Chris Marchese

Chief Mining Analyst, GoldSeek & SilverSeek

Week Ended April-3, 2020

$GORO, $EXK, $PAAS, $NEM, $TXG.TO, $GPL, $AG, $USAS, $EXN.TO, $AEM, $AGI, $AR.TO, $ALO, $BTG, $EQX, $BTG, $GCM.TO, $INV.TO, $KGC, $KL, $PG.TO, $PVG, $OSK.TO, $OR, $SAND, $TMR.TO, $WPM

The Mexican federal government has mandated that all non-essential businesses, including mining, temporarily suspend operations until April 30 due to the COVID-19 virus. This will impact a number of operations (especially silver), although those with heap leach operations will continue, albeit at lower production rates. This could have material impacts (should the shutdown extend beyond end of April) on those companies without weaker balance sheets.

As a result of this, a large number of companies will be coming out with announcements regarding this mandated suspension. Companies not discussed further below but have put out a news release regarding suspensions of mining activities include: Gold Resource Corp (Oaxaca mining unit), Endeavour Silver (all operations), Pan-American Silver (Dolores and La Colorada), Newmont (Penasquito), Torex (ELG complex), Great Panther (Guanajuato mine complex, Topia), First Majestic (La Encantada, Santa Elena, San Dimas), Americas Gold and Silver (Cosala operations), and Excellon (La Platosa).

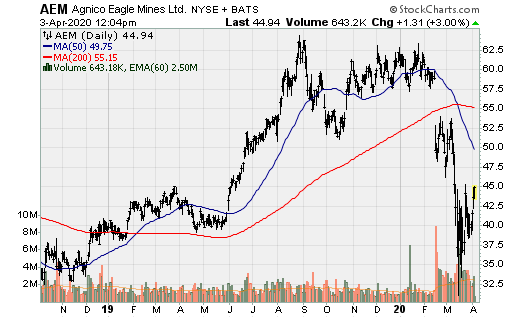

Agnico-Eagle: The senior producer that has already seen a larger number of operations temporarily suspended continues to get hit. Following the announcement by the Mexican federal government, the company is winding down operation at least through the end of the month at Pinos Altos, Creston Mascota and La India. Its Kittila mine in Finaland is expected to continue to operate, leaving Agnico with only one operating asset. Agnico is well financed and will be able to withstand a prolonged shutdown of operations.

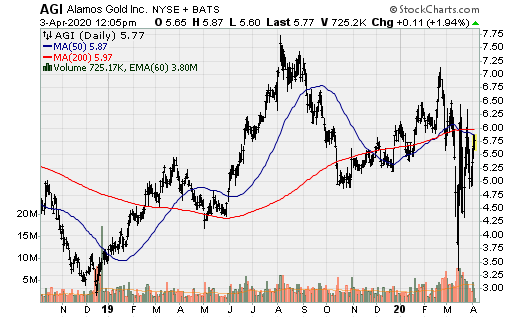

Alamos Gold: As expected, the company will be suspending its Mulatos operations per the mandate from the Mexican government through the end of the month. It has also extended the suspension of operations at its Island Gold operations for an additional two weeks (April 22). Its Young Davidson mine has not been impacted and continues normal operations. Further, the company has a strong balance sheet with $215m in cash at the end of Q1 and $100m drawn under its $500m revolver.

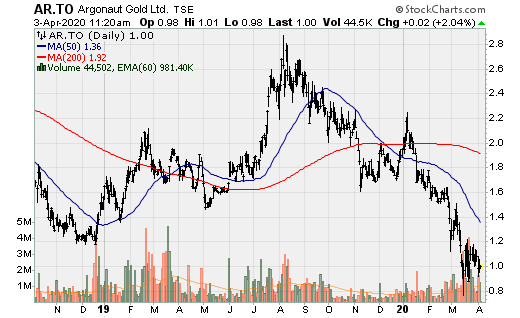

Argonaut Gold: M&A activity continues in spite of the recent COVID-19 pandemic. On Monday it announced it would acquire Alio Gold at the market price (no premium). This seems like a logical move, and creates an emerging intermediate gold producer, with two key development projects in the pipeline. This deal immediately increases its production profile to 235k AuEq oz. (in 2020) and Alio’s producing Florida Canyon mine will replace El Castillo as it becomes depleted in 2022. This also adds additional diversification (US, Canada, and Mexico) and gives the company a deeper pipeline (which will increase the quality of its operating portfolio over time). The company’s development pipeline includes the Magino, Cerro Del Gallo, and Ana Paula development projects. In my view, the real value associated with this acquisition lies in the Ana Paula development project in Mexico considering the acquisition price of approx. $45m +/-.

