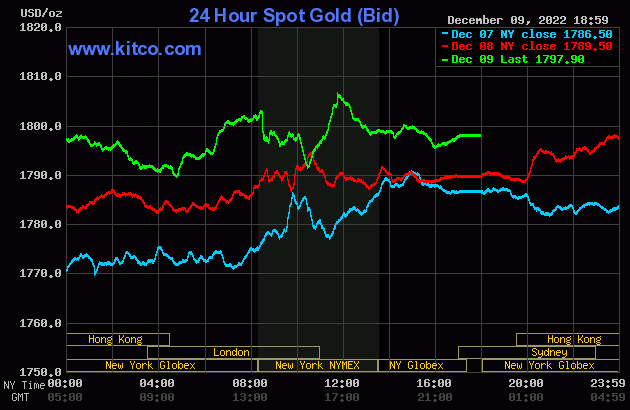

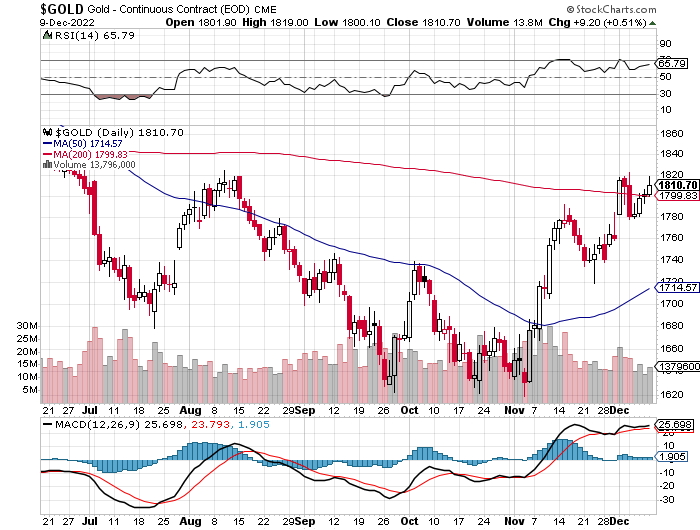

The gold price had a broad up/down move that began around 9 a.m. China Standard Time in GLOBEX trading in the Far East on their Friday morning -- and ended a few minutes before 10 a.m. in London. Its ensuing rally was capped and turned lower on the PPI news at 8:30 a.m. in New York -- and that sell-off lasted until around 10:25 a.m. CST. It rallied rather sharply from there until 11:45 a.m. CST -- and then was sold two steps lower until 4 p.m. in after-hours trading. It crept a few dollars higher from there until the market closed at 5:00 p.m. EST.

The low and high ticks in gold were reported by the CME Group as $1,800.10 and $1,819.00 in the February contract. The December/February price spread differential in gold at the close in New York yesterday was $12.60...February/ April $15.20 -- and April/June was $15.40 an ounce.

Gold was closed in New York on Friday afternoon at $1,797.90 spot, up $8.40 on the day. Net volume was pretty light at a bit under 144,000 contracts -- and there were just about 8,500 contracts worth of roll-over/switch volume on top of that...mostly into April and June.

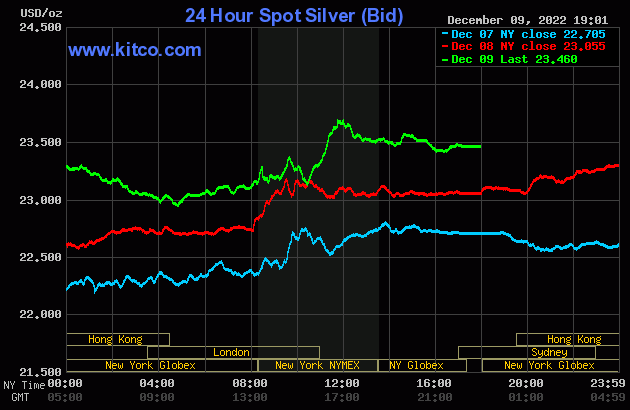

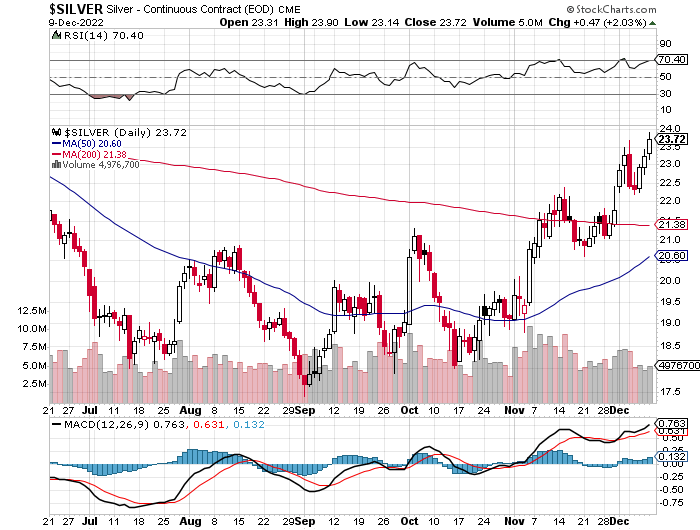

Silver's price path was managed in an almost identical fashion as gold's, except that the sell-off on the PPI news at 8:30 a.m. EST was very muted -- and its rally was capped and turned lower around 9:35 a.m. in COMEX trading in New York. After that, the price inflection points were the same as they were for gold.

The low and high ticks in silver were recorded as $23.14 and $23.90 in the March contract. The December/March price spread differential in silver at the close in New York yesterday was 18.2 cents...March/May was 17.0 cents -- and May/July was 19.4 cents an ounce.

Silver was closed on Friday afternoon in New York at $23.46 spot, up 40.5 cents on the day. Net volume was nothing special at 51,000 contracts -- and there was a bit over 3,000 contracts worth of roll-over/switch volume in this precious metal.

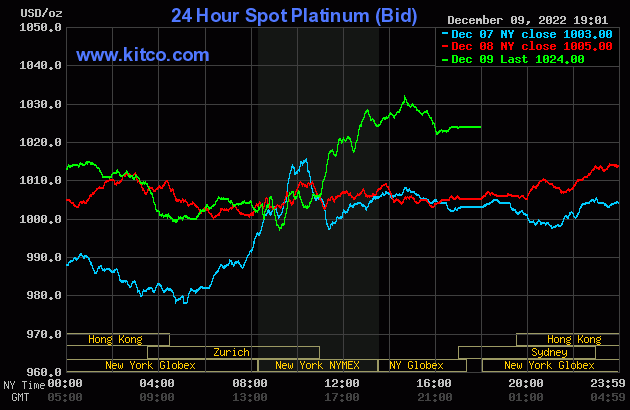

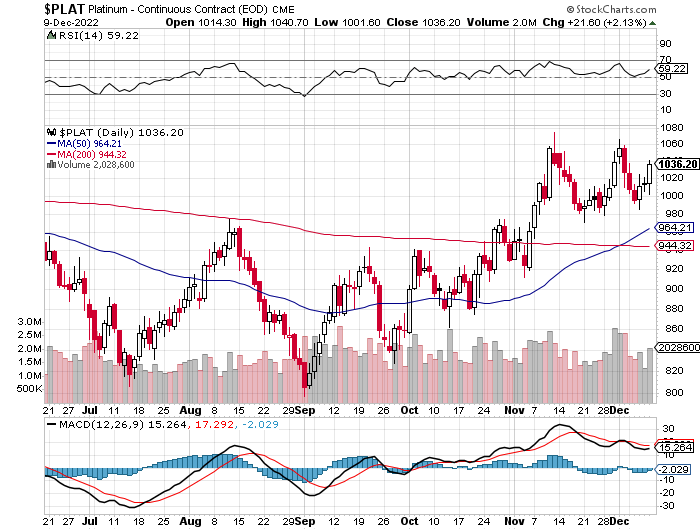

Platinum had the same up/down move as silver and gold, which ended minutes before 11 a.m. in GLOBEX trading in Zurich. It didn't do much after that, but was sold down to its low tick of the day shortly after 9 a.m. in COMEX trading in New York. Its choppy rally from there was capped for the final time around 2:45 p.m. in after-hours trading -- and it was sold lower until 4 p.m. It didn't do a thing after that. Platinum was closed at $1,024 spot, up 19 dollars from Thursday.

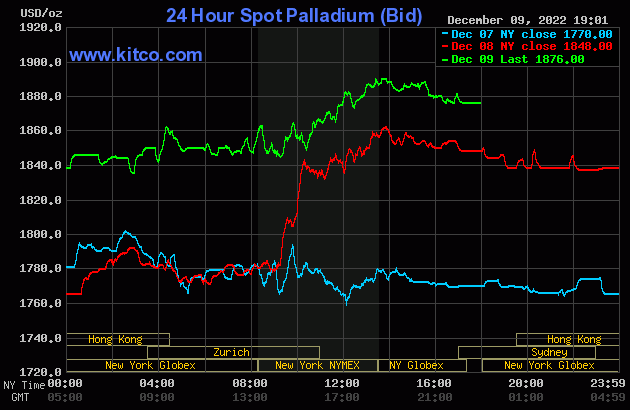

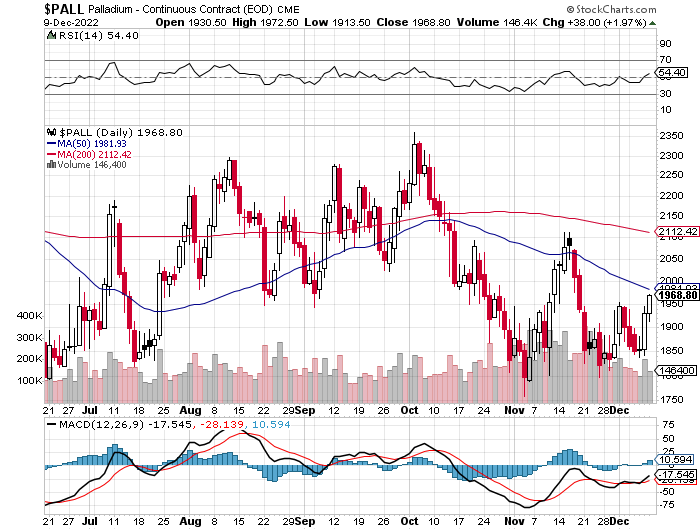

Palladium has a very broad and quiet down/up move in GLOBEX trading that ended around 9:30 a.m. in Zurich -- and from there it chopped quietly sideways until, like platinum, it took off higher very shortly after 9 a.m. in COMEX trading in New York. Its high tick was set around the 1:30 p.m. COMEX close -- and it too was sold quietly lower until trading ended at 5:00 p.m. EST. Palladium was closed at $1,876 spot, up 28 bucks on the day.

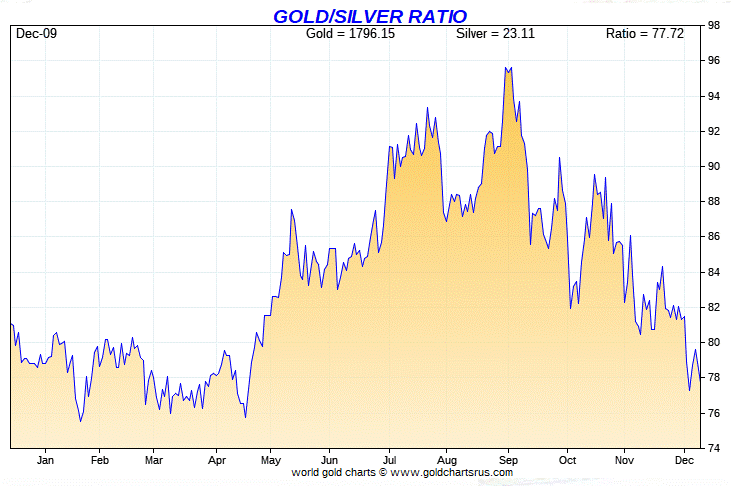

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 76.6 to 1 on Friday...compared to 77.6 to 1 on Thursday.

And here's Nick Laird's 1-year Gold/Silver Ratio Chart, updated with this past week's data and, as always, the Friday data point of 76.6 to 1 is not on it. Click to enlarge.

