The enthusiastic rally that began in gold...and also in the other three precious metals -- at the 6:00 p.m. Globex open in New York on Thursday evening, ran into the collusive commercial traders of whatever stripe all at the same time ...11:30 a.m. China Standard Time in Shanghai on their Friday morning. It was engineered quietly lower until they really got serious starting at 11 a.m. in London...setting its engineered low tick five minutes after the equity markets opened in New York on Friday morning. Its ensuing rally was rolled over at 11:40 a.m. -- and it was engineered quietly lower anew until the market closed at 5:00 p.m. EST.

The high and low ticks in gold were recorded by the CME Group as $4,215.10 and $4,032.60 in the December contract...and intraday move of $182.50 the ounce. The December/February price spread differential in gold at the close in New York yesterday was $35.30...February/April was $29.50...April/June was $30.10 -- and June/August26 was $29.50 an ounce.

Gold was closed in New York on Friday afternoon at $4,080.70 spot...down $89.60 on the day -- and $48.50 off its Kitco-recorded high tick. Net volume was, not surprisingly, extremely heavy at 281,000 contracts -- and there were around 61,500 contract worth of roll-over/switch volume on top of that.

I saw that 483 gold, plus 73 silver contracts were traded in November yesterday and, as is always the case, it remains to be seen just how much of that shows up in tonight's Daily Delivery and Preliminary Report data further down in today's column.

![]()

And, with no exceptions...none whatsoever...the silver price was managed in an exact same manner as gold's...including the precise timing of their high and low ticks, to the minute.

The high and lows in it were reported as $53.375 and $49.86 in the December contract...and intraday move of $3.515 an ounce. The December/March price spread differential in silver at the close in New York yesterday was an eye-watering 63.8 cents...March/May was 39.8 cents -- and May/July26 was 37.0 cents an ounce.

Silver was closed on Friday afternoon in New York at $50.474 spot...down $1.74 on the day -- and 45.4 cents off its Kitco-recorded low tick. Net volume was pretty heavy at a bit over 104,500 contracts -- and there were a bit over 25,500 contracts worth of roll-over/switch volume in this precious metal.

![]()

Platinum's high tick was also set at 11:30 a.m. in Shanghai on their Friday morning -- and 'da boyz' set a double bottom in it within fifteen minutes of each other around 9 a.m. in COMEX trading in New York. Its ensuing rally was capped at the 11:00 a.m. EST Zurich close -- and was also engineered lower anew until trading ended at 5:00 p.m. Platinum was closed at $1,541 spot... down 40 bucks on the day -- and 22 dollars off its Kitco-recorded low tick.

![]()

Despite what it shows on the Kitco chart below, the spike high tick in palladium was also set at 11:30 a.m. in Shanghai on their Friday morning -- and its low tick was set at the same time as gold and silver...9:35 a.m. in COMEX trading in New York. Its ensuing rally was capped around 10:50 a.m. EST -- and was engineered lower anew until minutes after 2 p.m. in the very thinly-traded after-hours market. It wasn't allowed to do much after that. Palladium was closed at $1,381 spot...down 29 dollars from Thursday -- and 27 bucks off its Kitco-recorded low tick.

Based on the kitco.com spot closing price in silver and gold posted above... the gold/silver ratio worked out to 80.8 to 1 on Friday...compared to 79.9 to 1 on Thursday.

Here's the 1-year Gold/Silver Ratio chart from Nick -- and updated with last week's data. Click to enlarge.

![]()

The dollar index closed very late on Thursday afternoon in New York at 99.16 -- and then opened higher by 10 basis points once trading commenced at 7:45 p.m. EST on Thursday evening...which was 8:45 a.m. China Standard Time on their Friday morning. It then wandered quietly lower until around 11:34 a.m. CST -- and then didn't do much of anything until it began to head unevenly higher starting around 2:02 p.m. CST. That rally topped out around 11:18 a.m. in London -- and then headed smartly lower until the 8:20 a.m. COMEX open in New York...with its ensuing rally ending at 12:20 p.m. EST. It then crawled very quietly lower until shortly before trading ended at 5:00 p.m. -- and didn't do much after that.

The dollar index finished the Friday trading session in New York at 99.27...up 11 basis points from its close on Thursday.

Here's the DXY chart for Friday...thanks to marketwatch.com as usual. Click to enlarge.

![]()

Here's the 6-month U.S. dollar index chart...courtesy of stockcharts.com as always. The delta between its close...99.275...and the close on DXY chart above, was 0.5 basis points above that. Click to enlarge.

![]()

You would be delusional if you though that what was happening in the currencies had any affect on what was going on in the precious metal space yesterday.

U.S. 10-year Treasury: 4.1480%...up 0.0360/+(0.88%)...as of the 1:59:53 p.m. CST close

For the week, the ten-year closed up 5.50 basis points -- and that's despite the best efforts of the Fed, which is a disquieting sign.

