Excerpt from this week's: Technical Scoop: Central Cuts, Inflation Threat, Under-Owned Gold

The Scorecard

Source: www.stockcharts.com

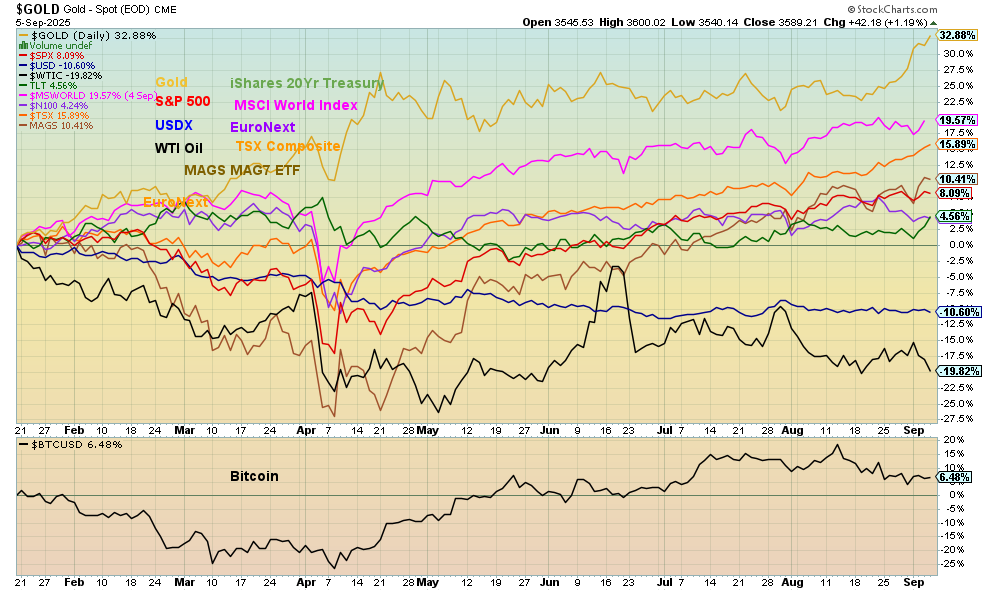

Gold’s recent surge has seen the yellow metal increase its lead over the rest, now up 32.8% since Inauguration Day on January 20. As we expected in our 2025 forecast, we believed the election of Donald Trump would be good for gold. We have not been disappointed. Gold rose 55% during Trump’s first term. Under Biden, gold rose slightly less, up 46%. We have also noted that gold appears to rise more under Republican presidents than Democrat presidents. For example, under George W. Bush gold rose 223%. Under Obama gold was up only 44%. The MSCI World Index (ex USA) remains second, up 19.6%. The reigning loser is still WTI oil, down 19.8%. The US$ Index remains the only other loser, down 10.6%.