![]()

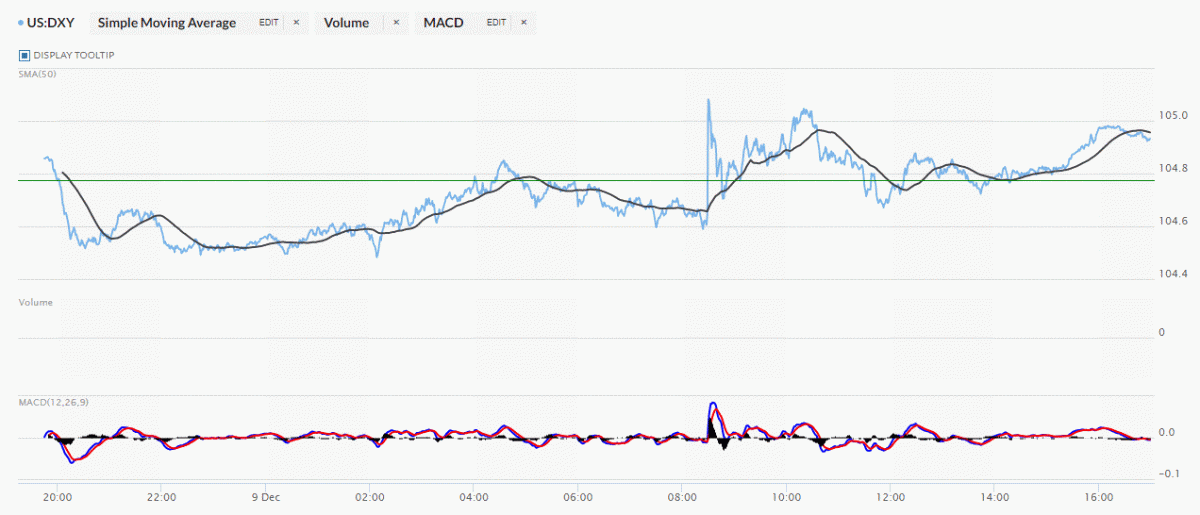

The dollar index closed very late on Thursday afternoon in New York at 104.77 -- and the opened higher by 9 basis points once trading commenced at 7:45 p.m. EST on Thursday evening, which was 8:45 a.m. China Standard Time on their Friday morning. Shortly after that it was sold lower until 9:32 a.m. CST -- and from there it wandered a bit unevenly sideways until a 'rally' commenced aroslvund 1:25 p.m. CST. That lasted until 9:35 a.m. in London -- and it then headed lower into the PPI number at 8:30 a.m. in New York. It spiked higher at that point, which only lasted a minute or so -- and it was then sold lower until 8:48 a.m. It then had an up/down move centered around 10:20 a.m. -- and ending at 11:52 a.m. From there it wandered quietly higher until the equity markets closed at 4 p.m. -- and from that juncture it edged a bit lower until the market closed at 5:00 p.m. EST.

The dollar index was marked-to-close in New York on Friday afternoon at 104.81...up only 4 basis points on the day -- and 12 basis points below its indicated spot close on the DXY chart below.

Here's the DXY chart for Friday, thanks to marketwatch.com as usual. Click to enlarge.

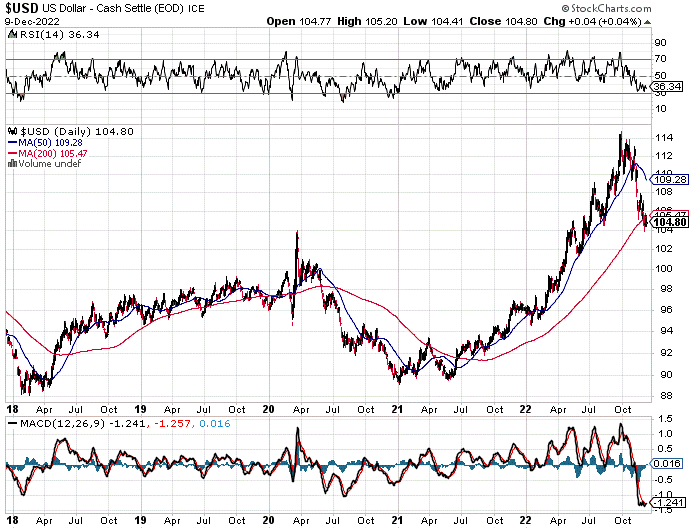

And here's the 5-year DXY chart that appears in this spot every Saturday -- and courtesy of the folks over at the stockcharts.com Internet site. The delta between its close...104.80...and the close on the DXY chart above, was 1 basis point below its spot close. Click to enlarge as well.

The precious metals certainly wanted to rally hard in New York yesterday, despite what the currencies were doing, but that wasn't allowed once again.

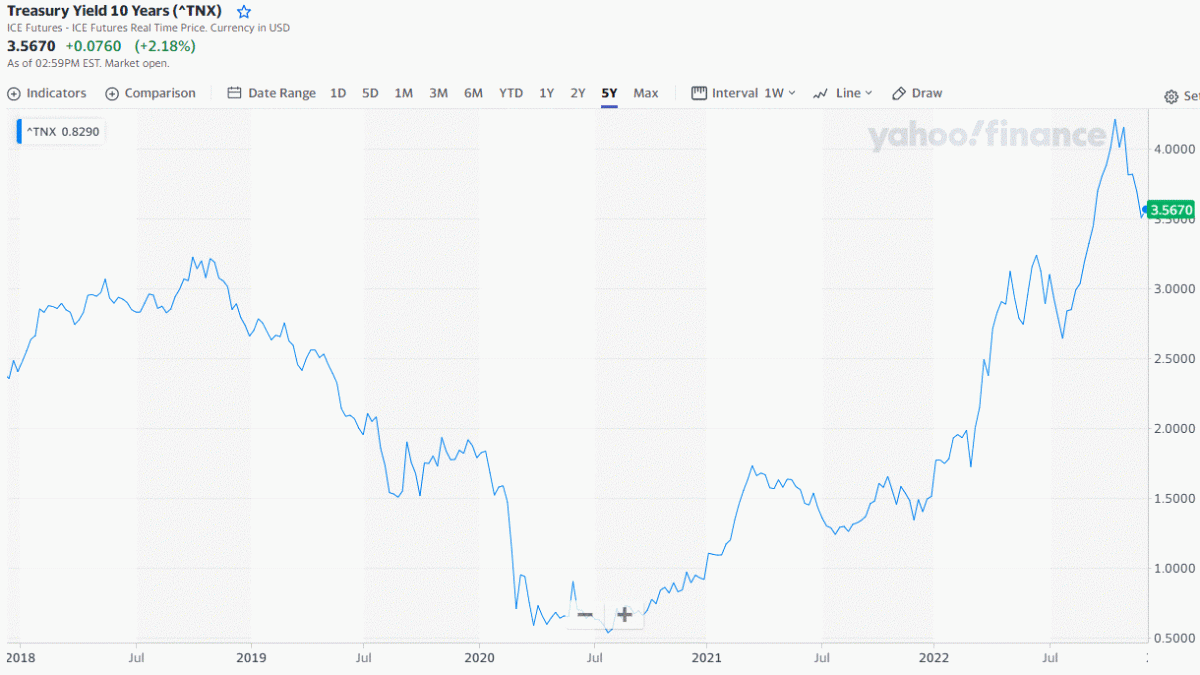

U.S. 10-year Treasury: 3.5670%...up 0.0760 (+2.18%)...as of 02:59 p.m. EST

Here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- and it puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

As I mentioned in this spot last week, it appears that 4% for the 10-year is the line in the sand for Fed at the moment. This yield curve control will obviously continue until the entire system is allowed to implode. And as Gregory Mannarino has been pointing out for years now, the debt market is where it will start when it does.

![]()

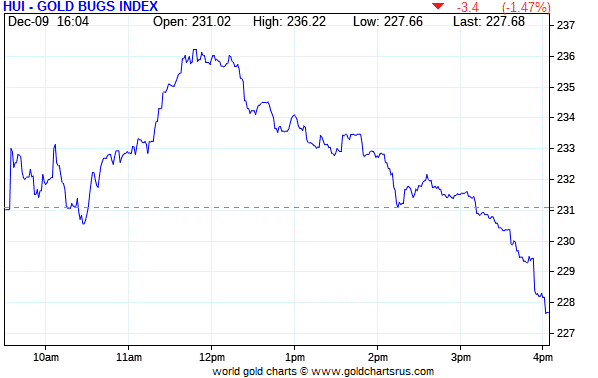

The gold stocks ticked a bit higher at the 9:30 opens in New York on Friday morning, but were then sold a bit lower staring about thirty minutes later -- and that sell-off lasted until around 10:30 a.m. EST. They then rallied until the gold price was capped at 11:45 a.m. Thirty minutes later the selling pressure commenced -- and they were sold down hard right into the 4:00 p.m. EST closes, with the HUI closing on its absolute low tick of the day...down 1.47 percent. I was shocked, as were you, I'm sure.

Computed manually -- and sansPeñoles once again, Nick Laird's Intraday Silver Sentiment/Silver 7 Index closed lower by 1.65 percent.

Peñoles didn't traded again yesterday, so the above index was computed based on the six silver mining companies that did.

Here's Nick's 1-year Silver Sentiment/Silver 7 Index chart, updated with Friday's candle. Click to enlarge.

All six of the silver stocks used to compute the above average closed down on the day -- and there certainly weren't any stars. The biggest underperformer was First Majestic Silver as it closed down 2.41 percent.

I checked at least a dozen silver and gold stocks...small, medium and large cap...and they all showed the exact same price pattern, hitting their highs of the day at or just after the highs in both gold and silver on Friday -- and all were sold lower after that, with their respective declines picking up steam during the last hour or so of trading.

And, like the bizarre and totally counterintuitive price action in the precious metal shares over the last few days, especially the silver equities, I was amazed once again. It was very disappointing. It made absolute no sense to me -- and I know it didn't for you, either.

The fact that there were more than willing buyers for all these precious metal shares that were sold for whatever reason yesterday, is certainly no consolation.

These are certainly times that try men's [and women's ] souls, that's for sure.

The new short report from the WSJ website yesterday evening showed that the short position in First Majestic Silver on the NYSE fell by another 5.52% to only 13.48 million shares, which represents 5.69% of the float.

The latest silver eye candy from the reddit.com/Wallstreetsilver crowd is linked here.

![]()

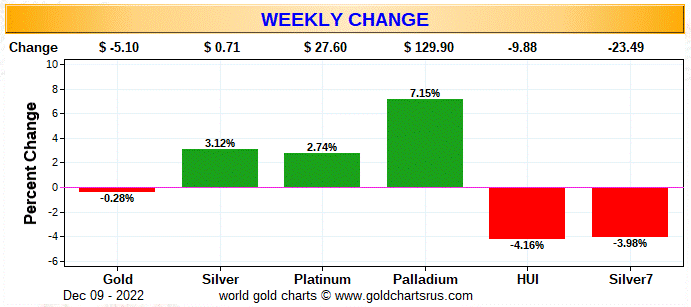

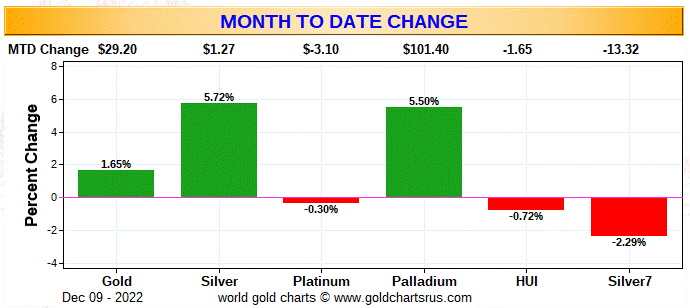

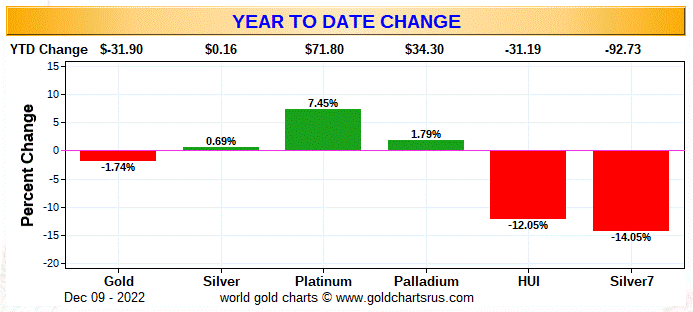

Here are the three usual three charts that show up in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the Silver 7 Index.

Here's the weekly chart -- and the stark underperformance of the precious metal shares is glaringly obvious...especially the silver stocks. Click to enlarge.

The month-to-date chart is back this week -- and all it does is amplify what the weekly chart shows, particularly the silver equities once again. Click to enlarge.

Here's the year-to-date chart -- and even though silver is back in positive territory bit a bit since the start of the year -- and the gold price nearly so, you'd never know it by looking at the performance of their underlying equities. Click to enlarge.

Although I'm loath to bring it up, but unless this was 1-day tax-loss selling on a massive scale...something I've not seen before...one has to at least consider the possibility that this is price intervention in the precious metal shares across the board. This won't be known for sure until the next short report comes out on December 27.

![]()

The CME Daily Delivery Report for Day 9 of December deliveries showed that 166 gold -- and 373 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the only two of the four short/issuers that mattered were Canada's BMO Capital and Marex Spectron, as they issued 114 and 48 contracts respectively...BMO Capital from its house account.

