PLEASE SEE UPDATE TO THIS PRESS RELEASE:

VANCOUVER, British Columbia, Aug. 20, 2019 (GLOBE NEWSWIRE) -- New Pacific Metals Corp. (TSX-V: NUAG) (OTCQX: NUPMF) (the “Company”) is pleased to announce the final results of a preliminary metallurgical test work program for its Silver Sand Project. The Company is very pleased with the positive results achieved so far from the completed test work. The results suggest that the mineralized materials from the Silver Sand Project would be amenable to processing using conventional flotation or whole ore cyanidation at atmospheric pressure at large scale. This preliminary metallurgical program has demonstrated that good silver extraction rates are possible using these simple extraction methods and that further improvements and refinements should be possible in future programs after fine-tuning the various test parameters.

HIGHLIGHTS OF THE COMPLETED TEST PROGRAM

- Composite samples of sulphide, transition and oxide mineralization were submitted for laboratory-scale rougher-scavenger flotation testing and this achieved up to 96.0%, 86.8% and 92.0% silver recovery respectively.

- Composite samples of sulphide, transition and oxide mineralization were submitted for bottle roll cyanidation testing and this achieved up to 96.7%, 97.0% and 96.3% silver extraction respectively.

- Samples of oxide mineralization were submitted for coarse column leach cyanidation testing and this achieved up to 82% silver extraction.

- High recoveries achieved during cyanidation tests indicate that silver-bearing minerals within the sulphide and transition composite samples tested can be considered non-refractory in nature.

- Composite samples were found to be mostly in the soft to medium grindability range with low to medium values of abrasion index.

METALLURGICAL TEST WORK DETAILS

Several metallurgical composites of oxide, transition and sulphide mineralization from two areas of the Silver Sand deposit were prepared from samples of available half-core. A geometallurgical sampling approach was used and was designed to highlight the effect of differences in silver grade, degree of oxidation and lithology.

Four independent geo-metallurgical test work programs (mineral characterization, comminution, froth flotation and cyanide leaching) were carried out on the different metallurgical composites. Six metallurgical domains (MET1 to MET6) were identified for the flotation and leaching test work and six geological domains (GEO1 to GEO6) were branded for the comminution test work.

Comminution, flotation and leaching programs were completed by SGS Mineral Services in Lima, Peru, while the mineral characterization work was completed by the Research Centre for Mining and Metallurgy (CIMM) and Oruro Technical University (OTU) in Bolivia. Results from the individual test work programs are summarized below.

Mineral Characterization

Mineral characterization work consisted of size fraction assaying, heavy liquids testing and a preliminary program of quantitative mineralogy. The mineral characterization and Sink & Float tests are designed to assess the mineral response to gravity separation.

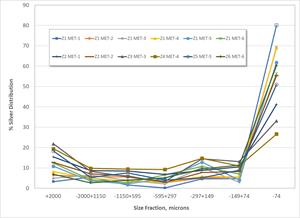

Size Fraction Assaying:

Twelve crushed composites were screened into seven size fractions, and each fraction was individually assayed to obtain a distribution of silver by size. Figure 1 shows the results and illustrates that for almost every composite, the silver tends to concentrate into the finest size fraction (-74 microns). This concentration effect gives rise to an upgrade in silver content of approximately 2.5 to 3 times within that fraction – a potentially useful processing characteristic.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/fdbfdb27-655e-463a-8765-44e2963e6248.

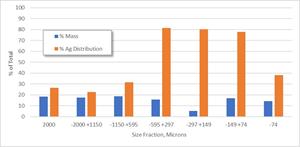

Heavy Liquid Testing:

Six of the composites (high and low grade oxide, transition and sulphide mineralization) were sized into seven fractions each, and these were then subjected to a simple gravity separation using heavy liquid at a density of 2.58 kg/l. On average for all composites, roughly 46% of the total silver was concentrated into 15% of the mass as a “dense” (>2.58 kg/l) fraction. Importantly however, this effect was far more pronounced on average within certain size fractions, as shown in the chart below, with roughly 80% of silver concentrated into less than 20% of the mass (in the 595 to 74-micron range).

The gravity concentration effect was not seen in the coarser size fractions (+595 micron), likely due to insufficient liberation of silver minerals in these size fractions.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/393511d4-b44d-4466-8114-8bbae6ce50b1.