The 2017 pre-feasibility study (PFS) outlined a robust operation but there are multiple opportunities for optimization, notably increasing average annual production. It is located in the highly prospective Guerrero Gold Belt (GBG) in Mexico, next to Equinox’s Los Filos operations and Torex Gold’s ELG mine complex and its Media Luna development project.

Per the PFS, the intial mine life is 7.5yrs (with significant exploration upside notably underground), producing on average 115k oz. Au @ cash costs and all-in sustaining costs (AISC) of $489/oz. and $524/oz., which is exceptional. With initial capital costs of $140m, the NPV5% and after-tax IRR are $223m and 34%. However, this is using a long-term gold price deck of $1,250/oz., making it far more valuable at today’s gold price. In addition to an increased open-pit mine life, there will also likely be an underground operation (M&I resource just 266k oz. but more exploration is needed). Limited drilling has taken place once Alio acquired Rye Patch Gold for its Florida Canyon operation.

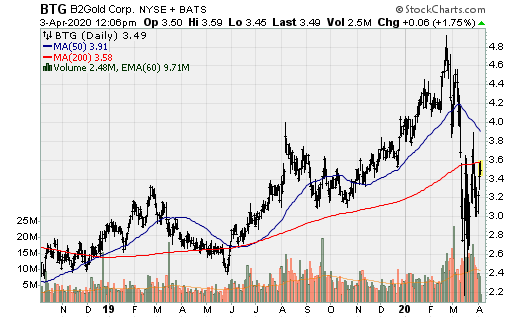

B2Gold: Mining returned to normal at its Masbate project in the Philippines and has all of its assets in operation. The company is one of the few companies that have not yet withdrawn 2020 production guidance. The West-African producers have weathered this wave of mining suspensions the best i.e. Endeavour, Semafo, etc., although that could change.

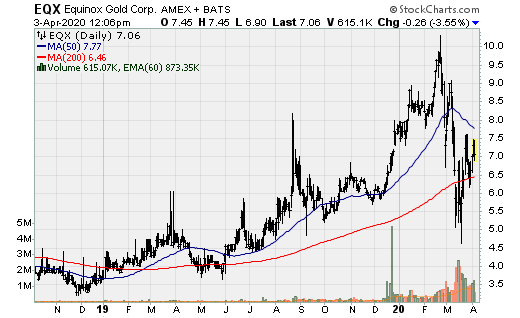

Equinox Gold: Per the mandate from the Mexican government, the company is suspending mining activities until the end of the month at its Los Filos operations. Gold production will continue albeit at a reduced level as it will continue processing solution from the heap leach pads. The company has also suspended mining operation at its Pilar mine in Brazil, complying with the state government restrictions. This will have little impact as the Pilar operation is very small and the highest-cost asset in its portfolio. The company’s RDM mine is recommencing full operation after a short-term suspension. As a precautionary measure, the company drew down the remaining $180m on its $400m revolver, leaving the company will approx. $300m in cash at the end of Q1.

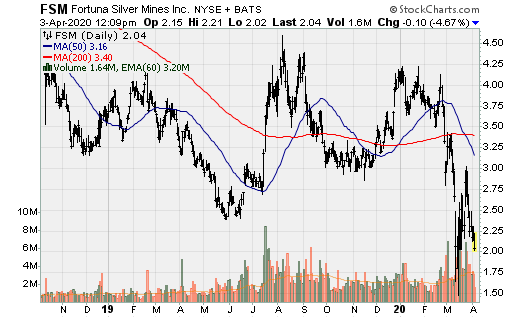

Fortuna: The company could be in for some hard times and not an insignificant amount of shareholder dilution. The on-going royalty dispute together with essentially 3 mining operations on care and maintenance could cost a fair amount of money if the countries in which it operates, extend mandated shutdowns. The credit facility has a covenant such that the debt to EBITDA ratio can’t be more than 3:1. In such a case, Fortuna would be forced to either refinance this facility or issue equity at whatever price to paydown debt. The creditor may make an exception given the pandemic but if not, it is worth noting that as at year end 2019, the debt-to-EBITDA was 1.7:1. Since then it has drawn down a further $40m on its debt facility. This is worth keeping an eye on.