The four biggest long/stoppers started off with JPMorgan, as they picked up 75 of those contracts for their client account. Next were BofA Securities and Canada's Scotia Capital/Scotiabank, as they stopped 36 and 19 contracts for their respective house accounts. In fourth place was Australia's Macquarie Futures, picking up 19 contracts for clients.

In silver, the only short/issuer was Canada's BMO Capital, as they issued all 373 contracts -- and all out of their house account. The four largest long/ stoppers began with BofA Securities, as they stopped 158 contracts for their own account -- and they were followed by JPMorgan, as they stopped 117 contracts for their client account. The last two were ADM and British bank HSBC, as they picked up 40 and 25 contacts respectively...HSBC for their own account.

The link to yesterday's Issuers and Stoppers Report is here.

Month-to-date there have been 16,578 gold contracts issued and stopped -- and that number in silver is 3,393 COMEX contracts. In platinum, that number is 1 contract -- and in palladium it's 142 contracts. I know that Ted will have something to say about this in his weekly review this afternoon.

The CME Preliminary Report for the Friday trading session showed that gold open interest in December dropped by 3,870 COMEX contracts, leaving 2,704 still open, minus the 166 contracts mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that 3,912 gold contracts were posted for delivery on Monday, so that means that 3,912-3,870=42 more gold contracts were added to the December delivery month. Silver o.i. in December fell by 80 contracts, leaving 1,729 still around, minus the 373 contracts mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that 55 silver contracts were posted for delivery on Monday, so that means that 80-55=25 silver contracts vanished from the December delivery month...the second day in a row where silver contracts have disappeared from December. [Ted and I had a discussion about this on the phone yesterday afternoon -- and he may or may not have something to say about it in his weekly review later today.]

Total gold open interest at the close on Friday rose by 3,940 COMEX contracts -- and total silver o.i. increased by 1,009 contracts. Both numbers are subject to some revision by the time the final figures are posted on the CME's website later on Monday morning CST.

January open interest in silver fell by 18 COMEX contracts, leaving 1,572 still around -- and gold o.i. in January is 1,317 contracts, up 20 from Friday.

![]()

There was another deposit into GLD yesterday, the fourth in a row, as an authorized participant added 74,449 troy ounces of gold. However, a fairly hefty 2,024,809 troy ounces of silver was removed from SLV.

The new short report was posted on The Wall Street Journal's website early on Friday evening EST -- and it showed the short positions in both GLD and SLV dropped from from the prior report. As of November 30, the short position in SLV declined from 54.62 million shares, down to 45.38 million shares, which is a drop of 9.24 million shares...16.92%. The short position in GLD declined from 1.103 million shares, down to 958,000 shares sold short...a drop of 13.21%.

The short position in SLV is still outrageous, but is nothing of concern in GLD.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD and SLV inventories, there was a net 47,662 troy ounces of gold added -- and a net 74,155 troy ounces of silver was taken out.

And still nothing from the U.S. Mint -- and nothing month-to-date, either. I now suspect that they may be done for the year.

![]()

There was very little activity in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday. Nothing was reported received -- and only 6,912.470 troy ounces/215 kilobars were shipped out. That all occurred over at Brink's, Inc.

There was a bit of paper activity, as 6,172.992 troy ounces/192 kilobars was transferred from the Registered category and back into Eligible over at Manfra, Tordella & Brookes, Inc. There were 3 kilobars each, two COMEX contracts in total, transferred from the Eligible category and into Registered over at HSBC USA and Brink's, Inc. respectively.

The link to Thursday's COMEX activity in gold, is here.

There was pretty big activity in silver, as 1,157,471 troy ounces/two truckloads were reported received over at Loomis International. There were only 121,068 troy ounces shipped out -- 60,814 troy ounces at Loomis International -- and the remaining 60,254 troy ounces departed CNT.

There was a bit of paper activity, as 23,415 troy ounces were transferred from the Eligible category and back into Registered over at Delaware -- and obviously going out for delivery in December.

The link to all of Thursday COMEX activity in silver, is here.

There was very decent activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday. There were 4,143 kilobars reported received -- and none were shipped out. Except the 129 kilobars that were dropped off at Loomis International, the remaining in/out activity happened over at Brink's, Inc. as usual. The link to that, in troy ounces, is here.

![]()

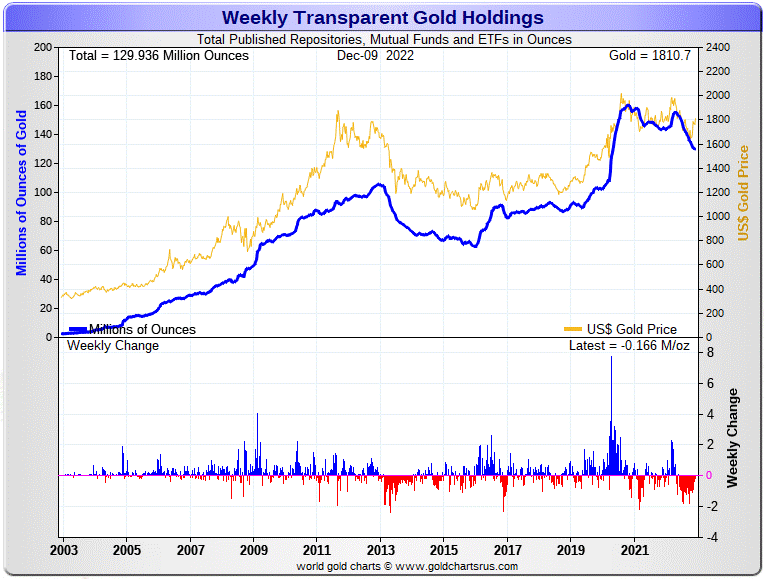

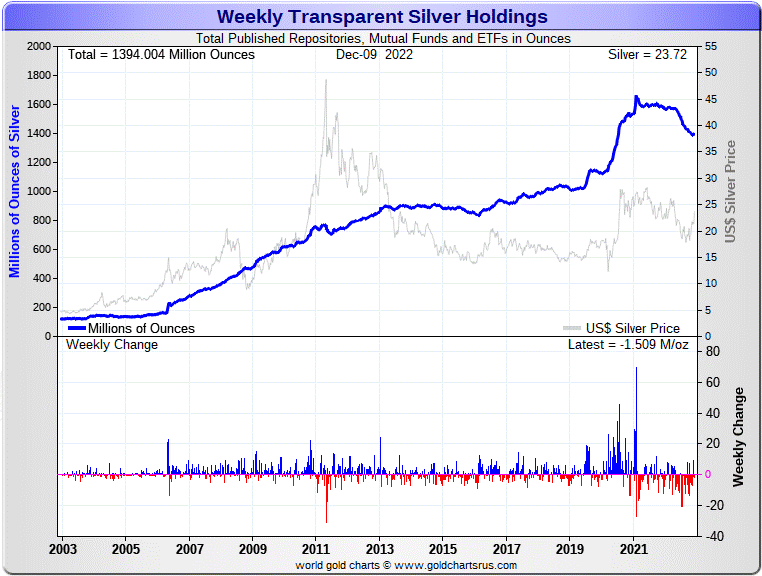

Here are the usual 20-year charts that show up in this space in every Saturday column. They show the total amount of physical gold and silver held in all know depositories, ETFs and mutual funds as of the close of business on Friday.

During the week just past, there was a net 166,000 troy ounces of gold removed -- and a net 1.509 million troy ounces of silver was taken out as well. Click to enlarge for both.

According to Nick Laird's data on his website, there has been a net 640,000 troy ounces of gold removed from-- and a net 4.992 million troy ounces of silver added to, all the world's known depositories, mutual funds and ETFs during the last four weeks.

That number in gold is down 488,000 troy ounces from last week, but in silver, that's up 5.734 million troy ounces from a week ago, when it showed that 742,000 troy ounces of silver had been removed over the last four weeks. That big jump higher in silver was mainly because of the huge amount added three weeks ago.

In silver over the last four weeks...there was a net 1.881 million troy ounces added to COMEX inventories -- and a net 1.657 million troy ounces was added to SLV. That left the remaining net 1.454 million troy ounces that was added to the rest of the world's ETFs and mutual funds -- and was mostly as a result of the 1.906 million troy ounces of silver added to SIVR during that time period.

That one heck of a reversal from just a week ago...but as I pointed out a few paragraphs ago, that's mainly because of the addition made three weeks ago.

In gold over the last month, the withdrawals were also mostly JPMorgan-related at the COMEX...0.405 million troy ounces. GLD/GLDM accounted for only 0.064 million troy ounces -- and the rest...0.171 million troy ounces, from the other gold ETFs and mutual funds.

It appears that we've turned the corner in silver -- and it most likely won't be long before the same happens in gold.

The physical shortage in silver at the both the wholesale and retail level continued this past week -- and still shows no signs whatsoever of abating. There also appears to be some serious physical tightness in gold at both these levels as well.

But, as you're more than aware, this extraordinary demand in all forms has not yet been allowed to manifest itself in their respective prices, as the Big 4/8 commercial shorts are still sitting on them.

Of course not to be forgotten about SLV is this not so little matter of the 45.38 million shares currently sold short in this ETF. That's down 9.24 million shares/ 17% as of yesterday's short report. The reason that number remains stubbornly high is certainly because the physical metal doesn't exist to deposit without driving the silver price to the moon. So instead of depositing the physical metal, the mostly one or two major authorized participants involved [according to Ted] are shorting the shares is lieu of that.

The next short report isn't due out until December 27.

Then there's still that other little matter of the 1-billion ounce short position held by Bank of America...with JPMorgan & Friends on the long side. Ted says it hasn't gone away.

![]()

I don't have space for the charts in today's column, but Nick Laird posted the November withdrawals from the Shanghai Gold Exchange yesterday afternoon. During that month, they reported that 115.44 tonnes of gold/3.71 million troy ounces of gold were taken out...along with 210.38 tonnes/6.76 million troy ounces of silver. The charts will be in Tuesday's column for sure.

![]()

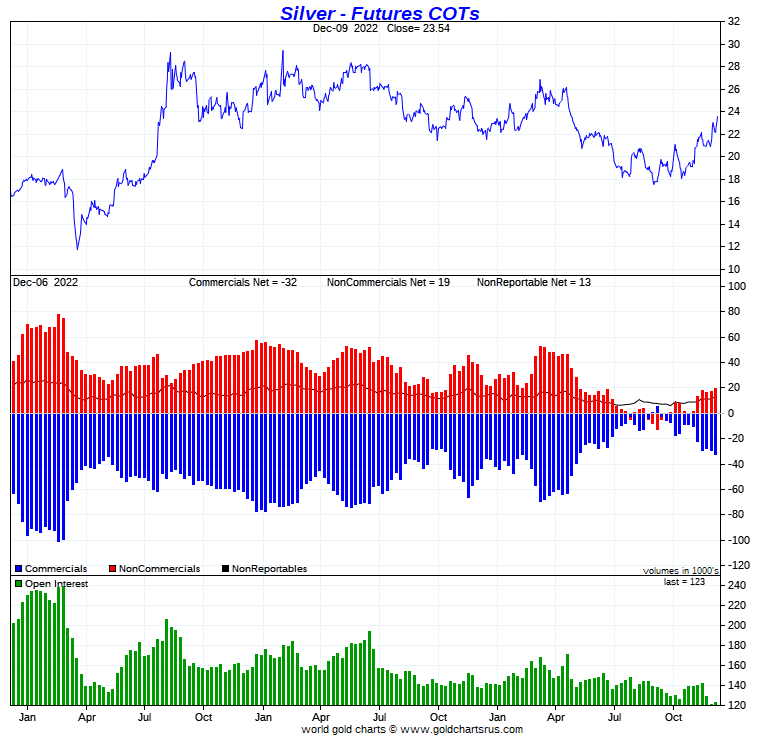

The Commitment of Traders Report, for positions held at the close of COMEX trading on Tuesday, December 6, show the expected increases in the commercial net short positions in both silver and gold. But considering the price moves in both these precious metals during the reporting week, the numbers weren't all that bad.

In silver, the Commercial short position increased by 3,265 COMEX contracts, or 16.33 million troy ounces of the stuff.

They arrived at that number by reducing their long position by 1,513 COMEX contracts -- and also increased their short position by 1,752 contracts. It's the sum of those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, the Managed Money traders did virtually nothing, reducing their net long position by a paltry 255 contracts. The big activity was in the Other Reportables and Nonreportable/ small traders categories, where both increased their net long position...the former by 1,980 COMEX contracts -- and the latter by 1,540 contracts.

Doing the math: 1,980 plus 1,540 minus 255 equals 3,265 COMEX contracts, the change in the Commercial net short position.

The Commercial net short position in silver [which no longer contains any Managed Money traders] now sits at 161.31 million troy ounces in Friday's report. That's up from the 144.99 million troy ounces that they were net short in this past Monday's COT Report...an increase of 161.31-144.99=61.32 million troy ounces/3,264 COMEX contracts. That change is obviously the headline number mentioned further up, which it has to be...with the tiny difference being a rounding error.