Comminution Testing

Four geological domain composites were subjected to a program of comminution scoping tests, including Crushing Work Index (CWi), Bond Ball Mill Work Index (BWi) and Abrasion Index (Ai). Twenty-one samples were tested in total. CWi tests reported energy consumptions between 4.8 and 11.3kWh/t, while the BWi measurements were from 4.8 to 15.9kWh/t with only one sample above 14 kWh/t. Thus, the majority of the samples tested fell into the category of soft or medium competency level for crushing and grinding. These early indications suggest that relatively low capital and operating costs could be anticipated for any potential comminution circuits. The reported values of abrasion index of between 0.06g and 0.54g corresponds to low to medium abrasivity for these samples. Sulphide materials reported the highest values in the range of medium abrasion behaviour, while the oxides were generally the lowest.

Flotation Testing

Three metallurgical composites of oxide, transition and sulphide mineralization were prepared for a program of froth flotation scoping work, consisting of 23 bench scale rougher-scavenger tests using a variety of conditions (grind sizes, reagent types, reagent dosages and, slurry pH). Composite grades are shown in Table 1 below.

Table 1 – Flotation Program Composite Details

| Composite ID | Head Assay | ||||

| Ag, g/t | Stot, % | Cu, % | Pb, % | Zn, % | |

| Oxide (Z1 FLOATMET 4) | 201 | 0.12 | 0.006 | 0.108 | 0.003 |

| Transition (Z1 FLOATMET 5) | 123 | 1.01 | 0.02 | 0.391 | 0.010 |

| Sulphide (Z1 FLOATMET 6) | 124 | 1.63 | 0.03 | 0.217 | 0.812 |

In general, the flotation performance of these composites was very good, with high silver recoveries achieved using Potassium Amyl Xanthate (PAX) as the primary mineral collector. Silver recoveries of up to 96% for the sulphide composite and 86.8% for the transition composite were reported using this simple approach. Silver recovery appeared to be relatively insensitive to pulp pH although finer grinds and the addition of a secondary collector appeared to give marginal increases in metallurgical performance for the transition composite.

Table 2 – Summary of Results for Rougher-Scavenger Test Work

| Composite | Flotation conditions | % Recovery | ||||

| P80 (µm) | Collector Mix/Dose | Pulp pH | Flotation Gas | Ag, % | Ssul, % | |

| Sulphide (Z1 FLOATMET 6) | 74 | PAX, 45 g/t | 9.0 | Air | 96.0 | 98.4 |

| Transition (Z1 FLOATMET 5) | 74 | PAX, 30 g/t + OX100, 15 g/t | Natural | Air | 86.8 | 94.8 |

| Oxide (Z1 FLOATMET 4) | 74 | PAX, 45 g/t + OX100, 20 g/t | 9.0 | N2 | 92.0 | 49.9 |

The oxide composite also responded well to standard sulphide flotation conditions with silver recoveries in the 90% range. Maximum recoveries were achieved using nitrogen gas for oxide composite flotation, although this slight improvement appears to have been achieved primarily as a result of higher concentrate mass pull.

These initial scoping tests show that silver minerals can be efficiently concentrated using relatively simple froth flotation conditions. Flotation concentrates containing 2,500 – 3,000 g/t silver were produced without using a cleaner flotation stage.

Bottle Roll Leach Testing

Four metallurgical composites of oxide, transition and sulphide mineralization were prepared for cyanide leaching test work as summarized in Table 3. The bottle roll test work program comprised of a battery of 33 individual scoping tests, each running for 72 hours and using a variety of conditions (grind sizes, cyanide solution strength, oxygen levels, and temperatures) to assist begin definition of the metallurgical characterization of Silver Sand mineralization.

Table 3 - Bottle Roll Composite Details

| Composite ID | Head Assay | ||||

| Ag, g/t | Stot, % | Cu, % | Pb, % | Zn, % | |

| LG Oxide (Z1 LEACHMET 1) | 29 | 0.15 | 0.010 | 0.062 | 0.008 |

| HG Oxide (Z1 LEACHMET 4) | 132 | 0.21 | 0.009 | 0.055 | 0.003 |

| HG Transition (Z1 LEACHMET 5) | 157 | 1.45 | 0.040 | 0.120 | 0.343 |

| HG Sulphide (Z1 LEACHMET 6) | 124 | 2.13 | 0.031 | 0.089 | 0.054 |

A variety of results were obtained from the work. A summary of the better data points is presented in Table 4 below.

