Silver just surged above $35 for a major decade-plus secular breakout! Seeing this long-slumbering asset famous for huge parabolic moonshots start running again is increasingly piquing traders’ interest. After lagging gold’s mighty cyclical bull, historical precedent argues silver has massive catch-up rallying to do. But speculators’ stretched silver-futures positioning and near-term gold risks leave silver’s breakout shaky.

Over the past quarter century, we’ve written and published 1,308 of these weekly web essays. One-tenth had silver in their title, either analyzing the metal or its miners. But recent years’ usually-poor silver price action left traders uninterested, so I ended up not writing about it for a long time. My last silver essay came way back in early October 2021, making the time since my longest span without diving into silver!

This volatile metal just wasn’t making any consistent headway, averaging $25.09 in 2021, $21.75 in 2022, and $23.36 in 2023. Historically silver has been heavily correlated with gold, since its fortunes dominate precious-metals sentiment. When gold carved its last major bottom of $1,820 in early October 2023, silver was running $20.94. Over the next 19.0 months into early May 2025, gold powered up an epic 88.1%!

That wasn’t just a mighty cyclical bull, but a monster upleg as well without a single 10%+ correction. If there was ever an environment where silver should shine, that was it. Yet rather than amplifying gold’s incredible strength, silver seriously lagged. During that gold-bull span, the white metal merely climbed 58.5% to $33.18. Silver has been a vexing disappointment, seriously underperforming its historic precedent.

After every quarterly earnings season, I analyze the latest fundamental results reported by the top 25 gold miners in both the leading GDX majors and GDXJ mid-tiers ETFs. For many years those were followed by analyses of the SIL silver-miners ETF’s 15 biggest components. While those quarterly-results essays are my favorites, they require far more work than technical ones and silver-stock interest was all but dead.

It wasn’t only traders abandoning silver, but even its own miners! Primary silver miners generating over half their quarterly revenues from silver dramatically dwindled, leaving only a handful. Former major silver producers increasingly focused their exploration efforts and mine-builds on way-more-profitable gold, transforming into primary gold miners. So my last silver miners’ fundamentals essay covered Q3’22 results.

Despite its spectacular history of parabolic moonshots, silver’s chronic underperformance in recent years has left it deeply out of favor. Still I continue to watch daily price data as well as the dominant SLV silver ETF’s holdings, and the weekly silver-futures positioning data. Occasionally when something interesting happens I discuss silver in our subscription newsletters, but those events have been fairly rare for some time.

So it’s delightful to see silver start surging again, like a surprise visit from an old friend you haven’t seen for years! On Monday June 2nd silver blasted 5.6% higher to $34.78, both its biggest up day and highest close since mid-October 2024. Gold soared 2.7% that day on an unusual confluence of trade-war and geopolitical fears. Late the prior Friday, Trump doubled his tariffs on steel and aluminum from 25% to 50%.

Then that Sunday Ukraine reportedly disabled or destroyed a third of Russia’s entire strategic-bomber fleet far from the frontlines with brilliant drone-swarm attacks, risking catastrophic retaliation! It was good to see silver surge with gold, but one day doesn’t make a trend. Silver didn’t get really interesting until this past week. On Thursday the 5th, silver surged 3.4% to a new gold-bull high despite gold slipping 0.4%.

Silver’s $35.61 close that day was its best in fully 13.3 years, a decisive secular breakout! Last Friday the 6th, silver followed up with another 0.7% advance despite gold sliding 1.5% on better-than-expected headline US jobs. Then this Monday the 9th, silver rallied another 2.3% to $36.66 despite gold merely climbing 0.6%. That was another 13.3-year high for silver, continuing its breakout which was exciting to see.

Are silver’s recent outperformance of gold and secular breakout likely to persist? Is silver finally awakening from its vexing years-long slumber? I sure hope so, as higher silver prices would boost trader sentiment for the entire precious-metals complex. Big silver gains fuel mounting interest, and are nicely amplified in the earnings of miners producing material amounts of it. Unfortunately silver is harder to analyze than gold.