Here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- which puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

Although the 10-year hasn't been allowed to trade above its 4.92% high tick set back on October 15, 2023 -- and has been in almost continual decline since, I strongly suspect that we've now seen the 3.9482% low for this cycle ...which was set back on October 22. It's also 50/50 on whether the Fed serves up another rate cut at the December FOMC meeting.

![]()

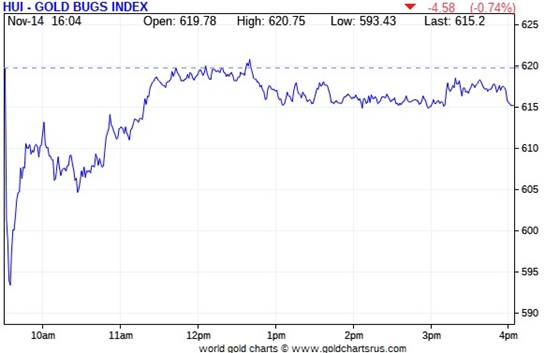

Not surprisingly, the gold shares gapped down at the opens of the equity markets in New York on Friday morning, but then came roaring back once 'da boyz' set gold's engineered low tick at 9:35 a.m. They actually managed to poke their heads above unchanged on the day around 12:40 p.m. EST...but then faded a bit as the gold price was engineered quietly lower anew. The HUI closed down only 0.74 percent -- and I'll have more to say about this in The Wrap.

![]()

The price path for the silver equities was identical, but because 'da boyz' beat silver up far worse than they did gold, Nick Laird's Silver Sentiment Index closed down 1.48 percent...which is still amazing. Click to enlarge.

![]()

For comparison, the Amplify Junior Silver Miners ETF (SILJ) closed lower by 1.34 percent.

The two stars were Santacruz Silver Mines and SSR Mining, as both actually closed up on the day...the former by 1.04 percent -- and the latter by 0.35 percent. The biggest underperformer was Aya Gold & Silver, as it closed down 3.57 percent.

The silver price premium in Shanghai over the U.S. spot price on Friday was only 2.8 percent -- and with their silver stockpiles at rock bottom, I'm surprised that the premium isn't far higher that this.

The reddit.com/Wallstreetsilver website, now under 'new' and somewhat improved management, is linked here. The link to two other silver forums are here -- and here.

![]()

Here are the usual three charts that appear in this spot in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the Silver Sentiment Index.

Here's the weekly chart -- and despite the pounding that 'da boyz' handed out to gold and silver on both Thursday and Friday, their gains earlier in the week still have everything wall-to-wall green...with the gold shares outperforming on a both a relative and absolute basis. Click to enlarge.

Here's the month-to-date chart -- and although silver has outperformed gold again, that hasn't helped its associated equities...not helped by the fact that Mr. Market punished some of these companies severely on their Q3 earnings reports. The HUI is still the king of the castle. Click to enlarge.

Here's the year-to-date chart -- and everything remains green...so despite this 4-week long bloodbath we've been through, we should be grateful. However, as you are more than aware, the equities should be up far more than they are...especially the silver stocks. This recent 'wash, rinse & spin' cycle has laid waste to everything. But this too shall pass. Click to enlarge.

Despite the fact that silver has finally broken the $50 barrier -- and the silver well in London is running close to empty, the gold/silver ratio remains at a farcical 80.8 to 1 as of the Friday's close. The 'normal' and historical ratio is around 15 to 1...which would put silver at about $272. And if priced at the ratio of 7:1 that it comes out of the ground at, compared to gold...that would put silver at $583 an ounce. So a triple-digit silver price is in our future -- and all that remains to be resolved is what that number will be -- and how soon 'da boyz' allow it to happen.

![]()

The CME Daily Delivery Report for Day 12 of November deliveries showed that 409 gold -- plus 45 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the two largest short/issuers were British bank Barclays and Citigroup, issuing 309 and 70 contracts respectively...the latter from their house account.

There were six long/stoppers in total -- and the largest by far was JPMorgan, picking up 231 contracts for clients. The next three down the list were Canada's BMO [Bank of Montreal] Capital, BofA Securities and British bank HSBC, stopping...62, 59 and 46 contracts respectively ...HSBC for their client account.

In silver, the two short/issuers were Wells Fargo Securities and ADM, issuing 41 and 4 contracts respectively...the former from their house account. The two long/stoppers were HSBC and JPMorgan, picking up 39 and 6 contracts for their respective client accounts.

In palladium, there were 10 contracts issued and stopped.

The link to yesterday's Issuers and Stoppers Report is here.

So far this month there have been 8,646 gold contracts issued/reissued and stopped -- and that number in silver is now up to 3,425 COMEX contracts. In platinum, it's 246 -- and in palladium...304.

Back on First Day Notice for November deliveries, there were only 5,032 gold, plus 2,315 silver contracts open for delivery this month -- and twelve days into this new delivery month, there have already been 72% more gold -- and 48% more silver contracts issued and stopped than that.

The demand for physical delivery has not let up -- and although it's unknowable at the moment, I suspect that December will be a huge, if not record, delivery month as well.

