it is, as the price action since the Tuesday cut-off has pretty much reversed everything that I've reported on above. However, I do hope you enjoyed reading it!

In gold, the commercial net short position rose by 10,961 COMEX contracts, or 1.10 million troy ounces.

They arrived at that number by reducing their long position by 7,012 contracts -- and they also increased their short position by 3,949 contracts. It's the sum of those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was all Managed Money traders -- and almost to the contract, as they increased their net long position by 10,893 contracts. The other traders didn't do much in aggregate, of course...but each went about it in wildly different manners. The 'Other Reportables' decreased their net long position by 1,135 contracts -- and the 'Nonreportable'/small traders increased their net long position by 1,203 COMEX contracts.

Doing the math: 10,893 plus 1,203 minus 1,135 equals 10,961 COMEX contracts, the change in the commercial net short position.

The commercial net short position in gold is now back up to 27.74 million troy ounces, up from the 26.64 million troy ounces they were short in last week's COT Report.

The Big 8 traders are short 22.78 million troy ounces, down a hair from the 22.96 million troy ounces they were short last week at this time. On a percentage basis, they are short just under 83 percent of the commercial net short position.

Ted pointed out on the phone that it appears that JPMorgan sold its remaining 3,000 or so long contracts during this past reporting week -- and is also market neutral in gold from a COT respective.

Here's Nick Laird's 3-year COT chart for gold, updated with yesterday's data. Like in silver, the change should be noted -- and then promptly forgotten. Click to enlarge.

|

|

This COT Report is so "yesterday's news" that I hated spending my valuable time writing it all up, knowing that the data in it is already worthless...as the post cut-off price action has negated it all...plus more, I would suspect.

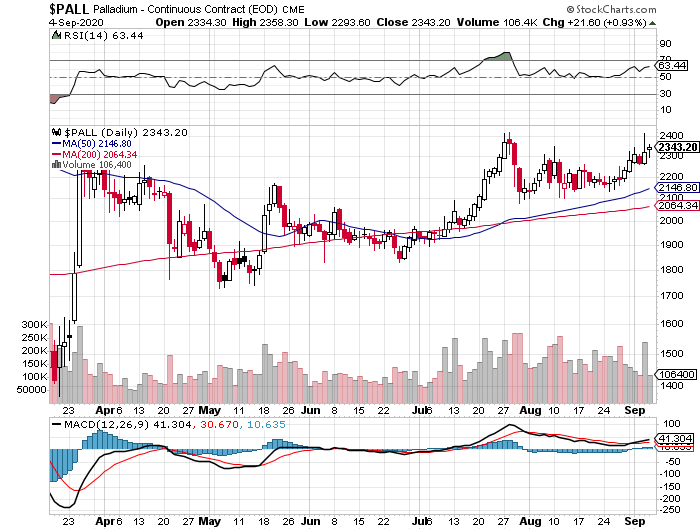

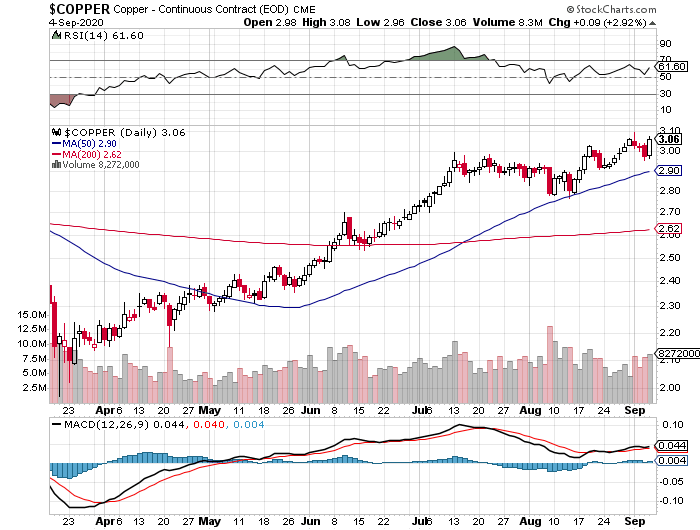

In the other metals, the Managed Money traders in palladium increased their net long position by 265 COMEX contracts during the last reporting week -- and are net long the palladium market by 3,428 contracts...around 35 percent of the total open interest...up 2 percentage points from last week. As I keep pointing out, the COMEX futures market in palladium, is a market in name only. In platinum, the Managed Money traders traders decreased their net long position by a further 2,127 COMEX contracts -- and are net long the platinum market by 9,686 COMEX contracts...about 16 percent of the total open interest, down from 20 percent last week. The other four categories in platinum [Other Reportables, Nonreportable, and even the Swap Dealers] continue to be net long against JPMorgan et al. In copper, the Managed Money traders increased their net long position by a further 6,469 COMEX contracts during this last reporting week -- and are net long copper by 69,120 COMEX contracts...1.73 billion pounds of the stuff...about 30 percent of total open interest, up from 28 percent last week.