The Big 8 shorts increased their short position to 63,362 COMEX contracts -- and that's up a tiny 672 contracts from the 62,690 contracts they were short in last Friday's COT Report.

The Big 4 shorts increased their short position to 43,508 COMEX contracts, up 1,189 contracts from the 42,319 contracts they were short in last Friday's Report.

That means that the Big '5 through 8' shorts reduced their short position by 1,189-672=517 COMEX contracts during the reporting week. So the Big 4 shorts were sellers -- and the Big '5 through 8' were buyers.

This left Ted's raptors, the 27 small commercial traders other than the Big 8 shorts, net long the COMEX futures market in silver by 31,100 COMEX contracts/155.5 million troy ounces...down about 2,600 contracts/13.0 million troy ounces...from the 33,700 contracts they were long in last Friday's report.

This means, of course, that they sold those 2,600 contracts for big profits. But considering where we are at this point in the rally in silver, I'm surprised that there are the raptors are still long the amount that they are.

Here's Nick's 9-year COT chart for silver, updated with this week's data points. Click to enlarge.

So, considering the price move we had during the reporting week, Ted was pleasantly surprised that this was all the damage there was from the Big 8, as they only added about 665 contracts to their short position on a net basis.

Add to that the fact that the Managed Money traders did next to nothing, means that the set up for a continuing rally in silver is very much intact from a COMEX futures market perspective, as things remain very bullish.

![]()

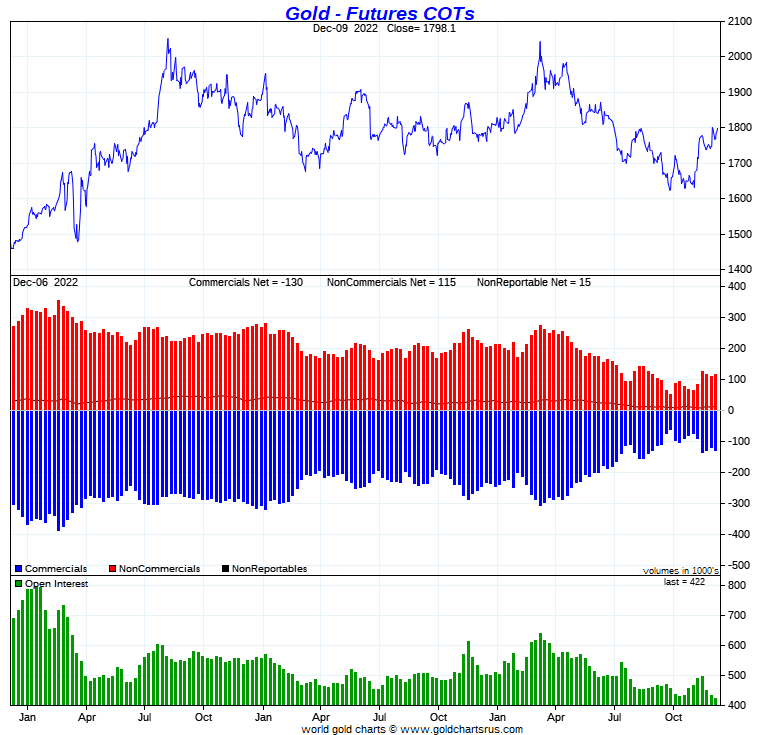

In gold, the commercial net short position rose by 10,846 COMEX contracts, or 1.085 million troy ounces of gold.

They arrived at that number by reducing their long position by 16,606 COMEX contracts, but also reduced their short position by 5,760 contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, the Managed Money and Nonreportable/small traders were the big buyers during the reporting week, as the former increased their net long position by 8,767 COMEX contracts -- and the latter increased theirs by a fairly hefty 5,724 contracts.

This means that the Other Reportables had to have been sellers during the reporting week -- and they were, reducing their net long position by 3,645 COMEX contracts.

Doing the math: 8,767 plus 5,724 minus 3,645 equals 10,846 COMEX contracts, the change in the commercial net short position.

Remember, that like in silver, the commercial traders can only buy what the non-commercial and small traders are prepared to sell.

In last week's COT Report, Ted was of the opinion that there's still one Managed Money trader left in the Big 8 short category. But they would have been at the bottom end of the Big '5 through 8' category...around 10,000 COMEX contracts worth.

However, when he looked at this week's COT Report, that assumption turned out not to be the case at all. There were no Managed Money traders left in the Big 8 commercial category, so last week's numbers were pure numbers -- and for that reason, made a big difference in the raptor category last week and this week, which I'll get into a bit further down.

The commercial net short position in gold now sits at 13.008 million troy ounces, which is up 1.085 million troy ounces from the 11.923 million troy ounces they were short in last Friday's COT Report. That's the headline number posted above, which it has to be.

The short position of the Big 8 traders worked out to 20.56 million troy ounces, up 0.52 million troy ounces from the 20.04 troy ounces they were short in last Friday's COT Report.

The short position of the Big 4 traders is 12.33 million troy ounces...up 0.45 million troy ounces from the 11.88 million ounces that the Big 4 were short in Monday's COT Report.

So that means that the short position of the Big '5 through 8' traders increased by 0.52-0.45=0.07 million troy ounces...not a lot. Most of the commercial selling this past reporting week was by the Big 4 and Ted's raptors.

In last Friday' COT Report, the raptors showed being net long 81,000 COMEX contracts...which Ted thought was too high by 10,000 contracts because he was under the impression that there was still a Managed Money traders short that 10,000 contracts in the Big '5 through 8' category. As it turned out, that assumption was not correct, as this week's COT Report showed that there was no Managed Money trader in last week's COT Report, so that 81,000 contract number was pure commercial traders.

Computing the raptor long position this week [the commercial net short position, minus the short position of the Big 8 traders] showed that Ted's raptors were net long 75,500 COMEX contracts...down 5,500 contracts for the record high long position they held last Friday.

Make no mistake about it, those remaining 75,500 COMEX contracts that the raptors are long, is a huge amount for them to be long this far off gold's low tick for this cycle -- and a really big deal according to Ted. Why haven't they -- and the silver raptors, not sold long ago?

Although his raptors sold some contracts in both silver and gold during the reporting week, they've got a very long way to go before they're back to market neutral...let alone going back on the short side.

Here's the 9-month COT chart for gold, thanks to Nick Laird as always. Click to enlarge.

During the last four weeks, the short position of the Big 8 traders [almost all the Big 4] has only risen by 10,000 contracts -- and considering how much higher in price we are in gold...over $100...it's obvious that the set-up in gold is just as bullish in this precious metal as it is silver -- and made even more so by the almost record high long positions held by Ted's raptors, the small commercial traders other than the Big 8.

Their respective rallies have a very long way to go...but the treachery of these big commercial shorts should never be overlooked as we continue higher.

![]()

In the other metals, the Managed Money traders in palladium decreased their net short position by 170 COMEX contracts -- and are net short palladium by 530 contracts. The Swap Dealers are still the only category that's net long palladium in the COMEX futures market at the moment. In platinum, the Managed Money traders decreased their net long position by a smallish 301 COMEX contracts -- and are net long platinum in the COMEX futures market by a very hefty 20,485 contracts. The Producer/Merchant category is the only category short platinum at the moment -- and they are mega net short by 31,151 COMEX contracts.

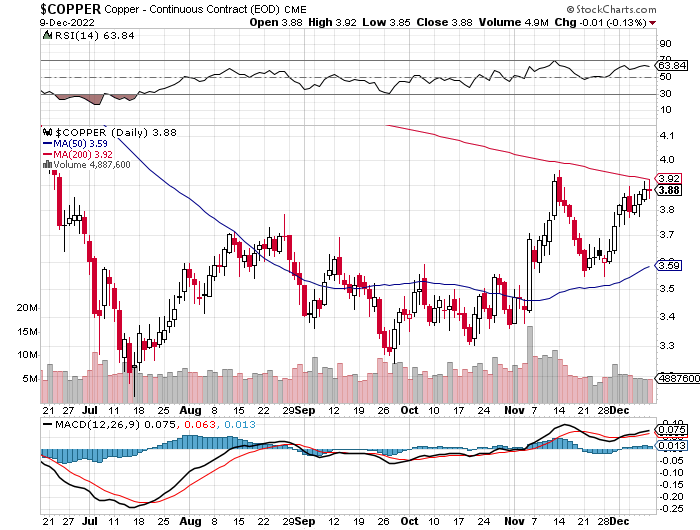

In copper, the Managed Money traders increased their net long position by 2,845 COMEX contracts -- and are still net long copper by 15,327 COMEX contracts...about 383 million pounds of the stuff. Copper continues to be a totally bifurcated market in the commercial category. The Producer/Merchants are still mega net short copper -- and the Swap Dealers are still mega net long.

Whether these bifurcated markets mean anything or not, will only be known in the fullness of time. Ted says it doesn't mean anything as far as he's concerned, as they're all commercial traders in the commercial category.

In this vital industrial commodity, the world's banks...both U.S. and foreign... are net long 12.4 percent of the total open interest in copper in the COMEX futures market as of yesterday's Bank Participation Report...up from the 9.9 percent they were net long in November's. At the moment it's the commodity trading houses such as Glencore et al., along with some hedge funds, that are mega net short copper in the Producer/Merchant category. The Swap/Dealers are mega net long.

![]()

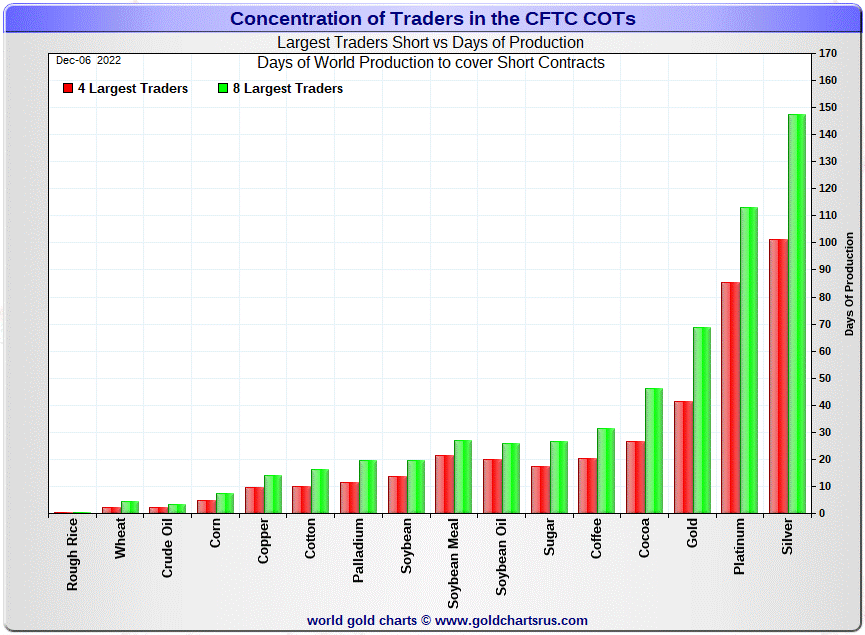

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, December 6. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in each physically traded commodity on the COMEX.

I consider this to be the most important chart that shows up in the COT series -- and it always deserves a moment of your time -- and Ted says that there are no Managed Money traders left in the Big 8 commercial category, so this weeks numbers in silver are accurate for the second week in a row.

In this week's 'Days to Cover' chart, the Big 4 traders are short about 101 days of world silver production, up 3 days from last Friday's COT Report. The ‘5 through 8’ large traders are short an additional 46 days of world silver production, down 2 days from last Friday's COT Report, for a total of about 147 days that the Big 8 are short -- and up 1 day from the prior COT Report.

That 147 days that the Big 8 traders are short, represents a bit under 5 months of world silver production, or 316.81 million troy ounces/63,362 COMEX contracts of paper silver held short by these eight commercial traders.

Ted said that his raptors, the 27 small commercial traders other than the Big 8 commercial shorts, are net long silver by 155.5 million troy ounces...down 13.0 million troy ounces from last Friday's COT Report.

In gold, the Big 4 are short 41 days of world gold production, up 1 day from the last COT Report. The '5 through 8' are short 28 days of world production, also up 1 day from last Friday's report...for a total of 69 days of world gold production held short by the Big 8 -- and obviously up 2 days from the prior COT Report.

Ted says that there are no Managed Money traders left in the Big 8 short category, so the above numbers are accurate.

The Big 8 traders are short 51.7 percent of the entire open interest in silver in the COMEX futures market, which is exactly unchanged from what they were short in last Friday's COT report. And once whatever market-neutral spread trades are subtracted out, that percentage would be something over the 55 percent mark. In gold, it's 48.7 percent of the total COMEX open interest that the Big 8 are short, up a bit from the 46.2 percent they were short in the prior COT Report -- and something close to the 55 percent mark once their market-neutral spread trades are subtracted out.