The CME Preliminary Report for the Friday trading session, showed that gold open interest in November increased by 188 COMEX contracts, leaving 448 still around...minus the 409 contracts out for delivery on Tuesday as mentioned in the Daily Delivery Report a few paragraphs ago. Thursday's Daily Delivery Report showed that 183 gold contracts were actually posted for delivery on Monday, so that means that 188+183=371 more gold contracts were added to November deliveries.

Silver o.i. in November dropped by 184 contracts...leaving 124 still open ...minus the 45 COMEX contracts out for delivery on Monday as mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 244 silver contracts were actually posted for delivery on Monday, so that means that 244-184=60 more silver contracts were added to November deliveries.

Total gold open interest in the Preliminary Report on Friday night unexpectedly rose...by 8,775 COMEX contracts. I was expecting a decline of at least double that amount. I'll be more than interested in what the final number shows on the CME's website on Monday morning. Total silver o.i. did what it was supposed to, as it fell by a hefty 6,894 COMEX contracts. I was hoping for more, actually.

[I checked the final open interest number for gold for Thursday -- and it showed the big decline that I was hoping for...from +17,242 contracts, down to +622 contracts. Final total silver o.i. for Thursday didn't decline much ...from +817 contracts, down to +404 COMEX contracts.]

Gold open interest in December in the final report for Thursday -- and posted on the CME's website on Friday morning, dropped by 15,338 contracts, leaving 255,928 COMEX contracts still open. The final silver o.i. number for December on Thursday declined by 5,996 contracts, leaving 78,456 COMEX contracts still around.

We're still nine business days away from First Day Notice for December deliveries -- and it's still way too soon to know if it's going to be a big delivery month for either gold or silver.

![]()

There was a hefty withdrawal from GLD yesterday, as an authorized participant removed 158,401 troy ounces of gold. But a surprising 1,451,376 troy ounces of silver were added to SLV.

The SLV borrow rate started the Friday session at 1.80% -- and closed at 1.83%...with 3.5 million shares available to short by the end of the day. The GLD borrow rate began the day at 0.80% -- and finished it at 0.54%... with 7.9 million shares available.

In other gold and silver ETFs and mutual funds on Earth on Friday ...net of any changes in COMEX, GLD and SLV activity, there were a net and very surprising 355,698 troy ounces of gold added...with just about half of that amount going into UBS. There were also a net 1,627,139 troy ounces of silver added as well, with the lion's share of that amount...1,292,776 troy ounces...ending up at iShares/SSLN. Another 100,140 troy ounces went into Sprott's PSLV.

There was no sales report from the U.S. Mint.

![]()

It was yet another day where no gold was reported received over at the COMEX-approved depositories...but 158,594.544 troy ounces/4,944 kilobars were shipped out. The largest 'out' amount were the 83,528.298 troy ounces/2,598 kilobars that left the International Depository Services of Delaware...with the remaining 75,426.246 troy ounces/2,346 kilobars departing Malca-Amit USA. There were 16,002 troy ounces transferred from the Registered category and back into Eligible over at JPMorgan. The link to all of Thursday's COMEX gold action is here.

There was some activity in silver, as one good delivery bar/1,016 troy ounces showed up at Delaware -- and 646,593 troy ounces were shipped out. The two largest 'out' amounts were the 501,859 and 129,596 troy ounces that left CNT and Loomis International respectively. There was no paper activity -- and the link to Thursday's COMEX gold action is here.

The Shanghai Futures Exchange updated their silver inventories as of the close of business on their Friday -- and it showed a smallish decrease of 228,915 troy ounces...leaving their silver inventories at 18.548 million troy ounces.

![]()

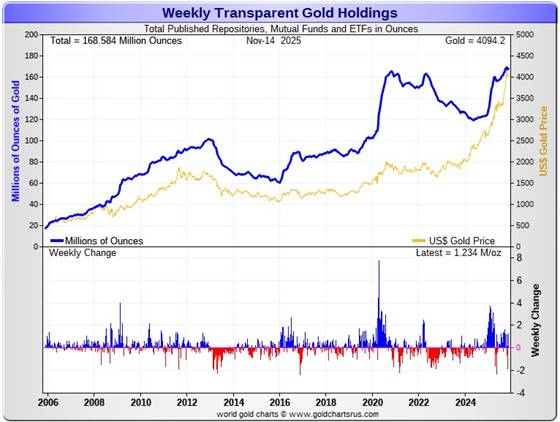

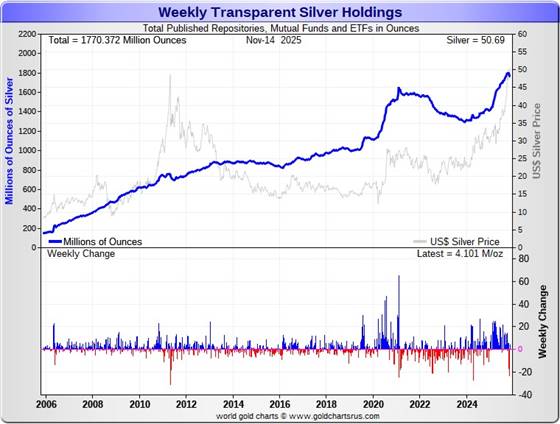

Here are the usual 20-year charts that show up in this space in every weekend column. They show the total amounts of physical gold and silver held in all known depositories, ETFs and mutual funds as of the close of business on Friday.