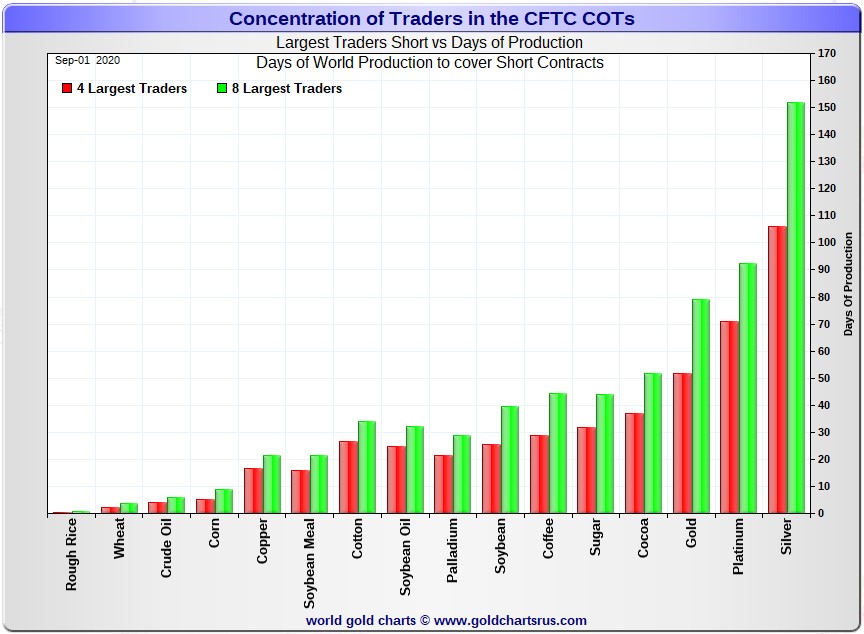

Here's Nick Laird's "Days to Cover" chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, September 1. It shows the days of world production that it would take to cover the short positions of the Big 4 - and Big '5 through 8' traders in each physically traded commodity on the COMEX. Click to enlarge.

|

|

The Big 4 traders are short about 106 days of world silver production, unchanged from last week's report. The '5 through 8' large traders are short an additional 46 days of world silver production...up a chunky 8 days from last week's COT Report - for a total of about 152 days that the Big 8 are short...obviously up 8 days from last week's report. This represents about five months of world silver production, or about 354 million troy ounces of paper silver held short by the Big 8. [In the prior reporting week, the Big 8 were short 144 days of world silver production.]

In the COT Report above, the Commercial net short position in silver was reported by the CME Group at about 259 million troy ounces. As mentioned in the previous paragraph, the short position of the Big 8 traders is around 354 million troy ounces. So the short position of the Big 8 traders is larger than the total Commercial net short position by about 354-259=95 million troy ounces...which is down about 2 million ounces from last week's report.

The reason for the difference in those numbers...as it always is...is that Ted's raptors, the 28-odd small commercial traders other than the Big 8, are net long that amount.

Another way of stating this [as I say every week in this spot] is that if you remove the Big 8 commercial traders from that category, the remaining traders in the commercial category are net long the COMEX silver market. It's the Big 8 [sans JPMorgan] against everyone else...a situation that has existed for over three decades in both silver and gold -- and in platinum and palladium as well.

As per the first paragraph above, the Big 4 traders in silver are short around 106 days of world silver production in total. That's about 26.50 days of world silver production each, on average...unchanged from last week's report. The four big traders in the '5 through 8' category are short 46 days of world silver production in total, which is 11.50 days of world silver production each, on average...up 2 full days from last week's report.

The Big 8 commercial traders are short 42.6 percent of the entire open interest in silver in the COMEX futures market, which is up pretty big from the 35.9 percent they were short in last week's COT report. And once whatever market-neutral spread trades are subtracted out, that percentage would be close to the 50 percent mark. In gold, it's 41.6 percent of the total COMEX open interest that the Big 8 are short, which is down a hair from the 41.8 percent they were short in last week's report -- and also approaching 50 percent once the market-neutral spread trades are subtracted out.

In gold, the Big 4 are short 52 days of world gold production, up 2 days from last week's COT Report. The '5 through 8' are short another 27 days of world production, down 3 days from last week's report...for a total of 79 days of world gold production held short by the Big 8... down 1 day from last week's COT Report. Based on these numbers, the Big 4 in gold hold about 66 percent of the total short position held by the Big 8...up 3 percentage points from last week's report.

According to Ted, JPMorgan sold their remaining long contracts in both silver and gold during this past reporting week -- and are now market neutral in both.

The "concentrated short position within a concentrated short position" in silver, platinum and palladium held by the Big 4 commercial traders are about 70, 76 and 72 percent respectively of the short positions held by the Big 8...the red and green bars on the above chart. Silver is down about 4 percentage points from last week's COT Report...platinum is down about 1 percentage point from a week ago -- and palladium is down about 3 percentage points week-over-week.

The Big 8 shorts are still hugely exposed in all four precious metal, at least in the COMEX futures market -- and that situation changed very little in gold during this past reporting week, but increased by a fairly substantial amount in silver.