I'll continue to remind you that Ted is still of the opinion that Bank of America is short about one billion ounces of silver in the OTC market, courtesy of JPMorgan & Friends. Goldman Sachs also has a derivatives position in silver in that market. They've increased it even more in the latest OCC Report for Q2/2022...which Ted figures is a long position. And not to be forgotten is the 45.38 million troy ounce short position in SLV...as of yesterday's short report.

The situation regarding the Big 4/8 concentrated commercial short positions in silver and gold is still obscene -- and is now worse than it was in silver back on March 8 when the nickel contract blew up on the LME -- and both of these precious metals hit their highs of the year. But on the other side of the Big 8 short coin are Ted's raptors...the small commercial traders other than the Big 8 shorts. They're still net long silver by 31,100 COMEX contracts -- and net long gold by around 75,500 contracts...as of yesterday's COT Report.

As Ted has been pointing out ad nauseam forever, the resolution of the Big 4/8 short positions will be the sole determinant of precious metal prices going forward.

And, as always, nothing else matters -- and that should now be obvious to all by now, except the willfully blind, of course...plus those whose so-called reputations and careers depend upon them not seeing it...as I also said in this spot last week.

Ted had a lot to say about this in his latest commentary in the public domain ten days ago, which is headlined "Closer, But Still No Cigar" -- and linked here. If you haven't read it, you should -- and if you have already, a second reading wouldn't hurt.

And I know from our conversation on the phone yesterday, that he has something very important to say about the Big 4 short positions in both silver and gold -- and I'm certainly looking forward to reading all about it. I already know what it is, but can't divulge it.

![]()

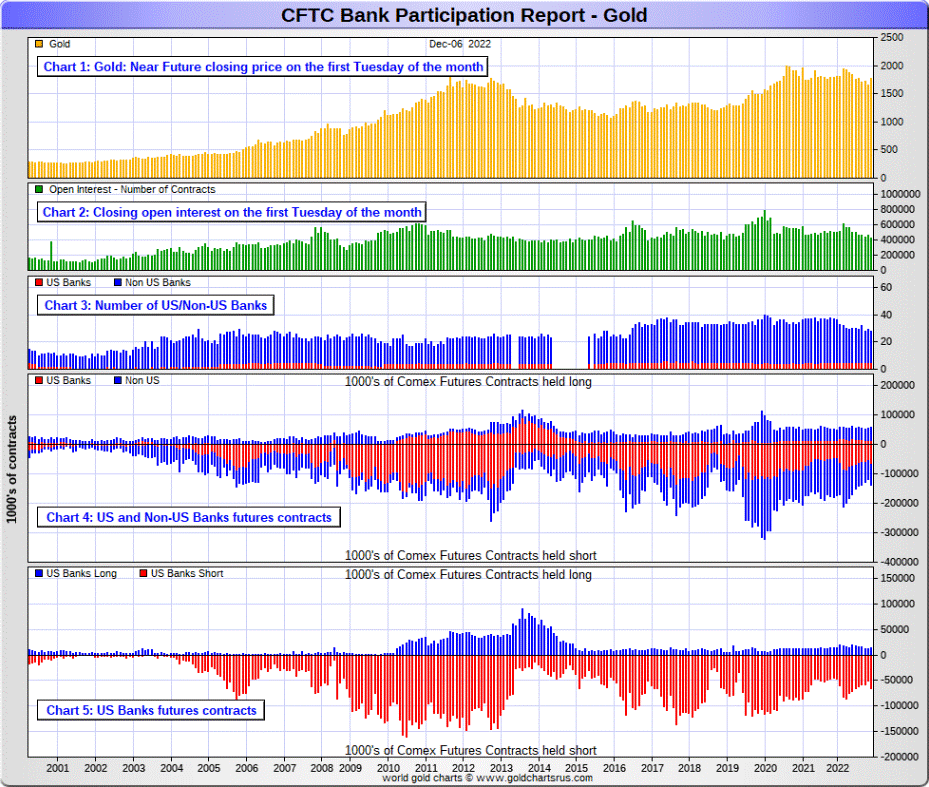

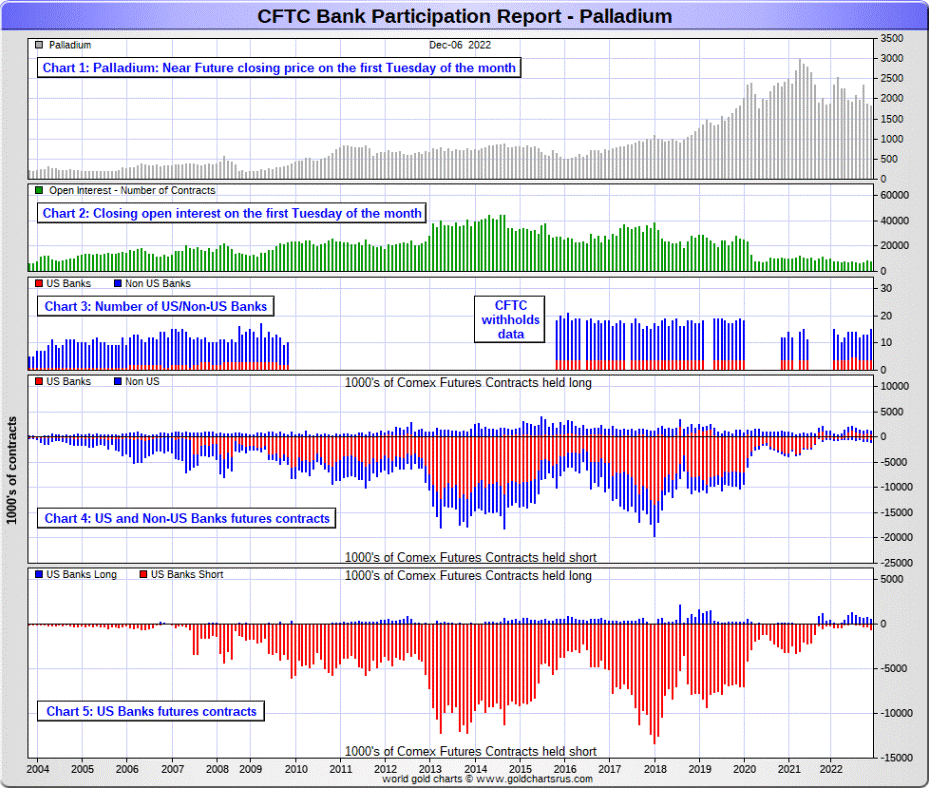

The December Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of Tuesday’s cut-off in all COMEX-traded products.

For this one day a month we get to see what the world’s banks have been up to in the precious metals. They’re usually up to quite a bit -- and they certainly were again last month.

[The December Bank Participation Report covers the time period from November 1 to December 6 inclusive...five reporting weeks, not the usual four.]

In gold, 5 U.S. banks are net short 51,071 COMEX contracts in the December BPR. In November’s Bank Participation Report [BPR] these same 5 U.S. banks were net short 38,100 contracts, so there was an increase of 12,971 COMEX contracts month-over-month. These U.S. banks haven't been this short gold since June's BPR...which was for May.

Citigroup, HSBC USA, Bank of America and Morgan Stanley would most likely be the U.S. banks that are short this amount of gold...plus one other...maybe Goldman. I still have my usual suspicions about the Exchange Stabilization Fund, although if they're involved, they are most likely just backstopping these banks if they get to the 'too big to fail' stage over this.

Also in gold, 23 non-U.S. banks are net short 30,693 COMEX gold contracts. In November's BPR, 24 non-U.S. banks were net short 26,626 contracts, which is not a huge number for them...an increase of 4,067 contracts.

At the low back in the August 2018 BPR...these same non-U.S. banks held a net short position in gold of only 1,960 contacts -- so they've been back on the short side in an enormous way ever since.

I suspect that there are at least four large banks in this group, HSBC, Barclays and Standard Chartered and also BNP Paribas. I still harbour suspicions about Scotiabank/Scotia Capital, Dutch Bank ABN Amro -- and Australia's Macquarie Futures. Other than that small handful, the short positions in gold held by the vast majority of non-U.S. banks are immaterial and, like in silver, have always been so.

As of this Bank Participation Report, 28 banks [both U.S. and foreign] are net short 19.3 percent of the entire open interest in gold in the COMEX futures market, which is up a bit from the 13.9 percent that 29 banks were net short in the November BPR.

Although the largest U.S. and foreign bullion banks dominate the Big 4/8 short category in gold, there are some hedge fund/trading houses that are short grotesque amounts of gold as well.

Here’s Nick’s BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank’s COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

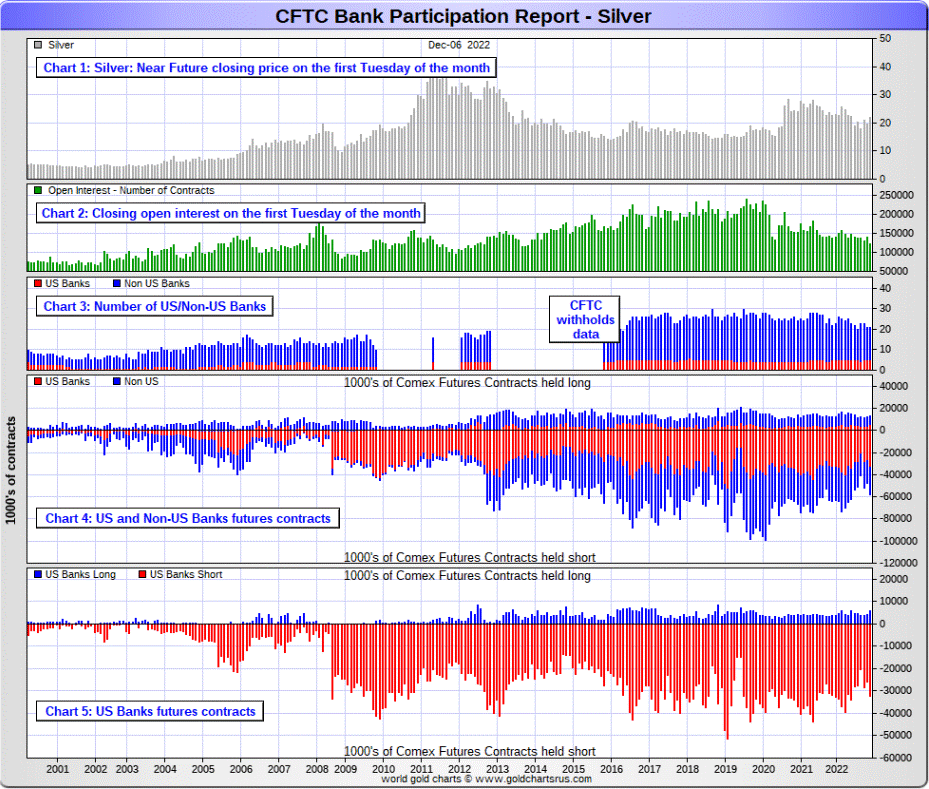

In silver, 5 U.S. banks are net short 26,695 COMEX contracts in December's BPR. In November's BPR, the net short position of these same 5 U.S. banks was 21,630 contracts, which is up 5,065 COMEX contracts from the prior month. These banks haven't been this short silver since January's BPR...which was for the month of December 2021.

The biggest short holders in silver of the five U.S. banks in total, would be Citigroup, HSBC USA, Bank of America, Morgan Stanley...and maybe Goldman Sachs. And, like in gold, I have my suspicions about the Exchange Stabilization Fund's role in all this...although, also like in gold, not directly.

Also in silver, 16 non-U.S. banks are net short 17,503 COMEX contracts in the December BPR...which is up 2,606 contracts from the 13,858 contracts that 16 non-U.S. banks were net short in the November BPR.

I would suspect that HSBC and Barclays hold a goodly chunk of the short position of these non-U.S. banks...plus some by Canada's Scotiabank/Scotia Capital still. I'm not sure about Deutsche Bank... but now suspect Australia's Macquarie Futures. I'm also of the opinion that a number of the remaining non-U.S. banks may actually be net long the COMEX futures market in silver. But even if they aren’t, the remaining short positions divided up between the other 12 or so non-U.S. banks are immaterial — and have always been so.

As of December's Bank Participation Report, 21 banks [both U.S. and foreign] are net short 36.1 percent of the entire open interest in the COMEX futures market in silver — up a very decent amount from the 25.6 percent that 21 banks were net short in the November BPR. And much, much more than the lion’s share of that is held by Citigroup, HSBC, Bank of America, Barclays, Scotiabank -- and possibly one other non-U.S. bank...all of which are card-carrying members of the Big 8 shorts.

I'll point out here that Goldman Sachs, up until late last year, had no derivatives in the COMEX futures market in any of the four precious metals. But they did show up in the last three OCC Reports. Ted thinks they're long silver in the OTC market. I shan't bother talking about the 1 billion troy ounce short position that Bank of America is short in the OTC market...thanks to JPMorgan & Friends, as I've already covered that ground further up.