During the business week just past, there were a net 1.234 million troy ounces of gold added -- and a net 4.101 million troy ounces of silver were also added.

According to Nick Laird's data on his website, a net 1.382 million troy ounces of gold were removed from all the world's known depositories, mutual funds and ETFs during the last four weeks. The two largest 'in' amounts were the 1.153 million oz. that went into China's ETFs, followed by the 671,000 troy ounces into those Crypto currencies/Tether. The two biggest withdrawals by far were the net 1.649 million troy ounces that left the COMEX -- and the 566,800 troy ounces that were shipped out of GLD. Lastly were the net 330,100 troy ounces that departed WisdomTree.

The amount of gold in all the world's ETFs and mutual funds remains very close to its all-time high...but should be far higher considering that gold is now $4,000 the ounce.

It should be noted that the amount of silver held in all these depositories, ETFs and mutual funds is a very noticeable amount above its old all-time high inventory level of January 2021.

A net 64.403 million troy ounces of silver were also removed during that same 4-week time period. That's all silver that was shipped out of everywhere else on Planet Earth -- and mostly into London.

The biggest 'in' amount over that four-week period were the 4.273 million troy ounces shipped into Aberdeen. That was followed by the 3.145 million ounce into iShares/SSLN. The biggest 'out' amount by far were the 30.797 million that left the COMEX. The next largest 'out' amount were the 17.726 million troy ounces out of SLV...followed by the net 1.534 million and 1.245 million troy ounces out of Deutsche Bank and WisdomTree respectively.

Retail sales have backed off quite a bit...but are still far stronger than they were a month or so ago -- and the retailers are have huge problems getting inventory from the wholesalers. There's very limited selection.

However, physical demand in silver at the wholesale level remains enormous/ rapacious. COMEX silver deliveries have been huge all year...including the October delivery month...where 39.565 million troy ounces were issued and stopped. This is triple what was posted for delivery in October on First Day Notice -- and October isn't even a scheduled delivery month for silver. The amount of silver being physically moved, withdrawn, or changing ownership has gone parabolic world wide. COMEX gold deliveries in October were 96% higher than posted on First Day Notice.

On top of that, November deliveries in both silver and gold are proceeding at a torrid pace as well...which is amazing, considering the fact that November is not a scheduled delivery month for either of these precious metals. So far there have been 864,600 troy ounces of gold issued and stopped -- and that number in silver is now up to 17.125 million troy ounces.

This "rapacious" silver demand will continue until available supplies are depleted...which now appears close at hand -- and we are also fast approaching the sixth year of a structural deficit in silver according to the ongoing reports from The Silver Institute.

The vast majority of precious metals being held in these depositories are by those who won't be selling until the silver price is many multiples of what it is today.

Sprott's PSLV is the third largest depository of silver on Planet Earth with 204.6 million troy ounces...up 600,000 troy ounces on the week -- and a great distance behind the COMEX, which has now been demoted to the second largest silver depository, where there are 475.7 million troy ounces being held...down a further 4.4 million troy ounces this past week...but minus the 103 million troy ounces being held in trust for SLV by JPMorgan.

That 103 million ounce amount brings JPMorgan's actual silver warehouse stocks down to around the 100.5 million troy ounce mark...quite a bit different than the 203.5 million they indicate they have...down a net 1.5 million troy ounces on the week.

PSLV remains a very long way behind SLV as well -- now the largest silver depository...with 489.3 million troy ounces as of Friday's close...up 4.2 million ounces from last week.

The latest short report [for positions held at the close of business on Friday, October 31] showed that the short position in SLV declined by 32.76%...from the 83.86 million shares sold short in the prior report...down to 56.38 million shares in this latest short report that came out this past Tuesday...10.49% of total SLV shares outstanding. This amount remains grotesque, obscene, hideous -- and fraudulent beyond all description...as there is no physical silver backing any of it as the SLV prospectus requires.

BlackRock issued a warning five or so years ago to all those short SLV that there might come a time when there wouldn't be enough metal for them to cover. That would only be true if JPMorgan decides not to supply it to whatever entity requires it. However, we are beyond that now, as the short position in SLV will never be covered through the deposit of physical silver, as it just doesn't exit -- and never will.

The next short report...for positions held at the close of trading on Friday, November 14...yesterday...will be posted on The Wall Street Journal's website on Tuesday evening EST on November 25.

Then there's that other little matter of the 1-billion ounce short position in silver held by Bank of America in the OTC market...with JPMorgan & Friends on the long side. Ted said it hadn't gone away -- and he'd also come to the conclusion that they're short around 25 million ounces of gold with these same parties as well. Once the silver price approaches three digits, we'll see if they need to get bailed, like Bear Stearns did back in 2008 -- and for the same reason.