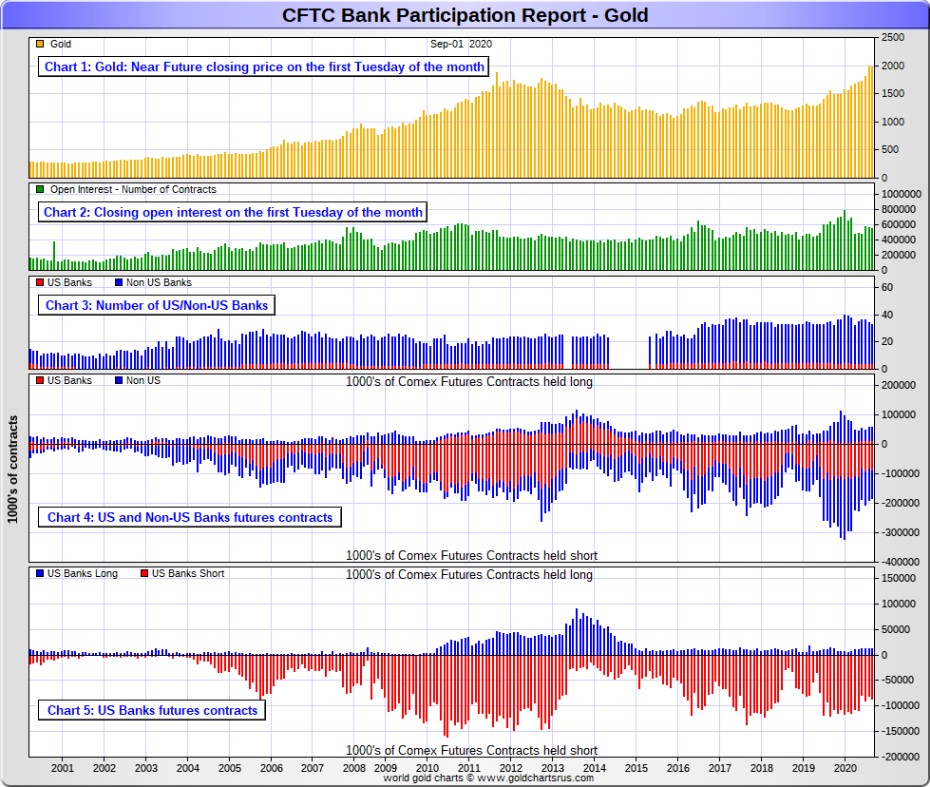

The September Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of Tuesday's cut-off in all COMEX-traded products. For this one day a month we get to see what the world's banks are up to in the precious metals -and they're usually up to quite a bit.

[The September Bank Participation Report covers the time period from August 4 to September 1 inclusive.]

In gold, 4 U.S. banks are net short 74,838 COMEX contracts in the September BPR. In August's Bank Participation Report [BPR] these same 4 U.S. banks were net short 68,185 contracts, so there was an increase of 6,653 COMEX contracts from four weeks ago. This was a bit of a surprise considering how much the gold price was engineered lower during the reporting period -- and I'll have more on that in my closing remarks at the end of this report.

Citigroup, HSBC USA and I suspect Goldman Sachs would hold the lion's share of this short position. As to who other U.S. bank might be that is short in this BPR, I haven't a clue, but it's a given that their short position would not be material.

Also in gold, 29 non-U.S. banks are net short 49,345 COMEX gold contracts. In August's BPR, 30 non-U.S. banks were net short 63,576 COMEX contracts...so the month-over-month change shows a very decent decrease of 14,231 COMEX contracts. That's the second month in a row that these non U.S. banks have decreased their short position by a substantial amount.

But at the low back in the August 2018 BPR...these same non-U.S. banks held a net short position in gold of only 1,960 contacts -- and they've been back on the short side in a big way ever since.

However, as I always say at this point, I suspect that there's at least two large non-U.S. bank in this group, one of which would be Scotiabank/Scotia Capital. I'm starting to have suspicions about Dutch Bank ABN Amro, plus Australia's Macquarie as well. Other than that small handful, the short positions in gold held by the vast majority of non-U.S. banks are immaterial.

As of this Bank Participation Report, 33 banks [both U.S. and foreign] are net short 22.6 percent of the entire open interest in gold in the COMEX futures market, which is down a tiny bit from the 23.5 percent they were short in the August BPR.

Here's Nick's BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank's COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