Once a quarter, the World Gold Council publishes outstanding Gold Demand Trends reports detailing global gold supply-and-demand fundamentals. Those are essential to understanding where gold’s capital inflows are coming from. But silver’s comparable World Silver Survey from the Silver Institute is only released once a year. And that’s around late April covering the prior calendar year, so that data really lags.

Without decent-resolution fundamental data to reveal high-level capital flows, silver is way more opaque. The two big things we can track are the daily holdings in the dominant SLV silver ETF and speculators’ weekly positioning in silver futures. The former sure didn’t contribute much to silver’s 58.5% advance during this mighty cyclical gold bull, with SLV holdings actually slipping 0.5% to 448.8m ounces during that span!

But silver’s breakout surge this month has attracted some American stock investors. As of midweek, SLV’s holdings have climbed a big 3.0% month-to-date to 473.6m ounces on differential SLV-share buying! Fully seven of June’s eight trading days to Wednesday have seen SLV-holdings builds. That’s the best streak since late March to early April 2024, when silver was blasting higher similar to what we’ve just seen.

Yet interestingly Wednesday’s SLV holdings remained a bit under their cyclical-gold-bull peak of 481.2m ounces from late October 2024. So while American stock investors are biting a bit, their silver-chasing buying has been modest at best. I thought about including an SLV-holdings chart, but with them largely meandering in a loose range there wasn’t much to see. Hopefully that changes soon on major SLV buying.

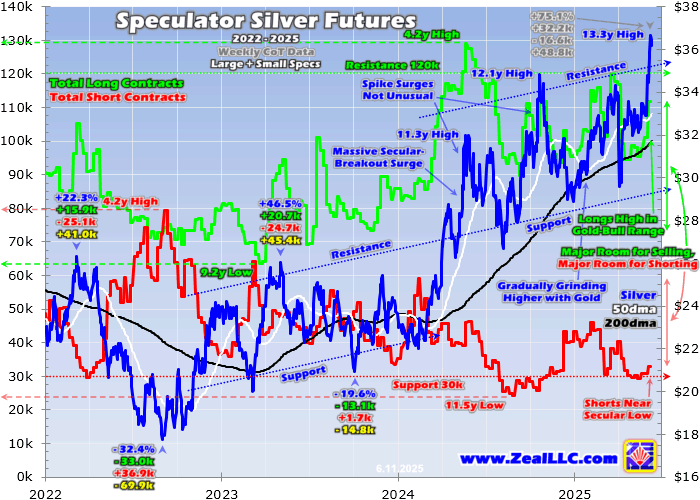

Far more illuminating is silver’s price action in recent years superimposed over speculators’ positioning in silver futures. I hadn’t run this chart since way back in April 2020, so much updating was necessary. The results were kind of a bummer too. Silver’s near-term setup looks fairly bearish with likely spec long buying and short covering appearing largely exhausted. Silver-futures specs wield outsized silver-price influence.

Each US silver-futures contract controls 5,000 ounces of this metal, worth $175,000 at $35 per ounce. Yet speculators are only required to keep $15,000 cash margins in their accounts for each contract traded. That makes for 11.7x maximum leverage, far beyond the 2x legal limit in stock markets since 1974! So each dollar traded in silver futures has up to 12x the price impact on silver as a dollar invested outright.

Silver’s recent secular breakout was exciting, generating lots of bullish commentary. Reading some of that, this breakout sounded like quite the technical milestone. Since silver has been so boring for so long, I hadn’t been paying close attention to it. Updating my own spreadsheets, I was disappointed to find that this heralded breakout is just the latest in a recent series. That leaves it less noteworthy technically so far.

In late May 2024, silver soared to an 11.3-year high after its original massive secular breakout surge. As you can see in this chart, that spike surge was way stronger and more impressive than this latest one! That catapulted silver up from a lower uptrend into a parallel higher one, in which it has been gradually advancing since. Then into late October 2024 another silver spike surge drove it to another new 12.1-year high.

Silver often acts like a gold sentiment gauge, outperforming the most when traders wax bullish on gold. The yellow metal was surging last autumn heading into the US presidential elections, so the white metal followed amplifying its gains. Though that spike surge established silver’s new higher uptrend, it was weaker than the preceding one. And silver’s gold-bull gains to there were only marginally better than gold’s.