The latest OCC Report for Q2/2025 came out about seven weeks ago now -- and it showed that the precious metal derivatives held by the four largest U.S. banks only increased by $25.8 billion/4.89% from Q1/2025...which is nothing much at all -- and that's despite the fact that precious metal prices rose fairly substantially during that time period.

JPMorgan's precious metals derivatives rose from $323.5 billion, up to $358.5 billion in Q2/2025 -- and Citigroup's also rose, but not by much, from $142.8 billion...up to $150.7 billion. BofA's fell from $61.7 billion, down to 44.7 billion -- and the derivatives position held by Goldman Sachs is a piddling and immaterial $219 million -- down from the $269 million held in Q1/2025.

But with JPMorgan holding 64.7% of all the precious metals derivatives... Citibank holding 27.2% -- and Bank of America about 8% of the total of the four reporting banks, it's only JPMorgan and Citigroup that matter.

And as I keep pointing out in this spot every weekend, the OCC indicator is flawed for two very important reasons, as way back 10-15 years ago, this report used to include the top dozen or so U.S. banks -- and included the likes of Wells Fargo and Morgan Stanley, amongst others... that are card-carrying members of the Big 8 shorts. Now the list is down to just four banks...so a lot of data is hidden...which is certainly the reason why the list was shortened. On top of that, the list doesn't include the non-U.S. banks that are members of the Big 8 shorts: British, French, German, Canadian -- and Australian.

Even though the government shut-down in the U.S. is over, there was no updated Commitment of Traders Report data posted on the CFTC's website. It still showed the numbers from 23 September.

![]()

CRITICAL READS & VIDEOS

Breaking Burry --Quoth the Raven

One major headline today is that Michael Burry, of The Big Short fame, is shuttering his fund, Scion Capital. In his letter calling it quits, he wrote: “Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.”

I’ve been around markets long enough to believe that short sellers are generally more objectively right than most investors. They called Enron a fraud when investment banks were telling people to buy it, they blew the whistle on Madoff before he collapsed and they warned repeatedly about 2008 on national television before the entire global economy nearly collapsed.

But market dynamics know nothing of objectivity anymore. They have become a rigged, bloated, algorithm-warped humiliation ritual masquerading as a market — a parody of what price discovery used to be.

This is the environment that broke Burry. The compass is broken, the poles have reversed, the Bizarro World is now and everything you ever knew about markets and economics is no longer as rooted in basics, fundamentals and common sense as you thought.

People keep asking whether Burry is “wrong” or whether he’s “lost it,” and the truth is simpler: Burry isn’t wrong. He just can’t escape the tractor beam of a market that has stopped behaving like a market.

Burry stepping back, deregistering his fund, walking away from managing outside capital — that doesn’t signal weakness. It signals awareness. It signals someone looking at conditions so distorted, so liquidity-fattened, so unmoored from fundamentals that the only rational choice is to stop playing until the distortions resolve themselves.

He’s just refusing to play a game whose rules have become incompatible with sanity. And when the music stops, all the things he sees — all the things shorts have been screaming about for years — will show up not as doomerism but as hindsight. The market always comes back to reality. It just likes to wait until everyone has convinced themselves that it never will.

When reality returns, Burry won’t look wrong. He’ll look early — right up until the moment he looks inevitable. Patience and reality haven’t disappeared; they’ve just been buried under liquidity. But they always re-emerge. Slowly, then violently.

This longish, but very worthwhile commentary showed up on the QTR's Fringe Finance substack site on Thursday -- and I found it on Zero Hedge. Another link to it is here.

![]()

Inflare aut mori -- Bill Bonner

The problem with the busy-bodies is that they are too busy. TV…tablets…TikTok — who has time read the classics, or to think at all?

An example: the destruction of the twin towers on 9/11 will bring some “economic good,” said celebrity economist Paul Krugman. “Now, all of a sudden we need some new buildings…rebuilding will generate at least some increase in business spending.”

Holy schmoley…hasn’t this man ever heard of the ‘broken window fallacy,’ the classic economic text by Frederic Bastiat? Digging a ditch, filling it up…and then digging it out again…does not make you better off. It is a loss…a waste of precious time and energy.

Every economic problem we face today has been faced before. Overspending, corruption, debt, panics and crashes. Every obvious ‘solution,’ dodge and fix has been tried, too. Some within the living memory…and some two millennia ago.

But no government has ever succeeded in improving an economy…other than by avoiding war, providing some rudimentary justice, and removing the impediments set in place by government itself.

It’s all there…the whole story, a tale of sweat, sin, mistake, genius, and luck…in more than 2,000 years of recorded history.

Why not learn from it?

This brief history lesson from ages past, is certainly worth your while -- and was posted on Bill's website on Friday morning sometime. I thank Roy Stephens for sending it -- and another link to it is here.

![]()

Was Monday’s global trading symptomatic of a Last Gasp of historic global liquidity excess? I’ve discussed the faltering U.S. Credit cycle. I’ve delved into super-cycle “terminal phase excess” – culminating with a historic AI mania and arms race. Today, Credit cycle dynamics and a fragile AI Bubble are on a collision course. Monday was more about the third leg in the stool – the ongoing global liquidity Bubble.