|

|

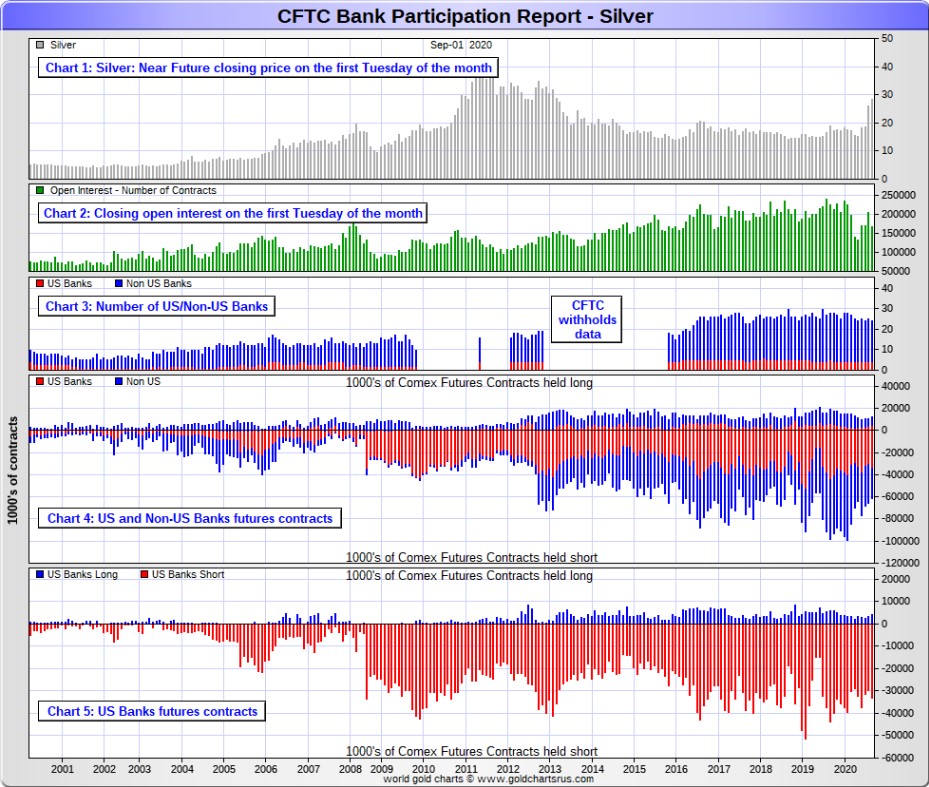

In silver, 4 U.S. banks are net short 28,864 COMEX contracts in September's BPR. In August's BPR, the net short position of these same 4 U.S. banks was 26,392 contracts, so the short position of the U.S. banks has increased by 2,472 contracts month-over-month. Like in gold this was a bit of a surprise, considering the engineered price decline in silver during that time period.

As in gold, the three biggest short holders in silver of the four U.S. banks in total, would be Citigroup, HSBC USA -- and Goldman in No. 3 spot -- and whoever the remaining U.S. bank may be, their short position, like the short position of the smallest U.S. bank in gold, would be immaterial in the grand scheme of things.

Also in silver, 20 non-U.S. banks are net short 20,796 COMEX contracts in the September BPR...which is down quite a bit from the 28,874 contracts that 21 non-U.S. banks were short in the August BPR. I would suspect that Canada's Scotiabank/Scotia Capital holds a goodly chunk of the short position of these non-U.S. banks. I also suspect that a number of the remaining 19 non-U.S. banks may actually be net long the COMEX futures market in silver. But even if they aren't, the remaining short positions divided up between these other 19 non-U.S. banks are immaterial - and have always been so.

As of September's Bank Participation Report, 24 banks [both U.S. and foreign] are net short 29.9 percent of the entire open interest in the COMEX futures market in silver-up a bit from the 26.9 percent that 21 banks were net short in the August BPR. And much, much more than the lion's share of that is held by Citigroup, HSBC USA, Goldman, Scotiabank -- and maybe one other non-U.S. bank.

Here's the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns-the red bars. It's very noticeable in Chart #4-and really stands out like the proverbial sore thumb it is in chart #5. Click to enlarge.

|

|

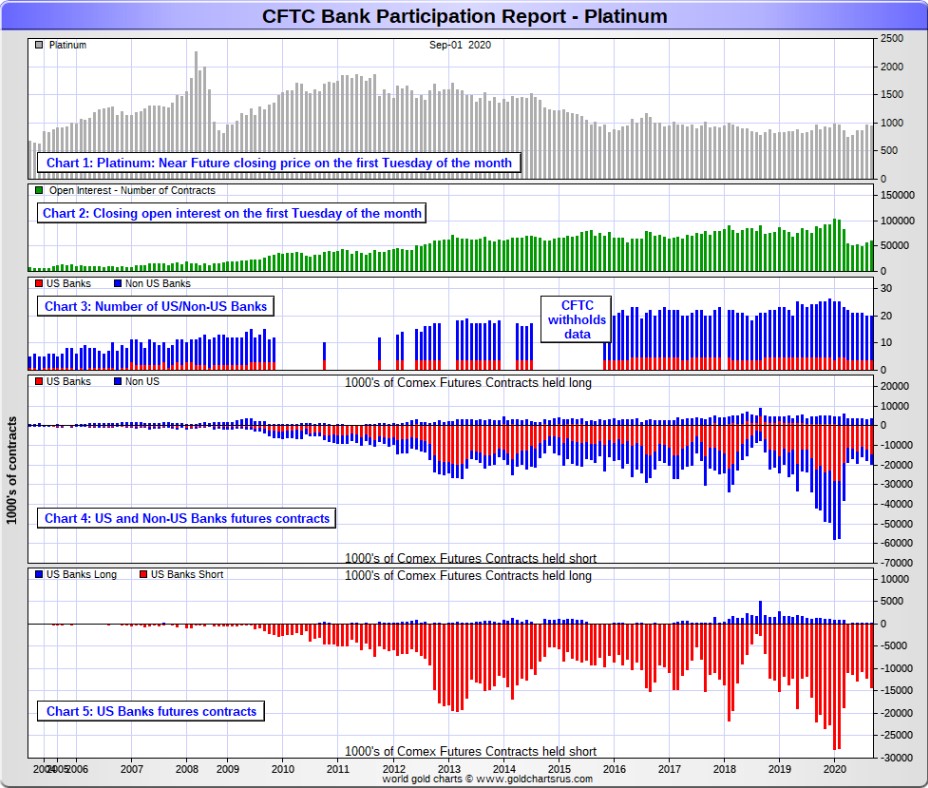

In platinum, 4 U.S. banks are net short 14,064 COMEX contracts in the September Bank Participation Report. In the August BPR, these same 4 U.S. banks were net short 11,898 COMEX contracts...so [for the second month in a row] there's been a decent-sized increase in the short position of the big 4 U.S. banks month-over-month.

