Excerpt from this week's: Technical Scoop: More Tariffs, Yield Concern, Precious Signal

Source: www.stockcharts.com

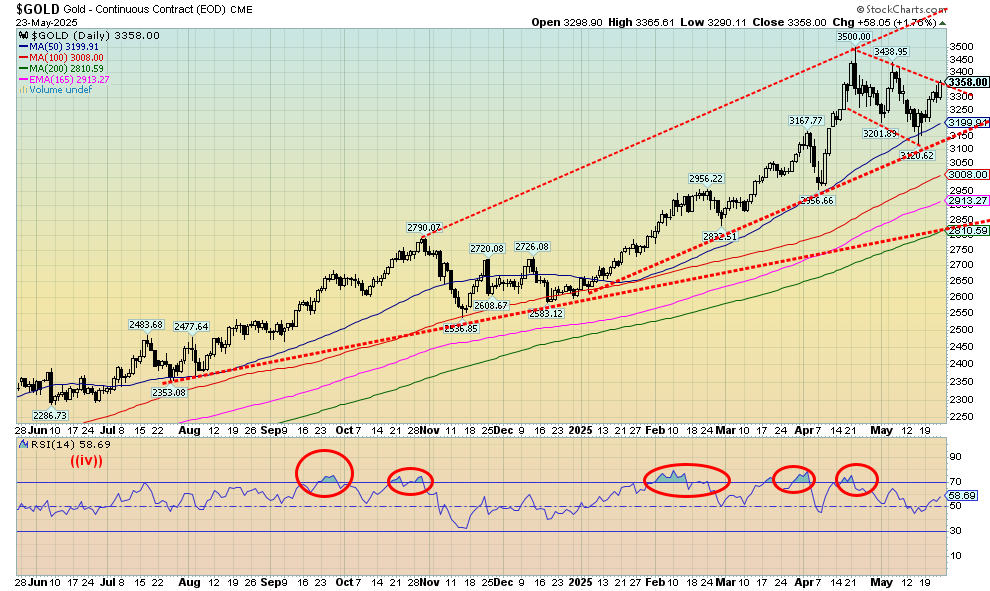

Nothing like a debt downgrade and threats of more tariffs to get gold to leap again. Add in the “Big, Beautiful Bill” and its threats of deficits to the outer edges of space (maybe it’s going to where no man has gone before). We have once again added a good reason to own gold. Repeat the mantra. Gold has no liability. It is a safe haven in times of geopolitical tensions, economic uncertainty and political uncertainty, and loss of faith in government. No wonder gold is up 27.3% in 2025, including a gain of 5.1% this past week. The previous week’s decline for gold was just a breather. If that potential bull flag formation is accurate, then a breakout over $3,375 could propel us to new highs with targets up to $3,740. The fly in the ointment is a breakdown under $3,150 instead. We are not expecting that. However, given we are in a period of seasonal weakness, we might not fully break out until around mid-June. Ideally, it is a higher low above $3,120.

Silver gained 3.9% this past week and its lagging gold continues to be a source of frustration and a warning sign. Platinum came alive, jumping to fresh 52-week highs, up 10.2%. Apparently, above-ground supplies are very low. Of the near precious metals, palladium gained 3.5% and copper was up 6.2%. We like copper leading. The gold stocks jumped with the Gold Bugs Index (HUI) up 8.7% and the TSX Gold Index (TGD) up 6.7%. But gold is the center of attention.

Even fund managers indicate it might be wise to hold a bit of gold in portfolios. The latest recommendation is at least 5%. In general, gold trades inversely to stocks.