Silver was up 61.2% then during gold’s 53.1% monster upleg at that point. Historically major silver moves have tended to at least double gold’s gains, making silver a leveraged play on gold. Silver needs to really outperform to make it worth owning. Unlike gold where investment demand can grow huge when upside is chased, silver’s dominant demand source is industrial. That isn’t price-sensitive, silver surges don’t grow it.

According to the latest World Silver Survey, in 2024 industrial demand accounted for 58.5% of the world’s total silver demand. Combined physical bar-and-coin demand and net silver-ETF inflows only accounted for 21.7%. Those ratios aren’t static, and can greatly shift if silver is really soaring attracting capital. The last year that actually happened was 2020, within which silver skyrocketed 142.8% in a 40.0% gold upleg!

That year silver investment demand soared to 58.0% of the world total, usurping industrial’s lead. For comparison, global gold investment demand per the latest Gold Demand Trends accounted for 23.7% of its total last year and 37.9% in 2020. And gold’s largest demand category of jewelry is sensitive to price trends, especially in Asia which is jewelry’s biggest-buying region. True industrial gold demand was just 6.5% in 2024.

Despite this recent excitement, silver’s latest spike surge is the smallest out of these last three during gold’s mighty cyclical bull. That could certainly change, but that’s were the score is currently. But specs’ silver-futures positioning reveals ominous major room for selling but not much more for big buying. Since leveraged futures trading is so ridiculously risky, it only attracts a small fraction of traders with finite capital.

At 11.7x leverage, a mere 8.5% silver move against specs’ bets would wipe out 100% of their capital risked! They can’t afford to be wrong for long in this realm. In this chart I noted the major silver swings that coincide with gold’s major ones in recent years. Each silver move is shown, along with the changes in spec longs and shorts and their total during those spans. All big silver rallies were fueled by big futures buying.

From silver’s own early-October-2023 low to this Monday’s latest high, it has powered up 75.1% at best over 20.2 months. Specs’ total silver-futures longs soared 32.2k contracts in that span, while their shorts fell 16.6k. That combines to 48.8k contracts of buying fueling silver’s bull run, the equivalent of 243.9m ounces! That’s a big number, with global silver mine production which is 72% byproduct running 835.0m last year.

In recent years, total spec longs have seen resistance near 120k contracts while total spec shorts have found support near 30k. Spec longs briefly surged above the former in mid-May 2024, hitting 129.1k or a 4.2-year high as silver soared to its original 11.3-year secular breakout. But those extremes didn’t last long. Conversely total spec shorts fell to a deep 11.5-year secular low of 24.2k contracts in late August 2024.

The Commitments of Traders reports detailing speculators’ futures positioning are current to Tuesdays, but not released until late Fridays. So the latest-available data before this essay was published was only to June 3rd, before silver’s three-trading-day surge straddling last weekend. At that point, total spec longs were already way up at 112.0k contracts while total spec shorts were way down at 32.8k. This is quite bearish.

While spec longs can briefly shoot over 120k in extreme bullishness and spec shorts briefly fall under 30k, those levels haven’t been sustainable for years. So those key long-resistance and short-support lines are the highest-probability zone for indicating exhausted silver-futures buying. These gunslinging traders’ capital is very limited, and once they are effectively all-in with high longs and low shorts their firepower is spent.

They likely don’t have much more room for either silver-futures long buying or short covering, but massive room to sell to unwind those high longs and low shorts! Silver-futures specs being largely tapped-out implies silver’s breakout will soon stall if it hasn’t already, unless big demand is coming from elsewhere. And if anything spooks silver-futures specs, they could rapidly dump major longs while ramping their shorts.

The extreme leverage inherent in silver futures is a double-edged sword. Big futures buying accelerates silver upside, while big futures selling does the same in the opposing direction. I like to consider specs’ futures positioning in the context of their bull trading range. Within their ranges during gold’s mighty cyclical bull since early October 2023, silver-futures spec longs and shorts were just running 69% and 24% up in!

Since silver surged again in this subsequent not-yet-reported CoT week, the former is now likely higher and the latter lower. Contrast that with gold futures, which were much more bullish for it as of June 3rd. Gold-futures spec longs were only 25% up into their own gold-bull trading range, while spec shorts were 17% up into theirs. Gold has enjoyed massive Chinese-investment and central-bank demand during this bull.