[At the 'low' back in July of 2018, these same U.S. banks were actually net long the platinum market by 2,573 contracts -- and they've still got a long way to go to get back to that number, if they ever do.]

Also in platinum, 16 non-U.S. banks are net short 2,249 COMEX contracts in the September BPR, which is down from the 2,674 COMEX contracts that these same 16 non-U.S. banks were net short in the August BPR.

[Note: Back at the July 2018 low, these same non-U.S. banks were net short only 1,192 COMEX contracts...so they're closing in on this low once again]

And as of September's Bank Participation Report, 20 banks [both U.S. and foreign] are net short 27.0 percent of platinum's total open interest in the COMEX futures market, which is up a tiny bit from the 26.1 percent that 21 banks were net short in August's BPR. But it's the U.S. banks, or most likely their clients, that are on the short hook big time. They have zero change of delivering into their short positions -- and will be forced to cover in the COMEX futures market at some point.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

|

|

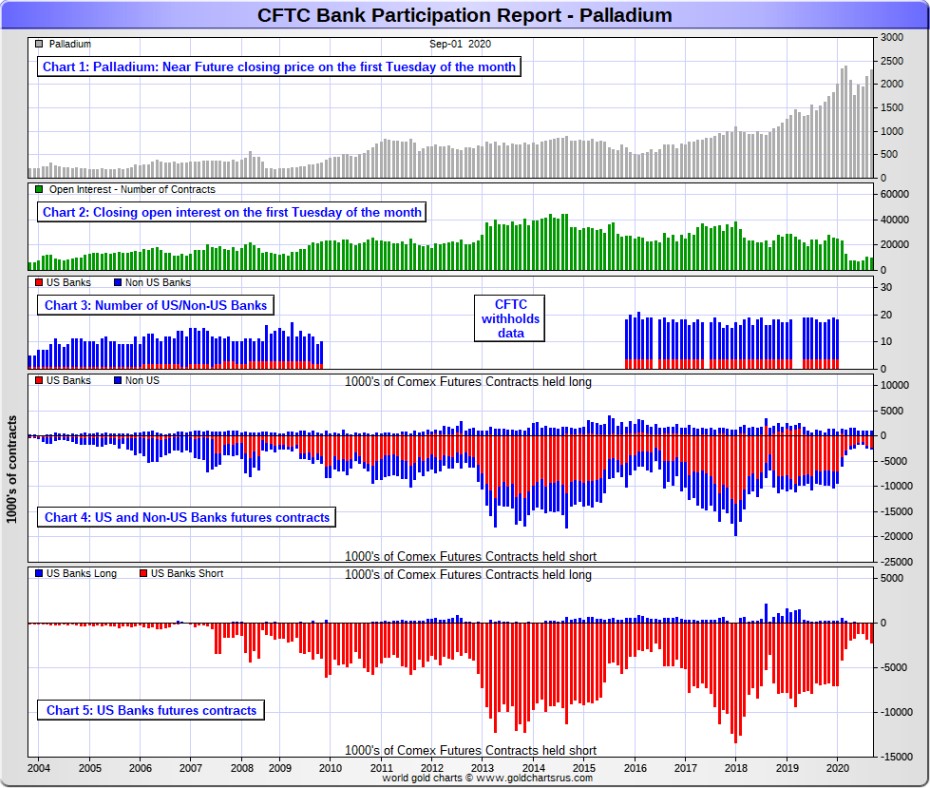

In palladium, '3 or less' U.S. banks are net short 2,183 COMEX contracts in the September BPR, up from the 1,761 contracts that these same '3 or less' U.S. banks were net short in the August BPR. Like in gold, silver and platinum, this is the second month in a row that the U.S. banks have increased their short position in palladium.

Also in palladium, '8 or more' non-U.S. banks are net long 426 COMEX contracts-compared to the 322 COMEX contracts that '8 or more' non-U.S. banks were net long in the August BPR.

And as I've been commenting for almost forever now, the COMEX futures market in palladium is a market in name only, because it so illiquid and thinly-traded. Total open interest at Tuesday's cut-off was only 9,698 contracts.

As of this Bank Participation Report, 11 banks [both U.S. and foreign] are net short 18.1 percent of the entire COMEX open interest in palladium...up from the 14.1 percent of total open interest that 14 banks were net short in May. Because of the small numbers of contracts involved, along with a tiny open interest, these numbers are pretty much meaningless. So, for the sixth month in a row, the world's banks are no longer involved in the palladium market in a material way -- and if they are, I suspect that it's their clients that are on the hook.