Money market fund assets (MMFA) surged $347 billion, or 25% annualized, over the past 12 weeks - and have ballooned an incredible $2.96 TN, or 64%, since October 2022. I associate this historic monetary inflation with the proliferation of leveraged speculation (i.e., “repo” borrowing financing Treasury “basis trades”). Federal Reserve research recently corroborated this analysis, which highlighted a doubling of hedge fund holdings domiciled in the Cayman Islands over two years, to end 2024 at $1.85 TN.

There is every reason to fear that U.S.-style leveraged speculation has proliferated throughout global finance – every nook and cranny. Clearly, a massive “yen carry trade” funded by cheap Japanese finance has stoked bond issuance globally. I suspect massive speculative leverage has accumulated throughout emerging bond markets. Leveraged speculation also dominates European debt markets. Especially over recent years, a sophisticated global infrastructure developed to profit from leveraged speculation and derivatives trading. Moreover, this historic speculative bubble was stoked over the past year by a global central bank easing cycle.

A strong case can be made that we’ve witnessed the heyday in global speculative Bubble excess and resulting liquidity overabundance. Importantly, this liquidity onslaught has masked major festering problems – at home and abroad. In a less accommodating market environment, France would today be up against the wall; markets would forcefully punish Japan and the UK; Greek, Italian and others’ finance would be suspect; EM issues (i.e., Brazil’s corporate debt) would be pressing. If not for liquidity excess, we would have today quite different U.S. economic and Credit environments.

Doug's weekly market commentary is always worth your while -- and this week's showed up on his Internet site just before midnight PST last night. Another link to it is here.

![]()

Two worthwhile and informative interviews

1. Inside Russia’s Mindset: How the Kremlin Sees This War -- Scott Ritter

This almost 28-minute video interview with former U.S. Marine intelligence officer -- and former U.N. weapons inspector Ritter was hosted by Judge Andrew Napolitano very late on Friday afternoon EST -- and is certainly worth your time if you have the interest. I thank Guido Tricot for sending it our way, along with the one that follows. The link to this one is here.

2. INTEL Roundtable w/Ray McGovern and Matt Hoh (in for Larry) - Weekly Wrap, 14-November

This interesting and worthwhile video interview with Matt and Ray was also hosted by the Judge. It was also posted on the youtube.com Internet site late on Friday afternoon -- and the link to it is here.

![]()

Washington state coin and bullion shops prepare to be driven out by taxes

A year ago, Kerry Rogers, a Seattle-area leasing agent, didn't know much about gold and silver. But that's changed.

Worried about the economy, inflation and the weak dollar, she recently started buying bullion.

"If the economy crashes or something, you have something to stand on," she said while shopping at Geoff Minor's The Metal Shop Gold & Silver in Redmond late last month. "It's kind of a good foundation, especially since the dollar seems to not be worth anything."

"If the economy crashes or something, you have something to stand on," she said while shopping at Geoff Minor's The Metal Shop Gold & Silver in Redmond late last month. "It's kind of a good foundation, especially since the dollar seems to not be worth anything."

Rogers was not alone at Minor's store. A steady flow of customers buying and selling gold bars and silver coins were buzzed through the locked door of the shop. Minor has rarely been busier than over the past year, he said, as investors have looked for safety and gold sellers have cashed out as prices for bullion soared.

But all that activity may soon come to a halt at Minor's shop and likely across Washington.

Minor will close his store in late December in response to the Legislature's move in the last session to end a longstanding sales tax exemption on the sale of bullion. Starting January 1, people who purchase precious metals in Washington will pay state and local taxes ranging from 7.5% to 10.6%.

Not a fan of Washington's tax policies, Minor said he was mulling an eventual move to Idaho anyway but hadn't planned to leave for at least a couple of years. He said he might open a shop in Coeur d'Alene or Sandpoint, Idaho, a state that doesn't tax bullion sales.

This news item showed up on the seattletimes.com Internet site on Friday at 10:00 a.m. PST -- and is the first of several articles I found on the gata.org Internet site. Another link to it is here.

![]()

Danny over at CapitalCosm interviews your humble scribe

This 38-minute video interview with Danny was conducted on Tuesday -- and was all about the precious precious metals, course, It was posted on the youtube.com Internet site on Wednesday...but for length reasons, I though it best to wait to post it in my Saturday missive. Another link to it is here.

![]()

Italian government eyes family gold in hunt for budget funds

Italian Prime Minister Giorgia Meloni's government is looking to gold -- and its soaring value -- to raise more money for the public coffers, as members of her right-wing coalition squabble over other elements of next year's budget.

Some lawmakers from the three-party governing coalition have proposed that the Italian exchequer could raise up to E2 billion from a scheme to entice citizens who own undocumented gold coins, jewelry, and bullion to declare their holdings, have it valued, and pay a 12.5% tax on its worth.

Many Italian families hold small stocks of gold that lack any proof of origin, as it is often inherited from parents and grandparents who traditionally saw the precious metal as safer than the lira, Italy's currency before the euro.

