Summary

- Silver producers are not making much money at today's prices, so naturally we seek exposure in exploration where the value is found.

- Great property, great location, great partner.

- Partner committed to spend $12.6 million in pre-development work.

Introduction

We have been looking hard to find a company that would give us exposure to silver. When in a bull market, silver really outperforms gold and we want to enjoy some of that action. As we write this, the gold to silver ratio is trading at 74* after it peaked not long ago at around 86-88. When gold and silver reached their highs a few years ago, the ratio was around 40. While some argue that the true ratio should be at 16-17, we can only come to the conclusion that the ratio will move down a lot from where it sits today at 74.

* It takes 74 ounces of silver to buy one ounce of gold

It's been hard to find the right silver company to invest in after our favorite producer got bought out (SilverCrest Mines (NYSEMKT:SVLC)). Most of the pure silver producers aren't making any money at today's prices, and therefore the producers don't really appeal to us.

Our appetite for risk is quite large, and when we find a situation where we can remove some of the risk but still enjoy a large upside, then it's time to get really excited. Today we are writing about a small and still undervalued junior with great exposure to silver prices, but with someone else currently picking up the bill for pre-development work.

Golden Arrow Resources (OTC:GARWF)

Large silver deposits are scarce, that's a fact. Silver is mostly a by-product from mines that produce other metals such as gold, copper, lead and zinc. This is the reason why silver companies receive a premium to gold companies in a bull market, but we are far from that still as this bull market just got started.

In August of 2011, Golden Arrow entered into an option agreement to acquire a 100% interest in the Chinchillas Silver Project. Remember, that was at a time when precious metals was still in a bull market which was just about to turn around.

Because of earlier exploration success, Golden Arrow avoided a lot of dilution during the bear market (2012-2015) partly by selling an NSR of Gualcamayo, a discovery made in 1996 and now owned by Yamana (NYSE:AUY).

Almost all junior exploration companies rely mostly on equity financing to fund their business. This is also the case for Golden Arrow but despite bringing their flagship property forward during the hardest of times, the company has a very good share structure.

Insiders (+ friends/family) own approximately 50% of the company and Silver Standard owns another 6%. That makes the free float quite tight which is often a good thing. But one also needs to understand that liquidity in the market can at times be low which often increases volatility.

Seven weeks ago Golden Arrow announced a financing which became heavily oversubscribed (to put it gently) and since all outstanding warrants/options are in the money already, the only correct thing to do is to look at the share count on a fully diluted basis which comes to ~94 million. That gives Golden Arrow a Mcap of roughly 70 Mcad.

Since Golden Arrow doesn't need to spend money on exploring Chinchillas (Silver Standard is picking up that bill), the company is in a strong financial position and we don't expect any additional financing this year.

Chinchillas Silver Project

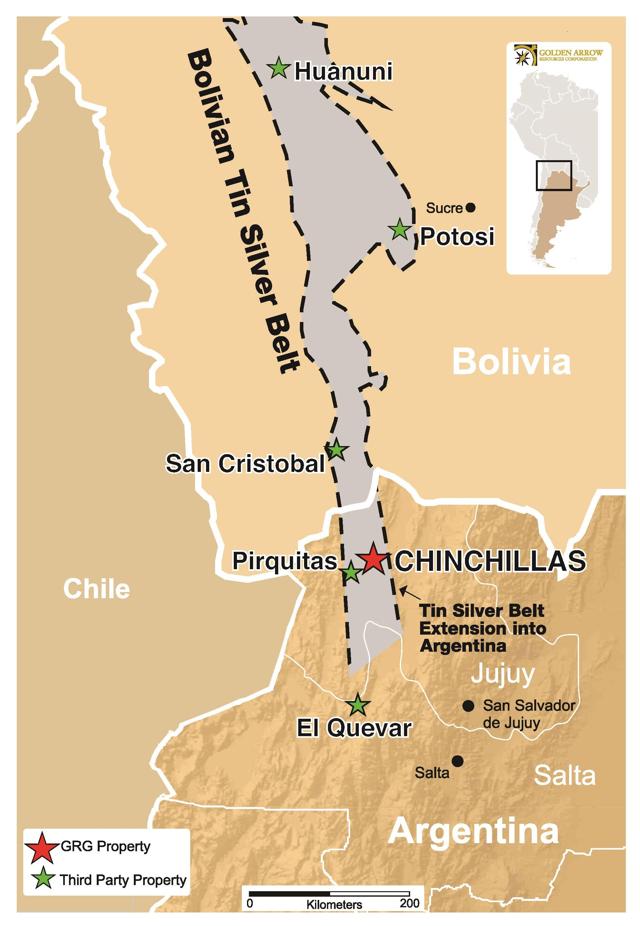

Golden Arrow's flagship property is called the Chinchillas Silver Project and is located in the prolific Bolivian silver-zinc-tin belt which extends into northern Argentina. The Chinchillas' geology is very similar to the San Cristobal Mine in Bolivia. San Cristobal mine hosts approximately 450 million ounces of silver, 8 billion pounds of zinc and 3 billion pounds of lead contained in 231 million tonnes of open pitable proven and probable reserves.