Here's the palladium BPR chart. And as I point out every month, you should note that the U.S. banks were almost nowhere to be seen in the COMEX futures market in this precious metal until the middle of 2007-and they became the predominant and controlling factor by the end of Q1 of 2013. But, as I mentioned above, they have imploded into insignificance over the last six or seven Bank Participation Reports -- and it remains to be seen if they return as short sellers again at some point like they've done in the past. Click to enlarge.

|

|

Except for palladium, only a small handful of the world's banks still have meaningful short positions in the other three precious metals -- and in most cases, it's their clients that are the ones on the short hook, not the banks themselves.

The one stand-out feature in this latest Bank Participation Report was the fact that, with no exceptions, the U.S. banks increased their short positions in all four precious metals -- and also without exception, all the non-U.S. banks decreased their net short positions month-over-month.

I don't know if it means anything, but I'm just mentioning it because I can't remember ever seeing that before.

JPMorgan is out of its short positions in both silver and gold -- and is currently market neutral in both as of this week's COT Report. It may be out in platinum and palladium as well, but there's no way to know that.

After the engineered price declines this week, the precious metals are certainly set up for a rocket ride higher when JPMorgan allows it -- and we're already off the launch pad in both gold and silver. But when things get really serious to the upside, it will be very much to the detriment of those Big 8 shorts in particular -- and the rest of the shorts in general, as their short covering will be the rocket fuel that drives precious metal prices to the moon, particularly silver.

The only thing we don't know for sure is if the Big 8 short/'da boyz' are done with their current engineered price declines or not. We should know more by this time next week.

I only have a small handful of stories, articles and videos for you today.

CRITICAL READS

Payrolls increase by nearly 1.4 million as the unemployment rate tumbles

Non-farm payrolls increased by 1.37 million in August and the unemployment rate tumbled to 8.4% as the U.S. economy continued to climb its way out of the pandemic downturn.

The unemployment rate was by far the lowest since the coronavirus shutdown in March, according to Labor Department figures released Friday. An alternative measure that includes discouraged workers and those holding part-time jobs for economic reasons also fell, down to 14.2% from 16.5% in July and 22.8% at the peak in April.

Economists surveyed by Dow Jones had been expecting growth of 1.32 million and the jobless rate to decline to 9.8% from 10.2% in July.

"It's another great day for American jobs and American workers," Vice President Mike Pence told CNBC. Pence added that the job growth and the single-digit unemployment rate is "real evidence that the American comeback is underway."

Markets initially reacted positively to the news, but stocks turned lower and continued the aggressive sell-off from Thursday.

This not-to-be-believed 'news' item showed up on the cnbc.com Internet site at 8:30 a.m. EDT on Friday morning -- and I thank Swedish reader Patrik Ekdahl for pointing it out. Another link to it is here. In a ZH post on Friday morning from Brad, it was pointed out that..."For one, the one-time impact of the Census had an outlier effect on the August payrolls, due to 238,000 temporary jobs hired for the 2020 Census. This led to a 251,000 jump in Federal workers, and a near record 344,000 increase in total government jobs. This means that government jobs were a whopping 25% of all job gains in August." Like I said yesterday, these job numbers would be massaged to perfection -- and they were. Gregory Mannarino's post market rant for Friday is linked here.

Future historians will view The Summer of 2020 as a Critical Juncture for the financial markets, with parallels to the Q1 2000 "blow off" top in Nasdaq (highs not exceeded for 16 years). From March 23rd trading lows to Wednesday's highs, the NDX rallied an incredible 84%. At the close of Wednesday trading, the Nasdaq100 (NDX) enjoyed a year-to-date gain of 42.2%. But an abrupt reversal saw the NDX sink 5.2% on Thursday and another 5% at Friday's trading lows (before ending the session down 1.3%).

The Fed's crisis operations unleashed a historic speculative Bubble, most conspicuously with the big technology stocks. FOMO (fear of missing out) forced professional asset managers into rapidly inflating tech stocks and tech-heavy indices - with nothing more than lip service paid to fundamentals and valuation. Meanwhile, the online trading community (further energized by government stimulus payments) went into speculative overdrive. The Robinhood, E-trade, Schwab and Fidelity platforms posted unprecedented surges in trading volumes as retail "investors" fully embraced technology stocks, the mantra stocks always go up, and the unfailing Fed "put."

Less obvious - but likely at least as consequential in fueling the destabilizing speculative melt-up - has been the system-wide proliferation of derivatives trading. From The Wall Street Journal: "Data by the Cboe Options Exchange show that U.S. equity call-options volume has risen 68% this year. That compares with 32% for put options..." Purchasing call options has been a highly lucrative endeavor over recent months. Owning call options on some of the big tech stocks has been nothing short of a once-in-a-lifetime bonanza.

The retail trading community has adopted options trading like never before. And I can only assume institutional derivatives trading (listed and over-the-counter) has exploded. In a speculative market melt-up backdrop in the face of readily apparent downside risk, playing the wild market upside with call options (or comparable derivatives) has been a reasonable institutional strategy. Selling call options also seemed to have made sense, both to boost returns and as a mechanism to offset the cost of purchasing put option downside protection.

I'll assume an unprecedented quantity of upside "call" options (trading on the exchanges or "OTC" derivatives purchased from brokerages) are currently outstanding. And when the market rally gained momentum, the writers/sellers of these derivatives were forced to buy the underlying stocks (or ETF shares, futures contracts) to hedge their rapidly increasing exposures to a rising market environment. A confluence of FOMO, manic retail speculation, and derivatives-related hedging fueled a historic speculative melt-up.