Table 4 - Bottle Roll Test Results Summary

| Composite ID | Grind P80, µm | % Sol. Strength | Consumption, kg/t | Temp℃ | Sparge Gas | % Extraction | ||

| NaCN | NaCN | CaO | Ag | Cu | ||||

| LG Oxide (Z1 LEACHMET 1) | 74 | 0.30 | 6.71 | 0.78 | 59 | O2 | 81.6 | 48.5 |

| HG Oxide (Z1 LEACHMET 4) | 74 | 0.30 | 3.94 | 0.78 | 59 | O2 | 96.3 | 34.5 |

| HG Transition (Z1 LEACHMET 5) | 50 | 0.30 | 9.78 | 0.78 | 56 | O2 | 97.0 | 81.6 |

| HG Sulphide (Z1 LEACHMET 6) | 50 | 0.30 | 10.2 | 0.79 | 57 | O2 | 96.7 | 73.7 |

Very high silver extractions (greater than 96%) were achieved for the sulphide and transition composites when intensive cyanidation conditions were used (oxygen sparging plus elevated pulp temperature). Oxide composite performance was more variable, with silver extractions between 81 and 96% achieved under similar conditions.

These leaching results are in general very encouraging and further optimization test work is recommended to better characterize the deposit.

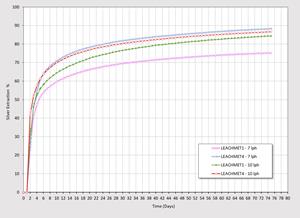

Column Leach Testing

Column leach tests were completed on the two oxide samples, using coarser material than the bottle roll work (crushed to 100% passing 1/2”). Each column test ran for 75 days and the dissolved oxygen (DO) level was maintained throughout all tests. (See Figure 3)

Table 5 – Column Leach Test Results Summary

| Composite ID | Mesh of Grind mm | % Sol. Strength | Solution Rate l/h/m2 | Consumption, kg/t | % Extraction (calculated from PLS concs) | ||

| NaCN | NaCN | CaO | Ag | Cu | |||

| Z1 LEACHMET 1 | -12.7 | 0.40 | 7.0 | 6.3 | 1.4 | 75.3 | 45.8 |

| Z1 LEACHMET 4 | -12.7 | 0.40 | 10.0 | 8.6 | 1.6 | 84.4 | 45.1 |

| Z1 LEACHMET 1 | -12.7 | 0.40 | 7.0 | 6.4 | 1.4 | 88.3 | 29.3 |

| Z1 LEACHMET 4 | -12.7 | 0.40 | 10.0 | 8.1 | 1.6 | 86.6 | 29.4 |

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c07b2e17-363b-4c5f-9bd7-f8f5e8926f5f.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c07b2e17-363b-4c5f-9bd7-f8f5e8926f5f.

Technical information contained in this news release has been approved by Andy Holloway, P.Eng., CEng., Principal Process Engineer at AGP Mining Consultants Inc., who is a Qualified Person for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

ABOUT NEW PACIFIC

New Pacific is a Canadian exploration and development company which owns the Silver Sand Project in Potosí Department of Bolivia, the Tagish Lake gold project in Yukon, Canada and the RZY Project in Qinghai Province, China. Its largest shareholders are Silvercorp Metals Inc. and Pan American Silver Corp., one of the world's largest primary silver producers, which operates six mines, including the San Vicente mine located in the Potosí Department of Bolivia.

For further information, contact:

| New Pacific Metals | |

| Corp. Gordon Neal | |

| President | |

| Phone: | (604) 633-1368 |

| Fax: | (604) 669-9387 |

| info@newpacificmetals.com | |

| www.newpacificmetals.com | |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain of the statements and information in this press release constitute “forward-looking information” within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: fluctuating equity prices, bond prices, commodity prices; calculation of resources, reserves and mineralization, foreign exchange risks, interest rate risk, foreign investment risk; loss of key personnel; conflicts of interest; dependence on management and others.

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Forward-looking statements or information are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements or information due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in the Company’s Annual Information Form for the year ended June 30, 2018 under the heading “Risk Factors”. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company’s forward-looking statements or information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this press release, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements or information if circumstances or management’s assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information. For the reasons set forth above, investors should not place undue reliance on forward-looking statements or information.

CAUTIONARY NOTE TO US INVESTORS

This news release has been prepared in accordance with the requirements of NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards, which differ from the requirements of U.S. Securities laws. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

Legal Notice / Disclaimer:

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. SilverSeek.com, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; SilverSeek.com makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of GoldSeek.com only and are subject to change without notice. SilverSeek.com assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

Additional Disclosure: The owner, editor, writer and publisher and their associates are not responsible for errors or omissions. The author of this report is not a registered financial advisor. Readers should not view this material as offering investment related advice. Authors have taken precautions to ensure accuracy of information provided. Information collected and presented are from what is perceived as reliable sources, but since the information source(s) are beyond our control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise outside of the trading timeframe listed above. Nothing contained herein constitutes a representation by the publisher, nor a solicitation for the purchase or sale of securities & therefore information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The companies mentioned herein may be sponsor of GoldSeek.com. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.