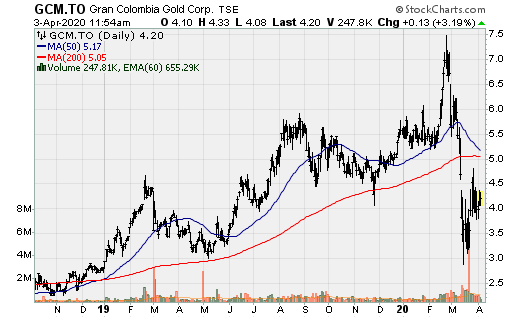

Gran Colombia: The company continued to set records in 2019, with record quarterly and annual production. Q4 all-in sustaining costs (AISC) were quite a bit higher in Q4 at $1,003/oz. and $916/oz. for the full year. The company generated $103m in operating cash flow in 2019 and $140m if you annualize Q4.

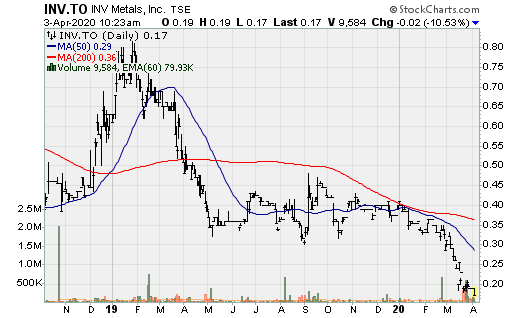

INV Metals: Announced an updated positive feasibility study for its Loma Larga Gold-copper-silver project in Ecuador. With initial development capital of $316m, this is expected to a low-cost operation with cash costs, all-in sustaining costs (AISC) and all-in costs (AISC + Initial development capital) of $559/oz., $627/oz. and $789/oz. This will be a project of scale with average annual production of 223k AuEq oz. (289k AuEq oz. over the first four full years). Using long-term price decks of $1,400/oz. Au, $18/oz. Ag, and $3/lb. Cu @ 5.00%, yields an after-tax NPV of $454m with an IRR of 28.3%. At a long-term gold price of $1,550/oz. the NPV and IRR increase to $552m and 32%. The rate of return would be significantly higher if taxes weren’t so high in Ecuador (I.e. @ 1,550/oz Au, the pre-tax NPV is $945m vs. the after-tax NPV of $552m).

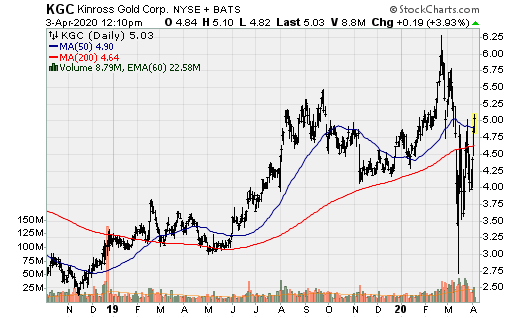

Kinross Gold: The company is in the enviable position of having numerous sizeable heap leach operations (in the event of a forced suspension of mining, heap leach operations will continue producing for up to 1-2 months) in many different geographic locations (Alaska x 1, Nevada x 2, Brazil x 1, Ghana x 1, Mauritania x 1, and Russia x 2). Further, as a precautionary measure, Kinross also drew down $750m from its $1.5B revolving credit facility.

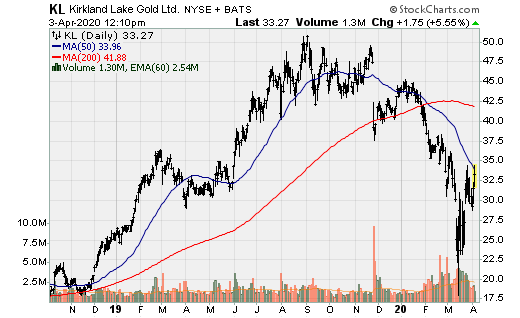

Kirkland Lake Gold: In addition to the temporary suspension at Detour Lake, the company announced a suspension of operations at its Holt Complex (a small non-core asset for Kirkland) and a reduction of operations at the Macassa Mine in Kirkland Lake. These measures are in place through the end of April. Its most profitable mining operation continues uninterrupted at Fosterville in Australia. Regardless, Kirkland Lake Gold arguably has the strongest balance sheet relative to its peer group.