It hosts a large silver resource number with lead and zinc as by-products:

- Measured Resource of 17 million ounces of AgEq at 149 g/t AgEq grade

- Indicated Resources of 138 million ounces AgEq at 141 g/t AgEq grade

- Average grade in Measured and Indicated 142 g/t AgEq

- Inferred Resources of 90 million ounces AgEq at 85 g/t AgEq grade

Silver Standard (NASDAQ:SSRI) owns and operates the Pirquitas silver mine just 30 kms away from Golden Arrow's deposit. And here's one of the biggest reasons why we like Golden Arrow so much, the Pirquitas mine is a ~10 million oz/year silver mine with only two or three years left of production.

Joint Venture with Silver Standard

Golden Arrow has a joint venture with Silver Standard where Silver Standard have a minimum pre-development expenditure commitment of $4 million with total pre-development expenditures estimated at $12.6 million. Silver Standard will also make payments in cash, of up to C$2 million to Golden Arrow upon completion of certain milestones during the Preliminary Period. This so called "Preliminary Period" ends on March 30th, 2017, and Silver Standard need to decide what they want to do by then.

To explain the partnership in short, Silver Standard will own 75% of Chinchillas and Golden Arrow 25%. GRG will accrue a 25% interest in Pirquitas mine's cash equivalent earnings, less expenses, during the Preliminary Period. On top of this JV agreement/option, Silver Standard owns 7% of the shares in Golden Arrow (before the recent financing).

We see three possible outcomes evolving between now and ten months from now. Either Silver Standard decides to close their Pirquitas mine after it is depleted, pack up their things and go home. Not very likely.

The other two scenarios are as follows: 1) Golden Arrow keeps its 25% ownership and becomes cash flow positive by this time next year or 2) Silver Standard acquires Golden Arrow to retain a 100% ownership of the ~250 million ounces of silver 30 kms from their existing mine.

The JV with Silver Standard is actually more of an "option to JV" as they can pull out before March 30th of next year. Until then SSO is expected to spend $12.6 million in pre-development work which will determine if they will become a 75/25 partner or walk away. Remember, when Silver Standard was negotiating this deal, silver was at $14.50-15 and not in demand. If Silver Standard liked the project by then, imagine how much more they will like it today at $17. Or at $25. As silver goes higher, so does the viability of the project and the ounces become more and more valuable. And this is exactly the kind of leverage and exposure to silver we want to own, lowered risk but with the true potential of a junior.

We will explain the kicker and the real reason why we are so keen on Golden Arrow. If we assume that Silver Standard go through and finalizes the JV, the same day that the contract is signed, Golden Arrow becomes 25% owner of the Pirquitas mine and on top of that, Silver Standard will cut a check to Golden Arrow for 25% of the net profits* from the Pirquitas mine accrued since October 1st, 2015.

*Minus 25% of the accrued pre-development expenses SSO has had, see press release

The Pirquitas mine is currently a >10 million oz silver producer with an AISC of $12-13/oz. Our conservative calculations would give GRG the following cash flow once they are a 25% owner of Pirquitas:

- Silver at $16 gives GRG 3.1 Mcad/quarter

- Silver at $18 gives GRG 3.7 Mcad/quarter

- Silver at $20 gives GRG 4.4 Mcad/quarter

(1 USD = 1.255 CAD)

When the partnership is final, a Newco will be formed and Pirquitas and the Chinchillas project will be included. This company will then be distributed to the existing shareholders of Silver Standard & Golden Arrow. Read the press release from Oct 1st, 2015, here.

The Pirquitas mine has somewhere between 2-3 years left of production so anyone can see how important Chinchillas is for Silver Standard. The Chinchillas mine will have anything from 15-20 years of life in it, assuming it can produce around 10 Moz/yr.

Valuation

So what should 25% of a 10Moz silver producer be valued at? Perhaps not 100% correct, but an easy way to at least get an idea is to look at Fortuna Silver. Fortuna (fvi.to) have a guidance to produce 9.6 million Ag Eq ounces in 2016 and they have a Mcap of 1.05 Billion. 25% of that is 263 Mcad. If we assume that Golden Arrow would have the same valuation, that would equal C$2.80 per Golden Arrow share.

If everybody would see this story the same way we see it, Golden Arrow stock should be a fairly easy double from today's levels. That's why we see Golden Arrow as one of the most exciting juniors out there right now, the risk/reward is right where we want it. As an extra kicker, Silver Standard could at any point also chose to simply make a bid for Golden Arrow, something that would not come as a surprise, especially if silver prices continue to move higher.

Conclusion

The conclusion is short and concise, we want leveraged exposure to silver with reduced risk which is exactly what we get due to Golden Arrow's JV. The partnership with Silver Standard removes risk and besides the silver exposure we also get a potential buy-out component. What's not to like?

We are getting quite convinced that the only outcome is for Silver Standard to buy Golden Arrow, but at what price? Since insiders control such a large stake of Golden Arrow, we think chances are good for a great bid. Is $1/oz in the ground reasonable? Perhaps if silver continues to go higher, in which case Golden Arrow could very well get an offer around C$2. Depending on when such a bid would materialize, we think anywhere between C$1.50-2.50 is possible.

Disclosure: I am/we are long GARWF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.