Traditionally, Italians have also given children and grandchildren small gifts of gold.

However, under current rules, they are discouraged from selling this gold through legal channels as they are required to pay a 26% tax on the total value of the sale if they lack documents to prove the original purchase price.

The rest of this ft.com story from yesterday is hidden behind their paywall -- and I found it embedded in a GATA dispatch on Friday morning. Another link to it is here.

![]()

China’s secretive gold purchases help fuel record rally

China’s unreported gold purchases could be more than 10 times its official figures as it quietly tries to diversify away from the U.S. dollar, say analysts, highlighting the increasingly opaque sources of demand behind bullion’s record-breaking rally.

Publicly reported buying by China’s central bank has been so low this year — 1.9 tonnes purchased in August, 1.9 tonnes in July and 2.2 tonnes in June — that few in the market believe the official figures.

Analysts at Société Générale estimate, based on trade data, that China’s total purchases could reach as much as 250 tonnes this year, or more than a third of total global central bank demand.

The scale of the country’s unreported purchases highlights the growing challenges facing traders trying to work out where prices go next in a market increasingly dominated by central bank purchases.

“China is buying gold as part of their de-dollarisation strategy,” said Jeff Currie, chief strategy officer of energy pathways at Carlyle, who says he does not try to guess how much gold the People’s Bank of China is buying.

“Unlike oil, where you can track it with satellites, with gold you can’t. There’s just no way to know where this stuff goes and who is buying it.”

Of course both Alasdair Macleod and I believe that China holds north of 20,000 tonnes of the stuff. But this is the first article in the main stream media that discusses the possibility that China is not being truthful about their gold reserves. This very interesting gold-related news item appeared on the ft.com Internet site on Thursday -- and I thank Hugh Thomas for sending it along. Another link to it is here. A derivative of this story appeared on the Singapore-based website businesstimes.com.sg on Friday -- and that's linked here. I thank Tim Gorman for that one.

![]()

Dan Oliver at the New Orleans conference: This time isn't different, it's the same

Dan Oliver, founder of Myrmikan Capital in New York, told the New Orleans Investment Conference last week that nothing has changed in 2,500 years in regard to gold's near-perfect monetary characteristics and government's inability to be responsible with money. Monetary debasement, Oliver showed, is almost as old as money itself, even as its various forms grow more sophisticated.

Some investors always like to believe that "this time it's different," but Oliver's presentation in New Orleans was titled "This Time It's the Same." His mastery of history is enthralling.

This longish, but very worthwhile commentary from Daniel is linked here in .pdf format -- and I found it in a GATA dispatch earlier in the week. But for length reasons thought it best to wait for Saturday's column.

QUOTE of the DAY

![]()

The WRAP

"Understand this. Things are now in motion that cannot be undone." -- Gandalf the White

![]()

Today's pop 'blast from the past' is one I've not featured before. It showed up on this group's 1980 album Super Trouper -- and was never destined to be a single...or a hit. However, the public thought otherwise -- and it was released as a single on 10 July 1981.

It has gone on to become one of the group's most enduring hits. Slant Magazine ranked the song at number 60 in their list of the greatest dance songs of all time in 2006 -- and number 66 in the revised 2020 list.

There was no promotional video for this one -- and all there is, is what is linked here. There's a killer bass line to this and, as always, infusion26 lays it down perfectly -- and that's linked here.

French composer Camille Saint-Saëns wrote The Carnival of the Animals for fun -- and for a private performance for two pianos and a chamber ensemble. He prohibited public performance of the work during his lifetime, feeling that its frivolity would damage his standing as a serious composer.

He relented only for the famous cello solo The Swan, which forms the penultimate movement of the work -- and which was published in 1887 in an arrangement by the composer for cello and solo piano. "Penultimate" is the word -- and here are Yo-Yo Ma and Kathyrn Stott doing the honours. As one commentary pointed out..."Music like this is why we have ears." The link is here.

![]()

The collusive commercial traders certainly made their presence felt on Friday...starting at 11:30 a.m. in Globex trading in Shanghai on their Friday morning.

On bear raids like yesterday, Ted Butler used to tell me that it was proof-positive that the collusive commercial traders of whatever stripe were behind it all, because it's a certainty that the Managed Money, Other Reportable traders, et al...who are all mega net long the precious metals in the COMEX futures market...didn't have a ZOOM conference call on Thursday evening, plotting how they could collectively lose many hundreds of millions of dollars the following day -- with all of them starting at at the same minute -- and ending at the same minute.

The purpose of their bear raid yesterday was most likely twofold...to cover as many short positions as they could -- and also to ensure that the precious metals were seen as no safe haven on the last trading day of the week...especially considering what else is going on in the markets and world these days.

But despite the losses 'da boyz' handed out in the precious metal space, their associated equities turned in a very admirable performance...all things considered.

I have two thoughts about that, with the first being that the handful of deep-pocket and in-the-know 'buy the dips' crowd was out and about scarfing up not only everything that was being sold in a panic...but much more than that as well. The reason being that they want to positioned for the next big 'up' leg that's most definitely coming.