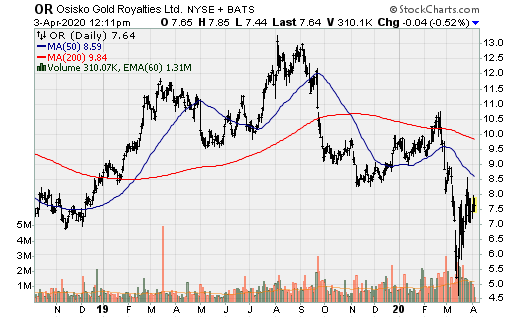

Osisko Gold Royalties: Following the news that the Canadian Malartic Mine will temporarily be placed on care and maintenance, Osisko withdrawn its production guidance for 2020. While Osisko will continue to generate positive operating cash flow, it announced a C$85m private placement with Investissement Quebec for general working capital purposes and to seize royalty and streaming opportunities that may present themselves.

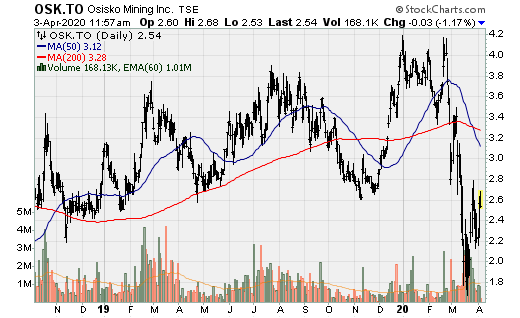

Osisko Mining: Osisko infill drilling continues to intersect high-grade mineralization further illustrating that Windfall is becoming a world class project following the fairly recent resource estimate. The aggressive drilling campaigns in recent years have paid off with over 5m oz. of total resources and significant remaining exploration upside. It is fair to think that it can add at least another 1-2m oz. in resources following the next drilling campaign (which has been suspended for the time being) or two of expansion drilling. Select highlights from these recent results include:

· 5.6m @ 149 g/t Au

· 2m @ 415 g/t Au

· 2m @ 85.7 g/t Au

· 2m @ 337 g/t Au

· 2m @ 243 g/t Au

· 18.1m @ 21.9 g/t Au

· 9.7m @ 36.9 g/t Au

· 2.2m @ 79.1 g/t Au

· 2.3m @ 61.2 g/t Au

· 6m @ 21.2 g/t Au

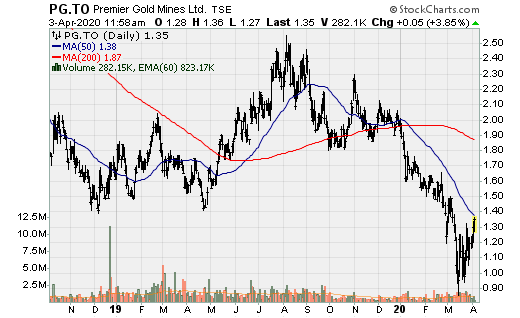

Premier Gold: The Mercedes mine in Mexico has suspended operations. It also announced it has made an offer to acquire the remaining 50% interest in the Greenstone Gold Mines Partnership from Centerra Gold for $205m. The principle asset is the Hardrock project.

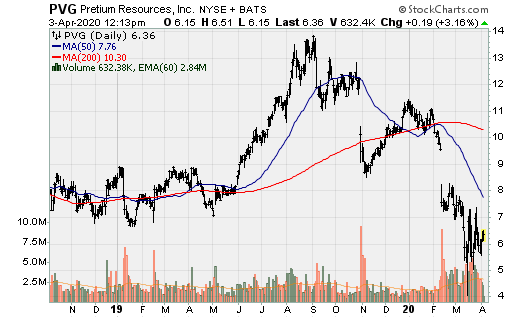

Pretium Resources: The Brucejack mine continues to operate but only personnel necessary to support gold production will continue to work at the mine. All capital projects and expansion drilling have been placed on hold and crews have been demobilized. As a result of deferring mine development, the mill will operate at reduced production rates should the ore supply be insufficient to operate at 3.8ktpd on a continued basis (which is likely if this continues for any prolonged period of time). As of the end of March, the company had a cash position of $40m and as a precautionary measure, following quarter end, the company submitted a request to draw down the remaining $16m from the revolving credit facility. For the remainder of the year, three quarterly payments of approx. $16.7m (plus interest) will need to be made on the term credit facility. Should Pretium have to suspend operations for any prolonged period of time, it will likely engage in an equity raise (though that is probably the smart thing to do right now as a precautionary measure, should the capital markets become more unstable).