Doug's weekly commentary is always a must read for me -- and I highly recommend that you do the same. It was posted on his Internet site in the wee hours of Saturday morning -- and another link to it is here.

Do you see what is happening, Dear Reader?

We're entering a new phase. Up until now, the Federal Reserve was backstopping Wall Street.

This created a huge shift in wealth from average people - with few financial assets - to the "rich," who own most of them.

But it was fake wealth. That is, the U.S. stock market could easily be cut in half. In a flash, about $17.5 trillion of "wealth" would disappear.

A few short sellers - who bet on lower prices - would make money. But most of the $17.5 trillion would simply vanish. Poof! It would be gone.

Because it was never real... never an honest reflection of what America's companies are really worth.

This commentary from Bill was posted on the rogueeconomics.com Internet site on Friday sometime -- and another link to it is here.

A Rogue Institution and a Clear and Present Danger to Liberty in America -- David Stockman

We have never heard more gibberish, double talk, and lies from one podium than we have from Fed Chairman Powell.

There is no other way to say it: The Fed has become a dangerous rogue institution that has usurped plenary power over the financial system.

This is all based on implicit theories that eventually lead to a massive speculative blow-off, even as it sucks the vitality out of the Main Street economy in the interim.

The implicit theory is brazenly simple: The Fed believes that relentless credit expansion fosters greater economic growth and full employment. It believes that there is no practical limit to how much debt the household, business, and government sectors of the economy can tolerate or any notable adverse trade-offs from ever-higher leverage ratios.

Self-evidently, lower interest rates foster more debt issuance.

When economic growth falters for any reason, the Fed's first action is to push rates even lower. This ratcheting process has gone on for more than three decades, and interest rates have, for all practical purposes, been obliterated.

This longish, but very worthwhile commentary from David put in an appearance on the internationalman.com Internet site on Friday sometime -- and another link to it is here.

Novichok, Navalny, Nordstream, Nonsense -- Craig Murray

Once Navalny was in Berlin it was only a matter of time before it was declared that he was poisoned with Novichok. The Russophobes are delighted. This of course eliminates all vestiges of doubt about what happened to the Skripals, and proves that Russia must be isolated and sanctioned to death and we must spend untold billions on weapons and security services. We must also increase domestic surveillance, crack down on dissenting online opinion. It also proves that Donald Trump is a Russian puppet and Brexit is a Russian plot.

I am going to prove beyond all doubt that I am a Russian troll by asking the question Cui Bono?, brilliantly identified by the Integrity Initiative's Ben Nimmo as a sure sign of Russian influence.

I should state that I have no difficulty at all with the notion that a powerful oligarch or an organ of the Russian state may have tried to assassinate Navalny. He is a minor irritant, rather more famous here than in Russia, but not being a major threat does not protect you against political assassination in Russia.

What I do have difficulty with is the notion that if Putin, or other very powerful Russian actors, wanted Navalny dead, and had attacked him while he was in Siberia, he would not be alive in Germany today. If Putin wanted him dead, he would be dead.

The writer of this commentary, Craig Murray..."is an author, broadcaster and human rights activist. He was British Ambassador to Uzbekistan from August 2002 to October 2004 and Rector of the University of Dundee from 2007 to 2010." This commentary was posted on his Internet site on Friday sometime -- and I plucked it from a Zero Hedge article that Brad Robertson sent our way. Another link to it is here.

Why Next Year Promises Big Things for Gold and Silver -- Sprott Weekly Wrap Up

It's been a frustrating, dull, no-fun week, but precious metals investors have a lot to look forward to in the next year. Host Craig Hemke and legendary investor Eric Sprott break down all the gold and silver news you need to see the bright future ahead.

In this edition of the Weekly Wrap Up, you'll hear:

- Why there's a "sobriety test" coming for the markets

- What's behind the runs on palladium and platinum

- Plus: Eric answers your listener-submitted questions

This 20-minute audio interview was posted on the sprottmoney.com Internet site early on Friday morning -- and another link to it is here.

The PHOTOS and the FUNNIES

Still only 2 kilometres from downtown Merritt on 18 April -- and about fifteen seconds after I took the fourth photo that was posted in Friday's column, we came across four mule deer grazing just on the other side of the wooden fence on our right. Since they were on her side of the car, my daughter took the first shot through the rails. We hadn't spooked them to that point, so I got out of the car and took the second photo from just behind the fence. After that they considered us too dangerous, so they walked across the road in single file in the third shot -- and I got one in mid-leap as it jumped the fence on the opposite side of the road. Click to enlarge.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The WRAP

"When the people want the impossible, only liars can satisfy." -- Thomas Sowell

Today's pop 'blast from the past' is is a power ballad that's 39 years young. Neither it, nor the American rock band that performs it, needs any introduction whatsoever. The link is here.

Today's classical blast is one I haven't feature before. It's Mozart's Piano Concerto No. 24 in C minor, K. 491. Mozart composed the concerto in the winter of 1785-1786, finishing it on 24 March 1786, three weeks after completing his Piano Concerto No. 23 in A major -- all before his 30th birthday.