Gold

Source: www.stockcharts.com

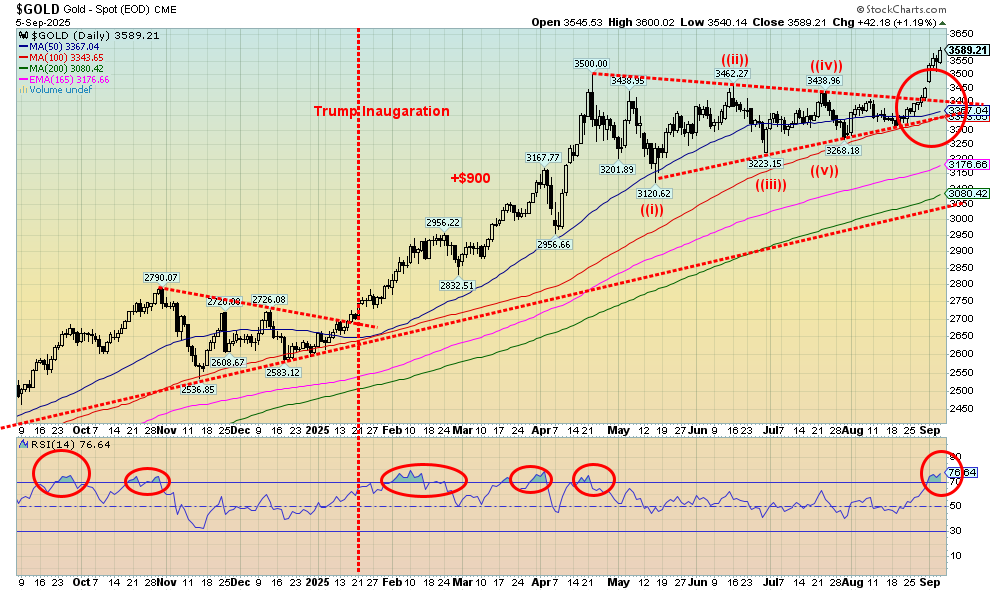

Gold! The shiny metal is the star, up a healthy 35.6% so far in 2025. Silver, gold’s junior partner, is up 40.1%. Gold is making all-time highs; silver, new 52-week highs. The gold stocks are soaring with the Gold Bugs Index (HUI) up 95.0% in 2025 to new 52-week highs while the TSX Gold Index (TGD) is up 91.1% to all-time highs. It has been a glorious period for the gold bugs.

Inflation, a slowing economy, rising unemployment, trade wars and Trump’s erratic approach to trade, real wars (Ukraine/Russia, Israel and everyone else in the Middle East), growing geopolitical tensions U.S. vs. Russia/China, G7 vs. BRICS, falling rates, potential for stagflation, Trump’s ongoing fight and takeover attempts with the Federal Reserve, his ongoing war to remake the federal civil service and fill positions with loyalists—it’s all out there. Gold is the go-to safe haven asset in times of economic uncertainty, geopolitical tensions, and domestic political tensions (rising polarization in G7 countries). Gold, as we note, is up 35.6% in 2025, bonds (U.S. 20-year Treasury bond) are up 4.4% plus coupon, while Bitcoin is up 19.2%.

On the week, gold rose 3.9%, silver was up 3.0%, and platinum up 0.6%. Of the near precious metals, palladium fell 0.2% and copper dropped 1.1%. TGD gained 5.6% while the HUI jumped 4.3%. Helping gold’s rise was a

continual decline in the US$ Index that was flat but gave up all its earlier gains on Friday following the employment reports. The US$ Index has been on a steady decline in 2025. The euro was up 0.2%, the Swiss franc was up 0.3%, the pound sterling was flat, while the Japanese yen fell 0.3%. The Cdn$, because of its weak employment report, lost 0.7%.

Over in the oil market, downward pressure continued. WTI oil dropped 3.1%, while Brent crude was off 2.7%. However, natural gas (NG) rebounded slightly with NG at the Henry Hub and EU Dutch Hub both up 1.0%. To no one’s surprise, the energy stocks fell with the ARCA Oil & Gas Index (XOI) off 3.2% and the TSX Energy Index (TEN) down 2.4%. Oil is being pressured by Saudi threats to up production and OPEC’s negative outlook.

Gold has now broken out of the ascending triangle formation that formed over the past five months. Targets are up to around $3,800. Many believe we’ll go even higher. Silver is targeting up to at least $42/$43. The gold stock indices are targeting HUI up to 550 and the TGD up to 645. It has been a great time to be in gold. The trouble is, right now all have reached into overbought territory with RSIs above 70. Granted, the RSI (and other indicators) can remain in overbought territory for some time, even a few weeks. So, it’s a warning sign, not necessarily a sign of a top. Worth noting is that we are continuing to see positive gains from junior miners. However, even the TSX Venture Exchange (CDNX) remains below its 2021 high.

Keep breakdown points in mind. The first breakdown point is 3,300 followed by 3,200. For silver, the points are $39.50 and $37.00. The gold stock indices have been in a steady rise since December 2024. Seasonally, we usually exhibit strength into September with a potential high in October followed by weakness into November/December. As the saying goes, you can’t go broke taking a profit. However, the conditions that have sparked this huge rally for gold are all in place and not expected to go away.

Could we have a melt-up? Yes, and as we note, our targets are above. Others have even higher targets but, as we say, one step at a time. Consolidations/corrections are healthy. Melt-ups are exhilarating but also potentially dangerous as too many get caught up in the euphoria. We’ve seen that many times. So, be long but be wary. We are always reminded that the one who became rich was the one that sold too early.

Read the FULL report here: Technical Scoop: Central Cuts, Inflation Threat, Under-Owned Gold

Copyright David Chapman 2025

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.