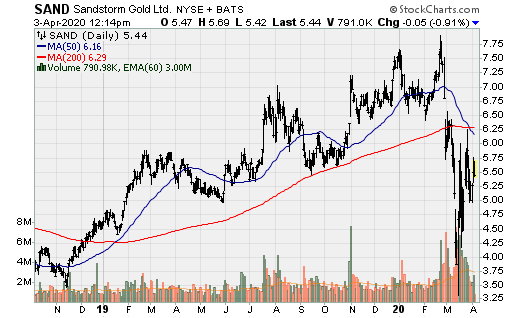

Sandstorm Gold Royalties: The company announced it sold approx. 13.4k oz. Au in Q1, with a $1,280/oz. Au cash margin. The company is renewing its normal course issuer bid (NCIB), giving the company the option to purchase 17m shares until April 5, 2021. Sandstorm has upwards of $50m coming in towards the end of April, provided its stock price is above $3.35/share. Ideally, over the next 12-18 months, the company will be able to acquire one or two large gold or silver streams or a number of smaller to mid-size royalties. Sandstorm already has the highest growth rate over the next 3yrs among its peers and significant optionality but it also now has the firepower to complete sizeable streaming deals. As this year progresses, it will see growth in attributable production from Fruta Del Norte and the Relief Canyon gold stream.

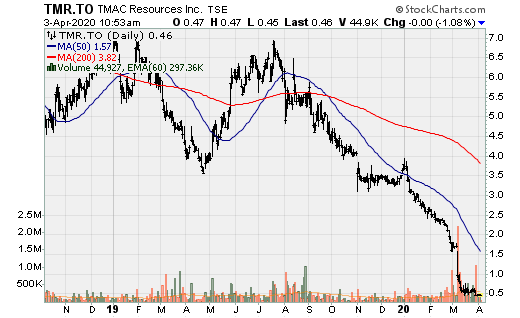

TMAC Resources: Released a PFS for its Hope Bay property. The PFS if for an expansion of both mining and processing rates. The company has been having trouble with recovery rates and being able to sufficiently supply enough feed to the mill and will build a new conventional processing plant. Capital investment needed to complete the expansion is estimated at $500m spread out over four years (2020-2023), a fair portion of which will be paid through on-going cash flow generation. The After-tax NPV5% using a $1,400/oz gold price is roughly $350m but this is solely based on reserves. There is an additional 1.7m oz. of M&I resources and 2.1m oz. Inferred (so the initial 15yr mine life will likely increase, perhaps considerably). Going forward, beginning in 2021, throughput will average 2ktpd through 2023 and increase to 4ktpd beginning in 2024. LOM AISC will be $986/oz. The company has stated that the feasibility study (FS) and eventual expansion at Hope Bay will either be with a new partner (JV) or a sale of the company. While this expansion isn’t particularly attractive, it does so at gold prices north of $1,800/oz.

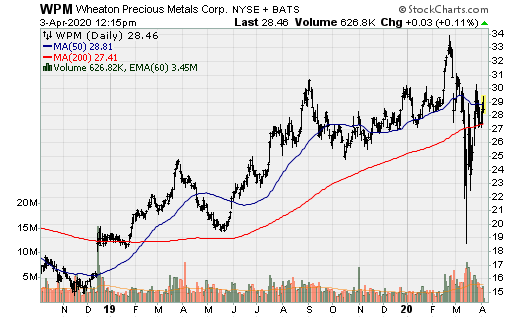

Wheaton Precious Metals: The company is withdrawing guidance for 2020. Wheaton Precious has an added benefit of significant asset diversification (as does its peer group: FNV, RGLD, SAND, and OR (less for OR)). A number of operations on which it has streaming interests have been temporarily suspended. These include Constancia, Yauliyacu, Pensaquito, and Voisey’s Bay, although the company doesn’t receive any cobalt from the latter until the start of 2021.

Chris Marchese for the Gold Seeker Report

Chief Mining Analyst at GoldSeek & SilverSeek

Chief Mining Analyst with GoldSeek and SilverSeek. Previously he was the Senior Mining Equity and Economic Analysis at The Morgan Report. He was a Co-Founder and Director of Lemuria Royalties, before it was acquired in March 2018. He also co-authored The Silver Manifesto with David Morgan in 2015.

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. GoldSeek.com, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; GoldSeek.com makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of GoldSeek.com only and are subject to change without notice. GoldSeek.com assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto. Fortuna Silver Mines is not a sponsor of this, or any other related, websites. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.