Source: www.stockcharts.com

Silver’s performance continues to be frustrating. We want silver to lead, not to follow reluctantly. Okay, we know that there is a lot of demand for silver, particularly for solar panels. So, we’ve speculated that the price may be being held back so as to not allow the costs to get out of hand. Others have noted that the gold/silver ratio is way out of whack (last at 100.37). If the ratio over 70 suggests silver is cheap and gold expensive, then over 100 is rare, suggesting gold is expensive and silver super cheap. Anytime the ratio went over 100 it didn’t remain there for long. And it’s only happened three times since 1970: first in 1991, second in 2020 during the pandemic panic, and now. None have lasted for very long. The odds of this one lasting are slim to none. Central banks have been on a gold-buying spree. However, that sustained demand is not expected to last. Where gold goes, silver usually follows. But then silver is often the leader in both up and down markets. In the 2008–2011 gold rush, gold gained 280% but silver was up 587%. The gold/silver ratio fell from 92 to 31. A gold/silver ratio over 100 won’t last.

Source: www.stockcharts.com

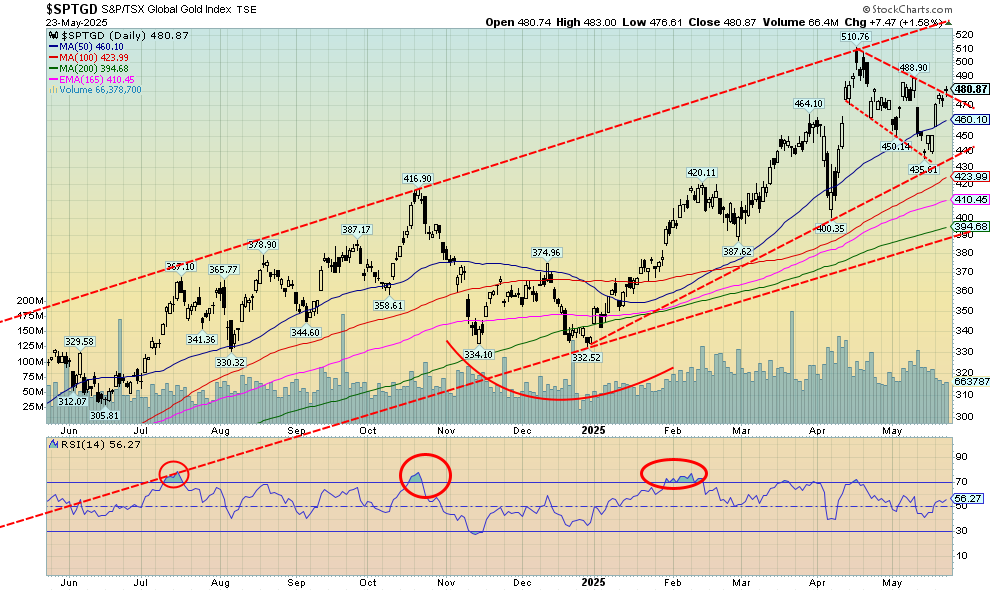

Thanks to safe haven gold-buying, the gold stocks rebounded from the previous week’s sharp pullback. The TSX Gold Index (TGD) was up 6.7% this past week while the Gold Bugs Index (HUI) jumped 8.7%. Both are now back over 40% for the year with the TGD up 42.7% and the HUI up 44.3%. If you are a gold bug, it’s been a happy year. Since 2000, gold is the best performer, up 1,068% (not counting any cryptos). The S&P 500, thanks to the dot.com and financial sub-prime crashes, is up only 295%. The gold stocks have not quite followed gold itself, but nonetheless the TGD is up 456% and the HUI up 434% since 2000. Silver is a disappointing laggard but still up 519%. We had noted that the TGD may be forming a bull flag since that last top at 510 in April. After that the TGD fell about 15% but has now rallied back 10.5%. It appears to be breaking that flag formation, but obviously we can’t confirm that just yet. If it is correct, then targets could be up to at least 550. The caveat is that the last low at 435 holds. Major support is down at 395. The past week was positive. Now we need to follow through to the upside. But, like gold, our expectations are still for a low in June.

Read the FULL report here: Technical Scoop: More Tariffs, Yield Concern, Precious Signal

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.