Here’s the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns—the red bars. It’s very noticeable in Chart #4—and really stands out like the proverbial sore thumb it is in chart #5. But, according to Ted, as of March 2020...they're out of their short positions, not only in silver, but the other three precious metals as well. Click to enlarge.

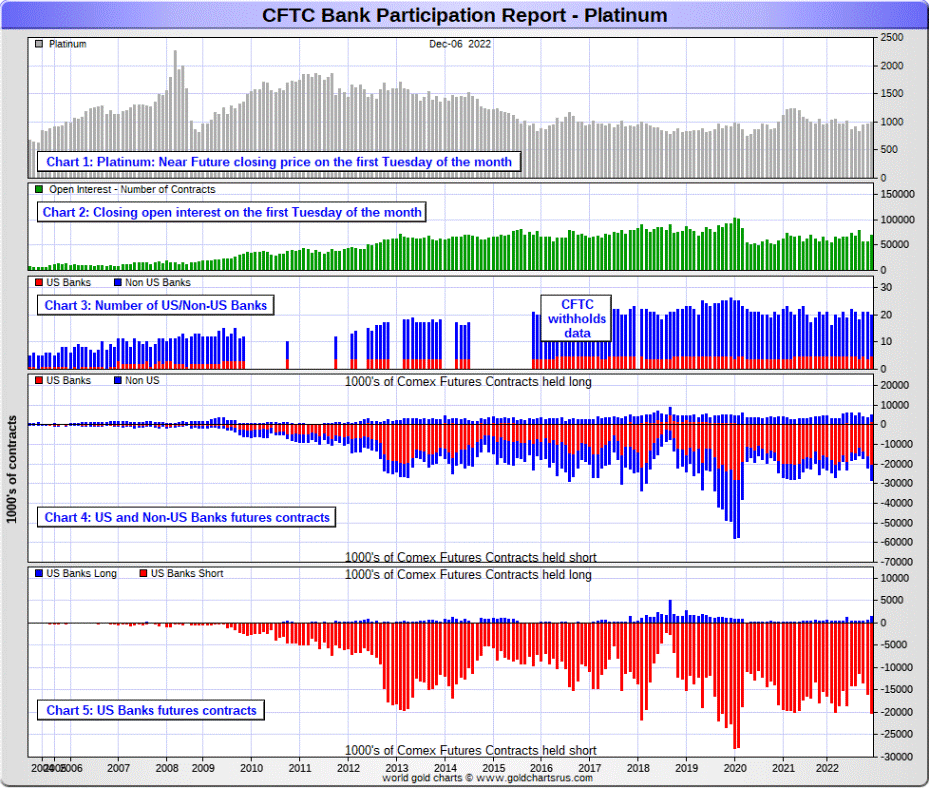

In platinum, 5 U.S. banks are net short 18,675 COMEX contracts in the December Bank Participation Report, which is up another 3,194 contracts from the 15,481 COMEX contracts that 4 U.S. banks were short in the November BPR. They haven't been this short platinum since the March BPR.

At the 'low' back in September of 2018, these U.S. banks were actually net long the platinum market by 2,573 contracts. So they have a very long way to go to get back to just market neutral in platinum...if they ever intend to, that is.

Also in platinum, 15 non-U.S. banks are net short 4,673 COMEX contracts in the December BPR, which is up 1,682 contracts from the 2,991 contracts that 17 non-U.S. banks were net short in the November BPR. These non-U.S. banks haven't been this short platinum since June 2021 -- and I certainly don't like the trend.

And as of December's Bank Participation Report, 20 banks [both U.S. and foreign] are net short 33.9 percent of platinum's total open interest in the COMEX futures market, which is up from the 32.7 percent that 21 banks were net short in November's BPR.

So the higher the platinum price has risen, the more the world's bullion banks have been going short over the last few months.

But it's the U.S. banks that are on the short hook big time -- and the real price managers. They have little chance of delivering into their short positions, although a very large number of platinum contracts have already been delivered during the last few years. But that fact, like in both silver and gold, has made no difference whatsoever to their paper short positions. The situation for them [the U.S. banks] in this precious metal is as almost as equally dire in the COMEX futures market as it is with the other two precious metals...silver and gold...particularly the former.

Platinum remains the Big commercial shorts' No. 2 problem child after silver. How it will ultimately be resolved is unknown, but most likely in a paper short squeeze, as the known stocks of platinum are minuscule compared to the size of the short positions held -- and that's just the short positions of the world's banks I'm talking about here.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

In palladium, 4 U.S. banks are net short a piddling 65 COMEX contracts, up 551 contracts from the 486 COMEX contracts that these same 4 U.S. banks were net long in November's BPR.

Also in palladium, 11 non-U.S. banks are net long 215 COMEX contracts in the December BPR, up 240 contracts from the 35 contracts that 9 non-U.S. banks were net short in November.

These palladium numbers held by the bullion banks of the world are meaningless in the grand scheme of things.

As I've been commenting on for almost forever, the COMEX futures market in palladium is a market in name only, because it's so illiquid and thinly-traded.

Its total open interest in yesterday's COT Report was only 7,785 contracts... compared to 68,821 contracts of total open interest in platinum...122,558 contracts in silver -- and 422,100 COMEX contracts in gold.

The only reason that there's a futures market at all in palladium, is so that the Big 8 commercial traders can control its price. That's all there is, there ain't no more.

As of this Bank Participation Report, 15 banks [both U.S. and foreign] are net long 1.9 percent of the entire COMEX open interest in palladium... compared to the 5.4 percent of total open interest that 13 banks were net long in November's BPR.

And because of the small numbers of contracts involved, along with a tiny open interest, these numbers are pretty much meaningless.

But, having said that, for the last almost three years in a row now, the world's banks have not been involved in the palladium market in a material way. And with them now net long by a microscopic amount, it's all hedge funds and commodity trading houses that are left on the short side.

Here’s the palladium BPR chart. Although the world's banks are now net long at the moment, it remains to be seen if they return as big short sellers again at some point like they've done in the past. Click to enlarge.

Excluding palladium for obvious reasons...only a small handful of the world's banks, most likely four or so in total -- and mostly U.S.-based, except for HSBC, Barclays and maybe Standard Chartered...continue to have meaningful short positions in the precious metals. It's a near certainty that they run this price management scheme from within their own in-house/proprietary trading desks...although it's a given that some of their their clients are short these metals as well.

The futures positions in silver and gold that JPMorgan holds are immaterial -- and have been since March of 2020...according to Ted Butler. And what net positions they might hold, would certainly be on the long side of the market. It's the new 7+1 shorts et al. that are on the hook in everything precious metals-related.

And as has been the case for years now, the short positions held by the Big 4/8 traders/banks, is the only thing that matters...especially the short positions of the Big 4 -- and how this is ultimately resolved [as Ted said earlier] will be the sole determinant of precious metal prices going forward.

The Big 8 shorts, along with Ted's raptors...the small commercial traders other than the Big 8 commercial shorts...continue to have an iron grip on their respective prices -- until they don't. At this point in time, nothing appears to have changed in that regard.

Considering the current state of affairs in the world today -- and the physical shortage in silver -- and maybe in gold as well, the chance that these big bullion banks could get overrun at some point is certainly within the realm of possibility if things go non-linear.

I have a fairly decent number of stories and articles for you today.

![]()

CRITICAL READS

Core Producer Prices Surged in November; Food & Brokerage Costs Spiked

Having fallen for four straight months, the year-over-year change in Producer Prices was expected to continue to slow in November to +7.2% (from +8.0% in October) with a 0.2% increase MoM. However, the headline printed hotter than expected (+0.3% MoM) - the highest since June. This left the YoY PPI at +7.4%, the lowest since May 2021...Click to enlarge.

Core PPI (Ex Food and Energy) soared 0.4% MoM (double the 0.2% expectations)...

While Energy prices dropped to their lowest since Feb 2022, Food prices soared to record highs...

About one-third of the November rise in the index for final demand services can be traced to prices for securities brokerage, dealing, investment advice, and related services, which jumped 11.3 percent. The indexes for machinery and vehicle wholesaling, loan services (partial), fuels and lubricants retailing, portfolio management, and long-distance motor carrying also moved higher.

Conversely, prices for transportation of passengers (partial) fell 5.6 percent. The indexes for automobile and automobile parts retailing and for traveler accommodation services also decreased.

The November advance in prices for final demand goods was led by a 38.1-percent jump in the index for fresh and dry vegetables. Prices for chicken eggs; meats; canned, cooked, smoked, or prepared poultry; and tobacco products also moved higher. Conversely, the gasoline index fell 6.0 percent.

Prices for diesel fuel, residential natural gas, and primary basic organic chemicals also declined. The index for fresh vegetables (except potatoes) jumped 43.1 percent. Prices for raw milk and for nonferrous metal ores also advanced.

And based on a 16-month-lagged M2 rate-of-change, PPI (and CPI) are about to lurch considerably lower...

Bear in mind that while PPI is slowing, it is still extremely high and we shouldn't expect The Fed to pause any time soon at these levels.

This multi-chart Zero Hedge news item put in an appearance on their Internet site at 8:39 a.m. EST on Friday morning -- and another link to it is here. A CNBC story about this from Swedish reader Patrik Ekdahl is headlined "Wholesale prices rose 0.3% in November, more than expected, despite hopes that inflation is cooling" -- and linked here.

![]()

Hungarian Inflation Spirals as Orban-Central Bank Rift Deepens

Hungarian inflation accelerated toward one of the European Union’s highest levels as a deepening rift between Prime Minister Viktor Orban and the central bank raised questions about economic policy.

Consumer prices rose an annual 22.5% in November, exceeding the median estimate of 22% in a Bloomberg survey, according to the Budapest-based statistics office. That compares with a 21.1% jump in October, when Hungarian price growth was already the third-worst in the EU.

Central bank Governor Gyorgy Matolcsy warned lawmakers this week that Hungary was on the brink of an economic crisis — and possibly a prolonged period of stagflation with anemic growth and high inflation — as various price controls under Orban’s rule collide with “the basic rules of the economy.”

The November price surge didn’t take into account the effects of the removal of a fuel price cap following a nationwide gasoline shortage. The measure, in place for more than a year, buckled under a spike in demand, a drop in supply and maintenance work at Hungary’s only refinery, which cut domestic output almost in half.

The scrapping of the fuel cap may add 2 to 2.3 percentage points to headline inflation, much of it from December onward, Portfolio news website reported, citing estimates from Economic Development Minister Marton Nagy.

This news item showed up on the Zero Hedge website at 3:30 a.m. on Friday morning EST -- and another link to it is here.

![]()

Egypt inflation jumps to five-year high of 18.7% in November

Egypt's annual urban consumer inflation rate surged to a five-year high of 18.7% in November, closely matching analyst expectations, data from the statistics agency CAPMAS showed on Thursday.

The inflation figure, up from 16.2% in October, was the highest since December 2017, when it hit 21.9%. The price rises followed a currency devaluation in October and continued restrictions on imports.

The median forecast in a Reuters poll of 14 economists had expected inflation of 18.75%. Six economists also forecast that core inflation, due out later on Thursday, would come in at a median 21.6%.

The increase reflected a continued jump in month-on-month inflation, with prices rising 2.3% compared to 2.6% in October, Naeem Brokerage said in a note.

The monthly increase was "as driven by higher production costs, amid a weakening Egyptian Pound, in addition to supply shortages," Naeem wrote.

The above five paragraphs are all there is to this brief Reuters story that was posted on their website at 3:52 p.m. EST on Thursday afternoon. It was picked up by the investing.com website -- and I found it on Wallstreetsilver. Another link to the hard copy is here.

![]()

BlackRock: Prepare For Recession "Unlike Any Other"... and What Worked Before "Won't Work Now"

The world's largest investment manager has gone all in - and says a global recession is right around the corner. What's more, the financial tricks deployed by Central Banks in the past 'won't work this time.'

According to BlackRock, the global economy has entered a phase of elevated volatility, and that a recession is imminent due to central banks aggressively boosting borrowing costs to tame inflation. Their actions, according to a team of BlackRock strategists, will ignite more market turbulence than ever before.

"Recession is foretold as central banks race to try to tame inflation. It's the opposite of past recessions," the team wrote In their 2023 Global Outlook (embedded below), which says that the global economy has already exited a four-decade period of stable growth and inflation, and has now entered a period of heightened instability.

And when things get bad, "Central bankers won't ride to the rescue when growth slows in this new regime, contrary to what investors have come to expect. Equity valuations don't yet reflect the damage ahead."

"What worked in the past won't work now," said the strategists. "The old playbook of simply 'buying the dip' doesn't apply in this regime of sharper trade-offs and greater macro volatility. We don't see a return to conditions that will sustain a joint bull market in stocks and bonds of the kind we experienced in the prior decade."