That means American gold-futures speculators and American stock investors buying gold-ETF shares haven’t had to do much of gold’s heavy lifting. But as this silver-futures chart reveals, silver’s big swings in recent years have been heavily dependent on silver-futures trading. Silver’s price action has been highly positively correlated with spec longs and negatively correlated with spec shorts, like gold’s is in normal bulls.

With silver far more reliant on silver-futures buying and that looking largely spent based on recent-years precedent, silver’s latest secular breakout looks more precarious. If silver futures’ spec longs were near gold futures’ 25% or even under 50%, there would be a great near-term bullish case for more upside soon. But being way up at 69% before silver’s latest surge is concerning, showing dwindling capital for buying.

Over the past couple months or so, gold has been mired in a high consolidation. It surged too far too fast into mid-April, reaching unsustainable crazy-overbought extremes. So either a quicker selloff or slower high consolidation was necessary then to rebalance sentiment. The latter has won out so far, as I explained last week in an essay on gold stocks breaking out despite gold drifting. Its fortunes are a risk for silver.

While the odds are getting lower with each passing week, gold could still roll over into a correction-grade 10%+ selloff. That would be the first of this entire cyclical bull, likely seriously ramping bearish sentiment. When gold sells off materially, silver almost always follows and fares worse. Case in point was during the biggest selloff of this gold bull, 8.0% into mid-November 2024 on the US dollar surging after Trump’s victory.

Silver fell 10.5% in that exact span, and actually suffered a wider much-worse 17.1% correction into late December! When gold is falling and bearishness flares, silver almost always amplifies bears the brunt. Silver’s biggest hope for this latest secular breakout persisting is gold staying high, near the upper end of its high-consolidation trading range between about $3,175 to $3,425. Otherwise silver-futures selling will likely mount.

So as exciting as silver’s recent spike surge to 13.3-year secular highs has been, the underlying setup isn’t great for further gains. If gold rolls over for any reason, silver will almost certainly follow. Gold faces potential selling pressure if good trade-war news or better-than-expected US economic data gooses the extremely-oversold US Dollar Index, which will spawn gold-futures selling. That could happen any day here.

My gold-stock analysis last week also applies to silver, as both the miners and the white metal usually act like leveraged plays on the yellow one. If gold can hold near highs or forge higher on foreign buying, the similar gold-stock and silver secular breakouts should persist. But if gold gets dragged materially lower, gold stocks and silver will fold like cheap lawn chairs. Thus odds are we’ll see lower entry points a little later.

So these summer doldrums are a great time to be researching fundamentally-superior smaller gold and silver miners. That’s what we’ve been doing at Zeal, creating shopping lists of the mid-tiers and juniors with the best near-term upside potential based on their current fundamentals and coming growth. We’ll pull the trigger and start redeploying when it looks like gold’s high consolidation or selloff has mostly run its course.

Successful trading demands always staying informed on markets, to understand opportunities as they arise. We can help! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

Our holistic integrated contrarian approach has proven very successful, and you can reap the benefits for only $10 an issue. We extensively research gold and silver miners to find cheap fundamentally-superior mid-tiers and juniors with outsized upside potential. Sign up for free e-mail notifications when we publish new content. Even better, subscribe today to our acclaimed newsletters and start growing smarter and richer!

The bottom line is silver’s latest secular breakout looks shaky. All three during gold’s mighty cyclical bull have been fueled by speculators buying silver futures. But with spec longs now high and shorts low in their gold-bull trading ranges, silver-futures buying is likely getting tapped-out. These super-leveraged traders have far more room to dump longs and ramp up shorting than keep buying, which is ominous for silver.

Silver sentiment and thus silver fortunes are highly dependent on gold’s. Gold has been drifting sideways on balance in a high consolidation for a couple months now. If that rolls over into a bigger selloff, silver will almost certainly get sucked in like usual. And gold faces considerable downside risk with the US dollar extremely oversold and likely to bounce. Silver’s breakout won’t survive a larger gold pullback or correction.

Adam Hamilton, CPA

June 13, 2025

Copyright 2000 - 2025 Zeal LLC (www.ZealLLC.com)