Excerpt from this week's: Technical Scoop: Worse Inflation, Unemployment Rise, Market Highs

The Scorecard

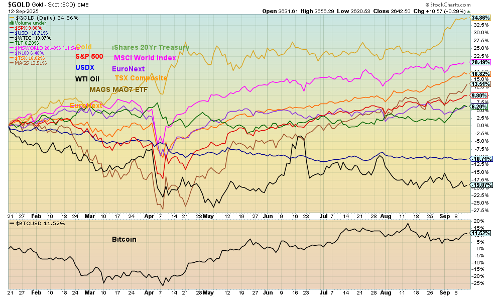

Source: www.stockcharts.com

As expected, gold not only maintains its lead but the spread is widening. Gold is now up 34.9% in 2025. Next is the MSCI World Index (ex U.S.), up 20.5%. Oil remains last, down 19.9%, while the US$ Index is down 10.7%.

Gold and Silver

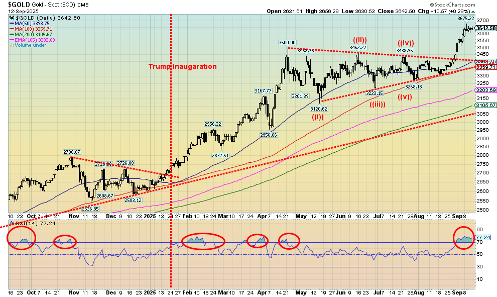

Source: www.stockcharts.com

After consolidating from April to August, gold has broken out and is now on the next wave to an upside. The records continue to fall as gold has now set a record high 30 times so far in 2025. Interestingly, on an inflation- adjusted basis we are now at, near, or have surpassed the all-time high set in 1980, depending on how it is calculated. The S&P 500 long ago passed its inflation-adjusted high.

The breakout from that months-long consolidation suggests a target of at least $3,800. We closed at $3,642 on Friday. Silver is also breaking out, closing at its highest level since 2011. Still above is the 1980 and 2011 high near $50. Further away is the inflation-adjusted high of at least $146, but some believe it’s up to $192. Nonetheless, gold and silver have been the place to be in a year that has been punctuated with economic uncertainty and geopolitical and domestic political tensions. We should add that platinum, the overlooked precious metal, has been the best performer so far in 2025, up 53.5% vs. silver up 44.1% and gold up 37.9%.

Many have asked whether it is still worthwhile to buy gold and silver. The answer is yes, citing the decline in the U.S. dollar, the confiscation of Russian reserves after the 2022 invasion of Ukraine, the huge U.S. debt and dangerous debt/GDP ratio of 124%, projected huge spending by the Trump administration as a result of its Big,

Beautiful Bill, and its ongoing attempt to seize control of the Fed. Upwards of thirty percent of U.S. debt or $10.5 trillion has been added since the 2020 pandemic year.

Add in signs that the U.S. economy is slowing, possibly rapidly, as the Fed prepares to cut rates despite signs that inflation is not going away, the geopolitical tensions continuing with the Russia/Ukraine war that now threatens to bring in NATO, the domestic political tensions which moved another notch higher with the assassination of Charlie Kirk – and we have ongoing perfect conditions for gold. Oh, and need we mention again the ongoing attempt of the Trump administration to take control of the Fed, an event that could shake the global financial system to its core.

As good as the rise of gold, silver, and platinum has been, the rise of the gold stocks has been nothing short of spectacular. The Gold Bugs Index (HUI) is up 103.0% in 2025 while the TSX Gold Index (TGD) has been making record highs, up 98.8% so far in 2025. The HUI has been setting 52-week highs but remains about 12.5% below its record 2011 nominal high. Many believe gold stocks are still under valued despite the huge rise in 2025.

So, the answer is yes, it is not too late to buy gold, silver, and platinum. That said, corrections could occur, especially now when we are getting consistent RSI readings above 70, a level that signals overbought. Corrections should be bought. North Americans under-own gold and silver compared to Asia and even Europe, given they are more enamoured with tech/AI. However, central banks have been buyers, purchasing an estimated 67 metric tonnes so far in 2025. The largest buyers have been China, Azerbaijan, Kazakhstan, and Poland, the latter being the largest buyer thus far in 2025. Only Serbia in Europe appears in the top 15 purchasers. No other European or North American/South American country appears on the list as it is dominated by Asian and some Middle Eastern countries. Countries like Canada hold no gold, having sold theirs back in 2016. Could that prove to be a big mistake?

On the week, gold rose 1.7%, silver was up 2.9%, platinum was up 1.6%, the near precious metal palladium was up 9.5%, and copper gained 2.5%. The gold stock indices were up with the HUI gaining 4.1% and the TGD up 4.0%. It’s no surprise to find that Golds (TGD), Metals (TGM), and Materials (TMT) have helped take the TSX Composite to record highs this year, up 18.4%. TGD is up 98.8%, TGM up 49.8%, and TMT up 62.6%. No other TSX sub-indices are close to challenging these three.

We should also mention the energy market where WTI oil rose 0.9% this past week and Brent crude was up 2.0%. Natural gas (NG) fell 3.3% but the EU NG rose 1.9% on renewed NATO/Russia tensions. Those same tensions helped oil rise this past week. The energy stocks saw the ARCA Oil & Gas Index (XOI) up 0.4% and the TSX Energy Index (TEN) up 3.2%.

Commodities have done well this year, although we note that the CRB Index is up only 1.7% in 2025 because energy is the largest component and, as we know, it has done poorly so far. Energy represents some 33% of the index with oil alone representing 23%.

Currencies were pretty quiet this past week with the US$ Index down 0.1%, the euro up 0.1%, the Swiss franc up 0.2%, the pound sterling up 0.4%, and the Japanese yen down 0.1%. The Cdn$ fell less than 0.1%.

Gold would be in trouble if it fell back below $3,350. That could signal a steeper correction. We’d prefer it hold above $3,400 going forward, a level that would rise as the market moves higher. Silver’s point is at $39; however, we’d prefer it remain above $40. For the HUI the point is 480, although again we’d prefer it remain

above 520.0. For the TGD the key point is 550 with again a preference that it remains above 620 on any pullback.

We are reading that some are predicting a huge blow-off in gold, bigger than what happened in 1979. Back then, gold rose over 400% from late 1978 to the peak in January 1980. A move like that today from the 2022 low would see gold rise to over $6,900. For silver it rose over 1,000% from a key low in 1978 to the high in 1980. Again, a comparable move today would see silver rise to around $175. Could it happen? Yes. Will it happen? We tend to take one step at a time. We’ll reassess gold once it achieves $3,800 while silver’s next target could be $44/$45. For the stock indices, the HUI targets next up to just over 600 while the TGD targets next up to over 700. The message is straightforward – stay long, add on dips. The reasons we are going up are not going away anytime soon.

Read the FULL report here: Technical Scoop: Worse Inflation, Unemployment Rise, Market Highs

Copyright David Chapman 2025

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.