So what can actually tame inflation? A deep recession, according to the report.

This commentary was posted on the Zero Hedge website at 12:25 p.m. EST on Friday afternoon -- and I thank Brad Robertson for sharing it with us. Another link to it is here.

![]()

Blackstone, Inflection Points and the Z.1 -- Doug Noland

I’ve been eagerly anticipating the Fed’s Q3 Z.1 report. As expected, Credit growth slowed somewhat. At a seasonally-adjusted and annualized (SAAR) $3.284 TN pace, Non-Financial Debt (NFD) growth slowed from Q2’s SAAR $4.318 TN and Q1’s SAAR $5.438 TN. NFD ended September at a record $68.463 TN, or 266% of GDP. Unless Q4 Credit growth surprises to the downside, 2022 debt growth will be second only to 2020’s onslaught.

For perspective, annual NFD growth averaged $1.816 TN during the two-decade period 2000 through 2019. This year’s growth in NFD will likely double this average, ongoing Credit excess that is creating ample inflationary fuel. While there was slowing in mortgage Credit growth, powerful lending booms continued. And as the Fed’s balance sheet contracts, the GSEs (government-sponsored enterprises) continue their substantial expansion.

Importantly, exceptionally strong lending growth ran unabated – bank and non-bank. Despite the Fed’s tightening cycle and a year of weak securities market performance, the Great Credit Bubble inflation was ongoing. It has been an extraordinary dynamic. The Fed commenced an aggressive tightening cycle. As one would expect, financial conditions tightened meaningfully – in the markets. Unexpectedly, general Credit and financial conditions away from the securities markets loosened. Indeed, market instability actually worked to bolster key Credit structures financing the economy, including bank lending and “private Credit.”

A brief jaunt down memory lane. Recall that two Bear Stearns Credit funds blew up in June 2007, marking the beginning to the end of the mortgage finance Bubble. As buyers of the riskier tranches of high-risk mortgage derivatives, their demise knocked out the marginal source of demand for riskier mortgage Credit. Yet the subprime eruption was not immediately contractionary. Instead, sinking Treasury and bond yields spurred a big rally in conventional mortgage securities prices. This extended the mortgage lending cycle. The $500 billion of second-half 2007 mortgage Credit growth bolstered the Bubble economy, while holding crisis dynamics at bay. It all came home to roost in late 2008.

Fast-forward to 2022. The Fed’s tightening cycle and resulting market instability worked to stoke the boom in non-market-based lending. Resulting strong system Credit growth underpinned economic resilience and tight labor markets. Loose finance and low unemployment supported strong household and business Credit fundamentals (i.e. low delinquencies/charge-offs), which further emboldened enterprising bank and non-bank lenders.

The role of so-called “private Credit” is huge and unappreciated.

As always, Doug's weekly commentary falls into the must read category for me -- and this week's is no exception. It was posted on his website very shortly after midnight on Saturday morning PST -- and another link to it is here.

![]()

China to use Shanghai exchange for yuan energy deals with Gulf nations -- Xi

China's President Xi Jinping said in Riyadh on Friday that China and Gulf nations should make full use of the Shanghai Petroleum and National Gas Exchange as a platform to carry out yuan settlement of oil and gas trade.

China and states of the Gulf Cooperation Council (GCC) are natural partners for cooperation, Xi said in a speech at the China-GCC summit.

"China will continue to import large quantities of crude oil from GCC countries, expand imports of liquefied natural gas, strengthen cooperation in upstream oil and gas development, engineering services, storage, transportation and refining, and make full use of the Shanghai Petroleum and National Gas Exchange as a platform to carry out yuan settlement of oil and gas trade," he said.

In his speech, Xi proposed other areas for cooperation in the next three to five years, including finance and investment, innovation and new technologies, as well as aerospace, and language and cultures.

"China is willing to carry out financial regulatory cooperation with GCC countries, facilitate GCC enterprises to enter China's capital market, establish a joint investment association with GCC, support sovereign wealth funds of both sides to cooperate in various forms," Xi said.

This rather brief Reuters story was picked up by the yahoo.com Internet site at 6:17 a.m. EST on Friday morning - and I found it on Wallstreetsilver. Another link to it is here.

![]()

A Day That Will Live in Infamy: Reflections on Pear Harbor -- Brian Maher

The Pearl Harbor aggression was not merely a crime — it was a blunder.

The Japanese had blundered their way into the American game trap. United States officials were adamant that Japan deliver the initial blow.

That is because they realized it would incense the American public into a very high state of vengeful incandescence. They would fill the recruiting stations with hundreds of thousands of men, each hot to get his hands around Tojo’s neck.

United States War Secretary Henry Stimson, in a diary entry from Nov. 25, 1941:

“The question was how we should maneuver them [the Japanese] into firing the first shot without allowing too much danger to ourselves.”

Just weeks later, here is the same Henry Stimson — reflecting on the wrecks of Pearl Harbor:

“My first feeling was of relief … that a crisis had come in a way which would unite all our people.”

And so the Japanese blunder.

Yet here is a question: Would the American people shake their fists so angrily against Japan… had they read the War Secretary’s personal diary?

We are ridden by doubt. They might rather storm his office in demand of answers.

Well, dear reader, the real story about the Japanese attack on Pearl Harbor has been leaking out slowly over the years, just like the JFK assassination -- and the goings-on surrounding 9/11. The best resource on this is the book by author Robert Stinnett titled "Day of Deceit: The Truth About FDR and Pearl Harbor". If you haven't read it, you owe it to you to do so. This worthwhile commentary by Brian was posted on the dailyreckoning.com Internet site on Wednesday -- and I've been saving it for today's column. Another link to it is here.

![]()

The debate between gold and bitcoin in 2023 -- Alasdair Macleod

The FTX scandal has thrown the future of cryptocurrencies into doubt.

Supporters of bitcoin, which has proved to be remarkably robust at a time when the whole cryptocurrency ecosystem is threatened by scandal and a systemic collapse, are still asserting that it is the future money.

This article addresses a number of issues that next year will make or break bitcoin’s claim over gold. Besides the interest of governments to prevent it having any monetary role, holders ignore the legal status of gold as money, and the different treatment likely to be accorded to bitcoin in criminal law. Furthermore, bulls of bitcoin are mainly only that: speculators hoping for a profit measured in their fiat currencies.

This is not to deny bitcoin’s virtues: only to question its monetary future relative to gold at a time when the period of declining interest rates, which played a large part in fuelling the cryptocurrency phenomenon, appears to have ended. Furthermore, the financial considerations in the geopolitical context centre on the dollar’s relationship with gold, leaving cryptocurrencies as wallflowers in the financial conflict between east and west.

Another short novel from Alasdair. This one was posted on the goldmoney.com Internet site on Wednesday -- and I found it in a GATA dispatch on Friday morning. Another link to it is here.

![]()

Ex-JPMorgan Gold Trader Found Guilty in Spoofing Trial

Former JPMorgan Chase & Co. gold and silver trader Christopher Jordan was convicted of wire fraud affecting a financial institution by a federal jury in Chicago, the latest win for U.S. prosecutors in their crackdown on illegal “spoofing” trades and market manipulation.

Jordan was found guilty Friday after a four-day trial in the same courthouse where two of his more senior colleagues on the JPMorgan precious-metals desk were convicted in August on spoofing-related charges for deceptive buy and sell orders. Jordan worked at the bank from 2006 to late 2009.

While his deceptive trades occurred before spoofing was made a crime in 2010, he used the same technique by placing large orders he never intended to execute and quickly canceled so he could make trades on the other side of the market, prosecutors said.

It was part of a “scheme to rig gold and silver markets in his favor,” Assistant U.S. Attorney Lisa Beth Jennings said in her closing statement. “The spoof orders the defendant placed tricked other traders” and were intended to deceive the market about supply and demand, she said.

“We are sorely disappointed by today’s verdict,” said defense lawyer James Benjamin. “Chris Jordan is a good and honorable man who did his job in good faith.”

Jordan’s sentencing was tentatively scheduled for May, 2023.

Yet, despite all that, the price management schemes continue. This Bloomberg story was picked by the ca.finance.yahoo.com Internet site at 10:08 a.m. EST on Friday morning -- and I thank 'Robert in Denver' for pointing it out. Another link to it is here.

![]()

Deutsche Bank seeks to rejoin key gold trading club in London

Deutsche Bank AG has applied to re-join the London Bullion Market Association — the world’s foremost standard setter for gold trading — as the German lender seeks to expand its trading unit.

The LBMA application “brings us into line with other banks that offer precious metal services,” Deutsche Bank said in a statement Friday. “It reflects the careful growth of our precious metals business in recent years, and growing client demand for our services.”

The move, potentially cementing the bank’s status in precious metals, is part of trading head Ram Nayak’s effort to maintain momentum at Deutsche Bank’s fixed-income business. Nayak’s unit has been the lender’s biggest growth driver over the past three years and key to Chief Executive Officer Christian Sewing’s turnaround strategy.

The lender was previously one of the few clearers of London-based transactions, and also participated in daily price-setting auctions for gold and silver. In 2014, the bank decided to stop trading physical precious metals.

The LBMA is a club of banks, traders and refiners that sets rules on everything from the specifications of bullion bars to responsible sourcing. Membership would give Deutsche Bank a seat at the table where decisions are made on how the world’s top precious metals market is run and would eventually allow it to participate in daily price-setting auctions again.

Another crook on the LBMA, just what we need, dear reader. Of course the Bloomberg reporter didn't ask the obvious question as to why gold's price has to be 'set' at all. This gold-related news item was picked up by the yahoo.com Internet site at 3:44 a.m. EST on Friday morning -- and I found it embedded in a GATA dispatch. Another link to it is here.

![]()