My other thought is that 'da boyz' were aggressive buyers -- and were preparing in advance to sell them into the next precious metals rally to ensure that their equities 'underperformed' yet again. We've seen instances of that in the past -- and on more than one occasion. We'll find out in due course if that's the case, I suppose.

Everyone and his dog knows that the precious metals...silver in particular ...should be price far higher than they are now -- and as Ted also correctly pointed out over the years..."there's only one reason when they're not." That's because of 'da boyz'...the not-for-profit sellers/short sellers of last resort in the commercial category.

After Friday's engineered closes, gold is still about $140 above its 50-day moving average -- and silver about $3.10 above its. Whether these price targets are something the commercial traders are aiming for, is unknown at the moment.

Platinum was closed right on its 50-day moving average on Friday...but palladium remains about 50 bucks or so above its.

Copper was left alone yesterday. It closed down 1 cent at $5.035/pound -- and 16 cents above its 50-day moving average.

Natural gas [chart included] closed down 14 cents on Friday -- and last traded at $4.51/1,000 cubic feet. It's now back below the oversold mark on its RSI trace by a tad. WTIC closed higher by $1.26 at $59.95/barrel -- and still below its 50-day moving average by around $1.15.

Here are the 6-month charts for the above Big 6+1 commodities...thanks to stockcharts.com as always -- and are are worth a look if you have the interest. Click to enlarge.

I'm not at all sure whether Friday's bear raid had anything to do with next Friday's big SLV options expiry. But yesterday's price action should leave no doubt in anyone's mind that 'da boyz' remain in charge of precious metal prices when it becomes necessary -- and in a bunch of other things as well, I'm sure.

Not only is there that big SLV options expiry next Friday...November 21...but reader Paul Fitzgerald informed me that options expiry for both gold and silver on the COMEX is on the following Monday...November 24.

So its certainly within the realm of possibility that things will remain 'volatile' for a while...which is a code word that 'da boyz' are going to keep precious metal prices under their collective thumbs until they allow their next rallies to begin.

However, the bid under this market is pretty hefty in all four precious metals -- and if these commercial traders weren't watching over them 24/7...it would be "to the moon, Alice!"...for all of them.

I also noticed that Friday was yet another example of where prices were bid higher in the Far East -- and then crushed when London and New York were open, which is another data point for my essay from a year ago headlined "Gold Manipulation: The 'London Bias'...1970-2024" -- and linked again here.

The fight between the East and West is being fought in many arenas... economic, monetary -- and militarily. The precious metals market is just another front in the battle, but without doubt the most important one. Because when this world-wide fiat currency system crashes and burns, which it will at some point, the only nations left standing will be those that hold the most gold.

At the moment, if you combine Russia's holdings...2,300+ tonnes -- and the well north of 20,000 tonnes that China holds, one has to suspect that those two nations combined hold close to half of all the central bank gold in the world. That doesn't include the other big BRICS+ nation...India. And as the saying goes..."He who has the gold, makes the rules."

But the real wild card remains silver, which is in a permanent structural supply/demand deficit situation from which I see no escape. Even if 'da boyz' allowed silver's price to rise to the whatever 3-digit price it ends up at, all it will do is drive world-wide investment demand to the outer edges of the galaxy...exacerbating the situation.

And no matter what the price, it will continue to come out of the ground at the rate of around 820 million ounces a year, as there's little new production scheduled to come on stream that I know of. Any new production that does appear will be sucked up into the demand vortex, never to be seen again.

And to complicate things even further, the current miners with silver in their names that we all know, own shares in -- and follow...will suddenly find themselves in a situation where their 'measured & indicated' ounces instantly fall into the 'proven & probable' -- and they may end up changing their mine plans to extend their life-of-mine...the smart thing to do -- and still make wild profits, plus pay big dividends. The result of doing this, which is of benefit to their shareholders, would be a reduction in output per year.

As for new mines coming on stream in the next year or so...there are a few, but their ounces will be of no consequence in the overall -- and as I pointed out recently, most of the silver needed to fill the the current structural deficit, has yet to be discovered.

As I've been saying for the last few weeks now, it's a circle that's impossible to square no matter how one looks at it. I'm sure that the powers-that-be are more than aware of that -- and it's way above my pay grade as to how this will all shake out.

The drum beat of that structural deficit is now deafening, as the LBMA found out last month. They survived that one by pulling in all their markers, but I doubt they'll be that lucky the next time around.

There were 58.293 million troy ounce of silver shipped out of the COMEX during October -- and another 11.001 million oz. so far this month. Without doubt, almost all of that was London-bound.

As Phil Baker, the ex-CEO of Hecla Mining -- and ex-President of the Silver Institute pointed out in a Kitco interview a few months back...the demand for physical silver worldwide has now become "rapacious."

Now we just watch and wait for that fact to be allowed to be reflected in its price...along with the financial "Bonfire" for those short silver that will follow in its wake.

I'm done for the day -- and the week -- and yes, I'm still "all in."

See you here on Tuesday.

Ed