As he intended to perform the work himself, Mozart did not write out the soloist's part in full. The premiere was in early April 1786 at the Burgtheater in Vienna.

The work is one of only two minor-key piano concertos that Mozart composed, the other being the No. 20 in D minor. The work is one of Mozart's most advanced compositions in the concerto genre. Its early admirers included Ludwig van Beethoven and Johannes Brahms.

Here's Murray Perahia, with the Finnish Radio Symphony Orchestra accompanying. Maestro Hannu Lintu conducts -- and the link is here. I'll note that Murray doesn't look all that well.

Considering the 'positive' jobs report, which no one believed for more than second, 'da boyz' really didn't lay the lumber to the precious metal in a meaningful manner at 8:30 a.m. in New York. And the fact that, except for palladium, they were allowed to close in the green on Friday afternoon, should be taken as a sign of better things ahead after the Labour Day long weekend is out of the way.

Looking ahead a couple of weeks, the next FOMC meeting will be upon us -- and one has to wonder what that will bring to the precious metals. The reason I mention it is that gold's 50-day moving average is only about $25 away -- and I'm curious about whether 'da boyz' have that target in sight...or is it a bridge too far?

But regardless of 'all of the above' the Big 8 remain firmly trapped on the short side in both silver and gold -- and have been for a very long time, despite their huffing and puffing recently -- and in the past.

But not to be forgotten, although a bit of a side show for most, is the short position of the Big 8 traders in both platinum and palladium, as there's absolutely no way out for them in either of these precious metals, either. Delivery, for the purposes of covering their short positions, is not an option, as the amount of physical metal required to do so, doesn't exist anywhere on Planet Earth -- and never will.

So we wait some more.

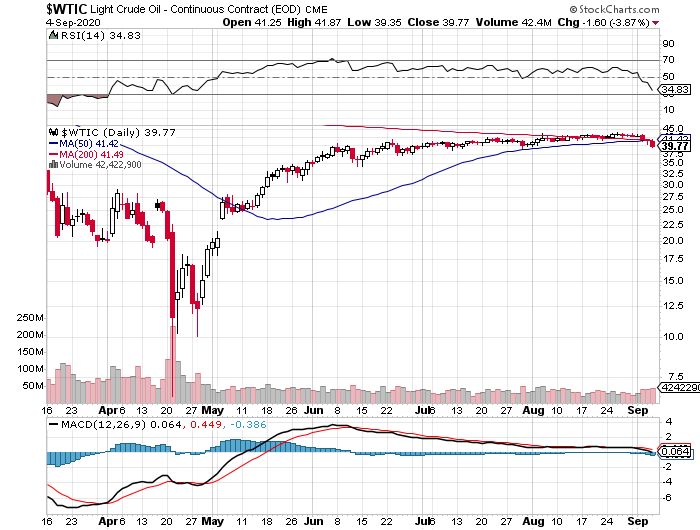

Here are the 6-month charts for the Big 6 commodities, courtesy of stockcharts.com -- and I'll point out that all the price action that occurred after the COMEX close on Friday...mostly positive...doesn't show up in their respective dojis below. Copper was allowed to rally yesterday -- and was higher by 9 cents, which is a pretty big move for that metal. WTIC made another attempt to reach its intrinsic value, as it closed down $1.60 a barrel...3.87 percent. Click to enlarge.

|

|

|

|

|

|

|

|

|

|

|

|

As far as the real world out there is concerned, the situation has been beyond hopeless for a very long time -- and there's zero chance that it will improve.

Only endless free money handed out to Wall Street banks and investment houses has prevented the equity markets from imploding.

The economic, financial and monetary systems have become so twisted, distorted and perverted, that they are unsalvageable. Only a totally new regime can fix this...a new Bretton Woods if you will...and that can only happen once the current system is allowed to collapse into a smouldering ruin. It would do that in a New York minute if allowed.

And when the powers-that-be are ready, I expect that is what will be allowed to happen.

I'm of the opinion that something rather spectacular will be allowed to occur before the U.S. Presidential election -- and if that's the case, the day of denouement is not far off. But I'm just speculating here...but not on the event itself, just the timing.

And if it's not before the election, it will obviously occur after. Total collapse is inevitable, as there is just no other way out.

And as I've stated on a number of occasions this, the 'Great Reset' that follows will not be pretty.

It's for that reason that I've been "all in" in the precious metals for as long as I can remember.

The stories about gold investing in particular are a dime a dozen these days. When I started writing on the Internet over fifteen years ago, a decent precious metal story was tough to find, now they're everywhere...although most are of dubious quality.

And although it grieves me greatly to have to type his name into my column, I note with some sort of twisted satisfaction that Jeff Christian of the infamous CPM Group had a youtube.com video out the other day entitled "No One Should be Short on Gold". One has to wonder, with the game just about up in this multi-generational precious metal price management scheme, if he's attempting to front-run the inevitable in an attempt to redeem himself. Time will tell.

Enjoy your long weekend here in North America -- and I'll add here what I said in Friday's column... "since I'm going to enjoying it to the fullest myself, I won't have a Tuesday column worthy of the name...if at all."

See you on Wednesday for sure.

Ed