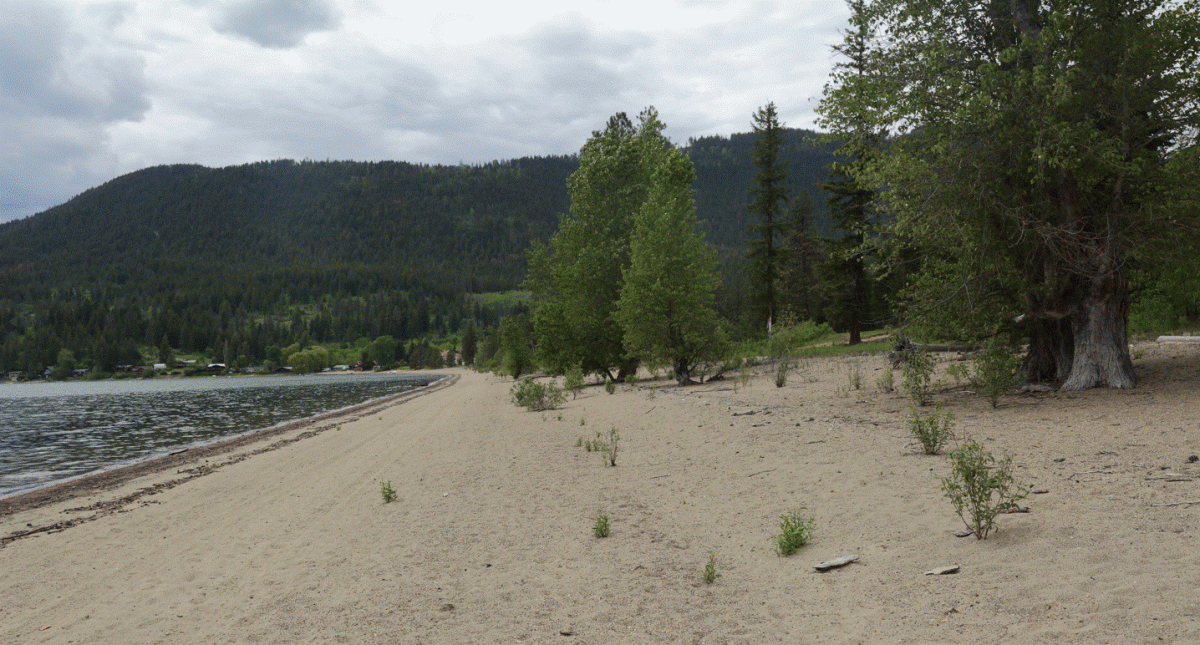

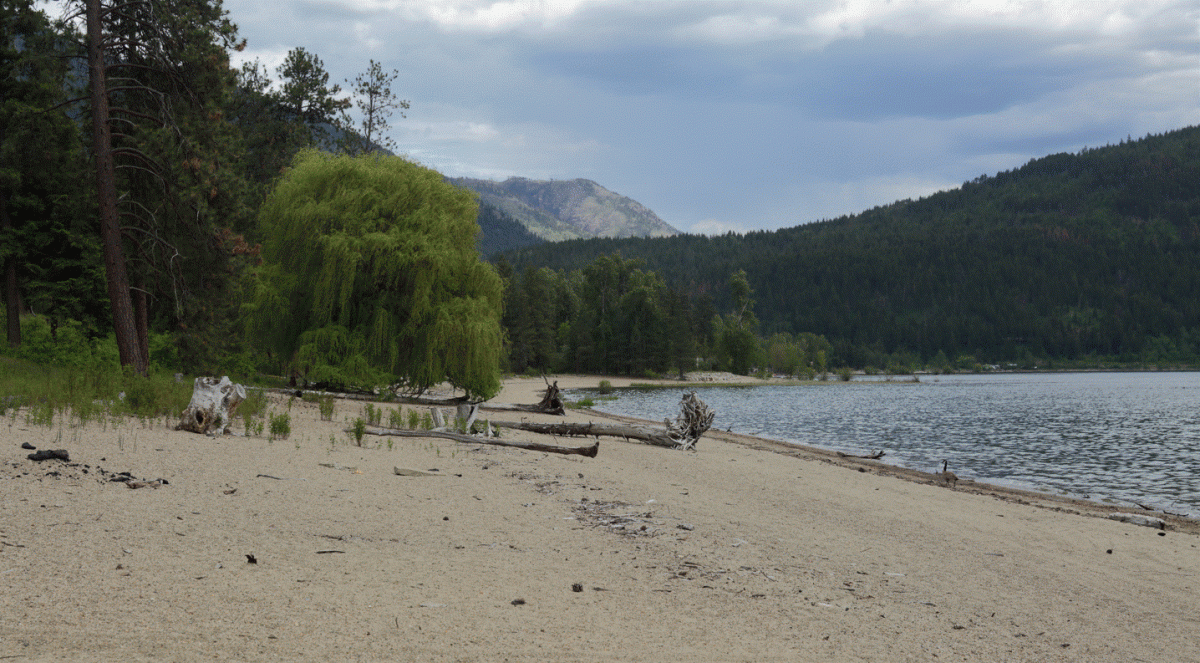

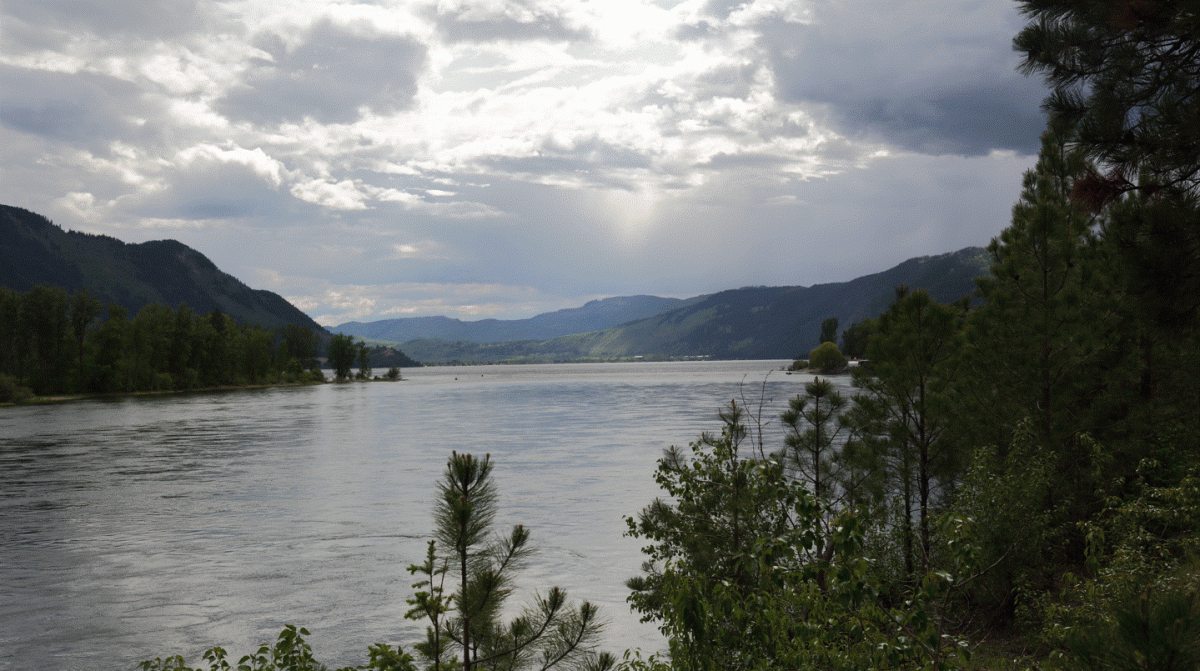

The Photos and the Funnies

Before leaving the Talking Rock Golf Club on May 29, we wandered around a bit -- and I took the first photo at the 18th hole -- a few steps from the hotel. As you can see it sides onto Little Shuswap Lake. Photos two and three were taken on the beach -- and looking in opposite directions. Photo four was taken on the way out -- and along the Little Shuswap River, where it drains into the lake. At the center left of the shot and in the far distance along the lake shore is the town of Chase -- and the start of the South Thompson River. Click to enlarge.

![]()

The WRAP

"Over the past four months, some 40 million oz. have departed the COMEX silver warehouses, while more than 140 million oz. have been moved in and out. Over that same time, the world mined 280 million oz., making the physical movement on the COMEX all the more remarkable. It’s easy and correct to focus on the net amount removed, but a mistake to overlook the frantic turnover – which implies extreme physical tightness." -- Silver analyst Ted Butler...03 December 2022.

![]()

Today's pop 'blast from the past' dates from 1977 -- and was a No. 1 hit for eight straight weeks on the Billboard Hot 100 -- and thirteen weeks in the Top 10. It's from the soundtrack to Saturday Night Fever. Neither the song, nor the Australian band that performs it, needs any introduction whatsoever -- and the link is here. There's a bass cover to this of course -- and that's linked here.

Last Saturday's classical 'blast from the past'...Camille Saint-SaënsSymphony No. 3 in C Minor, Op. 78...had the wrong link -- and for that I do apologize. The correct link for it is here.

This week's classical 'blast from the past' comes to us courtesy of Richard Wagner. It's a very short composition from his Romantic opera Lohengrin, which was first performed in Weimar, Germany on 28 August 1850...under the direction of Franz Liszt.

The most popular and recognizable part of the opera is the Bridal Chorus, colloquially known in English-speaking countries as "Here Comes the Bride," usually played as a processional at weddings. The orchestral preludes to Acts I and III are also frequently performed separately as concert pieces.

Today's offering is the prelude to Act III -- and it's a barn-burner of a work which, like all of Wagner's compositions, required a huge orchestra...usually around 100 chairs in total...with the more string players the better. The audience goes wild whenever it's performed -- and rightfully so.

Mariss Jansons conducts the Berlin Philharmonic -- and the link is here.

![]()

There's should be no doubt in anyone's mind that short sellers of last resort were out and about yesterday -- and that was most noticeable starting when then the PPI number hit the tape at 8:30 a.m. in Washington on Friday morning. Their presence was apparent even in the after-hours markets.

Gold was closed below $1,800 spot, but did manage to close above its 200-day moving average by around 10 dollars. But the volume number was pretty light, so 'da boyz' didn't have all that much trouble keep its price in line.

Silver closed higher for the third day in a row, but not as much as it would have if it had been allowed to trade freely. It's far above any moving average that matters -- and is back in overbought territory once again on its RSI trace. Volume was pretty light in it as well.

Platinum and palladium closed higher too but, like silver and gold, were closed well of their respective high ticks. Platinum is above any of its moving average that matter -- and after palladium's gain yesterday, it's now not that far below its 50-day moving average. Neither are anywhere near close to being overbought.

Copper was allowed to touch its 200-day moving average intraday on Friday, but was closed down a penny on the day at $3.88/pound.

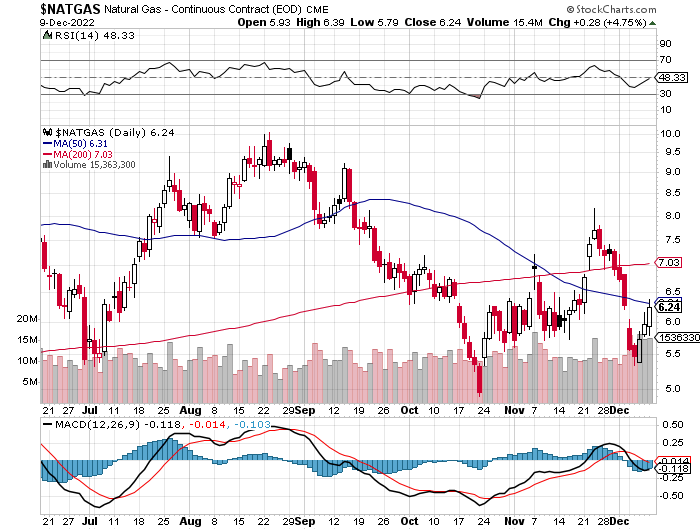

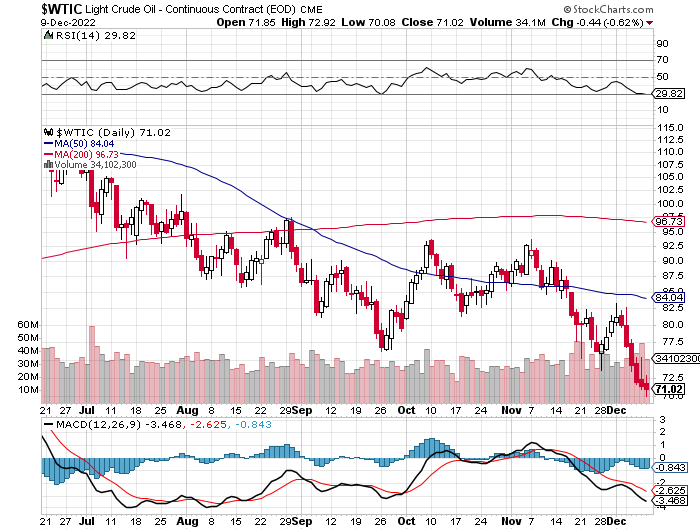

Natural gas [chart included] spent part of the Friday trading session above its 50-day moving average, but was closed below it by a bit. It finished the day higher by 28 cents, at $6.24/1,000 cubic feet. WTIC was closed lower for the sixth straight day, down 44 cents at $71.02/barrel -- and miles below any moving average that matters. It hasn't been this oversold since the third week of September -- and when it is oversold this amount, it doesn't normally stay at that price level for long.

Here are the 6-month charts for the Big 6+1 commodities, thanks to the good folks over at the stockcharts.com Internet site and, if interested, Friday's COMEX closing prices should be noted. Click to enlarge.

Like you, I'm not at all amused by the price action in the precious metal equities -- and that's particularly true of the silver shares.

As I said further up, the only two reasons that I could think of why that is the case -- and that's for tax loss purposes, or an entity is shorting the precious metal stocks across the board. If you have other explanation that makes sense, I'm all ears.

The last Fed meeting of the year starts on Tuesday -- and I'll be more than interested in what happens to precious metal prices once the smoke goes up the chimney at 2:00 p.m. EST on Wednesday. All of this counterintuitive price action might have something to do with what may result from that -- and I'll also be watching the GLOBEX open at 6:00 p.m. EST on Sunday evening with some interest as well.

It's very clear [at least to me] that neither gold or silver...or their associated equities...are being allowed to reflect the ongoing decline in the U.S. dollar index, or in the declines in other markets.

And that's despite the fact of the ongoing shortages in both at the retail -- and particularly the wholesale level. The hinky December deliveries are the latest straw in the wind in that regard.

Of course -- and as you already know, inventory levels are at all-time lows in copper -- and now platinum. The same can be said of nickel and zinc. You can put WTIC on that list as well because, despite its low price, there's not a lot of extra crude oil out there now that OPEC+ has withdrawn 2 million barrels of daily production -- and are threatening to cut production even more.

But despite all this, the powers-that-be continue to ride shotgun over their respective prices -- and until that changes, or we have a delivery default of some kind, nothing will change.

I'm still of the opinion that we are in some sort of 'care & maintenance' situation until the powers-that-be decide to pull the plug on everything. I'm on record as saying that I was expecting it before the end of this year, but the jury is still out on that.

As I pointed out in last week's Saturday column, there are a lot of pieces in motion on the precious metal chessboard right now, plus in other commodities -- and although all appears calm on the surface because their prices are being actively managed, it's very far from that under the waterline.

There are less than fifteen business days left between now and the year end -- and I already have the feeling that things are winding down going into the New Year. It's normally very quiet between Christmas and New Years...but I wouldn't bet the farm on that being the case this time.

The reason is simple...the drumbeat of the ongoing and ever-increasing physical shortage in silver [and gold] grows louder with each passing day -- and something has to give at some point, as this can't go on forever.

So we wait some more.

I'm still "all in" -- and will remain so to whatever end.

See you here on Tuesday.

Ed